Sensex

-

Upload

guru-chowdhary -

Category

Documents

-

view

6 -

download

0

description

Transcript of Sensex

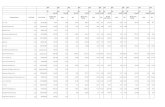

SENSEXTheS&P BSE SENSEX(S&P Bombay Stock Exchange Sensitive Index), also-called theBSE 30or simply theSENSEX, is afree-float market-weightedstock market indexof 30 well-established and financially sound companies listed onBombay Stock Exchange. The 30 component companies which are some of the largest and most actively traded stocks, are representative of variousindustrial sectorsof the Indian economy. Published since 1 January 1986, the S&P BSE SENSEX is regarded as the pulse of the domestic stock markets in India. The base value of the S&P BSE SENSEX is taken as100on 1 April 1979, and its base year as197879.Then the table of 30 stocks and weight.NIFTYTheCNX Nifty, also called theNifty 50or simply theNifty, isNational Stock Exchange of India's benchmarkstock market indexfor Indian equity market. Nifty is owned and managed byIndia Index Services and Products(IISL), which is a wholly owned subsidiary of the NSE Strategic Investment Corporation Limited.IISLhad a marketing and licensing agreement withStandard & Poor'sfor co-branding equity indices until 2013. The 'CNX' in the name stands for 'CRISILNSE Index'. The base period for the CNX Nifty index is November 3, 1995, which marked the completion of one year of operations ofNational Stock Exchange Equity Market Segment.Then the table of 50 stocks and weight.

ConclusionDuring this period the markets remained volatile mainly due to Greece debt concern which impacted the stock market but not considerably because of strong macro economic factors like the forex reserve in india is at all time high. The fall in crude oil prices is a major factor of boost for india since its a major import bill and also lowers the inflationary pressure as the inflation is now ranging from 5-6%. The new government policies and push for reform and clearance of stalled projects has given indian markets a positive outlook. The traders and investors are waiting for Quarter 1 earnings to come up and the management outlook for their companies for coming quarters. Moreover the monsoon will play a big role in determing the course of action of RBI rate cut in august as slower monsoon will discourage rate cut and also affect the earnings of the companies and july had a weak start as it was 6% below average. The parliament session will also affect the markets as opposition will try and stop the functioning of parliament with major bills in the pipeline and it may be difficult for the government to pass them and rally in the market may be affected by that. Also the US Federal Reserve Chairperson Janet Yellen said that the US Federal Bank may kickstart raising interest rates this year itself, which might fuel volatility across emerging markets including India. The Fed is liklely to raise rates in December, and will take interest rates higher by another percentage point over the course of the next year. the greece crisis which now keeps them in the Euro zone with another bailout package by the ECB will kepp the global markets and emerging markets volatile but strong fundamentals and little exposure of India will not have considerable effect in the long run.