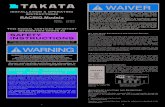

TAKATA,Documento Oficial

Transcript of TAKATA,Documento Oficial

-

8/20/2019 TAKATA,Documento Oficial

1/74

2012

Takata Corporation

Annual Report

-

8/20/2019 TAKATA,Documento Oficial

2/74

Contents

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2

>> CONTENTS

FORWARD-LOOKING STATEMENTS

The information provided in this document is not intended to be and should not be construed as an inducement to purchase or sell stock in Takata Corporation. You should

make any investment decisions relating to the stock in Takata Corporation on the basis of your own assessment and judgment. The information in this document includes

forward-looking statements and forecasts, as well as historical results. Please be informed that such forward-looking statements and forecasts are not guarantees of

future results, but rather are inherently risky and uncertain, and therefore actual results may be materially different. Takata Corporation does not assume any responsibility

for any damage resulting from the use of the information contained in this document.

Takata Principles 1

Profile 2

Financial Highlights 3

Message from the President 4

Total Safety Systems 8

Global Business Overview 10

Japan 12

The Americas 14

Europe 16

Asia 18

Research & Development 20

Global Regulations 26

Takata in the News 28Environment 30

Society 31

Corporate Governance 32

Board of Directors, Corporate Auditors,

and Executive Officers 34

Financial Section 35

Investor Information 72

>> COVER >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

3/74

Our mission - your safety.

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 1

Takata Principles

Philosophy

We embrace the pioneer spirit of our founder and

are motivated by the preciousness of life.

Mission Statement

Develop innovative products and provide superlative quality and

services to achieve total customer satisfaction.

Respect various personalities and cultures and keep associates highly

motivated under one Takata name to pursue common goals.

Be an active member of the community and

contribute to a better society.

Takata Way

To communicate openly and effectively.

To adhere to Sangen-shugi.

To be committed in everything we do.

>> TAKATA PRINCIPLES>> COVER >> FINANCIAL SECTION>> CONTENTS

-

8/20/2019 TAKATA,Documento Oficial

4/74

Profile

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 2

>> PROFILE

Takata Corporation is one of the world’s leading automotive safety systems

companies, supplying nearly all the world’s major automakers with a product

range that includes seat belts, airbag systems, steering wheels, child seats,

and electronic devices such as satellite sensors and electronic control units.

Founded in 1933 as a textile company in Shiga Prefecture, Japan, Takata

began to focus on businesses relating to automotive safety systems from the

early 1950s. Since bringing Japan’s first seat belt to market in 1960, Takata

has grown organically and through acquiring and successfully integrating

businesses around the globe. Today, Takata has plants in 20 countries and is

one of the most vertically integrated manufacturers in the global automotive

safety industry, operating within a regional and global framework that

encompasses the entire value chain.

Takata continues to undertake advanced research into high-technology safety

systems and products, and has received numerous awards for innovation and

excellence in automotive safety. Takata is investing for growth in emerging and

mature markets worldwide, building on its strong relationships with global and

local automakers to provide consistently high quality, reliable supply, and close

alignment with end-user needs.

Takata remains firmly committed to contributing to society

as a technology and value leader in automotive safety

systems and products, as it seeks to realize its dream

of a society with zero fatalities from traffic accidents.

>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

5/74

Financial Highlights

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 3

2012 2011 2010 2009 2008

For the year:

Net sales ¥ 382,737 ¥ 390,876 ¥ 350,914 ¥ 385,499 ¥ 515,857

Operating income 13,618 26,818 14,654 2,845 36,732

Ordinary income 13,499 27,008 15,672 369 36,397

Net income 11,937 18,237 6,942 (7,319) 22,878

At year end:

Net assets ¥ 161,186 ¥ 155,312 ¥ 150,789 ¥ 145,379 ¥ 175,200

Total assets 329,718 323,928 330,040 315,352 339,010

Net assets per share (yen) ¥1,924.80 ¥1,855.48 ¥1,805.06 ¥1,768.98 ¥2,145.79

Basic net income per share (yen) 143.55 219.31 84.62 (89.40) 280.89

Diluted net income per share (yen) — — — — 276.44

Capital adequacy ratio (%) 48.5 47.6 45.5 46.0 51.6

Return on equity (%) 7.6 12.0 4.7 (4.6) 13.0

Price-to-earnings ratio (times) 15.4 10.9 28.3 (9.0) 7.8

Notes:

1. Net sales is presented exclusive of consumption tax. 2. Diluted net income per share is not shown for the fiscal year ended March 31, 2009 because the Company made a net loss and no dilution was recorded due to

there being no outstanding potential shares of common stock. Diluted net income per share is not shown for the fiscal year ended March 31, 2010 as there were nooutstanding potential shares of common stock with dilutive effects. Diluted net income per share is not shown for the fiscal years ended March 31, 2011 and 2012 asthere were no outstanding potential shares of common stock.

Takata Corporation and Subsidiaries

(Millions of yen except where indicated)

Fiscal years ended March 31

Net income

2012

2011

2010

2009

2008

11,937

18,237

6,942

(7,319)

22,878

Millions of yen

Operating income

2012

2011

2010

2009

2008

13,618

26,818

14,654

2,845

36,732

Millions of yen

Net sales

2012

2011

2010

2009

2008

382,737

390,876

350,914

385,499

515,857

Millions of yen

Net assets per share

2012

2011

2010

2009

2008

Yen

143.55

219.31

84.62

(89.40)

280.89

Total assets

2012

2011

2010

2009

2008

329,718

323,928

330,040

315,352

339,010

Millions of yen

1,924.80

1,855.48

1,805.06

1,768.98

2,145.79

Basic net income per share

2012

2011

2010

2009

2008

Yen

>> FINANCIAL HIGHLIGHTS>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

6/74

Recovering fromnatural disasters

Takata’s performance for the fiscal year ended March 31,

2012 was deeply affected by two natural disasters: the

March 2011 earthquake in Japan, and the September

2011 flooding in Thailand. The impact on the automotive

industry has been well documented. Although our ownfactories were outside the disaster zones, disruptions to the

wider supply chain brought production at many automak-

ers to a halt. Sales and production at Takata during the

periods of disruption were inevitably hit hard, particularly in

Japan, Asia and the Americas. Despite such challenges, a

high pace of recovery efforts restored production far more

quickly than had at first seemed possible, and on a local

currency basis we managed to increase our consolidated net sales for the year by 2.6%. Considering

our exposure to customers severely constrained by the natural disasters, this is a noteworthy achieve-

ment. Taking currency translation effects into account, these issues led to a 2.1% net decrease in

consolidated sales to ¥382,737 million for the year.

The disruptions to the automotive industry had a severe impact on Takata’s profitability. Prior to the

resumption of full manufacturing in September 2011, we cut production at some locations by nearly

50%, and the lower overall capacity utilization ratio over the course of the year was one of the factors

that led to operating income falling 49.2% to ¥13,618 million. As a result, the operating profit margin

for the year was 3.6%.

Strong financial status maintained

Our financial position remains sound. Amid currency fluctuations and a troubled global economy we

have maintained a policy of ensuring high cash liquidity and an ability to capitalize on sustainable

growth opportunities over a three-to-five year time frame. Our shareholders’ equity ratio at the endof the year was 48.5%, our credit rating from JCR remains at A—as it has been since 2007—

and we issued a dividend of ¥30 per share for the year, the same level as in the previous year.

Slight increase in global automobile production

Given the unprecedented circumstances, it is perhaps unsurprising that the number of automobiles

manufactured globally showed only a small increase in fiscal 2012. Moderate economic recovery in

the US supported production growth. In Europe, excluding Germany, the economic slowdown

brought about by the financial crisis put the brakes on production. Emerging Asian markets like

China and India slowed from their rapid growth of the previous year. Major declines among Japanese

automakers were seen as a result of the natural disasters noted earlier. In Japan, production returned

to normal or higher-than-normal levels from the third quarter, but this could not completely compen-

sate for the massive disruptions in the first half of the year. Furthermore, the increases in production

occurred mostly in regions with low safety content per vehicle.

Message from the President

PRESIDENT AND COO

Shigehisa Takada

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 4

2012 marks 80 years since our founding. Under our new Global Vision—

One World One Takata—we are focused on becoming the world’s

leading global supplier of automotive safety systems.

>> MESSAGE FROM THE PRESIDENT>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

7/74

Growth strategy focuses on most promising markets

The global automotive safety parts market is valued at approximately ¥2 trillion and Takata is cur-

rently number two in the industry worldwide with a share of around 20%. Our goal is to become the

global industry leader. Our current medium- to long-term management plan is to achieve Group sales

of ¥500 billion and operating margin of 10%, and to achieve this we are focusing our resources on

emerging markets. These comprise a number of markets showing substantial, sustained growth, with

exciting long-term potential. Given the importance of these markets to the success of our strategy,

I would like to make some brief points about each of them, starting with China.

Expanding our network in China, the world’s largest car market

China has become the largest automotive market in the world. Nearly everything about this market

has increased in scale and sophistication, typified by how important the Shanghai Auto Show has

become on the international calendar. We are deeply committed to growing our business in China with

both domestic and global automakers, and are aligning our operations closely with the unique needs

of this market. An example of this approach is our new stand-alone technical center in Shanghai,

designed to enable a more rapid and focused response to specific local requirements.

India

India is another market with very high latent demand for automobiles. This emerging demand is essen-

tially an ongoing, secular trend. Despite the recent easing of growth amid fiscal tightening, we are

continuing to pursue our long-term strategy in this market, working closely with domestic and global

automakers to complement their expansion throughout the nation.

Thailand and Indonesia

After China, Thailand and Indonesia are the largest automotive markets in Asia. There is immense

activity and investment by major auto manufacturers in this region, and the outlook for automotive

growth is positive. We have a strong network of manufacturing plants, close to key manufacturers,

and have particularly strong relationships with the Japanese automakers that continue to enjoy very

high market share in this region.

Brazil and South America

Brazil is another nation with a strong secular growth trend. We have been active in Brazil for many

years and have very high market share as the leader in airbags and steering wheels. Our new Uruguay

plant began full production this year, shipping safety components to our assembly plants in Brazil.

As stricter safety regulations become progressively applicable to a broader range of vehicles in South

America, we are focusing intently on being first to capture the ensuing opportunities for growth.

Russia

Russia has become an increasingly significant element of the wider European automobile market, and

vehicle production volumes have shown impressive growth. Reflecting this, we have begun full scale

production at a new plant in the Western Russian district of Ulyanovsk, ideally placed to build on the

important relationships we have with leading manufacturers in the market.

Message from the President (cont.)

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 5

“We are deeply

committed to growing

our business in China

with both domestic and

global automakers,

and are aligning our

operations closely with

the unique needs of

this market.”

“Brazil is another nation

with a strong secular

growth trend. We have

been active in Brazil for

many years and have

very high market share

as the leader in airbags

and steering wheels.”

>> MESSAGE FROM THE PRESIDENT>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

8/74

Message from the President (cont.)

Creating a truly global organization and outlook

Within our industry, the term ‘globalization’ means more than ‘doing business in global markets’. For

automakers, globalization heralds a dramatic shift in production capacity from mature markets to

emerging economies, a strong trend toward international product standardization, and an increasing

number of major local automakers looking beyond their own borders. As a result, auto parts manu-

facturers are now expected to be able to provide uniform products in any region of the world. This

is a significant change in approach, and companies in our industry that fail to make the necessary

fundamental changes are unlikely to survive.

Anticipating this change in the industry, in April 2012 we aligned our value chain to enhance com-

petitiveness. We now have unified international teams with Associates aligned across our entire value

chain, from development through to sales, so that we can address the specific needs of each global

automaker in each of their markets. Each value chain division has strategic priorities to pursue. For

example, In R&D we are focusing our new product development on crash avoidance and electronic

systems, aiming to ensure strong differentiation in the market. In purchasing we are adopting more

efficient working capital management systems and driving down procurement costs. In manufacturing

we are putting in place stronger, more direct links with engineering, helping to create global standard

products and production processes that will increase our cost competitiveness. And at the manage-

ment level, we are committed to increasing the speed of our decision-making, with a slimmed-down

international management committee that can deliver resources to markets rapidly and effectively.

Through the global activities of our business units, we plan to show all our customers, wherever they

are in the world, that they have access to the very best safety products and services.

Growing our core and expanding into related areas

Our business strategy has two main elements: maximizing growth and profitability in our existing

business, and entering into new safety-related business areas. “Existing business” should not be

construed as meaning “doing exactly what we have always done.” We are making exciting advances

in airbags, seat belts and active safety systems, and in combination with regulatory advances in

growth markets and consumer sophistication in mature markets, this means that there are strong,

sustained opportunities for us to keep growing. An example of our continued development in an exist-

ing business area is the front center airbag we developed jointly with General Motors. We introduced

this world-first product in 2011 to provide additional protection to front seat occupants in side impacts,

and in doing so, proved once again that practical innovation is a powerful driver for business growth.

Safety Electronics is another area of innovation-based growth for Takata, as it lies at the heart of active

safety systems.

We have been making significant investments to ramp up our operations in new markets as well.

We have now taken the first steps in expanding our operations into Non-Automotive Safety systems,

most notably with the March 2012 acquisition of a BAE Systems subsidiary that produces seat belts

and other safety equipment for fixed wing aircraft, helicopters and race cars. This provides a credible

path into the aircraft industry and new markets outside of automobiles where we can both apply and

gain knowledge to grow the scale of our business, while remaining firmly within the field of safety that

has driven our business for so many decades.

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 6

“For automakers,

globalization heralds

a dramatic shift in

production capacity

from mature markets to

emerging economies,

a strong trend toward

international product

standardization, and an

increasing number of

major local automakers

looking beyond their

own borders.”

>> MESSAGE FROM THE PRESIDENT>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

9/74

Message from the President (cont.)

Championing safety: our evolving role

Takata’s growth as a pioneer in the automotive industry has been founded on providing safety prod-

ucts. In some respects, our terms of engagement with the automotive industry have been relatively

simple: automakers built cars, and we supplied safety components. However, today society and our

industry are undergoing substantial change, influenced by factors such as the stagnation of mature

markets, the rapid growth of emerging economies, the emergence of electric vehicles and other

responses to environmental concerns, and heightened awareness of safety and security in societies

around the world.

Given these changes, we recognize a need to reconsider our role in society. We believe we have

reached the point where we can contribute to the safety of the automotive market and society on a

broader front. This means carefully considering changes in the communities we serve. For example,

thirty years ago we played a pioneering role in promoting child seats in high-growth Japan. Now, we

need to consider what kind of safety systems are needed by the rapidly aging global population,

and by new modes of transport.

As part of this Total Safety approach, we are active in efforts to detect and prevent drinking and

driving, and have been active in initiatives to increase the correct installation of seat belts and child

seats so that every passenger in a vehicle can be kept safer. These needs are even more pressing in

emerging markets that are undergoing rapid motorization, giving us the opportunity to make use of

skills we have learned in mature markets. The same applies in environmental management, where

we have adopted reduce, reuse, recycle programs with significant results in many of our plants.

Acknowledging the past but focusing relentlessly on the future

In February 2011 we lost Juichiro Takada, the leader who made Takata what it is today. He was inspi-

rational in many ways, but in particular for the way he refused to give up until success was achieved,

no matter how tough the circumstances. Our Company now has an 80-year history of developing

technology and pursuing ever higher goals through both strong and weak economic cycles, but we

have no interest whatsoever in dwelling on our past achievements. The challenges and opportunities of

the future are far too great, and I will be working alongside our 37,000 group employees to ensure that

“Our mission—your safety” continues to be a guiding force for safety in the world of transportation.

We very much appreciate your ongoing interest and support.

Shigehisa Takada

President

June 2012

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 7

“In some respects, our

terms of engagement

with the automotive

industry have been

relatively simple:

automakers built

cars, and we supplied

safety components.

However, today society

and our industry are

undergoing substantial

change, influenced

by factors such as

the stagnation of

mature markets,

the rapid growth of

emerging economies,

the emergence of

electric vehicles

and other responses

to environmental

concerns, and

heightened awareness

of safety and security

in societies around

the world.”

>> MESSAGE FROM THE PRESIDENT>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

10/74 TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 8

Seat belts

Since commercializing Japan’s first seat belts in 1960, we have

continued to improve the effectiveness and comfort of seat

belts through innovation in areas such as textiles and weaving

technology. Recently we modified our motorized seat belt to

provide enhanced comfort and safety. In addition to automati-

cally tightening to restrain vehicle occupants when pre-crash

sensors detect risk of collision, the new comfort function reduces

the pressure exerted by the seatbelt during normal driving, hold-

ing vehicle occupants in position during sudden braking or sharp

turns. In 2010 we became the first in the world to commercialize

the airbelt, a new type of seat belt that inflates like an airbag at

the time of impact. We also recently developed new state-of-

the-art inkjet printing technology which allows us to create seat-

belt webbing with patterns, words or logos in a variety of colors.

Driver seat belts (Motorized seat belts)

Passenger seat belts (Motorized seat belts)

Rear seat belts

Airbag systems

Takata launched the first airbags in Japan in 1987. Since then

we have continued to enhance our capabilities in the develop-

ment, design and production of airbag systems and products,

from airbag textiles to hazard detection control units and inflator

technology, and today most of these operations are carried

out in-house. In addition to driver and passenger airbags, side

airbags, curtain airbags, and knee airbags that protect the legs

of front seat occupants, we have commercialized innovative

products such as the D-shape curtain airbag, which protects

the head as well as helping prevent passenger ejection, and a

far-side airbag that inflates between the left and right seats in

the event of a side collision to control the lateral movement of

vehicle occupants. In 2009 we marked the launch of our Vacuum

Folding Technology (VFT) which uses a proprietary packingprocess to reduce the size of airbags by up to 50% compared

to conventional airbags, with 35% less mass.

Driver airbags

Passenger airbags (Twin bag systems)

Knee airbags

Side airbags

Curtain airbags

Pedestrian head protection airbags

Takata’s advanced safety technology:

Surrounding the lives it protects

Our product range encompasses the

full spectrum of passive and active

automotive safety technology, and

the results of our advanced research

and relentless attention to detail can

be found throughout the anatomy of

a car—helping to protect occupants

and even pedestrians, and to reduce

the impact of traffic accidents on

individuals and on society.

1

3

2

1

3

2

4

5

6

1

3

2

1

3

2

45

6

Total Safety Systems

>> TOTAL SAFETY SYSTEMS>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

11/74

Total Safety Systems (cont.)

Seat belts

28.7%Other

27.6%

Airbags

43.6%

Salesby productcategory (FY2012)

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 9

Other

This category includes steering wheels, electronic devices such as vehicle occupant sensors, colli-

sion sensors, electronic control units (ECUs) for controlling airbag inflation, interior trim products such

as door panels and consoles, and child seats. In 2000, Takata acquired Petri AG, a German manu-

facturer with a strong track record that includes installing the world’s first airbags into commercially

produced vehicles. In 2009 we developed and commercially launched SafeTrak, a lane departure

warning system, which mitigates the risk of accidents caused by unintentional lane departures that

can result from lapses in driver concentration.

Steering wheels

Interior trim

Child seats

Satellite sensors

Electronic control units (ECUs)

Seat weight sensors (SWSs)

Pop-up hood devices

Lane departure warning systems

TAKATA INNOVATION

Front Center Airbag

From the passenger’sperspective, there are

two possible types of side

collisions. One occurs close

to the occupant (the near

side). The other happens

on the opposite side from

the occupant (the far side).

Current available inflatable

devices address near side

scenarios.

However, to provide

supplemental protection

to passengers in collisionsfrom both sides, Takata

has worked in partnership

with General Motors to

develop a Front Center

Airbag which inflates

between the left and right

front seats, and serves

as an energy-absorbing

cushion between the driver

and front seat passenger

in both near and far

side-impact crashes. The

tubular airbag is mounted

in the right side of thedriver’s seat, and is also

expected to provide benefit

in rollover crashes.

1

3

2

4

5

7

8

6

1

3

24

5

6

7

8

“...the results of our advanced research and

relentless attention to detail can be found

throughout the anatomy of a car—helping

to protect occupants and even pedestrians,

and to reduce the impact of traffic accidents

on individuals and on society.”

>> TOTAL SAFETY SYSTEMS>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

12/74

Global Business Overview

18/5/188/1/4

21,5001,500

Japan America

Brazil

Mexico

Uruguay41

Our global headquarters is located in

Tokyo, and in Japan Takata has eight

manufacturing plants, two of which

are located in the southwest island

of Kyushu, and one R&D facility. A

new cutting-edge servo sled test

facility is currently under construction

at our R&D facility, located in Shiga

Prefecture. We have approximately

1,500 employees in Japan.

Takata’s regional headquarters for the

Americas is in Auburn Hills, Michigan.

We have five plants and three R&D

facilities in the U.S. and nine plants in

Mexico. In South America, we have

three plants in Brazil, and a recently

completed a plant in Uruguay. We

currently have approximately 21,500

employees in the Americas.

COUNTRIES1

PLANTS/R&D FACILITIES2 /

CONSOLIDATED SUBSIDIARIES

MARKET SUMMARY

REGION NET SALES

REGION OPERATING INCOME

EMPLOYEES3

1. Countries in which Takata has a presence 2. Includes sled, testing and local application engineering facilities

3. Approximate as of March 31, 2012; full-time employees only

Millions of yen

2012

2011

2010

2009

2008

Millions of yen

1,174

2012

2011

2010

2009

2008

102,265

112,882

106,573

124,925

156,949

4,106

9,262

6,699

5,045

Millions of yen

2012

2011

2010

2009

2008

Millions of yen

128

(1,699)

(3,021)

2012

2011

2010

2009

2008

153,135

157,464

143,643

154,923

237,946

14,159

3,914

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 10

Japan The Americas

>> GLOBAL BUSINESS OVERVIEW>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

13/74

Global Business Overview (cont.)

15/4/22 12/4/14

11,500 2,000

Czech Republic

Germany

Morocco

Poland

Romania

China

India

Indonesia

Korea

Malaysia

87Philippines

Singapore

Thailand

Russia

South Africa

Takata’s regional headquarters for

Europe is located in Aschaffenburg,

Germany. We have fifteen factories

and four R&D facilities in the region,

and a new plant in Russia recently

commenced operations. We have

also established a new plant in

Morocco to supply local and regional

OEMS mainly in Southern Europe.

We have a total of around 11,500

employees in the region.

In the Asia region we have eleven

plants and three R&D centers in

seven countries, including new plants

in Indonesia and Tianjin and India,

and a new Technical Center

in Shanghai, China. We have

approximately 2,000 employees in

the region excluding Japan.

COUNTRIES1

PLANTS/R&D FACILITIES2 /

CONSOLIDATED SUBSIDIARIES

MARKET SUMMARY

REGION NET SALES

REGION OPERATING INCOME

EMPLOYEES3

1. Countries in which Takata has a presence 2. Includes sled, testing and local application engineering facilities

3. Approximate as of March 31, 2012; full-time employees only

Millions of yen

2012

2011

2010

2009

2008

Millions of yen

1,391

(3,383)

2012

2011

2010

2009

2008

116,635

108,477

98,136

112,132

144,472

5,785

4,117

5,695

Millions of yen

2012

2011

2010

2009

2008

Millions of yen

2012

2011

2010

2009

2008

76,188

82,320

72,750

68,295

73,709

3,581

9,625

8,660

7,245

9,319

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 11

Europe Asia (excluding Japan)

>> GLOBAL BUSINESS OVERVIEW>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

14/74

Japan

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 12

Business year in review

The automotive industry in Japan faced its greatest ever challenge in the aftermath of the March

2011 Great East Japan Earthquake. Vehicle production and sales fell drastically in the first half of theyear, despite the sometimes astonishingly rapid restoration of domestic manufacturing and logistics

infrastructure, the disaster still had a significant impact on autoparts suppliers such as Takata.

Automotive production levels began to normalize from August as remaining production and

distribution hurdles were overcome, and total vehicle production in Japan for the year reached

8.5 million, an increase of 3.4%.

Results and outlook

Net sales decreased 9.3% to ¥102,265 million, and operating income fell 55.7% to ¥4,106

million. These figures largely reflected operating losses in the first quarter followed by recovery

of results as vehicle production picked up again in the second quarter.

Looking ahead, Japan’s auto industry appears likely to remain under severe pressure from

the strength of the yen, compounded by other factors such as a shrinking domestic automotive

market, uncertain energy supply amid the continued shutdown of nuclear power plants, and

increasing energy costs. Japanese automakers are shifting more of their production to growth

markets and low cost manufacturing locations, and exporting fewer cars from Japan. Despite

these problems, we expect a moderate level of economic recovery to continue in Japan, sup-

ported by demand from disaster reconstruction and recovery measures.

At Takata we have been putting in place an operating structure to enable us to align more

closely with our automaker customers in every market, including Japan, and we are therefore

adjusting capacity and production within an overall framework of global growth for our business.

(Photos from top) Takata Corporation

Headquarters, Tokyo; Takata won a 2011

Good Design award for its Airbelt, a unique

fusion of existing airbag and seat belt

technologies

>> GLOBAL BUSINESS OVERVIEW: JAPAN

Takata is an acknowledged pioneer in Japan’s automotive safety systems market,

with a history of more than 50 years of innovation, technological development

and commitment to ever higher levels of automotive safety. Japan is Takata’s

global headquarters, playing a central role in group management, cost control

and product development strategy.

Japan: Operating incomeby quarter

Japan: Net sales by quarter Region as percentageof total sales

Millions of yen, rounded down

Millions of yen, rounded down

(727)

1,820

1,725

1,289

1Q

2Q

3Q

4Q

18,747

26,454

28,184

28,881

1Q

2Q

3Q

4Q 18.6%

FY2011: 19.9%

>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

15/74

Japan (cont.)

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 13

Japan

Despite disruptions from the March 11

disaster, Japan’s vehicle production was

restored more rapidly than anticipated,

and surpassed pre-quake levels by

September 2011.

Takata wins 2011 Good Design award for world’s first Airbelt

The Good Design awards assess not only aesthetics but also how items contribute to better

lifestyles and society. In October 2011, Takata won a Good Design award for the world’s first com-

mercialized Airbelt for passenger vehicles, with judges recognizing the innovative design approach

and Takata’s active ongoing pursuit of higher levels of passenger safety.

Launched commercially in 2010, Takata’s Airbelt features an airbag built into the webbing of

the seat belt, which on impact expands over the occupant’s head, shoulder and chest. Because

the belt inflates between the shoulder and head, it can reduce lateral head movement and provide

protection from impact with structural objects or other passengers inside the vehicle.

“At Takata we have

been putting in place

an operating structure

to enable us to align

more closely with our

automaker customers

in every market,

including Japan,

and we are therefore

adjusting capacity and

production within an

overall framework of

global growth for

our business.”

>> GLOBAL BUSINESS OVERVIEW: JAPAN

FY2013

FY2012

FY2011

FY2010

FY2009

8,882 (Forecast)

8,575

8,294

8,320

9,275

Auto Production Trends for JapanThousands of vehicles

Source: IHS Worldw ide Inc. Exclu ding trucks (as of J uly 2012)

>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

16/74

The Americas

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 14

Business year in review

Vehicle production in the Americas increased almost 10%, or over one million vehicles,

for the year under review, despite disruptions to the supply chain in the aftermath of naturaldisasters in Asia. Higher sales in the fourth quarter supported this increase in production.

Developments at Takata included the opening of our Uruguay facility, which began shipping

airbag components, and the commissioning of our new Servo Sled crash test laboratory in

Auburn Hills, Michigan, which now provides the most accurate crash data analysis available

in the industry.

We made two important acquisitions during the year as part of our drive to be a global leader

in transportation safety, purchasing BAE Systems subsidiaries BAE Systems Safety Products Inc.,

(based in Pompano Beach, Florida, USA) and Schroth Safety Products GmbH (based in Arnsberg,

Germany), now renamed Takata Protection Systems Inc. These acquisitions give us the opportu-

nity to extend our expertise to other transportation markets, such as airline and motor sports.

Results and outlook

Net sales in the Americas declined by 2.7% year on year to ¥153,135 million, and operating

income fell 96.7% to ¥128 million. Although production volumes at Ford, Chrysler, General

Motors, Hyundai and Nissan increased, helping to fill volume gaps left by several Japanese

OEMs, this broad change in product mix, along with reduced production after the natural

disasters, affected Takata America’s overall performance. Results were also affected by a one-

time charge to warranty claims and legal fees associated with an ongoing investigation by the

U.S. Department of Justice.

Performance at Takata began to improve in the fourth quarter of the year, with Honda and

Toyota returning to full production levels, and this improvement is expected to extend into thefollowing year.

(Photos from top) Steering wheel

production, Brazil plant; Auburn Hills,

Michigan, U.S.; Servo sled facility,

Auburn Hills, Michigan, U.S.

>> GLOBAL BUSINESS OVERVIEW: THE AMERICAS

Takata began operations in North America in 1984, and through

organic growth and acquisitions we have become a leading safety

systems supplier throughout North and South America. In addition to

the United States, we operate plants in Mexico, Brazil and Uruguay. A new

advanced crash test research laboratory located in Auburn Hills, Michigan

supports development programs of major U.S., European and Asian automakers.

36.7%FY2011: 37.0%

Americas: Operating incomeby quarter

Americas: Net sales by quarter Region as percentageof total sales

Millions of yen, rounded down

Millions of yen, rounded down

1Q

2Q

3Q

4Q

35,550

36,506

36,866

44,215

1Q

2Q

3Q

4Q

(334)

950

(2,297)

1,809

>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

17/74

The Americas (cont.)

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 15

North America

North America, the key market for the

Americas region, has seen stable growth

in vehicle production since 2010, and is

forecast to continue to grow in 2013.

New servo sled takes safety system testingto frontier levels of accuracy

Takata’s new state-of-the-art servo sled facility in Auburn Hills, Michigan, in the United States began

operations in the summer of 2011, bringing airbag and restraint testing in the Americas to a new

level of sophistication. Technical advances in the servo sled enable Takata to shorten the product

development cycle by creating a more precise correlation between servo sled test simulations and

actual full-vehicle crash tests run by OEMs. For example, the new sled can simulate vehicle nose-

diving under heavy braking, enabling engineers to develop a more accurate picture of occupant

movement in collisions—and helping Takata provide an even higher level of service to local and

international automakers.

“We made two

important acquisitions

during the year as

part of our drive to

be a global leader in

transportation safety...

These acquisitions give

us the opportunity to

extend our expertise

to other transportation

markets, such as

airline, military and

motor sports. We have

also begun working in

the aerospace industry,

supplying specialized

airbags for private

space shuttles.”

>> GLOBAL BUSINESS OVERVIEW: THE AMERICAS

FY2013

FY2012

FY2011

FY2010

FY2009

14,822 (Forecast)

13,719

12,425

9,782

10,842

Auto Production Trends for North AmericaThousands of vehicles

Source: IHS Worldw ide Inc. Exclu ding trucks (as of J uly 2012)

>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

18/74

Europe

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 16

Business year in review

The year under review saw continued variability in the automotive markets of Europe. In Western

Europe, the number of new car registrations eased 1.3%, with a considerable stabilizing effectfrom the German market, which recorded a growth in registrations of 6%. This was largely able to

compensate for lower sales in other key markets, such as France (down 18%), Italy (down 15%),

and Great Britain and Spain (each down 4%).

Meanwhile, the Eastern European market grew substantially, largely driven by a 38.7% increase

in Russia, where consumers purchased nearly 2.7 million new vehicles.

Growth in the Chinese automotive market continued to influence outcomes in Europe, with

manufacturers of premium European brands in particular benefiting from further strong export

sales to China.

Results and outlook

Net sales increased 7.5% to ¥116,635 million, led by sales to German automakers. This sales

growth contributed to a 40.5% increase in operating income to ¥5,785 million. During FY2012 we

increased European production capacity, with the construction of a new plant in Russia for seat

belts, airbags and steering wheels, and expansion of a plant in Romania.

For the year ahead, significant risks are coloring expectations for the European automotive mar-

ket. Foremost among these risks is the ongoing sovereign debt crisis and financial market volatility,

which caused a substantial slowdown in vehicle sales in the second half of the year under review.

Raw material prices are also a concern. On the positive side, regulatory developments in different

European nations are providing impetus for higher sales of airbags and other safety products, and

we are building even closer relationships with leading automakers throughout Europe. We are tak-

ing further steps to optimize our pricing, cost structure and manufacturing footprint, and expect tocompete strongly with our global peers in the year ahead.

(Photos from top) Aschaffenburg, Germany;

R&D center, Berlin, Germany; Takata display

at Frankfurt Motor Show

>> GLOBAL BUSINESS OVERVIEW: EUROPE

Takata’s manufacturing presence in Europe began in the U.K. in 1988. In 2000 we

acquired PETRI AG, a major German manufacturer of steering wheels, airbag systems

and other safety products. Today, our geographically diverse European footprint serves

automakers from Europe and around the world, supported by an advanced R&D

center that hosts the latest sled crash testing and product development facilities.

30,484

28.9%

FY2011: 26.5%

Europe: Operating incomeby quarter

Europe: Net sales by quarter Region as percentageof total sales

Millions of yen, rounded down

Millions of yen, rounded down

2,005

1,077

1,267

1,436

1Q

2Q

3Q

4Q

30,403

28,688

27,061

1Q

2Q

3Q

4Q

>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

19/74

Europe (cont.)

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 17

Germany

Germany, Europe’s key market, has

been resilient amid the faltering

European economy, benefiting from

exports of luxury vehicles to China on

the back of a weaker euro.

Network expansion and marketing in Europe

Supply capabilities strengthened in Eastern Europe

Takata is continuing to expand its plant network in Eastern Europe, which is an attractive loca-

tion for automakers needing cost-effective, high quality manufacturing. During FY2012 we started

production at a new plant in Russia.

Takata displays safety technology at the Frankfurt Motor Show

In September 2011, Takata showcased its safety technology at the Frankfurt Motor Show. The

centerpiece of our display was Takata’s Vacuum Folding Technology, which dramatically reduces the

size of the airbag in the steering wheel while reducing design limitations and environmental impact.

Also on display to the public was Takata’s new hood airbag, currently under development.

“...regulatory

developments in

different European

nations are providing

impetus for higher

sales of airbags

and other safety

products, and we are

building even closer

relationships with

leading automakers

throughout Europe.

We are taking further

steps to optimize our

pricing, cost structure

and manufacturing

footprint, and expect to

compete strongly with

our global peers in

the year ahead.”

>> GLOBAL BUSINESS OVERVIEW: EUROPE

FY2013

FY2012

FY2011

FY2010

FY2009

5,326 (Forecast)

5,800

5,561

5,136

4,976

Auto Production Trends for GermanyThousands of vehicles

Source: IHS Worldw ide Inc. Exclu ding trucks (as of J uly 2012)

>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

20/74

Asia (excluding Japan)

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 18

Business year in review

In Asia, vehicle production in the earlier part of the year to March 2012 was adversely affected by

the shortage of automotive parts following the March 2011 earthquake in Japan. The flooding in Thailand in October 2011 also had a large impact on manufacturing and sales at Japanese auto-

makers in Thailand. The overall growth rate in the region’s automotive markets is easing, partly

reflecting factors such as the scaling down of a vehicle subsidy program in China and monetary

tightening measures in India.

Results and outlook

Net sales decreased 7.4% to ¥76,188 million and operating income 62.8% to ¥3,581 million,

reflecting lower sales after the earthquake and flooding, along with higher raw material and

personnel costs across Asia.

During FY2012, we started construction of a new plant in Jakarta, Indonesia, to manufacture

seat belts, airbags and steering wheels. Construction proceeded on schedule and to budget, and

full production at the plant will begin in 2013.

We also completed construction of our new plant in Tianjin, our fourth plant in China after

Shanghai (two plants) and Changxing. Development of the Tianjin plant is our latest initiative

to meet growing demand in China’s domestic market, where we are strengthening our supply

network servicing automakers around Tianjin and securing more business opportunities from our

OEM customers located in the Northern China region.

(Photos from top) Tianjin, China; Shanghai,

China; Shanghai Technical Center

>> GLOBAL BUSINESS OVERVIEW: ASIA

Asia is central to Takata’s growth strategy, bringing significant

opportunities as motorization and growth in the region continue.

We have developed a responsive network in Asia’s emerging markets,

and with manufacturing and distribution hubs in eight countries outside

Japan, including China and India, Takata is soundly positioned for the future.

Asia: Operating incomeby quarter

Asia: Net sales by quarter Region as percentageof total sales

Millions of yen, rounded down

Millions of yen, rounded down

404

1,291

1,147

739

1Q

2Q

3Q

4Q 15.9%

FY2011: 16.6%

20,264

15,496

20,540

19,888

1Q

2Q

3Q

4Q

>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

21/74

Asia (excluding Japan) (cont.)

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 19

China

China surpassed the United States in

2009 as the world’s largest auto producer,

making it our key market in the Asia

region. China continues to achieve strong

growth in vehicle production, and is

forecast to grow further in 2013.

Close alignment with OEMs in the world’s largest market

An important initiative by Takata in China during the year was our establishment of a separate

entity—Takata (Shanghai) Vehicle Safety Systems Technical Center Co., Ltd. located in Shanghai—

with full responsibility for product development, design and evaluation. China is now the world’s

largest automobile producer, and global OEMs have undertaken large-scale investment in sales

networks and production plants, for local consumption and increasingly for export. Local OEMs are

also gearing up their businesses and have rapidly become competitive. By creating a fast-moving,

stand-alone technical center, Takata will be well positioned to collaborate directly with automakers

in China, and to produce products that are closely aligned with local market needs.

“We also completed

construction of our

new plant in Tianjin,

our fourth plant

in China after

Shanghai (two plants)

and Changxing.

Development of the

Tianjin plant is our

latest initiative to

meet growing demand

in China’s domestic

market, where we

are strengthening

our supply network

servicing automakers

around Tianjin and

securing more business

opportunities from

our OEM customers

located in the Northern

China region.”

>> GLOBAL BUSINESS OVERVIEW: ASIA

FY2013

FY2012

FY2011

FY2010

FY2009

17,135 (Forecast)

15,847

15,525

13,105

7,624

Auto Production Trends for ChinaThousands of vehicles

Source: IHS Worldw ide Inc. Exclu ding trucks (as of J uly 2012)

>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

22/74

R&D—the key to our leadership

in safety technology

Research & Development

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 20

1960Seat belt

First in Japan to commercialize

two-point seat belts

PRODUCT HISTORY

Forging new paths in automotive safety for six decades

Since beginning research into seat belts in 1952, Takata has been driven by the pursuit of

ever more effective automotive safety systems and products. In our relentless search for

progress we analyze real and potential accident scenarios from every perspective, exploring

in detail opportunities to both prevent accidents and minimize their impact on people’s lives.

Motivated by this strong sense of purpose, Takata continues to evolve today, advancing

with each groundbreaking achievement toward the realization of a safer future.

>> RESEARCH & DEVELOPMENT

Takata’s pedestrian airbag, designed to

help reduce the seriousness of injuries to

pedestrians as impact with a vehicle occurs

R&D has shaped the evolution of Takata since our establishment,

and it remains fundamental to our global business strategy. Our

heavy emphasis on R&D in every aspect of our business helps us

both respond to the diverse needs of different markets and set

the agenda for safety systems of the future.

Our integrated global R&D structure combines global develop-

ment programs with regional initiatives meeting specific customer

requirements, and encompasses the entire spectrum of safety

systems, from passive safety through to active safety. Our goal

is to facilitate groundbreaking innovation that pushes the limits of

current technology while at the same time bringing high quality,

reliable and robust safety features to the widest possible automo-

tive population. This means that our R&D success is measured as

much by creating innovative products as it is by developing cost-competitive safety products that

tap rapidly growing demand in emerging markets where pricing can be a key barrier to regulatory

change and consumer adoption.

Global R&D structure

Takata Group’s integrated R&D structure encompasses bases in Japan and the rest of Asia,

North America and Europe. Each of our key regions maintain a complete and independent R&D

structure with full engineering capabilities, and at the same time work together on a cooperative

basis to build Takata’s overall competi tiveness.

>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

23/74

(Millions of yen)

Japan 5,032

Americas 6,576

Europe 5,721

Asia 1,297

Adjustment (366)

Total 18,261

TAKATA DATA:

R&DInvestmentin FY2012by region

Research & Development (cont.)

In January 2011, we established Takata Shanghai Safety Systems Technical Center Co., Ltd.

from the spin-off of the Development and Design Division of Takata (Shanghai) Automotive Com-

ponent Co., Ltd., In China, now the world’s largest automotive market, it has become essential for

Takata to grow its business through the development, design and manufacture of products that

meet local market needs, and accordingly, we have established this new company in Shanghai to

handle local product development, design, evaluation and testing.

In late 2011 we completed construction of a new automotive sled test facility in Auburn Hills,

Michigan in the U.S. This facility uses a new type of sled to test automotive occupant safety restraint

systems for high-speed frontal and lateral impact conditions. It enables simulation that is much closer

to actual crash G forces, which follow an irregular pattern of sharp peaks owing to the presence of the

engine and other parts within the car. Takata’s network of advanced test sleds will be further enhanced

with the completion during 2012 of another cutting-edge facility in Echigawa, Japan.

In each region we work closely with automakers from the earliest stages of the technical devel-

opment process to ensure that commercialized products meet their respective specifications.

(1) Research and Development Division

This division focuses on areas including frontal impact passenger protection systems, side impact

and rollover passenger protection systems, pedestrian protection systems, motorcycle rider protec-

tion systems, crash avoidance and driver support systems. The Research and Development Division

pursues development of devices such as inflators and electronics through an integration of field

research, lab-based R&D, and protection safety system design. Another key area of the division’s

research is child restraint systems.

(2) Customer Relations and Engineering Division (product commercialization activity)

This division focuses on understanding customers’ needs and assessing the scale, characteristics

and potential of the market. Based on this assessment, the Research and Development Division

develops safety systems and related devices that can be presented to customers as specific prod-

uct examples. In this way, the accumulated experience and technical resources of the entire Group

can be used to create compelling customer proposals that not only meet existing needs but also

open the door to new possibilities in automotive safety.

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 21

>> RESEARCH & DEVELOPMENT

1987Airbags

First in Japan to commercialize

driver airbags

1977Child restraint systems

First in Japan to commercialize

child restraint systems

2003Motorized seat beltsFirst in Japan to commercialize

motorized seat belts

1962Crash test

First in Japan to conduct

public seat belt crash tests

>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

24/74

Research & Development (cont.)

Key initiatives in R&D

Impact biomechanics

By undertaking detailed analysis of actual traffic accident data from around the globe, we are

able to develop and test systems that reduce the risk of injuries or fatalities in the real world.

Our approach incorporates cutting-edge research into the biomechanics of crash injuries conducted

in collaboration with government agencies and leading research institutions such as The Children’s

Hospital of Philadelphia.

Proprietary new safety systems

Through our R&D activities we aim to develop proprietary new integrated safety systems, rather

than only engineering individual products or parts. Our approach encompasses passive safety,

which reduces the risk of injury to vehicle occupants in the event of an accident, and active safety,

in which detection systems help to prevent or reduce the severity of accidents. The scope of our

safety systems R&D covers all types of accident scenarios, including frontal impacts, side or rollover

impacts, collisions with pedestrians, and motorcycle impacts, along with groundbreaking applica-

tions in areas such as night vision, obstacle detection

and avoidance, and near-infrared spectroscopy sensors

to detect alcohol impairment.

Development of globally competitive productsWe aim to use technological advancements to maintain

the competitiveness of Takata Group, developing and

promoting around the world new safety systems based

on innovative ideas. In developing applications for the

technology we create, we present customers with

proposals from an early stage in their new vehicle plan-

ning process, based on the core systems and products

developed through our R&D activities.

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 22

(Photos from top) Front Center Airbag;

Inkjet print seat belt

>> RESEARCH & DEVELOPMENT

2006Motorcycle airbags

First in world to commercialize

motorcycle airbags

2012Three-point seat belt

First in world to develop fully

detachable three-point seat belt

2010Airbelts

First in world to commercialize

safety Airbelts

2005Twin bag systems

First in world to commercialize

twin bag systems

Pedestrian airbag

>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

25/74

Research & Development (cont.)

Takata’s ability to create innovative safety products

from one year to the next is made possible through

the passion, creativity, and attention to detail of its

people. As automotive technology rapidly evolves

and global safety regulations advance, Takata’s

testing division is tasked with devising and optimizing

product protocols that validate the performance and

quality of products.

Echigawa—Japan’s largest

The Echigawa Plant, situated in Shiga Prefecture,

about 50km (31 miles) north of Kyoto and just a short

drive from Takata’s first seat belt factory, is home to

Japan’s most comprehensive testing facilities. Within

this complex, which has more than 500 employees, testing engineers work in collaboration

with other business divisions, including seat belt manufacturing, parts procurement, R&D,

and prototype creation.

The scale of the testing facilities at Echigawa contrasts with the size of Takata’s

products, most of which can be held comfortably in one hand. This scale helps Takata to

conduct more detailed testing, to better meet customer requirements and compete in the

global arena.

Advanced testing facilities

Teams of engineers, armed with state-of-the-art equipment, spend their days conducting

highly specific tests, tailored to each product and each vehicle model fitted with Takata

products. Their largest piece of testing equipment is the crash test sled. Sled testing allows

engineers to reproduce the conditions of a full-scale crash test in a controlled environment

at a fraction of the cost of an actual vehicle crash test. Although most of the tests are

conducted in less than the blink of an eye, they provide engineers with detailed insight into

the performance of Takata’s products. This is achieved with the help of numerous sensors

and sophisticated high-speed cameras, which allow engineers to capture and analyze the

vital milliseconds of each event.

CLOSEUP: ECHIGAWA TEST CENTER 1/3

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 23

Takata’s global R&D program uses advanced technology and materials tocontinually extend the frontiers of automotive safety. Even more important than this

technology, however, are the people that turn great ideas into safer transportation.

This Closeup feature takes a behind-the-scenes look at the Echigawa Plant in

Shiga Prefecture, Japan, where teams of dedicated engineers are working to

realize Takata’s dream of reducing fatalities from traffic accidents to zero

“The scale of the testing

facilities at Echigawa

contrasts with the size

of Takata’s products,

most of which can be

held comfortably in

one hand. This scale

helps Takata to

conduct more detailed

testing, to better meet

customer requirements

and compete in the

global arena.”

An engineer explains the role of

test dummies

>> RESEARCH & DEVELOPMENT>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

26/74

The use of crash test dummies is fundamental to

servo sled testing. Despite their outward similarity

to simple fashion manikins, they are actually sophis-

ticated pieces of engineering. The dummies vary in

weight, size and proportion depending on the human

form they simulate, and each dummy incorporates

hundreds of sensors, designed to capture informa-

tion on impact forces, acceleration, position and

other such data. Close inspection of a typical adult

male dummy reveals that the body is of a humanlike

weight, with tough, rubbery skin.

Evolution of testing solutions

For some products, testing goes beyond the core

issues of safety, performance and quality to incorporate other aspects of the consumer

experience. For example: what does it sound like? The increase in hybrid and electric

vehicle technology has both changed and reduced the sounds generated by some

vehicles, prompting greater focus on the sounds emitted by components such as seat belt

buckles. Sound test engineers at the recently upgraded sound laboratory say that it’s not

as simple as reducing noise: they aim to minimize any irritating tones, and consider howparticular sounds, such as the definitive click of a seat belt buckle or the whirr of a seat

belt retractor, contribute to safety.

CLOSEUP: ECHIGAWA TEST CENTER 2/3

Research & Development (cont.)

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 24

“For some products,

testing goes beyond

the core issues of

safety, performance

and quality to

incorporate other

aspects of the

consumer experience.

The increase in hybrid

and electric vehicle

technology has both

changed and reduced

the sounds generated

by some vehicles,

prompting greater

focus on the sounds

emitted by components

such as seat belt

buckles.”

Preparing the test subjects

Takata is constantly working to diversify its testing solutions

>> RESEARCH & DEVELOPMENT>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

27/74

A global working culture

A visit to the packed dining hall at lunchtime shows

just how global Takata’s operations have become.

Despite being in a semi-rural area in heartland

Japan, there is a real diversity of people—local and

international, male and female, new graduates and

experienced veterans. These people typify Takata’s

global working culture, chosen not only for their

technical abilities, but also for their ability to present

and defend new ideas.

The animated conversations that take place in

the dining hall are part of what differentiates Takata

around the world. Engineers at Takata are given the

opportunity to redefine the industry, to be inventive,

and to focus on details that others might consider irrelevant. This kind of work environ-

ment has enabled Takata to develop people who are extremely passionate about their

work—even at lunchtime—and this has helped the company to consistently produce

technological breakthroughs. Over the years, some of Takata’s ideas have been greeted

skeptically by customers in their early stages, but in many cases these ideas have

eventually become the industry standard.

Future expansion

Takata’s test facilities are evolving as the scope of protection systems expands. Adjacent

to the main testing laboratories, construction is well underway on Takata’s new research

facility, due to be completed during 2012. The new facility will feature next-generation

testing equipment, including a new crash sled that incorporates the latest advances

in crash scenario simulation—and judging by Takata’s track record, it will contribute

to further innovation in the world of transportation safety systems.

CLOSEUP: ECHIGAWA TEST CENTER 3/3

Research & Development (cont.)

TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 25

“A visit to the packed

dining hall at lunchtime

shows just how global

Takata’s operations

have become. Despite

being in a semi-rural

area in heartland

Japan, there is a real

diversity of people—

local and international,

male and female,

new graduates and

experienced veterans.

These people typify

Takata’s global working

culture, chosen not

only for their technical

abilities, but also for

their ability to present

and defend new ideas.”

Takata’s new research facility at

Echigawa, due to be completed

during 2012

>> RESEARCH & DEVELOPMENT>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

28/74 TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 26

Global Regulations

Regulation as a driver of growth

A key driver of growth in the automotive safety products and systems industryis a general trend toward tougher safety regulations. New safety directives are

being issued in major markets worldwide, and enhanced safety standards are

also being progressively introduced in emerging markets.

EXAMPLES OF RECENT REGULATORY DEVELOPMENTS INCLUDE:

The Americas

U.S.

Revision of Federal Motor Vehicle Safety Standard (FMVSS) 214 This regulation for light vehicles (less than or equal to 3,855kg) requires a minimum percentage of

all vehicles marketed to be fitted with enhanced side impact protection (the evaluation now includes

oblique pole tests in addition to moving deformable barrier tests), increasing yearly from 20% from

September 1, 2010 to 100% in 2014.

Federal Motor Vehicle Safety Standard (FMVSS) 226 (newly established)

Established on January 13, 2011, FMVSS226 is a regulation aimed at reducing the incidence of

ejections of vehicle occupants through side windows in collisions. This regulation (for all passenger

vehicles, light truck vehicles and buses less than or equal to 4,536kg) will require advanced side

impact protection system that covers both front and rear seats, increasing yearly from 25% from

September 1, 2013 to 100% in 2016.

Insurance Institute for Highway Safety (IIHS) Vehicle ratings,

Frontal Small Overlap testing (from 2012) (newly established)

IIHS Vehicle ratings will adopt Frontal Small Overlap testing, and its rating results will be published in

the middle of 2012. The test will be carried out with an adult male dummy in the driver’s seat at an

impact speed of 64km/h, and an overlap rate of 25% between the driver side of the vehicle and the

barrier. The result will be indicated under a four-scale rating by criteria of dummy injury measures,

structural integrity, and more subjective kinematics and restraints.

LATIN AMERICA

LATIN NCAP (from October 18, 2010)

Established on October 18, 2010, the Latin New Car Assessment Program is based on Euro NCAP,

although its scope of evaluation is limited to offset frontal impact tests.

BRAZIL

CONTRAN Resolution 311/09 (established, April 7, 2009)

This regulation makes it mandatory for passenger and light commercial vehicles to be fitted with

front seat airbags. It is being applied progressively to all new types of vehicles from 2011 through

2013 and to all vehicles from 2010 through 2014.

CONTRAN Resolution 221/07 (established January 30, 2007)

This regulation introduces frontal impact criteria (an offset deformable barrier test similar to that

required by European regulations or a full-wrap rigid barrier test similar to that required by US

regulations). New types of vehicle must comply with this regulation from January 2012, while current

production models will be required to comply from January 2014.

ARGENTINA

Government-industry agreement on automotive safety standards*(effective November 16, 2009)

This regulation and agreement makes it mandatory for passenger and light commercial vehicles to

be fitted with frontal airbags. It is being applied progressively to all vehicles from 2010 through 2014.

BRAZIL

CONTRANResolution 311/09(established, April 7, 2009)

I–New car projects,local or imported:

Implementation Penetrationdate rate

January 1st 2011 10%

January 1st 2012 30%

January 1st 2013 100%

II–Cars under production,local or imported:

Implementation Penetration

date rate

January 1st 2010 8 %

January 1st 2011 15%

January 1st 2012 30%

January 1st 2013 60%

January 1st 2014 100%

ARGENTINA

Government-industryagreement on automotivesafety standards*

Implementation Penetrationdate rate

January 1st 2010 10%

January 1st 2011 15%

January 1st 2012 30%

January 1st 2013 60%

January 1st 2014 100%

*Acta Acuerdo ANSV-SICPYME- ADEFA-CIDOA de Fecha 16 deNoviembre de 2009

>> GLOBAL REGULATIONS>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

29/74 TA K ATA C O R P O R AT I O N A N N U A L R E P O R T 2 0 1 2 27

Global Regulations (cont.)

Europe

European New Car Assessment Program (Euro-NCAP)

On July 13, 2010, Euro NCAP announced the start of a new reward system known as Euro-NCAP

Advance for emerging safety technologies such as lane departure warning, blind spot monitoring,

attention assist, autonomous braking and emergency warnings.

Japan

Revision of the Road Traffic Law (effective June 1, 2008)

This revision makes it legally mandatory to wear seat belts in the rear passenger seats.

Revision of Technical Standards for Seat Belts

(effective October 1, 2006, completely adopted from July 1, 2012)

This revision makes it legally mandatory to equip 3-point seat belts with retractors for all seats in

passenger vehicles not exceeding 9 seats in capacity or 3,500kg in weight.

Revision of Japan New Car Assessment Program (JNCAP) (from FY2011)

This five-level scale rating for overall impact safety performance, which takes effect from FY2011,

will be based on full-wrap frontal impact tests, offset frontal impact tests, side impact tests, rear

impact tests, pedestrian protection tests and evaluation result of seatbelt reminder equipment.

In the pedestrian protection section, an additional leg form test will be included.

Asia

CHINA

Revision of China New Car Assessment Program (C-NCAP) (from latter half of 2012)

The test protocol for C-NCAP is scheduled to be revised from the latter half of 2012. The testing

speed for offset frontal impact tests will be increased to 64km/h from the current 56km/h, and

rear seat female dummy injury tests will be newly included in the assessment. C-NCAP will also

be expanded to include an evaluation of advanced safety systems equipment such as Safety Belt

Reminder (SBR), Side/Curtain Airbags, ISOFIX anchorages and Electrical Stability Control (ESC).

INDIA

Frontal Impact Standard – AIS-098/

Side Impact Standard – AIS-099

The government of India is planning to adopt frontal and side impact requirements as part of its

regulations. The effective date will be around 2016 for new types of vehicles and around 2019 forcurrent production models. The technical standards, AIS-098 (frontal impact) and AIS-099 (side

impact), are already available and are similar in content to European regulations.

ASEAN

ASEAN NCAP (from 2012) (newly established)

Established in 2012, the ASEAN New Car Assessment Program is based on Euro NCAP, although

its scope of evaluation is limited to offset frontal impact tests. The rating result is published

separately as adult occupant protection and child occupant protection in the latter half of 2012.

INDUSTRY NEWS

NCAP(New CarAssessmentProgram): An industry-run

program designed to

provide consumers with

information on the safety

of vehicle types, based

on a star rating system.

NCAPs have been adopted

in Japan, the U.S., Europe,

China, South Korea,

Australia, South America,

and, as of 2012, ASEAN.

The programs, methods

and criteria of tests

vary between regions.

Unlike safety regulations

issued by government

authorities, NCAPs have

no legal force, but their

tests often involve stricter

criteria than are required

by government safety

standards, making them

important arenas fortechnological competition

between automakers.

>> GLOBAL REGULATIONS>> COVER >> CONTENTS >> FINANCIAL SECTION

-

8/20/2019 TAKATA,Documento Oficial

30/74

Takata wins GM Supplier of the Year Awardfor the second year running

General Motors recognized Takata as one of its best global automotive suppliers at the 2011

General Motors Supplier of the Year award during the 20th annual awards presentation held at the

Detroit Institute of the Arts. This is the second year running that Takata has received the Supplier of