SWISS INFLATION EVENT CONDITIONAL INFLATION · PDF fileSWISS INFLATION EVENT CONDITIONAL...

Transcript of SWISS INFLATION EVENT CONDITIONAL INFLATION · PDF fileSWISS INFLATION EVENT CONDITIONAL...

SWISS INFLATION EVENT

CONDITIONAL INFLATION FORECAST

Nicolas A. Cuche-Curti, Swiss National Bank and University of St. Gallen

[email protected] http://cuche.net

Disclaimer – The opinions expressed in these notes and during the speech are solely

the responsibility of the author and do not necessarily reflect the views of his affiliations.

October 31, 2011

Swiss Inflation Event – November 2011 – Swiss Bond Commission

Nicolas A. Cuche-Curti CONDITIONAL INFLATION FORECAST

Introduction

2 Road map

– part I: to present the SNB’s monetarypolicy strategy (instruments → goals)and to give an overview how theSNB’s conditional inflation forecast iscomputed (intermediate indicator)

– part II: to present published SNB’s keyindicators in order to assess inflationaryand deflationary risk

2 CV

– current position: Deputy Head ofInflation Forecasting, SNB since 2003

– work experiences: StudienzentrumGerzensee, Avenir Suisse, UBS

– studies: Handelsschule Neuchatel,HSG, HEC Lausanne, University ofCalifornia at Berkeley

Swiss Inflation Event – November 2011 – Swiss Bond Commission 1/12

Nicolas A. Cuche-Curti CONDITIONAL INFLATION FORECAST

Part I Swiss National Bank and its strategy

2 Organizational chart

General Meeting of Shareholders

Bank Council

Governing Board

Enlarged Governing Board

Audit Board

Internal Auditors

Department I Zurich

Department III Zurich

Department II Berne

International Monetary Cooperation

Economic Affairs

Legal and Property Services

Finance and Risk

Financial Stability

Cash

Financial Markets

Banking Operations

Information Technology

StabFund

International Monetary Relations

Monetary Policy Analysis

Legal Services

Central Accounting

Banking System

Administration and Cashier‘s Offices

Technical Support and Storage

Money Market and Foreign Exchange

Banking Operations Analysis

Payment Operations

Banking Applications

International Trade and Capital Flows

Technical Assistance

Inflation Forecasting

Human Resources

Controlling

Risk Management

Security

Systemically Important Banks

Oversight

Asset Management

Back Office

Business Support Processes

Master Data

Infrastructure

Investment Strategy and Financial Market Analysis

Economic Analysis

Statistics

Pension Fund

Premises and Technical Services

Secretariat General

Communications

Documentation

Research Coordination and Education

Secretariat General Berne

Sou

rce:

SN

B(2

011)

:A

nn

ual

rep

ort

2010

Swiss Inflation Event – November 2011 – Swiss Bond Commission 2/12

Nicolas A. Cuche-Curti CONDITIONAL INFLATION FORECAST

Part I Swiss National Bank and its strategy

2 Monetary policy strategy

after 2000 – from Sep 11 before 2000

‘inflationtargeting’

monetarytargeting

final targetI price stabilityexplicit def. (< 2% and pos.)

price stabilityno explicit definition

intermediate targetII cond. infl. for., no targetmain indicator, communica.

monetary aggregatesvarious definitions

operational target III 3M Liborfloor 1.20 EURCHF

bank reservesgiro accounts

main instrument repo transactions currency swaps

Swiss Inflation Event – November 2011 – Swiss Bond Commission 3/12

Nicolas A. Cuche-Curti CONDITIONAL INFLATION FORECAST

Part I Swiss National Bank and its strategy

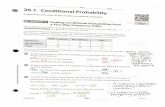

2 Element II Conditional inflation forecast as main indicator

SNB 7 Quarterly Bulletin 3/2011

1 Monetary policy decision of 15 September 2011The Swiss National Bank (SNB) will enforce

the minimum exchange rate of CHF 1.20 per euroset on 6 September with the utmost determination.It is prepared to buy foreign currency in unlimitedquantities. It continues to aim for a three-monthLibor at zero and will maintain total sight depositsat the SNB at significantly above CHF 200 billion.

With these measures, the SNB is taking astand against the acute threat to the Swiss econ-omy and the risk of deflationary development thatspring from massive overvaluation of the Swissfranc. Even at a rate of CHF 1.20, the Swiss franc isstill high and should continue to weaken over time.If the economic outlook and deflation risks sorequire, the SNB will take further measures.

The growth of the global economy has slowedsubstantially in the course of the second quarter.The outlook for the advanced economies, in par-ticular, has worsened considerably. In Switzerland,economic activity is suffering from both the strongSwiss franc and the softening in internationaldemand. The SNB expects growth to come to a halt

in the second half of the year. For 2011 as a whole,GDP growth can be expected at 1.5–2.0%. This isonly because of the favourable economic develop-ment in the first half of the year. Without the sta-bilising effect of the minimum exchange rate, therewould be a substantial threat of recession.

Uncertainty about the future outlook for theglobal economy remains exceptionally high and therisks for the global financial system have increasedsubstantially. The deterioration in the outlook for growth and fiscal problems in the advancedeconomies are both adversely impacting confidencein financial markets worldwide.

The SNB’s conditional inflation forecast hasshifted substantially downwards as a result of themassive appreciation in the Swiss franc and thedeterioration in the outlook for the global econ-omy. For 2011, the forecast shows an inflation rateof 0.4%, for 2012 a rate of –0.3% and for 2013 arate of 0.5%. This forecast is based on the assump-tion of a three-month Libor of 0.0% and a furtherweakening in the Swiss franc. In the foreseeablefuture, there is no risk of inflation in Switzerland.There are, however, downside risks for price stabilityshould the Swiss franc not weaken further.

Conditional inflation forecast of June 2011 and of September 2011Percentage change in national consumer price index from previous year

Inflation Forecast June 2011 (with Libor at 0.25%) Forecast September 2011 (with Libor at 0.00%)%

–0.5

0

0.5

1

1.5

2

2.5

3

2008 2009 2010 2011 2012 2013 2014Source: SNB

Chart 1.1

706096_QH_3_11_IN_e.qxp:705638_QH_1_11_IN_d 22.9.2011 14:17 Uhr Seite 7

Sou

rce:

SN

B(2

011)

:Q

uar

terl

yB

ulle

tin

,S

ep.

Swiss Inflation Event – November 2011 – Swiss Bond Commission 4/12

Nicolas A. Cuche-Curti CONDITIONAL INFLATION FORECAST

Part I Swiss National Bank and its strategy

2 Element II Conditional inflation forecast as main indicator

2 Some comments

– construction: different quantitative models– conditional forecast:. assuming a constant interest rate (so the name ‘conditional’); however the interest rate

cannot be expected to remain unchanged over the following 12 quarters. assuming the most likely international scenario (i.e. business cycles, monetary policies,

inflation rates, etc.); small open economy approach– interpretation: in general, the stance of monetary policy is changed when there is a

long-lasting deviation of the inflation forecast from the definition of price stability– interpretation: no systematic or mechanical monetary policy reaction to the inflation

forecast– dynamics of the forecast: gives some hints about likely future interest rates; if the forecast

at the end of the forecast period is near or above 2% (or below 0%), the likelihood ofincreasing (decreasing) interest rate is high

Swiss Inflation Event – November 2011 – Swiss Bond Commission 5/12

Nicolas A. Cuche-Curti CONDITIONAL INFLATION FORECAST

Part I Swiss National Bank and its strategy

2 Element III Target band for the

3M Libor in Swiss francs

SNB 25 Quarterly Bulletin 3/2011

Following the halting of liquidity-absorbingopen market operations, repo transactions expiredand SNB Bills became due for redemption. To speedup the increase in sight deposits, the SNB alsorepurchased outstanding SNB Bills.

From 8 August, the SNB undertook currencyswaps. A currency swap is a monetary policy instru -ment to create temporary Swiss franc liquidity. TheSNB purchases foreign currencies on the spot mar -ket and simultaneously sells them at forward rates.Further, from 24 August the SNB made liquidity- providing repo transactions with one-week matur-i t ies available on the market. These measuresresult ed in negative market interest rates.

Rise in banks’ surplus reservesStatutory minimum reserves averaged CHF 10

billion between 20 May and 19 August 2011. Theywere thus practically unchanged from the precedingperiod (20 February to 19 May 2011). On average,banks exceeded the requirement by around CHF 32.1 billion (previous period: CHF 20.2 billion).The average compliance level increased from 306%to 419%.

5.2 Money and capital market interest ratesThe three-month Libor stood at 0.18% in the

first six weeks following the June assessment. Itdropped significantly in August following the SNB’sannouncement of measures to counter the strengthof the Swiss franc. On 5 September it dropped to anew historic low of 0.0% (cf. chart 5.1).

In the second half of August, the differencebetween the three-month Libor and the three-month OIS – which is an indicator of the tensionand risk on the money market – temporarily increased to levels last seen during the financial crisis of2007/2008 (cf. chart 5.2). While at that timeexpansion of the three-month Libor/OIS interestrate spread reflected the rise in the three-monthLibor caused by rising credit and liquidity risks, therise in August 2011 was driven principally by theexceptionally high liquidity, which was reflected in the negative OIS.

Money market ratesDaily figures

3M Libor SNB repo rate SNB reverse repo rateTarget range 3M OIS

%

–0.5

0

0.5

1

1.5

2

2.5

3

3.5

2007 2008 2009 2010 2011Sources: Bloomberg, Reuters, SNB

Chart 5.1Spread between 3M Libor and 3M OIS

Daily figuresSpread

%

0.25

0.5

0.75

1

1.25

1.5

1.75

2007 2008 2009 2010 2011Sources: Bloomberg, Reuters

Chart 5.2

706096_QH_3_11_IN_e.qxp:705638_QH_1_11_IN_d 22.9.2011 14:17 Uhr Seite 25

Sou

rce:

SN

B(2

011)

:Q

uar

terl

yB

ulle

tin

,S

ep.

2 Some comments

– role: the 3M Libor is a significantshort-term, interbank interest rate forSwitzerland

– steering: the SNB influences the Liborthrough ON to 3-week repos

– repos: contract in which the seller ofsecurities agrees to buy them back ata specified time and price and to payinterest (repo rate)

– bank width: the target range is usuallyone-percentage point wide to ensure acertain flexibility

– targeted position within the bank: isusually announced

– temporary fluctuations: outside therange can be tolerated in specialcircumstances

Swiss Inflation Event – November 2011 – Swiss Bond Commission 6/12

Nicolas A. Cuche-Curti CONDITIONAL INFLATION FORECAST

Part II Inflation and deflation assessment

2 CPI inflation

SNB 21 Quarterly Bulletin 3/2011

The relationships between the inflation ratesof the various CPI components have remainedlargely stable over the past few quarters. Whereasprices for domestic goods reported a slightly posi -tive year-on-year development, those for foreigngoods were well below the year-back level. With therecent appreciation of the Swiss franc, this discrep -ancy has become more pronounced, but it hadalready been noticeable in the previous quarters(cf. chart 4.1). Prices for domestic goods are on adownward trend and thus showed negative year-on-year rates. Prices for services, by contrast, are tend -ing upwards. This pattern, too, changed little overthe past few quarters (cf. chart 4.2).

Slight fall in core inflationFor the evaluation of the CPI, the SFSO’s core

inflation rate (SFSO1), the trimmed mean (TM15)and the dynamic factor inflation (DFI) can be used.The latter two are calculated by the SNB. In thecase of the SFSO1, the same, mostly price-volatilegoods are excluded from the CPI every month,whereas in the TM15, the goods prices with thehighest and lowest annual inflation rates areexcluded each month. The two core inflation ratesare thus based on a reduced commodities basket.The broader-based DFI, by contrast, calculates coreinflation using an empirically estimated dynamicfactor model that includes other real and nominaleconomic data in addition to price data. Chart 4.3shows that core inflation has trended downwardsover the past few months after previously recordinga slight upward trend.

Revision of dynamic factor inflationThe SNB recently revised the data basis of the

DFI. In July 2011, the resulting DFI series was pub -lished for the first time in the Monthly StatisticalBulletin. Compared to the earlier series, the revisedDFI shows a bigger lead on inflation as measured bythe CPI and improved statistical features (cf.Monthly Statistical Bulletin, July 2011, p. III).

CPI: domestic and imported goods and servicesYear-on-year change

Total Domestic Imported Imported excluding oil%

–6

–4

–2

0

2

4

6

8

2007 2008 2009 2010 2011Sources: SFSO, SNB

Chart 4.1

CPI: domestic goods and servicesYear-on-year change

Goods Priv. services excl. rents Rents Pub. services%

–1

0

1

2

3

4

2007 2008 2009 2010 2011Sources: SFSO, SNB

Chart 4.2

Core inflation ratesYear-on-year change

CPI TM15 DFI SFSO1%

–1

0

1

2

3

4

2007 2008 2009 2010 2011Sources: SFSO, SNB

Chart 4.3

706096_QH_3_11_IN_e.qxp:705638_QH_1_11_IN_d 22.9.2011 14:17 Uhr Seite 21

Sou

rce:

SN

B(2

011)

:Q

uar

terl

yB

ulle

tin

,S

ep.

2 Some comments

– headline inflation: quarterly data,consumer prices, year-on-yearpercentage change

– oil price inflation: with a weight ofapp. 7%, energy prices can markedlyinfluence the inflation dynamics

– strong Swiss franc: with importedgoods having a weight of app. 27%,a strong currency reduces inflationarypressures (ceteris paribus, cheaperimported goods)

– strong Swiss franc: ceteris paribus,a strong currency weighs on theexport activity, which in turn reducesinflationary pressures

– strong Swiss franc: goods vs. servicesinflation dynamics

Swiss Inflation Event – November 2011 – Swiss Bond Commission 7/12

Nicolas A. Cuche-Curti CONDITIONAL INFLATION FORECAST

Part II Inflation and deflation assessment

2 Core inflation

SNB 21 Quarterly Bulletin 3/2011

The relationships between the inflation ratesof the various CPI components have remainedlargely stable over the past few quarters. Whereasprices for domestic goods reported a slightly posi -tive year-on-year development, those for foreigngoods were well below the year-back level. With therecent appreciation of the Swiss franc, this discrep -ancy has become more pronounced, but it hadalready been noticeable in the previous quarters(cf. chart 4.1). Prices for domestic goods are on adownward trend and thus showed negative year-on-year rates. Prices for services, by contrast, are tend -ing upwards. This pattern, too, changed little overthe past few quarters (cf. chart 4.2).

Slight fall in core inflationFor the evaluation of the CPI, the SFSO’s core

inflation rate (SFSO1), the trimmed mean (TM15)and the dynamic factor inflation (DFI) can be used.The latter two are calculated by the SNB. In thecase of the SFSO1, the same, mostly price-volatilegoods are excluded from the CPI every month,whereas in the TM15, the goods prices with thehighest and lowest annual inflation rates areexcluded each month. The two core inflation ratesare thus based on a reduced commodities basket.The broader-based DFI, by contrast, calculates coreinflation using an empirically estimated dynamicfactor model that includes other real and nominaleconomic data in addition to price data. Chart 4.3shows that core inflation has trended downwardsover the past few months after previously recordinga slight upward trend.

Revision of dynamic factor inflationThe SNB recently revised the data basis of the

DFI. In July 2011, the resulting DFI series was pub -lished for the first time in the Monthly StatisticalBulletin. Compared to the earlier series, the revisedDFI shows a bigger lead on inflation as measured bythe CPI and improved statistical features (cf.Monthly Statistical Bulletin, July 2011, p. III).

CPI: domestic and imported goods and servicesYear-on-year change

Total Domestic Imported Imported excluding oil%

–6

–4

–2

0

2

4

6

8

2007 2008 2009 2010 2011Sources: SFSO, SNB

Chart 4.1

CPI: domestic goods and servicesYear-on-year change

Goods Priv. services excl. rents Rents Pub. services%

–1

0

1

2

3

4

2007 2008 2009 2010 2011Sources: SFSO, SNB

Chart 4.2

Core inflation ratesYear-on-year change

CPI TM15 DFI SFSO1%

–1

0

1

2

3

4

2007 2008 2009 2010 2011Sources: SFSO, SNB

Chart 4.3

706096_QH_3_11_IN_e.qxp:705638_QH_1_11_IN_d 22.9.2011 14:17 Uhr Seite 21

Sou

rce:

SN

B(2

011)

:Q

uar

terl

yB

ulle

tin

,S

ep.

2 Some comments

– construction: exclusion principle vs.factor model

– definitions: SNB vs. FSO– role of core inflation: headline inflation

is in the monetary policy strategy (CPIinflation is relevant to households), butcore inflation help assess inflationarytrends

Swiss Inflation Event – November 2011 – Swiss Bond Commission 8/12

Nicolas A. Cuche-Curti CONDITIONAL INFLATION FORECAST

Part II Inflation and deflation assessment

2 Producer and import prices

SNSNB 22 Quarterly Bulletin 3/2011

4.2 Producer and import prices

Considerable decline in import pricesThe total supply price index (producer and

import prices) fell substantially between May andAugust. Driven by the appreciation of the Swissfranc, price reductions were observed in a largenumber of industries. The strongest price decreaseswere registered for imported goods, in particularfor energy.

In a year-on-year comparison, the importprice index turned negative in July and stood at–2.2% in August (cf. chart 4.4). Prior to that, infla -tion for imported goods had been above zero pri -marily due to distinctly higher energy prices year-on-year, whereas prices for consumer and capitalgoods were already tending downwards at the time.

Year-on-year, the producer price index hasbeen negative since March. In August, it came to–1.8%. In this index, too, it is primarily energyprices that exceed the previous year’s level despitethe recent decline. Producer prices for other goodsmostly fell over the same period. This reflects theappreciation of the Swiss franc, which has put pres -sure not only on the prices for goods earmarked forexport, but also on the prices of goods produced forthe domestic market.

4.3 Real estate prices

Sharp rise in residential property pricesand modest rent increasesPrices for residential property have continued

to rise sharply. The prices of single-family homesand owner-occupied apartments advertised innewspapers and the internet in the second quarterwere around 5% up year-on-year. In addition toasking prices, there are further indices, some ofthem using different methods, that measure thedevelopment of actual transaction prices. Theseindices all suggest that transaction prices in thesecond quarter were also considerably higher thanone year back (cf. chart 4.5).

The increase in residential property prices isonly partially explained by the changes in popula -tion, per capita income and interest rates. The riskof adverse developments will increase if the sharpprice rise continues.

The interest rate decline remained an import-ant reason why rents did not rise to the same extent as prices for residential property. Rents forapartments available on the market and the rentalcomponent of the CPI in the second quarter were up by 2.3% and 1.3% respectively, year-on-year(cf. chart 4.6).

Transaction prices, single-family homesNominal, hedonic

Wüest & Partner Fahrländer Partner IAZIIndex

110

120

130

140

150

02 03 04 05 06 07 08 09 10 11Sources: Fahrländer Partner, IAZI, Wüest & Partner

Chart 4.5Producer and import prices

Year-on-year changeTotal Producer prices Import prices

%

–10

–7.5

–5

–2.5

0

2.5

5

7.5

2007 2008 2009 2010 2011Source: SFSO

Chart 4.4

706096_QH_3_11_IN_e.qxp:705638_QH_1_11_IN_d 22.9.2011 14:17 Uhr Seite 22

Sou

rce:

SN

B(2

011)

:Q

uar

terl

yB

ulle

tin

,S

ep.

2 Some comments

– role: beginning of the ‘productionchain’

– interpretation: incomplete pass-through between IPI/PPI and CPI

– construction: census quality

Swiss Inflation Event – November 2011 – Swiss Bond Commission 9/12

Nicolas A. Cuche-Curti CONDITIONAL INFLATION FORECAST

Part II Inflation and deflation assessment

2 Inflation expectations

SNB 23 Quarterly Bulletin 3/2011

Apartment rents and reference interest rateNominal, year-on-year change (lhs)

Existing rents Offer rentsReference interest rate on mortgage (rhs)

% %

1

2

3

4

5

6

2007 2008 2009 2010 2011

2.8

3

3.2

3.4

3.6

3.8

Sources: Federal Office for Housing (FOH), SFSO,Wüest & Partner

Chart 4.6Survey on expected movements in prices

12-month price development expectationsDecrease Unchanged Modest increase Strong increase

%

10

20

30

40

50

60

70

2007 2008 2009 2010 2011Sources: SECO, SNB

Chart 4.7

4.4 Inflation expectations

Lower inflation expectations Against the background of the appreciation of

the Swiss franc and a dampened global economicoutlook, the survey on the development of con -sumer prices suggests a distinct lowering of infla -tion expectations.

The quarterly survey conducted by SECO inJuly shows that inflation expectations of house-holds have receded in comparison with April’s figures (cf. chart 4.7). The proportion of respond -ents expecting prices to rise moderately or sharplyin the coming twelve months dropped below 50%,whereas there was a increase in the number of res -pondents who expected unchanged or falling prices.

The monthly Credit Suisse ZEW Financial Market Report, which is based on responses fromaround 40 financial market experts, reveals anongoing downward trend in inflation expectationssince April 2011. In August, only 14% of all respond -ents believed that CPI inflation rates would rise inthe coming six months, as against 77% in April and41% in June. By contrast, 49% expected no changeand 37% anticipated decreasing inflation rates.

Producer sale prices expected to sink The quarterly KOF survey asks industrial and

wholesale companies how they expect purchase andsale prices to perform in the next three months.Compared to the April figures, the results of theJuly survey indicate that the scope for priceincreases has narrowed. Whereas in April, mostrespondents expected rising purchase and saleprices, the majority in July believed that purchaseprices would remain unchanged and sale prices sink.

706096_QH_3_11_IN_e.qxp:705638_QH_1_11_IN_d 22.9.2011 14:17 Uhr Seite 23

Sou

rce:

SN

B(2

011)

:Q

uar

terl

yB

ulle

tin

,S

ep.

2 Some comments

– mechanism: inflation expectations mayinfluence actual inflation, self-fulfillingprocess

– measurement: financial assets vs.surveys

– survey: main survey in Switzerlandis the SECO’s consumer confidencesurvey with two questions about pastand future price developments

Swiss Inflation Event – November 2011 – Swiss Bond Commission 10/12

Nicolas A. Cuche-Curti CONDITIONAL INFLATION FORECAST

Part II Inflation and deflation assessment

2 Term structure

SNSNB 26 Quarterly Bulletin 3/2011

Term structure of Swiss Confederation bondsAfter Nelson-Siegel-Svensson. Years to maturity (hor. axis)

Mid-September 11 Mid-June 11 Mid-March 11%

0.5

1

1.5

2

2.5

0 5 10 15 20Source: SNB

Chart 5.3

Long-term interest rates at a new lowMedium and long-term interest rates, which

had risen considerably since their temporary low of summer 2010, have been falling again since Apriland have reached new historic lows. The yield onten-year Swiss Confederation bonds, for example, fellfrom 1.7% in mid-June to 1.0% in mid-September.Yields on corporate bonds with high credit ratingsmoved largely in parallel with those of Confederationbonds, while yield premia on lower-rated corporatebonds have risen since the deterioration of the economic outlook at the end of July. The decline in long-term interest rates is attributable to two factors: high demand for Swiss franc investmentsfrom investors seeking a safe haven, and marketexpectations that short-term rates will remain lowfor a prolonged period.

Yield curve shifts downwardsAs a result of the decline in both short and

long-term interest rates, the yield curve shifteddownwards between June and September (cf. chart5.3). In addition, in September it was flatter thanin June. The difference between the yield on ten-year Confederation bonds and the three-monthLibor was 1.0 percentage points in mid-September,as against 1.5 percentage points in mid-June andan average of 1.3 percentage points since the mid-1990s.

Estimated real interest rate

3 years, ex ante%

–0.5

–0.25

0

0.25

0.5

0.75

1

1.25

1.5

2007 2008 2009 2010 2011Source: SNB

Chart 5.4

Real interest rates remain lowEstimated real interest rates rose slightly

between June and September because estimatedinflation expectations fell faster than nominalinterest rates. The estimated three-year real inte r-est rate was –0.1% in September 2011, comparedwith –0.2% in June (cf. chart 5.4). The inflationexpectations used to calculate real interest ratesare based on inflation forecasts generated by variousSNB models.

706096_QH_3_11_IN_e.qxp:705638_QH_1_11_IN_d 22.9.2011 14:17 Uhr Seite 26

Sou

rce:

SN

B(2

011)

:Q

uar

terl

yB

ulle

tin

,S

ep.

2 Some comments

– interpretation: inflation expectationsinfluence the long end of the curve

– current juncture: ‘flight to quality’effects dominate

Swiss Inflation Event – November 2011 – Swiss Bond Commission 11/12

Nicolas A. Cuche-Curti CONDITIONAL INFLATION FORECAST

Part II Inflation and deflation assessment

2 Monetary aggregates

SNB 29 Quarterly Bulletin 3/2011

5.5 Monetary and credit aggregates

Sharp rise in monetary baseThe monetary base, which is composed of bank-

notes in circulation, plus the domestic banks’ sightdeposits with the SNB, increased very substantiallyin August, reflecting the increased liquidity on the Swiss franc money market. The monetary basehad already risen significantly in autumn 2008 inresponse to the monetary policy reaction to theintensification of the financial crisis and hadremained at a high level since then, with somelarge fluctuations (cf. chart 5.10).

Strong growth in the broadly based monetary aggregatesThe M1, M2 and M3 aggregates provide a bet -

ter insight than the monetary base into the impactof monetary policy on the economy and prices. Theyhave also grown strongly since autumn 2008 (cf.chart 5.11). In August, M1 (cash in circulation,sight deposits and transaction accounts) was 9.7%above its level a year earlier, while M2 (M1 plussavings deposits) was 8.4% higher and M3 (M2 plustime deposits) rose by 7.6% in the same period(table 5.1). At present, the increase in M3 is beingdriven mainly by the growth in lending.

Higher growth in lending The rise in bank lending has picked up slightly

even though the results of the SNB’s quarterly survey of lending suggest that the banks slightlytightened lending standards and conditions formortgage lending to private households in the second quarter.

Mortgage claims, which account for aroundfour-fifths of total bank loans, increased by a year-on-year rate of 4.8% in the second quarter andJuly, compared with 4.6% in the first quarter. Thegrowth in mortgage claims rose considerably inautumn 2008 following the reduction in the three-month Libor and had been slowing slightly sincethe start of 2010 (cf. chart 5.12).

Monetary aggregatesSeasonally adjusted

M1 M2 M3 Monetary base (rhs)In CHF billions In CHF billions

100

200

300

400

500

600

700

800

95 00 05 10

40

60

80

100

120

140

160

180

Source: SNB

Chart 5.10

Growth of monetary aggregatesYear-on-year change

M1 M2 M3%

0

10

20

30

40

50

2007 2008 2009 2010 2011Source: SNB

Chart 5.11

Mortgage claims and 3M Libor

Mortgage claims (year-on-year change) 3M Libor%

1

2

3

4

5

6

7

00 01 02 03 04 05 06 07 08 09 10 11Sources: Reuters, SNB

Chart 5.12

706096_QH_3_11_IN_e.qxp:705638_QH_1_11_IN_d 22.9.2011 14:17 Uhr Seite 29

Sou

rce:

SN

B(2

011)

:Q

uar

terl

yB

ulle

tin

,S

ep.

2 Some comments

– quantitative theory of money: inflationis a monetary phenomenon

– current juncture: precautionarydemand

Swiss Inflation Event – November 2011 – Swiss Bond Commission 12/12

���������������� ������� � ���� ������ �� ��������������������� ����� ���� ��������

�������������������������� ���!������

�

������� ��������������"����������� �������������������

Central bank total assets*

Source: Thomson Financial, own calculation. *Series are indexed (June 2006 = 100).

50

100

150

200

250

300

350

400

06 07 08 09 10 11

ECBFedBoJBoESNB

Swiss M3 and CPI (% y/y)

Source: Thomson Financial, own calculation.

M3 series is brought forward by 24 months vis-a-vis the CPI series.

Both series represent moving averages over a gliding 2-year window.

-2

0

2

4

6

8

10

12

14

73 77 81 85 89 93 97 01 05 09 13

-6

-4

-2

0

2

4

6

8

10M3 24 (LS)

CPI (RS)M3 changes have a lead vis-a-vis CPI changes. Latest M3 developments argue for further increases in the Swiss CPI.

EURCHF and Swiss versus euro area CPI inflation differential

Source: Thomson Financial, own calculation.

-3.5

-3.0

-2.5

-2.0

-1.5

-1.0

-0.5

0.0

0.5

99 00 01 02 03 04 05 06 07 08 09 10 11

1.1

1.2

1.3

1.4

1.5

1.6

1.7

1.8

CPI y/y, difference betweeneuro area and Switzerland

EURCHF (RS)

Swiss stock prices and "excess liquidity"

Source: Thomson Financial, own calculation.

0

2000

4000

6000

8000

10000

88 90 92 94 96 98 00 02 04 06 08 10 12 14

0.90

0.95

1.00

1.05

1.10

1.15

1.20

1.25

1.30SMI index (LS)M3/nominal GDP (RS)

������������� ���������������

����������������������������

������������

������ ���������� �������� ����� ���������� ! "#"$

���������������������%������� �&'����"( �)*�+ ,���������-���'���'��������������� �����������������

#

$ ��������������"���"�%��&��������������

'!( �) $ �( )*+�( �

.���������� �����/.������� �����������0�� ���

� 1 � ����������,�"����"�� �,��

� 1 � ������������� �,��

�����������������

� '����"��&��"������� �����������������������&��-��"�������� ����

.

�����������&��������� ����

� �����������"������"�������������������"���� �������"��&��������

� ��������������������/ �����������"� *!0�*�1 ��"� �'��������������� �������&

-5%

0%

5%

10%

15%

20%

25%

30%

1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011

UK yoy realised inflationUS yoy realised inflationEU yoy realised inflationSwiss yoy realised inflation

-60%

-40%

-20%

0%

20%

40%

60%

80%

100%

1975 1980 1985 1990 1995 2000 2005 2010

UK RPI

U.S. CPIEuro HICP

2

+�������������������� ����,

2���3�����������&������������$ �����

������������ ��������

� ��� ����� ��������

� ���

�+ ,

����� ��������� ���

������'������

)4 ������)* �

��������$ �����

5�����-���

����� ��������� ���

�����������

2���6$ ,��&����

��������$ ��������"��

( ���� ���"����&���

3

2���37�������������&�������������$ �����

� �����"���� �����������������4� %�����"�������������5� %�����"�������

��

�

� ������������� �� ������

6

��728

�7�8

�728

�7�8

�728

�7�8

�728

#7�8

#728

$ ���2 $ ���3 $ ���6 $ ���9 $ ���: $ ���� $ ����

2���*����������$ �����

2������,�����

�7�8

�728

�7�8

�728

�7�8

�728

#7�8

$ ���2 $ ���3 $ ���6 $ ���9 $ ���: $ ���� $ ����

2��� *!���������$ �����2������,�����

2���37��;�"��������*�1 0� *!��"� �'�

)4

�)*

8 5�

9"�

����� �����7��:!

����� �����7�;6!

�7�8�728�7�8�728�7�8�728#7�8#728.7�8.728

$ ���2 $ ���3 $ ���6 $ ���9 $ ���: $ ���� $ ����

2���*<���������$ �����

2������,�����

����� �����7�;<!

9

2���67��$ ,��&�������������$ ��������"��

5�����-�����'���"����� ������� ���'�� 4 = ������� �

5�����-�����'���"�55 = ������5

.�&'������ ���������

�������

:

2���67��;�"��������*�1 0� *!��"� �'=�*�� �������������� ������.������5���

������������������ �����"�������������

� �� ��

�����������

5��� ��

�������

5

� > ������������������� ����"��&�����*�1 0� *!��"� �'������������������������������������������ �,���

��

�.8

��8

�8

�8

.8

38

98

?���� ?���� ?���� ?���� ?���� ?���� ?���� ?���� ?���� ?���� ?���� ?���� ?����

� �� ���5���*�����������

� �� ���5���*���������������

2���67��;�"��������*�1

)4 ���������> ���� �����/.����������"��������

? '����� "�*��'���

�.8

$ ��6

?���6

����6

1 ���6

$ ��9

?���9

����9

1 ���9

$ ��:

?���:

����:

1 ���:

$ ���

:�8)��,���; ��� �� ���5���*���������������

668)��,���; ��� �� ���5���*�����������

##8)��,���; ��� �� ��

� �� ��$ ����������������

:�

:2

���

��2

���

��2

���

��2

�#�

�#2

�.�

���3 ���6 ���9 ���:

)��,��

� �� ���5���*���������������

� �� ���5���*�����������

��

��8

��8

�8

�8

�8

#8

.8

28

?���� ?���� ?���� ?���� ?���� ?���� ?���� ?���� ?���� ?���� ?���� ?���� ?����

� �� ���5���*�����������

� �� ���5���*���������������

2���67��;�"�������� *!

�)* ���������> ���� �����/.����������"��������

? '����� "�*��'���

�.8

$ ��6

?���6

����6

1 ���6

$ ��9

?���9

����9

1 ���9

$ ��:

?���:

����:

1 ���:

$ ���

:�8)��,���; ��� �� ���5���*���������������

2:8)��,���; ��� �� ���5���*�����������

�:8)��,���; ��� �� ��

� �� ��$ ����������������

:�

:2

���

��2

���

��2

���

��2

�#�

���3 ���6 ���9 ���:

)��,��

� �� ���5���*���������������

� �� ���5���*�����������

��

�.8

�#8

��8

��8

�8

�8

�8

#8

.8

28

?���� ?���� ?���� ?���� ?���� ?���� ?���� ?���� ?���� ?���� ?���� ?���� ?����

� �� ���5���*�����������

� �� ���5���*���������������

2���67��;�"�������� �'�

8 5����������> ���� �����/.����������"��������

? '����� "�*��'���

�.8

$ ��6

?���6

����6

1 ���6

$ ��9

?���9

����9

1 ���9

$ ��:

?���:

����:

1 ���:

$ ���

:�8)��,���; ��� �� ���5���*���������������

998)��,���; ��� �� ���5���*�����������

��8)��,���; ��� �� ��

� �� ��$ ����������������

:�

:2

���

��2

���

��2

���

��2

�#�

�#2

���3 ���6 ���9 ���:

)��,��

� �� ���5���*���������������

� �� ���5���*�����������

�#

�����������

�.

2���37�������������&�����2�����������������$ �����

�7�8

�728

�7�8

�728

�7�8

�728

#7�8

���2 ���3 ���6 ���9 ���: ���� ����

�/ ��2�����������$ �����

�2

�7�8

�728

�7�8

�728

�7�8

�728

#7�8

���2 ���3 ���6 ���9 ���: ���� ����

�/ ��2�����������$ �����

�/ ��2�����������!������

2���67��$ ,��&�������������������$ ��������"��

� !�����������������/ ��2�����������$ ����������&�*�1 ��"� *!�2������,�������������

�7��8

@ ���&�� ����

�7238�/ ��2�����������$ ������; ������!������

+��,��&� �����;������@ ������"����������

�3

+�����������������+���!��������"�%

� '����"��&��������������������������������������A���"

:�

:2

���

��2

���

��2

���

���3 ���6 ���9 ���: ���� ����

��������������+���!��������"�% ������������ �� �� �����"�%

�6

�������1 ����

���� ���,����'�����"�%�!������

+�=�5..�B�C���#�#�.6#32�����7��������D ����7���

� -���' ���!��������A���"

+�=�5.��B�C..���2�2��#:�����7�����D ����7���

� ��������> @�� �!��������A���"

+�=�5.��B�C..���2�2��##$ �����7;��&��D ����7���

�9

4 ��� ��� ��

@ �����������������=�+������������� �"�����������������������������������������������=�B�C����������������%������"���������������������������������������������������������������������������������E����������������"��������F��"�B��C�������������������� �����������0���0���������0�"������������"������0�����"���������������������� � ��"����������������%������"����������������������7

�� �������"���������=�( �������� ������0����90���������������7��-����"�)��� ����������G � �����@ � ������������� ������,��&0������� �,���0��"�������������� ����� �&�� ��������������7�1 ����&��������������������"0�"��������������� ����������������"�"��������������������"�����7������� ����������� ����0����������������-�����"����������������������������"�����7����=HH���� � ����7����7��� H�������H�&�����H�����H"��������������7�����=HH���7��� �7��� H*���"���������H��� �������������������������������������"���"�����������-���������"���������������&������������G��������������������������&��)��� �)���7@ �������������������������������"��������������7�����������"�����"����,�����"������������������� ������������"�����������������������7��@ ��������0���������������"��� �������������������� ����������������������������������"�������������E�����������������������7�!����������#��'�����"�$ ������1 ����� ��=����������� �"�������������"�����������"���%�"������"�������&��������"������������"������������"��������%�"����7�'�������"����"��������"�������������* 7�7��%�� �������������"��������B����"��&��������� ����C�B�C�������������"�"���������������������"0��"�������������"0������������������������������"��&�* 7�7��%�����"��������F��"�B��C������������������������������� ���������� �,����&����������������������������� ������""�����"�������7�@ ����"��&�0���������"����,�"��������"����������������������� ����������� �����"����"�����%�"�����7+����������������������������"���������������BI����������GC�J ����������� ������,��&�"�������������������,�')�7��+����������������������"�"������������������ �����������������7�'�����������������������������������"��������"��������������������������&�������������������������&�������������������������������������� ���7�( ���������"���������������&��������������0����������� ������������"���������������������������������"����� ������������������ �����,����������������0��������"������������������������������������������������ ����7�+�������������������������� ������������������������"�������E����������&�0��"���������������������&����������"����������������������������� ����������������������7�������������"��������������"��������������������������0�"��������0����������"��� ������0�����"��&���������������"�������������������������������������"���� ���0�� ������ ���� �������� �������� �&��0���� �&��������"��������������������������&�������������0������� ���������������������&���0�"����0���"���������� �,���� ,�������"������0����,���������� � ������"H���������� ������,���������������������������������������"�"��������������������������E���������������������7�� �����������������0��������������0������������������������������������0�"��������0��������0������ ���������������� ������������������������"��������������-���������������&����� �����������������������������������������7�+��������������"�������"�������������������� ������������������������������7����������������� � ��"������������������"����"���������������������0�������������������� ����"�������"������������������0��"�������������"����"����"���������������������������7�+�����������"������ ������ ����������� ����� �������������� �"�����"�����������������&������������������� ���� �,����B����"��&����&������� �,����-��"���C7�+��������� ���� ������������������������������"�"�������"��������������0�������� ��"�������������������� ��������������"7+������� � ����������������&�� "��������������*<��"� ������������������������������� �������������������������� ����"�����"����@ �������:�������������������������"�$ �,����@ ������� B�������'��� ������( �"��C����27�������"������"�������������������������������%������������� �����������&����������� ����7�+���������� ����������������������������������������������������" ������������"���������������������������7������������� ����������� ������,��&�"�������������������,�')�0���������"��"���&���"������������������������@ ���������BI��@ GC��"�� �� �����������)��"�������,� %���&�7�@ !�)@ K���@ '�+@ )��� �7����1 ��+!��*+�� �+/ ���$ @ + !�@ )��� �+/ �*� �+ 1 ��+@ + ��@ � 1 0��� ��( � � �+�( � �+/ ! > �+/ 0�@ �� '+��! �'( � ����)�+K��( !��+���( � + � +�7�@ � K�* 7�7�' !�( � �> ��/ �� �+( � �� �+�@ �+!@ � �@ �+�( � ��� �@ � K�� �*!�+K�1 ���*�� 1 �/ ! �� ��/ ( *)1 �1 ( ��( �( � )K��K��( � +@ �+�� �@ �! '! � � +@ +�; �( ���@ !�)@ K���@ '�+@ )��� �7��� �+/ �* 7�70�����'�,�@ �����0�� ���K��,0�� ���K��,����337���E��������������"���������������������������������������0�@ ��@ ��@ '�+@ )0������������ ������,��&�1 �����������@ ��@ ���,�)�� ���"0�����������"����������������������"���B!�&���������� �7=�:93H��.6:.H�3C0����"����������&������� ��������������@ ����7�@ ���������@ �����������������������������&�������������������������������������"�������"������������"�"��������������������&��������������� ���@ ��@ ���������������@ ����0�@ ��@ �+( > !��� ( !+/ 0��9���( $ $ ����( � !��+! +0�?( / @ � � ��*! 0�����7�@ ��@ ��@ '�+@ )����@ � �@ ���)�@ + �( ���@ !�)@ K���@ '�+@ )7� ���* 7�7�������������"���������"��%����������������������&�����������,�')������������������������������ ��E����"������������������&����������� ������������7��������,�')�����,��������������"����������&������� ���� ��� ��� �����"�������������������������"������ ��������A"�����������&��������7L ������&�����������,�')��B����C7�@ ���&�����������"7�� ������������������������� ����������"���"�������� ����������������������������������� �����������������������������������������7���������,�')�������&������"���� �&�"�� �7����3�367�!�&������"������������������'��0�)��"��0� �.�2/ '7

@ ""������������ �������&�"��&������������������������������"��������-����7�M�:���2 *1 N *��.#3

Inflation-Linked BondsSlide 1/18

Asset Management

Swiss Bond Commission

How to hedge against rising inflation?

Alexandre Bouchardy, CFANovember, 2011

Inflation-Linked BondsSlide 2/18

Asset Management

Inflation – A brief summary of the recent history

Source: Credit Suisse, OECD

1. Switzerland and Germany are the only countries that have achieved an average inflation rate below 3%

2. Inflation is volatile and has a positive bias. In Switzerland:

Only 2 years of negative inflation -0.6% (1959) and -0.5% (2009)

Peaks of close to 10% (1974), 6.5% (1981) and 5.9% (1991)

Above 4% for 25% of the time

0%1%2%3%4%5%6%7%8%9%

10%

Switzer

land

German

y

Japa

nUnit

ed S

tates

Canad

aNor

wayFr

ance

Sweden

Austra

liaUnit

ed K

ingdo

m Italy

OECD aver

age (

since

1971

)

Spain

Greec

e

Average inflation rate since 1956

Inflation-Linked BondsSlide 3/18

Asset Management

Instruments providing an inflation protection

a) Commodities and equities: attractive inflation hedge over the long term but highly volatile over the short and medium term

b) Real estate: standard inflation hedge, but liquidity issues

c) Inflation-linked bonds (ILB): offer the best risk/return profile Source: Barclays Capital, Credit Suisse

Annual real return and risk of various assets: 1987 to 2009

Inflation-Linked BondsSlide 4/18

Asset Management

Solution 1: Global inflation-linked bonds Advantages:

1. ILB are less risky than conventional bonds because they guarantee a real rate of return over time.

2. ILB count as a safe investment over an interest rate cycle, even safer than money market.

3. Diversification into inflation-linked bonds enhances the risk/return profile of a portfolio.

4. Provide protection against inflation uncertainty: inflation volatility and risk have massively increased in the aftermath of the financial crisis. An inflation protection is more than ever warranted.

Disadvantages:

1. Lack of diversification: 3 countries/regions account for 89% of the developed market with 38% for the

US, 25% for the UK and 26% for the Euro-zone (France 54%, 35% IT, 12% GE).

2. Negative performance over a period possible even though inflation increases.

3. Very long duration: the real duration of the investment universe is higher than 9, which is ill-suited for

most investors.

Source: Credit Suisse

Inflation-Linked BondsSlide 5/18

Asset Management

Source: Credit Suisse, Bloomberg, Barclays Capital

Efficient frontier– optimal allocation to ILBThe total volatility is significantly reduced when including ILB in a fixed income portfolio.

Historical data show that the performance was very similar (period 1997- 2011 H1), although this period was disinflationary. This argues for an uncompensated inflation risk, so why should someone run a risk for which he is not compensated for?

The least risky portfolio had approximately 65% ILBs.

Historical performance indications and financial market scenarios are no guarantee for current or future performance

100% inflation linked bonds (ILBs)

6.68%

6.69%

6.70%

6.71%

6.72%

6.73%

6.74%

6.75%

6.76%

4.40% 4.60% 4.80% 5.00% 5.20% 5.40% 5.60%

Portfolio standard deviation

Por

tfolio

mea

n re

turn

100% nominal bonds

65% ILBs, 35% nominals

Comparison: Barclays World Government inflation-linked Index hedged in USD vs Barclays Breakeven Index hedged in USD

Inflation-Linked BondsSlide 6/18

Asset Management

Inflation expectations

Real interest rates No change in real interest rates

No change in expected inflation

Same performance of inflation-

linked and nominal bonds. Both

outperform cash.

No change in real rates

Rising inflation expectations

No change in real rates

Falling inflation expectations

Rising real rates

No change in expected inflation

Inflation-linked bonds outperform

nominal bonds and cash.

Inflation-linked bonds

underperform nominal bonds.

Same performance of inflation-

linked and nominal bonds. Both

underperform cash.

Real interest rates

Real interest rates

Real interest rates

Inflation expectations

Inflation expectations

Inflation expectations

Which market conditions favour ILB?

No preference

Best case

Worst case

No preference

Source: Credit Suisse

Inflation-Linked BondsSlide 7/18

Asset Management

Solution 2: Money market investments (Switzerland)

Source: SNB, Bloomberg, Credit Suisse* measured as the discount rate prevailing at the beginning of the year minus the inflation rate

-6%

-5%

-4%

-3%

-2%

-1%

0%

1%

2%

3%

4%

1956

1959

1962

1965

1968

1971

1974

1977

1980

1983

1986

1989

1992

1995

1998

2001

2004

2007

2010

Real money market rate*

1. Since 1956, the average real rate of return was 0.05%

2. Negative return for 36% of the time

3. Periods of prolonged negative real interest rates (1970s)

Inflation-Linked BondsSlide 8/18

Asset Management

Solution 3: Synthetic inflation-linked bonds

Combination of conventional bonds together with inflation swaps to build synthetic inflation linked bonds

Inflation protection without the sub-optimalities associated with inflation-linked bonds

Benefits:

ILB bond portfolio available in CHF

Increased diversification as no restriction to inflation-linked bonds

Increased yield by adding defensive corporate bonds

Flexible and cost effective solution as no allocation change of the existing bond portfolio warranted

Customized benchmark possible

Precise measure of inflation risk in the portfolioSource: Credit Suisse

Inflation-Linked BondsSlide 9/18

Asset Management

PrincipalPay FixedReceive InflationNominal Coupon

Bond + inflation-swap = synthetic inflation-linked bond

Synthetic inflation-linked bonds – Description

we combine bonds denominated in CHF with swaps on European and US inflation. This represents a proxy hedge that works as long as inflation surprises in these markets are correlated with Swiss inflation.

Source: Credit Suisse

Inflation-Linked BondsSlide 10/18

Asset Management

Measuring the interest rate risk – Dual Duration

We can distinguish two types of durations:

– real rate duration: sensitivity with respect to changes in the real rates

– Inflation duration: sensitivity with respect to changes in inflation expectations

For nominal bonds: nominal duration = real duration = inflation duration

For inflation-linked bonds: nominal duration = real duration, inflation duration = 0

To compare nominal bonds with inflation-linked bonds often an equivalent nominal duration for ILB is calculated:

nominal duration of inflation-linked bonds = real duration * beta

(with beta normally assumed to be = 0.5)

The dual duration is the more precise measure as beta is not constant, varies across maturities and has the tendency to be directional

Source: Credit Suisse

Inflation-Linked BondsSlide 11/18

Asset Management

Dual Duration – Real interest rate duration

0 5 10 15-0.2

0

0.2

0.4

0.6

0.8

1

Tenor [years]

Spo

t Dur

atio

n D

ensi

ty

PortfolioBenchmark

Real Duration Density Cumulated Real Duration Density

0 5 10 150

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

Tenor [years]

Spo

t cum

ulat

ed D

urat

ion

Den

sity

PortfolioBenchmark

Every cashflow is flagged as real and/or inflation linked

Clear separation of the two interest rate dimensions

Source: Credit Suisse

Inflation-Linked BondsSlide 12/18

Asset Management

Dual Duration – Inflation duration

0 5 10 15-0.4

-0.2

0

0.2

0.4

0.6

0.8

1

Tenor [years]

Spo

t Dur

atio

n D

ensi

ty

PortfolioBenchmark

0 5 10 150

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

Tenor [years]S

pot c

umul

ated

Dur

atio

n D

ensi

ty

PortfolioBenchmark

Inflation Duration Density Cumulated Inflation Duration Density

Source: Credit Suisse

Inflation-Linked BondsSlide 13/18

Asset Management

Appendix

Inflation-Linked BondsSlide 14/18

Asset Management

Yield curve decompositionNominal bonds react to movements in nominal interest rates independently from the source of the change, i.e. real rates or breakeven inflation.Real bonds (ILB) react only to changes in real interest rates and are immune (protected) against changes in inflation expectations.

Inte

rest

rat

es

Nom

inal

rat

e

Rea

l rat

eB

reak

-eve

nin

flatio

n

Ris

kpr

emiu

mE

xpec

ted

infla

tion

Source: Credit Suisse

Inflation-Linked BondsSlide 15/18

Asset Management

Inflation-linked bond – non-accreting structure

Source: Credit Suisse

Graphs are just calculation examples

Year Inflation Notional Coupon

1 1.5 100 4.52 1.8 100 4.83 1.3 100 4.34 1.9 100 4.95 2.2 100 5.26 2.5 100 5.57 2.8 100 5.88 3.2 100 6.29 2.8 100 5.8

10 2.7 100 5.7

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

1 2 3 4 5 6 7 8 9 100

20

40

60

80

100

120

Coupon (lhs) Inflation (lhs) Notional (rhs)

Non-accreting structureMaturity of the bond: 10 years

Coupon: 3% (real coupon)

Type: non-accreting structure, i.e. adjustment of coupons only

Very few issues outstanding, mostly supranational bonds

Inflation-Linked BondsSlide 16/18

Asset Management

Inflation-linked bond – accreting structure

Source: Credit Suisse

Graphs are just calculation examples

Accreting structureMaturity of the bond: 10 years

Coupon: 3% (real coupon)

Type: accreting structure, i.e. adjustment of the notional only

Market standard, most government bonds have an accreting structure

Year Inflation Notional Coupon

1 1.5 101.5 3.0452 1.8 103.327 3.1003 1.3 104.6703 3.1404 1.9 106.659 3.2005 2.2 109.0055 3.2706 2.5 111.7306 3.3527 2.8 114.8591 3.4468 3.2 118.5346 3.5569 2.8 121.8535 3.656

10 2.7 125.1436 3.754

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

1 2 3 4 5 6 7 8 9 100

20

40

60

80

100

120

Coupon (lhs) Inflation (lhs) Notional (rhs)

Inflation-Linked BondsSlide 17/18

Asset Management

Source: Bloomberg, Credit Suisse, OECD

Inflation differential – Switzerland vs. France and the USAFrance USA EMU (since 1998)

Average -2.07% -1.17% -0.97%Standard deviation 3.46% 2.55% 0.60%Correlation to Swiss inflation 0.5 0.54 0.81

-20

-15

-10

-5

0

5

56575859606162636465666768697071727374757677787980818283848586878889909192939495969798990001020304050607080910

Swiss minus French inflation

Swiss minus US inflation

Swiss minus EMU inflation

Last date point: December 2009

Inflation-Linked BondsSlide 18/18

Asset Management

Disclaimer This document constitutes marketing material and is not the result of a financial analysis or research and therefore not subject to the "Directives on the Independence of Financial Research" published by the Swiss Bankers Association. The content of this document does therefore not fulfill the legal requirements for the independence of financial research and there is no restriction on trading prior to publication of financial research. The information and opinions contained in this document were produced by Credit Suisse AG as per the date stated and may be subject to change without prior notification. Although the information has been obtained from and is based upon sources that Credit Suisse AG believes to be reliable, no representation is made that the information is accurate or complete. Only the provisions, conditions and risk warnings contained in the client's current agreement are legally binding. Credit Suisse AG does not accept liability for any loss arising from the use of this document or from the risks inherent in financial markets. Historical returns and financial market scenarios are no guarantee of future performance. This document constitutes neither an offer nor a recommendation to conclude a discretionary mandate or another financial transaction. Before concluding a discretionary mandate or another financial transaction, the recipient is advised to check that the information provided is in line with his/her own circumstances with regard to any legal, regulatory, tax or other consequences, if necessary with the help of a professional advisor. In general, the investment products featured in this document should only be purchased by existing or future discretionary mandate clients of Credit Suisse AG. The investment objectives and risk assessments, etc. contained in this document are target values that must be viewed in relation to the market situation. There is no guarantee that these target values will be maintained or achieved. In connection with the provision of services, Credit Suisse AG may receive fees, commissions, reimbursements, discounts or other monetary or non-monetary benefits (collectively known as “remunerations”), which will form an additional part of Credit Suisse AG’s compensation. In receiving payments by third parties Credit Suisse AG interests may be adverse to those of its clients. Detailed information on remunerations or potential conflicts of interests can be found in the list “Remunerations” and in the Credit Suisse AG "Summary Conflicts Policy". Both documents and more details about these payments may be obtained upon request from your relationship manager. This document will be distributed by Credit Suisse AG, Zurich, a Bank being regulated by the Swiss Financial Market Supervisory Authority. This document is not intended for persons who, due to their nationality or place of residence, are not permitted to receive such information under local law. Neither this document nor any copy thereof may be sent to or taken into the United States or distributed in the United States or to any US persons. The same applies in any other jurisdiction except where compliant with the applicable laws.

Copyright © 2011 Credit Suisse Group AG and/or its affiliates. All rights reserved.