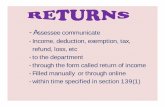

Income Tax Planning in India With Respect to Individual Assessee MBA Project

Salaried Assessee and Indian Income Tax

Transcript of Salaried Assessee and Indian Income Tax

EXEMPTED INCOMES & DEDUCTIONs FOR THE SALARIED ASSESSEE

FOR ASSESSMENT YEAR 2015-16

PRESENTED BY : AJAY GARG, Team AGBians

EXEMPTED INCOMES,

ALLOWANCES AND PERQUISITES

FOR SALARIED ASSESSEEPRESENTED BY : AJAY GARG,

Team AGBians

HOUSE RENT ALLOWANCE

CONDITION The Actual HRA received

from the Employer

Actual Rent Paid by you – 10% of your basic Salary

40% of your Salary (in case non metro city)

50% of your Salary (in case metro city)

PRESENTED BY : AJAY GARG, Team AGBians

TRANSPORT ALLOWANCE

EXEMPTION LIMIT

UP TO Rs. 800

pmFor Pune

PRESENTED BY : AJAY GARG, Team AGBians

Step 1 : Find out unfurnished accommodation's value

Step 2 : Find out Furniture value if it is furnished house.

RENT FREE ACCOMMODATION

HOUSE

Value of perquisite: Value of unfurnished accommodation plus value of furniture.

PRESENTED BY : AJAY GARG, Team AGBians

OTHER THAN GOVERNMENT EMPLOYEES:

When Accommodation is owned by the Employer

Accommodation is provided where Population is :-

Less then 10 lakh- 7.5 % of Salary More then 10Lakh but less then

25 lakh – 10% of salary More then 25 Lakh- 15 % of Salary

When Accommodation is taken on lease or on hire

Actual Amount of Lease Rent or 15 % of salary

When Accommodation is Provided in Hotel

24% of Salary or Actual Charges Payable PRESENTED BY : AJAY GARG,

Team AGBians

Whichever is less

Whichever is less

CONT..

MOTOR CAR / OTHER CONVEYANCE

VALUATION OF MOTOR CAR 1. WHEN USED WHOLLY

FOR OFFICIAL PURPOSES

NIL

2. WHEN USED WHOLLY FOR PERSONAL OF THE EMPLOYEE

Amount Actually Incurred by the Employer + Normal Depreciation(10% of Cost of Car) + Driver Salary Paid by the Employer - Any amount Charged from the Employee

PRESENTED BY : AJAY GARG, Team AGBians

When the motor Car is Owned or hired by the Expenses are borne by

1. Employer : Rs. 1800 (Rs. 2400 If engine Capacity More then 1600 CC)+ Rs.900 (For Chauffeur)

Employer : Rs. 1800 (Rs.2400 If engine Capacity More then 1600 CC)+ Rs.900 (For Chauffeur)

Employee: Rs. 600 (Rs.900 If engine Capacity More then 1600 CC) + Rs.900 (For Chauffeur)

2. Employee: Actual Amount of expenditure borne by the employer – Part of the attributable Office Expenditure by the employee that is: Rs. 1800 (Rs. 2400 If engine Capacity More then 1600 CC)+ Rs.900 (For Chauffeur)

Employee: Actual Amount of expenditure borne by the employer – Part of the attributable Office Expenditure by the employee that is: Rs. 1800 (Rs. 2400 If engine Capacity More then 1600 CC)+ Rs.900 (For Chauffeur)

MOTOR CAR / OTHER CONVEYANCE

CONT..

MEDICAL TREATME

NT

TO AN EMPLOYEE

Or HIS FAMILY MEMBER

EXPENDITURE

ALLOWED

IF

CERTIFICATE SPECIFYING

THE

DISEASE OR AILMENT

MAX. Rs. 15000 P.A.

PRESENTED BY : AJAY GARG, Team AGBians

EXPENDITURE INCURRED BY THE EMPLOYER

FOR AN EMPLOYEE OR HIS FAMILY

MEMBER

Amount of Deduction:-

Amount Permitted by the Reserved by the Bank Exclude Travelling Expenditure if Gross Total Income More then Rs.200000

PRESENTED BY : AJAY GARG, Team AGBians

PRESENTED BY : AJAY GARG, Team AGBians

TAX TREATMENT FOR PROVIDENT

FUND STATUTORY

RECOGNISED

UNRECOGNISED

1. EMPLOYER CONTRIBUTION

EXEMPT EXEMPT UP TO 12% OF SALARY

EXEMPT

2. INTEREST CREDITED ON EMPLOYER,s CONTRIBUTION

EXEMPT

EXEMPT UPTO 9.5% OF SALARY

EXEMPT

3. EMPLOYEE,S CONTRIBUTION

DEDUCTION U/S 80C

DEDUCTION U/S 80C

NO DEDUCTION, TAXABLE AS SALARY

DEDUCTIONS

PRESENTED BY : AJAY GARG, Team AGBians

DEDUCTIONS COVERED UNDER 80C

PPF

LIC

NSC FDT.

Fees

PRESENTED BY : AJAY GARG, Team AGBians

CONT..

DEDUCTIONS COVERED UNDER 80C

CONT..

Equity Linked Saving Scheme

HOME LOAN

PRINCIPAL REPAYMEN

T

STAMP DUTY AND

REGISTRATION CHARGES

FOR A HOME

INFRASTRUCTURE BOND

NABARD RURAL BOND

PRESENTED BY : AJAY GARG, Team AGBians

Public Provident

Fund Maximum Limit

If I Invest for Rupees 100000 annually, then it will be Deducted from the Taxable Income

PRESENTED BY : AJAY GARG, Team AGBians

CONT..

In case Policy Issued up to 31.03.2012

20% of the assured - Amount In Case Policy Issued on or after 01.04.2012 10% of the assured -Amount

LIFE INSURANCE PREMIUM

PRESENTED BY : AJAY GARG, Team AGBians

CONT..

Investment Exempted

PRESENTED BY : AJAY GARG, Team AGBians

CONT..

FIXED DEPOSITS

INCOME

EXEMPT

INTEREST TAXABLE

PRESENTED BY : AJAY GARG, Team AGBians

CONT..

Maximum Limit up to Rupees one lakh Maximum - two Children Self Study expenditure is not Allowed

PRESENTED BY : AJAY GARG, Team AGBians

CONT..

EQUITY LINKED SAVING SCHEME

MUTUAL FUND

ELSS

OTHER MODE

INVESTED

DEDUCTION

ALLOWED

PRESENTED BY : AJAY GARG, Team AGBians

HOME LOAN PRINCIPAL REPAYMENT

THE PRINCIPAL PAYMENT OF THE EMI QUALIFIES FOR DEDUCTION UNDER 80C

EVEN INTEREST PAYMENT SHALL ALSO BE ALLOWED AS DEDUCTION UNDER SECTION 24 UNDER HOUSE PROPERTY OF THE INCOME TAX

PRESENTED BY : AJAY GARG, Team AGBians

INFRASTRUCTURE BOND

AMOUNT INVESTED IN SUCH BONDS IS ALLOWED AS DEDUCTION

THESE BONDS ARE ISSUED BY THE INFRASTRUCTURE COMPANIES

PRESENTED BY : AJAY GARG, Team AGBians

NABARD BOND

NATIONAL BANK FOR AGRICULTURE & RURAL DEVELOPMENT

ALLOWED AS DEDUCTION

INVESTMENT PRESENTED BY : AJAY GARG,

Team AGBians

CONTRIBUTION TO PENSION FUND OF LICDEDUCTI

BLE AMOUNT

AMOUNT PAID OR DEPOSITED BY THE ASSESSEE

MAX. Rs. 100000

PRESENTED BY : AJAY GARG, Team AGBians

CONTRIBUTION TO PENSION SCHEME OF CENT. GOVT.DEDUCTI

BLE AMOUNT

AMOUNT PAID OR DEPOSITED BY THE ASSESSEE

MAX. 10% of SALARY

PRESENTED BY : AJAY GARG, Team AGBians

DEDUCTION U/S 80C, 80CCC and 80CCD

Clubbed Together

Maximum

Limit up to Rs. 1,00,000/-

PRESENTED BY : AJAY GARG, Team AGBians

Section 80CCE

INVESTMENT IN EQUITY SAVING SCHEME

DEDUCTIBLE

AMOUNT

AMOUNT PAID OR DEPOSITED BY THE ASSESSEE

50%of AMOUNT or Max. Rs. 25000

PRESENTED BY : AJAY GARG, Team AGBians

PRESENTED BY : AJAY GARG, Team AGBians

MEDICAL INSURANCE PREMIUM

AMOUNT OF

DEDUCTION

FOR INSURANCE ON

HEALTH OR PREVENTIVE

HEALTH CHECK UP OF SELF , SPOUSE , AND DEPENDENT

CHILDRENS

MAX..Rs. 15000

& 20000 FOR

SENIOR

AMOUNT OF DEDUCTION

AMOUNT OF EXPENDITURE OR Rs. 40000

WHICH EVER IS LESS

PRESENTED BY : AJAY GARG, Team AGBians

DEDUCTION UNDER 80 E

INTEREST

ON EDUCATION

LOANPRESENTED BY : AJAY GARG,

Team AGBians

DEDUCTION 80 G•100% for certain

donations

•50% for Some Other Donations

•Caution : The Receipt must have PAN Number

•Preserve this receipt PRESENTED BY : AJAY GARG,

Team AGBians

If Rent paid and HRA not received by Employee then look for Section 80GG

Condition

25% Total Income 2000Per

Month

Rent

paid

over

10% of

total

Income

PRESENTED BY : AJAY GARG, Team AGBians

DEDUCTION 80 GG

REBATE SECTION 87 A

CONDITION

TAXABLE INCOME UP TO Rs. 500000

RELIEF MAX. Rs.2000

Assuming an inflation rate of 10% and a notional rise in the threshold exemption from Rs. 2,00,000/- to Rs. 2,20,000/-

PRESENTED BY : AJAY GARG, Team AGBians

SELF OCCUPIED PROPERTY

PRESENTED BY : AJAY GARG, Team AGBians

Interest on Housing Loan Repayment Maximum up to 150000/-

INTEREST FROM SAVING ACCOUNT 80 TTA

EXEMPT UPTO MAXIMUM OF 10000/-

PRESENTED BY : AJAY GARG, Team AGBians

Ajay Garg Corporate Counsel and

mwww.agbcorplegal.com

09811386723