SM-Unit-3 BCG-mat

-

Upload

ankur-rastogi -

Category

Documents

-

view

217 -

download

0

Transcript of SM-Unit-3 BCG-mat

-

7/29/2019 SM-Unit-3 BCG-mat

1/36

23-1

Unit-3Corporate Parenting,

BCG- Matrix and Porters Diamond.

-

7/29/2019 SM-Unit-3 BCG-mat

2/36

23-2

Corporate Parenting

The concept Corporate Parenting views a corporation in terms ofresources and capabilities that be used to build businessunit value as well as generate synergies across businessunits. According Campbell, Goold and Alexander-

Multibusiness companies create value by influencing orparenting the business they own. The best parent companiescreate more value than any of their rivals would if theyowned the same business. Those companies have what wecall parenting advantage

Corporate parenting generates corporate strategy by focusing oncore competencies of its parent corporation and on thevalue created from the relationship between the parent theparent and its business.

-

7/29/2019 SM-Unit-3 BCG-mat

3/36

23-3

Developing a CorporateStrategy

According to Campbell, Goold and Alexander that the

search for appropriate corporate strategy involves

three analytical steps:

1. Examine each Business unit (or target firm in case ofacquisition) in terms of its strategic factors.

2. Examine each Business unit (or target firm) in terms of

areas in which performance can be improved

3. Analyze how well the parent corporation fits with thebusiness unit (or target firm)

-

7/29/2019 SM-Unit-3 BCG-mat

4/36

23-4

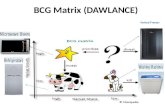

BCG MatrixBCG-Matrix was developed by Bruce Henderson in The

year 1970 for Boston Consulting Group to help

corporation analyzing their business units or Product

lines. In general, for large Companies, there is always a

problem of resource allocation amongst its businessunits in some logical/rational ways. To overcome such

problem, Boston Consulting Group (BCG) has developed

a Model called BCG Matrix. It also called Growth share

Matrix.

The BCG model requires management to plot the position

of their business units (or products) against two axes:

1. Relative market share. 2. Market growth rate.

-

7/29/2019 SM-Unit-3 BCG-mat

5/36

23-5

- BCG argue that all firms in the industry face essentially the same experience curveeffects. Consequently as the industry progresses the unit costs of each participant

will fall. Inevitably this will lead to falling prices. The firm that survives this process

will be the firm with the lowest costs which, by extension, will be the one with the

highest cumulative volume. The conclusion is that domination of the market is

essential for low costs and hence competitive success. Hence high relative marketshare is sought within the BCG matrix.

High relative share therefore brings several

1. . The enjoyment of lower unit costs and therefore higher current margins than

competitors at the same price levels.

2. The ability to be a price leader- if the firm decides to cut price, others must follow

to maintain their sales, but in so doing may find themselves selling at below unit

costs.

3. The dominance of the market means that the product will become the benchmark

product- the real thing against which others may be seen as pale imitations.

-

7/29/2019 SM-Unit-3 BCG-mat

6/36

23-6

-

7/29/2019 SM-Unit-3 BCG-mat

7/36

23-7

Boston Consulting Group Matrix

Portfolio of Strategic Business Units

High Market Share Low

IndustryGrowth Rate

High

Low$$$

1 2

3 4cash cows

stars question marks

dogs

-

7/29/2019 SM-Unit-3 BCG-mat

8/36

23-8

1. Stars. These are products that are in high

growth markets with a relatively high share of

that market. Stars tend to generate high

amounts of income. Keep and build your stars.

2. Cash Cows. These are products with a high

share of a low growth market. Cash Cows

generate more than is invested in them. So keepthem in your portfolio of products for the time

being.

Boston Consulting Group Matrix

-

7/29/2019 SM-Unit-3 BCG-mat

9/36

23-9

3. Question Marks (Problem Children). These are

products with a low share of a high growth

market. They consume resources and generate

little in return. They absorb most money as youattempt to increase market share.

4. Dogs. These are products with a low share of

a low growth market. They do not generate cashfor the company, they tend to absorb it. Get rid

of these products.

Boston Consulting Group Matrix

-

7/29/2019 SM-Unit-3 BCG-mat

10/36

23-10

Strategies to deal with

. Stars: stars are Very competitively strong due to high relative marketshare, although their current results will be poor due to the need to invest

considerable funds into keeping up with the market growth rate. The

strategy here is to hold market share by investing sufficient to match

the commitment of rivals and the requirements of the marketplace.

Cash cows. These are mature products (low growth rate) which retain a

high relative market share. The mature stage means that their prospects

are limited to falling prices and volumes. Therefore investment will be

kept under strict review and instead the priority is to maximize the

value of free cash flows through a policy of harvesting the product.

Harvest means to minimize additional investment in the product tomaximize the case the division is spinning off. This cash can be used

to support the question mark products as well as satisfy demands for

dividends and interest. Holding may also be used for early-mature stage

products where the market may repay the extra investment.

-

7/29/2019 SM-Unit-3 BCG-mat

11/36

23-11

Question marks (Problem children). These products are in a

high growth market which means that it is early in the product life cycle andtherefore has the potential to repay present investment over its life cycle.

Indeed the high market growth rate means that the firm will already be

investing considerable sums in it. The low relative market share, however,

means that this business unit is unlikely to survive in the long run because it

will have a lower cost competitor. Management must decide betweeninvesting considerably more in the product to build its market share or

shutting it down now before it absorbs any further investment which it

will never repay. Investing to build can include: Price reductions;

Additional promotion & securing of distribution channels; Acquisition

of rivals; Product modification.

-

7/29/2019 SM-Unit-3 BCG-mat

12/36

23-12

Dogs: Dogs come into being from two directions: Formercash cows that have lost market share due to managements refusal toinvest in them; Former question marks which still had a low relative share

when the market reached maturity. In either case the BCG recommends

divestment of the product or division. This can mean selling it to a rival, or

shutting it down to liquidate its assets for investment in more promising

business units.

In deciding whether or not to divest a dog, the following considerations

should be taken into account:

(a) Whether the dog still provides a positive contribution or not.

(b) What is the opportunity cost of the assets it uses? For example, the

contribution from products that could be made using its factory or the interest

on the net proceeds from liquidation of the SBU.

(c) The impact on the rest of the portfolio that would result from divesting the

SBU.

-

7/29/2019 SM-Unit-3 BCG-mat

13/36

23-13

Boston Consulting Group Matrix

Key

Each circle represents

one of the firmsbusiness units

Size of circle

represents the relative

size of the business

unit in terms of

revenue

-

7/29/2019 SM-Unit-3 BCG-mat

14/36

23-14

BENEFITS OF THE BCG MATRIX

BCG model is helpful for managers to evaluate balance in the firms

current portfolio of Stars, Cash Cows, Question Marks and Dogs.

It provides a base for management to decide and prepare for future

actions.

The model is simple and easy to understand. LIMITATIONS OF THE BCG MATRIX :

High market share is not the only success factor.

There is no clear definition of what constitutes .

The model uses only two dimensions market share and growth rate.This may tempt management to emphasize a particular product, or to

divest prematurely.

The model neglects small competitors that have fast growing market

shares.

-

7/29/2019 SM-Unit-3 BCG-mat

15/36

23-15

FACTOR CONDITIONS

DEMANDCONDITIONS

RELATING AND

SUPPORTINGINDUSTRIES

STRATEGY, STRUCTURE,

AND RIVALRY

Porters National Diamond Framework

1. FACTOR CONDITIONSHome grownresources/capabilities more importantthan natural endowments.

2. RELATED AND SUPPORTING INDUSTRIESKey role ofindustry clusters3. DEMAND CONDITIONSDiscerning domestic customers drive quality & innovation

4. STRATEGY, STRUCTURE, RIVALRY. E.g. domestic rivalry drives upgrading.

-

7/29/2019 SM-Unit-3 BCG-mat

16/36

23-16

Porters Diamond Model

Michael E. Porter introduced a diagramthe Porter

diamondthat has become very well known

It Focuses on four central aspects of the home base, which

Porter views as the determinants of competitive advantage Factor conditions

Demand conditions

Related and supporting industries

Firm strategy, structure, and rivalry

Main argument: Nations are most likely to succeed in

industries or industry segments where the national diamond

is most favorable

-

7/29/2019 SM-Unit-3 BCG-mat

17/36

23-17

Factor conditions

Porter considers labor, land, natural resources, andphysical capital to be basic factors that are largelyinherited

More important from Porters point of view areadvanced factors that are created which include

Sophisticated infrastructure

Labor educated and trained in very specific ways

Focused research institutions

Porter also makes a distinction between

Generalized factorscan be used in a number of differentindustries

Specialized factorstailored for use in specific industries

-

7/29/2019 SM-Unit-3 BCG-mat

18/36

23-18

Demand conditions

It Stresses three aspects in the home base

Demand composition

Sophisticated, demanding, and anticipatory(anticipates trends in global demand) homedemand contributes to firms success

Demand size and pattern of growth

Large, rapidly-growing, and early homedemand are positive aspects of the home base

Degree of internationalization

The more home demand is synchronized withinternational demand trends, the more itcontributes to firms competitiveness

-

7/29/2019 SM-Unit-3 BCG-mat

19/36

23-19

Related and supporting industries

Supplying industries in the home base has several

advantages in downstream industries

Efficient, early, rapid, and sometimes preferential

access to the most cost-effective inputs

Ongoing coordination

Innovation and upgrading

A competitive domestic supplier industry is better than

relying on well-qualified foreign suppliers.

-

7/29/2019 SM-Unit-3 BCG-mat

20/36

23-20

Firm strategy, structure, and rivalry

Firm strategy, structure, and rivalry

One country differs from another with regard to

managerial systems and philosophies and with regard

to capital markets Institutional environments that allow firms to take a

long-term view contribute positively to competitiveness

Presence of a large number of competing firms or rivals

in the domestic industry Competition among firms is necessary for allocative efficiency

in a market system, but domestic rivalry contributes to dynamic,

technological efficiency

-

7/29/2019 SM-Unit-3 BCG-mat

21/36

23-21

The role of government

The role of government in Porter's Diamond Model is

"acting as a catalyst and challenger; it is to encourage -

or even push - companies to raise their aspirations and

move to higher levels of competitive performance " .

They must encourage companies to raise their

performance, stimulate early demand for advanced

products, focus on specialized factor creation and to

stimulate local rivalry by limiting direct cooperation and

enforcing anti-trust regulations.

-

7/29/2019 SM-Unit-3 BCG-mat

22/36

23-22

Criticism

Criticism on Porter's national diamond model resolves

around a number of assumptions that underlie it. As

described by Davies and Ellis:

"sustained prosperity may be achieved without a nationbecoming 'innovation-driven', strong 'diamonds' are not in

place in the home bases of many internationally

successful industries and inward foreign direct

investment does not indicate a lack of 'competitiveness'

or low national productivity".

Porter generalised from the American case; for

developing countries the model may be wrong.

-

7/29/2019 SM-Unit-3 BCG-mat

23/36

23-23

Portfolio Analysis

Meaning of Business Portfolio: a business portfolio isthe collection of strategic business units or product lines that make acorporation. The optimal business portfolio is one that fits perfectly to the

companys strengths and helps to exploit the most attractive market.

In portfolio analysis, top management views its product lines and business

units as series of investments from which it expects a profitable return. Two most popular portfolio analysis techniques are there. The BCG Growth

share matrix and GE Nine cell matrix.

Objectives of Portfolio Analysis:

1. To analyze the current business portfolio and decide which SBU or Productline should receive more or less investments.

2. To Develop growth strategies for adding new products and business to the

portfolio.

3. To decide which product or business should no longer be remained.

-

7/29/2019 SM-Unit-3 BCG-mat

24/36

23-24

Steps in portfolio approach

1. Define the business unit or product line.

2. Classify these SBUs or product lines on a portfolio grid according to the

competitive position and attractiveness.

3. Using the framework, assign strategic mission to each unit for growth and

financial objectives.factors affecting Portfolio Analysis

1. Mission, Vision, Objectives, goals of the organisation

2. The value system of the promoters and expectations of the investors.

3. The risk taking capacity of the management

4. The stage of PLC.

5. The golobalisation and Liberalisation policies.

6. The external competitive environment.

7. The resource availability.

-

7/29/2019 SM-Unit-3 BCG-mat

25/36

23-25

Advantages of portfolio analysis

1. Helps in strategy formulation

2. Provides rationale behind corporate planning for investment or divestment.

3. It provides guidelines in allocating corporate resources.

4. It conveys information about performances of individual business units or product

lines

5. It helps in taking strategic decision

6. It helps in the analysis of strengths and weakness.

7. It suggests flexible solutions of various problems.

Limitations of portfolio analysis:

1. It can be a difficult task to analyze each individual business unit or product line.

2. It is time consuming

3. It is very difficult to define the product or market segment

4. It is very difficult to decide in which stage of PLC is the product line

5. The simple matrix models are not very accurate.

-

7/29/2019 SM-Unit-3 BCG-mat

26/36

23-26

GE Nine cell Matrix

General Electronics with the help of McKinsey & Company Consulting firm,developed a more complicated matrix with Nine Cell called GE Nine cell

matrix. Four steps are followed to analyse the portfolio

1. Selecting criteria for rating industry.

2. Selecting the key factors needed for the success of each factors3. Plot a matrix structure

4. Plot firms future portfolio.

-

7/29/2019 SM-Unit-3 BCG-mat

27/36

23-27

GE Nine Cell Portfolio Matrix

Components of Industry attractiveness

Nature of rivalry

Number, Size & strength of competitors, Price wars

Strength of buyers and sellers

Ease of New Entrants

Economic Factors

Market saturation or growth, Capital intensity, Profitability

Components of Business strength

Cost advantage, Quality image, Manufacturing flexibility,

Delivery speed, Liquidity, Profitability, Skillful personnel

-

7/29/2019 SM-Unit-3 BCG-mat

28/36

23-28

GE Nine Cell Matrix

High Medium Low

High Invest andGrow

Selective

Growth

Grow or

Let Go

Medium

SelectiveGrowth

Grow orLet Go

Harvest

Low

Grow or Let

Go

Harvest Divest

Industry Attractiveness

Business

Strength

Based on the subjective assessments on the levelsof market attractiveness and business strengths, each SBU falls inone of the NINE different cells of strategic option.

-

7/29/2019 SM-Unit-3 BCG-mat

29/36

23-29

Strategic Implications of

the G.E. 9-Cell Matrix

SBUs in 3 upper left cells get topinvestment priority

SBUs in 3 middle diagonal cells merit

steady investment to maintain & protect

their industry positions

SBUs in 3 lower right cells are candidates

for harvesting or divestiture

-

7/29/2019 SM-Unit-3 BCG-mat

30/36

23-30

Advantages of G.E. 9-

Cell Matrix

Allows for intermediate rankings between

high & low and between strong & weak

Incorporates a wider variety of strategically

relevant variables than the BCG matrix

Stresses the channeling of corporate

resources to SBUs with the greatest

potential for competitive advantage &

superior performance

-

7/29/2019 SM-Unit-3 BCG-mat

31/36

23-31

Weaknesses of G.E. 9-

Cell MatrixProvides no guidance on specifics of SBUstrategy

Only suggests general strategic posture --aggressive expansion, fortify-&-defend,

or harvest/divest

Doesnt address the issue of strategic

coordination across related SBUs

Tends to obscure SBUs about to take off or

crash & burn -- static, not dynamic

-

7/29/2019 SM-Unit-3 BCG-mat

32/36

23-32

The 10 Stages of Corporate Life Cycle / stages of

development

1. Courtship. Would-be founders focus on ideas and future possibilities,

making and talking about ambitious plans. Courtship ends and infancy beginswhenthe founders assume risk.

Infancy. The founders' attention shifts from ideas and possibilities to results. Theneed to make sales drives this action-oriented, opportunity-driven stage. Nobody pays

much attention to paperwork, controls, systems, or procedures. Founders work 16-

hour days, six to seven days a week, trying to do everything by themselves.

Go-Go. This is a rapid-growth stage. Sales are still king. The found ersbelieve theycan do no wrong. Because they see everything as an opportunity, their arrogance

leaves their businesses vulnerable to flagrant mistakes. They organize their

companies around people rather than functions; capable employees can--and do--

wear many hats, but to their staff's consternation, the founders continue to make

every decision.

Adolescence. During this stage, companies take a new form. The founders hirechief operating officers but find it difficult to hand over the reins. An attitude of us

(the old-timers) versus them (the COO and his or her supporters)hampers operations.

There are so many internal conflicts, people have little time left to serve customers.

Companies suffer a temporary loss of vision.

-

7/29/2019 SM-Unit-3 BCG-mat

33/36

23-33

Prime. With a renewed clarity of vision, companies establish an even

balance between control and flexibility. Everything comes together. Discipline yetinnovative, companies consistently meet their customers' needs. New businesses

sprout up within the organization, and they are decentralized to provide new life-cycle

opportunities.

Stability. Companies are still strong, but without the eagerness of their earlierstages. They welcome new ideas but with less excitement than they did during the

growing stages. The financial people begin to impose controls for short-term results inways that curtail long-term innovation. The emphasis on marketing and research and

development wanes.

Aristocracy. Not making waves becomes a way of life. Outward signs ofrespectability--dress, office decor, and titles--take on enormous importance.

Companies acquire businesses rather than incubate start-ups. Their culture

emphasizes how things are done over what's being done and why people are doing it.Company leaders rely on the past to carry them into the future.

Recrimination. In this stage of decay, companies conduct witch-hunts to find outwho did wrong rather than try to discover what went wrong and how to fix it. Cost

reductions take precedence over efforts that could increase revenues. Backstabbing

and corporate infighting rule. Executives fight to protect their turf, isolating themselves

from their fellow executives.

-

7/29/2019 SM-Unit-3 BCG-mat

34/36

23-34

Bureaucracy. If companies do not die in the previous stage--maybe theyare in a regulated environment where the critical factor for success is not

how they satisfy customers but whether they are politically an asset or

Liability--they become bureaucratic. Procedure manuals thicken, paper work

abounds, and rules and policies choke innovation and creativity. Even

customers--forsaken and forgotten--find they need to devise elaborate

strategies to get anybody's attention.

Death. This final stage may creep up over several years, or it may arrivesuddenly, with one massive blow. Companies crumble when they can not

generate the cash they need; the outflow finally exhausts any inflow.

-

7/29/2019 SM-Unit-3 BCG-mat

35/36

23-35

STAGES OF Corporation Development

A successful corporation tends to follow a pattern of structuraldevelopment as they grow and expand. Their growth can be seen in

four major stages.

Stage -01.

Simple structure: it is typified with the entrepreneur who promotesthe enterprise.

The entrepreneur is prime decision maker

A little formal structure of organisation

Managerial functions of planning, organising, staffing, directing andcontrolling are very limited

Strengths include: flexible and dynamic structure,

Weakness is too much dependence on entrepreneur

-

7/29/2019 SM-Unit-3 BCG-mat

36/36

23 36

StageII FUNCTIONAL STRUCTURE:

Transition to functional structure

Larger structural form

Stage-III Divisional Structure

Stage- IV Beyond SBUs

![[XLS] for the month Apr... · Web viewMargin MarketType MarketType MarketType MarketType MarketType_Text MarketType_Text Mast Mast Mat Mat Mat Mat Mat Mat Mat Mat Mat Mat Mat Match1](https://static.fdocuments.in/doc/165x107/5ab4774c7f8b9a2f438b92c4/xls-for-the-month-aprweb-viewmargin-markettype-markettype-markettype-markettype.jpg)