Specialty Tax Strategy & CARES Act Updates€¦ · Specialty Tax Strategy & CARES Act Updates Top 5...

Transcript of Specialty Tax Strategy & CARES Act Updates€¦ · Specialty Tax Strategy & CARES Act Updates Top 5...

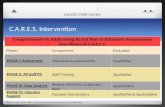

Presented by: Michael F. D’Onofrio

Specialty Tax Strategy & CARES Act Updates Top 5 Real Estate Pro Tips!

1. Cost Segregation & Bonus Depreciation 2. Improvements & Disposition Credits3. Energy Tax Credits & Incentives (179D/45L)

4. Construction Tax Planning & Insurance Appraisals5. CARES Act & Advanced Tax Exchange Strategies

(Opportunity Zones, Historic, Energy Tax Credit Investing)

Michael F. D’Onofrio is Managing Director of Engineered Tax Services (ETS) the country’s largest specialty tax engineering firm focused on wealth preservation, tax mitigation and tax credits utilizing IRS-approved strategies and an innovative, comprehensive approach with Cost Segregation, Renewable Energy Tax Incentives, Historic Tax Credits and new Opportunity Zones for companies and property owners to help maximize all Federal, State and Local incentives, credits, rebates available.

Michael lives in Charlotte, NC and works nationally delivering specialized engineering tax studies to local and national companies, investment firms, family offices and private equity investors. ETS has a team of over 100+ professionals in 20 offices nationally with HQ in West Palm Beach, Florida.

Your Presenter – Engineering & Specialty Tax Credit Expertise

Michael F. D’Onofrio | Managing [email protected]

Direct: 561-762-0044www.EngineeredTaxServices.com

Top 5 Real Estate Pro Tips!

Cost Seg & Bonus Depreciation

Improvements & Dispositions

Energy Tax Credits

Construction Tax Planning

Opportunity Zone & Tax Exchange

Federal COVID-19 Acts to Date

• Coronavirus Preparedness & Response Supplemental Appropriations Act (March 4)

– $8.3 billion emergency funding related to developing a vaccine, medical supplies, grants for public health agencies, etc.

• Families First Coronavirus Response Act (March 18)

– $192 billion Free coronavirus testing, paid leave, enhanced unemployment insurance, expanded food security initiatives, etc.

• Coronavirus Aid, Relief, and Economic Security Act “CARES Act” (March 26)

– $1.8 trillion Added tax provisions, small business loans, mortgage forbearance, etc.

• Paycheck Protection Program and Health Care Enhancement Act (April 24)

– $483 billion Increased Paycheck Protection Program authority, disaster loan funding and added funds for health care response

Tax Provisions of CARES Act

• Families First Coronavirus Response Act

– Mandates two weeks of paid sick leave for those impacted by COVID-19.

– Expands the Family and Medical Leave Act (FMLA) to provide up to 10 weeks of paid leave to care for children under 18 whose schools/childcare facilities are closed.

– Offers two refundable employer payroll tax credits to offset wage costs.

– Does not apply to private business of 500 or more employees.

Tax Provisions of CARES Act

• Business Provisions

– Employee retention tax credit: Refundable payroll tax credit for 50% of wages (up to $10,000) paid by employers to employees during crisis.

– Employer Payroll Tax Deferral: Delay of payment of employer payroll taxes from enactment to 12/31/20

– Net Operating Loss (NOL) relief: 5-year carryback

• Individual Tax Assistance

– Recovery Rebates: $1,200 (single filers); $2,400 (married couples); and $500 (per child). Phases out for single filers earning over $75,000 and married couples earning over $150,000.

Tax Provisions of CARES Act

• IRS Extended tax filing relief to July 15• 2019 tax returns with no interest or penalties• First and second quarter estimated payments• 1031 Like-Kind Exchanges (for deadlines

between April 1 and July 15)• NMHC seeking additional relief

• Opportunity Zone investments (for deadlines between April 1 and July 15)

Most Important for Real Estate…

New - Increased Loss Limitations-Ability to use more tax losses / NOLs now!New – 5yr Loss Carry Back ProvisionAbility to go back 5yrs in tax returns and possibly generate immediate tax $ refunds!

Small Business Loans• $670 billion ($349 billion + $321 billion) for loans to small

businesses (with 500 or fewer employees, full-time/part-time)– Up to 250% of average monthly payroll, maximum $10,000,000

– Loan is forgivable if:

• Employer keeps employees on payroll

• Over 8 weeks spends loan on payroll, rent, mortgages, utility payments

– Effective immediately through SBA lenders

– No fees, qualifying requires no collateral, no personal guarantee and borrower certifies they are impacted by COVID-19

– Retroactive to 2/15/20

– $10 billion for emergency grants up to $10,000

• NMHC is urging Treasury / SBA to clarify that all multifamily businesses with 500 or fewer employees qualify.

• SBA guidance is extremely unclear with respect to qualification.

• SBA can address this issue administratively, but NMHC is also asking Congress to act should SBA not do so.

Federal Reserve Loans• Federal Reserve established Main Street Lending Program

• Two facilities: Main Street New Loan Facility (MSNLF) Main Street Expanded Loan Facility (MSELF)

• Goal to assist small and medium-sized businesses with $600 billion in loans.

• Available to businesses with 10,000 or fewer employees or 2019 revenue of $2.5 billion or less.

• Minimum loan of $1 million.

• Loan limit lesser of $25 million or 4 times EBITDA when added to existing but undrawn debt (MSNLF); and $150 million, 30 percent of existing but undrawn debt, or 6 times EBITDA (MSELF).

• Loans have 4-year maturity with principal and interest deferred for one year.

Future Stimulus & Legislative Outlook?

• COVID-19 4.0 package on agenda now…

• May 12 House Democrats released massive stimulus proposal dubbed Health and Economic Recovery Omnibus Emergency Solutions Act or HEROES Act for short.

• Proposal massive not only in its estimated $3 trillion cost but also in its size, with more than 1,800 pages included in the bill.

• Provisions calling for another round of stimulus payments, extended unemployment benefits and other direct financial assistance.

• HEROES Act would eliminate the limitation on itemized deductions for state and local taxes (SALT) for the 2020 and 2021 tax years.

– interesting provision revisits hard-fought issue for many high-tax states

May take longer to move bill with debates on state aid and deficit impact

Presented by: Michael F. D’Onofrio

PRO TIP #1Cost Segregation & 100%

Bonus Depreciation

New Depreciation Rules

100% Bonus Depreciation

Section 179 Expensing Rules

✓ Cost Segregation identifies and accelerates

depreciation on 5-year and 15-year personal

property and what qualifies for Bonus

✓ Bonus Depreciation increased to 100% also applies

to Purchases of Existing Buildings in addition to

new construction and improvements

✓ Section 179 Expanded ability to expense

immediately up to $1 Million also including new

Roofs, HVAC, Security Systems

What is Cost Seg?

Cost Segregation Study methodically reviews all property assets to properly identify and reclassify:

Real Property (depreciated over 27.5 or 39 years)

Personal Property (depreciated over 5 or 15 years)

- All Personal Property assets now also qualifies for new 100% Bonus Deprecation!

How is this done? Yes, the IRS allows it!

• Invoices, Drawings, Blueprints reviewed and site visit conducted to analyze building as part of detailed Engineering-based Cost Segregation Study

• Can also go back Retroactively 5-10+ years!

• Don’t forget Improvements and Dispositions!

• Generally Requires the filing Form 3115 is easy

TIMING ILLUSTRATION

Presented by: Michael F. D’Onofrio

PRO TIP #2Maximize Improvements Renovations & Value-Add

Capturing Dispositions

What Are Dispositions?

Capturing Tax Value of a Removed Building Asset Creates an Immediate Tax Deduction!

Typically existing improvements (Lights, HVAC, Roof, Windows, etc) remain on long-term 27.5 or 39-year depreciation schedule and available for Immediate Tax Write-Off!

CPAs call it (PAD) Partial Asset Disposition

ETS maximizes Improvements with a Cost Seg Study by capturing any Abandonment and Dispositions for serious increased cash benefits and Enhanced ROI!

Presented by: Michael F. D’Onofrio

PRO TIP #3Capture All Energy

Tax Incentives & CreditsFederal - State - Local Utility

Energy Tax Credits

PASSED:

2019 Extender Bill

179D & 45L

Energy Tax Credits

Retroactive for all new construction and renovations completed 2018, 2019, 2020!

179D Energy Tax Deductions

What is 179D?

• Incentivize Energy Efficient Green Building

• New Construction or Renovations

• All Commercial, Retail, Industrial Properties

• Residential and Multifamily 4+ Stories

• Up to $1.80 per sf Bonus Tax Deduction

• For new Lighting, HVAC, Roof, Windows

• Placed in Service Dates: 2006 – 2020

45L Energy Tax Credit

What is 45L?

• Incentivize Energy Efficient Green Building

• New Construction or Renovations

• Residential and Multifamily 3 Stories and Less

• $2,000 Tax Credit per unit

• For new Lighting, HVAC, Roof, Windows

• Placed in Service Dates: 2006 – 2020

Presented by: Michael F. D’Onofrio

PRO TIP #4Insurance Replacement

AppraisalsSave $ on Premiums

Presented by: Michael F. D’Onofrio

PRO TIP #5Understand Strategies in

New “CARES Act”COVID-19 Stimulus Plan of 3/2020

Presented by: Michael F. D’Onofrio

ADVANCED TAX STRATEGIES- Maximize Capital Stack

- Defer, Reduce, Eliminate(Opportunity Zones & 1031 Exchanges)

- Tax Credit Investing (Solar, Historic, OZ)

Find, Capture and Stack Incentives!

Opportunity Zone

Strategies in Many States

Opportunity Zone Snapshot

Investor Sells Stock or

Has A Capital Gain

Investor Places Gains into

Qualified Opportunity Fund

(QOF) within 180 Days

QOF Buys Real Estate or

Business in Qualified

Opportunity Zone

QOF Invests $ Matching

Purchase Price (-land) into

Property Development

Hold 10 Years

Pay No Capital Gains on

Acquired Property or

Business Appreciation

Taxes on Original Capital

Gains Due: Dec. 31, 2026

or Upon Sale

Hold 7 Years for 15% basis

increase (pay taxes on 85%

of capital gains)

Hold 5 Years for 10% basis

increase (pay taxes on 90%

of capital gains)

Sources: Marcus & Millichap Research Services

Tax Exchange Alternative Investment

Solar Project Investments:$250 Million+ Tax Credits Available Now

➢Immediate 2020 Federal Investment Tax Credit (ITC) of 26% + 100% Bonus Depreciation in current year + Cash Flow for 6 years➢20%+ annual IRR with ~70% of original investment returned with

tax savings in next quarterly or annual filing with tax credits + depreciation + possible state and local cash rebates➢CARES ACT Impact: ➢1 year Look back on Tax Credits!➢5 year Lookback on Depreciation!➢Buying Solar Power Plant in 2020 allows use of the Depreciation

immediately and potentially Going Back 5 Years and recover Taxes Paid. ➢2015, 2016, 2017, 2018 and 2019 Taxes Paid can be recovered

through Amended Returns.

Presented by: Michael F. D’Onofrio

For Additional Information Contact:

Michael F. D’Onofrio | Managing [email protected]

Direct: 561-762-0044www.EngineeredTaxServices.com