Southeast Asia Tech Investment –FY 2020 - Cento Ventures

Transcript of Southeast Asia Tech Investment –FY 2020 - Cento Ventures

Southeast Asia Tech Investment – FY 2020

dmpABOUT CENTO VENTURES

2

Cento Ventures is a venture capital firm focused on technology startupsbuilding products and services emerging from the digital transformation ofpromising growth markets, particularly Southeast Asia.

We are based in Singapore and backed by a team well experienced ininternet business. We operate three funds that invest across industriesthrough a disciplined, well-researched approach to locate technologyinvestment opportunities originating from the Southeast Asian region.Three main principles guide our investments:

- Sectors ready for digital transformationThere is an excellent opportunity for technology to solve some of theinefficiencies present in emerging markets. However, technology alone doesnot digitalise industries. Most of our investments apply innovative businessmodels to large industry sectors that are set in their ways, using technologyas an enabler.- Tech startups at an early stage, but with proof points

Our investments are usually at Series A, where we lead the round. This helpsus establish a solid relationship with the founder, and to influence companystrategy. We only invest once a company can show that a market exists forits product and that it is ready to use extra capital to scale.

- Founders with great ambitionWe look for founders who want to build large digital companies that areleaders in their category. In a fragmented region, such as Southeast Asia,operating across multiple countries often essential. Our preference is forbusiness models that are light on physical assets and where the foundershave ambitious plans to scale internationally.Cento Ventures is convinced that the opportunity exists for Southeast Asianfounders to build transformational digital companies, and we look forward toworking with more startup teams to create new success stories.Learn more about us at cento.vc or our Facebook or Linkedin pages.

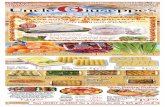

dmpTotal investment in 2020 matches 2019

2020 marked our memories with its extraordinary challenges for individuals,families, and organisations. Yet, it was also a year of fortitude and resilience.From data in the first half of the year, we had expected to see a slowdown intechnology investment resulting from the COVID-19 related restrictions.Overall, 2020 looks like a very ‘normal’ year for SE Asia tech investment. Thetotal number of deals fell by 8%, but the amount of capital invested was aboutthe same as in 2019, at just over $8B. We tracked 333 deals in the secondhalf of 2020, almost identical to the same period in 2019, and higher than in2018. The region’s leading tech companies continued to raise large rounds,with ‘mega-deals’ accounting for just over half of total investment, similar to2019.

Stable round sizes

Median round sizes were stable with Pre-A rounds of $0.3M, Series A roundsof $3M, and Series B of $10M. We saw a slight reduction in the share ofearly stage investment (those sized at less than $3M), with 238 deals in 2020compared to 281 in 2019.

Indonesia and Singapore regain dominance

2020 confirmed the reversion to the typical geographic distribution of deals.70% of capital was invested in Indonesian startups, and Indonesia andSingapore startups combined accounted for 64% of the total number of dealsdone.

Sector diversification continues

Over half of tech investment flowed to the super-app companies (our ‘multi-vertical’ category) and to online retailers – totalling just over $4B in 2020.Other sectors that saw rising interest included Payments, Logistics and LocalServices.

Investment into payments & other financial services startups now forms thelargest sector after the multi-vertical one. Sometimes this intersects as thesuper-apps build their own financial services arms. At present half ofinvestment in this sector goes into payments startups, with the rest spreadacross the other types of fintech. We have added a breakdown of investmentwithin the fintech sector so we can track its evolution from paymentprocessing and lending, to include a wider range of financial products.

INTRODUCTION

3

How was Southeast Asia tech investment during COVID-19? Another ‘normal’ year?

dmpINTRODUCTION

4

New unicorns

2020 saw JustCo included in Southeast Asia’s companies valued over $1B.We also saw expansion of the group of startups that have exceeded $100Min valuation, adding more than 20 names that included Stashaway, Waresix,Mekari, Shopmatic, Sunday.

Decline in exits

As noted in our report for the first half of the year, liquidity events are where2020 differed most from previous years. While the number of exits ended upon par with 2018, the proceeds generated fell significantly to under $1B. Wethink it’s fair to assume that some larger potential deals have been delayed,as the sort of extensive due diligence required by international acquirers washarder to accomplish during this period of travel restrictions.

Looking ahead to 2021

Tech investment may not have reached any new heights in 2020, but startupsin the region have risen to the various challenges and proven they can findnew opportunities to grow and attract new investment. We anticipate that ifthe pandemic recedes throughout 2021, we will see resumed growth in VCinvestment alongside some notable exits, by the time our next report ispublished in H1 2021.

Thank you

Mark Suckling, Laphat Tantiphipop

dmp$8.2B INVESTED IN 2020

5

Capital invested, $B and deals done, #Southeast Asia technology investmentlandscape remained resilient in 2020. COVID-19 shown negligible impact on the overallinvestment amount and deal activities,dropping slightly from 2019 at -3% and -8%.

Familiar names continue to take up themajority of the capital invested. Grab, Go-Jekand Go-Pay, Bukalapak, Traveloka aloneaccounted for almost 50% of the yearinvestment volume.

Notes:

The numbers in page 5-10 include all eventsrelated to technology investment albeitconsidered not relevant to venture space, e.g.,ICOs, project financing, corporate subsidiaryinvestment. Further analysis only includesevents that are standard equity-based ventureinvestments in digital companies within ourframework.

Source: Cento research

$0.3 $0.2 $0.5 $1.0 $0.9 $1.2 $1.6 $2.1 $1.4 $4.3 $8.8 $3.8 $6.4 $2.1 $5.9 $2.3

43 54

110 110

226 205

224

156

209 208 210 222

372

332 312

333

-

5 0

1 00

1 50

2 00

2 50

3 00

3 50

4 00

$ -

$ 1

$ 2

$ 3

$ 4

$ 5

$ 6

$ 7

$ 8

$ 9

$ 10

2013H1

2013H2

2014H1

2014H2

2015H1

2015H2

2016H1

2016H2

2017H1

2017H2

2018H1

2018H2

2019H1

2019H2

2020H1

2020H2

Capital Invested # of Deals

• SE Asia maintained a similar level of investment to 2019 • # of deals dropped slightly at -8% in the same period

dmp$4.7B INVESTED IN >$100M DEALS

6

Capital invested, $B and deals done, #Mega-deals (those with the value of dealssized above $100M) remained a sizablecontributor to the region’s total investmentvolume. This deal size accounted 57% ofinvestment proceeds in 2020, compared to56% in 2019, and 78% in 2018.

The mega-deals investment is similar to 2019level, while smaller deals show a 6% declinefrom their 2019 peak.

Source: Cento research

$0.3 $0.1 $0.3 $0.4 $0.6 $0.6 $0.7 $0.6 $0.8 $1.2 $1.3 $1.5 $2.0 $1.7 $2.1

$1.4 $0.1 $0.2

$0.6 $0.3 $0.7 $0.9 $1.5

$0.6

$3.2

$7.5

$2.3

$4.4

$0.4

$3.8

$0.9

$0.3 $0.2$0.5

$1.0 $0.9$1.2

$1.6$2.1

$1.4

$4.3

$8.8

$3.8

$6.4

$2.1

$5.9

$2.3

43 54

110 110

226 205

224

156

209 208 210 222

372

332 312

333

-

5 0

1 00

1 50

2 00

2 50

3 00

3 50

4 00

$ -

$ 1. 0

$ 2. 0

$ 3. 0

$ 4. 0

$ 5. 0

$ 6. 0

$ 7. 0

$ 8. 0

$ 9. 0

$ 10 .0

2013H1

2013H2

2014H1

2014H2

2015H1

2015H2

2016H1

2016H2

2017H1

2017H2

2018H1

2018H2

2019H1

2019H2

2020H1

2020H2

$100M or smaller deals $100M+ deals # of Deals

>$100M deals accounted for 57% of 2020 investment with only a 0.5% YoY decrease

dmp

$0.1 $0.1 $0.2 $0.1

$0.2 $0.2 $0.3 $0.2 $0.3 $0.3 $0.3

$0.4 $0.6

$0.5 $0.5 $0.5

$0.1 $0.03 $0.1 $0.1

$0.3 $0.3

$0.4

$0.3 $0.3

$0.4 $0.4

$0.8

$0.9

$0.8

$1.1

$0.4

$0.1

$0.2

$0.1 $0.1

$0.1

$0.3

$0.4 $0.6

$0.3

$0.5

$0.4

$0.6

$0.5

43 53

109 107

224

202 220

153

208 203 204 214

367

330

304

328

-

5 0

1 00

1 50

2 00

2 50

3 00

3 50

4 00

$ -

$ 0. 5

$ 1. 0

$ 1. 5

$ 2. 0

$ 2. 5

2013H1

2013H2

2014H1

2014H2

2015H1

2015H2

2016H1

2016H2

2017H1

2017H2

2018H1

2018H2

2019H1

2019H2

2020H1

2020H2

≤$10M >$10M- $50M >$50M - $100M # of deals

$3.5B INVESTED IN <$100M DEALS

7

Capital invested, $B and deals done, #, excluding $100M+ transactionsMega-deals often attract the majority ofinvestment proceeds as well as mediaheadlines. However, smaller deals that occurregularly can be a better indicator for theecosystem’s health compared to the sporadicoutsized deals that fluctuate the trend.

In 2020, the >$50M-$100M deals receivedrecord investment volume at $1.1B, a 26%increased from 2019. >$10M-$50M see a lessencouraging outcome with a 17% YoYdecrease to $1.5B. Investment into $10Mdeals and smaller remain stable at ~$1B peryear.

Source: Cento research

• >$50M-$100M deals see record investment and strongest growth at 26% YoY• >$10M-$50M see the sharpest decline, dropping 17% from 2019 peak.

dmp$50M+ DEALS GROW, SMALLER DEALS DECLINE

8

$0.5M or smaller deals $0.5M+ to $3M deals $3M+ to $10M deals

$10M+ to $50M deals $50M+ to $100M deals $100M+ deals

Source: Cento researchCapital invested, $M

Deal #

$9 $26 $48 $36 $30 $28 $49 $42

40

114

220

163 162146

281

238

0

5 0

1 00

1 50

2 00

2 50

3 00

$ -

$ 10

$ 20

$ 30

$ 40

$ 50

$ 60

2013 2014 2015 2016 2017 2018 2019 2020

$50 $82 $217 $196 $217 $220 $337 $315

3763

145 135 145 138

214 207

0

5 0

1 00

1 50

2 00

2 50

$ -

$ 50

$ 10 0

$ 15 0

$ 20 0

$ 25 0

$ 30 0

$ 35 0

$ 40 0

2013 2014 2015 2016 2017 2018 2019 2020

$65 $167 $197 $321 $347 $461 $702 $599

1226

3348

6275

116104

0

2 0

4 0

6 0

8 0

1 00

1 20

1 40

$ -

$ 10 0

$ 20 0

$ 30 0

$ 40 0

$ 50 0

$ 60 0

$ 70 0

$ 80 0

2013 2014 2015 2016 2017 2018 2019 2020

$126 $223 $607 $673 $727 $1,186 $1,790 $1,487 6

11

26 2634

47

7469

0

1 0

2 0

3 0

4 0

5 0

6 0

7 0

8 0

$ -

$ 20 0

$ 40 0

$ 60 0

$ 80 0

$ 1, 00 0

$ 1, 20 0

$ 1, 40 0

$ 1, 60 0

$ 1, 80 0

$ 2, 00 0

2013 2014 2015 2016 2017 2018 2019 2020

$100 $165 $152 $100 $667 $891 $870 $1,092 1

2 21

8

12 12

14

0

2

4

6

8

1 0

1 2

1 4

1 6

$ -

$ 20 0

$ 40 0

$ 60 0

$ 80 0

$ 1, 00 0

$ 1, 20 0

2013 2014 2015 2016 2017 2018 2019 2020

$112 $815 $928 $2,359 $3,743 $9,756 $4,759 $4,734 1

45

76

14

7

13

0

2

4

6

8

1 0

1 2

1 4

1 6

$ -

$ 2, 00 0

$ 4, 00 0

$ 6, 00 0

$ 8, 00 0

$ 10 ,0 00

$ 12 ,0 00

2013 2014 2015 2016 2017 2018 2019 2020

dmpSE ASIA SHOWS MOST RESILIENCE AMONG EMERGING MARKETS

9

The economic impact of COVID-19 ondifferent startup ecosystems variedsignificantly. Startups investment in developedmarkets experienced robust growth. The USand EU both received a record investmentamount in 2020.

Among emerging markets, Southeast Asiaexperienced the least fluctuating impact. Theregion sees a minor overall decrease,compared to other markets that see a sharpdecline in either the investment volume ornumber of deals done.

Notes:The denominators to both the capital investedand the number of deals in each region arebased on its respective 2019 numbers.

Source: Cento researchPitchbook - European Venture Report 2020

NVCA – Venture Monitor 2020KPMG - Venture Pulse APAC Q4 2020

Baobab - Africa Venture Capital and Start-up Funding 2020

% of VC capital invested and deals done by region, 2020 vs. 2019

-38%-31%

6% -3%13% 15%

0.4% 3%

-20% -8%

-0.3%

24%

Africa India China SE Asia US EU

Change in Capital Invested Change in # of Deals

dmp

58 122

260 201 187 180

393 339

22

55

110

102 145 126

165

153

6

11

25

23 32

41

45

43

3

9

14

24

20 33

51

46

2013 2014 2015 2016 2017 2018 2019 2020

Pre A A B C+

DEALS SIZE AND VALUATION AT EACH STAGE ARE STABLE

10

Deals done by series, # Median deal size by series, $M

Source: Cento research

$0.5 $0.2 $0.2 $0.3 $0.3 $0.3 $0.3 $0.3$1.7

$1.0$1.8 $1.5 $2.0 $2.3

$3.0 $2.8$3$4

$7$8 $8

$10 $10 $10

2013 2014 2015 2016 2017 2018 2019 2020

$1.8 $1.7 $2.0 $3.0 $2.6 $2.3 $1.0 $2.7$5 $6 $7 $6 $8 $10 $12 $10$12

$21 $20

$28 $28

$43

$27

$34

2013 2014 2015 2016 2017 2018 2019 2020

Pre-A A B

Median valuation by series, $M

dmpProceed (US$M) 2013 2014 2015 2016 2017 2018 2019 2020

2019-2020 Change

Multi-vertical - 52 346 770 2,550 4,535 3,429 3,114 -9%

Retail 71 182 210 837 955 1,915 773 939 21%

Payments 19 26 86 115 117 473 413 801 94%

Logistics 1 15 34 64 136 129 221 542 145%

Financial Services 37 7 139 138 189 418 534 465 -13%

Travel & Hospitality 34 13 78 176 392 52 528 275 -48%

Local services 9 376 442 826 50 92 115 244 112%

Real estate & Infrastructure 4 2 9 17 41 517 167 160 -4%

Business Automation 6 13 29 29 44 140 168 145 -14%

Healthcare 0 12 26 37 62 12 224 114 -49%

Advertising & Marketing 8 22 122 21 82 37 144 112 -22%

Employment 3 4 8 11 22 24 40 54 37%

Entertainment / Non-Gaming 1 4 52 84 349 17 130 43 -67%

Education 0 7 12 9 16 61 162 29 -82%

Entertainment / Gaming 4 8 11 11 5 14 19 22 18%

Others - - 1 3 5 - 38 8 -78%

Comms & Communities 4 23 16 48 1 10 3 3 1%

2X INVESTMENT IN PAYMENTS, LOGISTICS & LOCAL SERVICES

11

Capital invested by sector, $M

The full-year COVID impact on each sectorshows both expected and surprising results.Travel is heavily hit, dropping almost 50% YoYand would be as much as 95% if not forTraveloka $250M round. Healthcare andeducation did not enjoy a continual growthfrom their 2019 record despite muchanticipation.

Many of the fundamental internet economysectors received a positive boost. Payment,logistics, and local services doubled their 2019financing. Retail grew slightly at 21%. Multi-vertical companies, which operate acrossmany of these sectors, see minimal changes.

Notes:For a detailed definition of each sector, pleasesee our methodology slide.

Source: Cento research

Multi-vertical

Retail

Payments

Logistics

Financial Services

Travel & Hospitality

Local services

Real estate & Infrastructure

Business Automation

Healthcare

Advertising & Marketing

Employment

Entertainment / Non-Gaming

Education

Entertainment / Gaming

Others

Comms & Communities

• Payment rose to the 3rd most funded sector. • Travel investment dropped unsurprisingly. More surprising is the decline in healthcare and education.

dmpFINTECH ACCOUNTS FOR 20% OF DEALS

12

Source: Cento researchNVCA – Venture Monitor 2020

Crunchbase – Venture Report EU 2020IT Juzi -中国新经济创业与投资分析报告

Fintech as % of total capital invested and deals done, SE AsiaCapital invested by fintech sector, $M Fintech as % of total capital invested by region, 2020

2018 2019 20202018-2020 Total

Core Payments*

Lending - Business

Multi-Vertical

Lending - Consumer

Wealth Management & Capital Markets

Data Analytics

Insurance

BaaS

11%

13%

18%

22%

17%

21%

8 %

1 0%

1 2%

1 4%

1 6%

1 8%

2 0%

2 2%

2 4%

2018 2019 2020

% of Capital Invested % of Deals

30% 18% 13% 5%

EU SE Asia US China

• Proportion of Southeast Asia fintech investment is on par with developed markets. • Core payment, lending, and company with multiple financial offerings dominate, but others are picking up the pace.

* Some companies in the main Payment sector visible in the previous page expanded to multiple verticals or added banking capability; thus, are broken out as such in the fintech subcategory.

Capital Invested (US$M)

2018 2019 20202018-2020 Total

Payments273 413 678 1,364

Lending - Business141 104 171 416

Multi-Vertical252 20 136 409

Lending - Consumer77 176 27 280

Wealth Management & Capital Markets41 67 103 211

Data Analytic55 111 21 187

Insurance35 38 81 154

BaaS17 18 48 83

dmpRegional Indonesia Singapore Vietnam Thailand Malaysia

>$10

B

Southeast Asia is home to 9 independentcompanies and 5 subsidiaries valuedabove $1B (with Sea Group market-caphaving reached $50B). However, webelieve a more comprehensive view of theregion’s capability to generate shareholdervalue in the digital space is provided byalso accounting for the growing cohort of$100M, $250M, and $500M companies.

>$1B

>$25

0M>$

100M

SE ASIA’S TECH LEADERS

13

• 2020 continues to generate new set of companies valued above $100M, $250M, and $1B

Source: Cento research Publicly-listed company

• List of companies are not exhaustive• Data is based on the latest substantial financings,

liquidity events or known business developments

2020 New Entry

Valu

atio

n

dmpRegional Indonesia Singapore Malaysia Thailand Vietnam Philippines

>$1B

>$10

0M*

Razer

OTHER $100M+ COMPANIES PRESENT IN THE REGION

14

Selected $1B+ and $100M+ enterprise value businesses, executed via prior acquisition / non-third party funded subsidiary

An overview of the value beingcreated in the digital space inSoutheast Asian would be incompletewithout noting:

• A significant and growing set ofdigital businesses previouslyacquired by or created within largercompanies that are continuing togrow around their respectiveopportunities within Southeast Asia

• A number of overseas players -usually from adjacent markets inNorth Asia - focusing on SoutheastAsia as a primary source of growth.

• A number of Southeast Asia-originating companies that built theirdomestic advantage into asignificant international footprintbeyond Southeast Asia

Search

Bigo

Select $100M+ enterprise value businesses by global players targeting Southeast Asian market or by Southeast Asia based players targeting a global opportunity.

Source: Cento research* List of companies are not exhaustive

Publicly-listed company 2020 New Entry

dmpMulti-Vertical Core Payments

Wealth Management & Capital Markets Lending Insurance Data Analytics

>$1B

>$25

0M>$

100M

PAYMENT PRODUCES MOST $100M+ COMPANIES WITHIN FINTECH

15

SE Asia Financial Services and Payment Leaders:Breakdown of Top Primary Segments with Leaders of valuations above $100M, $250M, $1B

Source: Cento research* List of companies are not exhaustive

Publicly-listed company Non-Fintech platforms with strong financial components

dmp

65%

65%

70%

52%

70%

16%

19%

19%

19%

14%

7%

3%

3%

3%

5%

6%

8%

2%

4%

5%

4%

2%

6%

22%

4%

2%

2%

1%

1%

2%

2016

2017

2018

2019

2020

28%

30%

31%

23%

27%

31%

34%

32%

33%

37%

12%

12%

10%

11%

12%

11%

10%

8%

9%

6%

8%

8%

15%

19%

14%

9%

6%

4%

4%

5%

2016

2017

2018

2019

2020

Indonesia Singapore Malaysia Thailand Vietnam Philippines

ALL INVESTMENT: INDONESIA IS MAIN FOCUS AGAIN

16

Source: Cento researchCountry of origin is defined as where the company was founded

and where it is believed to generate its core revenues

Indonesia startups regained their share ofcapital invested in 2020. This is primarilydriven by Gojek investment, with support froman array of mega-deals into companies suchas Bukalapak, Waresix, Kopi Kenangan, andLinkaja.

Malaysia, Thailand, and the Philippines alsosee an increase in allocation, while Vietnamsees a significant drop in 2020 after its later-stage companies already closed large roundsback in 2019.

Notes:The data in this slide excludes companies witha truly regional footprint (e.g. Grab, SeaGroup, and Lazada) and would bias the data ifallocated to a particular country.

Share of capital invested by country

Share of deals done by country

• Indonesia attracts over 2/3 of capital invested in 2020• Malaysia, Thailand, and Philippines also see an increased allocation of capital.

dmp

56%

33%

51%

17%

19%

20%

5%

10%

6%

4%

13%

13%

43%

2%

3%

1%

4%

2018

2019

2020

40%

32%

22%

38%

30%

43%

5%

7%

8%

8%

7%

9%

6%

13%

9%

3%

12%

9%

2018

2019

2020

Indonesia Singapore Malaysia Thailand Vietnam Philippines

FINTECH INVESTMENT: ID MOST CAPITAL. SG MOST DEALS.

17

Source: Cento researchCountry of origin is defined as where the company was founded

and where it is believed to generate its core revenues

Zooming into the financial services andpayment sectors, we observe a differentdynamic compared to the country distributionof all capital invested. Although Indonesia andSingapore still hold the first and second place,Thailand and Malaysia fintech companies arealso prevalent with 10% and 13% capitalallocation.

In terms of the number of deals, Singaporetook the lead at 43%, while Indonesia’s shareof deals continues to decrease from previousyears. Other countries are more equallydistributed.

Notes:The data in this slide excludes companies witha truly regional footprint (e.g. Grab, SeaGroup, and Lazada) and would bias the data ifallocated to a particular country.

Share of capital invested by country, financial services sector

Share of deals done by country, financial services sector

• Capital invested: Indonesia still dominate, but other countries are gaining ground. • # of deals: Indonesia see decreasing share, with Singapore becoming more dominant.

dmp

27 36 56 43 38 43 68 45

2

5

12

14

11

12

15

14

5

1

5

6

52

2013 2014 2015 2016 2017 2018 2019 2020

Trade Exit Known Secondary IPO

LOWER EXIT PROCEEDS GENERATED IN 2020

18

Proceeds realised at exit, $M Liquidity events, #

Source: Cento research*$1.65B of 2018 exit proceeds accounted for Grab acquisition of Uber SEA entities$1.7B of 2019 exit proceeds accounted for YY acquisition of Bigo

• Secondary transactions continue to play a significant role in liquidity generations.• Liquidity from IPO remains limited.

$171 $708 $370 $281 $430 $2,001* $2,423* $456$79

$239$733 $823

$1,883

$168

$557

$455

$378 $9 $35

$931

$208

$7

2013 2014 2015 2016 2017 2018 2019 2020

Trade Exit Known Secondary IPO

dmp

$183

$387

$135

$90

$266

$94

$311

$77

$17

$62

$30$44

$56$45

$57

$30$7 $2 $6 $12

$21$8 $6 $6

2013 2014 2015 2016 2017 2018 2019 2020

Top DecileTop QuartileMedian

EXIT VALUATIONS ALSO DECLINE

19

Exit valuations, $M

Source: Cento research

• Top decile exits declined to under $100M• Top quartile valuation fell while median valuation remains at previous year level.

The size of Investment proceeds and valuationsattract attention from the investment and startupcommunity alike. Nevertheless, we believe abalanced view of the ecosystem requires us toalso understand the size of return the regionproduces.

In 2020, top decile valuation continued to oscillatebetween ~$300M and slightly under $100M. Topquartile valuation fell from the $45M-$55M range,while the median valuation remains at $6M.

Notes:The data is based on acquisition, secondary, andIPO exits with known valuation.

dmp

$7 $9 $16 $9 $9 $19 $12 $8

14

23

37

28

20

25

37

15

2013 2014 2015 2016 2017 2018 2019 2020

$11 $22 $38 $29 $43 $37 $40 $72

4

8

13

10 12 12 13

20

2013 2014 2015 2016 2017 2018 2019 2020

$95 $63 $103 $143 $80 $149 $151 $151

8

4

9

15

8

12

14 13

2013 2014 2015 2016 2017 2018 2019 2020

$1M - $50M EXITS GROW

20

Source: Cento researchAmount, $M

Events, #

Liquidity events and proceeds, <$1M Liquidity events and proceeds, $1M+ to $5M Liquidity events and proceeds, $5M+ to $20M

Liquidity events and proceeds, $20M+ to $50M Liquidity events and proceeds, $50M+ to $100M Liquidity events and proceeds, >$100M

$70 $150 $189 $176 $195 $148 $277 $291

2

5 5 5 6

5

8 9

2013 2014 2015 2016 2017 2018 2019 2020

$67 $239 $220 $163 $175 $271 $404 $221

1

3 3

2

3

4

6

3

2013 2014 2015 2016 2017 2018 2019 2020

$843 $543 $620 $2,743 $1,753 $2,097 $176

3

2 2

6

2

5

1

2013 2014 2015 2016 2017 2018 2019 2020

• $1M+ to $5M exits expanded the most, almost doubling it 2019 amount.• Exits above $50M see sharp decline.

dmp

22%

69%

38%

46%

16%

56%

12%

23%

19%

45%

11%

11%

4%

18%

11%

6%

1%

2%

25%

5%

7%

32%

7%

4%

1%

1%

10%

2016

2017

2018

2019

2020

21%

43%

33%

32%

32%

29%

27%

15%

29%

30%

22%

10%

9%

4%

16%

16%

8%

11%

5%

14%

9%

6%

25%

20%

7%

3%

6%

7%

9%

2016

2017

2018

2019

2020

Indonesia Singapore Malaysia Thailand Vietnam Philippines

SG STARTUPS GENERATE MOST LIQUIDITY

21

Source: Cento researchCountry of origin is defined as where the company was founded

and where it is believed to generate its core revenues

Each country’s dominance in the liquidityproceeds allocation is more dynamic, compared tothe investment proceeds where each countryholds a similar position year over year.

The leading country position continues to swingbetween Singapore and Indonesia, with Singaporeaccounting for 45% this year. Thailand, Malaysia,Vietnam contest for second place. Thailand took2020 with 25%. Vietnam took 2018, and Malaysiaalmost took 2017 and 2019.

The distribution of liquidity events is more evenlydistributed, with the exception of the Philippinesthat did not generate an exit in 2020.

Notes:The data in this slide excludes companies with atruly regional footprint (e.g., secondarytransactions in Grab and Lazada) and would biasthe data if allocated to a particular country.

Share of liquidity proceeds by country

Share of liquidity events by country

• Singapore is the major source of liquidity, contributing almost half of the exit proceeds. • Thailand achieved a new record for the share of liquidity generated, 25% in 2020 vs <6% in past years.

dmpRETAIL SECTOR GENERATES MOST LIQUIDITY

22

Source: Cento research

A quarter of the liquidity generated during the 5years period of 2016 to 2020 is driven by the retailsector, with sizable deals such as Alibaba-Lazadaacquisition and multiple secondaries in the regionmajor eCommerce platforms. Adding localservices, and non-gaming entertainment, the theresectors accounted for over 60% of the total exitvolume.

Other significant sectors include payment andmulti-vertical companies which togethercontributed another quarter of liquidity.

Share of liquidity proceeds by sector, 2016 - 2020

Retail, 27%

Local services, 19%

Payments, 12% Multi-vertical, 12%

Advertising & Marketing, 1%

Others, 2%

Entertainment / Non-Gaming, 16%

Real estate &

Infrastructure, 4%

Financial Services, 3%

Business Automation, 2%

Travel &

Hospitality, 2%

• Top 5 sectors accounted for 86% of total liquidity generated. • Namely retail, local services, entertainment, payments, and multi-vertical companies.

*Non-Gaming Entertainment sector includes YY acquisition of Bigo

dmp

18%2% 5%

12% 12%

46%

30%22%

20%

86%

58%

64%70%

37%64%

16%

58%

12%

31%

23%17%

7%

3%

22%

4% 5%1% 1%

9%3%

40%

2013 2014 2015 2016 2017 2018 2019 2020

Digital Co - SE Asia Digital Co - Others Traditional Co Investment Co

46%53%

42% 43% 40% 44%49% 52%

29%28%

27%19% 29% 19%

21% 16%

21%20%

27%30%

27%

15%

22%20%

4% 5% 8% 4%

21%

8% 12%

2013 2014 2015 2016 2017 2018 2019 2020

Digital Co - SE Asia Digital Co - Others Traditional Co Investment Co

Distribution of liquidity proceeds by acquirer type*

23

Distribution of deals done by acquirer type*

Source: Cento research.*The data is exclusive of IPO events.

*Digital Co – Companies with core business driven by digital technology.Traditional Co – Companies that primarily rely on traditional business models.Investment Co - VC, PE, and investment holding companies.

INVESTMENT COMPANIES ARE A MAJOR SOURCE OF EXITS • VC, PE, and investment holding companies contributed 40% of liquidity proceeds• Acquisition activities from digital companies outside of SE Asia slowed.

dmp$3,900

$3,258

$1,158 $1,130 $1,069$822

$258 $192 $182 $170

China

Singapo

re

Austra

liaUSA

Indon

esiaJa

pan

Malaysia

Thailan

d

Norway UK

110

67

45

30 29 28 28

20 18 17

Singapo

re

Indon

esiaJa

pan

Thailan

d

Malaysia

USA

Vietnam

Philipp

inesChina

Austra

lia

Top 10 acquirers’ countries of origin, by deals done, 2013-2020, #

24

Source: Cento researchBased on trade exit and secondary events with known acquirers

Top 10 acquirers’ countries of origin, by proceeds, 2013-2020, $M

SE AsiaOther Asia Others

ASIA-BASED ACQUIRERS PREDOMINATE• Majority of acquisition capital are from outside of Southeast Asia• While local acquirers are the key source for the number of deals done.

dmpMALAYSIA MAINTAINS HIGH RATIO OF EXITS TO INVESTMENTS

25

Indonesia Singapore Malaysia

Thailand Vietnam Philippines

Source: Cento research

Liquidity / Investment Ratio

Capital invested, $M

Exit Proceeds Generated, $M

$1,512 $4,833 $5,630 $182 $1,199 $746

0.1x

0.2x

0.1x

0 .0x

0 .1x

0 .1x

0 .2x

0 .2x

0 .3x

0 .3x

$ 0

$ 1,0 0 0

$ 2,0 0 0

$ 3,0 0 0

$ 4,0 0 0

$ 5,0 0 0

$ 6,0 0 0

2015-16 2017-18 2019-20

$605 $1,333 $1,466 $647 $322 $576

1.1x

0.2x0.4x

0 .0x

0 .2x

0 .4x

0 .6x

0 .8x

1 .0x

1 .2x

$ 0

$ 20 0

$ 40 0

$ 60 0

$ 80 0

$ 1,0 0 0

$ 1,2 0 0

$ 1,4 0 0

$ 1,6 0 0

2015-16 2017-18 2019-20

$103 $330 $996 $84 $310 $121

0.8x0.9x

0.1x

0 .0x

0 .2x

0 .4x

0 .6x

0 .8x

1 .0x

1 .2x

$ 0

$ 20 0

$ 40 0

$ 60 0

$ 80 0

$ 1,0 0 0

$ 1,2 0 0

2015-16 2017-18 2019-20

$218 $230 $362 $520 $173 $326

2.4x

0.8x 0.9x

0 .0x

0 .5x

1 .0x

1 .5x

2 .0x

2 .5x

3 .0x

$ 0

$ 10 0

$ 20 0

$ 30 0

$ 40 0

$ 50 0

$ 60 0

2015-16 2017-18 2019-20

$234 $270 $421 $38 $31 $176

0.2x0.1x

0.4x

0 .0x

0 .1x

0 .1x

0 .2x

0 .2x

0 .3x

0 .3x

0 .4x

0 .4x

0 .5x

$ 0

$ 50

$ 10 0

$ 15 0

$ 20 0

$ 25 0

$ 30 0

$ 35 0

$ 40 0

$ 45 0

2015-16 2017-18 2019-20

$67 $93 $123 $41 $4 $137

0.6x

0.0x

1.1x

0 .0x

0 .2x

0 .4x

0 .6x

0 .8x

1 .0x

1 .2x

$ 0

$ 20

$ 40

$ 60

$ 80

$ 10 0

$ 12 0

$ 14 0

$ 16 0

2015-16 2017-18 2019-20

• Indonesia absorbed the highest investment amount, but the ability to produce liquidity is to be confirmed. • Thailand and Philippines see an uptick in the liquidity / investment ration, albeit still small in volume.

dmp

Methodology

dmpMETHODOLOGY

27

In this report, we analysed and verified close to 3,800 financing and liquidity events. Inevitably, a fewlarge deals would avoid detection on occasion of exceptionally secretive nature of the transaction ordue to the methodology we apply. It is also our impression that our pre-Series A deals data in theregion is far from exhaustive due to a sheer volume of deals in $ 10 - 250K range happening in themarket – while total dollar value of inflow and outflows is unlikely to be impacted heavily, do take our“number of deal” assessments for pre-Series A with a large handful of salt. Finally, as new facts cometo light and as erstwhile announcements are verified, we adjust our databases retroactively, leading tomild inconsistencies between various versions at the same period.

Category definitions and company profiles include:

This report aims to describe the state of financing and liquidity generated by companies focused ondigital technology-driven opportunities in Southeast Asia. The exact definition of what a digitaltechnology-driven opportunity constitutes is a subject of much debate. While leaving biotech, newmaterials and space tech out is relatively straightforward (but including software and digital servicesenabling these industries), telling an offline company with digital elements apart from a business wherevalue creation is primarily tied to either its technology core or its digital distribution is anything butsimple.

We have generally taken a view that if something is valued as a technology company, we can trust itsinvestors that it probably is. At the same time, we also endeavour to exclude categories that, whileadjacent to digital economy, tend to attract non-VC capital to a degree where their financing /liquidation events interfere with the signal from the rest of the ecosystem (notably, excluding thecompanies with valuations determined by token economics). Furthermore, we currently do not includetraditional TV stations, content producers, sports and entertainment brand, non tech-enabled consumerbrands, telcos, IT infrastructures and system integration companies as well as holding level entities thatbuy or develop technologies in addition to their core business into our reporting.

Key premises:

Numbers and conclusions in this study rely upon a company’s reported last round valuation. At best thisis a partial reflection of a company’s true value. To all in our audience who appreciate the importance offinancing terms over headline valuations, and who recognise that a more complete understanding of anyunderlying business is helpful, we apologise. To atone for this oversimplification, we’d like to take thisopportunity to give a commendation to the great work being done by a few in academia who probedeeply into the contradictory nature of how tech valuations are reported, and produce splendid researchthat will one day help us as an industry upgrade our reporting systems and, perhaps, change how techcompany narratives are formed. In this report, our recognition goes to Will Gornall and Ilya A.Strebulaev (professors at the Sauder School of Business at the University of British Columbia and theStanford Graduate School of Business, respectively) for their comprehensive work on “Squaring VentureCapital Valuations with Reality”, available here:https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2955455 and with media coveragehttp://nymag.com/intelligencer/2018/11/fake-unicorns-are-running-over-the-venture-capital-industry.html

Geographies covered:

This iteration of our report does not make an attempt at covering some of the newer digital ecosystemswithin ASEAN beyond the customary six countries, or the developments in countries starting to gravitatetowards SE Asia venture scene such as Pakistan, Bangladesh, Sri Lanka, Hong Kong, and Taiwan.

Data sources and completeness :

Our data is compiled from a number of sources, although we primarily rely on public pressannouncements and community disclosures from the companies and their investors. Our teamresearches the validity of claims to an extent possible and supplements incomplete information withinsights from our own industry sources and, on occasion, somewhat educated guesswork.

dmpMETHODOLOGY

28

Company classification:

Country of origin:

Determined by the country in which the company was founded, and has its primary base of operation(defined in terms of revenue, if known). At the (subjective) point where the company has bothoperations in multiple countries in Southeast Asia and substantial revenues generated in multiplecountries, then it may be classified as Southeast Asia / regional in the country of origin.

Sector classification:

Cento’s definition of the industry segment in which the company’s primary business focus sits. A fulltaxonomy of sector allocation is listed below. In cases where a company focus on multiple sectors withdifferent units generating thought to generate substantial revenue, then multi-vertical category is used.We also note that a company’s sector may change as the company progresses; the company’s sectoris evaluated according to the primary business focus during the event of financing.

• Advertising & Marketing Technology: companies that facilitate the acquisition of customersincluding coupons and rebates, price comparisons and affiliate marketing

• Business automation: tools that automates non industry-specific business activities such as CRM,ERP, workplace communication tools, etc.

• Comms & communities: social networks and dating

• Education: provision of goods and services revolving teaching and learning, including adult trainingand education

• Employment: companies that manage and facilitate the management of employees includingonboarding, benefit, payroll, etc.

• Entertainment/ Gaming: gaming development, distribution and publishing

• Entertainment/ Non-gaming: content production and news aggregation

• Financial Services: companies that apply technology into traditional banking services i.e. lending,wealth management, etc.

• Healthcare: provision of goods and services revolving around medical and wellness servicesincluding, but not limited to, e-pharmacy, medical tourism and telehealth

• Local Services: platforms that connect local merchants/ service providers to consumers in an urbansetting including, but limited to, ride-hailing services, local search and directory and food delivery

• Logistics: companies that facilitate the movement of goods including, but not limited to, acquiring,storing and transporting of goods

• Multi-vertical: our name for diverse digital businesses such as Grab & Gojek, often called ‘super-apps’

• Payments: companies that facilitate movement of capital

• Real Estate and infrastructure: construction, buying & selling and management of real estate assets,including the tools facilitating those activities

• Retail: companies that sell or rent goods using internet technology, including tools that facilitate thoseactivities e.g. Store-front management software, POS systems, etc.

• Travel: tourism and hospitality

dmpMETHODOLOGY

29

Sector classification – financial services:

• Banking as a Service: companies that digitise basic banking functions. This includes digital banksthat is licensed to provide financial services directly to clients, software layers that help bankscommunicate to external software, and companies that supplement banks’ process such as debtcollection.

• Core Payments: companies that enable a transfer of cash/cash equivalent between two or moreparties, including wallets and remittances.

• Data Analytics & Scoring: the utilisation of data to predict the credibility of consumers or businesses.

• Insurance: companies operate or assist in the distribution, product design, and underwriting ofinsurance products.

• Wealth Management & Capital Markets: companies engage in asset allocation to generate higherreturns, including platform that enable clients to manage their assets and those that do so on theclients’ behalf.

• Lending – Consumer / Business: Companies that facilitate individuals’ or businesses’ exchange ofcash/cash equivalent for a secured and unsecured repayment contract.

• Multi-vertical: companies that generate businesses from multiple financial products. This includeswallets that provide other financial services and multi-product financial comparison platforms.

Currency:

$ refers to United States Dollar (US$) unless otherwise stated.

Deal definitions:

Deal stage:

Each series definition is determined as follows:

- Pre-Series A: Purpose of investment tends to be building the idea/team; in some cases, the companygenerates revenue.

- Series A: The product has been built and proven via initial but repeatable revenue. Investmentpurpose tends to be establishing domestic position, and sometimes scaling regionally.

- Series B: Investment purpose tends to be building scale, either domestically or regionally.

- Series C+: any amount invested later than Series B. Series C, Series D, later series investments,pre-IPO, mezzanine.

We have also estimated a particular company’s valuation through a recent substantial financing orliquidity event and known business developments

Deal type:

We focus mainly on venture capital deals – investments made by fund entities into early stage startups,whether they are from independent funds of corporate venture capital entities. This is a subset of thetotal number of early stage tech deals in the region.

We separate the following from most of our data, apart from the ‘total capital invested and total dealsdone’ chart:

- Corporate transfers: events where a corporate entity funds an entity in the region in which it owns amajority or significant minority stake (e.g. Rocket Internet, Lippo Group)

- Project financing: A deal which was a partnership for an identified purpose – e.g. Grab-Honda.

- Non-Southeast Asia deals: e.g. India and China focused companies that happen to use Singapore fortheir corporate domicile.

dmp

www.cento.vc

+65 6816 2810

Office address: Level 20, Capital Tower, 168Robinson Road, Singapore 068912

Mailing address: Cento Ventures, 3 Church Street,Level 8, Singapore 049483

Contact

30

![[GUIDE] Ubuntu Debian CentO...](https://static.fdocuments.in/doc/165x107/55340b6c4a795936578b49ce/guide-ubuntu-debian-cento.jpg)