Simplify, preserve and enhance · a multi-disciplinary approach to managing your complex financial...

Transcript of Simplify, preserve and enhance · a multi-disciplinary approach to managing your complex financial...

Simplify, preserve and enhance.

1507-1092 - APC_PC_Brochure COVER_E.indd 1-3 2015-09-21 3:43 PM

Simplify, preserve and enhance.

Simplify, preserve and enhance.

Your wealth is the cumulative result of your hard work,

discipline, and astute management. Yet the opportunities

it affords may also come with unique responsibilities,

challenges and questions.

We understand that the decisions concerning your wealth

are among the toughest you may ever have to make.

For peace of mind, you want to feel secure knowing that all your

financial and wealth management goals can be addressed through

a solution that is unique to your needs. You need a solution that can

simplify, preserve and enhance your wealth.

Experience the advantage of

Assante Private Client wealth management services.P

P ASSANTE PRIVATE CLIENT

A personalized program tailored to your

unique needs and goals

The four pillars of Assante Private Client

PERSONALIZED INVESTMENT STRATEGY

• A customized detailed plan for your investments tailored to your specific goals

• Strategically engineered Private Client Managed Portfolios supported by award-winning investment management teams

TAX EFFICIENCY

• Tax-effective investing through our Corporate Class structure

• Customizable tax efficient cash flow available through our T-Class platform

The private client difference.

The four pillars of Assante Private Client

Assante Private Client is a complete wealth management service offering that integrates

investment management, through our Private Client Managed Portfolios, with wealth

planning and personalized advice for investors with at least $1,000,000 to invest.

Our comprehensive approach to managing your financial affairs is tailored to your

personal requirements.

While many other private client programs focus solely on investment management, we offer

a multi-disciplinary approach to managing your complex financial affairs. By integrating

investment management, wealth planning and personalized attention in a single customized

program, we help to simplify, preserve and enhance your wealth.

COMPREHENSIVE WEALTH PLANNING ADVICE

• Personalized advice and recommendations for your investment, insurance, tax and wealth transfer strategies – specific to your financial goals, objectives and evolving needs

• Ongoing support from our team of professionals to assist you in the unique and complicated wealth planning situations you may face

ADVANCED REPORTING AND TAX INFORMATION

• Detailed quarterly statements consolidated for all of your family’s accounts

• Comprehensive tax reporting for your personal, corporate, and trust accounts

Your personalized investment strategy.

Personalized investment strategy

A CLEAR ROADMAP FOR YOUR INVESTMENTS

Working with your advisor and your dedicated Investment Counsellor, we will explore your investment objectives and goals, liquidity needs, growth expectations, tolerance for risk, income requirements, investment time horizon, anticipated changes in lifestyle and tax considerations.

Based on your unique circumstances, we will create a detailed plan known as an Investment Policy Statement.

It details a plan for your customized portfolio, by taking into account your individual circumstances and tolerance for risk, and sets out your asset allocation strategy – how your portfolio will be invested.

Your custom portfolio is built to offer the highest potential returns for the amount of risk you are willing to take, and is carefully managed to stay within these guidelines.

Your Assante Private Client experience begins with the development of a personalized

investment strategy.

P

A tailored portfolio strategically engineered for you

CI Multi-Asset Management is an in-house group of investment professionals who play an active role in the design and management of Private Client Managed Portfolios.

The CI Multi-Asset Management team embraces the philosophy of active management and applies it to all aspects of its investment process, which seeks to deliver predictable investment outcomes by using a full set of asset classes in its disciplined portfolio construction.

The team uses a strategic asset allocation strategy to construct each portfolio and regularly reviews the strategic asset mixes to ensure that they offer the highest expected return for each level of risk. CI Multi-Asset Management uses its own capital market expectations driven by valuations and fundamentals, and also considers research from State Street Global Advisors, a global investment manager with over US$2 trillion in assets under management.

The in-house team is also responsible for ongoing due diligence and overall program maintenance. The proprietary program for the selection and monitoring of managers, as well as their portfolio-building techniques, incorporate a best practices approach to ensure the managers adhere to their investment mandates.

CI Multi-Asset Management’s rigorous process is comparable to those used by Canada’s top consulting firms for large institutional investors. The team oversees approximately $42 billion of investments on behalf of clients.

Our portfolio recommendations are supported by a widely recognized team of accredited

investment professionals.

Feel secure knowing your weal s handled wi care.

PFeel secure knowing your weal s handled wi care.

Strategic asset allocation and professional money management

Your personalized portfolio

incorporates many components.

Two major components that

contribute to its performance are

the strategic asset allocation

of the portfolio – in other words,

the mix of asset classes – and

the portfolio managers

who manage them.

As an investor, you want to know

that the professionals managing

your money are among the best.

CI Multi-Asset Management brings

together a large selection of affiliated

and institutionally recognized

portfolio managers, chosen for their

leadership in their mandates and

for the value they add to your portfolio.

Using strategic asset allocation and

regular rebalancing to produce

stable returns over time, we

make sure your portfolio remains

true to your goals.

IT IS WELL DIVERSIFIED

No single investment is right for every point in time. A properly diversified portfolio is needed to help capture gains from asset classes that are performing well, while limiting exposure to those that are underperforming. Private Client Managed Portfolios brings you the diversification benefits of strategic asset allocation across 21 mandates within 11 separate asset classes. Your portfolio also includes diversification by country, market capitalization, industry sector and investment style.

WE CHOOSE MANAGERS FOR THEIR ABILITY TO PERFORM

We select portfolio managers based on their investment process, proven value add and “fit” into the overall portfolio diversification strategy, favouring portfolio managers who are willing to differentiate themselves from the benchmark.

Strategic asset allocation and professional money management

WE MONITOR THE MANAGERS TO ENSURE THEY CONTINUE TO BE THE BEST CHOICE

Our ongoing evaluation of the managers against strict criteria ensures that they adhere to their defined investment mandate. The managers must invest according to the investment approach for which they were hired and deliver consistent risk-adjusted performance.

TACTICAL PORTFOLIO MANAGEMENT

Our portfolio managers, through their specialized mandates, have the discretion and opportunities to add value to your portfolio using day-to-day tactical actions through stock selection and sector allocation.

WE KEEP YOU ON TARGET

We continuously monitor your portfolio to ensure that your asset allocation remains appropriate. If any part of your portfolio deviates from its target allocation by more than 10%, we take appropriate steps to bring it back in line to its target weight. Regular rebalancing helps you achieve better risk-adjusted long-term returns because it automatically leverages the discipline of “buying low and selling high” by realigning your assets from those that have performed exceptionally well to other areas of your portfolio that have lagged.

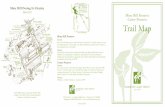

A

B D

C

Target Asset Mix

A

B D

C

Out of balance

A

B D

C

Back in balance

Varied Market Growth

Rebalance

An investment plan made for you.

Private Client investment platform

PRIVATE CLIENT INVESTMENT POOLS

are professionally managed by institutional managers chosen for their ability to meet their respective risk and performance mandates. We employ the diverse portfolio management expertise of teams at CI Investments, a CI Financial company, and other firms from around the globe. Investment strategies and manager selection within each portfolio are designed to meet your particular asset allocation requirements. For tax efficiency and portfolio flexibility, the pools are available in trust and corporate class structures.

SEGREGATED SECURITY MANDATES

provide the benefit of professional money management to investors with direct ownership of a portfolio containing either Canadian or U.S. stocks, or individual government and corporate bonds. The holdings are managed on a discretionary basis and held as part of a broader asset allocation. They are ideal for investors who may have foreign tax reporting requirements or desire greater transparency in the viewing of their holdings.

ALTERNATIVE INVESTMENTS

offer sophisticated investors with the ability to invest into non-conventional assets including private equity, hedge funds, real estate and derivatives. Investing in assets that may diversify a portfolio from conventional vehicles, such as stocks and bonds, can reduce certain investment risks or provide alternative methods of investing into traditional categories to extract the potential for higher returns. The strategies offered by Assante Private Client are available to enhance core portfolios that hold Private Client Investment Pools or segregated security mandates and can provide diversity to a sound investment strategy.

Assante Private Client offers a comprehensive platform of investment options consisting

of private pools, segregated security mandates and alternative investment strategies. A

dedicated Investment Counsellor will work with you and your advisor to determine which

type of investment or combination of investments best meets your needs.

TAX-WISE INVESTING ACROSS FAMILY ACCOUNTS

With your registered and non-registered assets being taxed differently, we strategically allocate your investments between the accounts across your portfolio to give you the greatest tax efficiency.

TAX-WISE INVESTING WITH CORPORATE CLASS

Many investment mandates in Private Client Managed Portfolios are available in our Corporate Class structure, an innovation that may allow you to increase after-tax returns without taking on additional risk.

The Corporate Class structure, when compared to traditional trust structures, extends additional tax efficiencies to non-registered investments. For example:

Defer and Minimize

You may defer and minimize tax payments given the low distribution payout policy.

Receive tax-efficient distributions

You can receive tax-efficient capital gains or Canadian dividends – currently the most tax-efficient sources of income from all pools regardless of mandate.

Help your investments make an impact

When an individual or corporation donates publicly traded securities (such as Corporate Class) to a registered charity, current tax law allows you to effectively eliminate the tax on the unrealized gain. When combined with its low dividend payout policy, Corporate Class can provide greater tax-deferred growth resulting in larger unrealized capital gains, ultimately decreasing the after-tax cost of your charitable donation.

Tax efficiency

For investments held outside a registered plan, tax efficiency is a critical issue. Taxes reduce

the returns on your portfolio and your investment income. Private Client Managed Portfolios

offer you tax-effective investment strategies to help minimize your tax bill.

PTax-wise withdrawals with T-Class

WITH T-CLASS, YOU CAN:

• Generate 100% tax deferred cash flow from your portfolio. T-Class payments are in the form of return of capital, which can provide higher after-tax cash flow than with a conventional systematic withdrawal plan. Return of capital distributions will reduce the adjusted cost base or ACB of an investment. Over time, the ACB may fall to zero, in which case the payments from T-Class will be treated as capital gains – which are still taxed at favourable rates.

• Customize your payments to fit your needs by selecting a percentage or a fixed dollar amount per month.

• Significantly vary your after-tax income depending on the nature of the payment. The chart below shows the difference in the after-tax value of $10,000 in cash flow from interest, dividends, capital gains and return of capital*.

Private Client Managed Portfolios give you the flexibility to generate sustainable,

tax-effective cash flow from your non-registered investments without sacrificing the

potential for growth or choice of investments through our T-Class platform.

0

3,000

6,000

9,000

12,000

InterestIncome

DividendIncome

CapitalGains

Return ofCapital†

$5,000 $5,000

$6,500

$7,500

$10,000

$3,500

$2,500

Net after tax

Taxes paid*

*Assumes a tax rate of 50% for interest income, 35% on eligible dividend income and 25% for capital gains as of 2018.

Tax rates based on an average of the highest combined federal and provincial personal income tax rates.†Taxes are deferred until return of capital (ROC) is depleted. ROC distributions reduce the adjusted cost base (ACB) of the investment. Over time, the ACB may fall to zero, in which case 100% of the monthly payments from the T-Class investments will be classified as

capital gains. Please note that T-Class shares may pay a taxable annual dividend in addition to the monthly ROC payments.

Comprehensive wealth planning.

Comprehensive wealth planning advice

PRESERVE AND ENHANCE YOUR WEALTH

There are many important questions to consider in creating the road map for your future: What do I have today? Will it be enough to meet my needs? What happens if things change? Will my family be protected? How can I maximize what I leave as an inheritance? How does my business impact my financial plan? By asking these simple questions, we can uncover the risks and opportunities that can help you preserve and enhance your wealth.

A dedicated wealth planning professional will work with you and your advisor to produce a detailed analysis of your personal financial circumstances and gain an in-depth understanding of your current financial status, lifestyle objectives and plans for your estate. This information is reviewed and analyzed by our team of wealth planning professionals to create your personal Wealth Plan.

Your Wealth Plan is a powerful resource that maps out your life-long plan. It is designed to preserve and enhance your wealth by presenting you with effective tax, estate, and financial strategies tailored to your situation,

whether you’re retired, still working or own your own business. Our financial planners, tax accountants, estate lawyers and insurance specialists will work with you, your advisor and your lawyer or accountant to implement the recommended strategies, maintaining a cohesive and integrated approach for your personal Wealth Plan.

TACKLE THE COMPLICATIONS THAT LIFE CAN BRING

Your Assante Private Client experience is ongoing. In addition to creating your personal Wealth Plan, our team of experts are available to help guide you and address your evolving needs as your life and financial situations change.

INCORPORATE YOUR GOALS AND VALUES

For many investors, financial success goes beyond just what they build for themselves. With your advisor, Assante Private Client offers strategic gift planning advice, a platform for donor-advised funds, and partnerships with leaders in the gift planning space. By incorporating your philanthropic goals into our wealth planning process, we ensure your wealth and values can leave a lasting impact.

Assante Private Client is more than an investment program, it’s a complete wealth

management solution.

TRACKING YOUR PROGRESS

Every quarter, you will receive an all-inclusive report on your portfolio, showing the value of your holdings, your personal rate of return, a summary of all of your account activities, as well as details of your current holdings.

To complement our integrated approach to managing your wealth, we can also create tailored tax packages, including select statements that may be sent directly to your accountant or lawyer, so that all of your professional advisors have a big-picture view of your progress.

TAX PREPARATION MADE SIMPLE

Detailed tax packages, including information on your taxable income, capital gains/capital losses, and any investment counsel fees charged to the account are provided on a calendar-year basis.

Your tax package can also be customized to the fiscal year of your corporation or trust, as needed.

For your convenience, you can access your online account information to obtain copies of your statements or tax packages at any time.

Advanced reporting and tax information

Regular reporting and communication are an important ongoing part of managing

your wealth.

A Private Client experience you can trust

RBC INVESTOR SERVICES TRUST

To help safeguard your investments, we use the independent and professional services of RBC Investor & Treasury Services (RBC I&TS), a wholly-owned subsidiary of Royal Bank of Canada — one of the largest1 and safest2 banks in the world.

As the custodian of your portfolio, RBC IT&S is regulated by the Office of the Superintendent of Financial Institutions (OSFI). RBC I&TS segregates client securities from its own assets and, in the very unlikely event of RBC I&TS’ insolvency, client securities would not be available to creditors of RBC I&TS.

RBC I&TS has strict internal controls in place to protect client assets and information. Regular, independent audits of these controls are performed in accordance with established and recognized standards.

* Certain account types such as RESP may not be opened directly through RBC I&TS and may instead be opened at CI Investments Inc. However, RBC I&TS continues to be the custodian of the investment pools you hold in these account types and you benefit from the same protections as your assets held directly in your RBC I&TS account(s). 1Royal Bank of Canada Annual Report 2018 based on market capitalization 2Global Finance, World’s Safest Banks 2018.

With Assante Private Client, you can feel secure knowing that your wealth is handled

with the utmost care and security.

P

Experience you can trust.

Backed by the strength of CI Financial

Private Client Managed Portfolios are managed by Assante Private Client, a division of CI Private Counsel LP, and offered exclusively through the advisors of Assante Wealth Management Ltd.

CI Private Counsel LP is a wholly owned subsidiary of CI Financial, one of the largest and most respected financial services firms in Canada, with $136.4 billion in assets under management and $180.6 billion in total assets*.

Since its founding over 50 years ago, CI Financial has grown into one of the top three firms in its industry, offering a broad range of investment products and services, including an industry-leading selection of investment funds.

*As at September 30, 2018.

Responsible investing

The investment landscape has changed and the way profits are made has become intimately tied to the society and environment in which we live. This has led to a growing investor base that seeks to combine competitive risk-adjusted returns with positive societal and environmental outcomes, commonly referred to as responsible investing. In February 2017, CI Investments, a subsidiary of CI Financial, became a signatory to the United Nations Principles for Responsible Investment (UNPRI), joining a global network of organizations committed to understanding the investment implications of environmental, social and governance (ESG) factors. CI Investments is also an Associate Member of the Responsible Investment

Association (RIA), Canada’s membership association for responsible investment. CI’s in-house portfolio management teams, including Cambridge Global Asset Management, Signature Global Asset Management, Harbour Advisors and CI Multi-Asset Management, use ESG criteria to help identify factors that may impact financial returns, share prices and risks that may not be adequately recognized in traditional investment analysis. CI Investments believes that this plays a role in achieving the best possible risk-adjusted returns for our funds. Furthermore, CI’s external managers are expected to consider ESG factors in their investment processes, policies and practices, as stipulated in CI Investments’ Responsible Investment Policy.

Private Client Managed Portfolios are made available through Assante Private Client, a division of CI Private Counsel LP (“Assante Private Client”). The pools used in the Private Client Managed Portfolios are managed by CI Investments Inc., an affiliate of CI Private Counsel LP. Commissions, trailing commissions, management fees and expenses may all be associated with investments in Private Client Managed Portfolios and the use of other services. The pools used in the Private Client Managed Portfolios are not guaranteed, their values change frequently and past performance may not be repeated. Please consult your advisor before investing. Assante Private Client is a registered adviser under applicable securities legislation. This document has been prepared for use by Assante Private Client and is intended solely for information purposes. It is not a sales prospectus, nor should it be construed as an offer or an invitation to take part in an offer. Private Client Managed Portfolios are available exclusively through Assante Capital Management Ltd. – Member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada – and Assante Financial Management Ltd. ®CI Investments, the CI Investments design, Cambridge, Harbour Advisors and Harbour Funds are registered trademarks of CI Investments Inc. ™Signature Global Asset Management and Signature Funds are trademarks of CI Investments Inc. Cambridge Global Asset Management, Harbour Advisors and Signature Global Asset Management, are each a division of CI Investments Inc. Cambridge Global Asset Management is a business name of CI Investments Inc. used in connection with its subsidiary, CI Global Investments Inc. Certain portfolio managers of Cambridge Global Asset Management are registered with CI Investments Inc. Published January 10, 2019.

1801-0108_E (1/19)

For more information about Assante Private Client

speak to an Assante Wealth Management advisor.

Simplify, preserve and enhance.P1507-1092 - APC_PC_Brochure COVER_E.indd 4-6 2015-09-21 3:43 PM

Simplify, preserve and enhance.P1507-1092 - APC_PC_Brochure COVER_E.indd 4-6 2015-09-21 3:43 PM