Tank Storage Asia Thomas Ng 30 Sep 2015 v2

Transcript of Tank Storage Asia Thomas Ng 30 Sep 2015 v2

Thomas NgChairman, The Global Ports

Forum

Game-Changers in Oil & Gas: Implications for Asia Tank Storage

I Recent Oil & Gas Trends

II AIIB, RMB Internationalisation, One Belt-One Road Strategy, etc

III Implica-tions

Table of Contents

Asia Oil & Gas game-changers• Changing dynamics, game, players and

rules• New demand map, changes in energy

mix, and unconventional supply sources• Shift in trading and investment patterns• Volatility in prices, technological

breakthroughs• Environment, efficiency and climate

change• Is energy security a national security

matter?• Heightened geopolitical, cyber and other

risks

Complex dynamics in Asia• Substantial deposits of rich natural

resources • The prizes of the new Great Game -

Pipelines, tanker routes, petroleum consortiums and PSCs

• AIIB, One Belt-One Road, South China Seas, China Silk Road Fund

• East of Baku – it is China and Russia to play

• Sanctions against Russia hurt Central Asia

• Intra-Central Asian conflicts, political succession risk

Russia to China

Russia pivot to Asia

Central Asia and China…• “Pan-Asian global energy

bridge” from Persian Gulf to China

• Kazakhstan, Turkmenistan and Uzbekistan in China’s energy security nexus

• China to reduce dependence on ME oil, avoid “Malacca Dilemma” and address Xinjiang’s unrest

• Kazakhstan and Uzbekistan’s uranium deposits for China’s 30 new nuclear power plants

A showdown between Moscow and Beijing over Central Asia?

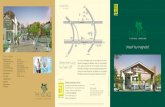

China-Europe “Silk Railway” and “Maritime Route”

Some of Asian Oil & Gas projects

• China’s energy “Silk Road” over Central Asia

• $45 bn Southern Gas Corridor by 2018• Iraq’s Kurdish gas from early 2018 • Iran is back in the oil and gas game• Turkmen gas to the Caspian and

Afghanistan• China’s claims in the South & East China

Seas• Mynamar’s new pipeline to Yunan, China• Pakistan’s China Pakistan Economic

Corridor

11

Roles of individual members

ASEAN: facilitate economic integration through AEC and ASEAN+1 FTAsASEAN’s economic role is reinforced by political consid-

erations;

strategic location astride East Asia’s critical trade routes

neutral position in the traditional tensions of Northeast

Asian countries

intermediary role between China/US and China/IndiaChina, Japan and Korea: pursue a high level of liberalization

for CJK FTA

High standards as a platform for RCEP

China needs to pursue comprehensive economic reforms

Peaceful and Prosperous Regional Economic Order

12

The Asian Infrastructure Investment Bank (AIIB)

Could be a rival or/and a complement to ADB and the Washington institutions

A countermeasure to the western-dominated development banks(World

Bank, IMF, ADB)

A complementary source for infrastructural funds in Asia

Expected to contribute to the regional economic integration in the Asia-Pa-

cific Need to adopt international best practices

AIIB would need to implement practices of governance, environmental and social safeguards, procurement, etc.

work with or add values to multilateral development institutions (ADB and WB) Address concerns for China’s infrastructure lending history and practice

in Africa China’s growing economic stature should be reflected in the governance structure

of global institutions - Reforms of global institutions are needed

Forms of Regional Economic Competition

Authorized Capital in AIIB

AIIB Share Allocations

Signing Ceremony of AA of AIIB, Jun 15

Infrastructure Lending in Asia

17

Internationalization of the RMB By the end of 2014, RMB ranked 5th as the most traded currency

According to SWIFT's report, at 2.2% of SWIFT payment behind JPY (2.7%), GBP

(7.9%), EUR (28.3%) and USD (44.6%)

The average monthly RMB trade settlement up from CN ¥ 320 billion in 2013 to

¥ 480bn in 2014

The Renminbi Qualified Foreign Institutional Investor (RQFII) quotas extended to five

other countries UK (15 Oct 2013), Singapore (22 Oct 2013), France (20 June 2014), Korea (18 July 2014),

Germany (18 July 2014), and Canada (8 Nov 2014), each with the quotas of ¥ 80bn except for Canada and Singapore ( ¥ 50bn)

Previously, only Hong Kong was allowed, with a ¥ 270bn quota The path of RMB internationalization can be divided into three phases

Trade finance

Investment

Reserve currency (in the longer term)

Other Forms of Regional Economic Competition

18

Internationalization of the RMB

The road to the RMB Internationalization is far from complete

Size of the home economy relative to others

Economic stability in the form of low inflation, small bud-

get deficits and stable growth

Strong official and institutional support

Deep, open and well-regulated capital markets (in a de-

liberately slow progress)opening up of China’s onshore capital marketgreater access for foreign investors to local capital marketsdeeper global RMB liquidity and wider cross-border flow

channels

Other Forms of Regional Economic Competition

RMB Internationalisation:Developments

19

RMB Internationalization: ProspectsMicro level: Increase Liquidity Supply and

Streamline Reflow process

Cut red tapes on approval process for cross-border use of RMB;Expand RMB payment in tourism, shopping and study in foreign countries; Explore measures to enable overseas public listed company to pay interests and dividend in RMB; Encourage policy banks and other financial institutions to expand RMB external financing and facilitate overseas development aid in RMB;

20

RMB Internationalization: ProspectsMicro level: Increase Liquidity Supply and

Streamline Reflow

Promote RMB bond issue in domestic and international market; Encourage use of RMB as a denominated currency in global outsourcing and commodity transactions; Encourage use of swap lines and expand financing channels for clearing banks and RMB participating banks in domestic market;

21

RMB Internationalization: ProspectsMacro level: Reform, Growth, Infrastructure and

Soft Power

Expand economic and financial opening up and reform : capital account, interest rate and exchange rate;

Sustain strong and stable economic growth;

Upgrade market infrastructure for cross border use of RMB: China International Payment System (CIPS), bond market development, regulation clean-up;

22

23

RMB Internationalization: ProspectsMacro level: Reform, Growth, Infrastructure

and Soft Power

Improve institutions and international coordination.

“One Belt and One Road” strategy .

IMF SDR review later this year

History may provide a guidance

24

RMB Internationalization: ProspectsMacro level: “One Belt and One Road”

strategy

A NEW SILK ROADREGIONAL COOPERATION VIA NEW OVERLAND AND

MARITIME LINKAGES

China opens new USD 2.5 bil oil & gas pipeline through Myanmar, Feb 15

Obama opens new chapter in relations btw US & Myanmar, Nov 13

China-Myanmar border conflict – Kokang shells fall. China sent troops to border,

May 15

China’s consortium study on new USD 28 bil Thailand Kra Canal, May 15

China consortium study on new USD 28 bil Thailand Kra Canal, May 15

Kra Canal ??– Singapore’s maritime trade dominance along Straits of

Malacca challenged ?

Iranian Ports – The Post Sanction Era, Mehdi Rastegary, Sina Ports Iran, Sep

15 • 6 Ports to watch -

Chabahar, Shahid Rajaee Port, Bushehr Port, Assaluyeh Port, Imam Khomeini Port, and Khoramshahr.

• Chabahar is the port that India is eyeing to develop to compete with Gawdar, Pakistan.

• Oil tanker fleet capacity of 15 mil ton/yr

• Strait of Hormuz -bunkering, economic supply of oil products, and availability of infrastructure and equipment,

Iran welcomes India USD 85 mil private investment for Chabahar port project, Aug 15

India-Iran Strategic Chabahar Port to be Operational by December 2016, Will Give Access to Afghanistan, Central Asia

CHINA PAKISTAN ECONOMIC CORRIDOR – USD 46 bil, Apr

15

CHINA PAKISTAN ECONOMIC CORRIDOR

China Sri Lanka Port Project – Xi visit – Sep 2014

Sri Lanka Colombo South Harbour (Hambantota) expansion/China

submarine visit

Bangladesh “aborted” China backed USD 8 billion port in

Sonadia island

Japan JICA (ADB?) funds Bangladesh Matarbari port

LNG tankers lie unused around Singapore as gas downturn turns to crisis, Feb 15

S.Korea to build LNG bunkering terminals, wants to dominate duel-fuel tanker building, Jul

15

Chinese independents ENN, Guanghui Energy get foothold in LNG trade as restrictions lifted, May 15

Pertamina to partner with Kalla Group for 4-mtpa LNG receiving terminal, Apr 15

Philippines' First Gen seeks partner for $1 bln LNG import terminal, Mar 15

China Deepsea Oil rigs in South China Seas

China builds 6 artificial islands in South China Seas and builds 3rd airstrip

China builds 6 artificial islands in South China Seas and builds 3rd airstrip

Saudi Arabian Crude Oil Production & Brent Price

China Oil production & consumption

China Peak Oil ? - Oil Production Trajectories of Daqing and Prudhoe Bay, ‘000 bpd

China Peak Oil ? - Slowing Changqing Output Suggests Tight Oil Insufficient to Offset Core Fields’

Decline

China Peak Oil ? - Offshore Oil Production Will Not Turn the Tide of Oil Production Declines

Key implications• The game, players and rules have changed.• Oil & Gas security from Lisbon to Shanghai

requires new approaches or serious adaptation of the old ones

• A potential security and economic crisis in the making – esp the downturn started from China & the South China seas dispute

• Volatility not only in prices but also in social security

• Develop win-win propositions for all in order to reduce geopolitical tensions

• Tank storage investors still have many other new attractive destinations

Thank you

Cosco China runs 3 mil TEU/yr Greek Piraeus Port

Cosco Pac & CMHI acquires 65% of Turkey Kumport for USD920 mil, Sep

15