TA S M A N I A N Accounting - tqa.tas.gov.au · T AN Q ONS A TY TA S M A N I A N Accounting CE R T...

Transcript of TA S M A N I A N Accounting - tqa.tas.gov.au · T AN Q ONS A TY TA S M A N I A N Accounting CE R T...

TA

SM

AN

IAN

QU

AL

IFIC

AT

ION

S A

UT

HO

RIT

Y

T A S M A N I A N Accounting

C E R T I F I C A T E Subject Code: ACC315111 O F E D U C A T I O N 2011 Assessment Report

2011 Assessment Report

Question 1 (a) Many candidates chose Property Plant and Equipment, Prepaid Expense and Accounts

Payable. Most were able to explain adequately what these were, but often omitted to state the type of account/category that these fell into, or which report they would appear on. The previous syllabus clearly delineated between Accounts Payable and Other Payables, and teachers should be encouraged to continue to emphasise the difference between these. Very few candidates wrote that Accounts Payable are for credit purchases of inventories. Few candidates chose Transactions, possibly because this required a more formal definition.

Suggested solutions: Transaction = financial event that affects the elements of the accounting equation. Give an e.g. pg 26 of text Prepaid expenses = current asset, expenses that have been paid and recorded in the current accounting period but will not eb incurred until a future accounting period. Give an e.g. See pg 110 of text Accounts payable = current liability, people the business owes money to because it has bought goods or services on credit from them. Also called creditors. Pg 19 of text Property, plant and equipment = assets purchased by the business to enable them to operate and intended to be kept for longer than the current accounting period pg 87 of text Suggested marking scheme: 2 marks for definition and 1 mark for example. (b) Many candidates chose the Historic Cost example and the Accounting Entity example.

Few chose the Matching principle or the Accounting Period examples. Most answers were able to identify the breach but didn’t give a reason to explain what the issue was with regard to effect on the Financial Reports (Income Statement or Balance Sheet). E.g. increasing the value of assets boosts the value of the assets on the Balance Sheet, but takes away the objective evidence provided by the original purchase price, and therefore may be misleading to external parties, which is why ‘conservative’ accountants follow the Historic Cost principle, and leave assets at the original price in most cases.

Depreciation: Some candidates gave the reason for Diminishing balance as being because older assets are used less as they age. This is not really the case. The explanation should be that while they are used consistently over their life, it is the resale value of these assets which falls sharply in the early years of the life of the business – cars and computers are good examples of assets which work well for years, but have sharply falling resale values. Depreciation is really estimating the fall in value (in terms of resale value) of the asset.

Accounting 2

Subject Code: ACC315111

2011 Assessment Report

Suggested solutions: See pp 433 – 434 of the text (v) Historical Cost /accept Original cost. (HC mentioned under limitations of accounting reports pg 542) (vi) Matching principle p105 (vii) Accounting period (viii) Accounting entity Suggested marking scheme: 1 mark for identifying the assumption and 2 marks for explanation. (c) Suggested solutions: (ix) See page324-5 of textbook Suggested marking scheme: 3 marks for definitions + 1 mark for correct calculation = 4 marks. Correct calculation = 60 000 + 2500 = 62 500 (x) See page 105 of the textbook Suggested marking scheme: 3 marks for definitions + 1 mark for using the data = 4 marks Recognised on May 5 Realised on May 27 (xi) See page 492 – 493 of textbook Suggested marking scheme: 2 marks each for explanation of 2 purposes= 4 marks (d) Suggested solutions: (xii) Textbook p328, 331 – 332, 343 Suggested marking scheme: Definition (2 marks) Two methods and explanation (2+2= 4 marks) Examples = 2 marks PPE Register 2 marks = 10 marks. (xiii) Textbook p 291, 294 and 382 Suggested marking scheme: 2 marks for definition of inventories 2 marks for each control = 4 2 marks for explanation of perpetual inventory system 2 marks for rationale for stocktake (xiv) Textbook p 66, p 69 Suggested marking scheme:

Accounting 3

Subject Code: ACC315111

2011 Assessment Report

2 for definition 3 for Tax Invoice 5 marks for explanation of supply chain on each party

Question 2 (a) Part (a) was answered quite well by most candidates.

Some candidates included the year as part of the date, others did not. Please clarify whether this is needed in view of how the question is written and presented.

Most of the errors and omissions had been referred to in previous year’s Examiners Reports and candidates are reminded to read these carefully. For example, the entry on April 20th requires 2 narrations – one for the sale of inventory to the customer, and the other to record the Cost of Goods Sold. (refer to Chapter 3 of the current text book) Also the date is required a second time when there are two transactions on the same day. Previous Examiners Reports make comments about the use of abbreviations. Candidates should remember that the Chart of Accounts is a good guide to the correct names for accounts which are either debited or credited as a result of the journal entries that are prepared. Half a mark was deducted if candidates stated that Insurance Premium was to be debited, rather than Insurance/Insurance Expense. Marks were also deducted for writing CAB or Bank instead of Cash at Bank.

The best answers for the entry on May 3rd included the word ‘Loan’. Using the Chart of Accounts as a guide, the credit entry should be Loan – Tasmania Bank not simply Tasmania Bank.

The narrations given were inadequate in many cases.E.g. If a document number is given (e.g. Cheque No.) this should always be included in the narration; if GST free, this should be included so that it is clear that GST has not been overlooked; the basis on which depreciation has been calculated (3 months, straight-line method) needs to be stated for full marks; cash or credit etc. Some candidates incorrectly wrote ‘reversing entry’ instead of ‘correction entry’ or ‘introduced capital’ rather than ‘commenced business’.

(b) Many candidates omitted the date. It’s important to remember that the transaction

written should provide sufficient detail so that a complete journal entry could then be prepared. The question in the exam paper needs to be clearer on this point. The answer space could include a date and transaction column (as in the question for part (a),) to clearly indicate what is required.

When writing the transaction, all details need to be included so that correct information is available for entering and recording in the journal. It is not correct to write ‘Paid $10,000 cash and paid remaining balance on credit’. It is more accurate to state that

Accounting 4

Subject Code: ACC315111

2011 Assessment Report

$10,000 cash was paid for the deposit, with the remaining $30,000 on credit. The words ‘paid’ and ‘received’ by definition refer to a cash transaction.

Some candidates omitted the value of the transaction and omitted or wrongly stated the GST status of the transaction.

Candidates are reminded to include the $ sign. E.g. Services performed 550 does not clearly demonstrate application of the Monetary accounting assumption.

The answer to Question 2 is included on the next page as some minor changes to the answers were made.

Accounting 5

Subject Code: ACC315111

2011 Assessment Report

Suggested solutions: 1 mark for the debit entry, 1 mark for the credit entry and 1 mark for a suitable narration. ½ mark deduction for not listing debit first and ½ mark deduction for not indenting credit entry. All entries worth 3 marks except on April 20, 5 marks (3 + 2) = Total 32 marks Extract from the General Journal of Food for the Heart

Date Details Debit ($) Credit ($) 2011 Mar 31 Cash at bank 5 000 Inventories (or Inventory Control) 7 500 Delivery vehicle 15 000 Accounts Payable

Capital 7 500

20 000 (Owner commenced business with assets and

liabilities)

Apr 1 Insurance expense 1 000 GST credits received 100 Cash at Bank 1 100 (Paid quarterly insurance premium, cheque no 460) Apr 1 Office Furniture 5 000 GST credits received 500 Harvey Norman 5 500 (Purchased office furniture on credit from Harvey

Norman)

Apr 20 Cash at Bank 2 200 Sales 2 000 GST Collected 200 (Cash sales) Cost of Goods Sold 435 Inventories (or Inventory Control 435 (Cost of goods sold) Apr 23 Inventories (or Inventory Control) 121 Cash at Bank 121 (Purchased GST free inventories, cheque no 461) Apr 27 Wages 240 Cleaning expenses 240 (Correcting entry) May 3 Cash at Bank 20 000 Loan/ Tasmania Bank 20 000 (Borrowed $20 000 from Tasmania Bank) May 14 Drawings 44 Inventories (or Inventory control) 40 GST Credits Received 4 (Owner withdrew goods for own use)

Accounting 6

Subject Code: ACC315111

2011 Assessment Report

June 30 Wages 1 400 Accrued Expenses

(Adjustment for wages owing) 1 400

June 30 Depreciation on office furniture 125 Accumulated depreciation on office furniture 125 (Straight line depreciation for 3 months)

(b)

Date Debit entry Credit Entry 6 January Accounts Receivable

Control $550

Service Fees Revenue $500 GST Collected $50

9 February Motor Vehicle $40 000 Cash at Bank $10 000 Accounts Payable Control $30 000

17 March Sales Returns and Allowances $150 GST Collected $ 15

Accounts Receivable $165

27 April

Computer $1400 Capital $1400

Transaction On January 6th, performed service fees on credit for $550 GST inclusive or Wellington Distributors charged fees for services provided on credit for $550. On February 9th, bought motor vehicle for $40 000, paying a deposit of $10 000 and owing the balance on credit On March 17, goods previously sold on credit for $165 (GST inclusive) were returned. GST Collected on these goods was $15

On April 27 owner (Wendy Wellington) contributed computer worth $1 400 to the business

Suggested marking scheme: 2 marks per transaction = 8 marks -½ mark for no date

Accounting 7

Subject Code: ACC315111

2011 Assessment Report

Question 3

Overall the question was completed well – as it should have been because it was very straightforward with no tricks or traps! Candidates in future years should take note of the following points however: Headings – Candidates often waste good marks writing incorrect headings or missing them out altogether. Remember, it is ‘Income Statement for the year ended.....’ and ‘Balance Sheet as at.....’ Columns – Ensure correct columns are used so that a final figure is arrived at in the far right column. Many candidates did not use the correct column to show the sub-total for Non Current Assets. Owners Equity – A large number of candidates did not set this out correctly in the Balance Sheet. It is always ‘......Plus Net Profit , Less Drawings.....’ not the other way around! The Bad Debts Adjustment was not well done. Candidates should familiarise themselves with the correct application of this adjustment in both the Income statement and Balance Sheet. The Delivery Vehicles depreciation was not done well either. Many candidates did not complete the calculations correctly. The Bank Loan was recorded as a Non-Current Liability in many cases, even though it was clearly shown as maturing in the next financial year. Many candidates subtracted the ‘rent due’ instead of adding it to the existing rent revenue.

Accounting 8

Subject Code: ACC315111

2011 Assessment Report

Suggested marking scheme: Item Incorrect Deduction Income Statement Item omitted completely 3 Balance Sheet item included 3 Adjustment ignored 4 Expense item recorded as Revenue 2 Adjustment incorrect, i.e. adjustment attempted but incorrect figure

2

Wrong expense classification 1 Additional information ignored 2 Mathematical errors 1 Sub-totals missing 1 Incorrect columns 1 Incorrect figure transferred from Trial Balance 1 Incorrect heading 1 Incorrect rulings in Income Statement (one deduction only) 0.5 Balance Sheet Item omitted completely 3 Income Statement item included 3 Adjustment ignored 3 GST Accounts not cleared 3 Asset recorded as Liability 2 Adjustment incorrect, i.e. adjustment attempted but figure incorrect

2

Wrong asset classification 1 Mathematical errors 1 Sub-totals missing 1 Less Drawings before Add Net Profit 1 Incorrect columns 1 Incorrect rulings in Balance Sheet (one deduction only) 0.5

Balance Day Adjustments:

Dr Cr Inventory adjustment $700 Inventory control $700 Drawings $150 Advertising expense $150 Bad & doubtful debts $370 Provision for doubtful debts $370 Accrued Revenue $200 Rent Revenue $200 Depreciation of DV $1 328 Accumulated dep’n on DV $1 328 GST Collected $2 800 GST Clearing $200

GST Clearing $2 800 GST Credits Received $200

Accounting 9

Subject Code: ACC315111

2011 Assessment Report

Question 3 (a) Port Latta Putas Income Statement for year ended 30 June 2011

Sales 156 000 Less Cost of goods sold Cost of goods gold 112 000 Add Inventory adjustment 700 112 700 Gross Profit 43 300 Add Other Revenue Rent Revenue 2 590 2 590 45 890 Less Other Expenses Selling & distribution expenses Salaries – sales 8 400 Advertising 9 450 Depreciation of delivery vehicles 1 328 19 178 General & administrative expenses Telephone Expenses 330 Insurance 2 490 Rates 1 730 Office Salaries 5 300 Electricity expense 1 190 11 040 Finance expenses Credit/Debit Card Charges 620 Interest on loan 600 Bad and Doubtful Debts 810 2 030 32 248 Net loss $13 642

Accounting 10

Subject Code: ACC315111

2011 Assessment Report

Question 3 (b) Port Latta Putas Balance Sheet as at 30 June 2011

ASSETS Current Assets Accounts receivable control 15 000 Less Provision for doubtful debts 450 14 550 Inventory control 22 300 Accrued Revenue 200 37 050 Non Current Assets Other Financial Assets Shares 2 000 Property, Plant & Equipment Land 58 800 Delivery vehicle 9 800 Less Accumulated depreciation on DV 4 488 5 312 Shop room Fittings 8 000 Less Accumulated depreciation on SRF 2 400 5 600 69 712 Intangibles Patents 8 200 79 912 116 962 Less LIABILITIES Current Liabilities Bank Overdraft 5 200 Accounts payable control 13 200 Bank Loan (maturing January 2012) 5 000 GST clearing 2 600 26 000 Non Current Liabilities Mortgage 44 600 44 600 70 600 Net Assets 46 362 OWNERS EQUITY Capital 35 870 Plus Net profit 13 642 49 512 Less Drawings 3 150 46 362

Accept amounts for Rent Revenue, Shares and Patents in previous column. Accept ‘Capital plus Net Profit’ in previous column.

Accounting 11

Subject Code: ACC315111

2011 Assessment Report

Question 4 (a) (i) and (ii) The completion of the ‘Cash at Bank account deposits’ and ‘Cash at Bank

account withdrawals’ was generally poorly done. Many candidates failed to include all the details required ie the date (many erroneously included the dates the transactions appeared in the bank statement and not the 31 August), did not complete the ‘Details’ column and failed to calculate the final total.

Candidates must ensure that this part of the question is completed in the answer

booklet as several candidates scored 0 on this part of the question even though they successfully completed the Cash at Bank A/c.

(iii) Those candidates who completed the Cash at Bank A/c using either a pencil

balance or the columnar format were less likely to make errors and consequently lose marks than those who chose to do a formal balance. The opening balance date, 1 August, was often incorrectly written as 31 July or 31 August resulting in a 0.5 deduction.

(iv) The Bank Reconciliation Statement was generally accurately completed.

However, many candidates failed to include a separate column and sub-total for unpresented cheques. Only a few candidates erroneously added unpresented cheques first. The mark allocation of 2 marks for 3 cheques should be reviewed as this is problematic. (3 marks were allocated here and candidates lost a mark instead for not using a separate column for unpresented cheques and including a sub-total).

(v) The majority of candidates were able to explain the purpose of a bank

reconciliation ie to match the business’s cash records with those of the bank, an organisation external to the business, to check the accuracy of the cash records and to detect errors. Most, however, did not explain that this process also helps in the detection of fraud. Some candidates incorrectly stated that the main aim of a BRS was to highlight cash flow problems.

The question specifically asked candidates to use examples from Burnie

Mountain Bikes when outlining two reasons why it is sound business practice to carry out regular bank reconciliations. Most candidates successfully referred to two of the following in their explanation: the unpresented cheques, stating a specific example of at least one cheque number and amount; the deposit not yet credited of $2 200; the Account Fees of $30 and Service Fee of $17; and the Direct Deposit for Rent of $150. Better candidates were able to provide details about who had this information in their records and who did not. Those candidates who wrote in general about unpresented cheques and deposits not yet credited without providing specific examples from Burnie Mountain Bikes were not awarded full marks.

Accounting 12

Subject Code: ACC315111

2011 Assessment Report

(b) (vi) The Statement of Estimated Receipts from Accounts Receivable for Eureka was generally accurately completed. However, many candidates were able to correctly calculate the figures for the first and second month after sale but failed to do so for the third month and consequently were awarded half marks.

(vii) The calculation of estimated Payments to Accounts Payable was poorly done. It is

important that candidates read the information provided carefully. Most correctly included the $12 400 owing at 31 October in November’s payments but then entered other payments to accounts payable in subsequent months as ‘Cash Purchases’ on a separate line and simply copied the figures directly from the table, also ignoring the statement that ‘all purchases are on credit’. Hence only scoring 0.5 out of 3 possible marks.

The recording of Operating Expenses in the Cash Budget was also inaccurately

completed by many candidates. Many failed to remove the amount of $4 000 for Depreciation, therefore only scoring 1 out of 2 marks. Some candidates not only failed to remove the Depreciation in the first instance but then added it back in to the figures so that it was double counted. These candidates were given zero marks out of a possible 2 here.

Candidates should be reminded not to use the headings, Estimated Cash Receipts

and Estimated Cash Payments, in the Cash Budget to record figures but should instead include separate lines for Collections from Accounts Receivable and Payments to Accounts Payable.

Many candidates lost 0.5 marks for not including Dr next to the $10 000 Bank

Balance at Start. The Bank Balance at the end of each month should also state if it is expected to be a Dr or Cr balance.

(viii) Candidates were marked according to the relevance of their comments in relation

to the budget they had prepared in question (vii). The majority were able to provide an overview of the expected cash position of the business at the start and end of the budgeted period, as well as comment on the changes that were expected to take place in receipts and payments over this time, as revealed by their budget.

Many candidates failed to provide possible solutions to the problems highlighted

in their budget and consequently were only able to receive a maximum 3 marks. (ix) Most candidates gained the full 2 marks for explaining one advantage of

preparing a cash budget. (x) The vast majority of candidates were able to successfully explain one limitation

of the financial analysis provided by a cash budget, with most stating that the figures are estimates only, not actual ones, and should therefore be used as a guide only in decision making.

Accounting 13

Subject Code: ACC315111

2011 Assessment Report

Suggested solutions: (i)

Cash at Bank account deposits Date Details $$ 2011 Aug 5 Sales 1760 10 Capital 3000 12 EFTPOS Sales 550 19 Sales 1980 26 Debtors 2200 31 Sub Total 9490 31 Direct deposit 150 9640

Suggested marking scheme: Cash at Bank account deposits =2 marks (1 for Direct Deposit, 1 for final total, 0.5 mark deduction for incorrect ruling)

(ii)

Cash at Bank account withdrawals Date Details Chq No $ 2011 Aug 1

Purchases 508 1590

2 Creditors 509 1760 8 Creditors 510 1800 9 Creditors 511 1650 12 Insurance 512 330 15 Purchases 513 1870 21 Drawings 514 1000 28 Postage 515 145 31 Sub Total 10145 31 Account fees 30 31 Service fee 17 10192

Suggested marking scheme: Cash at Bank account withdrawals = 2 marks (1/2mark for each entry = 1 marks, 1 mark for final total, 0.5 mark deduction for incorrect ruling)

Accounting 14

Subject Code: ACC315111

2011 Assessment Report

(iii) T account format

Extract from General Ledger of Burnie Mountain Bikes Cash at Bank Account

2011 Aug 1 Aug 31

Balance Receipts

457 9 640

2011 Aug 31

Payments

10 192

Suggested marking scheme: 2 marks (0.5 for opening balance, 0.5 for pencil balance, 0.5 each for Receipts and Payments, deduct 0.5 marks for incorrect dates). Accept any wording in the Particulars column which gives the correct sense to the account.

OR Columnar Format (iii)

Date Particulars Debit ($) Credit ($)

Balance ($)

August 1

Balance

457 (Dr)

August 31

Receipts

9 640

10097 (Dr)

August 31

Payments

10 192

95 (Cr)

OR Columnar Format (iii)

Date Particulars Debit ($) Credit ($)

Balance ($)

August 1

Balance

457 (Dr)

August 31

Payments

9 640

10 192

9 735(Cr)

August 31

Receipts

95 (Cr)

95

Accounting 15

Subject Code: ACC315111

2011 Assessment Report

Suggested marking scheme:

2 marks (0.5 for opening balance, 0.5 each for Receipts and Payments, 0.5 for correct final balance, deduct 0.5 marks for incorrect dates). Accept any wording in the Particulars column which gives the correct sense to the account. (iv)

Burnie Mountain Bikes Bank Reconciliation Statement

as at 31 August 2011 Credit balance as per bank statement $ 600 Plus Deposits not yet credited Less Unpresented cheques

Cheq No

Amount

2200 2800

507 880 513 1870 515 145 2895 Credit balance as per cash at bank account $95

Suggested marking scheme: 1 marks for opening line (0.5 for words + 0.5 for amount), 1 marks for deposit not yet credited , 1 mark for sub total, 2 marks for unpresented cheques and 1 mark for closing line (0.5 for words + 0.5 for amount) = 6 marks. (v) Regular bank reconciliations are done for two reasons: To check the accuracy of the cash records and to detect errors To help deter fraud Reasons: 4 marks for each of 2 reasons using examples from Burnie Mountain bikes To determine actual Cash at Bank balance To find out unpresented cheques To find out bank account fees To find out direct deposits To find out DNYC 4 (b) (vi) Marking Scheme: 3 marks ( 1 for correct total for each of the 3 months = 3 marks. Half marks given if total is omitted Statement of Estimated Receipts from Accounts Receivable

Credit Sales in:

Total $

Estimated Cash to be received in:

November December January August 20 000 3 000 - - September 24 000 7 200 3 600 - October 28 000 13 300 8 400 4 200 November 32 000 - 15 200 9 600 December 36 000 - - 17 100 January 40 000 - - - 23 500 27 200 30 900

Accounting 16

Subject Code: ACC315111

2011 Assessment Report

(vii) Eureka Cash Budget for the three months ending 31 January 2012.

November($) December ($) January($) Estimated Cash Receipts Collections from Accounts receivable 23 500 27 200 30 900 Dividends Revenue 800 Total Estimated Receipts 23 500 28 000 30 900 Estimated Cash Payments Payments to Accounts payable 12 400 9 600 10 800 Operating Expenses 6 000 7 500 9 000 Drawings 2 000 2 000 2 000 GST Payable 1 840 Purchase of New equipment 10 000 10 000 10 000 Total Estimated Payments 30 400 30 940 31 800 Bank Balance at Start 10 000 Dr 3 100 Dr 160 Dr Excess of Receipts over Payments Excess of Payments over Receipts 6 900 2 940 900 Bank Balance at end 3 100 Dr 160 Dr 740 Cr

Marking Scheme: 13 marks 1 mark for accounts receivable line as per their calculations (.5 for words and .5 for amounts), 1 mark for Dividends, 3 marks for Accounts Payable line, 2 marks for correct Operating Expenses (- 1 mark off if included Depreciation), 1 mark for Drawings, 1 mark for GST Payable, 1 mark for new equipment, 1 mark for opening bank balance, 1 mark for completing Bank section and 1 mark for correct final bank balance = 13 marks (viii) Discuss the implications of the cash budget for the financial position of Eureka. Suggested Marking Scheme: 5 marks made up of 3 marks for general comments and 2 marks for a suitable solution for deficit General comments: sales are predicted to rise steadily each month but not enough to cover the operating expenses and purchase new equipment Cash position predicted to go from a healthy $10 000 to a $740 deficit. If the owner wishes to purchase the new equipment which may be needed to increase sales in the gym, then they need to consider how to find the funds required. Possible Solutions: Arrange a bank overdraft Defer purchase or renegotiate the purchase terms (eg take out a loan) Reduce drawings or operating expenses (ix) One advantage of preparing a cash budget. (See pages 634 – 635 of textbook)

Accounting 17

Subject Code: ACC315111

2011 Assessment Report

Cash budget reveals when shortages of funds may occur and how best it may be possible to fund a predicted shortage of that size – allows owner/managers to plan for informed decision making Indicates when surpluses may occur and that owner can consider what to do with excess funds see when commitments are due reveals weaknesses in business debt collection policy allows you to make adjustments for seasonal fluctuations form of control over cash Marking Scheme: 2 marks for the general idea (x) One limitation of the financial analysis provided by a cash budget. Marking Scheme: 2 marks for the general idea The figures are budgeted figures or estimates not actual ones. How accurate are these predictions of the future? Depends on quality of input There are a number of economic and social factors which cannot be predicted. Question 5

Candidates should: • Be thorough, but succinct and precise. • Read the question carefully and answer the question that has been asked. • Specifically mention figures where relevant. • Take note of the marks allocated for each part of the question and structure their answer

accordingly. Part a) (a) Generally very well done. Most common error was incorrect format, eg times per year. (b) Parts (iv), (v) and (vi) were mostly well done, with the most common issue being that

candidates were not specific enough about the data given regarding the business to score full marks in (iv) and (v), and not enough ‘explanation’ was given in (vi) to score full marks.

Many candidates incorrectly discussed Turnover of Inventories as a measure of financial stability.

Part (vii) was not well done overall. Many candidates did not know the limitations of

using ratio analysis to measure the performance of a business. The most common mistake was candidates explaining the limitation of using only ratio analysis to measure the performance of a business.

Accounting 18

Subject Code: ACC315111

2011 Assessment Report

(c) The two most common errors in this part were incorrectly using the terms profit, loss, expense and revenue instead of surplus,

deficit, net increase or net decrease, inflow and outflow. being unclear on what each of the sections of the CFS show (eg many candidates

wrote that receiving dividends or interest on a bank account would improve inflows from investing activities).

Part (viii) was mostly well done, with the most common issue being that candidates were not thorough enough in their explanation to score full marks.

Part (ix) was not as well done. Many candidates did not answer the question that was asked and instead wrote about how to improve the cash flow position.

Part (x) was generally well done, with the two most common errors being those detailed above. Also, many candidates discussed the ‘month’ of June rather than the year ended 30 June 2011.

Suggested marking scheme: Item Incorrect Deduction Income Statement Item omitted completely 3 Balance Sheet item included 3 Adjustment ignored 4 Expense item recorded as Revenue 2 Adjustment incorrect, i.e. adjustment attempted but incorrect figure

2

Wrong expense classification 1 Additional information ignored 2 Mathematical errors 1 Sub-totals missing 1 Incorrect columns 1 Incorrect figure transferred from Trial Balance 1 Incorrect heading 1 Incorrect rulings in Income Statement (one deduction only) 0.5 Balance Sheet Item omitted completely 3 Income Statement item included 3 Adjustment ignored 3 GST Accounts not cleared 3 Asset recorded as Liability 2 Adjustment incorrect, i.e. adjustment attempted but figure incorrect

2

Wrong asset classification 1 Mathematical errors 1 Sub-totals missing 1 Less Drawings before Add Net Profit 1 Incorrect columns 1 Incorrect rulings in Balance Sheet (one deduction only) 0.5

Accounting 19

Subject Code: ACC315111

2011 Assessment Report

Balance Day Adjustments: Dr Cr Inventory adjustment $700 Inventory control $700 Prepaid Expenses $150 Advertising expense $150 Bad & doubtful debts $370 Provision for doubtful debts $370 Accrued Revenue $200 Rent Revenue $200 Depreciation of DV $1 328 Accumulated dep’n on DV $1 328 GST Collected $2 800 GST Clearing $200

GST Clearing $2 800 GST Credits Received $200

(i)

Cash at Bank account deposits Date Details $$ 2011 Aug 5 Sales 1760 10 Capital 3000 12 EFTPOS Sales 550 19 Sales 1980 26 Debtors 2200 31 Sub Total 9490 31 Direct deposit 150 9640

Suggested marking scheme: Cash at Bank account deposits =2 marks (1 for Direct Deposit, 1 for final total, 0.5 mark deduction for incorrect ruling)

(ii) Cash at Bank account withdrawals Date Details Chq No $ 2011 Aug 1

Purchases 508 1590

2 Creditors 509 1760 8 Creditors 510 1800 9 Creditors 511 1650 12 Insurance 512 330 15 Purchases 513 1870 21 Drawings 514 1000 28 Postage 515 145 31 Sub Total 10145 31 Account fees 30 31 Service fee 17 10192

Cash at Bank account withdrawals = 2 marks (1/2mark for each entry = 1 marks, 1 mark for final total, 0.5 mark deduction for incorrect ruling)

Accounting 20

Subject Code: ACC315111

2011 Assessment Report

(iii) T account format Extract from General Ledger of Burnie Mountain Bikes

Cash at Bank Account 2011 Aug 1 Aug 31

Balance Receipts

457 9 640

2011 Aug 31

Payments

10 192

Suggested marking scheme: 2 marks (0.5 for opening balance, 0.5 for pencil balance, 0.5 each for Receipts and Payments, deduct 0.5 marks for incorrect dates). Accept any wording in the Particulars column which gives the correct sense to the account.

OR Columnar Format (iii)

Date Particulars Debit ($) Credit ($)

Balance ($)

August 1

Balance

457 (Dr)

August 31

Receipts

9 640

10097 (Dr)

August 31

Payments

10 192

95 (Cr)

OR Columnar Format (iii)

Date Particulars Debit ($) Credit ($)

Balance ($)

August 1

Balance

457 (Dr)

August 31

Payments

9 640

10 192

9 735(Cr)

August 31

Receipts

95 (Cr)

Suggested marking scheme: 2 marks (0.5 for opening balance, 0.5 each for Receipts and Payments, 0.5 for correct final balance, deduct 0.5 marks for incorrect dates). Accept any wording in the Particulars column which gives the correct sense to the account.

95

Accounting 21

Subject Code: ACC315111

2011 Assessment Report

(iv) Burnie Mountain Bikes

Bank Reconciliation Statement as at 31 August 2011

Credit balance as per bank statement $ 600 Plus Deposits not yet credited Less Unpresented cheques

Cheq No

Amount

2200 2800

507 880 513 1870 515 145 2895 Credit balance as per cash at bank account $95

Suggested marking scheme: 1 marks for opening line (0.5 for words + 0.5 for amount), 1 marks for deposit not yet credited , 1 mark for sub total, 2 marks for unpresented cheques and 1 mark for closing line (0.5 for words + 0.5 for amount) = 6 marks. (v) Regular bank reconciliations are done for two reasons: To check the accuracy of the cash records and to detect errors To help deter fraud Reasons: 4 marks for each of 2 reasons using examples from Burnie Mountain bikes To determine actual Cash at Bank balance To find out unpresented cheques To find out bank account fees To find out direct deposits To find out DNYC 4 (b) (vi) Marking Scheme: 3 marks ( 1 for correct total for each of the 3 months = 3 marks. Half marks given if total is omitted Statement of Estimated Receipts from Accounts Receivable

Credit Sales in:

Total $

Estimated Cash to be received in:

November December January August 20 000 3 000 - - September 24 000 7 200 3 600 - October 28 000 13 300 8 400 4 200 November 32 000 - 15 200 9 600 December 36 000 - - 17 100 January 40 000 - - - 23 500 27 200 30 900 (vii) Eureka

Accounting 22

Subject Code: ACC315111

2011 Assessment Report

Cash Budget for the three months ending 31 January 2012. November($) December ($) January($) Estimated Cash Receipts Collections from Accounts receivable 23 500 27 200 30 900 Dividends Revenue 800 Total Estimated Receipts 23 500 28 000 30 900 Estimated Cash Payments Payments to Accounts payable 12 400 9 600 10 800 Operating Expenses 6 000 7 500 9 000 Drawings 2 000 2 000 2 000 GST Payable 1 840 Purchase of New equipment 10 000 10 000 10 000 Total Estimated Payments 30 400 30 940 31 800 Bank Balance at Start 10 000 Dr 3 100 Dr 160 Dr Excess of Receipts over Payments Excess of Payments over Receipts 6 900 2 940 900 Bank Balance at end 3 100 Dr 160 Dr 740 Cr Marking Scheme: 13 marks 1 mark for accounts receivable line as per their calculations (.5 for words and .5 for amounts), 1 mark for Dividends, 3 marks for Accounts Payable line, 2 marks for correct Operating Expenses (- 1 mark off if included Depreciation), 1 mark for Drawings, 1 mark for GST Payable, 1 mark for new equipment, 1 mark for opening bank balance, 1 mark for completing Bank section and 1 mark for correct final bank balance = 13 marks (viii) Discuss the implications of the cash budget for the financial position of Eureka. Suggested Marking Scheme: 5 marks made up of 3 marks for general comments and 2 marks for a suitable solution for deficit General comments: sales are predicted to rise steadily each month but not enough to cover the operating expenses and purchase new equipment Cash position predicted to go from a healthy $10 000 to a $740 deficit. If the owner wishes to purchase the new equipment which may be needed to increase sales in the gym, then they need to consider how to find the funds required. Possible Solutions: Arrange a bank overdraft Defer purchase or renegotiate the purchase terms (eg take out a loan) Reduce drawings or operating expenses (ix) One advantage of preparing a cash budget. (See pages 634 – 635 of textbook) Cash budget reveals when shortages of funds may occur and how best it may be possible to fund a predicted shortage of that size – allows owner/managers to plan for informed decision making

Accounting 23

Subject Code: ACC315111

2011 Assessment Report

Indicates when surpluses may occur and that owner can consider what to do with excess funds see when commitments are due reveals weaknesses in business debt collection policy allows you to make adjustments for seasonal fluctuations form of control over cash Marking Scheme: 2 marks for the general idea (x) One limitation of the financial analysis provided by a cash budget. Marking Scheme: 2 marks for the general idea The figures are budgeted figures or estimates not actual ones. How accurate are these predictions of the future? Depends on quality of input There are a number of economic and social factors which cannot be predicted. Suggested Marking: Note : Answers need to round calculations to two decimal places and round up rather than down. (a) (i) GPR = GP/Net Sales x 100= (Net Sales – CGS)/ Net Sales x 100 =(812 000 – 520 000)/812 000 x 100/1 = 35.96% Marking Scheme: 2 marks for correct calculation. Minus ½ mark if incorrect format shown. Minus ½ mark if incorrectly rounded. (1/2 mark for any correct working that is shown) (ii) RROE = NP/AOE x 100/1 = 25 950/260 975 x 100/1 = 9.94% Marking Scheme: 2 marks for correct calculation. Minus ½ mark if incorrect format shown. Minus ½ mark if incorrectly rounded. (1/2 mark for any correct working that is shown) (iii) TOI = CGS/AI = 520 000/211 200 = 2.46 times = 148.37 days Marking Scheme: 2 marks for correct calculation. Minus 1 mark if incorrect format shown. Minus ½ mark if incorrectly rounded. (1/2 mark for any correct working that is shown) (b) (iv) Profitability – declining over the last 5 years indicating that the COGS has been increasing as a % of sales. GPR has decreased from 65 % to 46 % over the last 5 years with the last 2 years below the IA. NPR decreased for first 3 years but improved in last 2 years indicating better cost control but is still below the IA. Marking Scheme: GPR: ½ mark for pattern/trend, ½ mark for quoting figures, ½ mark for comparison to industry average, ½ mark for explanation of ratio relevant to the business (rather than simply defining what the ratio measures). NPR: ½ mark for pattern/trend, ½ mark for quoting figures, ½ mark for comparison to industry average, ½ mark for explanation of ratio relevant to the business (rather than simply defining what the ratio measures). (v) Financial Stability – of concern

Accounting 24

Subject Code: ACC315111

2011 Assessment Report

WCR has declined from 1.80:1 to 1.15: 1 and is significantly below the industry average of 1.52:1. This indicates the firm is unable to meet its financial commitments in the next 12 months. The Equity Ratio has increased from 47 % to 58% suggesting that the owner has greater ownership of the company and this ratio is above the industry average of 49%. Marking Scheme: WCR: ½ mark for pattern/trend, ½ mark for quoting figures, ½ mark for comparison to industry average, ½ mark for explanation of ratio relevant to the business (rather than simply defining what the ratio measures). ER: ½ mark for pattern/trend, ½ mark for quoting figures, ½ mark for comparison to industry average, ½ mark for explanation of ratio relevant to the business (rather than simply defining what the ratio measures). (vi) Course of action: Turnover of Inventories is too slow, it is significantly longer than the industry average and has increased over the last 5 years (from 30 days to 59 days). Need to analyse the turnover of inventory and consider things like: How to decrease the cost of goods sold Type of inventory – range, selling price, stock levels Examine wastage/theft Buying policy – cost and sourcing of inventories Publicity or advertising campaign which would increase sales at a greater % than the increase in cost Re WCR – convert short term loans to long term if appropriate Marking Scheme: 1 mark for listing an appropriate course of action and 1 mark for its explanation = 2 marks for logical response (vii) Limitations of ratio analysis and of the income statement and balance sheet figures (Refer page 567 of textbook) Possible answers may include: Ratios are based on financial data which has limitations. Interpretation is only as good as the accuracy of the data. Need for benchmarks Past being used to predict the future Use of historical cost figures Estimates and subjective opinion in some figures in the reports eg doubtful debts, depreciation and inventory valuations Problems with using averages in ratio formulae Change in conditions over time eg different events related to those time periods Price changes Marking Scheme: 2 marks for each limitation explained (c) (viii)

Accounting 25

Subject Code: ACC315111

2011 Assessment Report

Liffey Larder began the year with a cash balance of $20 000 and finished the year with an overdraft of $150, created predominantly by the purchase of an asset and drawings of $18 000. There were positive cash flows from operating activities. Marking Scheme: 2 marks for specifically detailing the change in cash position from $20 000 at the beginning of the period to $150 overdraft at the end of the year. 1 mark for detailing that the change in cash position was created predominantly by the purchase of an asset of $30 000 and the drawings of $18 000. 1 mark for pointing out the importance of the positive cash flows from operating activities. (ix) Recommendation: List the Other Outflows from operating activities separately: Knowing this would facilitate how best to react to the precarious cash position in which this firm finds itself. More detail about the type of asset that was purchased. (Marking scheme: 2 marks for any logical recommendation) (x) Purchase of an asset should not be financed by Cash from operations or carried forward cash balance. Defer purchase of asset or take out a loan or lease the asset Reduce drawings Increasing sales – advertising, reviewing credit policies, change in suppliers and sourcing cheaper products Marking Scheme: 1 mark for listing and 1 mark for briefly explaining each of two recommendations.

TASMANIAN QUALIFICATIONS AUTHORITY

ACC315111 Accounting

ASSES SMENT PANEL REPORT

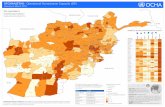

Award Distribution

Student Distribution (SA or better)

EA HA CA SA Total

This year L3% (33) 3L% (77) 39% (96\ L7% (43) 249

Last year s% (30) 26% (84) 38% (L23) 26% (84\ 32L

Last year (allexaminedsubjects)

LL% 20% 39% 30%

Previous 5 years L4% 25% 36% 25%

Previous 5 years(allexaminedsubjects)

LL% t9% 40% 30%

Male Female Year L1 Year L2

This year s2% (L29) 48% (L20) 28% (69) 72% (t8o)

Last year 49% (Ls&) s 1% (163) 28% (88) 73% (232)

Previous 5 years 54% 46% 32% 68%