Some stylized facts of Russian private pension funds

description

Transcript of Some stylized facts of Russian private pension funds

Some stylized facts of Russian private pension funds

Didenko AlexanderInternational Financial Laboratory

Questions

• What funds are efficient?• What metrics to use?• Is there any persistence?• Do they inform customers about risks?• Do they have behavioral biases?

Dataset and methods

• 30 quarters * 30 private pension funds• IIIQ’ 05 – IVQ’ 12• Data Envelopment Analysis • Malmquist productivity index• T- and KS-tests• Granger causality

DEA - conceptual model

Input 1

Input 2

Input N

Production Plans

Output 1

Output 1

Output 1

Data envelopment analysis

• We have j DMUs• Which use v inputs x• To produce u outputs y• DEA-efficiency is

defined as a ratio of a weighted sum of outputs to a weighted sum of inputs

Example from Coopers et al.

Malmquist index

• Decomposition of dynamic DEA to three components:– technical efficiency change on the best practice

technologies – change in scale efficiency– technical change measured as a shift in the

benchmark technology – which sum to total change

DEA – general model for funds

Financial Capital

Risk

Human Capital

Pension Funds

Return

Market Share

DEA – our specificaion

CVaR

E+R Ratio

Pension Funds

Active return

NAV Share

Diversification

CVaR

• Wuertz, Chalabi, Chen, Ellis (2009);

• RUPAI, RUPCI, RGBI• Alpha=0.05• Weekly data• Average quarterly CVaR

Diversification

• There are plenty of D. measures• We use that of Goetzmann, Kumar, 2008

H1. Funds convey useful info in names

• “professionally-looking” terms to indicate attitude to risk– “Balanced”– “Aggressive”,– etc.

• do funds really inform potential contributors about riskiness?• we classified funds by 5 categories of riskiness based on

names• affinity between CVaRs distribution of 5 classes• affinity of random subsamples inside classes• two-sample Kolmogorov-Smirnov and Student’s t tests

Affinity of CVaR distributions

• Classes 1, 2, 3 are way more homogeneous than any other class or total sample

• Classes 1 and 3 are very close• Class 4 is similar to class 2 and class 3• Only class 5 is REALLY different:– Distinctive both by T and KS measures– Homogeneous (after many resamplings)

H1. Busted/plausible?

BUSTED!

H2. Are funds prone to herding?

• We have information about aggregated portfolio structure

• We can test for– Correlation – Granger causation

• in changes of portfolio shares• Between funds and between quartiles of

capitalization/efficiency

Granger causality: equities

Sum of causation in eq.chng by fund

Sum of causation by cap quartile

We tested the same for:

• Malmquist efficiency quartiles• All 4 submeasures– No result

• Matrix of granger causation for randomly generated matrices with same proportions, means, sd’s– Results are similar to real granger-causation

matrices

H2. Herding/!Herding?

PLAUSIBLE

What specification to use?

• DRS, VRS, IRS, CRS, FDH? • Input/output/two-way?• We want to have some predictable measure• to have good logit-regression, we need sample

with some funds efficient and some – not• too much “efficiency” => bad

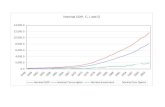

Dea

Malmquist productivity

• Same questions about specification• For our results be comparable • we have to use the same set of specifications

for DEA and Malmquist productivity

Window dressing?

Wow!

Dropping expense+reward ratio

H2. Funds do not window-dress?

PLAUSIBLE