Saddles and Bifurcations in an Overlapping Generations...

Transcript of Saddles and Bifurcations in an Overlapping Generations...

DEPARTMENT

OF ECONOMICS

P.O.BOX 4600, FIN-90014 OULU FINLAND, TEL +358 8 553 2905, FAX +358 8 553 2906, E-MAIL [email protected]

Working Papers

Saddles and Bifurcations in an Overlapping Generations Economy with a Renewable Resource

Erkki Koskela

University of Helsinki

Markku Ollikainen University of Helsinki

and

Mikko Puhakka

University of Oulu

Working Paper No. 0803 March 2008

ISSN 1796-7961

Saddles and Bifurcations in an Overlapping Generations Economy with a Renewable Resource

Abstract We incorporate a renewable resource as a factor of production and store of value into an overlapping generations model. We characterize dynamics and stability of steady state equilibria by introducing the concave resource growth function. The nature of equilibria in the presence of ‘well-behaved’ resource stock growth depends on the size of the intertemporal elasticity of substitution in consumption. If it is at least half, but not exactly one, steady states are saddle points. For intertemporal elasticity less than one half we use a parametric example with logistic growth to demonstrate the existence of stable equilibria (indeterminacy) and a subcritical bifurcation.

JEL classification: D90, Q20, C62.

Keywords: overlapping generations, renewable resources, bifurcation.

Erkki Koskela Markku Ollikainen Mikko Puhakka Department of Economics Department of Economics and Department of Economics Management P.O. Box 17 P.O. Box 27 P.O. Box 4600 FIN-0014 University of Helsinki FIN-0014 University of Helsinki FIN-90014 University of Oulu FINLAND FINLAND FINLAND [email protected] [email protected] [email protected]

1

1. Introduction Kemp and Long (1979) and Mourmouras (1991, 1993) were among the first to use an

overlapping generations framework to analyze the sustainable use of renewable

resources. They demonstrate the generally well-known fact that competitive equilibria

in overlapping generations economies may be inefficient, but do not study the

dynamics and stability of the model. Koskela, Ollikainen and Puhakka (2002) analyze

the dynamics of an overlapping generations (OG) renewable resource economy with

well-defined property rights and quasi-linear preferences, where the resource stock

serves as a store of value and as an input in the production of consumption good.

They show that all equilibria, be they efficient or not, are saddles.

In this paper we examine, if an OG economy with a renewable resource can

also have other types of dynamics than saddles. Our paper is a generalization and

extension of Koskela et al. (2002). Instead of quasi-linear utility function we postulate

more general preferences. We demonstrate that all the results of our previous paper

are not robust by showing that our more general model yields different outcomes. We

study the dynamical properties of an economy with a renewable natural resource,

which serves as a factor of production and a store of value. The inclusion of the

renewable resource implies one important difference relative to Diamond (1965).

Now the gross return from investing in the resource is not a linear function of the

resource stock. This feature will have implications for our results.

We characterize the steady state equilibrium and its efficiency, and in

particular, study its stability properties under the assumption that the property rights

to the renewable resource (forest or fish stock) are well-defined. The nature of the

steady state equilibrium will depend on the value of the intertemporal elasticity of

substitution in consumption. If the size of this elasticity is at least half, but different

from one, then steady states are saddle points. This result holds for a general strictly

concave resource growth function. For the values of intertemporal elasticity of

substitution less than one half we use a parametric example with logistic resource

growth to demonstrate the existence of a subcritical flip bifurcation.1 This means that

a repelling two-cycle emerges on that side of the flip bifurcation, where the steady

state is stable. Hence, we have shown that, instead of variability in natural conditions,

flip bifurcations and complex dynamics emerge in our model because of the mixture

1 The logistic growth curve is a rather standard specification in resource economics literature; see e.g. a

survey by Brown (2000).

2

of low elasticity of substitution in consumption and logistic growth. Our results are

similar to those of Olson and Knapp (1997) who demonstrate the existence of cycles

and multiple equilibria in an OG model with an exhaustible resource. Like we, they

find that the period two cycles are associated with a low intertemporal elasticity of

substitution. They also examine welfare issues.

The effect of renewable resources on economic growth is also an interesting

issue. Employing an endogenous growth model of a small economy, Eliasson and

Turnovsky (2004) show that the equilibrium resource stock is less than the maximum

sustainable yield. They also demonstrate that the steady state equilibrium growth rate

in an economy endowed with a renewable resource is less that it would be in the

absence of such a resource.

We proceed as follows. The basic set-up with a renewable resource is

recapitulated in section 2. Conditions for a unique steady state and its efficiency are

analyzed in section 3. In section 4 we study dynamical equilibria of a planar system

for harvesting and resource stock, and characterize the case where all the stationary

equilibria are saddle points. In section 5 we examine the case where saddle point

equilibria may not exist. Finally, section 6 summarizes our findings.

2. A General Model with a Renewable Resource We study the same perfect foresight overlapping generations model as in Koskela et

al. (2002) except that the present model is more general. We dispense with the linear

second period utility function by assuming the following time separable lifetime

utility function

(1) )()( 21tt cucuV β+= ,

where cit denotes the period i (=1,2) consumption of consumer-worker born at time t

and 1)1( −+= δβ with δ being the rate of time preference. The utility function is

increasing and strictly concave, i.e. 0>′u , 0<′′u with the Inada conditions. The

young generation supplies labor inelastically to firms in the consumption goods

sector. The firms in the consumption goods sector have a constant returns to scale

technology, ),( tt LHF , with inputs tH (the harvested resource) and tL (labor).

)(/),( tttt hfLLHF = , where th (= tt LH / ) is the per capita level of the harvest. The

per capita production function has the standard properties: 0>′f and 0<′′f with the

3

Inada conditions. The representative consumer-worker buys the consumption good

and saves in the financial asset or buys the available stock of the renewable resource.

The growth of the resource is )( txg , where tx denotes the beginning of

period t stock of the resource. )( txg is assumed to be a strictly concave function, i.e.

0<′′g . Besides owning the stock the current old generation (generation t-1 in period

t) will also get its growth, so that the stock they have available for trading is

)( tt xgx + . Furthermore, following renewable resource economics, we assume that

there are two values 0=x and xx ~= for which 0)~()0( == xgg so that there is a

unique value x̂ at which 0)ˆ( =′ xg . Hence, x̂ denotes the stock providing the

maximum sustained yield (MSY), while x~ is the maximal stock that the natural

environment can sustain. Since this is a natural resource, it is reasonable to assume

that there are no Inada conditions for the resource stock growth function.

The transition equation for the resource is

(2) )(1 tttt xghxx +−=+ .

The young generation can also participate in the financial markets by borrowing or

lending, the amount of which is denoted by ts . Their budget constraints are

(3) ttttt wsxpc =++ +11

(4) [ ] tttttt sRxgxpc 11112 )( ++++ ++= .

where tp is the price of the resource, tw the wage rate in terms of period t’s

consumption, and 11 1 ++ += tt rR is the interest factor. The young generation buys an

amount 1+tx of the resource stock from the representative firm. The firm has

harvested an amount th of the stock, and 1+tx has been left to grow. From (4), the old

generation consumes their savings including the interest, and the income they get

from selling the resource next period to the firm, [ ])( 111 +++ + ttt xgxp . Maximizing (1)

subject to (3)-(4) leads to the first-order conditions for ts and 1+tx

(5) )(')(' 211t

tt cuRcu β+=

(6) [ ] )(')('1)(' 2111t

ttt

t cuxgpcup β++ += .

4

The marginal rate of substitution between current and future consumption must be

equal to the interest factor, which equals the resource price adjusted growth factor, so

that we have the following arbitrage condition [ ] )/()('1 111 tttt ppxgR +++ += .2

Next we define the competitive equilibrium as follows.

Definition. A price system and a feasible allocation,

{ }∞=−1

121 ,,,,,, ttttt

ttt xhccwRp , is a competitive equilibrium, if

(i) given the price system, consumers and firms solve their decision

problems

and

(ii) markets clear for all t = 1,2,...,T

Note that our definition includes the decision made by the initial old, who are

the original owners of the renewable resource. They basically maximize (the utility

of) their old age consumption ( 02c ) by selling the resource and its growth to the firm.

The market clearing conditions are

(7a) )(121 ttt hfcc =+ −

(7b) )(1 tttt xgxhx +=++

(7c) st = 0

(7d) tt phf =′ )( and tttt whfhhf =′− )()( .

(7a) is the resource constraint and (7b) is the transition equation for the resource

stock. A combination of a representative consumer per generation with no

government debt, implies in (7c) that st = 0 . Finally, (7d) contains the optimal

conditions for profit maximization, which determine the evolution of factor prices, tp

and tw .3 Given the competitive equilibrium and first-order conditions, we obtain the

following planar system that describes the dynamics of the model:

(8) )(1 tttt xghxx +−=+

(9) [ ] =−− +1)(')(')(')(' tttttt xhfhhfhfuhf

2 By choosing x the young can affect the marginal return of the resource, g ′ . This reflects the fact that

a renewable resource, like fish stock, differs markedly from a conventional asset, whose return in a competitive environment is independent of the amount invested.

3 The cash flow going through the firm is [ ])(),(1 ttttttttttt xgxpLwhpLHFxp +−−−++ . Given the transition equation (8), maximization of profit leads to conditions presented in (7d).

5

[ ] [ ])('1))()(('')(' 11111 +++++ ++ ttttt xgxgxhfuhfβ

Equations (8) and (9) are the main objects of our study. Before analyzing the

qualitative properties of this system we characterize the steady state equilibria.

3. Steady State Equilibria

In the steady state ( 0=Δ th and 0=Δ tx ) the following equations hold

(10) )(xgh =

(11) [ ] [ ] [ ])('1))()(('')(')(')(' xgxgxhfuxhfhhfhfu ++=−− β .

Given the properties of the resource growth function, the curve defined by (10) is not

monotone. Totally differentiating (11) we get

(12) 0)'1)(('')('')('')(''

')('')'1(')('''')('21

12

22 >++−+−

+++=

ghxfcuhxfcufcugfcugcu

dxdh

βββ .

The steady state with general preferences and technology is not necessarily

unique. When the growth rate, )(' xg , is positive, the Euler equation can cross the

growth curve in many points. For the steady state to be unique, it is of course

necessary that the Euler equation cuts the growth curve from below. We next explore

the existence and uniqueness of the steady state. The equilibrium Euler equation (9) in

the steady state reduces to

(13) [ ][ ] )('1

))())(((''))())((('))((' xg

xgxxgfuxgxxgfxgfu

+=+

+−β

.

To simplify the [ ])(),(1 ttttttttttt xgxpLwhpLHFxp +−−−++ characterization of

the existence and uniqueness of the steady state we consider a parametrized example.

We assume that the periodic utility function is of an iso-elastic

form ))/1(1/()(11

ρρ −=−

ccu , where cuu ''/'−=ρ is the intertemporal elasticity of

substitution in consumption. The production technology in turn is assumed to be

Cobb-Douglas, αhhf =)( , 10 <<α . Using this utility function and the fact that in

steady state )(xgh = we can rewrite equation (13) as

(14) [ ] )()('1)(')(')(

)(')('1

xRHSxghxfhhfhf

xhfhhf≡+=⎟⎟

⎠

⎞⎜⎜⎝

⎛−−

+ βρ

.

RHS is a decreasing function of .x The term in parenthesis of the LHS (the marginal

rate of substitution in equilibrium) can be expressed as

6

(15) 1

)(')(

1

)(')(')()(')('

−−

+=

−−+

hx

hhfhfhx

hxfhhfhfxhfhhf .4

Using )(xgh = and that α/1/ =′ hff we can rewrite the LHS of (14) as

(16)

ρ

α

1

1)(

1

1)()(

⎟⎟⎟⎟

⎠

⎞

⎜⎜⎜⎜

⎝

⎛

−−

+=

xgx

xgx

xLHS .

where )(/1/1 xgx>−α . Since )(/ xgx is an increasing function of x , it follows that

∞=→ )(lim ˆ xLHSxx , where )ˆ(/ˆ1/1 xgx=−α . Differentiation of (16) yields

(17) .0)1

)(1(

1))(')(()(

1)(

1

1)(1)('

2

2

11

>

⎟⎟⎟⎟

⎠

⎞

⎜⎜⎜⎜

⎝

⎛

−−

−

⎟⎟⎟⎟

⎠

⎞

⎜⎜⎜⎜

⎝

⎛

−−

+=

−

xgx

xgxxg

xgx

xgx

xgx

xLHS

α

α

αρ

ρ

Given that 0)(' >xLHS and 0)(' <xRHS , it is sufficient for existence and

uniqueness that RHSx

xLHSx 0

lim)(0

lim→

<→

. Now we can rewrite this condition as

(18) [ ] )0()0('11

)0('11

1)0('

1

)0(

1

RHSg

g

gLHS =+<

⎟⎟⎟⎟

⎠

⎞

⎜⎜⎜⎜

⎝

⎛

−−

+= β

α

ρ

,

where we have used the fact that )0('/)(lim 0 gxxgx =→ , when 0)0( =g . The

economically interesting parameters are the elasticity of output with respect to harvest

(α ), the discount factor ( β ), and the intertemporal elasticity of substitution ( ρ ). The

higher the discount factor and the intertemporal elasticity of substitution and the

smaller the elasticity of output, the more likely it is that the condition (18) holds. The

impact of the intertemporal elasticity of substitution on the likelihood of the existence

of the steady state depends on the value of the term in parenthesis. If it is greater than

unity, increasing the elasticity will decrease the LHS, and thus makes it easier to

4 Note that since 0)(')(')(1 >−−= xhfhhfhfc in a steady state, then

01)(')()(' >⎥

⎦

⎤⎢⎣

⎡−−

hx

hhfhfhhf .

7

obtain the existence, while if it is less than unity, increasing the elasticity will increase

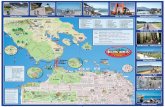

the LHS.5 We depict the behavior of functions )(xLHS and )(xRHS in Figure 1.

[ ] ) 0 ( ' 1 g + β

RHS

LHS

LHS(0)

x

LHS

RHS

Figure 1. Existence and uniqueness of the steady state equilibrium.

We collect this discussion in

Proposition 1. With iso-elastic utility and Cobb-Douglas production function, the

sufficient conditions for the existence and uniqueness of steady state

are the “high enough” discount factor, ,β the “high enough”

intertemporal elasticity of substitution, ρ , and/or “the small enough”

elasticity of output with respect to harvest, α .

Now we return back to the general case. In the subsequent analysis we will

concentrate on the nontrivial unique steady state. We will describe the loci 0=Δ tx

and 0=Δ th in the hx -space. The slope of the locus, )( tt xgh = , evaluated at the

steady state is

(19) )('0

xgdxdh

txt

t ==Δ

,

5 If we have the following logistic growth curve: 2)2/1()( xxxg −= , then 1)0(' =g . If 4/1<α ,

the term in brackets is less than unity. If 2/14/1 <<α , that term is bigger than unity.

8

so that it can be positive, zero or negative. The slope of the locus (derived in

Appendix 1) determined by equation (9), and evaluated at the steady state is

(20)

[ ])'1(')('')'1)(('''')(')('')(''')('')'1(')('')'1('')(')'1(')(''

2211

3221

0gfgxfgcugcugxfcufcu

gfcuggcugfcudxdh

tht

t

+−++−++−+++++

==Δ

ββββ

It is always positive given our assumptions on the utility function and the fact that

'1 g+ needs to be positive, because in the stationary equilibrium '1 g+ equals the

interest factor.

The unique steady state implies that the following inequality holds in the

steady state

(21) 00 =Δ=Δ

>tt xt

t

ht

t

dxdh

dxdh ,

so that the curve (9) with 0=Δ th cuts the growth curve from below.6

4. Dynamical Equilibria: Saddles Now we study how the dynamic behavior of our model and the nature of steady state

equilibrium depend on the economically important parameters. We continue to

assume that the steady state equilibrium is unique. To study the qualitative properties

of our model we start by considering paths for which tt xx ≥+1 and tt hh ≥+1 .7 It

follows from (8)

(22) tttttt xxghxxx ≥+−⇔≥+ )(1 tt hxg ≥⇔ )( .

This means that x is increasing (decreasing) below (above) the growth curve.

Studying the properties of the paths for which tt hh ≥+1 , requires a more

detailed analysis. In Appendix 1 (see equation A.3) we derive the following

expression (evaluated at the steady state) for the derivative of the right-hand side of

equation (9) above with respect to 1+th

6 Competitive equilibria in overlapping generations models can be inefficient. Keeping in mind

that )(' xg is the rate of interest in the steady state and the population growth rate is zero in our model, we conclude that all those steady states for which 0)(' ≥xg are efficient. This is the case where the real interest rate exceeds or is equal to the population growth rate. The steady states for which 0)( <′ xg are then inefficient.

7 Dynamics could be described by phase diagrams, as is convention. In the case of difference equations they are not, however, completely valid devices to illustrate dynamics.

9

(23) Ac

ufghrhs

t

≡⎟⎟⎠

⎞⎜⎜⎝

⎛−+=

∂∂

+ )(11''')'1(

21 ρβ ,

where )( 2cρ ( [ ])(''/)(' 222 cuccu−= ) is the intertemporal elasticity of substitution.

Given the values of tx and th , the right-hand side of equation (9) is an increasing

(decreasing) function of 1+th , if ρ is lower (higher) than unity.

If 1)( 2 >cρ we get from (9)

(24) [ ] ≤−−⇔≥ ++ 11 )(')(')(')(' tttttttt xhfhhfhfuhfhh

[ ] [ ])('1))()(('')(' 111 +++ ++ ttttt xgxgxhfuhfβ .

Note that we have replaced 1+th with th in (9) to get the above inequality. This weak

inequality is equivalent to the following statement

(25) [ ]

[ ] [ ] 1)('1)()((''

)(')(')('

111

1 ≤++

−−

+++

+

tttt

ttttt

xgxgxhfuxhfhhfhfu

β.

If 1)( 2 <cρ , the inequalities in (24) and (25) are reversed. Therefore, the motion of h

on both sides of the curve, where tt hh =+1 , depends on the size of intertemporal

elasticity of substitution. Hence the dynamics of the system can drastically change

when the intertemporal elasticity of substitution, ρ , passes through unity. If the

intertemporal elasticity of substitution is higher (lower) than one, then the substitution

effect of the interest rate exceeds (falls short of) the income effect.

In order to study formally the stability properties of dynamical equilibrium, we

rewrite equation (8) as follows

(26) ),()(1 tttttt hxGxghxx ≡+−=+ .

Substituting the RHS of (8) for 1+tx in (9) gives an implicit equation for 1+th ,

(27) ),(1 ttt hxFh =+

The planar system describing the dynamics of the renewable resource stock and

harvesting consists now of equations (26) and (27). The Jacobian matrix of the partial

derivatives of the system (8)-(9) can be written as

(28) ⎥⎥⎦

⎤

⎢⎢⎣

⎡ −+=⎥

⎦

⎤⎢⎣

⎡=

AB

AC

g

FFGG

Jhx

hx1'1

,

where A is defined in equation (23) and B and C are the partial derivatives of

equation (9) with respect to th and tx respectively, and have been derived in

10

Appendix 2. By defining 1

ˆ−

=ρρρ the two ratios in the Jacobian matrix can then be

expressed as

(29) ρβ

ˆ'''''

)(''')'1)(('''

)(''')('''

2

22

2

2

12

⎭⎬⎫

⎩⎨⎧

−+

−−=fgf

cufgcuf

cufcuf

AC

(30) ρ̂)'1(''

''')('''

)('')'1(')(''')('''

)('))(('''1

2

22

1

12

1

1

⎭⎬⎫

⎩⎨⎧

++

+++

+−=

gfgf

cufcugf

cufcuf

cuhxcuf

AB ,

where we can see the importance of the magnitude of the intertemporal elasticity of

substitution for the stability analysis. These elements of the Jacobian change signs

whenever ρ passes through unity, since the bracketed term in AC / is negative and

in AB / is positive.

The trace and determinant of the characteristic polynomial can be calculated as

(31) ⎭⎬⎫

⎩⎨⎧ +−+=

)('))(('''

1ˆ)'1(1

1

cuhxcuf

gD ρ

(32)

ρ̂)'1(''

''')('''

)('')'1(')(''')('''

)('))(('''1)'1(

2

22

1

12

1

1

⎭⎬⎫

⎩⎨⎧

++

+++

+−++=

gfgf

cufcugf

cufcuf

cuhxcufgT .

Armed with these calculations and the uniqueness condition (see Appendix 2) we get

Proposition 2. If the intertemporal elasticity of substitution is at least one half, but not

unity, then the unique steady state equilibrium is a saddle point.

Proof. See Appendix 3.

Steady states are saddle points for a wide range of values for intertemporal elasticity

of substitution. Empirical evidence on the size of the intertemporal elasticity of

substitution does not, however, necessarily coincide with those parameter values

presented in Proposition 2, but mainly points out to lower values. In his survey

Attanasio (1999) provides empirical evidence that the intertemporal elasticity of

substitution is below one and might be less than one half. More recently using

international data Yogo (2004) estimated the intertemporal elasticity of substitution to

be small, and in fact not significantly different from zero. Therefore, it is important to

study the characteristics of equilibria in the case when 2/1<ρ which we do next.

11

5. Dynamical Equilibria: Indeterminacy and Flip Bifurcations Above we showed that when 1>ρ , the determinant (D) and the trace (T) of the

system are positive, and D-T+1 < 0 so that steady states are saddles. These equilibria

are in area C in Figure 2, in which we have reproduced the familiar graphical

description of dynamical equilibria in a planar system (see e.g. Azariadis 1993, p. 66).

Stable equilibria lie in area B, and the other saddle point equilibria are in area A.

Thus, complex roots are not possible in our model.

Figure 2. Characteristics of stability in a planar system.

When 1<ρ , the determinant of the system becomes negative, and D-T+1 positive.

This means that the saddle-node bifurcations, which require among other things that

D-T+1 = 0, are not possible. We already proved that steady state equilibria are saddles

for 2/11 ≥>ρ . Since D+T+1 cannot be unambiguously signed for 21<ρ , it is

possible to have stable equilibria and flip bifurcations (see areas A and B in Figure

2). Assuming 2/1<ρ we have D < 0. We established in the proof of Proposition 2

that, when 1<ρ , then .01>+−TD To get stability (to be located in area B), we

need to have 01>++TD as well. Since we have shown the existence of saddles

when D < 0 (area A in Figure 2), we can also show the existence of flip bifurcations

D

T

D+T+1=0D-T+1=0

-2 2-1 1

-1

1

A B

C

12

(a movement from area A to B), if we can show the stability of equilibria. To

proceed we rewrite D+T+1 as follows

(33) { }1ˆ)'1( ++= MgD ρ

(34) { }1ˆ)'1( ++++= NMgT ρ ,

where 0)('

))(('''1

1 >+

−=cu

hxcufM , 0)'1(''

''')('''

)('')'1(')(''')('''

2

22

1

12

>⎪⎭

⎪⎬⎫

⎪⎩

⎪⎨⎧

++

++=

gfgf

cufcugf

cufcuf

N .

Using this notation we can express 1++TD after some manipulation as

(35) )ˆ1)('2(ˆˆ)'2(1 ρρρ +++++=++ gNMgTD .

where 0)1/(ˆ <−= ρρρ . At least in principle 1++TD can be zero or positive, if the

last term, the only positive term in the expression, dominates. If 0<D , 01>+−TD

and 01=++TD , we have a flip bifurcation (the line between areas A and B in

Figure 2).

Since our planar system is quite complex, mainly due to the nonlinear gross

return from investing in the natural resource, we conjecture that reducing the

dimension of our planar system to one by finding the center manifold (applying the

Center Manifold Theorem) for our model may not be a straightforward task.8 In this

section we therefore consider a parametric example with logistic growth function and

standard explicit functional forms for the utility and production functions

.)(;1),11/()(;21)(

112 αρ ρ

ρhhfccubxaxxg =≠−=−=

−

Using the expression for h , in the steady state, 2)2/1( bxaxh −= , and the Euler

equation and budget constraints, we end up with the following expression (see

Appendix 4) for the stock of the renewable resource in a steady state equilibrium

(36) ααβ ρρ −=

−+

−++1

21)1(1

1

bxabxa.

A straightforward but tedious calculation yields the following relatively complicated

formula for D+T+1

(37) ⎟⎟⎠

⎞⎜⎜⎝

⎛−−

−++

⎥⎦⎤

⎢⎣⎡ −−−

−+−+⎟⎟⎠

⎞⎜⎜⎝

⎛−

=++ρρ

αα

α

ρ 121)2(

)21)(1(

)211()2(

111 bxa

bxa

bxabxaTD

8 On the Center Manifold Theorem, see e.g. Guckenheimer and Holmes (1986), p. 127.

13

[ ] [ ]⎥⎥⎥

⎦

⎤

⎢⎢⎢

⎣

⎡

−+

−+

−++−++−++⎟⎟

⎠

⎞⎜⎜⎝

⎛−

⎟⎠⎞

⎜⎝⎛−

+−

bxa

bxaxbbxabxabxa1

)21()1(1)1()1(1

11

11

21 ρ

ββαβα

ρα ρ

ρρρρρ

In the sequel we undertake a numerical analysis for the parametric example of

our model. We assume the following values for parameters of the growth function and

the discount factor: 1== ba and 2/1=β .9 The values for growth parameters mean

that 1ˆ =x and 2~ =x , where 0)ˆ(' =xg and 0)~( =xg . Furthermore the condition

0)('1 ≥+ xg holds for all 20 ≤≤ x . Hence we use the assumptions of the growth

function, which in the one-dimensional case eliminate more complex dynamics, and

are in this sense “well-behaved”.10 Economically interesting parameters are the output

elasticity of resource (α ), which determines the price elasticity of resource demand,

and the intertemporal elasticity of substitution ( ρ ). For this reason our focus will be

on finding out for what values of these parameters we will get stability and flip

bifurcations. Solving α from equation (36) and plugging that value into (37) we find

out for what combinations of x and ρ D+T+1 is greater or less than zero or exactly

zero. Solving α from (36) we get

(38) ⎟⎟⎠

⎞⎜⎜⎝

⎛−++−+

−−

−+−

= ρρ βα

)1(11

222

222

bxabxabxa

bxabxa .

Plugging this relationship into (37) gives the following expression

(39) ⎟⎟⎠

⎞⎜⎜⎝

⎛−−

−++−+−+⎟⎟⎠

⎞⎜⎜⎝

⎛−

=++ρρβ

ρρρ

121)2()1)(2(

111 bxabxabxaTD

[ ][ ][ ] ⎥⎦

⎤⎢⎣

⎡−+++−−+−++−+−

⎟⎟⎠

⎞⎜⎜⎝

⎛−

+ ρρ

ρρ

ββρ

ρ )1(122)1(2)1(1)22)(2(

11

bxabxabxabxabxabxabx

[ ] ⎥⎦

⎤⎢⎣

⎡−+++−

−++−+−⎟⎟⎠

⎞⎜⎜⎝

⎛−

+ ρρ

ρρρρ

βββ

ρ )1(122))1(1()1)(2(

11

bxabxabxabxabxa

[ ] ⎥⎦

⎤⎢⎣

⎡−+++−

−++−+−⎟⎟⎠

⎞⎜⎜⎝

⎛−

+ ρρ

ρρ

ββ

ρ )1(122))1(1)(1)(2(

11

bxabxabxabxabxa .

9 If we want to interpret literally the length of the period in our overlapping generations economy to be

around 25 years, then the annual discount factor 0.975 (or the rate of time preference about 2.6 percent) means that the discount factor for 25 years should be around ½.

10 If the value of the parameter a varies, and in particular, is above three, then a period doubling bifurcation and chaos start to emerge even in this one dimensional logistic equation. Since this has been thoroughly studied in the existing literature on nonlinear dynamics, we use a parameter value for a , which in itself does not produce bifurcations or chaotic behavior in our framework, see e.g. Holmgren (1996), chapters 7-8.

14

To get a more precise idea where to look for stable equilibria, note that the

only positive term in this expression is the second term. Combining this term and the

first term we get after rearranging

(40) [ ]ρρ βρρ

)1()21(1

2 bxabxa−+−−⎟⎟

⎠

⎞⎜⎜⎝

⎛−−+ .

Consider first the efficient allocations, which lie on the left-hand side of the maximum

sustained yield, i.e. bax /0 ≤≤ . It is quite straightforward to see that the term in the

brackets of (40) is negative. This means that all the steady states are saddles.

Therefore, we should look for possible stable equilibria from the right-hand side of

the maximum sustained yield (MSY), where equilibrium is inefficient.

For given a , b and ρ , the stationary equilibrium condition (36) indicates that

there is an inverse relationship between α and x. Because we will now concentrate

on such allocations for which bax /> , the value of α must be relatively small for

equation (36) to hold.

1.94

1.96

1.98

x

0.1

0.2

r

-0.2

0D+T+1

1.94

1.96

1.98

x

Figure 3. D+T+1.

Our approach will be the following: We will first graph the surface defined by

equation (39) in the (D+T+1) ρx - space. Then we set D+T+1 = 0, and graph those

values of x and ρ for which D+T+1 = 0 holds. Figure 3 ( ρ marked as r) is a three-

dimensional graph of equation (39) (when α has been substituted in for the

expression of D+T+1). It points out to the fact that D+T+1 will be positive only for

15

extremely high (i.e. values which are close to x~ (= 2)) levels of the renewable

resource stock.

In Figure 4 we project those values of the resource stock x and the elasticity

of intertemporal substitution ρ for which D+T+1 is exactly zero, i.e., for which there

are flip bifurcations. Values of x and ρ , which lie above the curve will yield stable

equilibria, and for the values of x and ρ below the curve saddle point equilibria.

Figure 4. A characterization of indeterminacy and flip bifurcations.

In Figure 5 (α marked as a and ρ as r) we have depicted α , x and ρ in the

same diagram, i.e. we have graphed equation (38). This figure indicates that to get

stable equilibria and flip bifurcations the value of α needs to be quite small meaning

that production function is highly concave.

Hence, there is a set of parameter values of α and ρ , for which our

parametrized economy exhibits stable equilibria, i.e., indeterminacy and flip

bifurcations.11 12 This also means that there can be endogenous cycles in our model,

since the characteristic roots are of different sign. There are two types of flip

11 Figure 5 indicates that if e.g. under the assumptions 01.0=α and 03.0=ρ we get the level of the

steady state stock to be 1.95664 and the level of harvesting 0.04242. We also get 00119886.01 =++TD . If we instead let 011.0=α , we get the equilibrium stock to be 1.95228,

the level of harvesting 0.04658, and 00373852.01 −=++TD . 12 Kehoe and Levine (1990) characterize indeterminacy in many exchange economy OG models, but

without renewable resources.

ρ1.9

1.92

1.94

1.96

1.98

2

0 0.05 0.1 0.15 0.2 0.25 0.3

x

16

bifurcations. In a supercritical flip bifurcation a stable two-cycle emerges on the side

of the bifurcation value, where the steady state is a saddle. In a subcritical bifurcation,

an unstable two-cycle emerges on the side of the bifurcation value, where the steady

state is stable.

1.94

1.96

1.98

x

0.1

0.2

r

0

0.005

0.01

0.015

a

1.94

1.96

1.98

x

Figure 5. The emergence of stable equilibria and flip bifurcations.

To investigate the type of flip bifurcation, i.e. on which side of the flip

bifurcation a two-cycle exists, we resort to numerical simulations, and ask, whether it

is possible to find four numbers{ }2211 ,;, hxhx , which solve the following transition and

Euler equations.

(41) 211112 2

1 xxhxx −+−= and [ ] [ ]ρα

α

ραα

α

α

β

αα1

211

2

21

21

21

11

11

)(

)2(

)1( hxh

xh

xhh

h

+

−=

−− −

−

−

−

(42) 222221 2

1 xxhxx −+−= and [ ] [ ]ρα

α

ραα

α

α

β

αα1

121

1

11

11

11

22

12

)(

)2(

)1( hxh

xh

xhh

h

+

−=

−− −

−

−

−

If we find a four-tuple that fulfills equations (41) and (42), then a two-cycle exists.

We fixed 004.0=α , and picked the values of the intertemporal elasticity of

substitution from both sides of the Flip bifurcation curve in Figure 4. In Figure 6 we

have chosen to depict the emergence of the two-cycle for the resource stock x (the

vertical axis).

17

Since we picked the value of α to be quite small (consult Figure 5) the flip

bifurcation occurs for values of ρ (the horizontal axis) between 0.1825 and 0.1826. If

ρ = 0.1826, we have a saddle, and if it is 0.1825 we have a stable equilibrium These

assumptions lie in conformity with empirics, see e.g. Attanasio (1999) and Yogo

(2004). As Figure 6 indicates the period doubling occurs on the stable side, which

means that we have a subcritical flip bifurcation.

Figure 6. Subcritical flip bifurcation.

We are now in a position to summarize our findings in

Proposition 3. If the intertemporal elasticity of substitution is less than half, and the

resource growth function is logistic, there exists stable equilibria

(indeterminacy) and a subcritical bifurcation.

Flip bifurcations and complex dynamics emerge in our model with standard

overlapping generations structure due to the mixture of low elasticity of intertemporal

substitution in consumption and a well-behaved logistic growth.13 The parameter

values for the intertemporal elasticity of substitution for which we get stability and

flip bifurcations are empirically quite plausible. The parameter values of the share of

the resource in total output, α , are very small.14 Our results demonstrate, however,

13 Our result is related and conforms to Grandmont (1985), who showed in an exchange economy

overlapping generations model that cycles of any order and chaos can emerge, if the elasticity of the marginal utility of the second period consumption is higher than one.

14 Interestingly, Eliasson and Turnovsky (2004) have recently demonstrated that an OG economy with a renewable resource sector with limited size can coexist with constant ongoing growth elsewhere in the economy without exhausting the resource.

ρ

x

1.955

1.96

1.965

1.97

1.975

1.98

1.985

1.99

0.168 0.17 0.172 0.174 0.176 0.178 0.18 0.182 0.184

18

that there is a possibility that an overlapping generations renewable resource economy

may be a source for bifurcations and complex dynamics even in the absence of

shocks. The same types of results have been presented by Olson and Knapp (1997). It

would be an interesting further topic to analyze empirically if the observed cyclical,

irregular or spasmodic yields have actually been due to the variability of natural

conditions, or if any of them have been due to the fundamentals of the overlapping

generations economy.

6. Conclusions The stability properties of an overlapping generations economy have not so far been

studied carefully in models with renewable resource use. In this paper we examined

the dynamic properties of an overlapping generations economy with standard

assumptions about the utility and production functions, but augmented with a

renewable resource, which is both a factor of production and a store of value. We

asked whether the fundamentals, i.e. preferences and technology, instead of variability

of natural conditions can be a source of various types of observed dynamics.

We showed that the nature of the steady state equilibrium depends on the

value of intertemporal elasticity of substitution in consumption. In particular, if the

intertemporal elasticity of substitution is at least one half, but different from unity,

then steady states are saddle points. Interestingly, for smaller values of the

intertemporal elasticity of substitution, which are in conformity with empirical

evidence from consumption behavior, we use a parametric example to demonstrate

the existence of a subcritical flip bifurcation for the case of inefficient equilibrium.

This means that a repelling two-cycle emerges on the side of flip bifurcation where

the steady state is stable.

We have demonstrated a possibility for different types of equilibrium

dynamics in a standard overlapping generations model with a renewable resource. An

important further research topic would be to analyze empirically which of the

observed cycles and irregularities, if any, are due to the fundamentals of the

overlapping generations economy and which can be traced back to the variability in

natural conditions governing reproduction of the renewable resource stock.

19

Appendix 1. The RHS of equation [9] as a function of 1+th , and the derivation of equation [20]

• The right-hand side of equation (9) as a function of 1+th is A.1 [ ] [ ])('1))()(('')(')( 111111 ++++++ ++= tttttt xgxgxhfuhfhrhs β Differentiating this with respect to 1+th yields A.2 [ ]))((''''')'1(''')'1()(' 1 xgxfufgufghRHS t ++++=+ ββ [ ]''))(('''')'1( uxgxfufg +++= β Keeping in mind that ))(('2 xgxfc += we have

A.3 ⎟⎟⎠

⎞⎜⎜⎝

⎛−+=+ )(

11''')'1()('2

1 cufghRHS t ρ

β

where )('')('

)(2

22 ccu

cuc

−=ρ is the elasticity of intertemporal substitution. Hence

)0(0)(' 1 <>+thRHS when )1(1)( 2 ><cρ . • The derivation of equation (20). We first rewrite equation (9), and take into account the fact that we consider paths, where tt hh =+1 for all t but x may vary. A.4 [ ] [ ] ))('1())()(('')(')(')(' 1111 ++++ ++=−− ttttttttt xgxgxhfuxhfhhfhfu β Totally differentiating A.4 and taking into account equation (8) we get A.5 { [ ] −+++− + )('')(''))(('')('' 121 t

ttt

t xgcufxgxfcu β

[ ] } tttttt dhxgxgfxgxfcu ))('1()('1('))(('')('' 11112 ++++ ++−+β

= { ++++ + ))('1)(('')(')('1(')('' 121 tt

tt

t xgxgcuxgfcu β [ ][ ] } ttttt

t dxxgxgxgxgfcu ))('1())('1)((')('1')('' 112 ++ ++++β . Rearranging and evaluating A.5 at the stationary point, tt hh =+1 and tt xx =+1 , yields equation (20). Appendix 2. Development of the Jacobian Matrix of the Partial Derivatives For the purposes of stability analysis we develop the Jacobian matrix, its determinant and trace. A.6 ),(1 ttt hxGx =+

20

A.7 ),(1 ttt hxFh =+ The stability of the steady state depends on the eigenvalues of the Jacobian matrix of the partial derivatives

⎥⎦

⎤⎢⎣

⎡=

hx

hx

FFGG

J .

Calculating the partial derivatives we first obtain )('1),( tttx xghxG += , 1),( −=tth hxG . To get the partials of ),(1 ttt hxFh =+ we first differentiate implicitly A.8 ttt CdxBdhAdh +=+1 , where A, B and C are appropriate partial derivatives to be presented in a moment. Calculating these we take into account )(1 tttt xghxx +−=+ . Given the definitions of A, B and C we will then have

AChxF ttx =),( ,

ABhxF tth =),( .

As for A (as evaluated at the steady state) we get from A.3 A.9 ρβ ˆ)(''')'1( 2cufgA += .

where1

ˆ−

=ρρρ so that 0)(<>A , as 1)(><ρ . Totally differentiating (9) with respect

to th we obtain A.10 [ ]+++−+= )('))()(('')('')(')(')('' 11 tttt

tt

tt hfxgxhfcuhfcuhfB

[ ] [ ] 0)('')(')(')('1)('')(' 1212

122

1 <++ ++++ tt

ttt

t xgcuhfxgcuhf ββ , and totally differentiating (9) with respect to tx we have A.11 [ ] [ ] [ ]−+−+−= ++ )('1)('')(')(')('1)('')(' 1211

2tt

ttt

tt xgxgcuhfxgcuhfC β

[ ] [ ] [ ] 0)('1)('1)('')(' 212

21 >++ ++ tt

tt xgxgcuhfβ .

Next we evaluate A, B and C at the steady state. By taking into account the Euler condition at the steady state )(')'1()(' 21 cugcu β+= gives

A.12i ρβ

ˆ'''''

)(''')'1)(('''

)(''')('''

2

22

2

2

12

⎭⎬⎫

⎩⎨⎧

−+

−−=fgf

cufgcuf

cufcuf

AC

21

A.12ii ρ̂)'1(''

''')('''

)('')'1(')(''')('''

)('))(('''

12

22

1

12

1

1

⎭⎬⎫

⎩⎨⎧

++

+++

+−=

gfgf

cufcugf

cufcuf

cuhxcuf

AB .

Clearly, 0)(/ <>AC when )1(1 ><ρ , and 0)(/ <>AB when )1(1 <>ρ . We can now rewrite the Jacobian as follows

A.13 ⎥⎥⎦

⎤

⎢⎢⎣

⎡ −+=

AB

AC

gJ

1'1.

The determinant (D) and the trace (T) of the Jacobian matrix J are D =

AC

ABg ++ )'1( and T =

ABg ++ '1 respectively. Using equations A.9, A.10 and A.11

we obtain

A.14 ⎭⎬⎫

⎩⎨⎧ +−+=

)('))(('''

1ˆ)'1(1

1

cuhxcuf

gD ρ

A.15

ρ̂)'1(''

''')('''

)('')'1(')(''')('''

)('))(('''1)'1(

2

22

1

12

1

1

⎭⎬⎫

⎩⎨⎧

++

+++

+−++=

gfgf

cufcugf

cufcuf

cuhxcufgT .

Appendix 3. Proof of Saddle Point Stability We analyze the stability of system (26) and (27) on the basis of (8) and (9). The characteristic polynomial associated with the system (28) and (29) expressed in terms of D and T is A.16 0)( 2 =+−= DTp λλλ It is known from the stability theory of difference equations (see e.g. Azariadis, 1993, pp. 63-67) that for a saddle point to exist one of the roots of 0)( =λp must be less than one in absolute value. Thus for a saddle we need that D-T+1 < 0 and D+T+1 > 0 or D-T+1 > 0 and D+T+1 < 0. When ρ̂ is positive ( 1>ρ ) both the determinant and the trace in A.14 and A.15, respectively, are positive, which also means that D+T+1 > 0 holds. Making inferences about the sign of D-T+1 requires work. A straightforward calculation yields A.17 D-T+1=

⎭⎬⎫

⎩⎨⎧

+−

+−−

+−+−

)'1('''''

)(''')('')'1('

)(''')('''

)(''))(('''ˆ)1ˆ('

2

22

1

12

1

1

gfgf

cufcugf

cufcuf

cughxcufg ρρ ,

so that A.17 cannot be signed yet for 0ˆ >ρ . To get the sign of D-T+1 we use the assumption that our steady state is unique. This is assured by comparing slopes of the curves, where tt hh =+1 and tt xx =+1 . We develop the condition

A.18 00 =Δ=Δ

>tt xt

t

ht

t

dxdh

dxdh , as

22

A.19

[ ] ')'1(')('')'1)(('''')(')('')(''')(''

)'1(')('')'1('')(')'1(')(''

2211

3221 g

gfhxfgcugcuhxfcufcugfcuggcugfcu

>+−++−++−

+++++ββ

ββ .

Multiplying both sides of A.19 by the denominator (negative sign) on the left-hand side we get A.20 <+++++ 3

221 )'1(')('')'1('')(')'1(')('' gfcuggcugfcu ββ ')('')'1)((''''')(''''))(('''')('' 2211 ghxfgcuggcugfhxcugfcu ++−++− ββ '')'1)(('' 2

2 gfgcu ++ β . and collecting terms A.20 can be re-expressed as A.21 '''))(('')'1(')('''')('')('' 1

2221 gfhxcugfcugcufcu +++++ ββ

0')('')'1)(('' 2 <+++ ghxfgcuβ . Dividing by ( 0)(''' 2 <cuf β ), using Euler condition and )('2 hxfc += yields A.22

0'

')'1(1)('

)'1('))(('')('''

)'1(')(''''''

)(''')'1(')(''

1

1

2

22

1

1 >+

−++

++

+++

fgg

cugghxcu

cufgfcu

fg

cufgfcu

ρ. Now we multiply both sides by )'1/(' gf + (>0) to get

A.23 0'1)('

''))(('')('''

)'1(')('')'1(''

''')('''')(''

1

1

2

22

1

21 >−

++

++

++ g

cufghxcu

cufgfcu

gfgf

cuffcu

ρ.

Rearranging and taking into account the definition of ρ̂ yields A.24

0)'1(''

''')('''

)('')'1(')(''')('''

)(''))(('''')

ˆ1ˆ

(2

22

1

12

1

1 <⎭⎬⎫

⎩⎨⎧

+−

+−−

+−+

−gf

gfcuf

cugfcufcuf

cughxcufg

ρρ .

If 0ˆ>ρ (i.e. 1>ρ ) we get by multiplying with ρ̂ A.25

0)'1(''

''')('''

)('')'1(')(''')('''

)(''))(('''ˆ)1ˆ('

2

22

1

12

1

1 <⎭⎬⎫

⎩⎨⎧

+−

+−−

+−+−

gfgf

cufcugf

cufcuf

cughxcufg ρρ .

Note that this is exactly D-T+1, which means that we have a saddle when 1>ρ . If 0ˆ <ρ (i.e. 1<ρ ) we get by multiplying with ρ̂ A.26

0)'1(''

''')('''

)('')'1(')(''')('''

)(''))(('''ˆ)1ˆ('

2

22

1

12

1

1 >⎭⎬⎫

⎩⎨⎧

+−

+−−

+−+−

gfgf

cufcugf

cufcuf

cughxcufg ρρ

23

which means that D-T+1 is positive. To get a saddle in this case, we need to have D+T+1 < 0. To explore this possibility when 0ˆ<ρ we rewrite D and T as follows A.27i { }1ˆ)'1( ++= MgD ρ A.27ii { }1ˆ)'1( ++++= NMgT ρ ,

where 0)('

))(('''

1

1 >+

−=cu

hxcufM

0)'1(''

''')('''

)('')'1(')(''')('''

2

22

1

12

>⎪⎭

⎪⎬⎫

⎪⎩

⎪⎨⎧

++

++=

gfgf

cufcugf

cufcuf

N .

Using this shorthand notation D+T+1 can be expressed after some manipulation A.28 D+T+1 = )ˆ1)('2(ˆˆ)'2( ρρρ +++++ gNMg . The first two terms in (A.28) are negative, when 0ˆ <ρ . The third term is also negative when 0ˆ1 <+ ρ , which happens when 2/1>ρ . So we have a saddle in this case, too. This completes the proof of Proposition 2. Q.E.D. Appendix 4. Derivation of equation (38) Given the assumed functional forms, the Euler equation can be written A.29 [ ] 12 )'1( cgc ρβ+= . Plugging this into the equilibrium condition, )(21 hfcc =+ and using the budget constraint ))()(('2 xgxhfc += gives

[ ]ρρ

α

β)1(1))2/1((

1 bxabxaxc

−++−

= and [ ] [ ]))2/1((

)2/1(1))2/1((2 bxa

bxabxaxc−

−+−=

αα .

If we plug these expressions for consumption back into the equilibrium condition we get equation (36) in the text.

24

References

Attanasio, O.P. (1999): “Consumption,” in J. Taylor and M. Woodford, eds., Handbook of Macroeconomics, Vol.1B. Amsterdam: North-Holland, 741-812.

Azariadis, C. (1993): Intertemporal Macroeconomics. Oxford: Basil Blackwell. Brown, G.M. (2000): “Renewable Natural Resource Management and Use without

Markets,” Journal of Economic Literature 38, 875-914. Diamond, P.A. (1965): “National Debt in a Neoclassical Growth Model,” American

Economic Review 55, 1126-1150. Eliasson, L. and S.J. Turnovsky (2004): “Renewable Resources in an Endogenously

Growing Economy: Balance Growth and Transitional Dynamics,” Journal of Environmental Economics and Management, 48, 1018-1049.

Grandmont, J-M. (1985): “On Endogenous Competitive Business Cycles,” Econometrica 53, 995-1045. Guckenheimer, J. and P. Holmes (1983): Nonlinear Oscillations, Dynamical Systems,

and Bifurcations of Vector Fields. New York: Springer-Verlag. Holmgren, R.A. (1996): A First Course in Discrete Dynamical Systems, 2nd edition. New York: Springer-Verlag. Kehoe, T.J. and D.K. Levine (1990): “The Economics of Indeterminacy in

Overlapping Generations Models,” Journal of Public Economics, 42, 219-243. Kemp, M. and N. Van Long (1979): “The Under-Exploitation of Natural Resources:

A Model with Overlapping Generations,” Economic Record 55, 214-221. Koskela, E., M. Ollikainen and M. Puhakka (2002): ”Renewable Resources in an

Overlapping Generations Economy without Capital,” Journal of Environmental Economics and Management 43, 497-517.

Mourmouras, A. (1991): “Competitive Equilibria and Sustainable Growth in a Life-Cycle Model with Natural Resources,” Scandinavian Journal of Economics 93, 585-591.

Mourmouras, A. (1993): “Conservationist Government Policies and Intergenerational Equity in an Overlapping Generations Model with Renewable Resources,” Journal of Public Economics 51, 249-268. Olson, L.J. and K.C. Knapp (1997): “Exhaustible Resource Allocation in an

Overlapping Generations Economy,” Journal of Environmental Economics and Management 32, 277-292.

Yogo, M. (2004): “Estimating the Elasticity of Intertemporal Substitution when Instruments are Weak,” The Review of Economics and Statistics 86, 797- 810.