Source documents and journalizing process in a merchandising business

-

Upload

aileen-manc -

Category

Education

-

view

983 -

download

5

Transcript of Source documents and journalizing process in a merchandising business

SOURCE DOCUMENTS IN A

MERCHANDISING BUSINESS

• Also known as Business Documents,

• Provides evidence that a business transaction had

occurred.

• It tracks the history of business’s accounting records.

COMMONLY USED DOCUMENTS:a. Purchase invoice b. sales and purchase orders c. delivery receipts d. debit and credit memoranda e. vouchers f. Official receipts

1. Purchase invoice: or bill. Issued by the seller to the buyer to indicate that merchandise has been delivered. Basis of recording sales revenue on the seller’s book (sales invoice) and purchases on the buyer’s book (purchase invoice)

SALES INVOICE INFORMATION: (taken from Annex C of BIR Revenue Memorandum)A. Name and contact details of the seller. B. Tax details of the sellerC. Word “Invoice”D. Invoice numberE. Name and contact details of the buyerF. Date of the invoiceG. Credit termsH. Number of units deliveredI. Unit of measure for goods deliveredJ. Description of goodsK. Unit selling price of goodsL. Total amount of goodsM. Authorized signature.

SALES ORDER PREPARE SALES INVOICE

PURCHASE ORDER SALES ORDERPREPARE

2. Sales order is prepared when the buyer informs the seller that he wants to buy from the seller through a purchase order • If the buyer does not prepare a purchase order. The sales order only includes the ff:

a. name and contact details of the buyer b. description of goods c. number of units ordered.

3. DELIVERY RECEIPT: document issued by the seller to confirm if merchandise has been delivered to the billing address. CONTENT: a. Name of contact details of the sellerb. Tax details of the sellerc. Word “Delivery Receipt”d. Receipt numbere. Name and contact details of the buyerf. Date of the receiptg. Credit termsh. Number of units deliveredi. Unit of measure for goods deliveredj. Description of goodsk. Authorized buyer signature

6. DEBIT AND CREDIT MEMORANDUM: CREDIT MEMO: A transaction that reduces Amounts Receivable from a customer eg. The customer could return damaged goods.

Credit memo request is a used in complaints If the price calculated for the customer is too high

DEBIT MEMO: is a transaction that reduces Amounts Payable to a vendor because; you send damaged goods back to your vendor.

Debit memo request is used in complaints If the prices calculated for the customer were too low.

7. PAYMENT VOUCHER: • attached to supporting documents that requires

payment (invoice, company's purchase order and other information needed to process the seller’s invoice for payment.)

• an internal document used in a company's accounts payable in order to collect the necessary documentation and approval before paying a seller’s invoice.

CASH VOUCHER: approval of payment in cashCHECK VOUCHER: approval of payment in check

8. OFFICIAL RECEIPT: it acknowledge the receipt of cash or check. Used by the collecting party as evidence of payments. Required by the BIR. Failure to issue this may lead to understatement of revenues which is the basis of tax evasion. INFORMATION INCLUDED: a. Name and contact details of the sellerb. Tax details of the sellerc. Word “Official Receipt”d. Receipt numbere. Name and contact details of the buyerf. Date of receiptg. Amount in number and wordsh. Sales invoice number or reference

numberi. Authorized signature

• Merchandising transactions are recorded both in general and special journal.• A normal debit balance is increased by a debit and decrease by a credit• A normal credit balance is increased by a credit and decrease by a debit.

NORMAL DEBIT BALANCEAssets

Contra LiabilityOwner, DrawingContra Revenue

Costs and expenses

NORMAL CREDIT BALANCEContra Asset

LiabilitiesOwner, Capital

RevenuesContra Cost

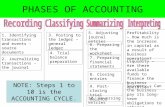

STEP 2: JOURNALIZING

TYPES OF ACCOUNTS

EXAMPLES

ASSETS Cash, Accounts Receivable, Merchandise Inventory, Prepaid Insurance, Office Supplies, Store Furniture and Fixtures, Store Equipment, Office Equipment, Delivery Equipment, Transportation Equipment

CONTRA ASSETS

Allowance for Doubtful Accounts, Accumulated Depreciation – Store Furniture and Fixture, Store Equipment

LIABILITIES Accounts Payable, Unearned Sales Revenue

REVENUES Sales Revenue

CONTRA REVENUES

Sales Returns and Allowances, Sales Discounts

COST AND EXPENSES

Purchases, Freight-in, Freight-out, Sales Salaries, Office Supplies Expense, Store Supplies Expense

CONTRA COST

Purchase Returns and Allowances, Purchase Discounts

1. a. Purchase of merchandise on cash. Purchases xx

cash xxb. Purchase of Merchandise on account

Purchases xxAccounts Payable xx

c. Purchase of merchandise with down paymentPurchases xx

Cash xxAccounts Payable xx

2. a. Purchase returns and allowances (cash basis)Cash xx

Purchase Returns and Allowances xxb. Purchase returns and allowances (on account)

Accounts Payable xxPurchase Returns and Allowances xx

c. Purchase returns and allowances (with down payment)Accounts Payable xx

Purchase Returns and Allowances xx

3. Partial payment of account with the supplierAccounts Payable xx

Cash xx4. a. Full payment of account beyond discount period

Accounts Payable xxCash xx

b. Full payment of account within discount periodAccounts Payable xx

Cash xxPurchase Discount xx

5. a. Sale of merchandise on cash basisCash xx

Sales xxb. Sale of merchandise on account

Accounts Receivable xxSales xx

5. c. Sales of merchandise with down paymentCash xxAccounts Receivable xx

Sales xx6. a. Sales returns and allowances (cash basis)

Sales Returns and Allowances xxcash xx

b. Sales returns and allowance (on account)Sales Returns and Allowances xx

Accounts Receivable xxc. Sales returns and allowances (with down payment)

Sales Returns and Allowances xxCash xx

7. Partial collection of customer accountCash xx

Accounts Receivable xx

8. a. Full collection of account beyond discount periodCash xx

Accounts Receivable xxb. Full collection of account within discount period

Cash xxSales Discount xx

Accounts Receivable xx9. a. Payment of freight on merchandise purchase

Freight – out xxCash xx

b. Payment of freight on merchandise soldFreight – in xx

Cash xx10. a. (1) Purchase of supplies on cash basis

Supplies xxCash xx

10. a. (2) Returns on supplies purchaseCash xx

Supplies xx10. b. (1) Purchase of supplies on account

Supplies xxAccounts Payable xx

b. (2) Returns of supplies purchaseAccounts Payable xx

Supplies xx11. a. (1) Purchase of equipment on cash basis

Equipment xxCash xx

a. (2) Allowance granted on equipment purchaseCash xx

Equipment xx

11. b. (1) Purchase on equipment with down paymentEquipment xx

Cash xxAccounts Payable xx

b. (2) Allowance granted on equipment purchaseAccounts Payable xx

Equipment xx12. Incurrence of expenses

________Expense xx________Payable xx

13. (1) Payment of expense________Expense xx

Cash xx(2) Payment of expense (already recorded in #12)

________Payable xxCash xx

14. a. (1) Initial investment of merchandise by the ownerMerchandise Inventory xx

Owner, Capital xxa. (2) Initial investment of merchandise with liability

Merchandise Inventory xxAccounts Payable xxOwner, Capital xx

14. b. Additional investment of merchandise by the ownerPurchases xx

Owner, Capital xx15. Withdrawal of merchandise by owner

Owner, Drawing xxPurchases xx

JOURNALIZING IN GENERAL AND SPECIAL JOURNAL

Four Common Types of Journal

1. Sales Journal (SJ): use to record sales of merchandise on account. 2. Purchase Journal (PJ): use to record purchase of merchandise on account. 3. Cash Receipt Journal (CRJ): use to record receipt of cash from whatever source. 4. Cash Disbursement Journal (CDJ): use to record payment of cash for whatever purpose. 5. General J0urnal (GJ): use to record transactions which cannot be recorded on any of the

specialized journal.

NOTE: CV (chech voucher), SI (Sales Invoice), OR (Official receipt)

DATE (PURCHASED RELATED) TRANSACTIONS

JUNE 11 Purchase from A merchandise on cash basis, P10,000 [CV#005]

11 Paid freight on merchandise purchased from A, P800 [CV#006]

12 Purchased from B merchandise worth P15,000 on terms 2/10, n/30

13 Purchased from C merchandise worth P20,000 on terms, 50% down, balance 2/10, n/30 [CV#008]

14 Returned P500 worth of merchandise purchased from A [OR#004]

15 Returned P1,000 worth of merchandise purchased from B

16 Returned P1,500 worth of merchandise purchased form C

17 Paid P2,000 in partial payment of account with C [CV#010]

22 Paid in full account with B [CV#012]

30 Paid in full account with C [CV3013]

DATE (SALES – RELATED) TRANSACTIONS

JUNE 15 Sold to D merchandise on cash basis, P10,000 [OR#005]

Paid freight on merchandise sold to D, P800 [CV#009]

16 Sold to E merchandise worth P15,000 on terms 2/10, n/30 [SI#001]

17 Sold to F merchandise worth P20,000 on terms 50% down, balance 2/10, n/30 [OR#006]

18 Received the return of P500 worth of merchandise sold to D [CV#011]

19 Received the return of P1,000 worth of merchandise sold to E

20 Received the return of P1,500 worth of merchandise sold to F

21 Collected P2,000 from F for partial payment of account [OR#007]

26 Collect in full the account with E [OR#008]

30 Collect in full the account with F [OR#009]