Teff value chain_eea_pptx

-

Upload

essp2 -

Category

Technology

-

view

166 -

download

1

Transcript of Teff value chain_eea_pptx

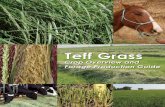

ETHIOPIAN DEVELOPMENT RESEARCH INSTITUTE

Using evidence in unraveling food supply chains in Ethiopia:

The case of teff from major production areas to Addis Ababa

Bart Minten, Seneshaw Tamiru, Ermias Engeda, and Tadesse Kuma IFPRI ESSP-II EDRI

Ethiopian Economic Association ConferenceJuly 19, 2013Addis Ababa

1

2

1. Introduction

• Importance of cities rapidly growing world-wide: In 1950: 30% living in cities; In 2010: 50%

• In Africa: projected to have 60% in cities in 2050• Rapidly growing rural-urban agricultural market flows, with

important implications on urban and rural food security• Increasing dependence of African cities on imported food,

blamed on uncompetitive local value chains• However, few scientific studies that look rural-urban food

value chains; • This leads often to a badly informed debate

3

Three conventional wisdoms on food value chains

• Perception 1: “Farmers obtain small share of final retail

price” (The Economist: “… too few subsistence farmers get a chance to sell their produce (and usually get less than 20% of the market price)” March 2nd-8th, 2013, p.9, in Leaders)

• Perception 2: “Value chains are long and there are many layers, causing inefficiency”

• Perception 3: “Sales are driven by distress immediately after harvest when prices are low”

4

Contribution of our research: Test validity of these perceptions

• Large surveys at each level of the value chain • Study major staple in Ethiopia, i.e. teff; by value the most

important crop in the country (1.6 billion USD in 2011/2012); the second most important cash crop in the country (after coffee)

• Look at: a/ structure of the value chain b/ average marketing marginsc/ margins over space and season d/ distress sales and seasonality in sales

• Purpose of the study is to understand major value chains from rural producers in major production zones to Addis, the major city in the country.

• Surveys with producers and communities upstream; rural and urban wholesalers and truckers midstream; cereal shops, mills, and cooperative retail downstream

2. Data

• Procurement/sales by rural traders 3. Structure of the value chain

Rural traders% bought % sold

from toFarmers 84.9Farmer-traders or rural assemblers 13.3Traders in wholesale markets/wholesalers 1.3 8.1Cooperative unions 0.3 0.0Brokers 76.3Mills/cereal shops 13.2Others 0.2 2.4Total 100.0 100.0Percentage sold to:Addis 92.8Rural zone where trader was interviewed 4.6Other zone 2.4

• Procurement/sales by urban traders/brokers 3. Structure of the value chain

% bought % sold from toFarmers 4.5Farmer-traders or rural assemblers 2.5Traders in wholesale markets/wholesalers 5.8Cooperative unions 0.0 1.3Traders located outside Addis 83.2Traders in Addis 9.8Enjera sellers 7.1Institutions 1.8Restaurants 1.4Mills 69.8Cereal shops 6.8Consumers 5.7Others 0.0 0.4Total 100.0 100.0

• Procurement/sales by urban retailers 3. Structure of the value chain

% bought % sold from toFarmers 9.8Farmer-traders or rural assemblers 4.3Cooperative unions 0.1Traders/brokers in Addis 68.3Traders located outside Addis 17.6Enjera wholesalers 1.3Enjera wholesale companies 0.0Enjera retailers with fixed shops 4.8Enjera retailers without fixed shops 5.2Institutions/restaurants 2.3Consumers 85.7Supermarkets 0.4Others 0.0 0.4Total 100.0 100.0

• Most common value chain is one with three intermediaries between producer and consumer:

Producer Regional trader Urban broker/trader Urban retailer Consumer

- Sometimes shorter, e.g. 32% of teff sold by urban retailers directly obtained in rural areas

- Sometime longer, e.g. 13% of procurement of rural traders from rural assemblers or farmer-traders

4. Structure of the value chain

• Farmers asked teff price at the time of the survey (October- November 2012) for their most common place of sale

• All value chain participants asked prices for the different teff qualities at the time of the survey (rural traders: October-November; urban traders and retailers: December)

• Consistent price collection on urban wholesale markets; price dropped in period 2; assumed retail, milling, and cleaning margin stayed similar for comparison

• Use all these prices to get at average price composition

4. Price formation

4. Price formation in value chain

(October 2012)

Magna

White Mix Red0.0

200.0

400.0

600.0

800.0

1000.0

1200.0

1400.0

1600.0

1800.0

Milling and cleaningUrban retailUrban wholesaleRural market/townFarmgateBi

rr/q

uint

al

• Farmers obtain between 78% (red) to 86% (magna) of the final urban retail grain price

• Average composition of margin between producer and consumers:

1/ Farmgate – rural markets: 15% 2/ Rural market – urban wholesale: 54%3/ Urban wholesale – urban retail: 19%4/ Milling and cleaning: 13%• Gives us average picture at time of survey; in rest of

presentation look at spatial and temporal variation

4. Price formation in the value chain

a. Understanding the transport sector- Survey was implemented with truck drivers that

transported teff to Addis- Questions on themselves, the owner, type of truck, and

characteristics of the last trip

b. Understanding the impact on farmers - Heterogeneity of farmers by transportation costs to Addis- Link teff prices and transport costs to Addis- Information on sales to whom by transport costs to Addis

5. Variation over space

Teff transport sector:• Average distance covered in last transaction is 228 kms• On average, transported for 2 sellers; sold to 3 buyers • Transport charges: 18 Birr/quintal for 100 kms or 10

USD/ton for 100 km• Regression of costs on size truck, road quality, number of

buyers and sellers• Distance only significant variable• For extra 100 kms travelled, transport charges go up by 13

Birr/quintal

5. Variation over space

• Strong price – transportation cost relationship • In case of white teff (most traded), producer share drops

from 90% close by to 80% for most remote

Teff price variation over space 1

00

01

10

01

20

01

30

01

40

01

50

0

Bir

r/q

uin

tal

0 50 100 150Transport costs to Addis (Birr/quintal)

Magna WhiteMix Red

• Regression analysis: for the 4 qualities: 1/ Use reported prices at time of survey; 2/ Use transaction price in last 12 months

• Independent variables: 1/ place of sales (farmgate or not); 2/ quantity sold; 3/ month of sales; 4/ transportation costs to Addis

• In none of the 8 specifications can hypothesis be rejected that producer price declines in line with transportation costs

Producer price variation over space

• Farmers close by more productive; Most remote farmers drop to subsistence level

Variation in teff sales over space 0

500

100

01

50

0kg

s

0 50 100 150Transport costs to Addis (Birr/quintal)

Sales per household Production per householdconsumption per household

• Produce of close by farmers goes to Addis; more remote farmers sell elsewhere or do not sell at all

Variation in teff sales over space

01

00

200

300

400

500

kgs

so

ld p

er

ho

use

ho

ld to tra

de

rs s

hip

pin

g to A

dd

is

0 50 100 150Transport costs to Addis (Birr/quintal)

• Storage: release smooth over the year

6. Temporal variation

N-D D-J J-F F-M M-A A-M M-J J-J J-A A-S S-O O-N0

100200300400500600700800900

storage

kg

• Two measures of distress sales:1. “Would you have sold the teff at this time if the price would have been 10% lower?”: 19% of transactions (“distress”) 2. “Would you have sold the teff at this time if the price would have been 50% lower?”: 10% of transactions (“extreme distress”)

• In 71% of the cases, farmers would not have accepted lower price

6. Temporal variation in sales

• Multinomal model (0=normal; 1=distress; 2=extreme distress):

1. Strong effect of the month of sales: More distress sales in months immediately after harvest2. Extreme distress sales characterized by smaller quantities sold (seemingly only done to cover immediate needs)3. Off-farm income leads to less distress and extreme distress sales 4. More remote households have more distress sales (poorer in general and play less the market)

Associates of distress sales

22

7. Conclusions 1. We find most common value chain to be rather short, with

on average 3 intermediaries between farmers and consumers

2. The share of the farmer in final retail price is about 80 %, using different methodologies (price at time of survey; price from transactions and taking seasonality of sales into consideration); share drops when farmers live further

3. Distress sales: 19% of transactions; Extreme distress: 10% of transactions; smooth storage release

These are seemingly all signs of well-functioning markets

23

7. Conclusions Why in contradiction with perceptions? 1. Few surveys; mostly case studies; problems of

representativity; 2. Important changes (roads; communication) have

happened that people are not aware of3. Teff unsophisticated value chain (little value addition by

value chain agents)4. Results different for perishable crops; root crops; or thin

markets5. Teff high price; e.g. maize different6. Traders easy to blame; their importance overstated

24

8. Implications 1. As market assessment hard (and often wrong), careful at

benefits and costs before interventions (such as cooperative marketing, modern commodity exchanges; warehouse receipt systems; price controls)

2. Lower transportation costs lead to higher prices for producers

3. Better qualities have higher producer share 4. If objective of policy makers is to reduce consumer prices,

focus on costs at the farm level (i.e. improved technologies); there is seemingly very little potential at the market level