Stephens conference call 022015

-

Upload

plg-consulting -

Category

Business

-

view

200 -

download

1

Transcript of Stephens conference call 022015

Logistics Engineering Supply Chain

Lower Oil Price Implications for the

North American Rail & Rail Equipment

Markets

Taylor RobinsonPresident

PLG Consulting

February 20, 2015

2

Boutique consulting firm with team members throughout North America

Established in 2001

Over 100 clients and 250 engagements

Practice Areas Logistics

Engineering

Supply Chain

Consulting services Strategy & optimization

Logistics assets & infrastructure development

Supply Chain design & operationalization

M&A/investments/private equity

Industry verticals Energy

Bulk commodities

Freight rail

Institutional investors and private equity

About PLG Consulting

Partial Client List

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

3

Deep rail industry experience

• Operational

• Commercial

• Design & engineering

• Equipment market

Broad shale development industry client

experience over past four years

• E&P companies

• Refiners

• Terminal developers

• Investors – private equity, hedge funds, investment

banks

• Government agencies, industry trade groups

• Equipment leasing

PLG’s Crude By Rail Qualifications

Diverse projects

• Frac sand supply chain design & implementation

• CBR supply chain optimization

• Rail commercial negotiations

• Rail car acquisition – commercial & technical inspection

• Comprehensive design & engineering – rail, marine,

tankage, product handling, and related facilities

• EH&S training

• Investment advising

• Industry’s only long term, CBR volume forecast with

complimentary rail tank car forecast

Recognized industry thought leader on CBR and

tank car markets

• Numerous industry presentations, articles and advising

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

4

Phil IrelandSenior Consultant

Phil has extensive hands-on senior level

experience in supply chain management, asset

sizing, strategy, and network optimization

gained from 30 years working with the

Canadian Pacific Railroad where he was

responsible for development and execution of

the $5 billion revenue plan. Phil has specific

experience in developing crude by rail supply

chain solutions including asset optimization

and pipeline terminal development. Based in

Calgary, he brings special expertise in

Canadian oil sands crude and the associated

transportation, terminaling, producer, and

refining issues.

Professional Experience

VP Service Design & Asset Optimization, Canadian Pacific Railway

Board Member, Indiana Harbor Belt Railroad

CRUDE BY RAIL / CANADA

Taylor RobinsonPresident

Taylor brings more than 25 years of executive

supply chain experience spanning automotive,

aerospace, food, and wind turbine industries

before joining PLG as the President. Utilizing

his real-world, global experience, Over the

past two years, Taylor has led PLG to grow

significantly by adding team network bench

strength, expanding their energy practice and

solidifying PLG’s reputation as the

unconventional energy logistics authority.

Professional Experience

VP Supply Chain and Production, Northern Power Systems

Executive VP of Supply Chain, Watts Water Technologies

Chief Procurement Officer, HJ Heinz

Director of Strategic Sourcing, Honeywell Aerospace

Procurement Manager, Honda of America

LEADERSHIP

PLG Crude by Rail Experts On the Call

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

5

ssSource: CAPP, About Oil Sands

Source: EIA, May 2014

US Shale

Unconventional Energy Resources and Extraction Technologies

Western Canadian (WC)

Oil Sands

Source: www.epmag.com

Steam Assisted Gravity Discharge (SAGD)Horizontal Drilling & Hydraulic Fracturing

Source: Marathon, February 2014

“Moore’s Law” at play:

Exponential advances in technology, resulting in:

-Declining costs

-Surging production

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

6

Shale Supply Chain and Downstream Impacts

Feedstock (Ethane)

Byproduct (Condensate)

Home Heating (Propane)

Other Fuels

Other Fuels

Gasoline

Gas

NGLs

Crude

Proppants

OCTG

Chemicals

Water

Cement

Generation

Process Feedstocks

All Manufacturing

Steel

Fertilizer (Ammonia)

Methanol

Chemicals

Petroleum Products

Petro-chemicals

Inputs Wellhead Direct

Output Thermal Fuels Raw Materials

Downstream Products

Impacts to-date include: Dramatic reduction in crude imports,

lower electricity costs, lower gasoline prices, increased refined products exports

The next wave: Manufacturing renaissance in the US based on

abundant, low cost energy and feedstocks

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

7

Chemical Industry Growth -- Front End of the N.A. Industrial Renaissance

October 2014

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

>$130B of announcedprojects over 10 yearsaccording to ACC

8

• New extraction technologies

resulting in record production of

gas, natural gas liquids (NGL),

and crude oil

• Water-borne imports of crude

being displaced by domestic

production

• North America on pace toward

full “energy independence” by

2020

The North American Energy Revolution So Far….

Source: CAPP Report, June 2014

Source: RBN Energy, December 2014

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

9

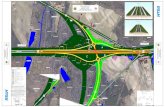

NA Crude Logistics Pre-2010

Sources: EIA, PLG analysis (Google Earth)

Light/Sweet

Heavy/Sour

Pacific Northwest Refiners

California Refiners

2,525kbpd

PADD VDemand

Midwest Refiners

3,375kbpd

PADD II Demand

East Coast Refiners

PADD I Demand1,075kbpd

LA Gulf Coast Refiners

TX Gulf Coast Refiners

PADD III Demand

8,150kbpd

Permian

ANS

Imports

Imports

Rail

Pipeline

Marine

Oil Sands

Imports GOM

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

10

NA Crude Logistics Today

Sources: EIA, PLG analysis (Google Earth)

Light/Sweet

Heavy/Sour

Pacific Northwest Refiners

California Refiners

2,525kbpd

PADD VDemand

Midwest Refiners

3,375kbpd

PADD II Demand

East Coast Refiners

PADD I Demand1,075kbpd

LA Gulf Coast Refiners

TX Gulf Coast Refiners

PADD III Demand8,150

kbpd

Eagle Ford

Permian

Bakken

Rail

Pipeline

Marine

Oil Sands

GOM

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

11

…But Oversupply Has Caused Precipitous Price Declines…

Source: RBN Energy, January 2015

WTI, Brent & Natural Gas 2014 and 2015

Citibank cut its crude price forecasts, saying West Texas Intermediate (WTI) could go as low as the $20 per barrel range before recovering to reach a new equilibrium.(Reuters, 2/09/2015)

The market doesn’t understand just how quickly oil companies are scaling back their activities, and as a result, oil prices could rebound faster than many observers expect.- Continental Resources CEO Harold Hamm (Fuelfix, 1/28/2015)

• U.S. shale oil industry has now entered

uncharted territories in its brief history

• Natural Gas and NGL pricing has also dropped

dramatically in a similar timeframe…due to

oversupply and NGL ties to oil prices

• Market experts have widely varied opinions on

what the rest of the year holds for pricing - $10

~ $70 per barrel…

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

12

Source: Baker Hughes, February 2015

…Shale Oil Rigs Are Falling Quickly…

• Producers have taken the following measures:

• Slashed their CAPEX by 30-50%+ for 2015

• Stopped drilling exploratory wells

• Focus drilling on known “sweet spots”

• Requesting suppliers for price reductions up to 30%

• Will continue to drill “held by production” wells to maintain land assets – but no production

• Conversely, Canadian oil sands producers are completing in-process wells as they already have

significant investments made

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

U.S. Land Oil Rigs

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

13

U.S.

…However, Crude Oil Production Will Continue To Grow

Canada

0

1

2

3

4

5

6

7

8

9

Lower 48 States (excl GOM) Crude Oil Production (MMBPD), Includes Lease Condensate

Source: EIA, February 2015Source: CAPP, January 2015

• ~$50 WTI price is very challenging for all

producers right now

• Cost reduction focus and “sweet spot” drilling

will continue to lower break even cost level

• Smaller, weaker players will fall while stronger

producers will actually grow during downturn

• Oil sands has a 20-50 year view on projects

• Have also cut R&D budgets and delayed

new greenfield projects

• SAGD wells also has lower break even costs

compared to shale wells

• Current pricing is a short term issue from

their perspective

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

14

0

200

400

600

800

1,000

1,200

1,400

1,600

0

50,000

100,000

150,000

200,000

250,000

Op

era

tin

g U

.S. L

an

d O

il R

igs

Ca

rlo

ad

s H

an

dle

d

U.S. Land Oil Rigs

All Sand Carloads

Petroleum Carloads

Rail Traffic Impact - Frac Sand vs. Crude by Rail

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

15

2009-2011

• CBR developed from the Bakken to bridge the gap until pipelines are built

• First unit train shipment in Dec. 2009

• Destination market: Cushing, OK WTI trading hub

2011-2013

• Ascendancy of trading as main growth driver in CBR; WTI-Brent-LLS differentials are key

• St. James, LA LLS hub becomes most attractive destination

• Coastal refineries begin rail receipt infrastructure build-out

• Tank car market overheats, becomes main growth constraint

2013-current

• CBR from Bakken assumes long-term structural role in crude oil market

• Bakken CBR transitioning to east and west coast markets; LLS and WTI converge as Permian and Eagle Ford growth floods USGC

• Canadian CBR build-out begins; tank car market reorienting to coiled/insulated car types (~2/3 of CBR fleet order backlog)

Historical U.S. Crude-by-Rail Growth

0

200

400

600

800

1,000

1,200

20

10-Q

1

20

10-Q

2

20

10-Q

3

20

10-Q

4

20

11-Q

1

20

11-Q

2

20

11-Q

3

20

11-Q

4

20

12-Q

1

20

12-Q

2

20

12-Q

3

20

12-Q

4

20

13-Q

1

20

13-Q

2

20

13-Q

3

20

13-Q

4

20

14-Q

1

20

14-Q

2

20

14-Q

3

20

14 O

ct

20

14 N

ov

U.S. Crude by Rail Volumes (kbpd)

US Crude Originations Bakken Crude Originations

0

200

400

600

800

1,000

1,200

1,400

Jan-1

1

Apr-

11

Jul-1

1

Oct-

11

Jan-1

2

Apr-

12

Jul-1

2

Oct-

12

Jan-1

3

Apr-

13

Jul-1

3

Oct-

13

Jan-1

4

Apr-

14

Jul-1

4

Oct-

14

US Bakken Basin Crude Production and Rail Transport (kbpd)

Production Crude by Rail

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

16

Historical Canadian Crude By Rail Growth

Source: National Energy Board (Canada), January 2015

» Canadian CBR lower in 2014 then predicted

Shutdown of Canexus Bruderhiem loading terminal due to pipeline issues – was largest loading terminal in Western

Canada

Delays in opening of other unit train loading terminals in Western Canada

Tighter differentials between Canadian and U.S. landed import heavy crude prices since Q1 2014

Approximately 85 kbpd of crude was also moved within Canada in addition to above export volumes

-

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

180,000

2012-Q1 2012-Q2 2012-Q3 2012-Q4 2013-Q1 2013-Q2 2013-Q3 2013-Q4 2014-Q1 2014-Q2 2014-Q3

Canadian Crude Oil Exports by Rail (bbl per day)

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

17

Pipeline Build-out Remains Key Logistics Issue for Oil Sands

Current pipelines are at capacity with higher

apportionment due to maintenance and expansion

Oil Sands pipelines are under intense scrutiny and

subject to court challenges and protests in U.S. and

Canada

NEB has extended its review of Trans Mountain expansion by 7

months

Recent Canadian Supreme Court ruling gives more power to First

Nations in land claims

Innovation with existing pipelines increasing capacity

Enbridge has temporarily switched the flows of Alberta Clipper and

Line 3 on 17.5-mile segment across the U.S.-Canadian border

Will maximize the flows under existing permits until the

Department of State review is completed on expansion

Increased Alberta Clipper flows by 27% to 570 kbpd in September

2014 and potentially up to 800 kbpd in 2015

Large Canadian oil producers and pipeline companies

are strategically investing in CBR as a flexible option to

pipelines for the short and long term

Likely Built Within

Medium Term (~2019)

Trans Mountain Express

(Kinder Morgan)

Alberta Clipper

(Enbridge)

Keystone XL

(TransCanada)

Likely Delayed

Until 2020 or Later

Northern Gateway

(Enbridge)

Energy East

(TransCanada)

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

18

North American CBR Volume Forecast

-

100

200

300

400

500

600

700

800

900

2013 2014 2015 2016 2017 2018 2019

North American Crude by Rail Volume Forecast (kbpd)

Bakken

Western Canada

Niobrara

Permian

Source: PLG Crude by

Rail & Tank Car

Forecast, Feb. 2015

Note: Based on current $50-55 WTI priceremaining constant

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

• Bakken & Oil Sands are main drivers of CBR volumes, accounting for ~87% of NA movements in 2017

• Other plays such as Niobrara and Permian are seeing increasing CBR activity but will be adequately served by pipelines long-term

19

Bakken Production and Takeaway Share

CBR share of production expected to remain stable due to the optionality it provides and the lack of pipeline options to the key

markets on West and East Coast

-

200

400

600

800

1,000

1,200

1,400

1,600

2014 2015 2016 2017 2018 2019

Bakken Takeaway Forecast (kbpd)

Crude by Rail Forecast

Pipeline Forecast

Local Refinery Forecast

Note: Based on current $50-55 WTI priceremaining constant

Source: PLG Crude by

Rail & Tank Car

Forecast, Feb. 2015

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

20

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

2014 2015 2016 2017 2018 2019

Western Canada Takeaway Forecast (kbpd)

CBR Forecast

Pipeline Forecast

Local Refinery Forecast

Note: Based on current $50-55 WTI priceremaining constant

Western Canada Production and Takeaway Share

Source: PLG Crude by

Rail & Tank Car

Forecast, Feb. 2015

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

Proportion of production handled by rail expected to ramp up through 2017 and then drop back as pipeline capacity starts to develop

21

Industry Awaiting U.S. DOT PHMSA Decision – May 2015

NPRM (July 2014) addressed following key areas:

Classification & characterization of mined gases and liquids

Rail routing risk assessment

Reduced operating speeds

Enhanced braking

Three tank car options announced for HHFT trains – Option 2 (9/16” tank, no enhanced

braking) is likely the new standard

Recent accidents continue to put pressure on increasing tank car

safety specifications

Current rail tank car market conditions

New-build backlog is 20-24 months and most/all orders have “no cancellation” clauses

New order active on “pause” till new rules announced in May

Some orders for 9/16” cars already on order books

Current lease price ~$1,900 / month

Spot market rate is ~$1,000/month or lower, very soft market

Numerous crude oil sets are in storage, leading to improved operations and availability

of power which was in short supply

Industry in a holding pattern - general sentiment is “wait and see”

Tank CarInsulation

Top Fittings Housing Manway

Tank Jacket

Tank Shell

Tank Head

Head Shield

Source: API with PLG simplification

Bottom Outlet Valve/Protection Skid

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

22

Small Covered Hoppers – Market Update

Current market is one of “mixed signals”

Significant activity in short-term subleasing and railcar storage

Some shifting of new-build delivery schedules

Minimal outright cancellations of car orders

“Mixed signals” should be expected due to oil price volatility and continual revisions to 2015

well completion plans

Availability positions are showing some “cracks”

New-build production schedules are “full” through mid-2016….for now

A few late-2015 low volume, new-build slots are available through negotiation

Overriding attitude for 2016 production is “wait and see”

Typical full service lease rates are currently $650 - $675, down from late Q3

2014 (was over $700)

Frac sand shippers/receivers will continue to move towards more efficient

methods of rail transportation, especially with heightened pressure on frac

sand delivered cost per ton

Cement consumption is expected to grow by 8%+ in 2015

Cement railcar lessees are carefully watching the market for lease opportunities

Plastic pellet cars are successfully competing for small hopper build capacity

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

23

Presentation Summary

We are in the early innings of the North American

energy revolution

Natural gas – the first shale “oversupply” example

Crude oil – new shale and maturation of Canadian oil sands

NGL – a valuable byproduct from natural gas and crude drilling

Downstream chemicals and manufacturing – coming soon!

Lower hydrocarbon pricing environment is mainly

caused by oversupply

Pricing will speed up cost reduction throughout supply chain

Industry consolidation will ensure long term global

competitiveness

Lower oil prices will dampen growth profile for shale oil and

crude by rail volume in the short term

Tank car and small covered hopper market has shifted gears to

“neutral” for now

Expect volatility in the middle and later innings as well!

Lower Oil Price Implications for the North American Rail & Rail Equipment Markets

Logistics Engineering Supply Chain

Thank You !For follow up questions and information,

please contact:

Taylor Robinson, President+1 (508) 982-1319 / [email protected]

This presentation is available for download at:http://plgconsulting.com/category/presentations/