SKS Microfinance Q1FY15: NII up 41% to Rs890 mn; Buy

11

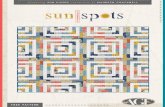

CMP 284.45 Target Price 327.00 ISIN: INE180K01011 JUNE 30 th 2014 SKS MICROFINANCE LTD Result Update (PARENT BASIS): Q1 FY15 BUY Index Details Stock Data Sector Finance BSE Code 533228 Face Value 10.00 52wk. High / Low (Rs.) 309.90/101.55 Volume (2wk. Avg.) 451000 Market Cap (Rs. in mn.) 35817.94 Annual Estimated Results (A*: Actual / E*: Estimated) YEARS FY14A FY15E FY16E Net Sales 5189.92 6176.00 7102.41 EBITDA 2881.49 3658.80 4149.61 Net Profit 698.52 1299.56 1623.85 EPS 6.46 10.32 12.90 P/E 44.07 27.56 22.06 Shareholding Pattern (%) 1 Year Comparative Graph SKS MICROFINANCE LTD S&P BSE SENSEX SYNOPSIS SKS Microfinance Limited was founded in 1997, a non-banking financial company - micro finance institution, provides micro finance services. In Q1 FY15, Net profit jumps to Rs. 493.21 mn an increase of 892.37% against Rs. 49.70 mn in the corresponding quarter of previous year. The company’s net sales registered 29.29% increase and stood at Rs. 1518.16 million from Rs. 1174.26 million over the previous year quarter. Operating profit is Rs. 983.11 mn as against Rs. 528.01 mn in Q1 FY14, an increase of 86.19%. Net interest income grew by 41% to Rs. 890 mn in Q1 FY15 from Rs. 630 mn in Q1 FY14. In Q1 FY15, the company’s Portfolio excluding the states of A.P and Telangana was Rs. 27830 mn a growth of 39% (YoY) and 7% (QoQ). As of June 30, 2014, the company’s Net worth of Rs. 8910 mn and capital adequacy is at 39.6%. Cash and cash equivalents stood at Rs. 4880 mn. Loan disbursement grew by 40% to Rs. 1160 mn in Q1 FY15 from Rs. 8300 mn in Q1 FY14. The company announced a 1% reduction in the interest rate charged from borrowers from 24.55% to 23.55% with effect from October 1, 2014. The un-availed deferred tax benefit stood at Rs. 5420 million as of June 30, 2014. SKS credit rating for bank borrowings was upgraded to A1+ from A1 for short-term facilities and to A+ from A for long-term facilities for an aggregate sum of Rs. 20000 million. Net Sales of the company are expected to grow at a CAGR of 29% over 2013 to 2016E respectively. PEER GROUPS CMP MARKET CAP EPS P/E (X) P/BV(X) DIVIDEND Company Name (Rs.) Rs. in mn. (Rs.) Ratio Ratio (%) SKS Microfinance Ltd 284.45 35817.94 6.46 44.07 6.70 0.00 SE Investments Ltd 370.45 15025.50 13.87 26.71 3.08 10.00 Magma Fincorp Ltd 98.95 18612.70 7.13 13.73 1.59 40.00 Cholamandalam Investment and Finance Company Ltd 395.90 56783.10 25.38 15.60 2.88 10.00

-

Upload

indianotescom -

Category

Economy & Finance

-

view

321 -

download

0

description

In Q1FY15, SKS Microfinance's Net profit jumps to Rs. 493.21 mn an increase of 892.37%. Net interest income grew by 41% to Rs. 890 mn in Q1FY15 from Rs. 630 mn in Q1FY14. Maintain buy

Transcript of SKS Microfinance Q1FY15: NII up 41% to Rs890 mn; Buy

- 1. CMP 284.45 Target Price 327.00 ISIN: INE180K01011 JUNE 30th 2014 SKS MICROFINANCE LTD Result Update (PARENT BASIS): Q1 FY15 BUY Index Details Stock Data Sector Finance BSE Code 533228 Face Value 10.00 52wk. High / Low (Rs.) 309.90/101.55 Volume (2wk. Avg.) 451000 Market Cap (Rs. in mn.) 35817.94 Annual Estimated Results (A*: Actual / E*: Estimated) YEARS FY14A FY15E FY16E Net Sales 5189.92 6176.00 7102.41 EBITDA 2881.49 3658.80 4149.61 Net Profit 698.52 1299.56 1623.85 EPS 6.46 10.32 12.90 P/E 44.07 27.56 22.06 Shareholding Pattern (%) 1 Year Comparative Graph SKS MICROFINANCE LTD S&P BSE SENSEX SYNOPSIS SKS Microfinance Limited was founded in 1997, a non-banking financial company - micro finance institution, provides micro finance services. In Q1 FY15, Net profit jumps to Rs. 493.21 mn an increase of 892.37% against Rs. 49.70 mn in the corresponding quarter of previous year. The companys net sales registered 29.29% increase and stood at Rs. 1518.16 million from Rs. 1174.26 million over the previous year quarter. Operating profit is Rs. 983.11 mn as against Rs. 528.01 mn in Q1 FY14, an increase of 86.19%. Net interest income grew by 41% to Rs. 890 mn in Q1 FY15 from Rs. 630 mn in Q1 FY14. In Q1 FY15, the companys Portfolio excluding the states of A.P and Telangana was Rs. 27830 mn a growth of 39% (YoY) and 7% (QoQ). As of June 30, 2014, the companys Net worth of Rs. 8910 mn and capital adequacy is at 39.6%. Cash and cash equivalents stood at Rs. 4880 mn. Loan disbursement grew by 40% to Rs. 1160 mn in Q1 FY15 from Rs. 8300 mn in Q1 FY14. The company announced a 1% reduction in the interest rate charged from borrowers from 24.55% to 23.55% with effect from October 1, 2014. The un-availed deferred tax benefit stood at Rs. 5420 million as of June 30, 2014. SKS credit rating for bank borrowings was upgraded to A1+ from A1 for short-term facilities and to A+ from A for long-term facilities for an aggregate sum of Rs. 20000 million. Net Sales of the company are expected to grow at a CAGR of 29% over 2013 to 2016E respectively. PEER GROUPS CMP MARKET CAP EPS P/E (X) P/BV(X) DIVIDEND Company Name (Rs.) Rs. in mn. (Rs.) Ratio Ratio (%) SKS Microfinance Ltd 284.45 35817.94 6.46 44.07 6.70 0.00 SE Investments Ltd 370.45 15025.50 13.87 26.71 3.08 10.00 Magma Fincorp Ltd 98.95 18612.70 7.13 13.73 1.59 40.00 Cholamandalam Investment and Finance Company Ltd 395.90 56783.10 25.38 15.60 2.88 10.00

- 2. ANAYSIS & RECOMMENDATION- BUY SKS Microfinance Limited a non-banking financial company - micro finance institution, provides micro finance services. Net sales of the company have increased by 29.29% in the current quarter over the corresponding quarter in the previous year. Net profit grew by an insignificant 892.37% in Q1 FY15. EBDITA rose by 86.19% in Q1 FY15 over the same quarter previous year. The company credit rating for bank borrowings was upgraded to A1+ from A1 for short-term facilities and to A+ from A for long-term facilities for an aggregate sum of Rs. 20000.00 million. Loan disbursement grew by 40% (YoY) to Rs. 11600.00 million in Q1FY15. The un-availed deferred tax benefit stood at Rs. 5420.00 mn as of June 30, 2014 and will be available to offset tax on future taxable income. Non-AP Portfolio was Rs. 27830.00 million a growth of 39% (YoY) and 7% (QoQ) as of June 30, 2014. The companys Net worth stood at Rs. 8910 mn and capital adequacy at 39.6% as of June 30, 2014. We expect that the company surplus scenario is likely to continue for the next three years, will keep its growth story in the coming quarters also. Thus we recommend BUY for the scrip with a target price of Rs. 327.00. QUARTERLY HIGHLIGHTS (PARENT BASIS) Results Updates- Q1 FY15 SKS Microfinance Limited was founded in 1997; non- banking financial company - micro finance institution, provides micro finance services has reported its financial results for the quarter ended 30 JUNE, 2014. The companys net profit jumps to Rs. 493.21 million against Rs. 49.70 million in the corresponding quarter ending of previous year, an increase of 892.37%. Revenue for the quarter rose by 29.29% to Rs. 1518.16 million from Rs. 1174.26 million, when compared with the prior year period. Reported earnings per share of the company stood at Rs. 3.92 a share during the quarter as against Rs. 0.46 over previous year period. Profit before interest, depreciation and tax is Rs. 983.11 million as against Rs. 528.01 million in the corresponding period of the previous year. Months June-14 June-13 % Change Net Sales 1518.16 1174.26 29.29 PAT 493.21 49.70 892.37 EPS 3.92 0.46 752.83 EBITDA 983.11 528.01 86.19

- 3. Break up of Expenditure Latest Updates The company had Incremental draw-downs of Rs. 5750 million in Q1 FY15 The company announced a 1% reduction in the interest rate charged from borrowers from 24.55% to 23.55% with effect from October 1, 2014 and also could reduce its cost of borrowing by 1% to 12.6% in Q1- FY15 (13.5% in FY14). Loan disbursement grew by 40% to Rs. 1160 million in Q1 FY15 from Rs. 8300 million in Q1 FY14. In Q1 FY15 the companys Portfolio excluding the states of A.P and Telangana was Rs. 27830 mn a growth of 39% (YoY) and 7% (QoQ) from Rs. 20030 mn in Q1 FY14. Net interest income grew by 41% to Rs. 890 million in Q1-FY15 from Rs. 630 million in Q1-FY14. The un-availed deferred tax benefit stood at Rs. 5420 million as of June 30, 2014 and will be available to offset tax on future taxable income. Given the carried forward tax loss, no tax provision was required for Q1 FY15. Net worth of Rs. 8910 million and capital adequacy at 39.6% as of June 30, 2014. Cash & Bank Balance stood at Rs. 4880 million. SKS credit rating for bank borrowings was upgraded to A1+ from A1 for short-term facilities and to A+ from A for long-term facilities for an aggregate sum of Rs. 20000 million. Break up of Expenditure (Rs in millions) Q1 FY15 Q1 FY14 % CHNG Employee Benefit Expenses 539.09 420.45 28% Dep & Amortization Exp 11.56 9.79 18% Other Expenses 185.91 168.61 10%

- 4. COMPANY PROFILE SKS Microfinance Limited was founded in 1997, a non-banking financial company - micro finance institution, provides micro finance services to women in the rural areas in India who are enrolled as members and organized as joint liability groups. It offers income generation and mid-term loans to self-employed women to support their business enterprises, such as raising livestock, running local retail shops, tailoring, and other assorted trades and services. The company also provides mobile loans for financing mobile phones and telephone services; housing loans for the construction of new houses, or improvement and extension of existing houses; and gold loans secured by gold jewelry to meet short term liquidity requirements. In addition, it provides life insurance products. SKS distributes small loans that begin at Rs. 2,000 to Rs. 12,000 (about $44-$260) to poor women so they can start and expand simple businesses and increase their incomes. Their micro-enterprises range from raising cows and goats in order to sell their milk, to opening a village tea stall. The company uses the group lending model where poor women guarantee each others loans. Borrowers undergo financial literacy training and must pass a test before they are allowed to take out loans. Weekly meetings with borrowers follow a highly disciplined approach. Re-payment rates on our collateral-free loans are more than 99% because of this systematic process. The company offers micro-insurance to the poor as well as financing for other goods and services that can help them combat poverty. It is committed to creating a distribution network across underserved sections of society in order to provide easy access to the full portfolio of microfinance products and services. It also looks at using this network to add value to the lives of its members by providing quality goods and services that our members need at less than market rates. SKS delivers microfinance through a joint group liability model. The villages are selected on the basis of a thorough survey and consequently sangam meetings and group recognition tests conducted. The company firmly believes that Technology is one of its biggest differentiator in the industry. It has designed and deployed a web-based Business Intelligence portal using state-of-art technology and a highly flexible and scalable platform to support the business growth and operations and has also built an integrated and encrypted MPLS communication network encompassing a world class Data Centre delivering mission critical services and enhancing collaboration across the organization.

- 5. FINANCIAL HIGHLIGHT (PARENT BASIS) (A*- Actual, E* -Estimations & Rs. In Millions) Balance Sheet as at March 31, 2013 -2016E FY13A FY14A FY15E FY16E SOURCES OF FUNDS Shareholder's Funds Share Capital 1082.13 1082.13 1082.13 1082.13 Reserves and Surplus 2821.79 3510.00 4809.57 6433.42 1. Sub Total - Net worth 3903.92 4592.13 5891.70 7515.55 Non Current Liabilities Long term Borrowings 2656.04 3002.07 3212.21 3372.83 Long term Provisions 2632.62 1862.15 1601.45 1665.51 2. Sub Total - Non Current Liabilities 5288.66 4864.22 4813.66 5038.33 Current Liabilities Short term Borrowings 5705.21 3323.51 2658.81 2286.57 Other Current Liabilities 9942.48 11806.55 13223.34 14148.97 Short Term Provisions 274.25 385.55 454.95 509.54 3. Sub Total - Current Liabilities 15921.94 15515.61 16337.09 16945.09 Total Liabilities (1+2+3) 25114.52 24971.96 27042.45 29498.97 APPLICATION OF FUNDS Non-Current Assets a) Fixed Assets Tangible assets 84.70 65.86 72.45 77.52 Intangible assets 27.11 30.91 33.69 35.71 Intangible assets under development 1.31 15.04 18.20 21.11 Total Fixed Assets 113.12 111.81 124.34 134.34 b) Non-current investments 2.00 2.00 2.20 2.42 c) Long Term loans and advances 2825.75 2292.69 2590.74 2875.72 d)Other non-current assets 364.26 328.51 354.79 376.08 1. Sub Total - Non Current Assets 3305.13 2735.01 3072.07 3388.56 Current Assets Trade receivables 5.56 51.07 57.20 61.77 Cash and Bank Balances 8605.88 6397.08 7036.79 7599.73 Short-terms loans & advances 12815.97 15235.01 16222.93 17710.48 Other current assets 381.98 553.79 653.47 738.42 2. Sub Total - Current Assets 21809.39 22236.95 23970.38 26110.41 Total Assets (1+2) 25114.52 24971.96 27042.45 29498.97

- 6. Annual Profit & Loss Statement for the period of 2013 to 2016E Value(Rs.in.mn) FY13A FY14A FY15E FY16E Description 12m 12m 12m 12m Net Sales 3321.98 5189.92 6176.00 7102.41 Other Income 203.66 258.44 366.98 385.33 Total Income 3525.64 5448.36 6542.99 7487.74 Expenditure -5005.47 -2566.87 -2884.19 -3338.13 Operating Profit -1479.83 2881.49 3658.80 4149.61 Interest -1427.19 -2142.21 -2313.59 -2475.54 Gross profit -2907.02 739.28 1345.21 1674.07 Depreciation -64.36 -40.76 -45.65 -50.22 Profit Before Tax -2971.38 698.52 1299.56 1623.85 Tax 0.00 0.00 0.00 0.00 Net Profit -2971.38 698.52 1299.56 1623.85 Equity capital 1082.13 1082.13 1259.20 1259.20 Reserves 2821.79 3510.01 4809.57 6433.42 Face value 10.00 10.00 10.00 10.00 EPS -27.46 6.46 10.32 12.90 Quarterly Profit & Loss Statement for the period of 31st Dec, 2013 to 30th Sep, 2014E Value(Rs.in.mn) 31-Dec-13 31-Mar-14 30-Jun-14 30-Sep-14E Description 3m 3m 3m 3m Net sales 1333.19 1382.96 1518.16 1594.07 Other income 63.45 90.81 171.36 147.37 Total Income 1396.64 1473.77 1689.52 1741.44 Expenditure -596.79 -641.90 -706.41 -738.05 Operating profit 799.85 831.87 983.11 1003.38 Interest -575.41 -550.45 -478.34 -545.31 Gross profit 224.44 281.42 504.77 458.08 Depreciation -10.17 -10.27 -11.56 -12.14 Profit Before Tax 214.27 271.15 493.21 445.94 Tax 0.00 0.00 0.00 0.00 Net Profit 214.27 271.15 493.21 445.94 Equity capital 1082.13 1082.13 1259.20 1259.20 Face value 10.00 10.00 10.00 10.00 EPS 1.98 2.51 3.92 3.54

- 7. Ratio Analysis Particulars FY13A FY14A FY15E FY16E EPS (Rs.) -27.46 6.46 10.32 12.90 EBITDA Margin (%) -44.55 55.52 59.24 58.43 PBT Margin (%) -89.45 13.46 21.04 22.86 PAT Margin (%) -89.45 13.46 21.04 22.86 P/E Ratio (x) -10.36 44.07 27.56 22.06 ROE (%) -76.11 15.21 21.41 21.11 ROCE (%) -11.54 26.77 31.03 31.45 Debt Equity Ratio 2.14 1.38 0.97 0.74 EV/EBITDA (x) -20.64 10.66 9.47 8.16 Book Value (Rs.) 36.08 42.44 48.20 61.09 P/BV 7.88 6.70 5.90 4.66 Charts

- 8. OUTLOOK AND CONCLUSION At the current market price of Rs. 284.45, the stock P/E ratio is at 27.56 x FY15E and 22.06 x FY16E respectively. Earnings per share (EPS) of the company for the earnings for FY15E and FY16E are seen at Rs. 10.32 and Rs. 12.90 respectively. Net Sales of the company are expected to grow at a CAGR of 29% over 2013 to 2016E respectively. On the basis of EV/EBITDA, the stock trades at 9.47 x for FY15E and 8.16 x for FY16E. Price to Book Value of the stock is expected to be at 5.90 x and 4.66 x respectively for FY15E and FY16E. We recommend BUY in this particular scrip with a target price of Rs. 327.00 for Medium to Long term investment. INDUSTRY OVERVIEW The services sector has been a great stimulus to the Indian economy accounting for 56.9 per cent of the gross domestic product (GDP), wherein the financial services segment has been a major contributor. The growth of the financial sector in India at present is nearly 8.5 per cent per year. Dominated by commercial banks which have over 60 per cent share of the total assets, Indias financial sector comprises commercial banks, insurance firms, non-banking institutions, mutual funds, cooperatives and pension funds, among other financial entities.

- 9. The last two decades have seen the sector developing a more contemporary outlook. The Government of India has helped in this development, introducing reforms to liberalize, regulate and enhance the countrys financial services. Today, India is recognized as one of the worlds most vibrant capital markets. Notwithstanding challenges, the sectors future seems to be in good hands. Insurance Sector Digital channels will influence nearly 75 per cent of the insurance policies sold by 2020 during the pre-purchase, purchase or renewal stages. Insurance sales from online channels will be 20 times what it is today by 2020, with overall internet influenced sales expected to be around Rs 300,000400,000 crore (US$ 50.3167.06 billion). Indian insurance companies will spend Rs 12,100 crore (US$ 2.01 billion) on information technology (IT) products and services in the current year, a 12 per cent increase over 2013, according to Gartner Inc. This forecast takes into account spending by insurers on internal and external IT services, software, hardware and telecommunications. The software segment is predicted to be the fastest developing external segment, which is increasing at 18 per cent in 2014 overall, driven by the growth of insurance-specific software. Mutual Funds Industry in India More than 80 per cent of Indian investors are satisfied with their mutual fund schemes, according to a survey by Financial Intermediaries Association of India (FIAI). The survey also stated that 60 per cent of the mutual fund investors were satisfied with services of advisers and distributors of investment schemes. Private Equity, Mergers & Acquisitions in India Mergers and acquisitions (M&A) activity between India and the European Union is poised to grow in FY 2014 15. The IT and business process outsourcing (BPO) industry are expected to lead the way in scouting for acquisitions in Europe. Private equity (PE) firms invested US$ 2.27 billion in the period of JanuaryMarch 2014, a 93 per cent increase from the investments (US$ 1.18 million) made during the same quarter of 2013. There were five investments of US$ 100 million or more in the quarter against one in the corresponding period of 2013. Foreign Institutional Investors (FIIs) in India Non-resident Indians (NRIs) and FIIs will now be allowed to invest in the insurance sector, within the overall 26 per cent cap on foreign direct investment (FDI). The department of industrial policy and promotion (DIPP) in a press note confirmed that apart from insurance companies, the relaxation would also cover insurance brokers, third-party administrators (TPAs), surveyors and loss assessors.

- 10. FIIs were gross buyers of debt securities valued at Rs 30,266 crore (US$ 5.07 billion) and sellers of bonds worth Rs 11,450 crore (US$ 1.91 billion) in the period January 124, 2014, which resulted in a net inflow of Rs 18,816 crore (US$ 3.15 billion), according to the SEBI. Also, during the same period, FIIs invested Rs 3,473 crore (US$ 582.21 million) into the equity market, making their total investment in debt and stocks to be around Rs 22,289 crore (US$ 3.73 billion). Foreign investors invested about Rs 371,342 crore (US$ 62.25 billion) into Indias stock market in the four years ended December 2013. This figure surpasses the investments in the boom years of 200508. Investments by FIIs in the Indian stock market crossed the Rs 1 trillion (US$ 16.77 billion) mark in December 2013 the third time this has been achieved since FIIs entry into the capital market in 199293. Financial Services in India: Recent Developments American Express Co. has bought a minority stake in Bengaluru-based payment device maker Ezetap Mobile Solutions. Non-banking financial company (NBFC) Manappuram Finance Ltd (MFL) has entered into an agreement to acquire Milestone Home Finance Company from Jaypee Hotels. Financial Services: Government Initiatives Given the growth of the Indian film industry, Third Eye Cinema Fund (TCEF), a SEBI-registered alternative investment fund, is set to enter the Indian market. Those not connected with the Hindi film segment will now soon be able to reap the benefits of the sectors growth. TCEF aims to generate about 25 per cent returns. In an effort to give impetus to bilateral ties, India and South Korea have decided to strengthen cooperation in many key sectors, including trade, investment and defence. Nine pacts in different fields, including one in cyber space cooperation, were inked following talks between the Indian prime minister and the South Korean president. Disclaimer: This document prepared by our research analysts does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The information contained herein is from publicly available data or other sources believed to be reliable but do not represent that it is accurate or complete and it should not be relied on as such. Firstcall India Equity Advisors Pvt. Ltd. or any of its affiliates shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. This document is provide for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision.

- 11. Firstcall India Equity Research: Email [email protected] C.V.S.L.Kameswari Pharma U. Janaki Rao Capital Goods B. Anil Kumar Auto, IT & FMCG M. Vinayak Rao Diversified C. Bhagya Lakshmi Diversified B. Vasanthi Diversified Firstcall India also provides Firstcall India Equity Advisors Pvt.Ltd focuses on, IPOs, QIPs, F.P.Os,Takeover Offers, Offer for Sale and Buy Back Offerings. Corporate Finance Offerings include Foreign Currency Loan Syndications, Placement of Equity / Debt with multilateral organizations, Short Term Funds Management Debt & Equity, Working Capital Limits, Equity & Debt Syndications and Structured Deals. Corporate Advisory Offerings include Mergers & Acquisitions(domestic and cross-border), divestitures, spin-offs, valuation of business, corporate restructuring-Capital and Debt, Turnkey Corporate Revival Planning & Execution, Project Financing, Venture capital, Private Equity and Financial Joint Ventures Firstcall India also provides Financial Advisory services with respect to raising of capital through FCCBs, GDRs, ADRs and listing of the same on International Stock Exchanges namely AIMs, Luxembourg, Singapore Stock Exchanges and other international stock exchanges. For Further Details Contact: 3rd Floor,Sankalp,The Bureau,Dr.R.C.Marg,Chembur,Mumbai 400 071 Tel. : 022-2527 2510/2527 6077/25276089 Telefax : 022-25276089 E-mail: [email protected] www.firstcallindiaequity.com