Style and Trend

-

Upload

bilal-riaz -

Category

Documents

-

view

215 -

download

0

Transcript of Style and Trend

-

7/30/2019 Style and Trend

1/12

Style and Trend: Strategicchoice Presented by:

Muhammd Farhan

Mustafa RasheedNauman Rasheed

Sami Suhail

Taimoor KhalidUsman Ali

MBA-2, Section-B

-

7/30/2019 Style and Trend

2/12

Quantitative Facts

By 1993, textile formed about 65% ofPakistans total exports of Rs. 6.8

billion with knitwear

Average for knitwear selling price was$42 per dozen in 1992

US knitwear market, estimated at

around $15 billion Quota investment alone would require

Rs. 50 million.

-

7/30/2019 Style and Trend

3/12

Qualitative Facts

High profitability in knitwear

US market deal with large orders

European market: small orders, high

variety, price competition, trendy andcolorful

Distribution: direct selling; managerial

and financial inefficiencies Promotion was mainly through direct

mail, trade fairs and agents in Europe

-

7/30/2019 Style and Trend

4/12

Issues

Shortage of finance restricting Styleand Trends to small units

The textile industry could not produce

very fine yarns Lead time is high in knitwear industry

Strict criteria of international buyers in

selecting suppliers Poor working capital of several units

-

7/30/2019 Style and Trend

5/12

Core Issue

Evaluation of integrated knitwear

f irm oppor tun i ty and management

(all three entrepreneurs)

-

7/30/2019 Style and Trend

6/12

Exhibits Analysis

Exhibit-1: current ratio, quick ratio, daysreceivable and days payable highlightsome negativity, debt has decreasedover period, total debt/total assetschanged from 37.08% to 4.81%

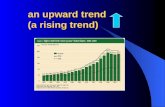

Exhibit 2: knitwear textile exports havegrown to $464.1 million in 1993 from

$166.9 million in 1988. Exhibit 8: Pakistan scores lowest in

production & management dimensionsrelative to other competing countries

-

7/30/2019 Style and Trend

7/12

Exhibits Analysis

Exhibit-9: Pakistan has lowest value tovolume ratio and thus it earns lessforeign exchange with massive

imports

Exhibit-12: This exhibits shows

increasing general trend in quotaprices and suggests a great degree ofvolatility in prices for category 338

-

7/30/2019 Style and Trend

8/12

Alternative-1

Advantages Disadvantages

New potential supply channels Quantitative trade restrictions

Longterm relationships, technological &

management assistance Stringent/difficult to meet quality standards

Large brandnames & buying houses

Short lead times, less wastage, high working capital

requirements meant costsNo ned to attend foreign fairs or visit

buyers offices Quota investments (Rs. 50 million)

Steady supply orders -

Scenario 1: 100% sales to US market in category 338

-

7/30/2019 Style and Trend

9/12

Alternativ-2

Advantages Disadvantages

New potential supply channels for US Quantitative trade restrictions

Longterm relationships, technological &management assistance (US) Stringent/difficult to meet quality standards

Large brand names & buying houses (US) More stress

No ned to attend foreign fairs or visit

buyers offices Greate marketing effort in Europe & Far East

Reduced quota investments Smaller & costly order

Lower working capital Lower margins on European Sales

Good margins in Middle East Extra 10% cost

Steady supply orders Shorter delivery time for Europe

50% sales to US market and 50% sales to Europe & other markets

-

7/30/2019 Style and Trend

10/12

Alternative-3

Advantages Disadvantages

More stressNo ned to attend foreign fairs or visit

buyers offices Greate marketing effort in Europe & Far East

Low quota investment ( a million rupees) Smaller & costly orderLower working capital Lower margins on European Sales

Good margins in Middle East Extra 10% cost

Steady supply orders Shorter delivery time for Europe

Sales to markets other than US

-

7/30/2019 Style and Trend

11/12

Decision

Scenario 1: (100% sales to US marketin category 338) because ;

it cannot handle issues or limitations

due to suppliers in germination stageto increase responsiveness forentering European and Far East

markets. Ginning sector is run by uneducated

people who are not quality conscious

-

7/30/2019 Style and Trend

12/12

Implementation

This option wont create issues interms of supply

Pakistani players dont compete inhigh value product category. Hence,producing high value items will

minimize the impact of quantitativetrade restrictions and quotainvestments