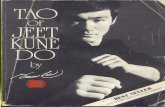

The Tao Te Ching fileThe Tao Te Ching Lao−Tse. Table of Contents The Tao Te Ching.....1

Technology Opportunity -...

Transcript of Technology Opportunity -...

January 2017 Issue

1

TechnologyOpportunity

&

In This Issue:• What I Learned in Vegas This Year• 5 Tech Trends to Watch in 2017• 2 Stock Highlights from CES• Company News & Position Updates

A New Year for Tech: Taking a Peek Inside CES 2017

At the start of every year, I fly out west to Las Vegas, Nevada for my annual trip to the International Consumer Electronics Show — the world’s largest trade exhibition and home to pretty much every emerging technology trend the industry has to offer.

Every January, CES draws in upwards of 150,000 attendees and thousands of exhibitors, making it one of Sin City’s most anticipated events, as well as one of my favorite networking and research opportunities around.

Anyone who’s been to the Consumer Electronics Show before knows that the labyrinth of booths and conference tracks is no small feat to navigate. Calling CES a “zoo” would surely be an understatement, but once you get your footing, it’s entirely worth it.

Already having a few rounds of CES under my belt, I found myself heading into Vegas this year less overwhelmed, better prepared, and more excited than I had been ever before… and I can tell you now that I wasn’t at all disappointed with how it all turned out.

No doubt, CES 2017 showcased an incredible range and depth of new and disruptive technologies, many of which investors will want to be keeping a close eye on as we open 2017. And while it’ll certainly be impossible to showcase everything I witnessed over the course of my three-day stay in Vegas this year, now is as good a time as any to share my experiences and insights from the conference.

With that all said, we’re going to break the body of this month’s issue into two components, centering it all on CES...

First, we’re going to define and explore what I think can easily be considered the five overarching themes of CES 2017. These are going to be the biggest tech trends we’ll be focusing on from now through December (and likely beyond), as we tease out the potential

January 2017 Issue

2

TechnologyOpportunity

&

investment angles for each one.

Second, we’re going to take a look at two publicly traded companies that really stood out to me this year. You’ve already heard of at least one of these companies before, but based on what I saw at CES, both are positioned to redefine themselves entirely.

Before we get to those two firms, though, let’s first take a look at those five big tech trends highlighted this year at CES:

Trend #1: The Dawn of Artificial Intelligence

Artificial intelligence was undoubtedly one of the top tech trends of 2016. Last year we saw the introduction of a number of personal digital assistants (PDAs), the most notable being Amazon’s (NASDAQ: AMZN) Alexa and Alphabet’s (NASDAQ: GOOG) own Google Assistant.

According to a recent Allied Market Research report, the global intelligent virtual assistant market is expected to reach $3.6 billion by 2020, coming in at a CAGR (compound annual growth rate) of 35.2%. You don’t need me to tell you what an incredible growth opportunity that represents...

Digital assistants, while not entirely new, have just begun to show their true promise with the functionality of Alexa and Google Home. While Apple Inc. (NASDAQ: AAPL) first brought PDAs to the mainstream with its introduction of Siri in 2011, the feature has gone widely ignored by iOS users due to lack of utility and poor voice recognition.

If CES 2017 was any indication as to the future of AI, though, we’re only just getting started thanks to PDAs of a higher caliber. Amazon’s Alexa in particular dominated the conference, finding itself integrated into a long list of devices hoping to leverage Alexa’s free API (Skills Kit) to their benefit.

Here’s some context from David Pierce over at Wired:

These things will be everywhere. You’ll find dozens of Alexa-enabled devices at CES. Ford rolled in with a car that summons your assistant with a button on the steering wheel. Klipsch built a speaker with an Echo Dot-sized hole at the top. Whirlpool appliances respond to commands barked at your Echo. Before long you’ll change channels on your Dish Hopper DVR just by yelling at it. Even your LG fridge will work with Alexa to play music, set timers, and tell you how many tablespoons are in a cup.

January 2017 Issue

3

TechnologyOpportunity

&

And here’s an incomplete list of showcased devices at CES being integrated with Alexa:

• Westinghouse, Element, and Seiki are all building TVs that use Alexa voice control.

• LG put Alexa in a refrigerator and its smart home robot “Hub.”

• Ford is putting Alexa in its cars (Fusions and F-150s) as a driver assistant.

• Volkswagen also plans to put Alexa in its cars.

• Huawei (pronounced “wah-way”) is integrating Alexa in its new Mate 9 smartphone.

• Whirlpool made new washers, dryers, refrigerators, and ovens that can be controlled with Alexa.

• Dish’s Hopper DVR is getting Alexa voice control.

• Samsung’s robotic vacuum is integrating Alexa.

• ADT is adding Alexa control to its Pulse security system.

• Linksys’s Velop router will support Alexa commands.

• Coway’s Omega smart air purifiers will, too.

• Array and Brinks are making connected smarts locks with Alexa integration.

All told, GeekWire reports that developers have so far created 7,000 distinct “skills,” or commands, for Alexa-integrated devices like those listed above. That’s more than double the number of skills Alexa had in September, and seven times the number of skills it had in June of 2016.

2017 is no doubt poised to be a huge year for PDA adoption, if CES was any indicator. Think the beginnings of Space Odyssey’s HAL 9000, but less ruthless and more consumer driven.

Amazon and Google will likely buck the AI/PDA trend, while Apple will continue to lag behind. We expect that these kinds of intelligent assistants will strongly drive trends in mobile device sales beginning in 2018 as the age of meaningful hardware upgrades for smartphones comes to an end.

January 2017 Issue

4

TechnologyOpportunity

&

Trend #2: The Rise of Automated Vehicles

Automated vehicles, or AVs, aren’t a development exclusive to CES 2017, but we continued to see this as an emerging trend at the conference this year. From major automotive manufacturers to prominent chipmakers to more obscure telematics firms, the tech industry is clearly betting big on a driverless future.

Hyundai (OTC: HYMTF), for one, revealed this year that it’s building self-driving prototypes on its Ioniq hatchback platform, which comes as a standard hybrid, plug-in hybrid, and plug-in EV. The company is taking a different approach compared to most other auto-manufacturers, skipping pricey spinning Lidar sensors in exchange for less-expensive sensors such as radar, forward-facing Lidar, and a multi-camera array.

Hyundai’s goal is to make AVs affordable for the average consumer, but the company doesn’t plan to be ready until 2021. For now, the firm’s driverless tech is clearly lagging behind the competition.

NVIDIA (NASDAQ: NVDA) CEO Jen-Hsun gave a keynote this year, announcing collaborations with HERE and ZENRIN that will expand the firm’s end-to-end HD mapping (Live Map) capabilities for self-driving cars. Jointly, the company announced an extension of its partnership with Audi (OTC: VLKAY), with the two companies planning to put “advanced AI” vehicles on the road by 2020.

Nissan Motor Co. (OTC: NSANY) also gave a keynote this year, with CEO Carlos Ghosn pledging to bring the company’s driverless cars to consumers by 2020. The project, dubbed “ProPilot technology,” is expected to be spearheaded by the company’s Sunderland manufacturing plant in the UK.

Jointly, Nissan announced it will launch at least 10 car models with various degrees of driverless features within the next three years. This will potentially make Nissan the first carmaker to achieve mass consumer adoption for AVs.

BMW (OTC: BMWYY) used CES as a platform to announce a partnership with Intel (NASDAQ: INTC) and Mobileye (NYSE: MBLY) to bring a fleet of self-driving cars to the road for testing in 2017. Toyota (NYSE: TM) also announced a driverless car concept, as did Faraday Future with its fully electric FF91.

As driverless cars make their way to the mainstream, investors will have a few clear options to play the trend: invest in the carmakers directly, in the component and chip-makers under the hood, or in telematics companies who will provide 3D maps. You can expect detailed coverage on these investing opportunities from us as the industry matures.

January 2017 Issue

5

TechnologyOpportunity

&

Trend #3: Virtual and Augmented Reality

Among all the tech trends that we saw emerge in 2016, virtual and augmented reality were undoubtedly the biggest. And while we expect that in 2017, the media will put more of a focus on digital assistants as hype around VR/AR takes a pause, CES wasn’t short on exposure whatsoever.

All told, CES showcased 71 virtual reality exhibitors at the show this year, up nearly 50% from last year. The conference also had a separate dedicated area for VR and AR exhibitors. Most of these were lesser-known startups and not game changers by any means, but the list also included some of tech’s biggest players as well.

During Huawei’s keynote, Google revealed its second Daydream VR headset, which will be compatible with Huawei, Asus, and ZTE phones. As VR makes its way into the hands (or, better yet, onto the faces) of more consumers, this will grow the developer community, feeding what should be a self-fueling cycle.

That is, by opening Daydream to more users, Google will attract more developers, who will create more apps, which will attract more users, and so on. The company is following the same playbook as it did with Android, and we all know what an incredible success (90% market share) that has been.

I had the opportunity to check out a few AR/VR product demos. GoPro’s (NASDAQ: GPRO) stood out in particular, but we have doubts about the current 3D capture method, which essentially involves tossing a bunch of GoPro Heros together — a clunky and expensive solution. Until the firm can create a single omni-directional camera for 3D capture, we’re not feeling especially optimistic.

I also had the chance to visit Kopin Corporation (NASDAQ: KOPN), the Massachusetts-based electronics manufacturer that could be considered a competitor to Himax (NASDAQ: HIMX). The firm was showcasing its OLED micro-displays inside its Solos smart glasses, which are being marketed to cyclists. Solos provides a heads-up display (HUD) so users can check their speed, navigation, etc. while riding.

As neat as Solos was to use, though, there’s realistically no mass appeal to

January 2017 Issue

6

TechnologyOpportunity

&

the device, and Kopin remains a bit too risky from a financial standpoint to put much faith in. The stock has been rallying since November but hasn’t turned a profit for over a year. Himax remains the much safer bet right now considering its alternative revenue streams, not to mention that it has far more traction in the AR/VR space.

Trend #4: Ultra-High Definition TV (8K, OLED, Quantum Dot)

4K televisions (also known as ultra-HD) have been showcased at CES for the last two years, yet I still can’t help but get hit with that “wow” factor every time I see one. Better yet, now we have 8K televisions, which are even more impressive...

If you’ve yet to see a 4K or 8K TV up close, you probably don’t know what all the fuss is about, but I can tell you the picture quality on these devices is truly incredible given the right content. Obviously it’s impossible to see what these displays can do without having one in front of you, but I believe it’s as much of a step up from HD as HD was from standard definition.

Now, technically speaking, that’s not precisely true: an HD set offers about five times as many pixels as a standard-definition television, while a 4K offers about four times as many pixels as HD… but you get the idea. It actually looks like you can reach inside these things, there’s so much clarity. It’s like a portal to another world, but of course it isn’t.

In previous years, we’ve seen OLED (organic light-emitting diodes) as the rising stars for ultra-high definition televisions. This trend has brought some incredible gains to stock such as LG Display (NYSE: LPL) and Universal Display (NASDAQ: OLED). This year, we’re beginning to see further traction of a new material: QLED (quantum dot LEDs).

Quantum dots are microscopic, man-made crystals about 10,000 times smaller than the width of a human hair (between two and 10 nanometers). Each dot is technically a miniature semiconductor, meaning it can convert incoming energy.

More specifically, a quantum dot can convert blue light into nearly any other color on the visual spectrum. A smaller quantum dot emits shorter wavelengths like green and turquoise, while bigger quantum dots emit longer wavelengths like orange and red.

What this means is that by laying a sheet of quantum dots over the backlight, television OEMs are able to enhance the color of backlit displays. Each dot can be tuned to fit a specific wavelength, making for even more distinct reds, greens, and blues than standard colored LEDS.

All said and done, the wider color gamut offered by quantum dot displays boosts color reproduction by 30%.

January 2017 Issue

7

TechnologyOpportunity

&

Quantum dots are also more energy efficient because they only make the colors needed — a concept otherwise known as pure color. Traditional LCD displays, on the other hand, have to produce extra colors and then block out what you’re not supposed to see (obviously not the most efficient form of display).

We expect the quantum dot industry to follow a similar trajectory as OLED has… but lagging 5-10 years behind. Keep an eye out in future issues and mailings, as we’re pinning down a few opportunities in this space.

Trend #5: Next-Generation Networking (5G)

When it comes to a highly publicized trade show like CES, it tends to be the flashiest items that get the most attention. It’s easy to draw up hype around things like self-driving cars, drones, 3D-printers, and even virtual reality because you can see those things in action. When it comes to something invisible like the Internet, though, it’s much easier to overlook.

Of course, sometimes it’s the technologies that fly under the radar that offer investors the most promise. Hype tends to inflate the price of stocks beyond their true value, and if you’re disciplined, you’ll find yourself sitting out a trend to avoid the risk of getting caught on top of a bubble.

This year at CES, 5G was the epitome of a sleeping giant. It didn’t sparkle or glimmer, and it didn’t draw any huge crowds, but it will be the glue that holds so many of the aforementioned emerging technologies together. Driverless vehicles, Ultra-HD televisions, smart devices, real-time VR — all of these innovations will require a powerful (high speed and low latency) next-generation data network.

In short, 5G is all about widespread connectivity between devices. 3G brought us the picture era, 4G enabled streaming video, and 5G will bring about the much-awaited Internet of Things.

As Qualcomm CEO Steven Mollenkopf had to say during his keynote:

5G isn’t incremental improvement in connectivity or even just a new generation of mobile. 5G will be a new kind of network, supporting a vast diversity of devices with unprecedented scale, speed and complexity… 5G will have an impact similar to the introduction of electricity or the automobile, affecting entire economies and benefiting entire societies.

In an economic study commissioned by Qualcomm, it is now predicted that the 5G value chain will generate up to $3.5 trillion in annual revenue by 2035 and support up to 22 million jobs.

January 2017 Issue

8

TechnologyOpportunity

&

Jointly, the study forecasts up to $12 trillion in goods and services enabled by 5G could be produced by the same year.

5G standards aren’t expected to be set until 2018, but there are already opportunities emerging as network providers begin to roll out this new tech. Expect us to keep you informed with related news and recommendations.

In the meantime, here are our two recommendations from CES this year:

CES Stock #1: Corning Inc. (NYSE: GLW)

Corning Inc. manufacturers high-quality ceramic and glass material for consumer and industrial applications. The company is well known for its incredibly durable Gorilla Glass product line, commonly found on the face of consumer devices such as smartphones and tablets.

Despite its near stranglehold on display in the consumer market, though, pigeonholing Corning simply as an iPhone and iPad supplier would be a big mistake. The company is actually very well diversified as a producer of various environmental materials, fiber-optic products, and other specialty materials.

From a pure value standpoint, Corning’s numbers are quite strong. Profit margins are robust at 11.3%, cash significantly outweighs debt, and price-to-earnings remains at just 12.7 versus a competitor average of 16.6.

What we like most about Corning, though, is its ability to present both trailing value and future growth. The company has a solid history of product innovation and continues heavy work in R&D. It’s a constant innovator and will continue to expand its product line in the coming years.

One particular area of interest is the automotive market. Corning first revealed back in 2015 that it wants to put Gorilla Glass into automobiles and began working with BMW to do so. Fast-forward to this year’s CES event, and Corning has officially launched its automotive product line, with glass specifically tailored to the auto market.

Showing off the potential of its glass, Corning prototyped an electric car equipped with a Gorilla Glass windshield, sun roof, rear window, dashboard, touchscreen steering wheel, and a separate control panel. Distracted by more technical demonstrations, we failed to get a picture of the vehicle, but as you will see on the next page, the booth was packed this year.

January 2017 Issue

9

TechnologyOpportunity

&

So why Corning’s Gorilla Automotive Glass? Well, to start, it’s thinner, lighter, and stronger than traditional automotive glass. This brings a range of benefits to auto-manufacturers, including lighter vehicles, thinner designs, debris-resistant windshields (Gorilla Glass Automotive is two times more resistant to sharp stone impact), and lower center of gravity.

Jointly, I was told by a company representative at CES that Corning’s Gorilla Glass offers better optical clarity and touch sensitivity, making it ideal for emerging technology features such as touchscreen faces and HUD (heads-up display).

Considering the quantity of material required to outfit a vehicle compared to a six-inch mobile device, breaking into the automotive market would be a major boon for Corning. In fact, it has the potential to more than double the addressable market for the company.

According to Business Insider, the total glass opportunity in the automotive market is 5.5 billion square feet. For LCD screens in consumer electronics devices, the total is 4 billion square feet.

Penetrating the automotive market will take time, and Forbes expects Corning to take another two to three years before making an impact, but given a three- to five-year time horizon, we’re incredibly confident in this stock.

Even with the automotive division yet to bring in sales, year-over-year revenue growth currently stands at 10.3%, which is an impressive feat considering $9.1 billion in annual revenue. Corning

January 2017 Issue

10

TechnologyOpportunity

&

also offers a 2.2% forward dividend yield, making it a reasonable income play as we wait for new market opportunities to develop.

We rate Corning Inc. (NYSE: GLW) a “Strong Buy” under $26.00. The risk level is “Low.”

CES Stock #2: TomTom NV (OTC: TMOAF)

I know, I know… This is a bit unusual, as we featured TomTom in our issue last month, but I wanted to reiterate the pick once again. After visiting the firm’s booth at CES earlier this month, I’ve become really excited about TomTom and figured it was worth stressing, plus sharing with those of you who haven’t had the chance to check out last month’s issue (we’re also moving the “Buy Under” a bit).

As you might already know, TomTom made its name in the automotive industry as a provider of standalone GPS mapping and navigation systems. The company also manufacturers GPS sports watches, action cameras, and telematics solutions. This is the current foundation of the company, but it is not why we’re interested...

TomTom is inarguably less a value play and more speculative growth than Corning. It operates on paper-thin profit margins (0.25%) and at a current P/E of 52.6. But thanks to recent developments in its mapping technology, TomTom is poised to become a major player in the autonomous driving arena, which may very well justify the current premium.

We also believe it is a prime acquisition target for automotive makers developing autonomous vehicles.

The company’s HAD (highly automated driving) solution provides a highly accurate and realistic representation of roadway profiles, including curvature and terrain information. In relatively simple terms, the company uses its HD Map and RoadDNA solutions to designate between cars, roads, pedestrians, etc. in real time.

Again, I had the chance to see the mapping up close and in person at CES and was incredibly impressed with the clarity and accuracy of it all.

According to TomTom, HAD is the most disruptive change in the automotive industry since the invention of the car. With it, a vehicle can correlate the company’s proprietary “data” with data obtained by its own sensors. And by doing this correlation in real time, the vehicle knows exactly where it is located on the road, even while traveling at high speeds.

January 2017 Issue

11

TechnologyOpportunity

&

If we’re to trust management, the growth prospects for TomTom right now are incredibly strong. The company expects its Telematics, Automotive, and Licensing businesses to grow at a CAGR of around 15% between 2016 and 2020. In speaking with representatives at CES, 80% of the automotive industry is currently considering its mapping for autonomous applications.

TomTom trades as an ADR at a market cap of $1.95 billion on revenue of $1.115 billion and net income of $42.4 million. This puts the firm at a reasonable price-to-sales ratio of 1.8 but, again, a less desirable price-to-earnings ratio of 52.6.

As a final note, the float for TomTom remains quite low, so the stock is thinly traded. If you’re looking to build a position you will likely have to do so over time.

We rate TomTom NV (OTC: TMOAF) a “Buy” under $9.50. The risk level is “Medium-High.”

Portfolio Snapshot and Updates

ABB Ltd. (NYSE: ABB)

Snapshot:

ABB Group is a multinational industrial automation corporation headquartered in Zürich, Switzerland. The company operates primarily in robotics and power/automation technologies. It ranks as a top 200 Forbes company and is one of the largest engineering firms in the world, with over 135,000 employees, operations in ~100 countries, and annual revenue over $35 billion.

ABB is a company focused on keeping up with technological innovation. A diversified global powerhouse, the firm is found at the center of current developments in fields such as (but not limited to) clean energy, smart grids, microgrids (localized, independent grids), robotics, industrial asset effectiveness, and sustainable transport.

Updates:

ABB has been on a roll since December, earning upgrades from Bank of America/Merrill Lynch, Baird, and Morgan Stanley. While we tend to not put much weight on institutional ratings, the positive price action that has coincided is more than welcome.

ABB has jointly secured a $100 million U.S. order from the Los Angeles Department of Water

January 2017 Issue

12

TechnologyOpportunity

&

and Power (LADWP) to modernize an aging power converter, on top of a $640 million project with India’s national electric grid operator to build the country’s longest power transmission link.

All told, these projects are relatively small compared to ABB’s top line, but they hint at continued benefit from ABB’s power transmission projects and ongoing infrastructure maintenance.

We rate ABB Ltd. (NYSE: ABB) a “Hold.” The risk level is “Low.”

Amazon Inc. (NASDAQ: AMZN)

Snapshot:

Amazon is an American e-commerce and cloud computing company. It is the largest Internet-based retailer in the United States and the world’s largest provider of cloud infrastructure services. The company also produces consumer electronics and sells digital media content.

Updates:

Amazon continues its expansion efforts, announcing last week it will be adding “more than 100,000 new, full-time, full-benefit jobs” in the U.S. over the next year and a half, notably at its fulfillment centers.

Jointly, Amazon made waves the Consumer Electronics Show in Las Vegas this month with its digital personal assistant Alexa. Alexa will be integrated into a slew of new devices, many of which are listed in the body of this issue above.

To restate, developers have so far created 7,000 distinct “skills,” or commands, for Alexa-integrated devices. That’s more than double the number of skills Alexa had in September, and seven times the number of skills it had in June of 2016.

Amazon is, right now, dominating the AI space, as well as e-commerce. We’re up ~56% on the position since February of last year and plan to hold for a while longer.

We rate Amazon (NASDAQ: AMZN) a “Hold.” The risk level is “Low.”

January 2017 Issue

13

TechnologyOpportunity

&

***Brooks Automation (NASDAQ: BRKS)

Snapshot:

Brooks Automation is a uniquely positioned robotics stock, as it allows us to play both consumer technology and biotech at the same time. The firm is headquartered in Chelmsford, MA, with direct operations in North America, Europe, and Asia.

Brooks provides both automation and cryogenic solutions for multiple markets including semiconductor manufacturing and life sciences. Its robots help companies automate the storage, retrieval, and testing of biologic samples so scientists don’t have to. This all is done to ensure consistency and help fight against accidental contamination or injury.

Updates:

Brooks hit a nine-year high in late December and has received an upgrade from Credit Suisse earlier this month. Aside from that, there’s no news for the robotics company this issue. We will, however, be adjusting the firm to a “Hold,” as it has surpassed our previous “Buy Under” price.

We’re currently up ~8.2% on the stock. I recommend instituting a stop-loss if you wish to protect your gains.

We rate Brooks Automation (NASDAQ: BRKS) a “Hold.” The risk level is “Medium.”

Editas Medicine (NASDAQ: EDIT)

Snapshot:

Editas Medicine is a genetic engineering company that originally spawned from five scientific founders considered world leaders in the fields of genome editing with specific expertise in CRISPR/Cas9 and TALEN technology. The all-star group of academics includes Feng Zhang of MIT, George Church and J. Keith Joung of Harvard Medical School, David R. Liu of Howard Hughes Medical Institute, and Jennifer Doudna of Berkeley.

Updates:

I recommend anyone interested in Editas check out the company’s latest investor presentation that was given at the J.P. Morgan Healthcare Conference earlier this month. The slide deck can be found at Editas’ investor relations page here (under “Presentations”).

January 2017 Issue

14

TechnologyOpportunity

&

Inside, Editas lays out its 2016 accomplishments and 2017 goals. Notably, this year, we can look forward to Editas submitting an IND for its LCA10 program, and to initiate its LCA10 clinical history study mid-year. As a reminder, LCA is a genetic eye disease that leads to blindness, affecting about 1 in 80,000.

We rate Editas Medicine (NASDAQ: EDIT) a “Hold.” The risk level is “High.”

Fanuc Corporation (OTC: FANUY)

Snapshot:

Fanuc Corporation is a leader in industrial robotics, with a product lineup that includes factory automation systems, laser cutting, motion control, and compact motors. Fanuc serves a wide range of industries including aerospace, agriculture, construction, metal forming, and automotive manufacturing.

Updates:

No news or updates for Fanuc this issue.

Fanuc Corporation (OTC: FANUY) is a “Strong Buy” under $20.00. The risk level is “Low.”

Faro Technologies (NASDAQ: FARO)

Snapshot:

Faro Technologies (NASDAQ: FARO) designs, develops, and manufactures software-driven 3D measurement/imaging systems. Faro enables manufacturers to inspect components and assemblies, plan production, document large-volume spaces or structures in 3D, and, in turn, maximize efficiencies.

Faro’s products are used by manufacturers in quality control, scanning for errors. They are also useful for design and engineering with applications in 3D printing and reverse-engineering. Its imaging systems are even used in crime scene analysis and crash re-creation.

Faro’s measurement devices can examine and extract information from an object or part, ultimately enabling engineers to analyze each component of the object in great detail. Major clients include Boeing, BMW, KUKA, Airbus, Bosch, Audi, and Siemens.

January 2017 Issue

15

TechnologyOpportunity

&

Updates:

No news or updates for Faro this issue.

We rate Faro Technologies (NASDAQ: FARO) a “Buy” under $36.00. The risk level is “Medium-Low.”

Flex Inc. (NASDAQ: FLEX)

Snapshot:

Flextronics International (recently re-branded as Flex) provides customized electronics manufacturing services (EMS) to original equipment manufacturers (OEMs) in the electronics industry. The company also supports supply chain efforts through services packaging, transportation, design, maintenance, repairs, etc.

Over the years, Flex has developed a long customer list of recognizable OEMs including Cisco Systems, Dell, Eastman Kodak Company, Ericsson Telephone Company, Hewlett-Packard, Kyocera, Microsoft, Motorola, Nortel Networks, Sony-Ericsson, and Xerox.

Updates:

No new updates for Flex this month, but the company will report third-quarter fiscal 2017 results on Thursday, January 26, and hold a conference call after marker close. A live webcast and recording of the call will be accessible at the firm’s investor relations website here.

As usual, keep an eye out next issue for our take on the call.

Flex Inc. (NASDAQ: FLEX) is a “Buy” under $13.50. The risk level is “Medium.”

***Himax Technologies, Inc. (NASDAQ: HIMX)

Snapshot:

Himax Technologies, Inc. is a fabless semiconductor company headquartered in Tainan City, Taiwan. The company seems to have intentions to infiltrate the world of virtual and augmented computing. Facebook uses its video processing chips for the Oculus Rift, while Microsoft and Google use its near-field displays for the HoloLens and Project Aura (previously Google Glass).

January 2017 Issue

16

TechnologyOpportunity

&

Updates:

Himax continues to “correct” as analysts issue further downgrades, citing the exact same reason as before: Microsoft’s HoloLens is not shipping in high volumes.

Despite having known this for months (and having no reason to expect meaningful revenue from the development-stage HoloLens in the first place), investors keep letting these downgrades push them out of the stock, and that’s a shame.

If you take a look at trading action during these recent sell-offs, you’ll find something especially telling: huge spikes in volume following each downgrade. In other words, there are investors out there ready to buy shares in bulk on every dip. Could it be the smart money? I’ll leave it up to you to figure that out.

As we said last month, we’re not persuaded by institutional ratings, especially when Himax is now trading at an incredible value. I don’t mean to push the idea that this is a guarantee because there’s no such thing, but Himax is a screaming buy at these levels. For full disclosure, I picked up my own block of shares last week.

As counterintuitive as it may seem, this is not a selling opportunity for Himax longs — it is a buying opportunity, pure and simple. Our time horizon on Himax is not a short one — otherwise we would have sold when we were up +30% back in April of last year.

Conventional investing wisdom tells us to average down when companies we like go on sale, and that’s exactly what we’re going to do.

January 2017 Issue

17

TechnologyOpportunity

&

That said, we are doubling our position in Himax this issue at current (bargain-level) prices. At 2X weight, this puts us at an average entry price of $7.12.

Himax (NASDAQ: HIMX) is a “Buy” under $10.00. The risk level is “Medium.”

Intellia Therapeutics (NASDAQ: NTLA)

Snapshot:

Intellia is a genetic engineering firm that uses CRISPR technologies licensed from Jennifer Doudna, who serves as a scientific advisor for the firm. Intellia represents a potential hedge against another one of our holdings, Editas Medicine, as the two companies are engaged in an important patent dispute over the groundbreaking precision genome editing tech.

Updates:

This month, Intellia has joined Genomics England as the first dedicated genome editing company to participate in its “100,000 Genomes Project,” which will sequence 1000,000 genomes of patients of England’s National Health Service (NHS). The project will be focused on patients with rare genetic diseases and cancer and will give Intellia access to critical genomics information, helping it to develop potential genome-editing treatments.

Intellia Therapeutics (NASDAQ: NTLA) is a “Buy” under $22.00. The risk level is “High.”

iRobot Corporation (NASDAQ: IRBT)

Snapshot:

iRobot is an American robotics company that serves the consumer, medical, enterprise, and military industries. iRobot’s product functions range from home cleaning to telecommunication to various military operations. iRobot currently generates the vast majority of its revenue from its Home Robotics division.

Updates:

No major news for iRobot this month, but I’d like to make a quick comment on recent price action. As it stands, we’re up 80% on the position since 2013, as the company is now trading near a five-year high. A ceiling is being tested at ~$60.20, and there’s a good chance we’re

January 2017 Issue

18

TechnologyOpportunity

&

going to see momentum stall.

iRobot has also lost some of its inherent value proposition, as share price has outpaced revenue growth. We’re going to continue our coverage on the company, but don’t be afraid to take that 80% gain off the table or put a stop-loss in to protect your gains.

iRobot (NASDAQ: IRBT) is a “Hold” at current prices. The risk level is “Medium.”

JinkoSolar (NYSE: JKS)

Snapshot:

JinkoSolar (NYSE: JKS) is a Chinese firm that makes a variety of photovoltaic (PV) products, including solar modules, solar cells, silicon ingots, and silicon wafers. The company operates internationally (69% outside of China) in two segments: manufacturing and solar projects.

Updates:

No news or updates for Jinko this issue.

JinkoSolar Holding Co. is a “Strong Buy” under $18.00. The risk level is “Medium.”

Oceaneering International, Inc. (NYSE: OII)

Snapshot:

Oceaneering International provides engineering services and hardware primarily to customers operating in marine environments. The company’s services are marketed to oil and gas companies as well as the aerospace and construction industries. The company receives the bulk of its revenue from ROVs and Subsea Products.

Updates:

No news or updates for Oceaneering this month, aside from an announcement of the fourth-quarter and full-year 2016 earnings, expected on Wednesday, February 8. The firm will hold a conference call and webcast at 10:00 a.m. CST. Materials will be available at Oceaneering’s investor relations page here.

Oceaneering International is a “Hold” at current levels. The risk level is “Medium.”

January 2017 Issue

19

TechnologyOpportunity

&

Opko Health, Inc. (NYSE: OPK)

Snapshot:

Opko Health is a mid-stage biotechnology development and medical diagnostics company. OPK has a deep drug candidate pipeline spanning from kidney disease to cancer treatments. It also provides a revolutionary diagnostic test known as the 4Kscore, used in prostate cancer screening. The company’s proprietary diagnostic technologies allow doctors to keep blood-based tests in house rather than outsourcing to outside laboratories.

Updates:

OPKO’s long-acting growth hormone deficiency therapy hGH-CTP (in partnership with Pfizer) missed its primary Phase 3 endpoint late last month, sending shares down quite sharply on the announcement. The drug was supposed to show a change in torso fat mass versus a placebo but failed to do so.

Executive vice president Steve Rubin commented OPKO would be able to resubmit positive results to the FDA without having to redo the trial. Specifically, OPKO believes one or more outliers may have influenced the primary outcome of the study. The company “is undertaking further review of the study population as promptly as possible.”

We’ll have to wait a little longer to see how this turns out, but in any case, the sell-off seems overdone. Now would be a good time to pick up shares if you’ve been waiting for an opportunity to get into OPKO.

Opko Health, Inc. (NYSE: OPK) is a “Buy” under at $10.00. The risk level is “Medium.”

Parker-Hannifin Corp (NYSE: PH)

Snapshot:

Parker-Hannifin is an American manufacturer specializing in motion and control technologies, which allow customers to move and position materials, machines, and equipment during manufacturing. In brief, the company serves customers by helping them maximize their automation processes — from manufacturing to waste disposal.

Parker is well diversified on the global front, with slightly more than half of its revenue coming from 45 countries overseas. Approximately 73% of sales come from Parker’s Industrials segment, 18% from Aerospace, and 8% from Climate and Industrial Control.

January 2017 Issue

20

TechnologyOpportunity

&

Updates:

No news or updates for Parker this issue, but we’re currently up ~30% on the position since July of last year. The company is still fairly priced, but it’s not the value play we once saw it as, and it has settled above our “Buy Under” price. We’re reducing to a hold.

Parker-Hannifin Corp (NYSE: PH) is a “Hold” at current levels.

Rockwell Automation (NYSE: ROK)

Snapshot:

Rockwell is an American provider of industrial automation solutions and equipment. This includes various power, control, and information systems that fall under two segments, Architecture/Software and Control Products/Solution, which work out close to a 50/50 split.

Headquartered in Milwaukee, Wisconsin, Rockwell is a Fortune 500 company that employs over 22,000 people and serves customers in more than 80 countries. Its top brands include Allen-Bradley and Rockwell Software.

Updates:

No news for Rockwell this month, but the company is scheduled to report fiscal 2017 first-quarter results on Wednesday, January 25, before market open. The release and subsequent conference will be made available on the Rockwell Automation IR page here.

Keep an eye out for our take next issue.

Rockwell Automation Inc. (NYSE: ROK) is a “Buy” under $125. The risk level is “Medium.”

Spectra7 Microsystems. (OTC: SPVNF) (TSX: SEV)

Snapshot:

Spectra7 manufactures semiconductor devices for consumer electronics manufacturers. The stock is a speculative play on dedicated VR hardware, as its components were recently found in a teardown of Facebook’s Oculus Rift headset. Specifically, Mackie Research Capital has found two of Spectra’s “VR 7050” chips (bi-directional low latency data) in the USB & headset

January 2017 Issue

21

TechnologyOpportunity

&

connector and its “VR 7100” chip (high-speed video) in the headset connector.

Updates:

Spectra7 has been on a roll since our last issue, climbing ~56% over the last month. The company got some extra attention after presenting at CES earlier this month and announced preliminary fourth-quarter results that confirm our original growth thesis (admittedly later than expected).

Spectra7 expects to report fourth-quarter revenues of approximately $2.5 million, representing an increase of 135% sequentially and 58% year over year. The company expects to report revenues of approximately $8.6 million for the full year, representing an increase of 104% over last.

Gross margin as a percentage of revenue is expected to be approximately 59–61% compared to 55% last quarter and 46% last year. Barring any negative news, this month’s rally should continue through the first quarter. We’re going to raise our “Buy Under” to $0.50.

Spectra7 Microsystems is a “Buy” under $0.50. The risk level is “High.”

Telit Communications (OTC: TTCNF)

Snapshot:

Telit Communications specializes in M2M, or machine-to-machine, technology, enabling machines to communicate with each other. By leveraging its M2M capabilities, Telit has been heavily involved in the development of driverless cars, with six sales offices dedicated to the market in the U.S., Germany, Japan, China, and Korea. The firm sells directly to both carmakers and their suppliers.

Specifically, Telit markets several families of intelligent automotive modules offering up to 150 Mbps download and 50 Mbps upload speeds. These modules come in both cellular (long-range) and short-range variants.

Telit’s rugged, all-weather computer chips allow vehicles to perform a long list of tasks, from downloading firmware updates and uploading information from sensor feeds to mining consumer data and running complex applications. Basically, Telit can provide OEMs and suppliers the brains of a driverless car.

January 2017 Issue

22

TechnologyOpportunity

&

Updates:

No news or updates this issue.

We rate Telit Communications (OTC: TTCNF) a “Buy” under $3.50. The risk level is “Medium-Low.”

Teradyne (NYSE: TER)

Snapshot:

Teradyne has historically been a developer and supplier of automatic test equipment (ATE), but it recently purchased a company by the name of Universal Robotics, the world leader in customizable collaborative robots.

With an intuitive interface (no programming experience needed) and an estimated return on investment of just three to eight months, UR robots are a no-brainer for U.S. factories seeking to gain an edge. A UR robot can automate virtually anything, from assembly to painting to labeling to injection molding.

Teradyne offers a full line, with its UR3, UR5, and UR10 robotic arms. The robots are easy to program and set up and are flexible for redeployment.

High-profile customers include Samsung, Qualcomm, Intel, Analog Devices, Texas Instruments, and IBM.

Updates:

No news or updates this issue.

We rate Teradyne (NYSE: TER) a “Buy” under $25.00. The risk level is “Medium.”

TomTom NV (OTC: TMOAF)

Snapshot:

TomTom NV is a Dutch company that produces traffic, navigation, and mapping products. The company also makes action cameras, GPS sport watches, fleet management systems, and location-based products. TomTom’s business consists of four business units: Consumer,

January 2017 Issue

23

TechnologyOpportunity

&

Automotive, Licensing, and Telematics, through which it sells and licenses its technology and products.

Updates:

No news or updates this issue. See secondary recommendation with additional comments from CES in body above.

We rate TomTom (OTC: TMOAF) a “Buy” under $9.50. The risk level is “Medium-High.”

Technology and Opportunity Copyright © 2017, 111 Market Place, Suite 720, Baltimore, MD 21202. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. While we believe the sources of information to be reliable, we in no way represent or guarantee the accuracy of the statements made herein. Technology and Opportunity does not provide individual investment

counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Neither the publisher nor the editors are registered investment advisors. Subscribers should not view this publication as offering personalized

legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.

23