Setting the scene - PwC · Beware of optimistic economists 2 2.5 3 3.5 4 4.5 5 Apr-11 Oct-11 Apr-12...

Transcript of Setting the scene - PwC · Beware of optimistic economists 2 2.5 3 3.5 4 4.5 5 Apr-11 Oct-11 Apr-12...

Speakers

8

Economic update Austin Hughes – KBC

Business taxes Liam Diamond

Employment taxes Doone O’Doherty

Tax strategy Joe Tynan

Beware of optimistic economists

2

2.5

3

3.5

4

4.5

5

Apr-11 Oct-11 Apr-12 Oct-12 Apr-13 Oct-13 Apr-14 Oct-14 Apr-15 Oct-15 Apr-16 Oct-16

2012 2013 2014 2015 2016 2017

• Global growth has repeatedly

disappointed

• Uncertainty the new economic

watch word

• Facing up to risks and realities

11

Brexit has already begun for many Irish exporters

• Brexit in three parts:

• Exchange rate

pain

• Uncertainty

affecting

investment

• How distorted

will the new

order be?

12

Domestic demand improving unevenly

• Recovery now

broadening

• Pent-up demand

and legacy

problems

• Still lacking a ‘feel-

good’

13

Income taxes have surged while incomes have struggled

• Average earnings

only now returning to

pre-crisis levels

• Income tax increases

leading to suffering or

stability?

14

Public finances steadily approaching the promised (prudent) land

-8.9

-7.5

-6.2

-4.0

-2.7

-2.2-2.0

-1.1 -0.5

0.0

0.61.1

-11.0

-8.6

-8.1

-5.7

-3.5

-1.8

-0.9-0.4

-0.3

0.20.7 1.1

-12.0

-10.0

-8.0

-6.0

-4.0

-2.0

0.0

2.0

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

Ireland, Structural budget deficit (percentage of potential GDP at current prices)

Ireland, General Government Balance less Financial Transfers (% GDP)

• Only 3 of 28 EU

countries expected to

have a lower public

deficit in 2017

• Headline and

underlying government

deficit now close to

balance

• Promised land reached

in 2018, implying

greater scope for

‘giveaways’

15

Making a little go a long way

• Public spending and tax

adjustments altogether

smaller than the norm in

either good or bad times

• Budget broadly ‘indexes’ to

keep real value of spending

and effective tax burden

broadly unchanged—but

proportion of workforce

paying higher tax rate to

rise in 2017

• Will spreading the benefits

so thin be sustainable?

16

Fiscal space: the twilight zone

1.9

3.33.1

3.3 3.4 3.3

1.9

3.3 3.43.6 3.7 3.7

0

0.5

1

1.5

2

2.5

3

3.5

4

2016 2017 2018 2019 2020 2021

Reference rate of potential growth (New) Reference rate of potential growth (Previous)

1.21.6

1.8

3.23.5 3.6

1.2

1.7 1.8

3.43.6

5.6

0

1

2

3

4

5

6

2016 2017 2018 2019 2020 2021

Implied gross fiscal space now available (New)

Implied gross fiscal space now available (Previous)

• In spite of much stronger growth,

potential has declined?

• Revisions likely to boost fiscal space

in time for election 20??

• Fiscal space slightly exceeded in

Budget 2017

• Spending commitments limit scope

for tax adjustments

17

A shared view of a modest slowdown

Macroeconomic Forecasts for Ireland

2016 2017

KBCI DOF KBCI DOF

Consumer spending 3.5 3.3 3.0 2.9

Government consumption 6.0 5.9 3.0 2.4

Investment 16.7 15.8 11.3 6.0

Exports 4.2 3.6 4.0 4.5

Imports 7.5 5.9 6.0 5.1

GDP (f) 4.0 4.2 3.0 3.5

GNP (f) 3.7 2.8 2.5 4.5

General government balance (% GDP) -0.7 -0.9 -0.2 -0.4

BOP current account (% GDP) 10.5 9.4 8.0 8.2

General government debt 75.7 78.6 72.0 76.0

Employment (% change) 2.7 2.6 2.0 2.2

Unemployment rate 8.2 8.3 7.5 7.7

HICP 0.0 -0.1 0.5 1.3

• Department of Finance

and KBCI views broadly

similar

18

Higher house prices or more homes?

€100,000

€120,000

€140,000

€160,000

€180,000

€200,000

€220,000

€240,000

€260,000

€280,000

0

10

20

30

40

50

60

70

80

90

100

20

10

M0

3

20

10

M0

5

20

10

M0

7

20

10

M0

9

20

10

M1

1

20

11

M0

1

20

11

M0

3

20

11

M0

5

20

11

M0

7

20

11

M0

9

20

11

M1

1

20

12

M0

1

20

12

M0

3

20

12

M0

5

20

12

M0

7

20

12

M0

9

20

12

M1

1

20

13

M0

1

20

13

M0

3

20

13

M0

5

20

13

M0

7

20

13

M0

9

20

13

M1

1

20

14

M0

1

20

14

M0

3

20

14

M0

5

20

14

M0

7

20

14

M0

9

20

14

M1

1

20

15

M0

1

20

15

M0

3

20

15

M0

5

20

15

M0

7

20

15

M0

9

20

15

M1

1

20

16

M0

1

20

16

M0

3

20

16

M0

5

20

16

M0

7

First-Time Buyer, New Houses Bought (3mma) First-Time Buyer, Average Price, New Houses (3mma)

• A year later, a possible

error

• Spending on new homes

has roughly doubled in

past 3 years

• Will supply or prices

respond?

• Have lessons been

learned?

19

Summary

Passing a budget must count for something.

Public finances improving while economy gets a

little lift.

2017 likely to be a bumpy rather than a bumper

year.

The giveaways may not have not gone away for

good. 20

Budget 17 – Business taxes

• 12.5% rate “will not be changed”

• Update on Ireland’s International Tax Strategy published

• Independent review of corporate tax regime – Seamus Coffey

• Fair, competitive, certain, transparent regime which meets international standards

• Sugar tax – consultation, aligned with UK/2018

23

Budget 17 – “Getting Ireland Brexit Ready”

• “Safety nets”, “economic shock absorbers”….

• All positive tax changes = Brexit readiness

12.5% rate

6.25% KDB – “additional benefit” for SMEs

Retention of reduced 9% VAT rate (tourism/hospitality)

“Mobility” tax changes (SARP/FED)

Agri/marine sector, self employed, entrepreneurs etc.

• Review of 1% stamp duty on shares

24

Budget 17 – Financial Services

• S.110 changes (announced 6 Sept 2016)

• Considering further funds measures

• Estimated €50m tax yield for 2017

• Changes only applicable to Irish property investments

25

2016 – lots going on!

26

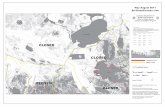

Ireland’s progress

EU ATAD

Inversions

US treaty

Apple & State Aid

US elections

BEPS

UK & Brexit

CCCTB

Common Consolidated Corporate Tax Base (“CCCTB”)

• Overall context for ATAD

• Unanimity required

• Impact of Apple case / Brexit

• Repeat of last time?

EU – 2 major tax initiatives

27

Anti-Tax Avoidance Directive (“ATAD”)

• CFC – 2019

• GAAR – 2019

• Hybrids – 2019

• Exit taxes – 2020

• Interest deductions – 2024

UK & Brexit

Ireland offers stability

Access to EU labour market critical

Ireland well placed for new FDI

There will be some relocations

Financial Services especially

28

Hard exit no later than March 2019: immigration control vs. free trade

Opportunities

UK & Brexit

x Uncertainty for Irish business

x Especially £ and Irish exports to UK

x Supply chain / border controls

x (New) UK competitive advantages?

x UK CT rate reduction aspirations

29

Hard exit no later than March 2019: immigration control vs. free trade

Risks

Apple & State Aid – competition law

30

Advantage

State resources

Selective

Distorts competition

Affects trade

€13bnplus

interest

Pre-Transfer Pricing

Pre-“Stateless” changes

A novel approach: “free for all”

Does it remind you of something?

Strong US reactions

Appeals x 2

US – a more (re)active IRS / Treasury

31

Election / reform?

Inversions

S.385 debt rulesState Aid

reactions

US/Ireland treaty

What happened to BEPS?

32

Transparency

Coherence

Substance

Transfer Pricing

Profits & “substance”

IP & DEMPE

Country by Country Reporting / +EU

OECD/EU “ruling” disclosures

EU accounts disclosures

Hybrids, mismatches, double non-taxation, etc.

Have we seen much coherence yet?

Ireland’s “BEPS” influenced journey

1990s

10% rate

2003

12.5% rate

2004

R&D tax credits

2009

IP tax depreciation

2014/2015

“Stateless”

removed

2015/2021

“IRNRs”

2004

HoldCo regime

2011

Transfer Pricing

2016

6.25% KDB

CbCR commences

OECD & EU disclosure regimes

2017

Strategy + “Independent review”

Accounts disclosure (EU)

Some more to come….

33

Areas of focus

34

Financial Services

• Brexit opportunities

• Regulatory regime

• US treaty qualification

• Irish property / S110s

• Funds / tax exempts

• Brexit challenges

• US treaty qualification

• EU ATAD

• Interest deductibility

• CFC / dividend taxation

PLCs / Domestic FDI

• Brexit risks & opps

• Apple / State Aid

• “Diverted Profits Tax”

• Phasing out IRNRs

• EU ATAD

So where does this position Ireland?

35

Affects trade

Attractive HoldCo regime

25% R&D tax credits

12.5% statutory rate

BEPS compliant regime

EU / Eurozone / OECD

Good treaty network (70)

IP tax depreciation

6.25% KDB

Not a ‘rulings’ regime

Access to talent pool

36

But the future is bright!

Uncertain times

Lots done, (some) more

to do

Ireland’s corporate tax future?

Universal Social Charge changes

40

Salary Before Budget

Salary After Budget

% Change

First €12,012 1% First

€12,012

0.5% 0.5%

Next €6,656 3% Next

€6,760

2.5% 0.5%

Next €51,376 5.5% Next

€51,272

5% 0.5%

Balance 8% Balance 8% -

Surcharge 3% Surcharge 3% -

International standing

42

IMD World Competitiveness Report 2016

World Economic Forum Report 2016

7th23rd

International comparisonSalary €55,000 (single)

Total effective tax rate (%)

0%

10%

20%

30%

40%

50%

60%

CH SGP UK US - NY IRL LUX NLD FRA GER

CH

SGP

UK

US - NY

IRL

LUX

NLD

FRA

GER

43

Effective Tax Rate

International comparisonSalary €95,000 (single)

Total effective tax rate (%)

44

0%

10%

20%

30%

40%

50%

60%

SGP CH US-NY UK FRA LUX IRL GER NLD

SGP

CH

US-NY

UK

FRA

LUX

IRL

GER

NLD

Effective Tax Rate

International comparisonSalary €200,000 (single)

Total effective tax rate (%)

0%

10%

20%

30%

40%

50%

60%

SGP CH US - NY UK LUX GER FRA IRL NLD

SGP

CH

US - NY

UK

LUX

GER

FRA

IRL

NLD

45

Effective Tax Rate

What else is out there?

Share based remuneration

CGT relief

Gifts / inheritances

Work, travel & mobility

Revenue audits

47

Other changes

52

Climate change and carbon tax09

Landlords and interest deductibility 02

Rent a room 03

Mortgage interest relief 04Home carers’

credit05

DIRT06

Earned income tax credit07

Home renovation incentive scheme 08

Help to Buy Scheme01

Three key factors

57

Increased

Transparency

International competition

Increased transparency

Demand for a fair share

UK anti-hybrid rules

CCCTB

Brexit

US election

From strategy to execution

58

Public CbCR

State Aid

CbCR

ATAD

International factors

BEPS

US/Ireland treaty

From strategy to execution

59

Domestic factors

Finance Bill #1

Property funds

Disclosure of accounts

Innovation R&D, KDB, IP

Interaction with Revenue

New Appeals process

Corporation tax review

Finance Bill #2

Directors’ Compliance Statement

Domestic political environment

Find out more @ pwc.ie

Budget 17 website

Brexit website

Graduate recruitment website

Alumni website

61

Thank you.

This content is for general information purposes only, and should not be used as a substitute for consultation with professional

advisors.

PwC firms help organisations and individuals create the value they’re looking for. We’re a network of firms in 158 countries

with close to 169,000 people who are committed to delivering quality in assurance, tax and advisory services. Tell us what

matters to you and find out more by visiting us at www.pwc.com

© 2016 PricewaterhouseCoopers. All rights reserved. PwC refers to the Irish member firm, and may sometimes refer to the

PwC network. Each member firm is a separate legal entity. Please see www.pwc.com/structure for further details.