td a a L r e P t 8 - Port Taranaki | the west gate · Maersk 4100 container vessels as well as...

Transcript of td a a L r e P t 8 - Port Taranaki | the west gate · Maersk 4100 container vessels as well as...

Port taranaki Limited annuaL rePort 2008

Port taranaki Limited annuaL rePort 2008

Directors

John Young JP, Chairman

John Auld, Deputy Chairman

Neil Leuthart

David MacLeod

Craig Norgate

David Walter QSO, JP

Peter Horton (appointed 12 December 2007)

Company Secretary

Bronwyn Clement

Executive Officers

Roy Weaver, Chief Executive

Ray Barlow, Operations Manager

Bronwyn Clement, Corporate Support Manager

Jon Hacon, Business Development Manager

Noel Henderson, Human Resource Manager

David Sharman, Chief Financial Officer

Auditors

Deloitte on behalf of the Auditor-General

Bankers

Bank of New Zealand Limited

Westpac Banking Corporation

Solicitors

Govett Quilliam

Contact Details

Breakwater Road

PO Box 348

New Plymouth 4340

New Zealand

Telephone: 64 6 751 0200

Facsimile: 64 6 751 0886

Website: www.porttaranaki.co.nz

Email: [email protected]

“PROVIDING SUBSTANCE TO TARANAKI’S ECONOMY BY OPERATING A SUCCESSFUL AND SUSTAINABLE BUSINESS”

MISSION STATEMENT OF PORT TARANAKI LIMITED

Highlights� 2

2007/2008�Review� 3-8

Statutory�Information� 9

Environmental�Report� 10-11

Social�Report� 12-13

Financial�Statements� 14-38

Report�of�the��Auditor-General� 39

Comparative�Review� 41

rePort 2008 Port taranaki Limited and GrouP

1

rePort 2008 Port taranaki Limited and GrouP

2008 2007

Revenue($m) 42.79 36.95

Profitbeforeinterestandtaxation($m) 11.28 8.96

Netprofitaftertaxation($m) 4.76 4.78

Totalshareholder’sequity($m) 89.26 71.56

Interestbearingdebt($m) 35.30 37.30

Shareholder’sequitytototalassetsratio 67.97% 62.30%

Netprofitbeforetaxtoequityratio 8.97% 10.41%

Interestbearingdebttoequityratio 39.55% 52.12%

Totaldividends($m) 1.80 1.00

Dividendspershare(¢pershare) 3.46 1.92

Numberofemployeesatperiodend 122 116

Totaltrade(millionsoffreighttonnes) 3.38 3.28

Vesselarrivals(over100GRT) 927 897

Totalgrossregisteredtonnage(GRT)(millions) 7.2 7.06

BerthOccupancy:

Generalberths 50% 40%

Tankerterminalberths 19% 18%

Serviceberths 34% 35%

2

HIGHLIGHTS

rePort 2008 Port taranaki Limited and GrouP

We are pleased to present this twentieth annual report on the affairs of Port Taranaki Limited to 30 June 2008.

3

2007/2008 REVIEW

FINANCIAL PERFORMANCERevenue from operations increased 15.79% from $36.92M in 2007 to $42.75M in 2008. This increase was primarily derived from higher berth, land, and plant and equipment utilisation associated with offshore oil and gas exploration and development activity together with a lift in bulk liquid volumes.

Notwithstanding the higher operating revenue, net profit after tax was flat at $4.76M in 2008 contrasted with the 2007 figure of $4.78M. This was due to a combination of higher operating expenditure and expenditure write-offs associated with the Pike River coal project.

Net profit after tax represented a 5.33% return on shareholder’s equity of $89.26M. The shareholder’s equity to total assets ratio has continued to improve to a strong 67.97%.

Cashflows from operations amounted to $9.21M in 2008 which enabled the repayment of $2.0M of debt, capital expenditure of $5.94M, and the payment of two fully imputed dividends to the Shareholder amounting to $1.8M (up from $1.0M in 2007).

TRADING ENVIRONMENTThe upturn in total cargo volumes since 2006 continued into 2008. Volumes grew again by increased activity principally in the energy sector.

Crude oils and condensates from Taranaki’s new fields boosted total bulk liquid volumes shipped from 2.08 million tonnes in 2007 to 2.24 million tonnes last year. The past two years have shown year-on-year growth in bulk liquid trades, a trend that

is expected to continue in the short term.

LPGs continued to decline, as predicted, on a diminishing Maui field. LPG volumes are expected to begin to grow again when the Kupe field is commissioned in 2009.

Major trade variances in petrochemicals were:

• Crude oils, up 8% • LPGs, down 20% • Petrol and Fuel Oil, up 20% • Bitumen, down 45%

Drought in the first half of the trading year had a major negative impact on fertiliser volumes. Fertiliser trades fell away to 2006 levels, however, bulk trades were lifted by record imports of animal feeds, principally grains and palm kernel.

The logging industry continued to be hard hit by high bulk shipping costs. Log volumes fell for the second year running but a turnaround is expected during the current year with a switch to containerisation of logs.

Major trade variances in dry bulk trades were:

• Fertilisers, down 39% • Animal Feeds, up 66% • Logs, down 22%

TOTAL TRADE VOLUMES 2004-2008

4,000

3,500

3,000

2,500

2,000

1,500

1,000

500

0

(000

s ton

nes)

2004 2005 2006 2007 2008

BULK LIQUIDS 2004-2008

3,000

2,500

2,000

1,500

1,000

500

0

(000

s ton

nes)

2004 2005 2006 2007 2008

CONTAINER VOLUMES PORT TARANAKI

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

TEU

2001 2002 2003 2004 2005 2006 2007 2008

rePort 2008 Port taranaki Limited and GrouP

104

The port posted a new record in containers with 59,586 TEU handled during the year.

Hamburg Süd commenced calls at the port with its ANZL direct service into North Asia in October adding to the existing services of Maersk’s Southern Star Express service (linking onto their OC1 and NZ1 main services) and Tasman Orient Line’s South-East Asia and East Asia services. Hapag Lloyd also commenced services at the port with slot shares on the Hamburg Süd vessels.

The port’s strategic positioning and its ability to economically deepen are attributes that will offer sustainable supply chain solutions to customers in an energy constrained future. The resurgence of coastal shipping and rail is of particular importance to New Zealand’s trading logistics and the port looks forward to continue to promote the most appropriate modes with supply chain partners and stakeholders.

Our thanks, once again, go to our customers for their support and for a successful 2007/2008 year.

OPERATIONSThe year has been dominated by supporting offshore construction activities with the port providing extensive facilities and logistical support for the Pohokura, Kupe, and Maari field developments.

The Tui field commenced operations and has had a stellar start

with production running 40% ahead of original predictions. The port’s tug Rupe has attended fifty offtake tanker connections to the FPSO Umuroa in the year for Australian Worldwide Exploration New Zealand (AWE).

Pohokura development drilling was completed in May and the field is now in full production with condensate being shipped through Newton King Tanker Terminal.

Kupe field construction and development drilling were also completed in May with the construction of the onshore production station continuing and first oil and gas due in mid 2009. Most of the equipment for the production station has been either built in Taranaki or imported through Port Taranaki.

Maari field construction started late in the year with the installation of the wellhead platform and the FPSO Raroa. Heavy equipment was stored on Breakwater 2 berth. This demonstrates the foresight of previous Boards in constructing the berth to high load standards ideal for such an operation and providing cost savings with users not having to transport the loads offsite for storage or have a heavy lift vessel standing by for months. Drilling of the production wells is expected to last through to mid 2009.

Six exploration wells have also been completed during the year for OMV, Origin, Pogo, and AWE.

The port invested in major upgrades of its Dynamic Underkeel Clearance (DUKC) system and environmental monitoring system, including the installation of a waverider buoy at the entrance to the newly dredged channel. These upgrades ensure that the best advantage is taken of the available depths and navigation is undertaken in the safest possible manner.

Pilots have undergone training on the port’s simulator model at the Devonport naval base to test the feasibility and

rePort 2008 Port taranaki Limited and GrouP

rePort 2008 Port taranaki Limited and GrouP

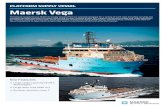

develop the techniques necessary for the safe handling of the Maersk 4100 container vessels as well as regular refreshers.

Two visits of the Maersk 4100 TEU vessels demonstrated the port’s ability to handle these large vessels. In November, the Maersk Duffield was the longest vessel at 281 LOA to visit the port.

Tug Kupe was purchased from Centreport to provide back up to the existing tugs when they are engaged in offshore activities.

Tug Tuakana assisted in the float off of the Ensco 107 rig at Admiralty Bay, the installation of the jacket and topsides in the Kupe field, and the installation of the FPSO Raroa in the Maari field during the year.

A contract was entered into with Q-West Boat Builders Limited, Wanganui, to provide a maintenance crew transfer launch to the Pohokura field for Shell Todd Oil Services Limited (STOS). Delivery of the “Rawinia” is expected in August and in the interim the pilot vessel Westgate provided the service.

The Newton King Tanker Terminal (NKTT) has seen the biggest loadings of petrochemicals, particularly methanol, with customers taking advantages of scale afforded by the port’s new 12.5m draft. In April 2008, the ‘Cabo Negro’ had the largest methanol loading and largest cargo at 44,992 tonnes. She was also the deepest draft vessel at 12.13m to visit the port.

STOS replaced its loading arm with a new one incorporating

the latest safety devices which will enhance the safety of oil transfer on the terminal.

An area of land was developed in Blyde Terminal to provide an additional 700 container slots. Extended hours instituted in the terminal to turnaround the new shuttle trains from Whareroa have shown great benefits to rail, Fonterra, and the port.

PROPERTYA long term lease with ABB Grain (NZ) Limited for 1.25 hectares on the Eastern Reclamation for a dry storage facility commenced on 1 December 2007. Construction of the store is scheduled for completion in August 2008.

The remaining land on the Eastern Reclamation continued to be in demand with storage for project cargoes and the fabrication and storage of concrete mattresses for the Kupe pipeline.

In preparation for the construction of the new port offices all the company owned residential properties in lower Bayly Road were vacated by year end. The new port offices are scheduled for completion in the third quarter 2009.

Due to the demand for land in close proximity to the port the tenants at 91-99 Breakwater Road were given notice and the sites will be cleared by the end of 2008. With the adjoining site at 20/22 Pioneer Road this block will be available for future port related development.

5

2007/2008 REVIEW

6

An opportunity to lease the adjoining Contact Energy site and relocate the company’s workshops to the site has been pursued.

Demolition of the company’s existing workshops and administration building will provide additional laydown area close to quayside.

Due to the high level of offshore activity there was high demand for short term storage within the port area.

Work has commenced with New Plymouth District Council on development of a structure plan for the port area.

Positive results relating to the public good aspect of the

Eastern Harbour Development project, incorporating a marina, were obtained from Taranaki wide surveys and focus groups commissioned by Venture Taranaki Trust.

Community, cultural, educational, social, and sporting activities at the recreational areas continued to be popular. Areas of concern continue to be the lack of public carparking and amenities, safety and noise issues due to commercial and recreational traffic using Oceanview Parade, and the standard of the walkway between Pioneer Park and the Lee Breakwater. The extension of Belt Road, as an alternative route to the Lee Breakwater, has been promoted.

rePort 2008 Port taranaki Limited and GrouP

rePort 2008 Port taranaki Limited and GrouP

7

2007/2008 REVIEW

PERSONNELIt has been a very busy year for everyone. Thank you to all staff for the way in which challenges have been met. To continue to provide first class services on a 24/7 basis is a challenge at any time but to do so in all weather and, in many cases, within applicable time constraints, is a credit to all. Continual vigilance is required to ensure that safe work practices are always followed. Staff can be proud of their 2007/2008 achievements.

If there is one aspect of the work undertaken that deserves special mention, it is safety. Safety is the cornerstone to all our activities and it is therefore paramount that it is part of our culture. The efforts of our Health and Safety Co-ordinator in using positive messages to enhance a safe working environment is delivering the desired results but this is an area where one can never become complacent.

The past twelve months has been another year with a high level of activity associated with the offshore oil and gas

industry. The flexibility of staff to work in other disciplines has been essential to enable the company to provide the services required by that industry on an as and when required basis.

After almost six years our weekly newsletter continues to be very popular and remains, to a large degree, the major communication channel within the port.

The Chief Executive held a “State of the Nation” meeting in September to update all staff of the company’s performance, future developments, and other topics of interest. With just over 40% of our staff subject to shift work and 70% of these without handovers, communications is an ongoing challenge and one that we are constantly working to improve.

2007/2008 saw five employees attain National Certificates in Cargo Handling, three employees attain National Certificates in Cargo Operations with the Supervision Strand, and one employee, Amanda Gunn, attain her National Certificate in Cargo Operations with the Planning Strand. Amanda became the first female in the Ports and Stevedoring Industry in

Fromlefttoright:Back–NeilLeuthart,DavidMacLeod,PeterHorton,andDavidWalter.Front–JohnAuld(DeputyChairman)andJohnYoung(Chairman).Insert–CraigNorgate.

BOARD OF DIRECTORS

rePort 2008 Port taranaki Limited and GrouP

JohnYoungChairman RoyWeaverChiefExecutive

8

New Zealand to achieve a national certificate in this field.

Staff numbers in 2008 increased from 116 fulltime permanent employees to 127 (including five vacancies in the process of being filled). The increase has been spread through the marine, cargo services, and works sections.

An additional pilot was engaged as part of a succession plan to cover for future movements and a marine operator for the coming into service of the “Rawinia” to service the Pohokura offshore production station. Five additional staff were engaged in cargo services to cover the growth in container throughput and to meet logistical requirements. An automotive diesel mechanic and an apprentice, plus a carpenter and a general hand have been engaged in the works section to meet the increased plant and equipment servicing requirements resulting from the additional activities.

Five of the company’s employees provided consultancy services/advice in the field of industrial relations, mooring systems, health and safety, marine accident investigation, and servicing requirements for the offshore oil and gas industry during 2007/2008.

GOVERNANCEAt the 2007 annual meeting, John Young and David Walter were re-elected directors of the company. Peter Horton joined the board from 12 December 2007. Seven board meetings and a two-day strategic planning workshop were held during the year.

As provided by section 42 of the company’s constitution, Neil Leuthart and David MacLeod retire by rotation at the upcoming twentieth annual meeting of the company.

The board’s audit committee comprising John Auld (Chairman), Neil Leuthart, David MacLeod, and Craig Norgate met three times during the year.

The board’s personnel committee comprised John Young (Chairman), David MacLeod, Craig Norgate, and David Walter. They met on two occasions.

OUTLOOK FOR 2008/2009The port has experienced a strong recovery in activity across the board in recent years despite the ongoing decline of the Maui field.

Exploration and development offshore in Taranaki is expected to continue, albeit, at a slower pace than recently experienced. Work developing Kupe and Maari will continue well into 2009.

Further offshore exploration is expected to take place in North Taranaki and at the Maui and Tui fields.

NKTT volumes are set to increase with additional product from both Pohokura and Kupe (2009) offsetting Maui’s decline. In addition, Methanex will double production with the recommissioning of their MOT2 plant, adding around 500,000 tonnes of cargo to export volumes.

Containers are the most volatile trade in the New Zealand ports’ scene today. Large trade swings have occured during 2007/2008 in a number of ports.

The influence of the world economy, New Zealand’s commodity exports, bunker fuel costs, carbon trading, steel prices, New Zealand’s distance from world markets, the buy-back of New Zealand Rail, and the re-emergence of coastal shipping all make the container trades a fertile area for innovation and new thinking. This will be an area of significant focus for the port in 2008/2009.

Opportunities continue to present themselves for the handling of bulk trades through the port. The recent decision by ABB Grain (NZ) Limited to hub their feed imports over two ports in the North Island, at Tauranga and Taranaki, is a milestone for the port. It comes on the back of a successful port deepening programme which has allowed vessels of panamax capability, up to 12.5 metre draft, to call at Port Taranaki.

Provision of marine services will continue to be a key to the port’s success. Contracts are in place with AWE to provide tug support to the Tui field and with STOS to provide a fast, new marine access craft for the Pohokura platform. These initiatives complement the port’s core pilotage and towage activities.

rePort 2008 Port taranaki Limited and GrouP

9

STATUTORY INFORMATIONComparison of Performance with Statement of Corporate Intent

As required under section 16 (4)(a) of the Port Companies Act 1998, a comparison of the performance targets in the Statement of Corporate Intent for the period 1 July 2007 to 30 June 2010 is shown below:

2008 Target Actual Achieved

Financial:Return(EBIT/ATA)onaveragetotalassets 5% 9% YesReturn(NPAT/ASF)onaverageshareholder’sfunds 4% 6% Yes

Non-financial:WharfUtilisation

Moturoa1and2 40-50% 53% YesNewtonKingTankerTerminal 20-30% 19% NoBlyde1and2 15-20% 48% YesBreakwater1and2 40-50% 40% Yes

DownturnsinmethanolandLPGarereflectedinthelowerwharfutilisationforNewtonKingTankerTerminal.

STATUTORY INFORMATION

ENVIRONMENTAL REPORT

10rePort 2008 Port taranaki Limited and GrouP

It is now five years since the company’s environmental policy was introduced in December 2002. This policy has served the port well and has been an integral part of the everyday life of the port’s employees, customers, and contractors. It has led to an increased awareness of the need to carry out all operations and developments with an eye on the environmental consequences.

In the next year the policy will be subject to a thorough review to ensure that it is relevant to the company’s operations and continues to be effective in delivering good environmental outcomes.

ENVIRONMENTAL POLICYPort Taranaki places a high value on the quality and long term sustainability of the environment in which it operates.

Accordingly, Port Taranaki gives a commitment to its stakeholders ensuring that its activities are conducted in a manner that

will avoid, remedy, or mitigate, to the most practical extent, any adverse effect on the environment.

Tomeetthisobjectivethecompanywill:

• Educate and train staff on the impacts of port operations on the environment.

• Ensure that responsibilities for environmental management are allocated to appropriate officers of the company.

• Develop and implement an Environmental Management Plan and associated Environmental Management System that will assist

the company to comply with relevant statutes and ensure that all operations have minimum practical adverse effect on the

environment.

• Ensure that in all development planning and activity, environmental considerations are given appropriate and careful

attention.

• Ensure that the company has plans and resources available for the handling of emergency response to environmental incidents.

• Monitor port activities in a systematic way to ensure compliance with statutory requirements and the objectives of the

company.

• Report on a regular and ongoing basis to the stakeholders in the business and the community at large.

• Ensure a process of continual improvement takes place through regular reviews of the company’s performance with regard to

environmental management.

The company recognises and asserts that its environmental performance is the responsibility of all its personnel and that they act in a

responsible manner to the continued betterment of the environment in which they work.

11

ENVIRONMENTAL REPORT

rePort 2008 Port taranaki Limited and GrouP

KEY PERFORMANCE INDICATORS(1) Non Compliance Notices for Port Taranaki’s Activities

The Port’s incident recording system logs all forms of incidents from all sources (including public complaints and incidents that occur on vessels and lessees’ property). This logging system provides information to monitor the activities within the port area and take follow up action to ensure the adverse effects of activities are minimised.

This year a total of twenty-four incidents of an environmental nature were recorded.

Eleven of these incidents were complaints from the port’s neighbours. Three related to dust from the Eastern Reclamation, three to port noise including construction noise from the grain store on the Eastern Reclamation, three to noise from the helicopter operation on the Eastern Reclamation, and two were of a general nature and related to plantings selection and the state of toilets at the Lee Breakwater.

Discharges to land included discharges on wharves or floating plant that did not result in contaminants entering the harbour waters. Of the eight in this category, two involved the spillage of small quantities (approximately 20–25 litres) of diesel by third parties, two involved the release of molasses, and the remaining four involved small quantities of petrol, rubbish, and a blocked storm water drain. None of these discharges resulted in significant environmental effects and clean up was readily achieved.

Of the three discharges to water only one was of significance. This was a discharge of diesel from a visiting tug while bunkering at Breakwater 1 berth. The matter was investigated and followed up by the Taranaki Regional Council.

During the hot, windy, drought conditions over summer and autumn, dust from the Eastern Reclamation resulted in the Port receiving an abatement notice. Action was immediately undertaken to contain the dust by the application of a dust suppressant and water trucks placed on standby.

(2) Ngamotu Beach Water Quality

The monitoring of Ngamotu Beach by the Taranaki Regional Council has produced the data below. The water quality has

been well inside the 2003 marine guidelines for contact usage with the exception of two events on 7 January and 28 February. These high level events were not persistent and are thought to be the result of a rain event just prior to the time of sampling. Follow up sampling revealed that normal low levels were quickly established.

The levels of the indicator pathogens were all low except as noted above when the levels rose and fell in the same manner as the Enterococci. (Enterococcus spp. has taken the place of faecal coliforms as the primary measure for water quality at public beaches. It is believed to provide a higher correlation than faecal coliform with many of the human pathogens often found in sewage). The low median values for all these indicators reflect acceptable water quality for recreational purposes.

(3) Marine Pollution Incidents and Accidents

There were no marine pollution incidents or accidents except as noted above.

OTHERAs in past years, there has been printer toner recycling through the Toner Recycle Centre.

Port Taranaki continued to sponsor the Department of Conservation’s “Seaweek”.

InCIdEnt�typE� InCIdEntS� InCIdEntS� non-�ComplIAnCE�� lASt�yEAR� tHIS�yEAR� notICES

dISCHARGE�to�lAnd� 6� 8� nonEdISCHARGE�to�wAtER� 4� 3� nonEdISCHARGE�to�AIR� 1� 5� onEnoISE�� 4� 6� nonEGEnERAl� � 2� nonETOTAL 15 24

NGAMOTU BEACH

Sampling Date

Ente

roco

cci (

nos/1

00 m

l)

12/11/07

26/11/07

4/12/07

20/12/07

7/01/08

14/01/08

28/01/08

7/02/08

28/02/08

11/03/08

10/04/08

1000

100

10

1

Action Level

Warning Level

PARAMETER UNIT NUMBER MINIMUM MAXIMUM MEDIAN OF SAMPLES

Conductivity @ 20°C mS/m 20 4540 4740 4680

E. Coli cfu/100 mls 20 1 230 8

Enterococci cfu/100 mls 20 1 350 5

Faecal Coliforms cfu/100 mls 20 1 250 8

Temperature °C 20 15.7 24.3 19.45

SOCIAL REPORT

12rePort 2008 Port taranaki Limited and GrouP

COMMUNITY• Paid dividend of $1,800,000 to shareholder, Taranaki

Regional Council.

• Sponsored $100,000 to Puke Ariki, Taranaki’s information and heritage centre, for the temporary exhibition of ‘A T.Rex Named Sue’ . This was the fourth and final payment.

• Sponsored Triathlon New Zealand $100,000 and the Taranaki Rugby Union $25,000.

• Continued sponsorship of “Westgate Rescue”, the Taranaki Volunteer Coastguard vessel.

• Continued to provide peppercorn lease rental charges to the New Plymouth District Council, the Department of Conservation, and the Taranaki Volunteer Coastguard.

• Continued discounted lease rental charges to community organisations.

• Provided and maintained access to public areas including the boat ramp, jetties and car/trailer parking at the Lee Breakwater for public enjoyment.

• Continued to provide lawn-mowing at Waitapu Cemetery, Bayly Road, for Waitapu Urupa Trustees.

• Sponsored Taranaki’s Surf Life Saving organisations, New

Plymouth Boardriders Club, New Plymouth Yacht Club (juniors and Taranaki Secondary Schools’ Sailing Team), Icebergs Swimming Club, Taranaki Multisport & Triathlon Club, Clifton Rowing Club on behalf of Sacred Heart Girls College and New Plymouth Boys’ High School for the New Zealand Secondary Schools’ Championship Regatta, Trans-Tasman Yacht race, Taranaki Young Peoples Trust for Spirit of New Zealand Sailing, New Zealand Family & Foster Care special children’s Big Splash party at the Aquatic Centre, and the Flannagan Cup Open Water Swim.

• Donated second hand computers to Sacred Heart Girls College.

• Continued to consult with the New Plymouth District Council and Ngati Te Whiti on the development and management of recreational areas in the vicinity of Ngamotu Beach (Port Areas of Mutual Interest) through the Ngamotu – Port Taranaki Liaison Group.

• Provided venue for the staging of the New Plymouth Triathlon festival in April, including the Weetbix Tryathlon and BG World triathlons, and other community activities.

• Conducted port tours and made presentations to various community groups.

To ensure the long-term sustainability of the business, Port Taranaki has continued to work with the community, its customers, and staff. Examples of activities during the year included:

SOCIAL REPORT

CUSTOMERS• Continued to provide forums for discussion on port - related

matters including environmental, health and safety, risk management, security, and transport through the Port Taranaki Safety Advisory Group, Port Taranaki Security Committee, the NKTT User’s Safety Group, and the Taranaki Transport Network.

• Published three issues of the Port Taranaki magazine, ‘PORTAL’, containing feature articles on customers.

• Held “We’re Deep” customer and staff function at Puke Ariki to celebrate the completion of the capital dredging project.

• Co-hosted Taranaki dinner for key petroleum industry customers at the New Zealand Petroleum conference.

• The Chief Executive continued as the chairman of Engineering Taranaki Consortium and a trustee of Venture Taranaki Economic Development Agency.

• The Operations Manager represented Port Companies on the Oil Pollution Advisory Committee to Government.

• Provided judge for Taranaki Chamber of Commerce Awards.

• Provided sponsorships and donations including:- Taranaki Chamber of Commerce, Wanganui Chamber of Commerce, Engineering Taranaki Apprenticeship Awards, CApENZ, Taranaki Federated Farmers Annual Conference, and Maersk golf tournament.

• Conducted port tours and made presentations to customers.

STAFF• Published the renamed weekly staff newsletter, “PortTalk”,

and the quarterly health and safety newsletter.

• Continued the availability of EAP Services Limited to staff and their families.

• Workplace support person visited all work areas on a weekly basis.

• Flu injections and hearing tests were offered to all staff.

• In-house courses on coping with stress and access to website “Sleepwell” and “Stressproofing” e-learning programmes for staff and their immediate family.

• Opportunities for staff to join group medical insurance schemes, a subsidised superannuation scheme and Kiwisaver, and the “Westpac Employee Pac”.

• Kiwisaver seminars and information sessions were offered to staff.

• Chief Executive continued as a trustee of the New Zealand Harbours Superannuation Plan.

• Social club organised a range of activities including mystery bus trip, black and white party, and kid’s Christmas party.

• Provided social club facilities including an onsite gymnasium.

• Continued summer vacation employment for tertiary students (children of current employees).

• One employee attended an Anakiwa Outward Bound course.

• Sponsored employee at World Triathlon Championships in Germany and an employee’s son on Spirit of New Zealand.

• Sponsored the Harry Blyde golf tournament.

• Sponsored staff as members of Moturoa Toastmaster’s Club.

13rePort 2008 Port taranaki Limited and GrouP

rePort 2008 Port taranaki Limited and GrouP

Income Statement

FORTHEYEARENDED30JUNE2008 PARENT&GROUP PARENT&GROUP 2008 2007 NOTE NZ$ NZ$

Revenuefromoperations 2 42,749,544 36,917,511

Operatingexpenses 2 (31,467,925) (27,952,648)

Operatingprofitbeforefinancingcosts 11,281,619 8,964,863

Interestrevenue 2 39,279 33,386

FinancingCosts 2 (3,312,010) (1,549,239)

ProfitBeforeTaxation 8,008,888 7,449,010

Taxation 3 (3,246,220) (2,672,342)

ProfitfortheYear 4,762,668 4,776,668

Earningspersharebasicanddiluted(centspershare) 6 9.16 9.19

Statement of Recognised Income and Expense

FORTHEYEARENDED30JUNE2008 PARENT&GROUP PARENT&GROUP 2008 2007 NZ$ NZ$

Gain/(Loss)onRevaluation 17 14,730,896 -

NetIncome/(expense)recogniseddirectlyinequity 14,730,896 -

ProfitfortheYear 4,762,668 4,776,668

TotalRecognisedRevenuesandExpensesfortheYear 19,493,564 4,776,668

Attributableto:

Equityholdersoftheparent: 19,493,564 4,776,668

19,493,564 4,776,668

Therearenoeffectsofchangesinaccountingpoliciestobedisclosedinthisstatement.

Theaccompanyingnotesformpartofthesefinancialstatements.

14

rePort 2008 Port taranaki Limited and GrouP

FINANCIAL STATEMENTSBalance Sheet

ASAT30JUNE2008 PARENT&GROUP PARENT&GROUP 2008 2007 NOTE NZ$ NZ$

CurrentAssets

Cashandcashequivalents 7 255,520 216,797

Tradeandotherreceivables 8 5,812,606 4,751,242

Inventories 9 159,141 135,934

Loan-Jebsens 10 48,336 -

6,275,603 5,103,973

NonCurrentAssets

Loan-Jebsens 10 - 586,825

Otherintangibleassets 12 162,916 201,455

Property,plantandequipment 11 123,604,872 108,469,731

Deferredtaxasset 5 1,274,584 501,923

125,042,372 109,759,934

TotalAssets 131,317,975 114,863,907

CurrentLiabilities

Tradeandotherpayables 13 3,590,785 3,041,224

Provisions 14 1,643,973 1,524,162

Borrowings 15 35,300,000 33,800,000

Taxationpayable 4 72,415 467,283

40,607,173 38,832,669

NonCurrentLiabilities

Borrowings 15 - 3,500,000

Provisions 14 1,454,000 968,000

1,454,000 4,468,000

Equity

Issuedcapital 16 26,000,000 26,000,000

Assetrevaluationreserve 17 36,611,833 21,880,937

Retainedearnings 18 26,644,969 23,682,301

89,256,802 71,563,238

TotalEquityandLiabilities 131,317,975 114,863,907

Theaccompanyingnotesformpartofthesefinancialstatements.

ForandonbehalfoftheBoard

Director Director

Dated26August2008

15

rePort 2008 Port taranaki Limited and GrouP

Statement of Cash Flows

FORTHEYEARENDED30JUNE2008 PARENT&GROUP PARENT&GROUP 2008 2007 NOTE NZ$ NZ$

CashFlowsFromOperatingActivities

Receiptsfromcustomers 46,828,774 41,245,477

Interestreceived 8,889 13,410

46,837,663 41,258,887

Paymentstosuppliersandemployees (29,964,586) (27,254,786)

Interestpaid (3,244,584) (1,545,721)

Incometaxpaid (4,413,749) (1,893,180)

(37,622,919) (30,693,687)

Netcashprovidedbyoperatingactivities 21 9,214,744 10,565,200

CashFlowsFromInvestingActivities

Saleofproperty,plantandequipmentandsoftware(netofdisposalcosts) 133 46,904

LoanrepaymentfromJebsens 566,830 -

566,963 46,904

LoantoJebsens - (624,985)

Purchaseofproperty,plantandequipmentandsoftware (5,942,984) (19,095,419)

Capitalisedinterestonpurchaseofproperty,plantandequipment - (1,107,578)

andsoftware

(5,942,984) (20,827,982)

Netcash(usedin)/providedbyinvestingactivities (5,376,021) (20,781,078)

CashFlowsFromFinancingActivities

Proceedsfromborrowings - 11,300,000

Repaymentofborrowings (2,000,000) -

Interimdividend (800,000) (500,000)

Finaldividend (1,000,000) (500,000)

Netcash(usedin)/providedbyfinancingactivities (3,800,000) 10,300,000

NetIncrease/(Decrease)inCashandCashEquivalents 38,723 84,122

CashandCashEquivalentsattheBeginningofYear 216,797 132,675

CashandCashEquivalentsattheEndofYear 7 255,520 216,797

Theaccompanyingnotesformpartofthesefinancialstatements.

16

rePort 2008 Port taranaki Limited and GrouP

17

STATEMENT OF ACCOUNTING POLICIESGENERALACCOUNTINGPOLICIES

Port Taranaki Limited (the “Company”) is a sea port company incorporated and domiciled in New Zealand.

The Company’s parent and sole shareholder is The Taranaki Regional Council.

The Company and its sole non-trading subsidiary Greyport Terminals Company Limited form the “Group”.

The financial statements for the Group were authorised for issue by the directors on 26 August 2008.

The principal activities of the port are described in Note 1.

StatementofCompliance

These are the financial statements of the Group presented in accordance with the Port Companies Act 1988 and the Companies Act 1993, prepared in accordance with the Financial Reporting Act 1993, and in accordance with New Zealand generally accepted accounting practice (NZ GAAP). They comply with New Zealand equivalents to International Financial Reporting Standards (NZ IFRS) and other applicable Financial Reporting Standards. The Group is a profit oriented entity.

BasisofPreparation

The financial statements are presented in New Zealand dollars, which is the Group’s functional and reporting currency, rounded to the nearest dollar.

They are prepared on the historical cost basis apart from certain assets which are stated at their fair value.

The accounting policies set out below have been applied consistently to all periods presented in these financial statements.

SIGNIFICANTACCOUNTINGPOLICIES

(a) Cash and cash equivalents

Cash and cash equivalents comprise cash on hand, cash in banks and investments in money market instruments. Bank overdrafts are shown within current liabilities in the balance sheet.

(b) Foreign Currency Monetary Balances

Transactions in foreign currencies are converted at the exchange rate ruling at the date of the transaction. At balance date all foreign currency monetary assets and liabilities are translated to New Zealand dollars using the prevailing spot rate of the day. Any gain or loss is recognised in the income statement in the reported financial period in which they arise.

(c) Financial Instruments

(c) (i) Derivative

A derivative is a financial instrument or contract whose value changes in response to the change in a specified interest rate, financial instrument price, commodity price, foreign exchange rate, credit index or other variable. It requires no or a nominal initial investment and is settled at a later date.

Derivative financial investments are initially recognised at fair value on the date a derivative contract is entered into and are subsequently measured at their fair value at each balance sheet date. The gain or loss on remeasurement to fair value is recognised immediately in the income statement. The Group does not undertake hedge accounting in accordance with NZ IAS 39.

The Group may enter into foreign currency forward exchange contracts, to hedge foreign currency transactions when purchasing major fixed assets and when payment is denominated in foreign currency. Gains and losses on such

contracts are recognised in the income statement each year at balance date or date of completion by restating the liability at the prevailing spot rate.

No derivative financial instruments were in place at year end.

(c) (ii) Financial Assets and Liabilities

Financial Assets at Fair Value Through Profit or Loss

A financial asset may be designated as at fair value through profit or loss upon initial recognition if:

a) such designation eliminates or significantly reduces a measurement or recognition inconsistency that would otherwise arise; or

b) the financial asset forms part of a group of financial assets or financial liabilities or both, which is managed and its peak performance is evaluated on a fair value basis, in accordance with the Group’s documented risk management or investment strategy, and information about the grouping is provided internally on that basis; or

c) it forms part of a contract containing one or more embedded derivatives and NZ IAS 39 ‘Financial Instruments: Recognition and Measurement’ permits the entire combined contract (asset or liability) to be designated at fair value through profit or loss.

Financial assets at fair value through profit or loss are stated at fair value, with any resultant gain or loss recognised in profit or loss. The net gain or loss recognised in profit or loss incorporates any dividend or interest earned on the financial asset. Fair value is determined in the manner described in note 20.

Loans and Receivables

Trade receivables, loans, and other receivables that have fixed or determinable payments that are not quoted in an active market are classified as ‘loans and receivables’. Loans and receivables are measured at amortised cost using the effective interest method less impairment. Interest is recognised by applying the effective interest rate.

Impairment of Financial Assets

Financial assets, other than those at fair value through profit or loss are assessed for indicators of impairment at each balance sheet date. Financial assets are impaired where there is objective evidence that, as a result of one or more events that occurred after the initial recognition of the financial asset, the estimated future cash flows of the investment have been impacted.

For financial assets, objective evidence of impairment could include:

a) significant financial difficulty of the issuer or counterparty; or

b) default or delinquency in interest or principal payments; or

c) it is becoming probable that the borrower will enter bankruptcy or financial re-organisation.

For certain categories of financial assets, such as trade receivables, that are assessed not to be impaired individually are subsequently assessed for impairment on a collective basis. Objective evidence of impairment for a portfolio of receivables includes the Group’s past experience of collecting payments, as well as observable changes in national or local economic conditions that correlate with default on receivables and expected uncollectable items.

rePort 2008 Port taranaki Limited and GrouP

For financial assets carried at amortised cost, the amount of the impairment is the difference between the asset’s carrying amount and the present value of estimated future cash flows, discounted at the financial asset’s original effective interest rate.

The carrying amount of the financial asset is reduced by the impairment loss directly for all financial assets with the exception of trade receivables, where the carrying amount is reduced through the use of an allowance account. When a trade receivable is considered uncollectible, it is written off against the allowance account. Subsequent recoveries of amounts previously written off are credited off against the allowance account. Changes in the carrying amount of the allowance account are recognised in profit or loss.

If in a subsequent period, the amount of the impairment loss decreases and the decrease can be related objectively to an event occurring after the impairment was recognised, the previously recognised impairment loss is reversed through profit or loss to the extent that the carrying amount of the investment at the date the impairment is reversed does not exceed what the amortised cost would have been had the impairment not been recognised.

Other Financial Liabilities

Other financial liabilities, including borrowings, are initially measured at market value, net of transaction costs.

Other financial liabilities are subsequently measured at amortised cost using the effective interest method, with interest expense recognised on an effective yield basis.

The effective interest method is a method of calculating the amortised cost of a financial liability and of allocating interest expense over the relevant period. The effective interest rate is the rate that exactly discounts estimated future cash payments through the expected life of the financial liability, or, where appropriate, a shorter period, to the net carrying amount of the financial liability.

(d) Inventories

Stocks of maintenance materials and supplies are valued at the lower of weighted average cost or net realisable value.

(e) Property, Plant and Equipment

Owned Assets

All items of property, plant and equipment except land are stated at cost less accumulated depreciation and impairment.

After recognition as an asset at date of transition to NZ IFRS an item of land whose fair value can be measured reliably shall be carried at a revalued amount, being its value at the date of the revaluation less any subsequent accumulated impairment losses. Revaluations shall be made with sufficient regularity to ensure that the carrying amount does not differ materially from that which would be determined using fair value at balance date.

Any revaluation increase arising on the revaluation of land is credited to a revaluation reserve, except to the extent that it reverses a revaluation decrease for the same asset previously recognised as an expense in the income statement, in which case the increase is credited to the income statement to the extent of the decrease previously charged. A decrease in carrying amount arising on the revaluation of land is charged as an expense in the income statement to the extent that it exceeds the balance, if any held in the revaluation reserve relating to a previous revaluation of that asset. On the subsequent sale or retirement of a revalued property, the

attributable revaluation surplus remaining in the revaluation reserve, is transferred directly to retained earnings.

After recognition as an asset, an item of property, plant and equipment other than land shall be carried at its cost less any accumulated depreciation and any accumulated impairment losses.

Maintenance Dredging

The cost of maintenance dredging incurred is expensed over the period of benefit through to the commencement of the next dredging campaign. The value of the unexpired portion of maintenance dredging at balance date is reflected in property, plant and equipment.

Subsequent Costs

Subsequent costs are included in the asset’s carrying amount or recognised as a separate asset, as appropriate, only when it is probable that the future economic benefits associated with the item will flow to the Group and the cost can be measured reliably. All other costs are charged to the income statement during the financial period in which they are incurred.

(f ) Intangibles

Intangible assets acquired by the Group comprise computer software and are stated at cost less accumulated amortisation and impairment losses.

Subsequent expenditure on capitalised intangible assets is capitalised only when it increases the future economic benefits embodied in the specific asset to which it relates. All other expenditure is expensed as incurred.

(g) Impairment

Assets are reviewed for impairment at each reporting date for events or changes in circumstances that indicate that the carrying amount may not be recoverable. An impairment loss is recognised in the income statement and is determined as the amount by which the asset’s carrying value exceeds it’s recoverable amount. The recoverable amount is the higher of an asset’s fair value, less costs to sell, and value in use. For the purposes of assessing impairment, assets are grouped at the lowest levels for which there are separately identifiable cash flows (cash generating units).

Recoverable amount is the higher of fair value less costs to sell and value in use. In assessing value in use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the assets for which the estimates of future cash flows have not been adjusted. If the recoverable amount of an asset (or cash-generating unit) is estimated to be less than its carrying amount, the carrying amount of the asset (cash-generating unit) is reduced to its recoverable amount. An impairment loss is recognised in the income statement immediately, unless the relevant asset is carried at fair value, in which case the impairment loss is treated as a revaluation decrease.

Where an impairment loss subsequently reverses, the carrying amount of the asset (cash-generating unit) is increased to the revised estimate of its recoverable amount, but only to the extent that the increased carrying amount does not exceed the carrying amount that would have been determined had no impairment loss been recognised for the asset (cash-generating unit) in prior years. A reversal of an impairment loss is recognised in the income statement immediately, unless the relevant asset is carried at fair value, in which case

18

rePort 2008 Port taranaki Limited and GrouP

19

STATEMENT OF ACCOUNTING POLICIESthe reversal of the impairment loss is treated as a revaluation increase.

(h) Employee Benefits

(h) (i) Long Term Benefits

The Group’s net obligation in respect to future benefits that can extend up to the date of retirement for all existing employees are long term benefits. They relate to benefits that employees have earned in return for their service in the current and prior periods, although they may or may not have vested at balance sheet date. The obligation is calculated using an actuarial method and is discounted to its present value. The discount rate the Group uses is the market yield on long term New Zealand Government bonds as at balance sheet date. The probability of the Group’s obligation to pay the future benefit is then determined actuarially.

Long term employee benefits for the Group include: ACC residual claims levies, long service leave, and retirement allowances.

Long Service Leave

The Group has long service milestones of 15, 25, 30 and 35 years of service. Leave entitlement accrued towards milestones not yet achieved are calculated in accordance with the long term benefits policy. No benefit is payable to an employee upon leaving the Group for any milestone worked towards but not achieved, however the probability of attaining vested status is determined and applied in calculating the expected liability amount.

Retirement Allowance

The Group has a retirement policy in place which provides for a retirement allowance. Actuarial calculations are made to assess both the amount projected to be paid (in accordance with the Group’s policy) and the probability that the employee will qualify for the allowance.

(h) (ii) Post Employment Benefits

Defined Benefit Plans

The Group is a participating employer in the National Provident Fund Defined Benefit Plan Contributors Scheme (“the Scheme”) which is a multi-employer defined benefit scheme. If the other participating employers ceased to participate in the Scheme, the employer could be responsible for the entire deficit of the Scheme ( see note 29). Similarly, if a number of employers ceased to participate in the Scheme, the employer could be responsible for an increased share of the deficit.

(h) (iii) Short Term Benefits

Short term benefits represent the Group’s net obligation with respect to benefits for services performed that are expected to be paid in the ensuing 12 months. These accruals are calculated based on existing remuneration rates expected to be in place when the benefits are paid.

Short term employee benefits for the Group include: Vested leave, sick leave, and the current portions of ACC residual claims levy, long service leave and retirement allowance provision.

Vested Leave

Where an employee has rendered service to the Group and has attained the right to paid leave, the undiscounted amount expected to be paid, is recognised as a current liability as all accumulated leave is expected to be used within 12 months of balance sheet date. The remuneration rates

expected to be in place when the benefits are paid is applied to the time owed for entitlements to holiday pay earned, and alternate days owing where statutory days have been worked, and long service leave where the milestone has been achieved.

Sick Leave

The Group measures the amount of additional payments that are expected to arise solely from the fact that the benefit accumulates. The accrual is for the amount estimated it will cost the Group for any employee taking leave in excess of their annual entitlement. It is calculated based on the average expected daily rate of all employees, and the actual number of sick days taken collectively by employees in excess of annual entitlement in the previous twelve months.

ACC

As a port operator, the Group is liable to pay residual claims levies to the ACC. The ACC actuary advises that the residual claims fund is expected to be fully funded by 2014. A provision is made at balance date reflecting the estimated amount payable through to 2014 based upon current residual levy rates. The assessed figure is discounted at the 10 year government bond rate to determine the final provision.

The current portion of the ACC provision, sick leave provision, the long service leave provision, and retiring allowance provision are presented as current employee benefit provisions.

(i) Provisions

A provision is recognised in the balance sheet when the Group has a present legal or constructive obligation as a result of a past event, and it is probable that an outflow of economic benefits will be required to settle the obligation. If the effect is material, provisions are determined by discounting the expected future cash flows at a pre-tax rate that reflects current market assessments of the time value of money and, where appropriate, the risks specific to the liability.

(j) Trade and Other Payables

Trade and other accounts payable are recognised when the Group becomes obliged to make future payments resulting from the purchase of goods and services. Subsequent to initial recognition, trade payables and other accounts payable are recorded at amortised cost. Given the nature of these liabilities amortised cost equals their notional principal.

(k) Interest Bearing Borrowings

All loans and borrowings are initially recognised at fair value, net of transaction costs. Subsequent to the initial recognition, loans and borrowings are carried at amortised cost with any difference between the initial recognised amount and the redemption value being recognised in the profit and loss over the period of the borrowing using the effective interest rate method. Borrowing costs are recognised as an expense when incurred, except that they are capitalised in accordance with (r) below.

All interest bearing loans and borrowings are measured at amortised cost using the effective interest rate method which allocates the cost through the expected life of the borrowing. Amortised cost is calculated taking account of any issue costs.

Borrowings are classified as current liabilities (either advances and deposits or current portion of term debt) unless the Group has an unconditional right to defer settlement of the liability for at least 12 months after the balance sheet date.

rePort 2008 Port taranaki Limited and GrouP

20

(l) Income Tax

Income tax on the profit or loss for the year comprises current and deferred tax. Income tax is recognised in the income statement except to the extent that it relates to items recognised directly in equity, in which case it is recognised in equity.

Current tax is the expected tax payable on the taxable income for the year, using tax rates enacted or substantially enacted at balance sheet date, and any adjustment to tax payable in respect of previous years.

Deferred tax is provided using the comprehensive balance sheet liability method, for temporary differences between the carrying amount of assets and liabilities for financial reporting purposes and the amounts used for taxation purposes. Deferred taxation assets attributable to tax losses or deductible temporary differences are recognised when realisation is probable. Deferred taxation liabilities attributable to taxable temporary differences are amounts of income taxes payable in future periods. However, deferred tax assets and liabilities are not recognised if the temporary differences giving rise to them arise from the initial recognition of assets and liabilities (other than as a result of a business combination) which affects neither taxable income nor accounting profit. Deferred tax assets and liabilities are calculated using the tax rates expected to apply when the assets are recovered or liabilities settled, based on those tax rates which are enacted or substantively enacted at balance sheet date.

The measurement of deferred tax liabilities and assets reflects the tax consequences that would follow from the manner in which the Group expects, at the reporting date, to recover or settle the carrying amount of its assets and liabilities. Current and deferred tax is recognised as an expense in the income statement except when it relates to items credited or debited directly in equity. Deferred taxation assets and liabilities can be offset when they relate to income taxes levied by the same taxation authority.

(m) Dividends

Provisions for dividends are recognised in the period in which they are authorised and approved.

(n) Goods and Services Tax (GST)

All items in the balance sheet are stated exclusive of GST with the exception of receivables and payables, which include GST. All items in the income statement are stated exclusive of GST. Cash flows are included in the cash flow statement on a gross basis. The GST component of cash flows arising from investing and financing activities which is recoverable from, or payable to the taxation authority is classified as operating cash flows.

(o) Revenue Recognition

Revenue is measured at the fair value of the consideration received or receivable.

Rendering of services

The Group recognises revenue for the rendering of services when the amount can be measured reliably, it is probable that the economic benefits associated with the transaction will flow to the entity, the stage of completion of the transaction at balance sheet date can be measured reliably and the costs incurred or to be incurred can be measured reliably.

Interest Revenue

Interest revenue is accrued on a time basis, by reference to

the principal outstanding and at the effective interest rate applicable, which is the rate that exactly discounts estimated future cash receipts through the expected life of the financial asset to that asset’s net carrying amount.

(p) Associates and Subsidiaries

(p) (i) Associates

Associates are those entities in which the Company has significant influence, but not control, over the financial and operating policies. The financial statements include the Company’s share of the total recognised gains and losses of associates on an equity accounted basis, from the date that significant influence commences until the date that significant influence ceases. When the Company’s share of losses exceeds its interest in the associate, the Company’s carrying amount is reduced to nil and recognition of further losses is discontinued except to the extent that the Company has incurred legal or constructive obligations or made payments on behalf of the associate.

Under the equity method, the investment in the associate is initially recognised at cost and the carrying amount is increased or decreased to recognise the Company’s share of the profit or loss of the associate after the date of acquisition. The Company’s share of profit or loss is included in the Income Statement. Dividends received from the associate company reduce the carrying amount of the investment.

(p) (ii) Subsidiaries

Subsidiaries are those entities in which the Company has control over the financial and operating policies. The financial statements are consolidated from the date that control commences until the date that control ceases. Consolidated financial statements are presented as those of a single economic entity, (the “Group”).

(q) Research and Development

Expenditure on research activities, undertaken with the prospect of gaining new scientific or technical knowledge and understanding, is recognised in the income statement when incurred. Expenditure on developing the application of any research findings will only be capitalised if able to demonstrate all of the following conditions: It is technically feasible to complete so it will be available for sale or use, intended to be completed, able to be used or sold, will generate probable future economic benefits, there are adequate technical, financial and other resources to complete the development to use or sell, and can be measured reliably during its development.

(r) Borrowing Costs

The Group recognises as an expense within the income statement all borrowing costs incurred, with the exception of interest costs incurred during construction/assembly of major capital projects, which is capitalised as part of the initial cost of the respective assets.

(s) Depreciation

Property, plant and equipment other than land are depreciated on a straight line basis over their estimated useful lives.

Depreciation periods are:

Buildings 5 to 33 years Port installations 5 to 66 years Plant, equipment and fittings 2.5 to 25 years Floating plant 3 to 25 years Maintenance dredging 2 years

rePort 2008 Port taranaki Limited and GrouP

21

STATEMENT OF ACCOUNTING POLICIESCapital dredging 50 years

The residual values, and the useful lives of assets are reviewed at least annually and, if expectations differ from previous estimates, the change shall be accounted for as a change in accounting estimate in accordance with NZ IAS 8.

(t) Amortisation

Amortisation is charged to the income statement on a straight-line basis over the estimated useful life of the intangible assets unless the estimated useful life is indefinite. There are no indefinite life intangible assets held at balance sheet date. Other intangible assets are amortised from the date they are available for use. The estimated useful lives are as follows:

Computer Software 2 - 4 years

(u) Operating Leases

i) Payments made under operating leases are recognised in the income statement on a straight-line basis over the term of the lease, except where another systematic basis is more representative of the time pattern in which economic benefits from the leased asset are consumed.

ii) Rental income from operating leases is recognised on a straight-line basis over the term of the relevant lease.

(v) Statement of Cash Flows

Cash flows from operating activities are presented using the direct method.

Definitions of terms used in the Statement of Cash Flows:

- Cash means cash on deposit with banks, net of outstanding bank overdrafts.

- Investing activities comprise the purchase and sale of property, plant and equipment, investment properties and investments.

- Financing activities comprise the change in equity and debt capital structure of the Group and the payment of cash dividends.

- Operating activities include all transactions and events that are not investing or financing activities.

CRITICALACCOUNTINGJUDGEMENTSANDESTIMATES

In the application of NZ IFRS management is required to make judgements, estimates and assumptions about carrying values of assets and liabilities that are not readily apparent from other sources. The estimates and associated assumptions are based on historical experience and various other factors that are believed to be reasonable under the circumstance, the results of which form the basis of making the judgements. Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the period in which the estimate is revised if the revision affects both current and future periods.

Management have made judgements that relate to the estimated useful life of property, plant and equipment, its fair value, and the value of receivables. The judgements are disclosed in Statement of Accounting Policies (s), and Notes to the Financial Statements, note 8 provision for impairment and note 11 carrying amount, revaluations and other disclosures.

ADOPTIONOFNEWANDREVISEDACCOUNTINGSTANDARDS

In the current year the Group has adopted all of the Standards and Interpretations issued by the International Accounting Standards Board (the IASB) and the International Financial Reporting Interpretations Committee (IFRIC) of the IASB that are relevant to its operations and effective for the current reporting period.

At the date of authorisation of the financial report, the following Standards and Interpretations were on issue but not yet effective: Effective�for�annual� Expected�to�be�� reporting�periods� initially�applied�in�the�� beginning�on�or�after� financial�year�ending

- NZ IFRS 1 - First-time Adoption of New Zealand Equivalents to International Financial Standards - Amendments 1 January 2009 30 June 2010

- NZ IFRS 2 - Share-Based Payment - Vesting Conditions and Cancellations - Amendments 1 July 2009 30 June 2010

- NZ IFRS 3 - Operating Segments - Business Combinations - Revised 1 January 2009 30 June 2010

- NZ IFRS 4 - Insurance Contracts - The Scope of Insurance Activities and Differential Reporting Concessions - Amendments 1 January 2009 30 June 2010

- NZ IFRS 8 - Operating Segments 1 January 2009 30 June 2010

- NZ IAS 1 - Presentation of Financial Statements - Puttable Financial Instruments and Obligations Arising on Liquidation - Revised Amendments 1 January 2009 30 June 2010

- NZ IAS 23 - Borrowing Costs - Revised 1 January 2009 30 June 2010

- NZ IAS 27 - Consolidated and Separate Financial Statements - Revised 1 July 2009 30 June 2010

- NZ IAS 27 - Consolidated and Separate Financial Statements - Cost of an Investment in a Subsidiary, Jointly Controlled Entity or Associate - Amendments 1 January 2009 30 June 2010

- NZ IAS 32 - Financial Instruments: Presentation - Revised 1 January 2009 30 June 2010

- Improvements to New Zealand Equivalents to International Financial Reporting Standards Various 30 June 2010

- Omnibus Amendments (2007) 1 January 2008 30 June 2009

- IFRIC 12 - Service Concession Arrangements 1 January 2008 30 June 2009

- IFRIC 13 - Customer Loyalty Programmes 1 July 2008 30 June 2009

- IFRIC 14 - NZ IAS-19 - The Limit on a Defined Benefit Asset, Minimum Funding Requirements and their Interaction 1 January 2008 30 June 2009

- IFRIC 15 - Agreements for the Construction of Real Estate 1 January 2009 30 June 2010

- IFRIC 16 - Hedges of a Net Investment in a Foreign Operation 1 October 2008 30 June 2010

Application of the Standards, Amendments and Interpretations is not expected to have a material impact on the financial statement account balances of the Group but may require additional financial statement disclosures.

rePort 2008 Port taranaki Limited and GrouP

22

Notes to and forming part of the Financial Statements FORTHEYEARENDED30JUNE2008

1 SegmenTALRepORTing

TheGroupoperatesinoneeconomicandgeographicsegment,thatbeingthefacilitatingofexportandimportactivities

throughPortTaranaki.

PARENT&GROUP PARENT&GROUP 2008 2007 NZ$ NZ$

2 pROfiTfROmOpeRATiOnS

(a)Revenue

PortOperatingRevenuefromsaleofservices 40,914,690 35,587,811

LeaseandRentalRevenue 1,834,854 1,329,700

42,749,544 36,917,511

Interestrevenue 39,279 33,386

Totalrevenue 42,788,823 36,950,897

(b)Profitbeforetaxation

Profitbeforetaxfortheyearhasbeenarrivedatafter

chargingthefollowing:

Employeebenefits 11,387,105 9,788,845

CostofServicesUsed 1,772,959 3,867,072

Generalexpenses 5,160,832 3,936,919

Interestexpense 3,312,010 1,549,239

MaintenanceDredging-depreciation 1,067,478 855,894

MaintenanceDredgingothercosts 80,222 60,836

RepairsandMaintenance 7,532,922 5,366,278

DepreciationandAmortisation(refernotes11and12) 4,464,975 4,033,957

(excludesmaintenancedredging)

Netlossondisposalofproperty,plantandequipment 1,432 42,847

34,779,935 29,501,887

IncludedinGeneralexpenseswerethefollowingexpenses:

Changeinestimateddoubtfuldebts 31,000 (7,000)

Donations - 568

TranslationAdjustmentscomprising:

NetlossonJebsensLoan 2,049 58,136

Netlossonforeigncurrencybankbalances 24,899 16,539

Netgainoncashandcashequivalents (27) 151

Paymentstoauditor

Auditfees 54,013 52,879

ConversiontoNZIFRS - 30,000

54,013 82,879

rePort 2008 Port taranaki Limited and GrouP

FORTHEYEARENDED30JUNE2008 NOTES TO THE FINANCIAL STATEMENTS

23

PARENT&GROUP PARENT&GROUP 2008 2007 NZ$ NZ$

IncludedinEmployeeBenefitswerethefollowingexpenses:

Paymentstodirectors

JSAuld 27,000 25,625

PDHorton 11,373 -

NDLeuthart 20,500 20,486

DNMacLeod 20,500 20,486

MCNorgate 20,500 20,000

DEWalter 20,500 20,486

EJYoung 34,000 33,833

154,373 140,916

3 incOmeTAxexpenSe/(cRediT)

a)IncomeTaxrecognisedintheIncomeStatement

Currenttaxexpense 4,018,881 1,980,347

Deferredtaxontemporarydifferences (772,661) 691,995

IncomeTaxExpense/(Income)perIncomeStatement 3,246,220 2,672,342

Incometaxiscalculatedatanaverageeffectivetaxrateof33percentoftheestimatedassessableprofit

fortheyear.

b)ReconciliationofAccountingProfitBeforeTaxandIncomeTaxExpense/(Credit)

Profitbeforetaxation 8,008,888 7,449,010

Incometaxexpensecalculatedat33% 2,642,933 2,458,173

Taxeffectofnondeductibleexpensesinprofitbeforetax 547,705 241,949

Taxeffectofratechangeonfuturetaxbenefits 109,115 60,318

Priorperiodadjustmentsimpactingincomeexpenseunder/(over) (53,533) (88,098)

IncomeTaxExpenseperIncomeStatement 3,246,220 2,672,342

4 TAxATiOnRefundAbLe/(pAyAbLe)

Openingbalance (467,283) (380,116)

Prioryeartaxpaid/(refund) 413,749 293,180

Priorperiodadjustment 53,533 86,936

Currenttaxationpayable (4,072,414) (2,067,283)

Provisionaltaxationpaid 4,000,000 1,600,000

TaxationRefundable/(Payable) (72,415) (467,283)

rePort 2008 Port taranaki Limited and GrouP

FORTHEYEARENDED30JUNE2008

24

5 defeRRedTAxASSeT Depreciation/ Provisions/ Receivables/ Amortisation Payables Prepayments Total NZ$ NZ$ NZ$ NZ$

Asat1July2006 420,531 819,292 (45,905) 1,193,918

(Charged)/creditedtotheIncomeStatement (700,004) 6,654 1,355 (691,995)

Asat30June2007 (279,473) 825,946 (44,550) 501,923

(Charged)/creditedtotheIncomeStatement 646,082 121,930 4,649 772,661

Asat30June2008 366,609 947,876 (39,901) 1,274,584

On17May2007,theNewZealandGovernmentannouncedinitsannualbudgetthatthecorporatetaxrateofNew

Zealandwillbereducedfrom33%to30%witheffectfrom1April2008.ForPortTaranakiLimitedthereductionintax

ratewilloccurfrom1July2008whichisthestartofitsfinancialyear.

Therearenoincometaxlossescarriedforward.

6 eARningSpeRShARe

Basicearningspershareiscalculatedbydividingtheprofitfortheperiodbytheweightedaveragenumberofordinary

sharesonissueduringtheperiod.

Dilutedearningspershareiscalculatedbyadjustingtheprofitfortheperiodandtheweightedaveragenumberof

ordinarysharesonissueduringtheperiod,fortheeffectsofalldilutiveinstruments,ofwhichtherewerenoneduring

theperiod.

PARENT&GROUP PARENT&GROUP 2008 2007 NZ$ NZ$

Profitfortheperiod 4,762,668 4,776,668

Weightedaveragenumberofsharesonissue 52,000,000 52,000,000

Basicanddilutedearningspershare(centspershare) 9.16 9.19

7 cAShAndcAShequivALenTS

Cashatbankandonhand 255,520 216,797

Thecarryingamountforcashandcashequivalentsequalsfairvalue.

8 TRAdeAndOTheRReceivAbLeS

a)Current

Tradereceivables 5,613,027 4,262,379

Provisionforimpairment (40,000) (9,000)

Nettradereceivables 5,573,027 4,253,379

Otherreceivables 229,809 165,147

Prepayments 8,018 20,177

Relatedpartyreceivables(note24) 1,752 312,539

5,812,606 4,751,242

Thefairvalueoftradeandotherreceivablesapproximatestheircarryingvalue.

Theaveragecreditperiodonsalesofgoodsis49days(2007:42days).Theparentreservestherightentirelyatits

discretiontoapplyaninterestchargeat2.5%permonthcompoundingonoverdueaccounts,asper‘Standard

conditionsofbusiness’4.5(c)issuedbyPortTaranakiLimited.Ifcredithasbeengranted,thenpaymentforservices

rePort 2008 Port taranaki Limited and GrouP

FORTHEYEARENDED30JUNE2008

25

NOTES TO THE FINANCIAL STATEMENTSrenderedisduebythe20thofthemonthfollowinginvoice.TheGrouphasprovidedinfullforanyreceivablesover

90daysoldwhichareconsideredpotentiallyunrecoverable.Allotherdebtorsareprovidedforbasedonestimated

irrecoverableamountsdeterminedbyreferencetopastdefaultexperience.

IncludedintheGroup’stradereceivablebalancearedebtorswithacarryingamountof$916thousand

(2007:$618thousand)whicharepastdueatthereportingdateforwhichtheGrouphasnotprovidedasthere

hasnotbeenasignificantchangeincreditqualityandtheGroupbelievesthattheamountsarestillconsidered

recoverable.TheGroupdoesnotholdanycollateraloverthesebalances.Theaverageageofthesereceivablesis

44days(2007:65days).

PARENT&GROUP PARENT&GROUP 2008 2007 NZ$ NZ$

Movementintheprovisionforimpairment

Balance1July 9,000 16,000

Increase/(Decrease)inimpairmentprovisionrecognisedinincomestatement 31,000 (7,000)

Balance30June 40,000 9,000

IndeterminingtherecoverabilityofatradereceivabletheGroupconsidersanychangeinthecreditqualityofthetrade

receivablefromthedatecreditwasinitiallygranteduptothereportingdate.Theconcentrationofcreditriskliesintrade

debtorsofwhich28.75%,23(2007:18%,18)bynumberoftradedebtorsrepresenting90.92%(2007:89%)ofthetotal

amountoftradedebtors.Only16.31%(2007:14%)oftradereceivableswereoverduebutnotimpairedatbalancesheet

date.0.71%(2007:lessthan1%)oftradereceivableswereconsideredimpaired.Nocollateral,securityorothercredit

enhancementsareheldbytheGroup.Thedirectorsbelievethatthereisnofurthercreditprovisionrequiredinexcessof

theprovisionforimpairment.

9 invenTORieS

Maintenanceconsumables 159,141 135,934

10 Loan-Jebsens

Balanceat1July 586,825 -

Advancesduringtheyear - 624,985

Repaymentsduringtheyear (566,830) -

Interest 30,390 19,976

Translation(loss)/gain (2,049) (58,136)

Balanceat30June 48,336 586,825

Thecarryingamountfortheloanapproximatesfairvalue.

ThedenominatedforeigncurrencyofthisassetisUSdollars.Atbalancesheetdatethebalanceis$US36,648

(2007:$US432,039).

Thebalanceisinterestaccruedtothesettlementdateoftheprincipalamounton17January2008.Interestrate

applicabletothisloanwas9.7%.

rePort 2008 Port taranaki Limited and GrouP

FORTHEYEARENDED30JUNE2008

26

PARENT&GROUP PARENT&GROUP 2008 2007 NZ$ NZ$

11 pROpeRTy,pLAnTAndequipmenT

Land

Carryingamountat1July 32,244,953 31,104,470

Additions 821 1,140,483

Revaluations 14,730,896 -

Carryingamountat30June 46,976,670 32,244,953

Buildings

Asat30Junepreviousyear

Cost 16,606,937 16,017,939

AccumulatedDepreciation (8,198,807) (7,607,436)

Netbookvaluepreviousyear 8,408,130 8,410,503

Carryingamountat1July 8,408,130 8,410,503

Additions 19,971 588,998

Disposals (133) -

Depreciation (586,506) (591,371)

Carryingamountat30June 7,841,462 8,408,130

Maintenancedredging

Asat30Junepreviousyear

Cost 2,280,054 1,664,229

AccumulatedDepreciation (375,279) (1,019,589)

Netbookvaluepreviousyear 1,904,775 644,640

Carryingamountat1July 1,904,775 644,640

Additions - 2,122,338

Depreciation (1,067,478) (862,203)

Carryingamountat30June 837,297 1,904,775

PortInstallations

Asat30Junepreviousyear

Cost 36,884,538 34,610,696

AccumulatedDepreciation (14,235,555) (12,843,995)

Netbookvaluepreviousyear 22,648,983 21,766,701

Carryingamountat1July 22,648,983 21,766,701

Additions 650,526 2,313,479

Disposals - (30,686)

Depreciation (1,474,888) (1,400,511)

Carryingamountat30June 21,824,621 22,648,983

rePort 2008 Port taranaki Limited and GrouP

FORTHEYEARENDED30JUNE2008 NOTES TO THE FINANCIAL STATEMENTS

27

PARENT&GROUP PARENT&GROUP 2008 2007 NZ$ NZ$

Plant,equipment&fittings

Asat30Junepreviousyear

Cost 24,040,427 23,161,988

AccumulatedDepreciation (12,188,631) (11,588,128)

Netbookvaluepreviousyear 11,851,796 11,573,860

Carryingamountat1July 11,851,796 11,573,860

Additions 1,897,158 1,582,706

Disposals (1,432) (59,065)

Depreciation (1,371,719) (1,245,705)

Carryingamountat30June 12,375,803 11,851,796

Floatingplant

Asat30Junepreviousyear

Cost 11,467,834 11,461,685

AccumulatedDepreciation (2,764,082) (2,246,229)

Netbookvaluepreviousyear 8,703,752 9,215,456

Carryingamountat1July 8,703,752 9,215,456

Additions 1,029,129 7,042

Depreciation (492,121) (518,746)

Carryingamountat30June 9,240,760 8,703,752

Capitaldredging

Asat30Junepreviousyear

Cost 21,329,901 21,260

AccumulatedDepreciation (71,475) -

Netbookvaluepreviousyear 21,258,426 21,260

Carryingamountat1July 21,258,426 21,260

Additions 159,015 21,308,641

Depreciation (429,778) (71,475)

Carryingamountat30June 20,987,663 21,258,426

Capitalworksinprogress

Carryingamountat1July 1,448,916 10,306,704

Additions 5,899,725 20,339,786

Transferreduponcompletion (3,828,045) (29,197,574)

Carryingamountat30June 3,520,596 1,448,916

Totalproperty,plantandequipment 123,604,872 108,469,731

rePort 2008 Port taranaki Limited and GrouP

FORTHEYEARENDED30JUNE2008

28

Revaluations

Landassetshavebeenvaluedontheirhighestandbestusetakingintoaccounttheexistingzoning,potentialfor

utilisationandlocalisedportmarket.Alllandholdingsareusedorheldforportoperationalrequirementsandassuch

arevaluedundertherequirementsofNZIAS16usingfairvalue(marketvalue).

Landwasrevaluedat30June2008byMrIanBaker,aregisteredvaluerwithTelferYoung(Taranaki)Ltd,NewPlymouth.

TelferYounghavebeencontractedbyPortTaranakiasindependentvaluers.Therevaluedamountoflandusedinthis

reportamountsto$46,976,670.

Thecarryingamountoflandhaditbeenrecognisedunderthecostmodelisasfollows:

PARENT&GROUP PARENT&GROUP 2008 2007 NZ$ NZ$

10,364,837 10,364,016

Otherdisclosures

(i)Therearenoitemsofproperty,plantorequipmentwhicharenotincurrentuse.