SECOND QUARTER 2018 EARNINGS REPORT - Amazon S3 · Source: PGIM Real Estate - Asset Management...

Transcript of SECOND QUARTER 2018 EARNINGS REPORT - Amazon S3 · Source: PGIM Real Estate - Asset Management...

1

Contacts in Mexico City: Francisco Martinez Investor Relations Officer Tel: +52 (55) 5279-8107 E-mail: [email protected]

Contacts in New York: Maria Barona i-advize Corporate Communications, Inc. Tel: +(212) 406-3691 E-mail: [email protected]

SECONDQUARTER2018EARNINGSREPORT

Mexico City, July 26, 2018 – Terrafina® (“TERRA” or “the Company”) (BMV: TERRA13), a leadingMexican industrial real estate investment trust(“FIBRA”),externallyadvisedbyPGIMRealEstateanddedicatedtotheacquisition,development,leasingandmanagementofindustrialrealestatepropertiesinMexico,todayannounceditssecondquarter2018(2Q18)earningsresults.ThefiguresinthisreporthavebeenpreparedinaccordancewithInternationalFinancialReportingStandards(“IFRS”).Figurespresentedinthisreportare presented inmillions ofMexican pesos andmillions of U.S. dollars, unless otherwise stated. Additionally, figuresmay vary due to rounding.Terrafina’sfinancialresultsincludedinthisreportareunaudited.Asaresult,thementionedfiguresinthisfinancialreportarepreliminaryfiguresandcouldbeadjustedinthefuture.Thisdocumentmayincludeforward-lookingstatementsthatmayimplyrisksanduncertainties.Termssuchas"estimate","project","plan","believe","expect", "anticipate", "intend", and other similar expressions could be construed as previsions or estimates. Terrafina warns readers thatdeclarationsandestimatesmentioned in thisdocument,or realizedbyTerrafina’smanagement implyrisksanduncertainties thatcouldchange infunctionofvariousfactorsthatareoutofTerrafina’scontrol.FutureexpectationsreflectTerrafina’sjudgmentatthedateofthisdocument.Terrafinareservestherightorobligationtoupdatetheinformationcontainedinthisdocumentorderivedfromthisdocument.Pastorpresentperformanceisnotanindicatortoanticipatefutureperformance.

OperatingandFinancialHighlightsasofJune30,2018

Operating

• AsofJune30,2018,theoccupancyratewas95.5%,a68basispointincreasecomparedtothesecondquarterof2017(2Q17).Additionally,consideringsignedlettersofintent(LOI),occupancyfor2Q18was96.4%.

• Annualizedaverageleasingratepersquarefootat2Q18wasUS$5.07,aUS$0.08increasecomparedto2Q17.

• Terrafinareportedatotalof40.9millionsquarefeet(msf)ofGrossLeasableArea(GLA)comprisedof286propertiesand298tenantsin2Q18.

• 2Q18leasingactivitytotaled1.4msf,ofwhich18.0%correspondedtonewleases,39.0%toleaserenewalsand43.0%

to early renewals. Leasing activity wasmainly concentrated in the Chihuahua, Ciudad Juarez, Tijuana, Ramos Arizpe,Queretaro,Silao,CuautitlanIzcalli,SanLuisPotosi,Guadalajara,IrapuatoandHermosillomarkets.

2

Financial• RentalrevenuesreachedUS$47.6million,a14.2%orUS$5.9millionincreasecomparedto2Q17.

• NOIwasUS$47.9million,a14.6%orUS$6.1millionincreasecomparedto2Q17.

• TheNOImarginreached94.9%,a82basispointincreasecomparedto2Q17.• EBITDAreachedUS$43.6million,anincreaseof15.0%orUS$5.7millioncomparedto2Q17.

• EBITDAmarginwas86.4%,a111basispointincreasecomparedto2Q17.• Adjustedfundsforoperations(AFFO)reachedUS$28.8million,anincreaseof18.2%orUS$4.4millioncomparedto

2Q17.

• AFFOmarginwas56.7%,a241basispointincreasecomparedto2Q17.• DistributionstotaledUS$28.8million.Asaresult,TerrafinawilldistributePs.0.7020perCBFI(US$0.0364perCBFI)

fordistributionscorrespondingtotheApril1toJune30,2018period.

• TheannualizeddistributionwasUS$0.1456;consideringtheaveragesharepriceforthe2Q18ofUS$1.47(Ps.28.46),Terrafina’sdividendyieldforthequarterwas9.9%.

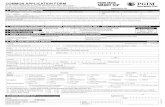

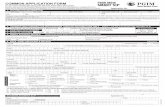

FiguresindollarsintheIncomeStatementwereconvertedintopesosusingtheaverageexchangeratefortheperiod.(1)Millionsofsquarefeet.(2)Occupancyattheendoftheperiod.(3)Indicatestheleaserenewalrateoftheleases,includesearlyrenewals.(4)Excludingaccruedincomeasitisanon-cashitem.(5)Earningsbeforeinterest,taxes, depreciation and amortization. (6) Certificados Bursátiles Fiduciarios Inmobiliarios - Real Estate Investment Certificates. (*) Revenues and expenses have beenadjustedforthecalculationoftheabovementionedmetrics.FiguresindollarsintheBalanceSheetwereconvertedusingtheclosingexchangerateoftheperiod.Pleaserefertothe“2Q18FinancialPerformance"and"Appendices"sectionavailableinthisdocument.Source:PGIMRealEstate–AssetManagementandFundAccounting

3

OperatingandFinancialHighlights

Operating Jun18 Jun17 Var.

NumberofDevelopedProperties 286 260 26

GrossLeasableArea(GLA)(msf)1 40.9 36.5 4.4

LandReserves(msf) 6.17 6.26 -0.09 OccupancyRate2 95.5% 94.9% 68bps Avg.LeasingRent/SquareFoot(dollars) 5.07 4.99 0.08 WeightedAverageRemainingLeaseTerm(years) 3.46 3.49 -0.03 RenewalRate3 90.4% 87.9% 245bps

QuarterlyFinancial 2Q18 2Q17 Var. 2Q18 2Q17 Var.

fx 19.3911 18.5666

(millionsofpesosunlessotherwisestated) (millionsofdollarsunlessotherwisestated)

RentalRevenues4 921.8 773.6 19.2%

47.6 41.6 14.2%OtherOperatingIncome 50.9 45.8 11.2%

2.6 2.5 7.8%

NetRevenues 981.1 825.1 18.9% 50.6 44.4 14.0%NetOperatingIncome(NOI)* 926.9 776.3 19.4% 47.9 41.8 14.6%NOIMargin 94.9% 94.1% 82bps 94.9% 94.1% 82bpsEBITDA5* 842.0 704.5 19.5% 43.6 37.9 15.0%EBITDAMargin 86.4% 85.3% 111bps

86.4% 85.3% 111bps

FundsfromOperations(FFO)* 604.2 500.8 20.6%

31.3 26.9 16.3%FFOMargin 62.0% 60.6% 145bps 62.0% 60.6% 145bpsAdjustedFundsfromOperations(AFFO)* 555.3 452.5 22.7% 28.8 24.3 18.2%AFFOMargin 56.7% 54.3% 241bps 56.7% 54.3% 241bpsDistributions 555.3 452.4 22.7% 28.8 24.3 18.2%DistributionsperCBFI6 0.7020 0.5720 22.7% 0.0364 0.0308 18.2%

BalanceSheet Jun18 Mar18 Var. fx Jun18 Mar18 Var.

19.8633 18.3445

(millionsofpesosunlessotherwisestated) (millionsofdollarsunlessotherwisestated)

Cash&CashEquivalents 2,042.4 2,035.7 0.3% 102.8 111.0 -7.3%InvestmentProperties 46,176.3 42,165.3 9.5% 2,324.7 2,298.5 1.1%LandReserves 1,032.2 950.8 8.6% 52.0 51.8 0.3%TotalDebt 19,826.6 18,623.4 6.5% 998.2 1,015.2 -1.7%NetDebt 17,784.2 16,587.7 7.2% 895.3 904.2 -1.0%

4

CommentbyAlbertoChretin,ChiefExecutiveOfficerandChairmanoftheBoardDuring the secondquarter of 2018,we continued to generate solid results andbegan capturing the benefits from theacquisitionsofindustrialassetsthatwereconcludedatthebeginningofthesecondquarter.Moreover,thestrengthoftheindustrialrealestatesectorinMexicowasreflectedinhighleasinglevels,whichrepresentedatotalof1.4millionsquarefeetforTerrafina.ThemainleasingactivitywasconcentratedinthemarketsofChihuahua,CiudadJuarez,Tijuana,RamosArizpe,Queretaro,Silao,CuautitlanIzcalli,SanLuisPotosi,Guadalajara,IrapuatoandHermosillomarkets.RenewalactivityforTerrafinareached0.6millionsquarefeetand,intermsofearlyrenewals,thesewereanadditional0.6millionsquarefeet–aclearindicatorthatourtenantswanttosecurethepermanenceoftheiroperationinthelong-term.Asaresultofthestrongleasingactivityexperiencedinthefirsthalfof2018,Terrafinaloweredtheremainingportionofthematurityschedulefortheyearfrom8.1%inthefirstquarterto5.2%inthesecondquarterof2018.Secondquarter2018occupancy levels reached95.5%andsame-storeoccupancywas95.2%. Includingsigned lettersofintent,occupancylevelsforthequarterreached96.4%.Occupancyratesbyregionremainedstable,reaching97.2%intheNorthernregion,92.2%intheBajioregionand93.7%intheCentralregion.Averageannualleasingrentfor2Q18wasUS$5.07persquarefoot,aUS$0.08increasecomparedtothesecondquarterof2017 and a US$0.01 increase compared to the first quarter of 2018. Average rents by region remained in line, withUS$4.99persquarefootintheNorthernregion,US$5.16persquarefootintheBajioregionandaUS$5.27averagerentpersquarefootintheCentralregion.AsforTerrafina’smainfinancialindicatorsforthesecondquarterof2018,rentalrevenuesreachedUS$47.6million,NetOperatingIncomereachedUS$47.9millionwithanNOIMarginof94.9%,aswellasgeneratingUS$28.8millioninAdjustedFundsfromOperations.Finally,AnnualizedDistributionsperCBFIwerePs.2.81,orUS$0.1456,whichrepresenteda9.8%dividendyield,consideringtheaverageCBFIpriceforthesecondquarterof2018.ThankyouforyourinterestinTerrafina.Sincerely,

AlbertoChretinChiefExecutiveOfficerandChairmanoftheBoard

5

OperatingHighlights

HighlightsbyRegion

(asofJune30,2018) North Bajio Central Total

#Buildings 201 55 30 286

#Tenants 203 56 39 298

GLA(msf) 25.5 9.1 6.3 40.9

LandReserves(msf) 2.7 0.2 3.3 6.2

OccupancyRate 97.2% 92.2% 93.7% 95.5%

AverageLeasingRent/SquareFoot(dollars) 4.99 5.16 5.27 5.07

AnnualizedRentalBase% 62.4% 22.0% 15.7% 100.0%Source:PGIMRealEstate-AssetManagement

LeasingActivity

2Q18 2Q17 Var.

OperatingPortfolio(msf):

Renewals 0.6 0.9 -0.3

EarlyRenewals 0.6 0.1 0.5

NewLeases 0.3 0.5 -0.3

TotalSquareFeetofLeasesSigned 1.4 1.6 -0.1

Source:PGIMRealEstate-AssetManagement

NORTH - BajaCalifornia- Sonora- Chihuahua- Coahuila- NuevoLeon- Tamaulipas- Durango

BAJIO - SanLuisPotosi- Jalisco- Aguascalientes- Guanajuato- Queretaro

CENTRAL - StateofMexico- MexicoCity- Puebla- Tabasco

Terrafina’s2Q18Operations

26.5%

73.5%

ComposiconbyAssetTypeasof2Q18(asa%oftotalGLA)

Distribujon Manufacturing

6

OperatingHighlights(continued)

OccupancyandRentsbyRegion MaturitiesandRenewalsbyRegion

0

Consolidated

(AsofJune30,2018)

OccupancyRate

Avg.LeasingRent/SquareFoot(dollars) (AsofJune30,2018)

Maturities(numberofcontracts)

%ofTotalMaturities

Renewals(numberofcontracts)

%ofTotal

RenewalsNorth 97.2% 4.99 North 7 53.8% 5 71.4%BajaCalifornia 100.0% 4.40 BajaCalifornia 1 7.7% 1 100.0%Tijuana 100.0% 4.40 Tijuana 1 7.7% 1 100.0%

Sonora 88.5% 4.57 Sonora 1 7.7% 1 100.0%Hermosillo 88.5% 4.57 Hermosillo 1 7.7% 1 100.0%

Chihuahua 97.8% 5.03 Chihuahua 3 23.1% 3 100.0%Chihuahua 98.0% 5.43 Chihuahua 1 7.7% 1 100.0%CiudadJuarez 97.8% 4.70 CiudadJuarez 2 15.4% 2 100.0%Delicias 100.0% 5.98 Delicias 0 0.0% 0 0.0%GomezFarias 100.0% 3.34 GomezFarias 0 0.0% 0 0.0%CasasGrandes 100.0% 4.21 CasasGrandes 0 0.0% 0 0.0%

Coahuila 96.4% 5.05 Coahuila 2 15.4% 0 0.0%CiudadAcuña 100.0% 6.11 CiudadAcuña 0 0.0% 0 0.0%Monclova 100.0% 5.46 Monclova 0 0.0% 0 0.0%RamosArizpe 96.2% 4.88 RamosArizpe 1 7.7% 0 0.0%Saltillo 91.0% 5.44 Saltillo 1 7.7% 0 0.0%Derramadero 100.0% 6.64 Derramadero 0 0.0% 0 0.0%SanPedrodelasColinas 89.3% 2.10 SanPedrodelasColinas 0 0.0% 0 0.0%Torreon 100.0% 4.26 Torreon 0 0.0% 0 0.0%

NuevoLeon 93.3% 5.03 NuevoLeon 0 0.0% 0 0.0%Apodaca 100.0% 5.51 Apodaca 0 0.0% 0 0.0%Monterrey 91.0% 4.84 Monterrey 0 0.0% 0 0.0%

Tamaulipas 100.0% 4.65 Tamaulipas 0 0.0% 0 0.0%Reynosa 100.0% 4.65 Reynosa 0 0.0% 0 0.0%

Durango 100.0% 4.79 Durango 0 0.0% 0 0.0%Durango 100.0% 4.95 Durango 0 0.0% 0 0.0%GomezPalacio 100.0% 3.14 GomezPalacio 0 0.0% 0 0.0%

Bajio 92.2% 5.16 Bajio 5 38.5% 5 100.0%SanLuisPotosi 89.5% 4.89 SanLuisPotosi 0 0.0% 0 0.0%SanLuisPotosi 89.5% 4.89 SanLuisPotosi 0 0.0% 0 0.0%

Jalisco 100.0% 6.51 Jalisco 1 7.7% 1 100.0%Guadalajara 100.0% 6.51 Guadalajara 1 7.7% 1 100.0%

Aguascalientes 100.0% 4.76 Aguascalientes 0 0.0% 0 0.0%Aguascalientes 100.0% 4.76 Aguascalientes 0 0.0% 0 0.0%

Guanajuato 94.4% 4.80 Guanajuato 3 23.1% 3 100.0%Celaya 100.0% 5.29 Celaya 0 0.0% 0 0.0%Irapuato 81.8% 5.24 Irapuato 1 7.7% 1 100.0%Silao 100.0% 4.55 Silao 2 15.4% 2 100.0%

Queretaro 85.8% 4.78 Queretaro 1 7.7% 1 100.0%Queretaro 85.8% 4.78 Queretaro 1 7.7% 1 100.0%

Central 93.7% 5.27 Central 1 7.7% 1 100.0%StateofMexico 92.7% 5.49 StateofMexico 1 7.7% 1 100.0%CuautitlanIzcalli 100.0% 5.51 CuautitlanIzcalli 1 7.7% 1 100.0%Toluca 81.6% 5.39 Toluca 0 0.0% 0 0.0%CiudaddeMexico 100.0% 9.22 CiudaddeMéxico 0 0.0% 0 0.0%Azcapotzalco 100.0% 9.22 Azcapotzalco 0 0.0% 0 0.0%

Puebla 100.0% 3.20 Puebla 0 0.0% 0 0.0%Puebla 100.0% 3.20 Puebla 0 0.0% 0 0.0%

Tabasco 100.0% 3.99 Tabasco 0 0.0% 0 0.0%Villahermosa 100.0% 3.99 Villahermosa 0 0.0% 0 0.0%

Total 95.5% 5.07 Total 13 100.0% 11 84.6%Source:PGIMRealEstate-AssetManagement

Source:PGIMRealEstate-AssetManagement*Overthenumberofmaturedleasesinthequarter

7

2Q18OperationalPerformanceCompositionbyGeographicalDiversificationThe geographic diversification of Terrafina’s properties at 2Q18 (based on GLA per square foot) was as follows: theNorthernregionofMexicorepresented62.4%ofGLA,whiletheBajioandCentralregionsrepresented22.3%and15.3%ofGLA,respectively.

GeographicDistributionbyRegionandState

2Q18 asa%ofTotal

GLA2Q18 2Q17 asa%ofTotalGLA2Q17

North 25.55 62.4% 21.01 57.5%BajaCalifornia 0.90 2.2% 0.90 2.5%Tijuana 0.90 2.2% 0.90 2.5%

Sonora 0.33 0.8% 0.33 0.9%Hermosillo 0.33 0.8% 0.33 0.9%

Chihuahua 14.29 34.9% 13.66 37.4%Chihuahua 5.83 14.2% 5.44 14.9%CiudadJuarez 7.76 19.0% 7.74 21.2%Delicias 0.52 1.3% 0.29 0.8%GomezFarias 0.08 0.2% 0.08 0.2%Camargo 0.02 0.1% 0.02 0.1%CasasGrandes 0.09 0.2% 0.09 0.2%

Coahuila 6.84 16.7% 3.49 9.5%CiudadAcuña 0.24 0.6% 0.24 0.7%Monclova 0.35 0.8% 0.34 0.9%RamosArizpe 4.54 11.1% 2.00 5.5%Saltillo 0.62 1.5% 0.62 1.7%Derramadero 0.54 1.3% 0.00 0.0%SanPedrodelasColinas 0.15 0.4% 0.15 0.4%Torreon 0.39 1.0% 0.13 0.4%

NuevoLeon 1.94 4.7% 1.38 3.8%Apodaca 0.50 1.2% 0.50 1.4%Monterrey 1.44 3.5% 0.89 2.4%

Tamaulipas 0.47 1.1% 0.47 1.3%Reynosa 0.47 1.1% 0.47 1.3%

Durango 0.78 1.9% 0.78 2.1%Durango 0.71 1.7% 0.71 1.9%GomezPalacio 0.07 0.2% 0.07 0.2%

Bajio 9.12 22.3% 9.26 25.4%SanLuisPotosi 3.31 8.1% 3.30 9.0%SanLuisPotosi 3.31 8.1% 3.30 9.0%

Jalisco 1.66 4.0% 1.81 5.0%Guadalajara 1.66 4.0% 1.81 5.0%

Aguascalientes 0.75 1.8% 0.75 2.1%Aguascalientes 0.75 1.8% 0.75 2.1%

Guanajuato 1.42 3.5% 1.42 3.9%Celaya 0.12 0.3% 0.12 0.3%Irapuato 0.44 1.1% 0.44 1.2%Silao 0.87 2.1% 0.86 2.4%

Queretaro 1.98 4.8% 1.98 5.4%Queretaro 1.98 4.8% 1.98 5.4%

Central 6.25 15.3% 6.25 17.1%StateofMexico 5.40 13.2% 5.40 14.8%CuautitlanIzcalli 4.26 10.4% 4.26 11.7%Toluca 0.91 2.2% 0.91 2.5%Huehuetoca 0.23 0.6% 0.23 0.6%

CiudaddeMexico 0.02 0.1% 0.02 0.1%Azcapotzalco 0.02 0.1% 0.02 0.1%

Puebla 0.18 0.5% 0.18 0.5%Puebla 0.18 0.5% 0.18 0.5%

Tabasco 0.65 1.6% 0.65 1.8%Villahermosa 0.65 1.6% 0.65 1.8%

Total 40.92 100.0% 36.52 100.0%TotalGrossLeasableArea/millionsquarefeet.Potentialleasableareaoflandreservesarenotincluded.

Source:PGIMRealEstate-AssetManagement

8

CompositionbyAssetTypeAt the end of 2Q18, 73.5%of Terrafina’s portfolio consisted of properties dedicated tomanufacturing activitieswhile26.5%werededicatedtodistributionandlogisticsactivities.

CompositionbySectorAsofJune30,2018,tenantdiversificationbyindustrialsectorwasasfollows:

IndustrialSectorDiversification

2Q18 2Q17 Var.

Automotive 34.5% 31.9% 257bps

Industrialproperties 19.8% 20.0% -26bps

Consumergoods 14.5% 15.2% -69bps

LogisticsandTrade 9.6% 9.8% -21bps

Aviation 9.8% 10.4% -59bps

Non-durableconsumergoods 3.9% 4.4% -47bps

Electronics 8.0% 8.3% -35bps

Total 100.0% 100.0% Source:PGIMRealEstate-AssetManagement

26.5%

73.5%

ComposiconbyAssetTypeasof2Q18(asa%oftotalGLA)

Distribujon Manufacturing

CompositionbyAssetType

2Q18 2Q17 Var.

Distribution 26.5% 26.4% 9bps

Manufacturing 73.5% 73.6% -9bpsSource:PGIMRealEstate-AssetManagement

34.5%

19.8%14.5%

9.6%

9.8%3.9%

8.0%

DiversificaconbySectorasof2Q18(asa%ofleasedGLA)

AutomojveIndustrialproperjesConsumergoodsLogisjcsandTradeAviajonNon-durableconsumergoodsElectronics

9

CompositionofTopClientsTerrafinahasawidelydiversifiedtenantbasethatleaseindustrialpropertiesthroughoutseveralofMexico’smaincities.For2Q18,Terrafina’stopclient,top10clientsandtop20clients,represented3.3%,17.1%and26.8%oftotalrevenues,respectively.

TopClients

(AsofJune30,2018)

LeasedSquareFeet(millions) %TotalGLA

%TotalRevenues

TopClient 1.24 3.2% 3.3%

Top10Clients 6.75 17.3% 17.1%

Top20Clients 10.54 27.0% 26.8%Source:PGIMRealEstate-AssetManagement

Occupancy2Q18occupancyratewas95.5%,a68basispointincreasecomparedto2Q17.IncludingsignedLOIs,theoccupancyratewas96.4%. It is important tonote thatoccupancy rate indicatorspresented in this report reflect thequarterly closingrate.For2Q18,Terrafina’s leasingactivityreached1.4msf,ofwhich18.0%correspondedtonewleasingcontracts(includingexpansions),39.0%forcontractrenewalsand43.0%forearlyrenewals.

Leasingactivitymainly tookplace in theChihuahua,Ciudad Juarez,Tijuana,RamosArizpe,Queretaro,Silao,CuautitlanIzcalli,SanLuisPotosi,Guadalajara,IrapuatoandHermosillomarkets.Inadditiontothisleasingactivity,Terrafinasignedanadditional348,500squarefeetinLOIs.

LeaseMaturitiesTerrafinahad298tenantsunderleasingcontractsattheendof2Q18.Theleasingcharacteristicsofthesecontractshavean average maturity of three to five years for logistics and distribution properties and of five to seven years formanufacturingproperties.Annualaveragematurities(asapercentageofannualbaserents)remainatlevelsofbetween5%to22%forthenextfiveyears.

95.5%

3.6%0.9%

Occupancyasof2Q18(as%ofTotalGLA)

LeasedGLAVacantGLASignedLemersofIntent

2Q18 2Q17 Var.

LeasedGLA 95.5% 94.9% 26bps

VacantGLA 3.6% 4.9% -129bps

SignedLettersofIntent 0.9% 0.2% 68bps

Total 100.0% 100.0% Source:PGIMRealEstate-AssetManagement

10

ThefollowingtablebreaksdownTerrafina’sleasingmaturityschedulefortheupcomingyears:

Annual

BaseRent(millionsofdollars)

%ofTotal OccupiedSq.Ft(millions) %ofTotal

2018 9.5 4.8% 2.03 5.2%2019 34.8 17.6% 7.12 18.2%2020 44.5 22.5% 8.74 22.4%2021 37.0 18.7% 7.23 18.5%2022 16.9 8.5% 3.62 9.3%Thereafter 55.4 28.0% 10.35 26.5%Source:PGIMRealEstate–AssetManagement

CapitalDeploymentCapitalExpenditures(CAPEX)Terrafina’sCAPEXisclassifiedasrecurringexpensesthattookplacebasedonupcomingleasingmaturitiesandpropertyimprovements. The main goal of these expenses is the renewal of leasing contracts as well as the improvement ofpropertyconditionstakingintoaccounttenantrequirements.TerrafinaexpectstoapplyCAPEXtowardsvacantpropertiesaswellastowardsthedevelopmentofnewGLAbymeansofexpansionsand/ornewdevelopments.

Additionally,itisimportanttoconsiderthatCAPEXintendedforexpansionsandnewdevelopmentsarenotfinancedwithTerrafina’soperatingcashflowandthereforedonotpassthroughtheincomestatement.Capitalexpendituresaccountsarecomprisedasfollows:1) TenantpropertyimprovementresourcesaswellasrecurringmaintenanceCAPEX.2) Brokerandadministratorfees.3) CAPEXfornewdevelopments,whichduetotheirnature,aregenerallycapitalized.In2Q18,Terrafina’sinvestmentsintenantimprovementsandrecurringCAPEXwasUS$1.3million.TotalCAPEXfor2Q18isbrokendowninthefollowingtable:

CapitalExpenditures 2Q18 2Q18

(millionsofpesos)

(millionsofdollars)

TenantImprovements&RecurringCapex 25.3 1.3LeasingCommissions 20.0 1.0DevelopmentCapex1 8.2 0.4

TotalCapitalExpenditures 53.4 2.7

MaintenanceexpensesforvacantpropertiesareincludedintheTenantImprovements&

RecurringCapexfigures.(1)Capexforexpansions/newdevelopments.Source:PGIMRealEstate-AssetManagement

11

LandReservesTerrafina’s land reserve as of June 30, 2018 was comprised of 12 land reserve properties, equivalent to 6.2 msf ofpotentialGLAforthedevelopmentoffutureindustrialproperties.AsofJune30,2018,Terrafina’slandreservesweredistributedasfollows:

AsofJune30,2018

SquareFeet

(millions)

LandatCost

(millionsofpesos)

LandatCost

(millionsofdollars)

AppraisalValue

(millionsofpesos)

MarketValue

(millionsofdollars)

North 3.0 514.3 25.9 592.8 29.8Bajio 0.1 14.2 0.7 14.7 0.7Central 3.1 737.8 37.1 424.7 21.4

TotalLandPortfolio 6.2 1,266.3 63.7 1,032.2 51.9Source:PGIMRealEstate-AssetManagementandFundAccounting

12

2Q18FinancialPerformanceFinancialResultsandCalculationsTerrafina’s financial resultsarepresented inMexicanpesosandU.S.dollars.Figuresonthe incomestatement foreachperiodwereconvertedtodollarsusingtheaverageexchangerate for2Q18,while for thebalancesheet, theexchangerateatthecloseofJune30,2018wasapplied.Terrafina has in place best accounting practices for measuring the FIBRA’s (REIT) performance results by providingrelevant metrics to the financial community. Throughout the following financial performance section, additionalcalculations are available. It is important to note that these metrics must not be considered individually to evaluateTerrafina’sresults.ItisrecommendedtousethemincombinationwithotherInternationalFinancialReportingStandardsmetricstomeasuretheCompany’sperformance.Terrafina presents in this earnings report additional metrics such as Net Operating Income (NOI), Earnings BeforeInterests, Taxes, Depreciation and Amortization (EBITDA), Funds from Operations (FFO), and Adjusted Funds fromOperations(AFFO).Eachbreakdowncalculationisavailableinthisdocument.

Inaddition,TerrafinarecommendsreviewingtheAppendicesasareferenceoftheintegrationofdifferentitemsof

Terrafina’sfinancialstatement.Thisinformationisavailableinthelastsectionofthisdocument.

Pastperformanceisnotaguaranteeorreliableindicatoroffutureresults.

13

Same-StoreThefollowingtableshowsTerrafina’s2Q18same-storehighlightsandconsolidatedinformation:

(asofJune30,2018)

Same-Store1

2Q18Consolidated2

2Q18

NumberofProperties 259.0 286.0

OccupancyRate 95.2% 95.5%

GrossLeasableArea(GLA)(msf) 36.7 40.9

Avg.LeasingRent/SquareFoot(dollars) 5.02 5.07

Same-Store

2Q18Consolidated

2Q18Same-Store

2Q18Consolidated

2Q18

(millionsofpesos) (millionsofdollars)

RentalRevenues 816.4 921.8 42.1 47.6

NetOperatingIncome 824.2 926.9 42.6 47.9

NOIMargin 93.8% 94.9% 93.8% 94.9%

EBITDA 764.4 842.0 39.5 43.6

EBITDAMargin 85.2% 86.4% 85.2% 86.4%

FFO 530.7 604.2 27.4 31.3

FFOMargin 60.7% 62.0% 60.7% 62.0%

AdjustedFundsfromOperations 479.8 555.3 24.8 28.8

AFFOMargin 54.6% 56.7% 54.6% 56.7%

(1)SamepropertiesinformationevaluatestheperformanceoftheindustrialpropertieswithoutincludingrecentacquisitionsclosedinJanuary,

SeptemberandDecember2017.(2)IncludesacquisitionsclosedinJanuary,SeptemberandDecember2017.Source:PGIMRealEstate-AssetManagementandFundAccounting

RentalRevenuesIn2Q18,TerrafinareportedrentalrevenuesofUS$47.6million,a14.2%orUS$5.9millionincreasecomparedto2Q17.Rentalrevenuesdonotincludeaccruedrevenuesastheseareanon-cashitem.OtherOperatingIncomeIn2Q18,otheroperatingincometotaledUS$2.6million,a7.8%orUS$0.2milliondecreasecomparedto2Q17.Other operating incomemainly stem from tenant refunds from triple-net leases. Expenses reimbursable to Terrafinamainlyincludedelectricity,propertytaxes,insurancecostsandmaintenance.

NetrevenuesreachedUS$50.6millionin2Q18,anincreaseofUS$6.2million,or14.0%comparedto2Q17.

14

Revenues 2Q18 2Q17 Var.% 2Q18 2Q17 Var.%

(millionsofpesos) (millionsofdollars)

RentalRevenue 921.8 773.6 19.2% 47.6 41.6 14.2%

AccruedIncome1 8.4 5.8 46.5% 0.4 0.3 36.8%

OtherOperatingRevenues 50.9 45.8 11.2% 2.6 2.5 7.8%

ReimbursableExpensesasRevenues2 40.7 36.0 13.1% 2.1 1.9 10.3%

ReimbursableTenantImprovements 5.5 7.5 -26.1% 0.3 0.4 -28.9%

Othernon-cashincome 4.7 2.3 102.5% 0.2 0.1 86.7%

NetRevenue 981.1 825.1 18.9% 50.6 44.4 14.0%(1)Straightlinerentadjustment;non-cashitem.(2)TriplenetleasesexpensesreimbursedtoTerrafinafromitstenants.Source:PGIMRealEstate-FundAccounting

Foradditionalinformationregardingtherevenuebreakdownusedtocalculateadditionalmetricspresentedinthis

earningsreport,pleaserefertoAppendix1inthelastsectionofthisdocument.

RealEstateExpensesIn2Q18,realestateexpensestotaledUS$7.1million,anincreaseof9.1%orUS$0.6millioncomparedto2Q17.It is important todifferentiatebetweenexpenses that aredirectly related to theoperationand those that are for themaintenanceoftheindustrialportfolio;thelatterareusedintheNOIcalculation.

Theremainderoftheaccountsincludedinrealestateexpensesareconsiderednon-recurringexpensesandareusedtocalculateEBITDAandAFFO.

Foradditionalinformationregardingtherealestateexpensesbreakdown,pleaserefertoAppendix2inthelastsectionofthisdocument.

15

NetOperatingIncome(NOI)In2Q18,NOItotaledUS$47.9million,a14.6%orUS$6.1millionincreasecomparedwith2Q17.NOImarginincreasedby82basispointsreaching94.9%comparedto94.1%in2Q17.ThefollowingtabledisplaystheNOIcalculationfor2Q18:

NetOperatingIncome 2Q18 2Q17 Var.% 2Q18 2Q17 Var.%

(millionsofpesosunlessotherwisestated) (millionsofdollarsunlessotherwisestated)

RentalRevenues1 921.8 773.6 19.2% 47.6 41.6 14.2%

OtherOperatingincome2 55.8 51.7 8.0% 2.9 2.8 3.6%

NetRevenuesforNOICalculation 977.6 825.2 18.5% 50.5 44.4 13.6%

RepairandMaintenance -6.0 -8.2 -26.5% -0.3 -0.4 -30.4%

PropertyTaxes 0.6 -0.4 -280.0% 0.0 0.0 -266.5%

PropertyManagementFees -20.4 -16.6 23.0% -1.1 -0.9 17.8%

Electricity -13.1 -12.7 2.9% -0.7 -0.7 -5.0%

PropertyInsurance -2.9 -2.8 3.7% -0.2 -0.2 -0.4%

Security -5.0 -3.8 33.8% -0.3 -0.2 27.3%

OtherOperationalExpenses -3.9 -4.6 -14.0% -0.2 -0.2 -19.9%

RealEstateOperatingExpensesforNOICalculation -50.7 -48.9 3.6% -2.6 -2.6 -2.1%

NetOperatingIncome3 926.9 776.3 19.4% 47.9 41.8 14.6%

NOIMargin 94.9% 94.1% 82bps 94.9% 94.1% 82bps

(1)Excludesaccruedincomefromstraightlinerentadjustmentsasitisanon-cashitem.(2)Excludestenantimprovementsreimbursementswhichareincludedin'AFFO'(3)Theincomecalculationgeneratedbytheoperationoftheproperty,independentofexternalfactorssuchasfinancingandincometaxes.NOIistheresultofNetRevenues(includesrentalincomeandtriplenetleasesexpensesreimbursements)minusRealEstateOperatingExpenses(costsincurredduringtheoperationandmaintenanceoftheindustrialportfolio).Source:PGIMRealEstate-FundAccounting

FeesandAdministrativeExpenses(G&A)

G&Ain2Q18totaledUS$5.6million,a13.1%orUS$0.6millionincreasecomparedto2Q17.

ThefollowingtablebreaksdowntotalG&A:G&A

2Q18 2Q17 Var.% 2Q18 2Q17 Var.%

(millionsofpesosunlessotherwisestated) (millionsofdollarsunlessotherwisestated)

ExternalAdvisorFees1 -59.2 -47.7 24.1% -2.9 -2.6 11.3%

ProfessionalandConsultingServices -6.1 -8.9 -31.1% -0.4 -0.5 -22.0%

Payroll,Admin.FeesandOtherExpenses -45.6 -34.4 32.5% -2.3 -1.9 24.6%

TotalG&A2 -110.9 -91.0 21.9% -5.6 -4.9 13.1%(1)PLAAdministradoraIndustrial,S.deR.L.deC.V.,isaMexicanaffiliateofPGIMRealEstateandAdvisoraspertheAdvisoryContract.(2)GeneralandAdministrativeExpenses

Source:PGIMRealEstate-FundAccounting

16

EarningsBeforeInterest,Taxes,DepreciationandAmortization(EBITDA)In2Q18,EBITDAtotaledUS$43.6million,anincreaseofUS$5.7million,or15.0%,comparedto2Q17.EBITDAmarginfor2Q18was86.4%,a111basispointincreasecomparedto2Q17.ThefollowingshowstheEBITDAcalculationfor2Q18:

EBITDA 2Q18 2Q17 Var.% 2Q18 2Q17 Var.%

(millionsofpesosunlessotherwisestated) (millionsofdollarsunlessotherwisestated)

RentalRevenues1 921.8 773.6 19.2% 47.6 41.6 14.2%

OtherOperatingincome2 55.8 51.7 8.0% 2.9 2.8 3.6%

RealEstateExpensesforEBITDACalculation -51.3 -51.1 0.4% -2.6 -2.8 -4.9%

RealEstateOperatingExpensesforNOICalculation -50.7 -48.9 3.6% -2.6 -2.6 -2.1%

Advertising -0.5 -0.2 109.5% 0.0 0.0 -

Admin.PropertyInsuranceExpenses -0.7 -0.8 -14.3% 0.0 0.0 -17.7%

OtherAdmin.RealEstateExpenses 0.6 -1.1 -156.0% 0.0 -0.1 -144.9%

FeesandAdmin.Expenses -84.4 -69.6 21.2% -4.3 -3.8 12.3%

ExternalAdvisorFees -59.2 -47.7 24.1% -2.9 -2.6 11.3%

Legal,Admin.andOtherProfessionalFees -15.0 -12.3 22.1% -0.8 -0.6 26.7%

TrusteeFees -0.3 -2.2 -84.9% 0.0 -0.1 -86.7%

Payroll -6.8 -5.8 18.6% -0.4 -0.3 12.9%

OtherExpenses -3.0 -1.7 75.2% -0.2 -0.1 63.6%

EBITDA3 842.0 704.5 5.6% 43.6 37.9 15.0%

EBITDAMargin 86.4% 85.3% 111bps 86.4% 85.3% 111bps

(1)Excludesaccruedincomefromstraightlinerentadjustmentsasitisanon-cashitem.(2)ExcludestenantimprovementsreimbursementswhichisincludedinAFFOcalculation.(3)Earningsbeforeinterest,taxes,depreciationandamortization.Source:PGIMRealEstate-FundAccounting

ForadditionalinformationregardingthecommissionsandadministrativeexpensesbreakdownusedforthecalculationofEBITDAandAFFO,pleaserefertoAppendix3locatedinthelastsectionofthisdocument.

FinancingExpensesIn2Q18,financingexpensestotaledUS$12.7million,anincreaseof13.9%orUS$1.6millioncomparedto2Q17.

FinancialExpenses 2Q18 2Q17 Var.% 2Q18 2Q17 Var.%

(millionsofpesosunlessotherwisestated) (millionsofdollarsunlessotherwisestated)

InterestPaid -240.2 -205.4 17.0% -12.4 -11.1 12.2%

BorrowingExpenses -8.6 -3.8 127.2% -0.4 -0.2 105.9%

Recurring 0.0 -0.3 - 0.0 0.0 -

NonRecurring -8.6 -3.4 - -0.4 -0.2 -

InterestIncome 2.4 2.0 19.7% 0.1 0.1 13.8%

Total -246.4 -207.1 18.9% -12.7 -11.2 13.9%Source:PGIMRealEstate-FundAccounting

17

FundsfromOperations(FFO)/AdjustedFundsfromOperations(AFFO)In2Q18,FFOincreasedbyUS$4.4million,or16.3%comparedto2Q17,reachingUS$31.3million.FFOMarginwas62.0%,a145basispointincreasecomparedto2Q17.Additionally,TerrafinareportedanAFFOofUS$28.8million,anincreaseofUS$4.4million,or18.2%comparedto2Q17.AFFOmarginwas56.7%,anincreaseof241basispointsversus2Q17.

FundsfromOperations(FFO) 2Q18 2Q17 Var.% 2Q18 2Q17 Var.%

(millionsofpesosunlessotherwise

stated)(millionsofdollarsunlessotherwise

stated)

EBITDA 842.0 704.5 19.5% 43.6 37.9 15.0%FinanceCost1 -237.8 -203.7 16.7% -12.3 -11.0 12.0%FundsfromOperations(FFO) 604.2 500.8 20.6% 31.3 26.9 16.3%FFOMargin 62.0% 60.6% 145bps 62.0% 60.6% 145bpsTenantImprovements -25.3 -31.1 -18.8% -1.3 -1.7 -22.8%LeasingCommissions -20.0 -13.2 51.6% -1.0 -0.7 45.7%OtherNonRecurringExpenses3 -3.7 -4.1 -11.3% -0.2 -0.2 3.8%AdjustedFundsfromOperations(AFFO) 555.3 452.5 22.7% 28.8 24.3 18.2%AFFOMargin 56.7% 54.3% 241bps 56.7% 54.3% 241bps(1)NetOperationalInterestExpensescomprisedbyinterestpaid,recurringborrowingexpensesandotherinterestincome.(2)Capexreserveforexpensestoacquisitions,dispositions,legalandotherexpenses.Source:PGIMRealEstate-FundAccounting

ComprehensiveIncomeComprehensiveIncomefor2Q18reachedaprofitofUS$149.4million,comparedtoalossofUS$45.3millionin2Q17.

ThefollowingtablepresentsthecalculationofComprehensiveIncomefor2Q18:

ComprehensiveIncome 2Q18 2Q17 Var.% 2Q18 2Q17 Var.%

(millionsofpesosunlessotherwisestated) (millionsofdollarsunlessotherwisestated)

NetRevenues 988.9 825.1 19.8% 51.0 44.4 14.9%

RealEstateExpenses -137.4 -120.3 14.2% -7.1 -6.5 9.4%FeesandOtherExpenses -110.9 -91.0 21.9% -5.7 -4.9 15.8%Gain(Loss)fromSalesofRealEstateProperties 0.0 1.9 - 0.0 0.1 -NetIncome(Loss)fromFairValueAdjustmentonInvestmentProperties 4.1 -62.7 - 0.2 -3.4 -

NetIncome(Loss)fromFairValueAdjustmentonDerivativeFinancialInstruments

9.4 4.4 112.4% 0.5 0.2 103.4%

NetIncome(Loss)fromFairValueAdjustmentonBorrowings 246.3 -190.2 - 12.7 -10.2 -

Realizedgain(loss)onderivativefinancialinstruments -0.2 - - 0.0 -10.2 -ForeignExchangeGain(loss) -69.0 50.8 - -3.6 2.7 -OperatingProfit 931.1 418.1 122.7% 48.0 22.4 113.9%FinancialIncome 2.4 2.0 19.7% 0.1 0.1 -FinancialExpenses -248.8 -209.1 19.0% -12.8 -11.3 14.0%NetFinancialCost -246.4 -207.1 18.9% -12.7 -11.2 13.9%ShareofProfitfromEquityAccountedInvestments 7.4 15.7 - 0.4 0.8 -NetProfit(Loss) 692.1 226.6 205.5% 35.7 12.1 194.1%ItemsReclassifiedafterNetProfit(Loss)-CurrencyTranslationAdjustments 2,205.5 -1,066.9 - 113.7 -57.5 -

ComprehensiveIncome 2,897.6 -840.3 - 149.4 -45.3 -Source:PGIMRealEstate-FundAccounting

18

DistributionsperCBFIsIn2Q18,TerrafinageneratedUS$28.8millionofAFFOandthereforewilldistributeUS$0.0364perCBFI.

Distributions (millionsofpesosunlessotherwisestated) 2Q17 3Q17 4Q17 1Q18 2Q18 Var.%

(2Q18vs2Q17)

TotalOutstandingCBFIs(millionsofCBFIs) 791.0 791.0 791.0 791.0 791.0 0.0%

CBFIPrice1 32.35 31.29 30.20 28.68 28.46 -12.0%

Distributions 452.4 410.4 484.9 505.2 555.3 22.7%

DistributionsPerCBFI 0.5720 0.5188 0.6130 0.6386 0.7020 22.7%

FXRateUSD/MXN(averageclosingperiod) 18.57 17.83 18.93 18.78 19.39 4.4%

Distributions(milliondollars) 24.3 23.0 25.6 26.9 28.8 18.2%

DistributionsPerCBFI(dollars) 0.0308 0.0291 0.0324 0.0340 0.0364 18.2%

AnnualizedDistributionYield2 7.1% 6.6% 8.1% 8.9% 9.9% 279bps(1)Averageclosingpricefortheperiod.(2)AnnualizeddistributionpersharedividedbytheaverageCBFIpriceofthequarter.Quarterlydistributionyieldcalculationhasbeenannualized.Source:PGIMRealEstate-FundAccounting

DebtAsofJune30,2018,Terrafina’stotaldebtreachedUS$998.2million.TheaveragecostofTerrafina’slong-termdebtwas4.99%.AllofTerrafina’sdebtisdenominatedinU.S.dollars.

OutstandingDebt

(asofJune30,2018)

CurrencyMillionsof

pesosMillionsofdollars

InterestRate Terms Maturity

ExtensionOption Derivatives

LongTermDebt

Citibank1 Dollars 1,032.0 52.0 Libor+2.45% InterestOnly Jan2023 - US$120Mswap4/US$100Mcap5

Metlife Dollars 2,979.5 150.0 4.75% InterestOnly Jan2027 - -

Banamex2 Dollars 7,013.5 353.1 Libor+2.45% InterestOnly Oct2022 - US$105Mswap6

SeniorNotes3 Dollars 8,489.8 427.4 5.25% InterestOnly Nov2022 - -

NewYorkLife Dollars 311.9 15.7 5.19% Interest+Principal Feb2020 - -

TotalDebt 19,826.6 998.2

NetCash 2,042.4 102.8

NetDebt 17,784.2 895.3 (1)Unsecuredsyndicatedrevolvingcreditfacility.(2)Unsecuredsyndicatedtermloanfacility;interestonlyforthefirstthreeyears.(3)ValueatCost:US$425million/Ps.7,977million.

(4)Swapfixedrate:1.286%.(5)Capstrikeprice:1.75%(6)Swapfixedrate:1.768%.

Source:PGIMRealEstate-FundAccountingandTransactions

40.6%

59.4%

InterestRateBreakdown(asofJune30,2018)

VariableRate FixedRate

19

The following tables show leverage and debt service coverage as of June 30, 2018 as well as Terrafina’sprojectionsforthefollowingsixquarters:

Loan-to-Value(LTV)

(asofJune30,2018)(millionsofpesos)

(millionsofdollars)

TotalAssets 49,498.2 2,491.9

TotalDebt 19,826.6 998.2

Loan-to-Value(LTV)1 40.1%(1)TotalDebtdividedbyTotalAssetsasdefinedbytheNationalSecuritiesandBankingCommission(CNBV)

Source:PGIMRealEstate-FundAccountingandCapitalMarkets

DebtServiceCoverageRatio(DSCR)

period (millionsofpesos) (millionsofdollars)

Cash&CashEquivalents June30,2018 2,042.4 102.8

RecoverableTaxes Σnext6quarters 296.8 14.9

EBIT1afterdistributions Σnext6quarters 1,719.7 86.6

AvailableCreditLine June30,2018 4,818.7 242.6

period

(millionsofpesos) (millionsofdollars)

InterestPayments Σnext6quarters 1,500.5 75.5

PrincipalPayments Σnext6quarters 17.7 0.9

RecurringCAPEX Σnext6quarters 193.9 9.8

DevelopmentExpenses Σnext6quarters 290.9 14.6

DebtServiceCoverageRatio(DSCR)2 4.4x

(1)EarningsBeforeInterestandTaxes(2)(Cash&CashEquivalents+RecoverableTaxes+EBITAfterDistributions+AvailableCreditLine)/(InterestPayments+PrincipalPayments+RecurringCAPEX+DevelopmentExpenses)Source:PGIMRealEstate-FundAccountingandCapitalMarkets

20

Moreover,asofJune30,2018,TerrafinawasinfullcompliancewithitsdebtcovenantsrelatedtotheUS$425millionbondissuance(November2015),asfollows:

UnsecuredBondCovenants (asofJune30,2018) Terrafina BondCovenants

Loan-to-Value(LTV)1 40.1% ≤60%

DebtServiceCoverageRatio(DSCR)2 3.2x ≥1.5x

SecuredDebttoGrossAssetsLimitation 6.6% ≤40%UnencumberedAssetstoUnsecuredDebtLimitation 238% ≥150%

(1)TotalDebtdividedbyTotalAssets.(2)(NetIncome/Loss+InterestonDebt+UnrealizedGain/Lossoffairvaluechanges)/(allinterestandprincipalpaymentsonDebt)

Source:PGIMRealEstate-Transactions

21

AnalystCoverageThefollowingisalistofbanksandinstitutionsthatregularlypublishresearchreportsonTerrafina:-Barclays -Invex-BBVABancomer -ItaúBBA-Bradesco -JPMorgan-BofAML -Monex-BTGPactual -MorganStanley-BX+ -NAUSecurities-CitiBanamex -Scotiabank-CreditSuisse -Vector-GBM -Santander-HSBC -UBS-Interacciones

22

AboutTerrafinaTerrafina (BMV:TERRA13) is a Mexican real estate investment trust formed primarily to acquire, develop, lease andmanage industrial real estate properties in Mexico. Terrafina’s portfolio consists of attractive, strategically locatedwarehousesandotherlightmanufacturingpropertiesthroughouttheCentral,BajioandNorthernregionsofMexico.Itisinternallymanagedbyhighly-qualifiedindustryspecialistsandexternallyadvisedbyPGIMRealEstate.Terrafina owns 298 real estate properties, including 286 developed industrial facilities with a collective GLA ofapproximately40.9millionsquarefeetand12landreserveparcels,designedtopreservetheorganicgrowthcapabilityoftheportfolio.Terrafina’s objective is to provide attractive risk-adjusted returns for the holders of its certificates through stabledistributionsandcapitalappreciations.Terrafinaaimstoachievethisobjective throughasuccessfulperformanceof itsindustrialrealestateandcomplementaryproperties,strategicacquisitions,accesstoahighlevelofinstitutionalsupport,andtoitsmanagementandcorporategovernancestructure.Formoreinformation,pleasevisitwww.terrafina.mxPGIMRealEstatePGIMReal Estate is the real estate investment business of PGIM Inc., the global investmentmanagement business ofPrudentialFinancial, Inc. (NYSE:PRU). Redefining therealestate investing landscapesince1970,PGIMRealEstatehasprofessionals in 18 cities in theAmericas, EuropeandAsiaPacificwithdeep local knowledgeandexpertise, andgrossassetsundermanagementofUS$69.6billion(US$50.3billionnet)asofMarch31,2018.PGIMRealEstate’stenuredteamofferstoitsglobalclientbaseabroadrangeofrealestateequity,debtandsecuritiesinvestmentstrategiesthatspantherisk/returnspectrum.Formoreinformation,visitwww.pgimrealestate.comAboutPrudentialFinancial,Inc.PrudentialFinancial,Inc.(NYSE:PRU),afinancialservicesleaderwithmorethanUS$1trillionofassetsundermanagementas of June 30, 2018, has operations in the United States, Asia, Europe, and Latin America. Prudential’s diverse andtalented employees are committed to helping individual and institutional customers grow and protect their wealththroughavarietyofproductsandservices, includinglife insurance,annuities,retirement-relatedservices,mutualfundsandinvestmentmanagement.IntheU.S.,Prudential’siconicRocksymbolhasstoodforstrength,stability,expertiseandinnovationformorethanacentury.Formoreinformation,pleasevisitwww.news.prudential.comForwardLookingStatementsThisdocumentmayincludeforward-lookingstatementsthatmayimplyrisksanduncertainties.Termssuchas"estimate","project", "plan", "believe", "expect", "anticipate", "intend", and other similar expressions could be construed asprevisionsorestimates.Terrafinawarnsreadersthatdeclarationsandestimatesmentionedinthisdocument,orrealizedbyTerrafina’smanagementimplyrisksanduncertaintiesthatcouldchangeinfunctionofvariousfactorsthatareoutofTerrafina’scontrol.FutureexpectationsreflectTerrafina’sjudgmentatthedateofthisdocument.Terrafinareservestherightorobligationtoupdatetheinformationcontainedinthisdocumentorderivedfromthisdocument.Pastorpresentperformanceisnotanindicatortoanticipatefutureperformance.

23

ConferenceCall

Terrafina

(BMV:TERRA13)Cordiallyinvitesyoutoparticipateinits

SecondQuarter2018Results

Friday,July27,201811:00a.m.EasternTime10:00a.m.CentralTime

***

Toaccessthecall,pleasedial:fromwithintheU.S.1-877-830-2576fromoutsidetheU.S.1-785-424-1726ConferenceIDNumber:Terrafina

AudioWebcastLink:https://www.webcaster4.com/Webcast/Page/1111/26311

ConferenceReplayU.S.1-844-488-7474

International(outsidetheUS)1-862-902-0129Passcode:24061815

24

AppendixAppendix1–RevenuesTerrafina’srevenuesaremainlyclassifiedasrentalrevenuesandotheroperatingreimbursablerevenues.Additionally,thereareaccountingrevenuesthatmustberegisteredaccordingwithIFRS;however,theseareconsideredasnon-cashitemsandthereforeareexcludedinsomecalculations.ReimbursabletenantimprovementsareincludedinthetenantimprovementexpensesfortheAFFOcalculation.

Revenues

2Q18 2Q17 2Q18 2Q17

(millionsofpesos) (millionsofdollars)

NOIcalculation RentalRevenue 921.8 773.6 47.6 41.6

NonCash AccruedIncome1 8.4 5.8 0.4 0.3

OtherOperatingRevenues 50.9 45.8 2.6 2.5

NOIcalculation ReimbursableExpensesasRevenues2 40.7 36.0 2.1 1.9

AFFOcalculation ReimbursableTenantImprovements 5.5 7.5 0.3 0.4

NonCash Othernon-cashincome 4.7 2.3 0.2 0.1

NetRevenue 981.1 825.1 50.6 44.4

NOIcalculationShareofProfitfromEquityAccounted

Investments315.1 15.7 0.8 0.9

(1)Straightlinerentadjustment.(2)TriplenetleasesexpensesreimbursedtoTerrafinafromitstenants.(3)Profitfromjoint-venturedevelopments.

Source:PGIMRealEstate-FundAccounting

25

Appendix2–RealEstateExpensesReal estate expenses are comprised of recurring figures relatedwith the operation (used for theNetOperating Profitcalculation) as well as non-recurring figures used for metric calculations such as Earnings Before Interests, Taxes,DepreciationandAmortization(EBITDA),FundsfromOperations(FFO),AdjustedFundsfromOperations(AFFO).Thefollowingtablepresentstherealestateexpensesbreakdown,whichareusedforthecalculationofseveralmetrics.

RealEstateExpenses

2Q18 2Q17 2Q18 2Q17

(millionofpesos) (millionofdollars)

RepairandMaintenance -36.8 -46.8 -1.9 -2.5

NOIcalculation Recurring -6.0 -8.2 -0.3 -0.4

AFFOcalculation NonRecurring -30.8 -38.6 -1.6 -2.1

PropertyTaxes -4.8 -12.7 -0.3 -0.7

NOIcalculation Operating 0.6 -0.4 0.0 0.0

NonCash NonOperating -5.4 -12.4 -0.3 -0.7

NOIcalculation PropertyManagementFees -20.4 -16.6 -1.1 -0.9

NOIcalculation Electricity -13.1 -12.7 -0.7 -0.7

AFFOcalculation BrokersFees -20.0 -13.2 -1.0 -0.7

PropertyInsurance -3.6 -3.7 -0.2 -0.2

NOIcalculation Operating -2.9 -2.8 -0.2 -0.2EBITDA

calculation Administrative -0.7 -0.8 0.0 0.0

NOIcalculation Security -5.0 -3.8 -0.3 -0.2EBITDA

calculationAdvertising -0.5 -0.2 0.0 0.0

OtherExpenses -18.6 -6.1 -0.9 -0.3

NOIcalculation OperationalRelated -3.9 -4.6 -0.2 -0.2

NonCash NonOperationalRelated -15.3 -0.5 -0.8 0.0EBITDA

calculationAdministrative 0.6 -1.1 0.0 -0.1

NonCash BadDebtExpense -14.6 -4.7 -0.8 -0.2

TotalRealEstateExpenses -137.4 -120.3 -7.1 -6.5

Source:PGIMRealEstate-FundAccounting

26

Appendix3–FeesandAdministrativeExpensesFeesandadministrativeexpenses include figuresused formetric calculations suchasEarningsbefore Interests, Taxes,DepreciationandAmortization(EBITDA),FundsfromOperations(FFO),AdjustedFundsfromOperations(AFFO).Terrafina’sfeesandadministrativeexpensesbreakdownisavailableinthefollowingtableandindicatesthefiguresusedforthecalculationofthesemetrics:

FeesandAdministrativeExpenses

2Q18 2Q17 2Q18 2Q17

(millionofpesos) (millionofdollars)

EBITDAcalculation ExternalAdvisorFees -59.2 -47.7 -2.9 -2.6

LegalFees -1.4 -3.8 -0.1 -0.2

EBITDAcalculation Recurring 0.0 -0.3 0.0 0.0

AFFOcalculation NonRecurring -1.3 -3.5 -0.1 -0.2

OtherProfessionalFees -4.8 -5.1 -0.3 -0.3

EBITDAcalculation Recurring -2.4 -3.3 -0.2 -0.2

AFFOcalculation NonRecurring -2.3 -1.7 -0.1 -0.1

AdministrativeFees -35.4 -24.8 -1.8 -1.3

EBITDAcalculation Recurring -12.5 -8.6 -0.6 -0.5NonOperational

related NonRecurring1 -22.9 -16.2 -1.1 -0.9

EBITDAcalculation Payroll -6.8 -5.8 -0.4 -0.3

EBITDAcalculation TrusteeFees -0.3 -2.2 0.0 -0.1

EBITDAcalculation OtherExpenses -3.0 -1.7 -0.2 -0.1

TotalFeesandAdmin.Expenses -110.9 -91.0 -5.6 -4.9

(1)Nonoperationalrelatedadministrativefees.

Source:PGIMRealEstate-FundAccounting

27

Appendix4–ReconciliationReconciliationofNetProfit(Loss)toFFO,EBITDAandNOI

2Q18 2Q17 2Q18 2Q17 (millionsofpesos) (millionsofdollars)

ComprehensiveIncome(Loss) 2,897.6 -840.3 149.4 -45.3Add(deduct)CurrencyTranslationAdjustment: CurrencyTranslationAdjustment -

2,205.5 1,066.9 -113.7 57.5

Add(deduct)CostofFinancingAdjustment: NonRecurringBorrowingExpenses 8.6 3.4 0.4 0.2

Add(deduct)Non-CashAdjustment: ForeignExchangeAdjustments 69.0 -50.8 3.6 -2.7

Gain(Loss)onDerivativeFinancialInstruments 0.2 - 0.0 -FairValueAdjustmentonBorrowings -246.3 190.2 -12.7 10.2FairValueAdjustmentonDerivativeFinancialInstruments -9.4 -4.4 -0.5 -0.2FairValueAdjustmentonInvestmentProperties -4.1 62.7 -0.2 3.4Gain(Loss)fromSalesofRealEstateProperties 0.0 -1.9 0.0 -0.1

Add(deduct)ExpensesAdjustment: NonRecurringRepairandMaintenance 30.8 38.6 1.6 2.1

NonOperatingPropertyTaxes 5.4 12.4 0.3 0.7BrokersFees 20.0 13.2 1.0 0.7BadDebtExpense 14.6 4.7 0.8 0.3OtherNonOperationalRelatedExpenses 15.3 0.5 0.8 0.0NonRecurringLegalFees 1.3 3.5 0.1 0.2NonRecurringOtherProfessionalFees 2.3 1.7 0.1 0.1

Add(deduct)RevenuesAdjustment: AccruedIncome -8.4 -5.8 -0.4 -0.3OtherNon-CashIncome -4.7 -2.3 -0.2 -0.1ReimbursableTenantImprovements -5.5 -7.5 -0.3 -0.4

Add(deduct)NonOperationalAdministrativeFees NonOperationalAdministrativeFees 22.9 16.2 1.2 0.9FFO 604.2 500.8 31.3 26.9Add(deduct)CostofFinancingAdjustment: InterestPaid 240.2 205.4 12.4 11.1RecurringBorrowingExpenses 0.0 0.3 0.0 0.0InterestIncome -2.4 -2.0 -0.1 -0.1

EBITDA 842.0 704.5 43.6 37.9Add(deduct)ExpensesAdjustment: ExternalAdvisorFees 59.2 47.7 3.1 2.6RecurringLegalFees 0.0 0.3 0.0 0.0RecurringOtherProfessionalFees 2.4 3.3 0.1 0.2AdministrativeFees 12.5 8.6 0.6 0.5Payroll 6.8 5.8 0.4 0.3TrusteeFees 0.3 2.2 0.0 0.1OtherExpenses 3.0 1.7 0.2 0.1Advertising 0.5 0.2 0.0 0.0AdministrativePropertyinsurance 0.7 0.8 0.0 0.0OtherAdministrativeExpenses -0.6 1.1 0.0 0.1

NOI 926.9 776.3 47.9 41.8Add(deduct)ExpensesAdjustment:

RecurringRepairandMaintenance 6.0 8.2 0.3 0.4OperatingPropertyTaxes -0.6 0.4 0.0 0.0PropertyManagementFees 20.4 16.6 1.1 0.9Electricity 13.1 12.7 0.7 0.7OperatingPropertyInsurance 2.9 2.8 0.2 0.2Security 5.0 3.8 0.3 0.2OtherOperationalExpenses 3.9 4.6 0.2 0.2

Add(deduct)RevenuesAdjustment: OtherNon-CashIncome 4.7 2.3 0.2 0.1AccruedIncome 8.4 5.8 0.4 0.3ReimbursableTenantImprovements 5.5 7.5 0.3 0.4ShareofProfitfromEquityAccountedInvestments -15.1 -15.7 -0.8 -0.8

NetRevenue 981.1 825.1 50.6 44.4

28

ReconciliationofNetProfit(Loss)toAFFO 2Q18 2Q17 2Q18 2Q17

(millionsofpesos) (millionsofdollars)

ComprehensiveIncome(Loss) 2,897.6 -840.3 149.4 -45.3Add(deduct)CostofFinancingAdjustment: NonRecurringBorrowingExpenses -2,205.5 1,066.9 -113.7 57.5

Add(deduct)CostofFinancingAdjustment: NonRecurringBorrowingExpenses 8.6 3.4 0.4 0.2

Add(deduct)Non-CashAdjustment: ForeignExchangeAdjustments 69.0 -50.8 3.6 -2.7Gain(Loss)onDerivativeFinancialInstruments 0.2 - 0.0 -FairValueAdjustmentonBorrowings -246.3 190.2 -12.7 10.2FairValueAdjustmentonDerivativeFinancialInstruments -9.4 -4.4 -0.5 -0.2FairValueAdjustmentonInvestmentProperties -4.1 62.7 -0.2 3.4Gain(Loss)fromSalesofRealEstateProperties 0.0 -0.8 0.0 0.0

Add(deduct)ExpensesAdjustment: NonOperatingPropertyTaxes 5.4 12.4 0.3 0.7BadDebtExpense 14.6 4.7 0.8 0.3OtherExpensesNonOperationalRelated 15.3 0.5 0.8 0.0

Add(deduct)RevenuesAdjustment: AccruedIncome -8.4 -5.8 -0.4 -0.3OtherNon-CashIncome -4.7 -2.3 -0.2 -0.1

Add(deduct)NonOperationalAdministrativeFees NonAdministrativeFees 22.9 16.2 1.2 0.9

Add(deduct)CapexAdjustment: AFFO 555.3 452.4 28.8 24.3

29

Appendix5-CapRateCalculationTerrafinasubtractscashandlandreservesforthecapratecalculation.ImpliedcaprateandunderNAV(NetAssetValue)calculationareshowninthefollowingtables:

ImpliedCapRate

QuarterlyAveragePrice(dollars)¹ 1.47

(x)CBFIs(millionshares) 791.0

(=)MarketCapitalization 1,161.0

(+)TotalLiabilities 1,030.5

(-)Cash 102.8

(=)EnterpriseValue 2,088.6

(-)Landbank 51.9

(=)ImpliedOperatingRealEstateValue 2,036.7

NetOperatingIncome(NOI)2018e 185.0

ImpliedCapRate 9.1%

Figuresexpressedinmillionsofdollarsunlessotherwisestated.

(1)2Q18averagesharepriceofPs.28.46;andaverageexchangerateofPs.19.3911

CapRateCalculationwithNAV

(+)InvestmentProperties(excludinglandbank) 2,261.0

(+)Land 51.9

(+)Cash 102.8

(-)TotalLiabilities 1,030.5

(=)NAV1 1,385.2

(/)CBFIs(millionshares) 791.0

(=)NAVperCBFI(dollars) 1.8

CBFIPrice(NAVcalculation) 1.8

(x)CBFIs(millionshares) 791.0

(=)MarketCap 1,385.2

(+)TotalDebtandLiabilities 1,030.5

(-)Cash 102.8

(=)EnterpriseValue 2,312.9

(-)Landbank 51.9

(=)ImpliedOperatingRealEstateValue 2,261.0

NetOperatingIncome(NOI)2018e 185.0

ImpliedCapRate 8.2%

30

FinancialStatements

IncomeStatement

2Q18 2Q18

(thousandsofpesos) (thousandsofdollars)

Rentalrevenues

$930,232 $47,972

Otheroperatingincome

58,635 3,024

Realestateoperatingexpenses

(137,408) (7,086)

Feesandotherexpenses

(110,920) (5,720)

Realizedgain(loss)fromdisposalofinvestmentproperties

- -

Netgain(loss)fromfairvalueadjustmentoninvestmentproperties

4,109 212

Netgain(loss)fromfairvalueadjustmentonborrowings

246,282 12,701

Netgain(loss)unrealizedfromfairvalueonderivativefinancialinstruments

9,358 483

Realizedgain(loss)onderivativefinancialinstruments

(207) (11)

Foreignexchange(loss)gain

(69,004) (3,559)

Operatingprofit 931,077 48,016

Financeincome

2,422 125

Financecost

(248,788) (12,830)

Financecost-net (246,366) (12,705)

Shareofprofitfromequityaccountedinvestments

7,378 380

NetProfitfortheperiod 692,089 35,691

Items thatmaybesubsequently reclassified toprofitorloss-currencytranslationdifferences 2,205,470 113,736

TotalComprehensiveincomefortheperiod 2,897,559 149,427

31

FinancialStatements

BalanceSheet Jun-30-18 Jun-30-18(thousandsofpesos) (thousandsofpesos) (thousandsofdollars)

Assets Non-currentassets

Investmentproperties $46,176,289 $2,324,704(Cost:30/06/2018-Ps.45,597,200,US$2,351,450;31/03/2018-Ps.41,634,186,US$2,269,5735)

Investmentsaccountedusingequitymethod 449,436

22,626Derivativefinancialinstruments 70,828

3,566

Deferredchargesandaccruedincome 208,263- 10,485

Loanreceivable 38,613

1,944(Cost:30/06/2018-Ps.38,613,US$1,991;31/03/2018-Ps.35,660,US$1,944) Restrictedcash 36,934

1,859

Currentassets Otherassets 34,191

1,721

Loanreceivable 632

32(Cost:30/06/2018-632,US$33;31/12/2017-Ps.1,244,US$63) Recoverabletaxes 296,763 14,940Prepaidexpenses 4,461 225Deferredchargesandaccruedincome 5,463 275Accountsreceivable 133,905 6,741(Netofallowancefordoubtfulaccounts:30/06/2018-54,084,US$2,789;31/03/2018-Ps.36,454,US$1,987)

Cashandcashequivalents 2,042,416 102,824

Totalassets 49,498,194 2,491,942

NetassetsattributabletoInvestors Contributions,net 19,513,306

982,380

Retainedearnings 186,666

9,398Currencytranslationadjustment 9,328,922

469,656

Totalnetassets(NetEquity) 29,028,894 1,461,434

Liabilities

Non-currentliabilities

Borrowings 19,686,895 991,119(Cost:30/06/2018-Ps.19,700,401,US$1,015,951;31/03/2018-Ps.18,194,058,US$991,799) Tenantdeposits 297,217

14,963

Accountspayable 4,866

245Currentliabilities Tradeandotherpayables 229,704 11,564Borrowings 139,748 7,035(Cost:30/06/2018-Ps.139,748,US$7,207;31/03/2018-Ps.219,194,US$11,949) Tenantdeposits 110,870

5,582

Totalliabilities(excludingnetassetsattributabletotheInvestors) 20,469,300 1,030,509

Totalnetassetsandliabilities 49,498,194 2,491,942

32

FinancialStatements

CashFlowStatement Jun-18 Jun-18

(thousandsofpesos) (thousandsofdollars)

Cashflowsfromoperatingactivities (Loss)profitfortheperiod $798,114 $40,180

Adjustments: Netloss(gain)unrealizedfromfairvalueadjustmentoninvestmentproperties 558,798 28,132

Netloss(gain)unrealizedfromfairvalueadjustmentonborrowings (398,921) (20,083)Netloss(gain)unrealizedfromfairvalueadjustmentonderivativefinancialinstruments (38,921) (1,959)Realizedgainfromdisposalofinvestmentproperties 17,836 898

Baddebtexpense 22,953 1,156

Interestexpense 458,960 23,106

Interestincomeonbankaccounts (3,180) (160)

Shareofprofitfromequityaccountedinvestments (12,943) (652)

Decrease(increase)deferredrentsreceivable (15,548) (783)

Decrease(increase)inaccountsreceivable (98,220) (4,945)

Decrease(increase)inrecoverabletaxes 853,009 42,944

Decrease(increase)inreimbursedvalueaddedtax (466,237) (23,472)

Decrease(increase)inprepaidexpenses 7,311 368

Decrease(increase)inotherassets (8,359) (421)

Decrease(increase)intenantdeposits 19,318 973

(Decrease)inaccountspayable 22,733 1,144

Netcash(usedin)generatedfromoperatingactivities 1,716,703 86,426

Cashflowsfrominvestingactivities Acquisitionssofinvestmentproperties (481,977) (24,265)

Improvementsofinvestmentproperties (24,183) (1,217)

Proceedsfromdispositionsofinvestmentproperties - -

Acquisitionprepayment - -

Interestincomeonbankaccounts 3,180 160

Investmentsinjointventure 390 20

Loansreceivablepayment 594 30

Netcash(usedin)generatedfrominvestingactivities (501,996) (25,273)

Cashflowsfromfinancingactivities Proceedsfromborrowings - -

Principalpaymentsonborrowings (879,578) (44,282)

Interestexpense (449,479) (22,629)

Distributionstoinvestors (990,293) (49,855)

Restrictedcash (274) (14)

Netcash(usedin)generatedfromfinancingactivities (2,319,624) (116,779)

Net(decrease)incashandcashequivalents (1,104,917) (55,626)

Cashandcashequivalentsatthebeginningoftheperiod 3,209,041 161,556

Exchangeeffectsoncashandcashequivalents (61,708) (3,107)

Cashandcashequivalentsattheendoftheperiod $2,042,416 $102,824

33

FinancialStatements

StatementofChangesinEquity Netcontributions

Currencytranslationadjustment

Retainedearnings Netassets

(thousandsofpesos) BalanceatJanuary1,2018 $19,844,088 $9,169,409 $48,063 $29,061,560CapitalContribution,NetofIssuingCosts 0 - - -DistributionstoInvestors (330,782) - (659,511) (990,293)ComprehensiveIncome

Netlossoftheperiod - - 798,114 798,114OtherComprehensiveIncome CurrencyTranslation - 159,513 - 159,513TotalComprehensive(loss)income - 159,513 798,114 957,627

NetAssetsasofJune30,2018 $19,513,306 $9,328,922 $186,666 $29,028,894

(thousandsofdollars)

BalanceatJanuary1,2018 $999,033 $461,626 $2,420 $1,463,078

CapitalContribution,NetofIssuingCosts 0 - - -

DistributionstoInvestors (16,653) - (33,202) (49,855)

ComprehensiveIncome

Netlossoftheperiod - - 40,180 40,180

OtherComprehensiveIncome

CurrencyTranslation - 8,031 - 8,431

TotalComprehensive(loss)income - 8,031 40,180 48,211

NetAssetsasofJune30,2018 $982,380 $469,656 - $1,461,834