SATzilla: Portfolio-based Algorithm Selection for SAT

description

Transcript of SATzilla: Portfolio-based Algorithm Selection for SAT

SATzilla: Portfolio-based Algorithm Selection for SAT

Lin Xu, Frank Hutter, Holger H. Hoos, and Kevin Leyton-Brown

Department of Computer ScienceUniversity of British Columbia

Mainly based on [Xu, Hutter, Hoos, Leyton-Brown, JAIR, 2008]

SATzilla

• Excellent performance in SAT competitions [http://www.satcompetition.org/]

– 2 second places, one third place in 2003 SAT competition [Leyton-Brown, Nudelman, Andrew, McFadden & Shoham, 2003]

– 3 Gold, 1 Silver, 1 Bronze in 2007 SAT competition [Xu, Hutter, Hoos, & Leyton-Brown, 2007]

– 3 Gold, 2 Silver in 2009 SAT competition [Xu, Hutter, Hoos & Leyton-Brown, 2009]

• One gold in every category: Industrial/Handmade/Random

• Domain independent– MIPzilla, CSP, Planning …

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla 2

Solvers

InstanceInstance Feature extractor

Algorithm selector

Impact on the SAT community

Encouraged research on portfolio-based solvers for SAT

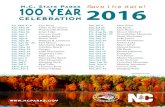

Final 2011 SAT competition results[http://www.satcompetition.org/]

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla

Category Random Handmade Industrial

Medalists

3Sppfolio (2) ppfolio seq

sparrow2011 sattime2011

eagleup march_rw

mphasesat_m

3S (3)Ppfolio (2)

ppfolio seq (2) clasp

glucose

glucose (2)glueminisat (2)

lingeling contrasat hack cirminisat hack mphasesat64

qutersat

Total medals 4/9 7/9 0/9

3

Outline

• Introduction• Related Work: – Algorithm selection

• SATzilla overview:– Building SATzilla – Running SATzilla

• SATzilla07 and beyond• Results • SATzilla since 2008• Conclusion

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla 4

Related work: algorithm selection

Select the best solver for each instance [Rice, 76]

– Regression-based• Linear regression (SATzilla)

[Leyton-Brown, Nudelman, Andrew, McFadden & Shoham, 2003; Xu, Hutter, Hoos, Leyton-Brown, 2007+]

• Matchbox [Stern et al., 2010]

– Classification-based• Logistic regression [Samulowitz & Memisevic, 2007]

• K-NN [O’Mahony & Hebrard, 2008]

• Decision tree [Guerri & Milano, 2004]

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla 5

What is SATzilla?

• Portfolio-based algorithm selection based on empirical hardness models [Leyton-Brown et al., 2002;2009]

– Use regression models to predict each algorithm’s performance

– Select the predicted best

• Many new techniques for improving robustness– Pre-solvers – Backup solver– Solver subset selection

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla 6

SATzilla: prerequisites

Identify a target distribution of instances

Select a set of candidate solvers, and measure runtime on a training set

Identify a set of features based on domain knowledge and collect feature values– Cheap to compute– Informative for prediction

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla 7

SATzilla core: predictive modelsGoal: accurately predict solver performance based on cheaply

computable features

Supervised machine learning: learn function f: features → performance

– Input: <features, performance> pairs– Output: f

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla

fw() = wT

Performance(y)Features ()

• 23.34• 7.21• …• …

Algorithm selector

8

SATzilla: selection based on models

• Predict each solver’s performance• Pick solver based on predictions

Feature extractor

Algorithm selector

InstanceInstanceInstanceInstance

Compute features

Make prediction

Run on selected solver

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla 9

Improving robustness

• Solver subset selection– More candidate solvers can hurt– select subset of solvers that achieves best overall performance

• Pre-solvers– Solve some instances quickly without need for feature computation– Increase model robustness

• Backup solver – In case something goes wrong

Feature extractor

Algorithm selector

Dealing with imperfect predictions:

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla

Algorithm selector

10

Time to run SATzilla!

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla 11

Step 1: pre-solving

Run pre-solvers for a fixed short amount of time– If solved, done

InstanceInstance

Feature extractor

Algorithm selector

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla 12

Step 2: compute features

Run feature extractor to get a set of feature values– If solved, done– If anything fails, simply run backup solver

InstanceInstance

Feature extractor

Algorithm selector

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla 13

Step 3: performance prediction

Predict performance of solvers and order them according to runtime predictions

Feature extractor

Algorithm selector

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla 14

Step 4: run top-ranked solver

Run the top-ranked solver. If a run fails, run the next-ranked solver.

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla 15

Feature extractor

Algorithm selector

InstanceInstance

SATzilla07: construction

Pre-solvers: manually selected

Backup solver: overall best

Model building:– Predict runtime– Hierarchical hardness models [Xu, Hoos, Leyton-Brown, 2007]

– Models handle “censored data” [Schmee & Hahn, 1979]

Solver subset selection: exhaustive searchXu, Hutter, Hoos, and Leyton-Brown: SATzilla 16

Improving SATzilla07 (1.)

Problem: manual pre-solver selection is not idealSolution: auto pre-solver selection based on validation

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla 17

Feature extractor

Algorithm selector

Improving SATzilla07 (2.-5.)

Problem: overall best solver best backup solverSolution: choose the best solver for instances not solved by pre-solvers and with problematic features

Problem: objective is not always runtimeSolution: predict and optimize true objective directly also enables cleaner use of incomplete solvers

Problem: exhaustive search for solver subset selection is infeasible for large portfolios Solution: local search for solver subset selection

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla 18

SATzilla vs candidate solvers

HANDMADE

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla 19

SATzilla vs candidate solvers

HANDMADE

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla

Oracle

20

SATzilla vs candidate solvers

HANDMADE

Pre-solving

Feat. Comp.

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla

Oracle

SATzilla07

21

SATzilla vs candidate solvers

HANDMADE

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla

Oracle

SATzilla07

SATzilla07(improved)

22

SATzilla09 [Xu et al., 2009]

New techniques– New features: clause learning, …– Prediction of feature computation cost

Feature time predictor

InstanceInstance

Minimal cost feature

extractor

Results: 3 Gold, 2 Silver in 2009 SAT competition - Gold for Industrial (SAT) category - Gold for Handmade (UNSAT) category - Gold for Random (SAT+UNSAT) category

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla 23

Feature extractor

Algorithm selector

New Results: Cost sensitive classification Goal: directly optimize the objective [Xu et al., 2011]

– Cost sensitive classification for every pair of candidates– Vote to decide the order of candidates

Improved performance over regression models, particularly with heterogeneous data sets

New SATzilla on SAT competition 2011

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla

Random Gap closed: 80%

55%33%

OracleHandmade Industrial

24

Recent work: Combining algorithm selection and algorithm configuration

Problem: what if you only have one strong solver but it is highly parameterized?

“Hydra”: combine algorithm selection and algorithm configuration [Xu et al., 2010; 2011]

– Automatically find strong, uncorrelated parameter settings– Construct portfolio from these

Results: clear improvement for both SAT and MIP– 2 × to 31 × faster for MIP– 1.2 × to 73 × faster for SAT

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla 25

Conclusion

• Portfolio-based algorithm selection can improve performance and robustness

• SATzilla-like portfolio approaches are the state of the art for many problems

• New directions since our JAIR paper:– better predictive models – automatic portfolio construction (“Hydra”)

Xu, Hutter, Hoos, and Leyton-Brown: SATzilla 26