Russian Federation Sugar Annual Planting Intentions Indicate

Transcript of Russian Federation Sugar Annual Planting Intentions Indicate

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY

USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT

POLICY

Date:

GAIN Report Number:

Approved By:

Prepared By:

Report Highlights:

Russian sugar beet production is expected to rebound strongly in 2011 and effectively displace a

significant portion of raw sugar imports in 2011/12. GOR subsidies and normal weather conditions

should allow industry to ultimately increase harvested area and production to 1.2 million hectares (24

percent over 2010) and 30 MMT (40 percent over 2010), respectively. In response, FAS-Moscow

expects Russia to slash raw sugar imports to just over 1.7 MMT. At the same time, Belarus is likely to

sustain shipments of refined sugar in order to support a 275,000-MT Russian import forecast. In the

meantime, price relief cannot come soon enough to Russia’s depleted sugar market.

Summary

Morgan Haas, Mikhail Maksimenko, Stephen Therrien

Morgan Haas

Planting Intentions Indicate Record Beet Production in 2011

Sugar Annual

Russian Federation

RS1118

4/15/2011

Required Report - public distribution

Russian sugar beet production is expected to rebound strongly in 2011 and effectively displace a

significant portion of raw sugar imports in 2011/12. GOR subsidies and normal weather conditions

should allow industry to ultimately increase harvested area and production to 1.2 million hectares (24

percent over 2010) and 30 MMT (40 percent over 2010), respectively. In response, FAS-Moscow

expects Russia to slash raw sugar imports to just over 1.7 MMT. At the same time, Belarus is likely to

sustain shipments of refined sugar in order to support a 275,000-MT Russian import forecast.

As the vast majority of sugar beet refining nears its finish midway through 2010/11, poor results have

continued to bolster import demand and price growth beyond earlier expectations.

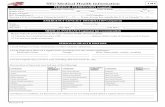

Table 1a. Russia: Sugar Beets, Area, Production, and Utilization (1000 HA, 1000 MT)

Sugar Beets

Russia

2009/2010 2010/2011 2011/2012

MY Begin: Jan 2009 MY Begin: Jan 2010 MY Begin: Jan 2011

USDA Official

New

Post USDA Official

New

Post USDA Official

New

Post

Area Planted N/A 1,050 N/A 1,160 N/A 1,200

Area Harvested N/A 900 N/A 910 N/A 1,130

Production N/A 24,800 N/A 21,500 N/A 30,000

Total Supply N/A 24,800 N/A 21,500 N/A 30,000

Utilization for Sugar N/A 24,800 N/A 21,500 N/A 30,000

Total Distribution N/A 24,800 N/A 21,500 N/A 30,000

Table 1b. Russia: Sugar, Centrifugal, Production, Supply, and Demand (1000 MT)

Sugar, Centrifugal

Russia

2009/2010 2010/2011 2011/2012

MY Begin: Oct 2009 MY Begin: Oct 2010 MY Begin: Oct 2011

USDA

Official

New

Post USDA

Official

New

Post USDA

Official

New

Post

Beginning Stocks 481 481 380 399 374

Beet Sugar Production* 3,313 3,444 2,850 2,980 4,175

Cane Sugar Production 0 0 0 0 0

Total Sugar Production 3,313 3,444 2,850 2,980 4,175

Raw Imports 2,100 1,949 2,750 2,600 1,725

Refined Imp.(Raw Val) 280 274 300 350 275

Total Imports 2,380 2,223 3,050 2,950 2,000

Total Supply 6,174 6,148 6,280 6,329 6,549

Raw Exports 0 0 0 0 0

Refined Exp.(Raw Val) 100 34 100 50 100

Total Exports 100 34 100 50 100

Human Dom. Consmp. 5,694 5,700 5,736 5,890 6,010

Other Disappearance 0 15 0 15 15

Total Use 5,694 5,715 5,736 5,905 6,025

Ending Stocks 380 399 444 374 424

Total Distribution 6,174 6,148 6,280 6,329 6,549

*New crop beet sugar production in August and September assumed to occur in October for PSD calculation.

Production

Sugar Beets

Russia will increase the 2011 planted area of sugar beets to a record 1.2 million hectares (3.0 percent

growth). Considering a return to normal weather conditions, sugar beet production of 30 MMT (40

percent growth) is thus expected for MY 2011/12.

While the total area devoted to sugar beet production in 2010 increased 10 percent to 1.16 million

hectares, the summer drought led to massive losses and decreased yields. Government officials reported

the drought impacted 17 out of the 26 sugar beet regions in Russia, and beets were killed or heavily

damaged in 250,000 hectares, which resulted in a failure of planned import substitution. According to

Sugar Beet magazine (#2, 2011) sugar beet producers lost 2.7 MMT of sugar beets in 2010 valued at

RUR4.3 billion.

Sugar beet production is concentrated in the Central and Southern Federal districts. Roughly 90 percent

of sugar beets are grown by large agricultural enterprises and farms that belong to refineries. The

balance is grown by small farms and private households.

In Russia, sugar beets are planted in April/May and harvested in September through November.

State Support for Development

In the framework of the federal target Program for the Development of Sugar Production, 2010-2012,

sugar beet producers will receive support for beet seed production and partial compensation for expenses

in order to improve profits for sugar production vis-à-vis other crops. Prior to the program’

implementation, profitability of beet producers had already grown from 4.7 percent in 2007 to 25.7

percent in 2009.

The Ministry of Agriculture reports increasing prices for agrochemicals, fertilizers, fuel and electricity

increase sugar beet production expenses. The federal target Program provides sugar beet producers

compensation for the purchase of fertilizers and plant protection chemicals.

The Russian sugar beet industry considers the absence of facilities for treating beet seeds as a bottleneck

to attaining self-sufficiency. With funding from the federal target Program, “Betagran Ramon” seed

treating plant is currently under construction in Voronezh oblast and will produce 20 percent of coated

beet seeds needed for Russian beet breeders. The facility will source seeds for treatment from

Astrakhan oblast and Italy. A similar plant will be built in Lipetsk oblast. (Sakharnaya Svekla, #10,

2010).

Russia prohibits the cultivation of biotech plants.

Refined Sugar

Assuming Russia misses its sugar extraction target of 13.58 percent and falls in line with its historical

average (12.8 percent), this would result in 3.8 MMT of beet sugar (4.2 MMT raw value) in MY

2011/12.

According to the Russian State Statistical Service (Rosstat), total refined sugar production in MY

2009/10 totaled 5.1 MMT (5.6 MMT raw value). However, two considerations must be taken into mind

when considering this number.

Production of refined sugar from sugar beets in August and September are considered to have

occurred in October for calculation of the marketing year.

Production of refined sugar from raw cane sugar indicates Russian customs statistics may be

currently underreported by approximately 8.5 percent. [Note: Since 2001, Russia’s customs

service has recorded only 56 percent of Brazil’s reported exports of raw cane sugar to Russia.]

Sugar beet stocks from the 2010 harvest were depleted shortly after the beginning of 2011, and the

production of refined sugar from raw cane sugar is likely to jump in the coming months as imports work

to offset this year’s short supply of domestic beet sugar.

Figure 1. Russia: Refined Sugar Production, Thousand MT

Source: Rosstat

State Support for Development

Almost half of the sugar processing plants in Russia were built before 1917, and none have been built in

the last 25 years. Sixty percent of processing equipment is worn out.

In order to renovate the industry, the Ministry of Agriculture approved subsidies for the reconstruction

and modernization of 18 refineries. Russia also plans to build five new refineries. Two of them are

already under construction and the necessary papers have been prepared for the remainder. Six billion

rubles ($200 million) will be invested in the construction of a new plant with a daily processing capacity

of 9,000 MT of beets in Tambov oblast.

To implement the above projects, the Russian Union of Sugar Producers reported investments in the

sugar beet production industry will grow from RUR14 billion ($460 million) in 2010 to RUR14.7 billion

($490 million) in 2011 and RUR15.8 billion ($526 million) in 2012. The GOR will subsidize a portion

of interest for investment credits for this purpose.

Trade

Russia’s trade policy remains based on the ideals of import substitution, but it welcomes raw sugar

imports to compensate for poor harvests. Russia also continues to expand its cooperation with Belarus

in respect to trade in refined sugar.

Raw Sugar Imports

Raw cane sugar imports are likely to fall back considerably with the expectation for a significantly

larger beet sugar production in MY 2011/12.

In the remainder of MY 2010/11, raw cane sugar imports should remain strong to help fulfill demand.

Brazil controls 80-85 percent of the historic market share for Russia’s raw cane sugar imports, while

Cuba and Thailand are also active market participants. In light of the particularly short sugar supply in

Russia this current year, on January 28, 2011, the Customs Union Commission decided to temporarily

lower the import duty for raw sugar from $140/MT to $50/MT in the period March 1 to April 30, 2011,

when sugar prices on the NYMEX reach $396.84/MT. The Customs Union also applied lower import

duties October 1, 2010.

In December 2009, the Customs Union adopted the seasonal import tariff regime that cuts duties

between $140 to $270/MT from January 1 to April 30 and August 1 to December 31. Reducing the

tariff prompts increased raw sugar shipments to Russia and helps supply the market until beet sugar

production begins in the end of August. The GOR decreased duties in a similar manner from May 1 –

July 31, 2010, which, at the time, helped to temporarily stabilize retail sugar prices. However, since that

time, tariff relief has not been able to alleviate rapid price inflation.

Refined Sugar Imports

Refined sugar imports are also likely to fall back, although to a lesser degree in MY 2011/12. Their

relatively smaller role in the Russian sugar market and Russia’s ties with Belarus are likely to prevent

too deep of an impact.

Belarus

On December 22, 2010, the Russian and Belarusian Ministries of Agriculture agreed to a Common

Agricultural Policy of the Russia-Belarus Union State as well as established 2011 import quotas for

dairy, meat and poultry, and sugar, in accordance with also agreed Union State food balance sheets.

According to the agreement, in CY 2011, Belarus will ship Russia 200,000 MT of refined beet sugar.

The shipments will be distributed evenly throughout the year.

According to Rosstat, refined sugar imports from Belarus increased to 180,000 MT as well as exceeded

the CY 2010 quota of 150,000 MT agreed to in September 2009.

Ukraine

Ukraine’s Prime Minister Azarov has asked Russia’s Prime Minister Putin to reconsider an earlier

request to establish a 100,000 MT duty-free quota for Ukraine to export refined sugar to Russia.

Russia’s sugar producers remain opposed to the deal. In accordance with the CIS inter-state agreement,

beet sugar originating from Ukraine will become duty-free beginning January 2013.

Consumption

Sugar consumption jumped in 2010 but it is yet uncertain if further growth in the food processing sector

will continue at recent rates through MY 2011/12. In 2010, the production of sugar-containing products

grew over 10 percent.

According to Business Press newspaper, quoting the International Sugar Company (ISC), Russia’s

population consumes 1.7 times more sugar than the food processing industry. ISC reported that Russia

used 5.5 MMT of sugar in CY 2010, including 1.2 MMT by the rural population, about 1.6 MMT by the

urban population, and more than 1.5 MMT of white sugar by the food industry. The balance is

unknown. ISC also mentions that according to its estimation, 14 percent of total Russian sugar use is

processed in the production of home-made vodka, which accounts for more than 30 percent of all vodka

in Russia. About 2.5 percent of sugar is consumed for non-food purposes.

Increased demand, combined with a disastrous 2010 domestic sugar crop, have contributed to a rapid

run-up in prices, which has been only moderately softened by occasion lower sugar import duties.

Figure 2. Russia: Sugar Prices, RUR/kg

Source: Ministry of Agriculture <http://www.mcx.ru/navigation/page/show/205.htm>;

Global Trade Information Services

Stocks

Sugar stocks will be flat in MY 2010/11 and MY 2011/12. According to the Russian Union of Sugar

Producers, Russia’s sugar stocks were 2.2 MMT on January 1, 2011, or 150,000 MT less than the 2010

volume.

The GOR actively regulates sugar supplies by means of (1) import duties for raw cane sugar and (2)

quotas for white beet sugar originating from Belarus.

As an additional measure of sugar market regulation, the GOR plans to sell 300,000 MT of sugar from

the state reserves at auction. Sales have not started yet. Sugar market experts believe that these

measures will stabilize the sugar market balance, as tight supplies have caused prices to rise steadily

since the middle of 2010.

Other Relevant reports

RS 1081 Union State Agrees to Common Agricultural Policy

RS1071 Russia Sugar Production Down Support Measures Extended

RS1067 Record High Planted Area Mitigated by Losses, Lower Yields

SUGAR PRODUCTION TABLES

Table 2. Russia: Sugar Beet Production 2007 2008 2009 2010

Sugar beet area, 1,000 Ha 1,065 819 823 1,160

--Agricultural enterprises 85.5% 87.9% 87.8% 87.2%

--Private farms 13.3% 11.0% 11.2% 12.1%

--Private households 1.2% 1.1% 1.0% 0.7%

Sugar beet harvest, 1,000 MT 28,236 29,000 24,800 22,200

Yield, MT/Ha 29.2 36.3 32.3 24.1

Source: Rosstat, Social and Economical Situation in Russia, June 2008, June 2009, June 2010

Table 3. Russia: Major Financial and Economic Indices of Sugar Beet Production 2007 2008 2009

Yield, MT/hectare 27.3 35.3 32.5

Production cost, RUR/MT 940 920 114

Production cost of sold product, RUR/MT 970 980 1,180

Farm gate price, RUR/MT 1,020 1,110 1,651

Profit from sold beets, million RUR 827 2,551 6,837

Profitability of sold beets, % 4.7 13.6 25.7

Source: Magazine “APK: Economics and Management” #8, 2010

Table 4. Russia: Major Target Indicators of the Sugar Development Program 2010 2011 2012

Sugar beet industry

--Beet sugar production, MMT 3.73 3.91 4.32

--Beet acreage, 1,000 ha 859 895 981

--Beet yield, MT/ha 363 365 369

--Sugar content in beets, % 16.8 16.9 17.3

Sugar beet processing industry

--Beet processing capacity, MT/day 302,300 310,600 385,960

--Volume of beet stocks, MMT 27.5 28.8 31.4

--Sugar extraction, % 13.56 13.58 13.76

--Beet losses on storage, % 3.6 3.3 3.0

Source: Ministry of Agriculture, “Development of Sugar Beet Production Industry of Russia for 2010-2012”

Table 5. Russia: Refined Sugar Production, by Type, Thousand MT

CY07 CY08 CY09 CY10

Total sugar production 6,069 5,870 5,070 4,745

From sugar beet 3,223 3,481 3,305 2,768

From raw sugar 2,859 2,389 1,765 1,977

Source: Rosstat

Table 6. Russia: Refined Sugar Production, Thousand MT Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep

07/08 1,102 913 537 146 187 223 143 198 555 548 422 813

08/09 1,107 967 563 172 166 197 115 236 379 395 163 834

09/10 1,241 869 259 51 103 223 38 559 599 300 [382] 607

10/11 1,000 727 156 24 N/A N/A N/A N/A N/A N/A N/A N/A

Source: Rosstat, [FAS-Moscow estimate]

Note: Monthly data may not reflect annual CY totals in Table 5, due to lack of monthly revisions.

SUGAR CONSUMPTION AND PRICE TABLES

Table 7. Russia: Sugar Consumption per Capita (kg), Calendar Year 9

0

9

1

9

2

9

3

9

4

9

5

9

6

9

7

9

8

9

9

0

0

0

1

0

2

0

3

0

4

0

5

0

6

0

7

0

8

0

9

4

7

3

8

3

0

3

1

3

1

3

2

3

3

3

3

3

3

3

4

3

5

3

5

3

6

3

6

3

7

3

8

3

9

3

9

4

0

3

7

Source: Rosstat, http://www.gks.ru/free_doc/new_site/business/sx/potr-rf08.xls

Table 8. Russia: Industrial Production of Sugar-containing Products 2009 2010 Δ (%)

Ice cream and deserts (1,000MT) 326 387 18.7%

Wafers, sweet cookies, crackers (1,000MT) 1000 1055 5.5%

Cocoa, chocolate, and sugar-containing candies (1,000MT) 1323 1461 10.4%

Table wines (million deciliters) 39.4 45.1 14.5%

Soft drinks (million deciliters) 283 317 12.0%

Source: Rosstat

Table 8. Russia: Sugar Beet and Refined Sugar Prices Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Farm-gate Price, Sugar Beet (RUR/MT)

200

9

1,19

0

1,22

5

1,15

0

1,18

2

1,18

2

1,13

8

1,12

1

1,18

2

1,20

3

1,47

8

1,45

8

1,68

0

201

0

1,65

6

1,74

0

1,71

3

4,00

0

1,78

0

1,58

8

1,58

8

1,70

0

1,51

8

1,90

0

2,04

3

1,91

8

201

1

2,44

9

1,97

3

2,53

0 N/A N/A N/A N/A N/A N/A N/A N/A N/A

CIF Import Price, Raw Cane Sugar (RUR/kg)

200

9

10.0

4

10.0

2

11.2

6

20.1

2

11.8

3

12.5

4

12.5

3

15.6

8

23.2

1

22.7

5

35.6

8

19.9

1

201

0

18.3

9

20.5

0

19.2

8

18.5

8

15.0

4

15.2

6

41.2

9

36.4

0

48.1

2

19.2

5

24.3

1

23.3

8

201

1

24.2

8 N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A

CIF Import Price, Refined Sugar (RUR/kg)

200

9

13.1

2

14.3

8

16.5

8

18.2

3

16.8

6

17.1

8

17.5

6

18.2

4

21.1

4

18.8

3

18.5

4

19.5

8

201

0

19.7

8

21.8

3

21.9

1

18.4

6

18.3

6

20.0

3

19.5

4

21.9

3

21.7

5

24.3

4

25.6

7

27.7

8

201

1

27.4

8 N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A

Processor Price, Refined Sugar (RUR/kg)

200

9

15.8

2

19.5

5

21.3

3

20.4

0

21.6

6

22.3

0

22.3

3

22.7

0

23.2

5

23.8

7

23.9

5

24.8

2

201

0

25.7

1

26.0

4

26.4

5

26.5

5

25.8

7

25.4

2

25.5

7

26.7

8

28.0

5

28.9

3

28.9

1

29.7

3

201

1

30.9

5

33.5

0

34.1

4 N/A N/A N/A N/A N/A N/A N/A N/A N/A

Retail Price, Refined Sugar (RUR/kg)

200

9

23.2

8

27.0

3

27.6

3

28.3

0

29.0

0

28.9

7

28.9

9

29.6

7

31.8

2

34.1

0

33.9

9

33.7

8

201 34.1 35.7 36.9 36.0 34.7 33.4 33.7 34.2 36.1 37.2 37.6 39.1

0 2 5 5 4 8 2 0 1 9 1 6 0

201

1

40.9

4

43.3

6

44.7

8 N/A N/A N/A N/A N/A N/A N/A N/A N/A

Source: Ministry of Agriculture, http://www.mcx.ru/navigation/page/show/205.htm;

Global Trade Information Services

SUGAR TRADE TABLES

Table 9. Russia: Sugar Exports, MT

2008/09 2009/10 2010/11

4th/08 1st/09 2nd/09 3rd/09 Total 4th/09 1st/10 2nd/10 3rd/10 Total 4th/10

170111 Cane Sugar, Raw, Solid Form, W/O Added

Flav/Color 1 2 0 1 4 3 1 0 3 7 2

170112 Beet Sugar, Raw, Solid Form, W/O Added

Flav/Color 1 0 1 1 3 1 0 0 0 1 0

170191 Cane/Beet Sugar, Refined, Solid, Added Flav/Color

3 12 19 14 48 17 26 29 8 80 7

170199 Cane/Beet Sug Chem Pure Sucrose Refind

Nesoi 19,871 46,745 41,986 39,376 147,978 4,741 7,110 19,344 238 31,433 447

Uzbekistan 12,025 26,247 17,755 15,712 71,739 386 656 1 5 1,048 10

Tajikistan 3,056 10,316 16,271 8,738 38,381 2,786 2,606 5,234 7 10,633 11

Turkmenistan 2,994 6,686 2,086 1,911 13,677 3 3,585 1,635 4 5,227 6

Kazakhstan 977 68 0 481 1,526 0 61 12,005 n/a 12,066 n/a

170211 Lactose & Lactose Syrup Cont 99% Lactse By Wt

0 0 0 1 1 2 0 4 3 9 2

170219 Lactose In Solid Form And Lactose Syrup,

Nesoi 1 1 0 0 2 1 1 0 0 2 7

170220 Maple Sugar And Maple Syrup 1 0 0 0 1 0 0 0 0 0 0

170230 Glucose (Dextrose), Under 20% Fructose In

Dry Form 152 141 737 1,022 2,052 2,814 4,131 1,875 2,994 11,814 631

170240 Glucose & Glucose Syrup Containing 20-49% Fructose

0 0 0 0 0 0 0 21 1,389 1,410 314

170250 Chemically Pure Fructose In Solid Form 13 2 4 3 22 7 23 33 10 73 27

170260 Fructose, Nesoi & Syrup, Ov 50% Fructose

In Dry Fm 19 3 9 8 39 15 6 15 12 48 11

170290 Sugar, Nesoi, Including Invert Sugar &

Syrup 6 7 6 25 44 10 11 11 44 76 19

170390 Molasses From Extraction/Refing Sugar, Nesoi

164,538 42,609 40,397 46,740 294,284 102,743 33,789 15,723 30,515 182,770 60,249

EU-27 57,812 17,784 24,590 19,402 119,588 63,460 21,974 8,165 12,464 106,063 26,003

Vietnam 48,852 13,661 11,426 14,046 87,985 29,024 4,232 771 0 34,027 5,296

Ukraine 51,831 4,724 2,086 7,947 66,588 3,861 1,521 3,668 16,051 25,101 26,711

Turkey 9,704 0 1,103 7,513 18,320 40,002 15,103 5,440 12,464 73,009 15,155

170410 Chewing Gum, Whether Or Not Sugar

Coated 264 259 204 277 1,004 159 108 197 78 542 105

170490 Sugar Confection (Incl Wh Choc), No Cocoa, Nesoi

6,558 4,308 5,577 6,257 22,700 6,069 5,538 12,277 8,343 32,227 10,293

NOTE: Excludes Belarus (entire time series) and Kazakhstan (since July 2010)

Source: Global Trade Information Services

Table 10a. Russia: Sugar Imports, MT

2008/09 2009/10 2010/11

4th/08 1st/09 2nd/09 3rd/09 Total 4th/09 1st/10 2nd/10 3rd/10 Total 4th/10

17 Sugars 612,556 145,061 876,251 353,830 1,987,698 107,641 421,658 1,599,706 65,873 2,194,878 269,342

170111 Cane Sugar, Raw, Solid Form, W/O Added Flav/Color 557,233 91,192 812,856 301,789 1,763,070 45,727 366,669 1,534,831 1,377 1,948,604 169,725

Brazil 511,539 89,619 645,378 242,982 1,489,518 8,455 317,059 1,311,305 0 1636819 147,138

Cuba 0 0 122,160 20,602 142,762 0 0 80,863 0 80863 0

Thailand 41,296 0 0 16,413 57,709 10,453 7,240 23,137 0 40830 0

170112 Beet Sugar, Raw, Solid Form, W/O Added Flav/Color 0 0 0 0 0 0 0 2 0 2 0

170191 Cane/Beet Sugar, Refined, Solid, Added Flav/Color 123 65 85 63 336 97 111 88 70 366 95

170199 Cane/Beet Sug Chem Pure Sucrose Refind Nesoi 15,899 26,067 28,665 20,442 91,073 18,718 14,746 16,779 22,055 72,298 43,157

EU-27 12,589 5,967 3,381 5,379 27,316 10,649 13,716 15,774 12,984 53,123 10,711

Moldova 0 13,193 11,612 6,188 30,993 0 0 0 5,742 5,742 23,287

Brazil 1,809 4,482 6,160 6,215 18,666 1,485 273 21 2,007 3,786 7,076

170211 Lactose & Lactose Syrup Cont 99% Lactse By Wt 1,428 1,431 2,343 2,991 8,193 3,212 3,868 3,892 5,586 16,558 7,111

170219 Lactose In Solid Form And Lactose Syrup, Nesoi 1 0 1 81 83 2 33 20 286 341 356

170220 Maple Sugar And Maple Syrup 12 1 8 5 26 8 7 10 26 51 11

170230 Glucose (Dextrose), Under 20% Fructose In Dry Form 10,377 8,612 11,308 8,737 39,034 9,831 9,332 10,962 5,271 35,396 13,133

170240 Glucose & Glucose Syrup Containing 20-49% Fructose 47 19 41 100 207 129 7 88 35 259 18

170250 Chemically Pure Fructose In Solid Form 1,699 690 2,353 1,274 6,016 1,752 1,757 2,358 1,414 7,281 1,537

170260 Fructose, Nesoi & Syrup, Ov 50% Fructose In Dry Fm 57 65 45 46 213 43 65 96 49 253 47

170290 Sugar, Nesoi, Including Invert Sugar & Syrup 4,822 2,413 3,402 2,508 13,145 6,966 6,849 11,337 11,633 36,785 11,299

170310 Cane Molasses From Extraction Or Refining Of Sugar 0 1 0 0 1 0 0 1 0 1 0

170390 Molasses From Extraction/Refing Sugar, Nesoi 0 0 0 0 0 0 0 0 0 0 0

170410 Chewing Gum, Whether Or Not Sugar Coated 83 217 199 187 686 135 96 124 46 401 29

170490 Sugar Confection (Incl Wh Choc), No Cocoa, Nesoi 20,777 14,287 14,946 15,606 65,616 21,023 18,119 19,117 18,025 76,284 22,824

EU-27 13,109 6,385 7,031 7,773 34,298 9,794 6,640 6,612 5,630 28,676 8,577

Ukraine 2,674 5,101 4,921 3,988 16,684 5,893 7,726 6,736 8,711 29,066 9,685

China 3,031 1,716 1,593 1,996 8,336 2,889 1,626 2,439 2,515 9,469 2,870

NOTE: Excludes Belarus (entire time series) and Kazakhstan (since July 2010)

Source: Global Trade Information Services

Table 10b. Russia: Refined Sugar Imports from Belarus, Thousand MT Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Total

MY 2008/09 6.5 9.4 4.6 20.2 14.9 13.5 13.1 18.1 16.7 8.6 10.9 9.5 146.0

MY 2009/10 11.4 14.0 9.0 18.5 20.7 7.9 22.0 14.5 22.2 14.4 8.0 17.4 180.0

MY 2010/11 17.6 13.0 12.0 15.0

Source: Rosstat, various