Shareholder value creation in a hesitant economy CF… · The Boston Consulting Group ... • Steel...

Transcript of Shareholder value creation in a hesitant economy CF… · The Boston Consulting Group ... • Steel...

Shareholder value creation in a hesitant

economy Ramesh Karnani

11 April 2013

BCG CFA Perth Presentation v6.pptx 1

Copyr

ight

© 2

013 b

y T

he B

osto

n C

onsultin

g G

roup,

Inc.

All

rights

reserv

ed.

Agenda

Introduction

Market expectations and equity prices

• Investor expectations reached record lows at close of FY2012...

• ...but expectations are recovering as equity prices rise

Organic growth in a hesitant economy

• With an uncertain outlook, how can companies position for outperformance?

• Creating value through growth: some lessons from history

• The impact of capital efficiency on value creation

Creating value through M&A

• What does the market have in store?

• Most acquisitions destroy value: how to avoid the M&A trap

1

2

3

4

BCG CFA Perth Presentation v6.pptx 2

Copyr

ight

© 2

013 b

y T

he B

osto

n C

onsultin

g G

roup,

Inc.

All

rights

reserv

ed.

Which was the best and worst performing sector of the

ASX300 since the GFC?1

1. March 2009 NOTE: GICS definitions used Source: Capital IQ, Datastream

Options

A Metals & Mining

Financials B

Industrials C

Energy D

1

BCG CFA Perth Presentation v6.pptx 3

Copyr

ight

© 2

013 b

y T

he B

osto

n C

onsultin

g G

roup,

Inc.

All

rights

reserv

ed.

Which was the best and worst performing sector of the

ASX300 since the GFC?1

1. March 2009 NOTE: GICS definitions used Source: Capital IQ, Datastream

Options

A Metals & Mining

Financials B

Industrials C

Energy D

Financials & Industrials have dramatically outperformed

TSR

24%

19%

5%

4%

1

BCG CFA Perth Presentation v6.pptx 4

Copyr

ight

© 2

013 b

y T

he B

osto

n C

onsultin

g G

roup,

Inc.

All

rights

reserv

ed.

Around 5,600 consulting professionals

worldwide in over 75 offices around the globe

• Majority with advanced degrees from leading

international business schools

• Many with hands-on management experience

The Boston Consulting Group

BCG — a leader in addressing strategy,

operations and organisational issues

Advising senior management at world's

largest companies

• Working with our clients to resolve core

issues of direction and performance …

• … resulting in sustainable competitive

advantage …

• … and lasting change through sustained

competence and close collaboration

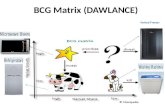

Leading in innovative strategic thinking

• Experience curve

• Portfolio analysis

• Time-based competition

• Digital transformation

• 'Big Data'/segment of one

Over 75 offices strategically placed worldwide

Worldwide presence and network

1

BCG CFA Perth Presentation v6.pptx 5

Copyr

ight

© 2

013 b

y T

he B

osto

n C

onsultin

g G

roup,

Inc.

All

rights

reserv

ed.

Introducing BCG's corporate development practice — our

topic map

Corporate

Strategy

Industry landscaping

Growth strategy

Portfolio strategy

Corporate vision

Finance excellence & organization

Corporate planning & budgeting

Monitoring & reporting

Value management

Post-merger

integration

PMI methodology

Functional expertise

Special situations

Industry expertise

M&A

Negotiation & transaction support

Partnering & alliances

Buy-side: Target identification & due diligence

PE best practices

Sell-side: divestiture & IPO support

Expert advice

Private Equity

TSR and investor strategy

Risk management M&A excellence &

organization

100 day program

Corporate

Processes

Source: BCG

1

BCG CFA Perth Presentation v6.pptx 6

Copyr

ight

© 2

013 b

y T

he B

osto

n C

onsultin

g G

roup,

Inc.

All

rights

reserv

ed.

1. Fundamental value reflects today’s proven performance, not some future promise of value creation (e.g., ‘blue sky’ growth potential)

2. The series of resulting economic profits is interpreted as what the investors expect in future periods, based on what they know today

3. Economic profit is net profit after tax (NPAT) less a capital charge

Source: BCG case experience

+ Future economic profit3 added on

the basis of the 'fade' concept2 Fundamental

Value (FV) Book value of

capital employed today3

Fundamental value is based on fading

returns and growth from current levels to

industry averages

BCG's proprietary valuation model compares the fundamental

value (FV) of a company with its current market capitalisation

Fundamental value (FV) methodology

FV

Market Capitalisation

Expectation premium

= value above FV

Empirically observed inputs

• Profitability and growth fade rates

• Profitability and growth fade-to rates

Current performance1 inputs

• Current profitability (ROI, ROE)

• Current growth rate

• Current capital employed

2

BCG CFA Perth Presentation v6.pptx 7

Copyr

ight

© 2

013 b

y T

he B

osto

n C

onsultin

g G

roup,

Inc.

All

rights

reserv

ed.

Change in Expectations and Fundamental Value by Sector Expectations had fallen in many industries despite strong earnings growth over the past two years

Change in Expectation Premium as % of MV

(Ppt pa, FY10-121)

10

0

-10

-20

-30

% Change in Fundamental Value

(CAGR %, FY10-12E2)

25 20 15 10 5 0 -5

ASX 200

Utilities Telcos

Software and Services

Real Estate

Insurance

Banks

Healthcare

Food and Staples Retailing Discretionary Retail

Media

Consumer Services

Transportation

Com. and Prof. Services

Capital Goods

Mining / Materials

Energy

1. 30/6/2010 to 30/3/2012 Source: Capital IQ

= ASX 200

Sustainable Performance

Unsustainable Performance Continued Decline

Turnaround

2

BCG CFA Perth Presentation v6.pptx 8

Copyr

ight

© 2

013 b

y T

he B

osto

n C

onsultin

g G

roup,

Inc.

All

rights

reserv

ed.

Market expectations have recovered from FY12 lows

1.0

0.5

0.0

FY13 FY12 FY11 FY10 FY09 FY08 FY07 FY06 FY05

Market Value / Fundamental Value

(Ratio)

2.0

1.5

FY04 FY03 FY02 FY01 FY00 FY09

1. Based on forecast of fundamental value in FY13 versus current market capitalisation for surveyed companies. P/E ratio based on forward P/E with exceptional records excluded. Source: Capital IQ

PE Ratio 14.2x 15.4x 14.0x 13.0x 12.2x 12.0x 12.2x 14.2x 11.0x 11.6x 11.7x 12.2x 11.4x 14.9x

2

BCG CFA Perth Presentation v6.pptx 9

Copyr

ight

© 2

013 b

y T

he B

osto

n C

onsultin

g G

roup,

Inc.

All

rights

reserv

ed.

Recent moves suggests the stock market has begun to

recognise fundamental value in the economy

Low levels of business investment

Companies sitting on their cash

Muted M&A activity

Talk of a recession

Everywhere we look there

is pessimism...

...but the fundamentals suggest

a different story

Low unemployment

Growth that most can only dream about

Recent market rally

Strong and deepening ties within Asia

Australia in 2020 – a snapshot:

• Gas production double current levels (could become world's largest LNG supplier)1

• Steel consumption in China still growing (total annual consumption expected to peak in 2025)2

• Twice the number of Chinese tourists visiting Australia (~1 million per year)3

• Others...

1. Economist Intelligence Unit; 2. Standard Chartered; 3. Tourism Australia

3

BCG CFA Perth Presentation v6.pptx 10

Copyr

ight

© 2

013 b

y T

he B

osto

n C

onsultin

g G

roup,

Inc.

All

rights

reserv

ed.

While businesses may be tempted cut costs in the face of

uncertainty, history suggests this is wrong path to take

20

30

0

10

Three responses to a slowdown Odds of breakaway

performance (%)

Cut costs deeper

than rivals

Source: 'Roaring Out of Recession', Gulati R., Nohria N., Wohlgezogen F., Harvard Business Review , March 2010

Invested more

than rivals

Cut costs deeper

and invested

more than rivals

Combination strategy

most likely to succeed

Defensive strategy least

likely to succeed

3

BCG CFA Perth Presentation v6.pptx 11

Copyr

ight

© 2

013 b

y T

he B

osto

n C

onsultin

g G

roup,

Inc.

All

rights

reserv

ed.

Businesses must pursue 'good' break-out growth to deliver

value to shareholders

Growth is important...1 ...but doesn't always add value2

20

15

10

5

0

10 yrs. 5 yrs. 3 yrs.

1. Sources of TSR for top-quartile performers (S&P 1200, 1991-2008); 2. Correlation of revenue growth and TSR (S&P 500, 1990-2009)

Source: Compustat, BCG ValueScience Center, 2008

Growth

Margin

Multiple

FCF

–20%

0%

20%

40%

–20% 0% 20% 40%

No growth

Bad growth

'Good growth'

Annual TSR

change (%)

Average annual

TSR (%)

Average annual revenue growth (%)

3

BCG document 12

Draft—for discussion only

Copyr

ight

© 2

013 b

y T

he B

osto

n C

onsultin

g G

roup,

Inc.

All

rights

reserv

ed.

BCG research has identified at least 4 factors that distinguish

'good', or value-creating, break-out growers

Prioritise the core

1

Expand

geographically

2

Acquire to grow

3

Preserve margin

and minimise debt

while growing

4

Source: BCG analysis

• Focus on growing the core – do what

you do best, but do it better

• Pursue returns > cost of capital and

operational excellence for the core

• Evaluate potential deals using consistent

strategic rationale

• Pursue targets that leverage and

reinforce the core

• Carefully evaluate all market entry

options (M&A, JV, organic etc.)

• Partner, as required, with governments

and/or local players

Key lessons

• Deliver growth that is profitable – not

'growth for growth sake'

• Avoid excessive capital intensity (i.e.

'capital-light' growth options)

Global Local

Examples

All companies should

take this focus

3

BCG CFA Perth Presentation v6.pptx 13

Copyr

ight

© 2

013 b

y T

he B

osto

n C

onsultin

g G

roup,

Inc.

All

rights

reserv

ed.

1. Company announcements, literature searches, annual reports and UBS 2. Bernstein research report, "Asia Pacific Oil & Gas", Feb 16 2011, BCG analysis (Note: An additional $4bn has been added to GLNG and QCLNG for post-FID drilling. All costs for projects beyond 2011 are Bernstein estimates)

Capital intensity is increasing across the resources sector:

capital efficiency is just as important as cost management

Australian LNG Liquefaction projects2 Australian Iron Ore projects1

1990 1985 2015 2010 2005 2000 1995

US$/tpa

3000

2000

1000

0

Project startup year

Operating Pre-commissioning

2007 2010 2005 2009 2011

US$/tpa

Project startup year

0

50

100

2012 2008 2006 2004

150

200

250

3

BCG CFA Perth Presentation v6.pptx 14

Copyr

ight

© 2

013 b

y T

he B

osto

n C

onsultin

g G

roup,

Inc.

All

rights

reserv

ed.

Working capital optimisation is a powerful lever for creating

value

Days

Queensland WA NSW Victoria

0

50

Dec-10

Dec-11

Days debtors1

Days payable2

Days

0

Queensland WA NSW Victoria

50

Numbers are indicative only Source: BCG Case Experience

Change in 2011 working capital balances if operating 2010 days

Debtors ($M) (30) 0 60 (10)

Payables ($M) 60 30 30 30

Net ($M) 30 30 (30) 20

Preventing working capital erosion saved $80m and

increased annual economic profit by $8m

3

BCG CFA Perth Presentation v6.pptx 15

Copyr

ight

© 2

013 b

y T

he B

osto

n C

onsultin

g G

roup,

Inc.

All

rights

reserv

ed.

As security prices rise, so too does M&A activity

4

# deals closed

200

150

100

50

0

ASX200 Price Index

8,000

6,000

4,000

2,000

0

Q1

2013

Q3

2012

Q1

2012

Q3

2011

Q1

2011

Q3

2010

Q1

2010

Q3

2009

Q1

2009

Q3

2008

Q1

2008

Q3

2007

Q1

2007

Q3

2006

Q1

2006

Q3

2005

Q1

2005

Q3

2004

Q1

2004

ASX200

Deals

Note: Price index quoted for end of quarter Source: MergerMarket, Datastream, Capital IQ

Recent run-up in the ASX200 suggests more

corporate activity is on the horizon for Australia

16 M&A report 2011 Video slides 24May11-JK-MUN.pptx

There are rewards for being first during an M&A wave

Sources: Thomson Reuters Datastream; Thomson Reuters Worldscope; BCG analysis. Note: The underlying sample consists of 26,444 M&A transactions between 1988 and 2010. Lower numbers for individual analyses are due to limited data availability for certain sub-samples. Industry M&A waves are periods of at least three years in which there is above average, clustered M&A activity with an identifiable peak. The first stage of such a cycle is its first two years. This analysis excludes all firms active in the financial services industry (based on Fama/French industry classifications). Includes all types of M&A (i.e. public-to-private, private-to-private, public-to-subsidiary) 1 CAR = cumulative abnormal return calculated over a seven-day window centered around the announcement date (+3/−3).

Overall, there is no advantage in doing deals

during an industry M&A wave ...

... but a closer look shows a

significant first-mover advantage

CAR1 (%)

1.5

1.0

0.5

0.0

Acquisitions during

industry M&A waves

0.9%

Acquisitions outside

industry M&A waves

1.0%

10,213 16,231

CAR1 (%)

1.5

1.0

0.5

0.0

0.9%

-0.7%-points

3rd stage of

an industry

M&A wave

0.5%

2nd stage of

an industry

M&A wave

0.9%

1st stage of

an industry

M&A wave

1.2%

5,703 7,865 2,668

n # of observations

4

17 MnA-TargetSearch-01May08-JK-RA-MUN.ppt

M&A and value creation: Do it right and be well prepared!

Four golden rules for successful M&A

1. Pick the right target • Strategic, capabilities and cultural fit • Ease of execution, relative to experience

2. Negotiate the right price, don't overpay

• Apply high-resolution valuation • Reasonable synergy expectations and

value drivers

3. Lay the groundwork for swift approval • No major regulatory delays • No unexpected enforced divestments

4. Manage the integration well

• Maintain core business growth and momentum

• Achieve synergies above announced levels

Source: BCG experience

“Which deal(s) will help us realize the

maximum value?”

• Deploy M&A to support overall strategy

• Develop a high-level screen to filter

potential targets on an on-going basis

• Be willing to walk away from the deal

“How do we get deal ‘xyz’ done?”

• Look at a deal in isolation

• Focus on "opportunity on the table"

Do

Don’t

Backup 4

Thank you

bcg.com | bcgperspectives.com