sustainable value Facts&Figures · 2016 GUIDANCE for the 12 months ended 31 December 1 Including...

Transcript of sustainable value Facts&Figures · 2016 GUIDANCE for the 12 months ended 31 December 1 Including...

Randgold Resources is an African focused gold mining and exploration company with listings on the London Stock Exchange (RRS) and NASDAQ (GOLD).

Major discoveries to date include the 7.5Moz Morila deposit, the 7Moz Yalea deposit and the 5.5Moz Gounkoto deposit, in Mali, the 4Moz Tongon deposit in Côte d’Ivoire and the 3.7Moz Massawa deposit in eastern Senegal. Randgold Resources Limited (Randgold) financed and built the Morila mine which, since October 2000, has produced more than 6Moz of gold and distributed more than $2 billion to stakeholders. It also financed and built the Loulo operation which started as two open pit mines in November 2005. Since then, two underground mines have been developed at the Yalea and Gara deposits.

The company’s Tongon mine in Côte d’Ivoire poured its first gold in November 2010.

Production from the Gounkoto open pit operation, south of Loulo, began in 2011 and a recently completed feasibility study has confirmed the viability of an underground mine planned to start in 2018.

In 2009, Randgold acquired a 45% interest in the Kibali project in the Democratic Republic of Congo (DRC). Since the acquisition, Randgold’s geologists have been instrumental in more than doubling the mine’s ore reserves to 11Moz making it one of the largest gold deposits in Africa. The mine was developed and is being operated by Randgold. First gold was poured in the third quarter of 2013.

Randgold also has a major project at Massawa in Senegal and an extensive portfolio of organic growth prospects, supported by intensive exploration programmes in Côte d’Ivoire, DRC, Mali and Senegal.

LSE : RRS • NASDAQ : GOLDwww.randgoldresources.com

Facts & FiguresFebruary 2016

Delivering sustainable

value

Key strengths■ Proven ability to discover multi-million

ounce gold deposits and convert them

into profitable mines

■ Substantial pipeline of future

prospects – group production continues

to grow

■ Cost profile to benefit from improving

grade and additional production

■ Solid balance sheet to support funding

of new developments

■ Expanding footprint in major West and

Central African gold fields

■ Pure gold focus gives undiluted

exposure to gold price upsideRandgold Resources Limited (‘Randgold’) shares in issue at 31 December 2015: 93.2 million.

$$

2011

1.00

2.00

3.00

4.00

5.00

02012 2013 2014 2015

$ million

20110

2012 2013 2014 2015

100

200

300

400

500

600$ million

20110

2012 2013 2014 2015

100

200

300

400

500

700

600

$ million

2011

100

200

300

400

500

600

02012 2013 2014 2015

$/oz

2011

200

400

600

800

02012 2013 2014 2015

Morila (40%) Loulo-Gounkoto (100%) Tongon (100%)

Kibali (45%)Head grade milled (g/t)

1.5

1

0.5

2

0

Lost Time Injury Frequency Rate (LTIFR)

20142015

Reserves (Moz) Resources (Moz)

oz/share

2010

0.05

0.1

0.15

0.2

02011 2012 2013 2014

Moz

10

15

20

25

30

0

Loulo

Gounk

otoMori

la

Tongo

nKiba

li

Group

000oz g/t

2011 2012 2013 2014 20150.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

2015*2014201320122011

5

Reserve ounce per share

0100200300400500600700800900

1000110012001300

0

1

2

3

4

$$

2011

1.00

2.00

3.00

4.00

5.00

02012 2013 2014 2015

$ million

20110

2012 2013 2014 2015

100

200

300

400

500

600$ million

20110

2012 2013 2014 2015

100

200

300

400

500

700

600

$ million

2011

100

200

300

400

500

600

02012 2013 2014 2015

$/oz

2011

200

400

600

800

02012 2013 2014 2015

Morila (40%) Loulo-Gounkoto (100%) Tongon (100%)

Kibali (45%)Head grade milled (g/t)

1.5

1

0.5

2

0

Lost Time Injury Frequency Rate (LTIFR)

20142015

Reserves (Moz) Resources (Moz)

oz/share

2010

0.05

0.1

0.15

0.2

02011 2012 2013 2014

Moz

10

15

20

25

30

0

Loulo

Gounk

otoMori

la

Tongo

nKiba

li

Group

000oz g/t

2011 2012 2013 2014 20150.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

2015*2014201320122011

5

Reserve ounce per share

0100200300400500600700800900

1000110012001300

0

1

2

3

4

$$

2011

1.00

2.00

3.00

4.00

5.00

02012 2013 2014 2015

$ million

20110

2012 2013 2014 2015

100

200

300

400

500

600$ million

20110

2012 2013 2014 2015

100

200

300

400

500

700

600

$ million

2011

100

200

300

400

500

600

02012 2013 2014 2015

$/oz

2011

200

400

600

800

02012 2013 2014 2015

Morila (40%) Loulo-Gounkoto (100%) Tongon (100%)

Kibali (45%)Head grade milled (g/t)

1.5

1

0.5

2

0

Lost Time Injury Frequency Rate (LTIFR)

20142015

Reserves (Moz) Resources (Moz)

oz/share

2010

0.05

0.1

0.15

0.2

02011 2012 2013 2014

Moz

10

15

20

25

30

0

Loulo

Gounk

otoMori

la

Tongo

nKiba

li

Group

000oz g/t

2011 2012 2013 2014 20150.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

2015*2014201320122011

5

Reserve ounce per share

0100200300400500600700800900

1000110012001300

0

1

2

3

4

$$

2011

1.00

2.00

3.00

4.00

5.00

02012 2013 2014 2015

$ million

20110

2012 2013 2014 2015

100

200

300

400

500

600$ million

20110

2012 2013 2014 2015

100

200

300

400

500

700

600

$ million

2011

100

200

300

400

500

600

02012 2013 2014 2015

$/oz

2011

200

400

600

800

02012 2013 2014 2015

Morila (40%) Loulo-Gounkoto (100%) Tongon (100%)

Kibali (45%)Head grade milled (g/t)

1.5

1

0.5

2

0

Lost Time Injury Frequency Rate (LTIFR)

20142015

Reserves (Moz) Resources (Moz)

oz/share

2010

0.05

0.1

0.15

0.2

02011 2012 2013 2014

Moz

10

15

20

25

30

0

Loulo

Gounk

otoMori

la

Tongo

nKiba

li

Group

000oz g/t

2011 2012 2013 2014 20150.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

2015*2014201320122011

5

Reserve ounce per share

0100200300400500600700800900

1000110012001300

0

1

2

3

4$$

2011

1.00

2.00

3.00

4.00

5.00

02012 2013 2014 2015

$ million

20110

2012 2013 2014 2015

100

200

300

400

500

600$ million

20110

2012 2013 2014 2015

100

200

300

400

500

700

600

$ million

2011

100

200

300

400

500

600

02012 2013 2014 2015

$/oz

2011

200

400

600

800

02012 2013 2014 2015

Morila (40%) Loulo-Gounkoto (100%) Tongon (100%)

Kibali (45%)Head grade milled (g/t)

1.5

1

0.5

2

0

Lost Time Injury Frequency Rate (LTIFR)

20142015

Reserves (Moz) Resources (Moz)

oz/share

2010

0.05

0.1

0.15

0.2

02011 2012 2013 2014

Moz

10

15

20

25

30

0

Loulo

Gounk

otoMori

la

Tongo

nKiba

li

Group

000oz g/t

2011 2012 2013 2014 20150.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

2015*2014201320122011

5

Reserve ounce per share

0100200300400500600700800900

1000110012001300

0

1

2

3

4

$$

2011

1.00

2.00

3.00

4.00

5.00

02012 2013 2014 2015

$ million

20110

2012 2013 2014 2015

100

200

300

400

500

600$ million

20110

2012 2013 2014 2015

100

200

300

400

500

700

600

$ million

2011

100

200

300

400

500

600

02012 2013 2014 2015

$/oz

2011

200

400

600

800

02012 2013 2014 2015

Morila (40%) Loulo-Gounkoto (100%) Tongon (100%)

Kibali (45%)Head grade milled (g/t)

1.5

1

0.5

2

0

Lost Time Injury Frequency Rate (LTIFR)

20142015

Reserves (Moz) Resources (Moz)

oz/share

2010

0.05

0.1

0.15

0.2

02011 2012 2013 2014

Moz

10

15

20

25

30

0

Loulo

Gounk

otoMori

la

Tongo

nKiba

li

Group

000oz g/t

2011 2012 2013 2014 20150.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

2015*2014201320122011

5

Reserve ounce per share

0100200300400500600700800900

1000110012001300

0

1

2

3

4$$

2011

1.00

2.00

3.00

4.00

5.00

02012 2013 2014 2015

$ million

20110

2012 2013 2014 2015

100

200

300

400

500

600$ million

20110

2012 2013 2014 2015

100

200

300

400

500

700

600

$ million

2011

100

200

300

400

500

600

02012 2013 2014 2015

$/oz

2011

200

400

600

800

02012 2013 2014 2015

Morila (40%) Loulo-Gounkoto (100%) Tongon (100%)

Kibali (45%)Head grade milled (g/t)

1.5

1

0.5

2

0

Lost Time Injury Frequency Rate (LTIFR)

20142015

Reserves (Moz) Resources (Moz)

oz/share

2010

0.05

0.1

0.15

0.2

02011 2012 2013 2014

Moz

10

15

20

25

30

0

Loulo

Gounk

otoMori

la

Tongo

nKiba

li

Group

000oz g/t

2011 2012 2013 2014 20150.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

2015*2014201320122011

5

Reserve ounce per share

0100200300400500600700800900

1000110012001300

0

1

2

3

4

Profit

Dividend per share3

Capital expenditure1

Group consolidated production1

Total cash cost of production1

Cash and cash equivalents

2016 GUIDANCE

for the 12 months ended 31 December

1 Including 40% of Morila and 45% of Kibali2 Attributable at 31 December 2014. To be updated end March 20163 In respect of the year under review but declared and paid in the

following year

Resources and reserves2

1.25-1.30GROUP CONSOLIDATED PRODUCTION 1 (MOZ)

590-630TOTAL CASH COST OF PRODUCTION 1

($/OZ)

240CAPITAL EXPENDITURE 1

($ MILLION)

KEY PERFORMANCE INDICATORS

$$

2011

1.00

2.00

3.00

4.00

5.00

02012 2013 2014 2015

$ million

20110

2012 2013 2014 2015

100

200

300

400

500

600$ million

20110

2012 2013 2014 2015

100

200

300

400

500

700

600

$ million

2011

100

200

300

400

500

600

02012 2013 2014 2015

$/oz

2011

200

400

600

800

02012 2013 2014 2015

Morila (40%) Loulo-Gounkoto (100%) Tongon (100%)

Kibali (45%)Head grade milled (g/t)

1.5

1

0.5

2

0

Lost Time Injury Frequency Rate (LTIFR)

20142015

Reserves (Moz) Resources (Moz)

oz/share

2010

0.05

0.1

0.15

0.2

02011 2012 2013 2014

Moz

10

15

20

25

30

0

Loulo

Gounk

otoMori

la

Tongo

nKiba

li

Group

000oz g/t

2011 2012 2013 2014 20150.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

2015*2014201320122011

5

Reserve ounce per share

0100200300400500600700800900

1000110012001300

0

1

2

3

4

Safety

*Proposed

LOULO-GOUNKOTO MINING COMPLEX

The Loulo-Gounkoto complex is located in the west of Mali near the border with Senegal. Both the Loulo and Gounkoto mines are owned by Randgold (80%) and the State of Mali (20%).

Key 2015 numbersfor the 12 months ended 31 DecemberRandgold’s flagship operation currently comprises the Loulo

underground mines, Yalea and Gara, and the Gounkoto open pit mine.

Production from open pit operations started at Loulo in 2005. This was followed by the development of the underground mines. Gounkoto, a greenfields discovery in 2009, poured its first gold in June 2011. The ore from Gounkoto is processed by the Loulo plant

LIBERIA

GUINEA

CÔTED’IVOIRE

SENEGAL

MAURITANIA

BURKINAFASO

700km

Loulo-Gounkoto gold complex

Randgold permits

Loulo

Gounkoto

MALI

Bamako

N

for the 12 months ended 31 December

under a tolling agreement. Based on current reserves, the complex has a scheduled Life of Mine to 2028.

Loulo-Gounkoto is now firmly established as a long life, high production operation. It will be reinforced by a new underground mine at Gounkoto, scheduled to reach full production in 2020. The complex is targeting gold production of 670 000oz in 2016.

Equity ownership 80% 2015 production (100%) 630 167ozTotal cash costs ($/oz) 675Profit from mining activity1 (100%) $298.4mSafety certification OHSAS 18001Environmental certification ISO 14001Loulo mineTotal reserves2 (100%) 4.9MozTotal resources measured and indicated2 (100%) 7.1Moz

Total resources inferred2 (100%) 2.1MozLost Time Injury Frequency Rate 0.87

Gounkoto mineTotal reserves2 (100%) 3.2MozTotal resources measured and indicated2 (100%) 3.8Moz

Total resources inferred2 (100%) 0.8MozLost Time Injury Frequency Rate 0

1 Profit from mining activity is calculated by subtracting total cash costs from gold sales, and is measured prior to depreciation, interest and corporate tax charges.

2 At 31 December 2014. To be updated end March 2016.

Production and forecast (000oz)

0

100

200

300

400

500

600

700

20162015

MORILA GOLD MINE

Morila is situated 280km south east of Bamako, the capital of Mali and is a joint venture between Randgold (40%), AngloGold Ashanti (40%) and the State of Mali (20%). Randgold has operated Morila since February 2008.

In 2009, Morila was converted to a stockpile treatment operation. Closure of the operation was originally scheduled for 2013 but a pit pushback, now complete, the tailings treatment project and the Domba project, could extend the life of mine to 2019.

Morila produced 122 374oz of gold in 2015 and is forecasting 89 795oz in 2016.

Key 2015 numbers

Equity ownership (operated by Randgold Resources) 40%2015 production (100%) 122 374ozTotal cash costs ($/oz) 674Profit from mining activity1 (100%) $60.5mTotal reserves2 (100%) 0.3MozTotal resources measured and indicated2 (100%) 0.3MozTotal resources inferred2 (100%) 0.2MozSafety certification OHSAS 18001Lost Time Injury Frequency Rate 0Environmental certification ISO 14001

1 Profit from mining activity is calculated by subtracting total cash costs from gold sales, and is measured prior to depreciation, interest and corporate tax charges.

2 At 31 December 2014. To be updated end March 2016.

for the 12 months ended 31 December

Work continues on the development of a commercial agribusiness to utilise the mine’s infrastructure and provide sustainable economic activity in the area after Morila’s eventual closure.

LIBERIA

GUINEA

CÔTED’IVOIRE

MAURITANIA

Bamako

MALI

BURKINAFASO

SENEGAL

700km

Morila mine

Randgold permits

N

Morila was discovered, developed and financed by Randgold. The mine was commissioned in October 2000 and since inception has produced more than 6Moz of gold and paid more than $2 billion to stakeholders.

Production and forecast (000oz)

0

25

50

75

100

125

150

20162015

TONGON GOLD MINE

The Tongon mine comprises two open pit operations, the Southern and Northern Zones, both of which have potential for more reserves.

The mine currently has a six year Life of Mine. In 2014 the geological model for the Southern Zone pit was updated, resulting in resource gains which replaced the reserves mined during the year. Tongon is targeting gold production of 290 000oz in 2016.

The Tongon mine is located within the Nielle exploration permit in the north of Côte d’lvoire, 55km south of the border with Mali. Randgold owns 89% of the company, the State of Côte d’lvoire 10% and 1% is held by a local company.

Key 2015 numbers

Equity ownership 89% 2015 production (100%) 242 948Total cash costs ($/oz) 836Profit from mining activity1 (100%) $75.4m

Total reserves2 (100%) 2.2MozTotal resources measured and indicated2

(100%) 2.7Moz

Total resources inferred2 (100%) 1.0Moz

Safety certification OHSAS 18001Lost Time Injury Frequency Rate 0.82

Environmental certification ISO 14001

1 Profit from mining activity is calculated by subtracting total cash costs from gold sales, and is measured prior to depreciation, interest and corporate tax charges.

2 At 31 December 2014. To be updated end March 2016.

for the 12 months ended 31 December

Mining at Tongon began in April 2010 and gold production from the open pit operation started in December 2010.

GHANA

BURKINA FASO

MALI

GUINEA

LIBERIA

Abidjan

CÔTE D’IVOIRE

500km

Randgold permits

Tongon gold mine

N

Production and forecast (000oz)

0

500

100

150

200

250

300

20162015

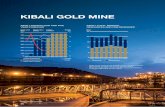

Equity ownership 45%2015 production (100%) 642 720ozTotal cash costs ($/oz) 604Profit from mining activity1 (100%) $358.2mTotal reserves2 (100%) 11MozTotal resources measured and indicated2 (100%) 16MozTotal resources inferred2 (100%) 4.4MozLost Time Injury Frequency Rate 0.56

1 Profit from mining activity is calculated by subtracting total cash costs from gold sales, and is measured prior to depreciation, interest and corporate tax charges.

2 At 31 December 2014. To be updated end March 2016.

KIBALI GOLD MINEThe Kibali mine development in the DRC is the largest project undertaken to date by Randgold. With a reserve base of 11Moz, it ranks as one of the largest gold mines in Africa. Key 2015 numbers

for the 12 months ended 31 December

The mine is operated by Randgold and represents an investment of more than $2.5 billion by the partners. Kibali is targeting gold production of 610 000oz in 2016.

Kibali comprises 10 permits covering an area of about 1 836km² in the Moto goldfields of the north east DRC, some 560km north east of the city of Kisangani and 150km west of the Ugandan border town of Arua. Kibali is a joint venture between Randgold (45%), AngloGold Ashanti (45%) and the Congolese parastatal SOKIMO (10%).

Production and forecast (000oz)

Kibali comprises an integrated open pit and underground operation as well as a 7.2Mtpa processing plant. The mine poured its first gold in Q4 2013 from open pit mining and is currently developing the underground mine via twin declines and a vertical shaft, with the handover of the vertical shaft scheduled in 2017. The project will ultimately be supplied by four hydropower stations supported by a thermal power station for low rainfall periods and as back-up.

900km

DEMOCRATICREPUBLICOF CONGO

CONGO

Kinshasa

CAMEROON

CENTRAL AFRICANREPUBLIC

SOUTHSUDAN

TANZANIA

UGANDA

RWANDA

BURUNDI

ZAMBIA

ANGOLA

Kibali gold mine

Randgold permits

N

0

100

200

300

400

500

600

700

20162015

MauritaniaSenegal

Ghana

Mali

Burkina Faso

Niger

Sudan

Nigeria

Cameroon

Libya

Congo

Angola

Chad

Zambia

Uganda

Central African Republic

Democratic Republic of Congo

Tanzania

South Africa

Egypt

Botswana

Zimbabwe

Côte d’Ivoire

Namibia

AlgeriaMASSAWA FEASIBILITY PROJECT

EXPLORATION

Massawa is one of the largest undeveloped orebodies in Africa. A grassroots exploration project in eastern Senegal, it was discovered in 2008.

Key 2015 numbers

Equity ownership 83%Total reserves1 (100%) 2.0MozTotal resources measured and indicated1 (100%) 3.0MozTotal resources inferred1 (100%) 1.7Moz

1 At 31 December 2014. To be updated end March 2016.

Massawa lies 700km south east of the capital city of Dakar and 90km to the west of Randgold’s Loulo and Gounkoto mines across the border in Mali. Randgold owns 83.25% of the project with a local company holding 6.75%. The State of Senegal will have a non-contributory 10% share of any mine developed on the property.

Resource TriangleRandgold continues to maintain its focus on organic growth through discovery and development of world class orebodies and has a pipeline of high quality projects and exploration targets.

The initial prefeasibility study on the open pit reserves was compiled in 2010. A feasibility study is currently being progressed.

Exploration programmes are currently underway in four countries: Mali, Senegal, Côte d’Ivoire, and the Democratic Republic of Congo, where Randgold has groundholdings of 13 912km²* hosting 141 targets.

Exploration and infill drilling continues to upgrade the geological confidence of the deposits near our mines, concentrating on resource definition and the discovery of mineable satellite ounces.

for the 12 months ended 31 December

Proterozoic

Archean

* including joint ventures.

N

DakarSENEGAL

MAURITANIA

BURKINAFASO

CÔTED’IVOIRE

MALI

600 km

Massawa gold projectRandgold permits

GUINEA

IDENTIFIEDANOMALIES

PRODUCTION

FEASIBILITYReserve/Resource

definition

EXPLORATIONTARGETS

Identified targets

Follow-up targets

Advanced targets

Inferred resources

Indicated and

measured resources

Reserve

definition

Operating

mines

Côte d’IvoireDRC

Senegal

Mali

ANNUAL RESOURCE AND RESERVE DECLARATIONat 31 December 20141 (abridged)

COMPETENT PERSONS: Yalea and Gara mineral resources were calculated by Mr Abdoulaye Ngom, an officer of the company, under the supervision of Mr Jonathan Kleynhans, an officer of the company and Competent Person. Loulo 3 mineral resources from Loulo were calculated by Mr Ivan Doku, an independent consultant, and reviewed by Mr Jonathan Kleynhans, an officer of the company and Competent Person. Baboto mineral resources from Loulo were calculated by Mr Simon Bottoms, an officer of the company and Competent Person. Gounkoto orebody mineral resources were calculated by Mr Sekou Diarra an officer of the company, under the supervision of Mr Jonathan Kleynhans, an officer of the company and Competent Person. Faraba mineral resources from Gounkoto were calculated by Mr Jonathan Kleynhans, an officer of the company and Competent Person. Tongon mineral resources were calculated by Mr Simon Bottoms and Mr Babacar Diouf, both officers of the company, under the supervision of Mr Jonathan Kleynhans, an officer of the company and Competent Person. Kibali mineral resources were calculated by Mr Ernest Doh, an officer of the company and Competent Person. Morila open pit resources were calculated by Miss Paula Ogilve, an independent consultant, under the supervision of Mr Jonathan Kleynhans, an officer of the company and Competent Person. Mr Rodney Quick reviewed all mineral resources as lead competent person. Mr Jonathan Kleynhans and Mr Rodney Quick are both Professional Natural Scientists and members of SACNASP and both have sufficient experience in the style of mineralisation and types of deposits under consideration and activity which they are undertaking as Competent Persons as defined in the 2012 addition in the ‘Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves’. The Loulo, Tongon, Morila, Massawa and Gounkoto open pit ore reserves were calculated by Mr Shaun Gillespie, an officer of the company and Competent Person and member of SAIMM. Kibali open pit ore reserves were calculated by Mr Nicholas Coomson, an officer of the company and Competent Person and member of AusIMM. Loulo underground reserves were calculated by Mr Andrew Fox, an independent consultant and Competent Person and member of AusIMM. The Kibali and Gounkoto underground ore reserves were calculated by Mr Tim Peters an independent consultant and a member of AusIMM. All Competent Persons have sufficient experience in the style of mineralisation and types of deposits under consideration and the activity which they are undertaking as Competent Persons as defined in the 2012 addition in the ‘Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves’.

Key numbers

$000 2015 2014

Gold sales1 1 394 889 1 434 873Total cash costs1 822 673 791 756Profit from mining activity1 572 216 643 117Exploration and corporate expenditure 45 067 36 765Profit for the period 212 775 271 160Profit attributable to equity shareholders 188 677 234 974Net cash generated from operations 396 982 317 618Cash and cash equivalents2 213 372 82 752Gold on hand at period end3 13 715 14 956Group production (oz) 1 211 288 1 147 414Group sales (oz) 1 210 844 1 134 941Group total cash cost per ounce1 ($) 679 698Group cash operating cost per ounce1 ($) 624 637Basic earnings per share ($) 2.03 2.54

1 Randgold consolidates 100% of Loulo, Gounkoto and Tongon, 40% of Morila and 45% of Kibali in the consolidated non-GAAP measures.2 Cash and cash equivalents excludes $16.9 million of cash at 31 December 2015 ($8.3 million at 31 December 2014) that relates to the group’s

attributable cash held in Morila, Kibali and the group’s asset leasing companies which are equity accounted.3 Gold on hand represents gold in doré at the mines (attributable share) multiplied by the prevailing spot gold price at the end of the period.

www.randgoldresources.com

for the 12 months ended 31 December

Chief executive officer Mark Bristow T +44 788 071 1386Group corporate communications managerLois Wark T +44 20 7557 7745 [email protected] and media relations Kathy du Plessis T +44 20 7557 7738 [email protected]

Randgold Resources Limited 3rd Floor, Unity Chambers, 28 Halkett Street St Helier, Jersey, JE2 4WJ, Channel Islands T +44 1534 735 333, F +44 1534 735 444

dPA5977

Mine/project Category

Tonnes Grade GoldAttributable

Gold2

Mt g/t Moz Moz

Mineral resources

Kibali 45%Measured and indicated 139 3.7 16 7.4

Inferred 60 2.6 4.4 2.0Loulo 80%

Measured and indicated 52 4.3 7.1 5.7Inferred 20 3.2 2.1 1.7

Gounkoto 80%Measured and indicated 28 4.3 3.8 3.0

Inferred 7.5 3.2 0.8 0.6Morila 40%

Measured 14 0.6 0.3 0.1Inferred 11 0.6 0.2 0.1

Tongon 89%Measured and indicated 34 2.5 2.7 2.4

Inferred 12 2.7 1.0 0.9Massawa 83%

Indicated 35 2.6 3.0 2.5Inferred 24 2.1 1.7 1.4

Total resources

Measured and indicated 301 3.4 33 21Inferred 128 2.5 10 6.6

Ore reservesKibali 45%

Proven and probable 83 4.1 11 4.9Loulo 80%

Proven and probable 33 4.6 4.9 3.9Gounkoto 80%

Proven and probable 22 4.4 3.2 2.5Morila 40%

Proven and probable 13 0.7 0.3 0.1Tongon 89%

Proven and probable 30 2.3 2.2 2.0Massawa 83%

Probable 21 3.1 2.0 1.7Total reserves Proven and probable 201 3.6 24 15 1 To be updated end March 2016.2 Attributable gold (Moz) refers to the quantity attributable to Randgold based on its interest (holding) in each specific operation/project.

Randgold reports its mineral resources and ore reserves in accordance with the JORC 2012 code. As such numbers are reported to the second significant digit. They are equivalent to National Instrument 43-101. Mineral resources are reported at a cut-off grade based on a gold price of $1 500/oz. The reporting of ore reserves is also in accordance with Industry Guide 7. Pit optimisations are carried out at a gold price of $1 000/oz, except for Morila which is reported at $1 300/oz. Ore reserves are reported at a cut-off grade based on $1 000/oz gold price within the pit designs. Underground reserves are also based on a gold price of $1 000/oz. Dilution and ore loss are incorporated into the calculation of reserves. Cautionary note to US investors: The United States Securities and Exchange Commission (the SEC) permits mining companies, in their filings with the SEC, to disclose only proven and probable ore reserves. Randgold uses certain terms in this annual report such as ‘resources’, that the SEC does not recognise and strictly prohibits the company from including in its filings with the SEC. Investors are cautioned not to assume that all or any parts of the company’s resources will ever be converted into reserves which qualify as ‘proven and probable reserves’ for the purposes of the SEC’s Industry Guide number 7. See glossary of terms on website at www.randgoldresources.com.