Technicals of KSE

-

Upload

saad-rehman -

Category

Documents

-

view

216 -

download

0

Transcript of Technicals of KSE

-

8/12/2019 Technicals of KSE

1/1

Highest

KSE100 24450 24560 24680 24800.69 24910 25025 25150 SS/UP 75.6 24866.08

AHCL 21.6 22 22.3 22.7 23 23.4 23.8 SS/UP 70 201.4

AICL 95.9 97.6 99.2 100.85 102.5 104.1 105.8 SS/UP 67.2 421.9

AKBL 13 13.4 13.7 13.98 14.3 14.6 14.9 SS/UP 69.9 106.2

ANL 5.2 5.5 5.8 6.15 6.5 6.8 7.1 SS/UP 66.4 98

ATRL 202.4 206 209.2 212.96 216.4 220 223.5 BD 62.3 315.9

BAFL 24.1 24.4 24.9 25.31 25.7 26.1 26.5 BD 62.2 66.1

BERG 58.4 59.3 60.5 61.46 62.4 63.2 64.5 SS/UP 82 92.55

BOP 9.3 9.7 10 10.26 10.6 10.9 11.2 BD 40.6 107.55

BYCO 7.5 7.8 8.1 8.47 8.8 9.1 9.4 BD 50.5 22.1

DAWH 52 52.9 53.7 54.69 55.6 56.5 57.4 BD 52.1 64.85

DGKC 74.1 75.4 76.8 77.93 79.2 80.6 81.8 SS/UP 75.4 121.65

EFOODS 89.4 91 92.6 94.06 95.4 97 98.7 BD 56.9 163.45

ENGRO 147.9 150.3 153 155.6 158.1 160.7 163.3 SS/UP 64.1 376.1

FATIMA 27.4 27.8 28.3 28.81 29.3 29.8 30.2 SS/UP 69.9 28.23

FCCL 13.1 13.4 13.8 14.02 14.4 14.7 15 SS/UP 71.1 17.19

FFBL 40 40.7 41.3 41.98 42.7 43.3 44 SS/UP 72.8 64.3

FFC 106.8 108.6 110.4 112.34 114.1 116 117.9 SS/UP 74.1 200.4

GLAXO 129.6 132 134.3 136.41 138.6 140.9 143.2 BD 62.3 152.12

HUBC 58.2 59.1 60.3 61.21 62.3 63.1 64.2 SW 45.3 74.58

JSCL 7.9 8.2 8.5 8.82 9.2 9.5 9.8 BD 51.7 1370

KAPCO 58.5 59.4 60.6 61.5 62.3 63.4 64.5 SW 54.4 69

LOTCHEM 6.1 6.4 6.7 7.03 7.4 7.7 8 BD 60.9 17.36

LUCK 268.2 273 277.8 282.12 286.8 291.5 296.2 SS/UP 70.8 285.76

MCB 272.3 276.9 281.7 286.62 291.3 296.2 300.9 BD 58.7 494.8

MLCF 25.1 25.5 25.9 26.33 26.8 27.2 27.6 SS/UP 69.5 33

NBP 51.8 52.6 53.5 54.43 55.4 56.3 57.1 BD 55.1 274.75

NETSOL 41.4 42 42.8 43.5 44.2 44.9 45.6 BD 56.2 59.51

NML 110.2 112 113.9 115.92 118 119.9 121.7 SS/UP 75.4 135.9

OGDC 266.5 271 275.8 280.15 284.5 289.3 294 SS/UP 74.9 284

PAEL 18 18.4 18.7 18.96 19.3 19.6 19.9 SS/UP 65.6 28.95

PAKRI 25.8 26.2 26.6 27.07 27.5 27.9 28.4 BD 57.5 774.95

POL 470.5 479 487.3 495.24 502.8 511.5 520 SS/UP 68.9 536.99

PPL 203.9 207 210.4 213.94 217.4 221 224.6 BD 62.7 281.65

PSO 306.6 311.5 317.7 322.66 327.2 332.9 338.7 SS/UP 67 544.9

PTC 28.9 29.3 29.8 30.34 30.8 31.3 31.8 SS/UP 66.7 50.9

SEARL 100.2 101.8 103.6 105.43 107.2 109 110.7 SS/UP 65.1 100.25

SNGP 21 21.4 21.7 22.04 22.4 22.8 23.1 BD 58.9 39.4

SSGC 23.7 24.1 24.5 24.86 25.3 25.7 26.1 BD 59.1 30.7

UBL 124.7 127 129.2 131.2 133.4 135.6 137.7 BD 53.4 223.2

SASML 06-Dec Company Book Closure EPS Payout

KOHS 09-Dec MCB 6 Dec - 13 Dec . r

35% D

AGL 10-Dec NCPL 12 Dec - 18 Dec . st

15% D

HAJT 10-Dec AICL 12 Dec - 18 Dec ***** .

% B

REST 10-Dec OGDC 13 Dec - 20 Dec 7.81 1st Q 20% D

SBL 11-Dec FFBL 13 Dec - 19 Dec 3.53 3rd Q 10% D

SIEM 13-Dec NPL 14 Dec - 21 Dec 1.53 1st Q 10% D

Technical Talk @ HORIZON by Shehzad Saeed

2008-2013Lowest

4781.78

Company Support Level 3 Support Level 2 Support Level 1 Yesterdaysclosing

Resistance Level 1

17.55

41.6

8.5

2.75

38.91

7.32

10.07

4.6

3.55

26.25

12.04

20.6

81.05

9.02

2.9

12.3

54.3

61

12.38

3.9

25.09

1.15

25.26

75

1.51

34.86

8.01

21.12

40.65

3.06

12.43

78

98.5

92.1

9.85

40

15.25

10.26

27.92

Abbreviations

This report has been prepared by Shehzad Saeed of Horizon Securities Ltd. & is provided for information purposes only. Under no

circumstances is to be used or considered as an offer to sell or solicitation of any offer to buy. While all reasonable care has been taken

to ensure that information contained therein is not untrue or misleading at the time of publication, we make no representation as to its

accuracy or completeness & it should not be relied upon as such. From time to time Horizon Securities Ltd & any of its officers or

directors may, to the extent permitted by law, have a position, or otherwise be interested in any transaction, in any securities directly or

indirectly subject of this report. This report is provided solely for information of professional advisers who are expected to make their

own investment decisions without undue reliance on this report & company accepts no responsibility whatsoever for any direct or

indirect consequential loss arising from any use of this report or its contents.

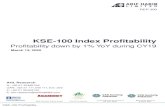

Yesterday, stocks remained in bullish sentiments owing to news about introducing two KSEs funds in New York stockexchange. During the day, market opened on positive note & kept on going upwards on support of Institutional & foreign

interest as hopes for stability in rupee value against the dollar and expected government initiatives on privatisation ofstate-owned enterprises triggered buying across-the-board. KSE100 index went up by 420.7 points, creating new high at24866.08, breaking previous highest ever level 24750.82 & closed in bullish sentiments with a net gain of 355.31 points at

24800.69 that also are the highest ever closing breaking 24588.47. KSE All share index went up by 334.81 points at 18469.19& closed with a net gain of 280.93 points at 18415.31. KSE30 index went up by 289.93 points at 18673.91 & closed with a net

gain of 230.53 points at 18614.51. KMI30 index went up by 710.68 points at 41715.75 & closed with a net gain of 619.77points at 44624.84. The volume fell to 210.59 million shares as against 227.49 million shares. The price of 232 stocks closed

after gains, 110 suffered losses and 23 remained unchanged.

Resistance Level 2 Resistance Level 3 Trend Daily RSI

DN > Downward trend. UP > Upward trend. RE > Recovery Expected. DE > Dip Expected. SS > Sell on Strength. BD > Buy on Dip. SW > Sideways SS+BD. WS > Wait & See policy. RSI > Relative Strength

Index RSI Range 0-100 Overbought If value is above 80 Neutral if value around 50, Oversold if is value around 20 www.horizonpak.com

For more Information and suggestion feel free to call or email to Mr.Shehzad Saeed 0300-4456783. To subscribe free daily technical analysis report email [email protected]

Disclaimer Board Meetings Announcements

Friday 6 Dec 2013