TAXES AND YOUR PORTFOLIO - Fidelity Investments and your Portfolio . Topic overview: It is important...

Transcript of TAXES AND YOUR PORTFOLIO - Fidelity Investments and your Portfolio . Topic overview: It is important...

2

John Sweeney

Executive Vice President, Retirement & Investing Strategies,

Fidelity Investments

YOUR HOST

JOIN THE CONVERSATION: @SweeneyFidelity

3

Louis Satisky

Regional Vice President,

Fidelity Investments

Howard Spielberg

Regional Vice President,

Fidelity Investments

PRESENTERS Taxes and

your Portfolio

JOIN THE CONVERSATION: @Fidelity │ @SweeneyFidelity │ #SomedayEvent

4

Retirement Planning

• Savings Strategy

• Income Strategy

• Personal

(Taxable, IRA,

Annuity)

• Workplace

Investments

• Benefits and

Social Security

• Health Care/

Long-Term Care

Income Protection

• Disability

• Premature Death

Protection

• Outliving Income

Asset Protection

• Estate Planning

• Wills

• Trusts

• Wealth Transfer

• Charitable Giving

Family Conversations

• Education

• Living Expenses:

Children and Parents

• Assisting Parents and

Relatives

Your Family Wealth planning is complex and unique to every family. We can guide you in considering questions and addressing concerns that help your family reach its wealth planning goals.

Investment Strategy

• Asset Allocation

• Tactical Allocation

• Asset Location

• Tax-Efficient

Investing

• Taxable Savings

Strategy

Retirement Planning

• Savings Strategy

• Income Strategy

• Personal

(Taxable, IRA,

Annuity)

• Workplace

Investments

• Benefits and

Social Security

• Health Care/

Long-Term Care

Income Protection

• Disability

• Premature Death

Protection

• Outliving Income

Asset Protection

• Estate Planning

• Wills

• Trusts

• Wealth Transfer

• Charitable Giving

Family Conversations

• Education

• Living Expenses:

Children and Parents

• Assisting Parents and

Relatives

Investment Strategy

• Asset Allocation

• Tactical

Allocation

• Asset Location

• Tax-Efficient

Investing

• Taxable Savings

Strategy

Fidelity does not provide legal, tax, or estate planning advice. Please consult an appropriately licensed professional for advice on your specific situation.

Primarily sourced from The New Advisor for Life, John Wiley & Sons, 2011, by Stephen D. Gresham with permission to reprint.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917. © 2014 FMR LLC. All rights reserved. 581279.12.0

WEALTH PLANNING OVERVIEW Taxes and

your Portfolio

5

OVERVIEW Taxes and

your Portfolio

Topic overview:

It is important to have a plan in place that addresses taxes. The fact is, taxes can have a significant impact on your investment returns at any stage of your investing life. We believe overlooking the potential impact of taxes is a common investor mistake.

Goals:

At Fidelity, we can help you develop an ongoing strategy – a plan that seeks to defer, manage, and reduce taxes.

What you’ll learn:

• How taxes can affect yourinvestments

• Strategies to help defer,manage and reduce taxes

• How Fidelity can help

6

POLL QUESTION #1

How would you describe your understanding of how taxes impact your investments?

Taxes and

your Portfolio

A. Very knowledgeable

B. Somewhat knowledgeable

C. Not very knowledgeable

YOUR RESPONSE

How would you describe your understanding of how taxes impact your investments?

15.5%

61.2%

23.4%

Very knowledgeable Somewhat knowledgeable Not very knowledgeable

Taxes and

your Portfolio

7

8

TYPES OF TAXES

*Tax rates as of January 2015.

†Includes 3.8% Medicare surtax, which applies to single filers with Modified Adjusted Gross Income (MAGI) above $200,000 and jointfilers with MAGI above $250,000.

Tax Types Impact*

Long-Term Capital Gains

Up to 23.8%† (plus state and local taxes)

Qualified Dividends

Short-Term Capital Gains Ordinary income tax rates are potentially subject to

the Medicare surtax — up to a total of 43.4%† (plus

state and local taxes) Interest and Non-Qualified

Dividends

Alternative Minimum Tax (AMT) Potential to increase your effective marginal tax rate

on long-term capital gains and qualified dividends

Do you know what you pay in taxes on

your investments? Q

Taxes and

your Portfolio

9

POLL QUESTION #2

Where do you think your tax rate will be in five years?

Taxes and

your Portfolio

A. Your tax rate will be higher

B. Your tax rate will be lower

C. Your tax rate will be

unchanged

YOUR RESPONSE Taxes and

your Portfolio

Where do you think your tax rate will be in five years?

40.7%

28.3% 31.0%

Taxes will be higher Taxes will be lower Taxes will be unchanged

10

11

100%

80%

60%

40%

20%

HISTORICAL TAX RATES

Top U.S. Federal Tax Rates

Data represents the top federal marginal ordinary income tax rates and long-term capital gains tax rates, including the Medicare surcharge, as reported by http://www.taxfoundation.org/taxdata/show/151.html, “U.S. Federal Individual Income Tax Rates History,” The Tax Foundation, September 9, 2011, and “Top Federal Income Tax Rates on Regular Income and Capital Gains since 1916,” Citizens for Tax Justice, May 2004.

Ta

x R

ate

0%

Top income tax rate Top capital gains tax rate

Year

1916 1932 1948 1964 1980 1996 2015

Where do you think your tax rate is headed

in the future? Q

Taxes and

your Portfolio

12

TAXES CAN SIGNIFICANTLY REDUCE RETURNS

Impact of taxes on investment returns* from 1926–2014

*Past performance is no guarantee of future results. This chart is for illustrative purposes only and does not represent actual or futureperformance of any investment option. Returns include the reinvestment of dividends and other earnings. Stocks are represented by theStandard & Poor’s 500 Index (S&P 500® Index). The S&P 500® Index is a registered service mark of The McGraw-Hill Companies, Inc.,and has been licensed for use by Fidelity Distributors Corporation and its affiliates. It is an unmanaged index of common stock prices of500 widely held U.S. stocks. Bonds are represented by the 20-year U.S. government bond. Inflation is represented by the ConsumerPrice Index (CPI), which is a widely recognized measure of inflation, calculated by the U.S. government. Please note that indexes areunmanaged and are not illustrative of any particular investment. It is not possible to invest directly in an index.

Morningstar Inc. All rights reserved. 3/1/2015. See Appendix A for more information.

10.1%

5.7%

8.1%

3.6%

Stocks after

taxes

Stocks Bonds after

taxes

Bonds

Ave

rag

e A

nnu

al R

etu

rn %

Taxes and

your Portfolio

13

CREATING A MORE EFFICIENT INVESTING STRATEGY

REDUCE REDUCE FUTURE TAXES

WITH INVESTMENTS AND

STRATEGIES INCLUDING:

• Roth IRAs

• Municipal bonds

• 529 college savings

accounts

• Charitable giving

DEFER

DEFER PAYING TAXES WITH TAX-ADVANTAGED

ACCOUNTS SUCH AS:

• 401(k)s

• 403(b)s

• IRAs

• Deferred annuities

MANAGE

MANAGE THE TAXES YOU

PAY BY EMPLOYING

STRATEGIES INCLUDING:

• Asset location

• Tax-loss harvesting

• Tax-efficient fund selection

• Managing mutual fund distributions

• Managing capital gains

Taxes and

your Portfolio

15

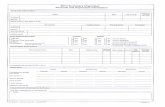

TAX-ADVANTAGED ACCOUNTS

*For a traditional IRA, full deductibility of a contribution is available to active participants whose 2015 Modified Adjusted Gross Income (MAGI) is $98,000 or less (joint) and$61,000 or less (single); partial deductibility for MAGI up to $118,000 (joint) and $71,000 (single). In addition, full deductibility of a contribution is available for working ornonworking spouses who are not covered by an employer-sponsored plan whose MAGI is less than $183,000 for 2015; partial deductibility for MAGI up to $193,000.

†Roth IRA income requirements: For single filers: For 2015, single filers with Modified Adjusted Gross Income (MAGI) up to $116,000 are eligibleto make a full contribution; a partial contribution can be made for MAGI of $116,000–$131,000. Married filing jointly: For 2015, MAGI up to$183,000 for a full contribution; partial contribution for MAGI of $183,000–$193,000.

‡Issuing insurance companies reserve the right to limit contributions.

Are you taking full advantage of your

employer-sponsored plans? Q

2015 Annual

Contribution Limits

Minimum Required

Distribution Rules

Contribution

Treatment

Employer-Sponsored

Plans

[401(k)s, 403(b)s]

• $18,000 per year per

employee

If age 50 or above,

$24,000 per year

• Mandatory withdrawals

starting in the year you turn

70½ (except for Roth)

• Pre-tax

IRAs

(Traditional* and Roth†)

• $5,500 per year

If age 50 or above,

$6,500 per year

• Mandatory withdrawals

starting in the year you turn

70½ (except for Roth)

• Pre-tax or After-tax

Tax-Deferred Annuities • No contribution limit‡ • Not subject to minimum

required distribution rules

for nonqualified assets

• After-tax

Taxes and

your Portfolio

18

REDUCING CAPITAL GAINS TAXES

$10,000 Hypothetical Pre-tax Gain*

$5,660

After-tax

gain

$4,340

Taxes

An investor keeps

$7,620

After-tax

gain 43.4% taxes paid

An investor keeps

23.8% taxes paid

Short term Long term vs.

1 YEAR

$2,380

Taxes

For this example, we assume the investor is subject to the top capital gains rate and is paying 43.4% on short-term gains and 23.8% on long-term gains. Tax savings will depend on an individual’s actual capital gains and tax rate, and may be more or less than this example. This is a hypothetical example for illustrative purposes only and is not intended to represent the performance of any investment.

*The taxes saved by waiting until a short-term investment gain (<1 year) becomes a long-term gain (>1 year) can be calculated as follows:(gain $) x (short-term rate – long-term rate) = tax savings.

Taxes and

your Portfolio

19

TAX-LOSS HARVESTING CAN MAKE A DIFFERENCE

Which lot should I sell?

GAIN

TAX LOT 2

50 Shares at $50/Share

50 Shares at $75/Share

SELL at $60/Share

LOSS

JAN. 2013 JAN. 2014 TODAY

TAX LOT 1

Generally, among asset classes, stocks are more volatile than bonds or short-term instruments and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Although the bond market is also volatile, lower-quality debt securities, including leveraged loans, generally offer higher yields compared with investment-grade securities, but also involve greater risk of default or price changes. Foreign markets can be more volatile than U.S. markets due to increased risks of adverse issuer, political, market, or economic developments, all of which are magnified in emerging markets.

The tax information contained herein is general in nature, is provided for informational purposes only, and should not be construed as legal or tax advice. Fidelity does not provide legal or tax advice.

For illustrative purposes only.

Taxes and

your Portfolio

20

-6%

-19%

-48%

-27%

-19%

-70%

-50%

-30%

-10%

10%

30%

50%

90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14

S&

P 5

00

® In

de

x T

ota

l R

etu

rn

Positive S&P 500® Index Negative S&P 500® Index Max Intra-Year Decline

ACTIVELY MANAGE LOSSES YEAR-ROUND

S&P 500® Index annual total returns and max intra-year declines: 1990–2014

What is your approach to

harvesting losses? QPast performance is no guarantee of future results. It is not possible to invest directly in an index. Returns are based on index price appreciation and dividends. Intra-year declines refer to the largest index drop from a peak to a trough during the year. For illustrative purposes only. Data as of 12/31/2014. Sources: Standard & Poor’s, Bloomberg.

Taxes and

your Portfolio

21

TAKING CONTROL

What strategies are you using to control

your tax impact? Q

Beyond your control

The FUND SELLS a holding

for a capital gain or receives

dividends or interest.

Current taxes are owed on the

fund’s taxable distributions

received by shareholders.

Within your control

INVESTOR SELLS

shares of a fund for a capital

gain/loss or to rebalance.

Current taxes are owed

on realized capital gains.

Taxes and

your Portfolio

22

MATCH THE RIGHT ACCOUNT WITH THE RIGHT INVESTMENT

The relative tax efficiency of these investments are generalizations and are not universally accurate. Each investment should be considered individually for the benefits of being held in a taxable or tax-deferred account.

1Equity Income Funds typically distribute most of their income in the form of Qualified Dividends, which for many taxpayers are taxed relatively lightly, allowing most Equity Income Funds and ETFs to be considered High Tax Efficiency investments when compared with other investment options that generate taxable income. However, for higher income taxpayers, Qualified Dividends may be subject to both a higher tax rate and also the Medicare surtax on investment income, which may make them less efficient for those investors.

2Applies to investors who are subject to high rates of state/local tax on investment income; for other investors, these bond funds should be considered Lower Tax Efficiency.

Consider for Taxable Accounts Consider for Tax-Deferred Accounts

MORE TAX EFFICIENT LESS TAX EFFICIENT

Have you matched your investments and

your accounts effectively? Q

Lower Tax Efficiency High Tax Efficiency Medium Tax Efficiency

Bond Funds with Large U.S.

Treasuries Allocations2

Typical Actively Managed Equity

Funds

Equity Index Funds (other than REITs)

Equity Index ETFs (other than REITs)

Equity Income Funds1

Equity Income ETFs1

Tax-Managed Equity Funds

Equity Separately Managed Accounts

High-Turnover Equity Funds

Mortgage Bond Funds

Corporate Bond Funds

Leveraged Loan / Floating

Rate Bond Funds

U.S. High Yield Bond Funds

Emerging Market Bond Funds

REIT Funds

Taxes and

your Portfolio

23

VALUE OF TAX-SENSITIVE INVESTMENT MANAGEMENT

Hypothetical cumulative value of tax-sensitive investment management—growth strategy*

$0.8

$1.0

$1.2

$1.4

$1.6

$1.8

$2.0

$2.2

2002

Po

rtfo

lio V

alu

e (

$M

)

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

$2.09M

$1.84M

Hypothetical Account Value with Tax-Sensitive Investment Management

Hypothetical Account Value without Tax-Sensitive Investment Management

A potential increase of $256,039 from

tax-sensitive investment management

*Based on strategy composites. (See Appendix B for information on the composites.) These results are hypothetical and do not represent actualvalue added to client accounts. Returns for individual clients will vary. Performance shown represents past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, and you may lose money.

For illustrative purposes only.

Taxes and

your Portfolio

25

HELP REDUCE TAXES NOW OR IN THE FUTURE

What strategies are you employing to

reduce current and future taxes? Q

Charitable

Giving

529 College

Savings

Accounts

Municipal

Bonds

Self-Directed

or Managed

Roth

Accounts

Roth IRA

Conversion

Taxes and

your Portfolio

26

• Expect higher taxes in the future

• Have a long investment time frame

• Can afford to pay taxes on the conversion from taxable accounts

• Want greater flexibility managing withdrawals

• Plan to pass most of your retirement assets to your beneficiaries

• Have IRA assets consisting entirely of nondeductible contributions

• Expect to have lower taxable income than usual this year

• Expect additional investment income in future years

• Have retirement accounts you expect to increase in the future

ROTH ACCOUNTS OR ROTH IRA CONVERSION

You might want to consider a ROTH conversion if you:

Taxes and

your Portfolio

27

When would you prefer to pay taxes?

How can you diversify your tax risk?

How would you prefer to manage your investments?

When do you need to access your money?

KEY CONSIDERATIONS Taxes and

your Portfolio

When would you prefer to pay taxes?

How can you diversify your tax risk?

How would you prefer to manage your investments?

When do you need to access your money?

28

1. Meet with a Fidelity Investment Professional.

2. Understand how taxes impact your investments.

3. Choose investment accounts and strategies to help meet your goals:

4. Set up regular check-ins.

5. Learn more at Fidelity.com/TEI.

HOW FIDELITY CAN HELP

Reduce Defer Manage

• Asset location

• Tax-loss harvesting

• Tax-efficient fund selection

• Managing mutual fund

distributions

• Managing capital gains

• 401(k)s

• 403(b)s

• IRAs

• Deferred annuities

• Roth IRAs

• Municipal bonds

• 529 college savings

accounts

• Charitable giving

Taxes and

your Portfolio

31

IMPORTANT INFORMATION: APPENDIX A

Taxes Can Significantly Reduce Returns data, Morningstar, Inc., 2015. Federal income tax is calculated using the

historical marginal and capital gains tax rates for a single taxpayer earning $110,000 in 2010 dollars every year.

This annual income is adjusted using the Consumer Price Index in order to obtain the corresponding income level

for each year. Income is taxed at the appropriate federal income tax rate as it occurs. When realized, capital gains

are calculated assuming the appropriate capital gains rates. The holding period for capital gains tax calculation is

assumed to be five years for stocks, while government bonds are held until replaced in the index. No state income

taxes are included. Stock values fluctuate in response to the activities of individual companies and general market

and economic conditions. Generally, among asset classes stocks are more volatile than bonds or short-term

instruments. Government bonds and corporate bonds have more moderate short-term price fluctuations than

stocks, but provide lower potential long-term returns. U.S. Treasury bills maintain a stable value if held to maturity,

but returns are generally only slightly above the inflation rate. Although bonds generally present less short-term risk

and volatility than stocks, bonds do entail interest rate risk (as interest rates rise, bond prices usually fall, and vice

versa), issuer credit risk, and the risk of default, or the risk that an issuer will be unable to make income or principal

payments. The effect of interest rate changes is usually more pronounced for longer-term securities. Additionally,

bonds and short-term investments entail greater inflation risk, or the risk that the return of an investment will not

keep up with increases in the prices of goods and services, than stocks.

Taxes and

your Portfolio

33

IMPORTANT INFORMATION: APPENDIX B (CONTINUED)

Performance shown represents past performance, which is no guarantee of future results. Investment return and principal value of

investments will fluctuate over time. A client’s underlying investments may differ from those of the composite portfolio. Returns for

individual clients may differ significantly from the composite returns and may be negative. Current performance may be higher or

lower than returns shown. Composite and after-tax benchmark returns are asset weighted because both are based on individual

client accounts. Pre-tax benchmarks are not asset weighted, because they are based on market indexes. Returns include changes

in share price and reinvestment of dividends and capital gains. The index performance includes the reinvestment of dividends and

interest income. An investment cannot be made in an index. Securities indexes are not subject to fees and expenses typically

associated with managed accounts or investment funds. The underlying funds in each composite portfolio may not hold all the

component securities included in, or in the same proportion as represented in, its corresponding customized benchmark. Only

Fidelity® Personalized Portfolios that are all stock or include national and state-specific municipal bond funds are included.

Availability of state-specific funds depends on client’s state of residence. Fidelity Personalized Portfolios (“FPP”) launched July

2010; performance before such date reflects only Fidelity Private Portfolio Service (“PPS”) accounts. See endnote 11 for more

information on how these returns and benchmarks are calculated.

The results in Appendix B represent average annual composite returns (net of fees) for FPP client accounts managed by Strategic Advisers

that use an all-stock strategy or a strategy with municipal bond funds. N on-fee-paying accounts may be included in composites. This may

increase the overall composite performance with respect to the net-of-fees performance. The pre-tax benchmarks consist of market indexes.

The after-tax benchmarks consist of mutual funds, because an investable asset with known tax characteristics is needed to calculate after-tax

benchmark returns for comparison.

Composite portfolio excess returns are the difference between composite portfolio returns and their applicable composite portfolio benchmark

returns. Both the pre-tax and after-tax composite portfolio benchmark returns are blended from either representative market indexes (for pre-

tax benchmarks) or representative mutual funds (for after-tax benchmarks) in weightings based on the long-term asset allocation of each

strategy. The benchmark returns are calculated monthly based on the long-term asset allocation of the strategies at that time so the

benchmarks reflect historical changes to the asset allocation of each strategy. The benchmark long-term allocation weightings may vary

slightly from individual client accounts due to individual account investments and activity. The tables on the next page detail the current

composition of the benchmarks for each of the investment strategies that are all stock or with a municipal bond fund component mentioned in

this webinar.

11 Based on strategy composites. (See Appendix C for information on the composites.) These results and slide 22 are hypothetical and do not

represent actual value added to client accounts. Returns for individual clients will vary. Performance shown represents past performance,

which is not a guarantee of future results. Investment returns and principal value will fluctuate, and you may lose money.

Taxes and

your Portfolio

35

IMPORTANT INFORMATION

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

© 2015 FMR LLC. All rights reserved.

740973.1.0

Before investing, consider the funds' investment objectives, risks, charges, and expenses. Contact Fidelityfor a prospectus or, if available, a summary prospectus containing this information. Read it carefully.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain orlose money.

Past performance is no guarantee of future results.

Diversification and asset allocation do not ensure a profit or guarantee against a loss.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bondprices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed incomesecurities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers andcounterparties. Unlike individual bonds, most bond funds do not have a maturity date, so holding them until maturity toavoid losses caused by price volatility is not possible.

The municipal market can be affected by adverse tax, legislative, or political changes, and by the financial condition ofthe issuers of municipal securities.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and shouldnot be considered legal, tax, or estate planning advice. Tax laws and regulations are complex and subject to change,which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate,complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, anddisclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult anattorney or tax professional regarding your specific situation.

Taxes and

your Portfolio