Session1Intro & Comp Adv

-

Upload

aryan-khanna -

Category

Documents

-

view

222 -

download

0

Transcript of Session1Intro & Comp Adv

-

7/30/2019 Session1Intro & Comp Adv

1/31

1

Comparative AdvantageInternational Trade Session 1

Daniel TRAA

-

7/30/2019 Session1Intro & Comp Adv

2/31

| 2

Globalization I:Increased trade in goods and services

Trade has grown faster than GDP

10

15

20

25

30

35

40

1980 1985 1990 1995

T r a

d e

( % G

D P )

World High income Low & middle income

mostly for East Asia; it has fallen for Africa

0

15

30

45

E-Asia &Pac.

Lat. Am. &Carib.

Mid East, N Af

South Asia Sub-S. Africa

E x p o r t s

( % G

D P )

1960 1970 1980 1990 1998

International Trade involves mostly exchanges among high income

countries.

Developing countries have increased their relevance, particularly East Asia,

but are still a small part.

-

7/30/2019 Session1Intro & Comp Adv

3/31

| 3

Trade in services and merchandise

Most of world trade is in goods(merchandise) 82%.

Services trail behind, but arethe fastest growingcomponent. Outsourcing is the latest trend

Share of goods and commercial services in total trade

(Percentages, based on balance of payments data)

Export Shares Import Shares

GoodsCommercial

Services GoodsCommercial

Services

World 81.4 18.6 81.4 18.6

North America 77.2 22.8 85.9 14.1

Latin America 86.0 14.0 84.1 15.9

Western Europe 78.8 21.2 79.4 20.6

Africa 81.5 18.5 76.8 23.2

Egypt 42.5 57.8 68.2 31.8

Nigeria 93.8 6.2 71.1 28.9

Asia 85.7 14.3 81.3 18.7

India 71.4 28.6 73.4 26.6

Indonesia 92.8 7.2 72.3 27.7

Japan 87.1 12.9 74.8 25.2

-

7/30/2019 Session1Intro & Comp Adv

4/31

| 4

Globalization II:Foreign Investment - complex strategies of multinationals

Global FDI Flows 2000 1995 1990 1985 1980 1975 1970FDI in millions of dollars 1,270,764 331,068 202,297 56,583 54,725 25,850 12,542FDI per capita (dollars) 210.3 58.8 41.4 12.8 13.6 9.8 5.3FDI as percentage of GDP 3.12 1.13 0.96 0.48 0.52 0.49 0.48FDI as percentage of exports 19.99 6.45 6.05 3.10 2.95 3.33 4.56

Gross foreign direct investment (% of GDP)

0

2

4

6

8

1976 1981 1986 1991 1996

World High income Low & middle income

Share of FDI flows, by group

0%

25%

50%

75%

100%

1980 1985 1990 1995

Low income

Middle income

High income

-

7/30/2019 Session1Intro & Comp Adv

5/31

| 5

Drivers of Modern Globalization

Lower transport and

communication costs

Development of international

institutions

The WTO

Regional Trade Agreements

Political decisions toward de-regulation and liberalization of

trade and FDI regulations

-

7/30/2019 Session1Intro & Comp Adv

6/31

| 6

Theory and practice of international tradeand foreign investmentWHAT WE WILL LEARN

Why do countries export certain goods and imports others?

What do countries and populations gain and loose from trade?

Why do multinationals exist and what are their effects?

Why do governments protect their industries and what are the costs andbenefits?

What are the effects of different protectionist instruments?

How do the institutions that regulate global trade work?

What have been the economic and social consequences of the rise in tradeand foreign investment with developing nations?

What has globalization brought to developing countries?

-

7/30/2019 Session1Intro & Comp Adv

7/31| 7

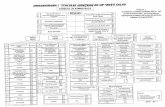

Organization of the course

Theories of international trade Comparative advantage Gains from trade: static and

dynamic

Losers and winners

Trade policy Policy Instruments The case for free-trade and

exceptions Policies for Strategic sectors Political economy and the realist

view

The effects of modernglobalization Trade and the developing

countries

Multinationals and FDI The effects in industrialized

countries

Institutions of global trade The W.T.O Regional agreements

-

7/30/2019 Session1Intro & Comp Adv

8/31| 8

Materials and exams

course website: www.danieltraca.com

Download class slides before class from website Also available at GES

Practice exams and answer keys available at website.

List of required sections available from website

Recommended textbook International Economics, 7 th edby Krugman P. and Obstfeld M., Addison -Wesley

Available in French

Additional readings available at website

http://www.danieltraca.com/http://www.danieltraca.com/ -

7/30/2019 Session1Intro & Comp Adv

9/319

The theory of Comparative Advantage

-

7/30/2019 Session1Intro & Comp Adv

10/31| 10

Absolute Advantage

It is the maxim of every prudent master of thefamily, never attempt to make at home what it willcost him more to make than buy What is prudentin the conduct of every family can scarce be folly inthat of a great kingdom If a foreign country cansupply us with a commodity cheaper than weourselves can make it, better buy it of them Adam Smith 1776

-

7/30/2019 Session1Intro & Comp Adv

11/31| 11

Absolute Advantage

Output per worker (productivity)

93SOUTH

8 10NORTH

Food(bushels)

Manufacturing(pieces)

-

7/30/2019 Session1Intro & Comp Adv

12/31| 12

Gains from specialization

Output

before after

1 northerner(FOOD toMANUF)

8 Food 10 Manuf

1 southerner(MANUF toFOOD)

3 Manuf 9 Food

North specializes inManufacturing and South inFood

There is more of both goods, if specialization follows absoluteadvantage

-

7/30/2019 Session1Intro & Comp Adv

13/31| 13

Comparative Advantage

"A country enabled to manufacturecommodities with much less labour that herneighbours may, in return for such commodities,import a fraction of the corn required for itsconsumption, even if corn could be grownwith much less labour than in the country fromwhich it was imported." David Ricardo

-

7/30/2019 Session1Intro & Comp Adv

14/31| 14

Output per worker (Productivity)

Manuf (pieces)

Food(bushels)

NORTH 10 10

SOUTH 3 9

Comparative AdvantageNorth is MORE productive in both goods

-

7/30/2019 Session1Intro & Comp Adv

15/31| 15

Even so, there are gains fromspecialization

2 x 9 18 Food

2 x 3 6 Manuf

2 southerners(Manuf toFood)

10Manuf 10 Food

1 northerner(Food toManuf)

afterbefore

Output A country has Comparative Advantage in a given good if its relative productivity inthat good is higher than in

other goods

Specialization according toComparative Advantage creates value , by increasingoutput.

-

7/30/2019 Session1Intro & Comp Adv

16/31| 16

How does the market work?

Does the decentralized international market achieve this pattern of specialization? How?

Who benefits and who looses from international trade in the free-market?

Among individuals within a country? Among countries?

-

7/30/2019 Session1Intro & Comp Adv

17/31

| 17

In Autarky...

Food

Manuf

North

Northern workerThey work in bothsectors, and tradeamong them at theautarky relative price

The relative price

P= pManuf /p Food In equilibrium, workers

must be indifferentbetween the twosectors.They must get thesame wage

S o u t h

-

7/30/2019 Session1Intro & Comp Adv

18/31

| 18

The prices in autarky (closedeconomy)

The relative price of Manuf (P) denotes how many bushels of Food for one piece of Manuf.

9

10

Food(bushels)

9/3 = 33SOUTH

10/10 = 110NORTH

PManuf (pieces)

-

7/30/2019 Session1Intro & Comp Adv

19/31

| 19

Relative prices, relative supply,relative demand

1

Manuf/Agro

Relative demand (RDW)It is the same in both countriesif preferences are the same

P

Relative Supply (RS N)NorthP N=

3Relative Supply (RS s )SouthP S=

[Manuf/Agro] S [Manuf/Agro] N

-

7/30/2019 Session1Intro & Comp Adv

20/31

| 20

In Autarky...

Food

Manuf

North

Northern worker Southern worker

The Northernerstrade among themat the autarky priceP N = 1

Food

Manuf

South

The Southernerstrade among themat the autarky priceP S= 3

-

7/30/2019 Session1Intro & Comp Adv

21/31

| 21

Wages and productivity

Are the wages the same in both sectors? Why? If not, where are they higher? Why?

Are they the same in both countries? Why? If not, where are they higher? Why?

-

7/30/2019 Session1Intro & Comp Adv

22/31

| 22

The Production Possibility Frontierand Welfare

NorthManuf

+1

-1

UN

10

10 Agro

The choice of consumersdetermines the allocation of labor

MRS =MUFood / MU Manuf = 1/P =1

ProductionPossibilityFrontier

-1/P N = -1

Equilibrium P=1 ,So that bothgoods areproduced

Slope =-Prod F / Prod M

NorthernWorkers in Agro

N

o r t

h e r n

W o r k e r s

i n

M a n u

f

-

7/30/2019 Session1Intro & Comp Adv

23/31

| 23

The beginnings of Trade

Manuf is relatively cheaper in the North. An enterprising Northerner takes 1 Manuf to the South and

exchange it for 3 Foods. Back in the North, she could sell 1 Foods for 1 Manuf with a net

gain of 1 Food.

There are gains from exchange because prices aredifferent: Trade occurs! What happens to the relative price of Manuf in North? And in the South?

-

7/30/2019 Session1Intro & Comp Adv

24/31

| 24

Openness in the Short Run...

Food Food

Manuf Manuf

1 . Tradestarts due to

arbitrage

2 . Prices adjust tonew scarcity

P rises in the North andfalls in the South

SouthNorthP S < 9/3P N >10/10

-

7/30/2019 Session1Intro & Comp Adv

25/31

| 25

In the Long-Run, there is re-allocation

Food Food

Manuf Manuf

North SouthEach country specializes

completely in, and exports, thegood in which it has

comparative advantage

There is one world price,which is between the

initial prices10/10 < P W 10/10

3 . Factors (workers) respond to new prices and profitability -- specialization

-

7/30/2019 Session1Intro & Comp Adv

26/31

| 27

How to determine the world price?

1

3

Manuf/Food

Relative Supply (RS W)World

South produces Food onlyNorth produces both

North produces Manuf onlySouth produces both

N o r t

h a n

d S o u

t h s p e c

i a l i z e

c o m p

l e t e l y

N o r t

h a n

d S o u

t h p r o d u c e

o n

l y M a n u

f

North andSouth

produceonly Food

Relative Demand (RD W)World

1

-

7/30/2019 Session1Intro & Comp Adv

27/31

| 28

The Gains from Trade according toComparative Advantage

North South

10

10 Food

Manuf

Food

Manuf

9

3

UN

US

US (Food)

UN(Manuf)-1/P N

-1/P S

-1/P W

-1/P W

-

7/30/2019 Session1Intro & Comp Adv

28/31

| 30

Some unrealistic features of themodel, so far

What if there are transport costs?

What if there are more than two goods?

What if factors cannot adjust to other sectors?

What if there are more than one factor?

Why is there always complete specialization?

-

7/30/2019 Session1Intro & Comp Adv

29/31

| 31

Transport Costs and Non-tradedgoods

If there are transport costs, the competitiveness edge of a country

must more than make up for this transport cost.

Otherwise, the good will not be traded, even if it is cheaper to

produce in one country. This good is called non-tradable.

In reality, economies spend large proportions of their income in these

type of goods.

It can become tradable, if transport costs fall or the productivity

advantages widen (globalization).

-

7/30/2019 Session1Intro & Comp Adv

30/31

| 32

Global markets vs. local marketsTRADABLES and NON-TRADABLES

Tradable goods can travelacross borders and haveinternational markets that setprices.

Non-tradable goods have theirprices set by supply anddemand in local markets. Often, the same good exists in

different countries because itis produced locally.

With globalization, many goodsand services have becometradable.

Consulting

Banking Telecoms Tourism

Hairdressers

Governmentservices Auto-repair Almost allservices

Services

Textiles Machinery Almost allgoods

Cement Housing McDonaldsHamburger

Goods

TradablesNon-tradables

-

7/30/2019 Session1Intro & Comp Adv

31/31

Summary

Comparative advantage: Consumers react to price differences and buy from lower price

foreign producers the goods in which their country does not havecomparative advantage (gains from exchange).

Producers react to price differences and allocate resources toindustries where relative productivity is higher, exporting thosegoods (gains from specialization).

Every country always has an industry in which it hasComparative Advantage and it is competitive in worldmarkets for that industry.