Slide 2

description

Transcript of Slide 2

Slide 2

After Exam 1

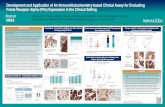

Distribution of Exam 1 Score18

17.5171716

15.515.515.515.515.5

1514

13.513.5

1312.512.5

1211.5

1110.5

101010

7

A Lecture From Mr. Romney

• http://www.youtube.com/watch?v=eur8rYBotxg

US Trade Balance (Deficit if Negative)

19601962

19641966

19681970

19721974

19761978

19801982

19841986

19881990

19921994

19961998

20002002

20042006

20082010

2012

-800,000

-700,000

-600,000

-500,000

-400,000

-300,000

-200,000

-100,000

0

100,000

US Trade Balance (Million Dollars)

Series1

Facts

• Data from http://www.census.gov/foreign-trade/statistics/historical/#

• US had no trade deficit before 1980• China joined world trade organization in

December 2001• Hot issue: is Chinese currency the main reason

for US trade deficit?

Hint 1

• Before 2000, US had trade deficit mainly with Japan and Germany

• Both countries use floating exchange rates

Hint 2

Hint 3

• In eco 201 you learn that it is demand and supply that determine the price, not vice versa

• Mr Romney just looks at the demand curve, and he forgets supply curve

Three Questions

• How to explain the rising trade deficit in early 1980?

• How to explain the rising trade deficit in early 1990?

• How to explain the falling trade deficit in late 2000?

Review

• We apply classical dichotomy to open economy

• We first find net export, then real exchange rate, and finally nominal exchange rate

Long Run Model for Exchange Rate

• Arbitrage will not stop until (Law of One Price)

(Absolute PPP)

(Relative PPP)

Discuss

• What may cause law of one price or purchasing power parity to fail?

• If inflation in England was higher than Germany in 1992, then British Pound was expected to ______________ against German Mark

Short Run Model

• The nominal exchange rate is the price for currency

• Suppose home is China, and foreign country is US

• The exchange rate for Chinese currency yuan is denoted by $/¥. Yuan appreciates when the exchange rate goes_______

Warm Up

• As yuan appreciates, the Chinese good becomes (more expensive or cheaper), and this will (increase or decrease) the demand for Chinese good

Demand and Supply

• The demand for yuan comes from China’s export

• The demand curve is downward sloping since China’s export falls as yuan appreciates.

• The supply for yuan comes from China’s import

• The supply curve is ______ sloping since China’s import ________ as yuan appreciates

Application

• How to explain that there are more and more Chinese students coming to US when yuan appreciates?

Graph Time

• The demand-and-supply diagram for yuan is

Critical Thinking

• Draw the demand and supply curve for Yuan, but now the exchange rate is ¥/$

Story Time

• In order to help China’s export, the Chinese government want to keep the value of yuan (low or high)

• That means, thanks to Chinese government’s intervention on the FX market, there will be (shortage or surplus) of yuan, and China will have trade (deficit or surplus)

How To Intervene

• Chinse government needs to constantly sell yuan and buy dollars on the FX market

• That means supply curve of yuan shifts to (right or left), and Chinese dollar reserve (rises or fall)

US Foreign Debt

There is no free lunch

• Undervalued Yuan helps Chinese export• Undervalued Yuan may lead to inflation in

China (How?)

Application: Quantitative Easing

• China exports good, and US exports inflation (to a country whose currency is pegged to US dollar)

China can control exchange rate, but only the nominal one, and only in short run

• In long run, price level in China will rise, and this will cause yuan to appreciate in real term, even though the nominal rate is fixed (how?)

In long run, the winner is

Currency Crisis

• George Soros vs Bank of England• Before September 1992, Pound was pegged to Mark• Soros thought Pound is ________ because inflation in

England was higher than Germany• To keep Pound from depreciating, Bank of England had

to ____ Pound and _____ Mark• The foreign reserve of England went ______• Crisis happened when __________• Soros tried again, in 1997, at HongKong, but this time….

Do not mess with Texas

• Because they are big!

Why do economists hate budget deficit?

• Rising government expenditure crowds out investment and export

• Investment is crucial for growth

Production Function

• Static Model, limited but still insightful• Why is Japanese economy stagnant?• Why is China’s growth faster than US?

Solow Model

• Dynamic Model• Proposed by Robert Solow, a Nobel winner• It shows how the income grows over time• The key concept is steady state (dynamic

equilibrium)

Per Worker Terms• • Let denote the per-worker term. Constant return to scale

implies that

Assuming constant saving rate

where is per-worker saving and is the saving rate.

Fundamental Equation

• Change of capital equals investment minus deprecation.

• when investment exceeds deprecation• otherwise• at steady state In other words, solves the

equation

Exercise

• Fundamental Equation:

• Find when • Find when • Find when

Critical ThinkingWhat if Increasing Marginal Product

• Fundamental Equation:

• Find when • Find when • Is the steady state stable?

Discuss

• What is the effect of rising saving rate on growth?

Steady State

• Dynamic equilibrium• No change over time• Fundamental equation

• At steady state, i.e., satisfies

Solow Model Without Population Growth

(1) At steady state is constant(2) At steady state is constant(3) At steady state is constant since (no population growth)(4) At steady state is constant• (4) is inconsistent with reality of persistent

growth in GDP

Dynamics

• Suppose at beginning • Then will rise () because investment exceeds

deprecation • But the growth rate falls as approaches • Just like a person, who grows fast when he is

baby, and stop growing eventually.

A Dilemma

• Figure 7-5 shows that higher saving can increase , so is good in long run

• But higher saving cuts current consumption, so is bad in short run

• Is there an optimal saving rate?

Golden Rule

• The goal is to find a saving rate so that the corresponding maximizes consumption

• At steady state (7)

is maximized when first derivative equals 0: (8)

We denote the steady-state that satisfies (8) as , called golden rule.

Optimal Saving Rate

• After finding , the optimal saving rate is (from the fundamental equation)

• Exercise: Find and when

Policy Implication

• If the current saving rate is less than , the government may consider policy that encourages more saving, such as higher tax break to 401K account

Solow Model with Population Growth

• Assuming the population growth rate is

where denotes the instantaneous change

Fundamental Equation

• Now the fundamental equation becomes

so can fall because either capital depreciates or population grows

Proof (Optional)

Application

• How does the one-child policy of China affect its long run living standard?

Solow Model with Population Growth

(1) At steady state is constant(2) At steady state is constant(3) At steady state grows (4) At steady state grows • (4) is consistent with persistent growth in GDP• (2) is inconsistent with persistent growth in

living standard.

Exercise

• At steady state grows at rate ___?___

• (Optional) At steady state grows at rate _?_ assuming is Cobb-Douglas

Summarize

• Saving can increase future living standard• Population growth can increase GDP• Population growth can reduce future living

standard• How about technology? Read chapter 8

(optional)