Sensex Sensex ‘Ease of Doing Business’ Has it become Easy...

Transcript of Sensex Sensex ‘Ease of Doing Business’ Has it become Easy...

Serving Since 1968Serving Since 1968Serving Since 1968Serving Since 1968 September 2015September 2015September 2015September 2015

Lunawat Bulletin

For Private Circulation Only

Lunawat & Co. Chartered Accountants www.lunawat.com

Inside …..

Compliance Due Dates

2

Income Tax 3-4

Corporate Law 5

RBI 5

Lunawat Up-dates

6

Market Watch Sensex Sensex Sensex Sensex

31.08.2015 : 31.08.2015 : 31.08.2015 : 31.08.2015 : 26283.0926283.0926283.0926283.09

31.07.2015 31.07.2015 31.07.2015 31.07.2015 : 28114.56: 28114.56: 28114.56: 28114.56

NiftyNiftyNiftyNifty

31.08.2015 : 31.08.2015 : 31.08.2015 : 31.08.2015 : 7971.307971.307971.307971.30

31.07.31.07.31.07.31.07.2015 : 8532.852015 : 8532.852015 : 8532.852015 : 8532.85

‘Ease of Doing Business’ – Has it become Easy!

After NDA coming to power one of the famous

tag line used by it was ‘Ease of Doing Business’.

Based on this theory it propagated ‘ Make in In-

dia’ too, as unless there is ease of doing business

in India, no one would come to do business in

India. Even after more than a year of NDA com-

ing to power, businessmen are not finding any-thing easy to do business in India. Customary changes in few forms were done, but if we see

the compliances, they have become more compli-

cated and cumbersome.

The fear of heavy penalties and prosecution due

to non-compliances is looming large over busi-

nessmen. The cost of compliance has gone up

tremendously. Government should act fast to

make the term ‘ Ease of Doing Business’ a true

reality and not just remain a slogan like ‘Sawach

Bharat Abhiyaan’.

Ease of doing business is a must for the business-

men to focus on business rather than compliances and contribute positively to the growth of the

nation.

What China’s market crash means for Indian Economy

With August 24 being termed 'Black Monday' as markets tumbled first in China and then in coun-

tries elsewhere. In China, the benchmark Shang-hai Composite Index fell an astounding 8.49 per

cent in one day. India’s benchmark index, Sensex, saw its biggest-ever intra-day fall in absolute

terms. The Chinese crisis is expected to put downward

pressure on the yuan versus the US dollar while

the rupee may be more resilient. This will result in Chinese imports into India becoming cheaper.

The impact of China slowdown will be felt very differently on various economies developed ver-

sus developing there could be a divergence be-cause most of the key developed economies do

not have a huge exposure to China but for certain Asian economies, the exposure is primarily on

the higher side.

For India, again, it is not so much when we look

at the domestic demand for China and even In-

dia's share in exports to China. So there will be a divergence from the China impact when it comes

to the growth angle but when it comes to posi-tioning, most of the correction is likely to be seen

all across the board.

As RBI Governor Raghuram Rajan has said re-

cently, "India is better placed compared to other countries with low current account deficit, and fiscal deficit discipline, moderate inflation, low

short-term foreign currency liabilities, very sizea-ble base of forex reserves." In the months ahead,

the Federal Reserve's actions could have a great

bearing on emerging market economies like In-

dia. Much will depend on the how well India is geared up to meeting these challenges.

Page 2

Lunawat Bulletin

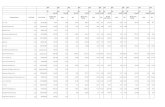

Compliance Due Dates

Due Date Related to Particulars

06.09.2015 (Sunday)

SERVICE TAX Deposit Service Tax for the month of August 2015 for Company Assessee

07.09.2015 (Monday)

TDS/TCS (Income Tax)

Deposit TDS/TCS for deductions/collections made during the month of August 2015.

15.09.2015 (Tuesday)

EPF Deposit PF under Employees Provident Fund & Misc. Provision Act, 1952 deducted for the month of August 2015.

15.09.2015 (Tuesday)

DVAT Deposit tax deducted at source under DVAT Act for the month of August 2015

15.09.2015 (Tuesday)

INCOME TAX

Deposit Advance Income Tax - 1st Installment (in the case of a non-corporate assessee) or 2nd Installment (in the case of a corporate-assessee) of advance for the assessment year 2016-17

21.09.2015 (Monday)

ESI Deposit ESI under Employees State Insurance Act, 1948 deducted for the month of August 2015.

21.09.2015 (Monday)

DVAT Deposit DVAT and CST for the month ended August 2015.

22.09.2015 (Tuesday)

TDS/TCS (Income Tax)

Issue of TDS Certificate for tax deducted under Section 194-IA in the month of August, 2015

22.09.2015 (Tuesday)

DVAT Issue of TDS certificates for the tax deducted at source under Rule 59(2).

30.09.2015 (Wednesday)

INCOME TAX • Due Date of Audit report under Section 44AB for the AY 2015-16 in the case of a corporate-assessee or non-corporate assessee (who is required to submit his/its return of income).

• Annual return of income and wealth for the assessment year 2015-16 if the assessee (not having any international or specified domestic transaction) is (a) corporate-assessee or (b) non-corporate assessee (whose books of account are required to be audited) or (c) working partner (of a firm whose accounts are required to be audited)

LIST OF HOLIDAYS

DATE DAY HOLIDAY

05.09.2015 Saturday Shree Krishna Janamashtami

Page 3

September 2015

Income Tax

Clarifications regarding on issues relat-

ed to grant on approval and claim u/s

10(23C) of the Income Tax Act,1961:

• It is sufficient for the prescribed authority to consider the

nature, existence for non-profit purposes and genuineness

of the applicant institution or the conditions prescribed

under various Provisos are also required to be considered at

the stage of granting approval.

• In case trust or institutions having obtained registration u/s

12AA as well as approval us/ 10(23C), if registration is

withdrawn at some point of time due to certain adverse

findings, the withdrawal of approval u/s 10(23C)(vi) shall

not be automatic but will depend upon whether these ad-

verse findings also impact the conditions necessary to keep

approval u/s 10(23C)(vi) alive .

• Mere generation of surplus by educational institution from

year to year cannot be a basis for rejection of application u/

s 10(23C)(vi) if it is used for educational purposes unless

the accumulation is contrary to the manner prescribed un-

der law.

• Collection of small and reasonable amounts under different

heads of fee which are essentially in the nature of fee con-

nected with imparting education and do not violate any

Central or State regulation does not, in general, represent a

profit making activity. Hence there is no justification for

treating these amounts as profit making activity .

• Denial of exemption would not be justifiable only on the

ground of induction of new trustees or removal of existing

ones. Unless the nature of activities of the trust or institu-

tion get changed or modified or no longer remain to exist

'solely for educational purpose and not for purposes of

profit'.

CBDT amends Income Tax Rules for computation of period of stay of Individual who is citizen of India and crew member of ship:

• The period of stay shall be begin on the date entered into the continuous discharge certificate in respect of joining the ship by the said individual for the eligible voyage and ending on the date entered into the Continuous Discharge Certificate in respect of signing off by that individual from the ship in respect of such voyage.

• Continuous discharge certificate shall have the same meaning assigned in the merchant shipping rules, 2001 made under the merchant shipping Act, 1958.

• Eligible voyage shall mean a voyage undertaken by a ship engaged in the carriage of passengers or freight in interna-tional traffic where- (i) for the voyage having originated from any port in In-

dia, has as its destination any port outside India; and (ii) for the voyage having originated from any port outside

India, has as its destination any port in India.

• for the voyage having originated from any port outside India, has as its destination any port in India.

CBDT amends Rules for computation

of period of stay for ship crew

“Do not Pray for an easy life, Pray for the strength to endure a difficult one

- Bruce Lee”

Page 4

Lunawat Bulletin

The statement referred to in sub-rule (7) of Rule 114G shall be

furnished through online transmission of electronic data to a

server designated for this purpose under the digital signature in

accordance with the data structure specified in this regard by the

Principal Director General of Income tax (Systems).

CBDT notifies procedure for registra-tion and submission of report- Annual

Information Report:

CBDT notifies 21 districts of Bihar as backward areas for higher Income Tax Benefits u/s 32 &32AD of the Act. The list of some of the notified districts is below:

1. Patna; 2. Muzaffarpur; 3. Gaya; 4. Aurangabad; 5. Darbhanga Etc..

CBDT Notifies higher Income Tax Bene-

fits u/s 32 &32 AD of the Act.

Income Tax

CBDT issues Guidelines for Selec-

tion of Cases for Scrutiny

CBDT has laid down the guidelines & selection criteria for manual selection of Scrutiny Cases for FY 2015-16. 1. Cases involving addition in an earlier assessment year in

excess of Rs. 10 lakhs where a substantial question of law or fact is pending

2. Cases involving addition in an earlier assessment year on the issue of transfer pricing in excess of Rs. 10 crore or more

3. All assessments pertaining to Survey under section 133A of the Income-tax Act, 1961 ('Act') excluding those cas-es where books of accounts, documents etc. were not impounded and returned income (excluding any disclo-sure made during the Survey) is not less than returned income of preceding assessment year.

4. Assessments in search and seizure cases to be made un-der section(s) 158B, 158BC, 158BD, 153A & 153C read with section 143(3) of the Act

5. Returns filed in response to notice under section 148 of the Act

6. Cases where registration u/s 12A of the IT Act has not been granted or has been cancelled by the CIT/DIT con-cerned, yet the assessee has been found to be claiming tax-exemption under section 11 of the Act.

7. Cases where the approval already granted u/s 10(23C)/35(1)(ii)/35(1)(iii)/10(46) of the Act has been withdrawn by the Competent Authority, yet the assessee has been found claiming tax-exemption/benefit under the aforesaid provisions.

8. Cases in respect of which specific and verifiable infor-mation pointing out tax-evasion is given by Government Departments/Authorities. The Assessing Officer shall record reasons and take prior approval from jurisdiction-al Pr. CCIT/CCIT/Pr. DGIT/DGIT concerned before selecting such a case for scrutiny.

Time Limit for filing ITR ex-

tended for the State of Gujrat

On consideration of reports of dislocation of general life due

to recent disturbances in the State of Gujrat, CBDT has ex-

tended the “Due Date” for filing of ITR from 31st August to

7th September 2015.

Page 5

September 2015

Corporate Law

RBI

MCA amends Rules to substitute An-

nual Return Form MGT 7 MCA, through a notification, has amended Companies (Management & Administration) Rules 2015 for substitution of Form No. MGT-7 of Annual Return of companies.

RBI grants “in-principle” approval

to 11 Banks for Payments Banks The Reserve Bank of India has decided to grant “in-principle” approval to set up payments banks under the Guidelines for Licensing of Payments Banks issued on November 27, 2014 (Guidelines). Details of “in-principle” approval. The “in-principle” approval granted will be valid for a period of 18 months, during which time the applicants have to comply with the requirements under the Guidelines and fulfil the other conditions as may be stipulat-ed by the Reserve Bank. On being satisfied that the applicants have complied with the requisite conditions laid down by it as part of “in-principle” approval, the Reserve Bank would consider granting to them a licence for commencement of banking business under Section 22(1) of the Banking Regulation Act, 1949. Until a regular li-cence is issued, the applicants cannot undertake any banking business.

“Detection and Reporting of Coun-

terfeit Notes”

Detection 1. Detection of Counterfeit Notes i. Over the Counter Banknotes tendered over the counter should be examined for authenticity through machines and such of these determined as a counterfeit one, shall be stamped as "COUNTERFEIT NOTE". ii. Bulk Receipts at Back Office / Currency Chest. 2. When a banknote tendered at the counter of a bank branch or treasury is found to be counterfeit, an acknowledgement receipt in the format must be issued to the tenderer, after stamping the note. The receipt, in running serial numbers, should be authenticated by the cashier and tenderer. Notice to this effect should be displayed prominently at the offices / branches for information of the public. The receipt is to be issued even in cases where the tenderer is unwilling to coun-tersign it. 3. No credit to customer’s account is to be given for counter-feit notes, if any, in the tender received over the counter or at the back-office / currency chest. 4. In view of the revision in the system of detection of coun-terfeit notes by banks, the following changes may be noted with respect to existing compensation and penalty for non-detection of counterfeit notes: Compensation The instructions on compensation to banks at 25% of the no-tional value of counterfeit notes detected and reported and the system of lodging claims for compensation by Forged Note Vigilance Cell of banks stand withdrawn. Penalty Penalty at 100% of the notional value of counterfeit notes, in addition to the recovery of loss to the extent of the notional value of such notes, will be imposed under the following cir-cumstances: a) When counterfeit notes are detected in the soiled note re-mittance of the bank. b) If counterfeit notes are detected in the currency chest bal-ance of a bank during Inspection / Audit by RBI.

Page 6

September 2015

© 2015 Lunawat & Co. All Rights Reserved Information in this document is intended to provide only a general outline of the subjects covered. We recommend that you seek professional advice prior to initiating action on specific issues. Lunawat & Co. does not take any responsibility for any loss arising from any action taken or not taken by anyone using this material.

Disclaimer

Lunawat Update

Our Services

• Audit and Assurance

• International Taxation

• Indian Direct Tax Laws

• VAT/Sales Tax

• Service Tax

• Corporate Laws

• Limited Liability Partnership

(LLP)

• NGOs/Societies and Trusts

• Compliance Audits

• Investigations

• Outsourcing Services

• Setting up Business in India

• Consulting Services

• Trainings

• Valuations

• XBRL

• Trade Marks

Daryaganj, New Delhi 54, Daryaganj, New Delhi – 110 002 Tel: +91 11 23270624 + 91 11 23279414 Email: [email protected]

Paschim Vihar, New Delhi A-2/132, Prateek Apartments, Paschim Vihar, New Delhi – 110 063 Tel: + 91 11 25278405 + 91 11 25278406 + 91 11 45581263 + 91 11 45581264 Email:[email protected] Karampura, New Delhi 109, Magnum House-1, Karampura Complex, New Delhi-110 015 Tel: + 91 11 25920301 + 91 11 25920303 Email: [email protected]

Mumbai Office No. 9, First Floor. Star Trade Centre, Chamunda Circle, Near Station, Borivali (W), Mumbai - 400 092 Tel: + 91 22 28954451 Email: [email protected] Keshopur, New Delhi WZ-339, 2nd Floor, Street No. 19, Santgarh, Keshopur, Outer Ring Road, New Delhi - 110 018 Tel: +91 11 28333914 Fax:+ 91 11 28331602

Presentations

During August 2015, our partner CA. Pramod Jain gave follow-

ing presentations:

• “Directors’ Report under Companies Act 2013” at Tri Na-

gar Keshav Puram CPE Study Circle.

• “Practical aspects of Finalization of Audits under Compa-

nies Act 2013” at Urban Estate CPE Study Circle, Faridabad.

• “Finalization of Audits for FY 2014-15 under Companies

Act 2013” at Pune Branch of WIRC of ICAI.

• “Conversion of Company into LLP” at Pune Branch of WIRC

of ICAI.

Editorial Team: CA. Vikas Yadav, CA. Samta Jain, Raman Goel and Shyam Karwa

We may be contacted at:

We also have ASSOCIATES at :

Chennai, Kolkatta, Ludhiana, Pune,

Chandigarh, Udaipur, Vadodara,

Bangalore, Cochin, Indore, Jodhpur,

Jaipur, Bharatpur, Hyderabad,

Jharsuguda, Panipat, Ranchi & Gha-

ziabad.

During August 2015, our partner CA. Rajesh Saluja gave

following presentations:

• “Financial Statement Analysis” at Yes Bank Ltd, Gur-

gaon.

• Financial Statement Analysis” at Yes Bank Ltd, Chen-

nai.

• “Commercial Thinking” at Bharti Infratel Ltd, Noida

• “Raising Financial and Commercial Quotient” at

Pragati Technologies Private Ltd.(UK based MNC),

Mumbai.

• “Commercial Thinking” at Bharti Infratel Ltd, Noida