ROUTE 128 & INTERSTATE 495 SUBURBAN OFFICE MARKET REPORT · 2017-07-10 · Greater Boston’s...

Transcript of ROUTE 128 & INTERSTATE 495 SUBURBAN OFFICE MARKET REPORT · 2017-07-10 · Greater Boston’s...

ROUTE 128 & INTERSTATE 495 SUBURBAN OFFICEMARKET REPORT

SECOND QUARTER 2017

Greater Boston’s suburban office market encompasses over 108 million square feet and consists of eight major submarkets concentrated along Route 128 and Interstate 495, the major thoroughfares that surround the city of Boston. With immense pressure across the Boston and Cambridge markets, tenants have been increasingly evaluating suburban locations for rent relief and future growth opportunities.

As Greater Boston’s premier suburban market, the Route 128 loop has garnered global recognition for its proximity to urban markets, excellent infrastructure, distinguished tenant base and top quality assets. During the second quarter, the market absorbed approximately 290,500 SF which lowered the overall vacancy rate to 10.3%. Route 128 boasts some of the region’s largest corporations from healthcare and education firms to emerging technology and TAMI tenants.

Interstate 495, the outer suburban belt, has traditionally served as the back office and corporate campus solution. However, as the eastern Massachusetts landscape has evolved and become more saturated, tenants are looking to I-495 locations for larger blocks of space as well as more economical solutions across all business sectors.

The experience at suburban locations has become increasingly important to today’s tenants. That includes contemporary lobbies, vibrant common corridors and interactive indoor/outdoor amenities which complement and enhance tenant’s private work spaces. Looking forward, with strong regional macroeconomic indicators and one of the nation’s fastest growing population bases, the Greater Boston suburban real estate market is poised from continued growth.

STRONG DEMAND ACROSS SELECT SUBURBS

MAY MASSACHUSETTS UNEMPLOYMENT

# 4.2%JUNE NATIONAL UNEMPLOYMENT

$4.0%ANNUAL

WAGE GROWTH

# 2.9%HIGHEST GDP

PER CAPITA NATIONALLY

4th

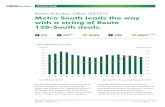

MARKET TRENDS

$18.00

$19.50

$21.00

$22.50

$24.00

$25.50

$27.00

$28.50

$30.00

YTD2017201620152014201320122011201020096.0%

8.0%

10.0%

12.0%

14.0%

16.0%

18.0%

20.0%

22.0%

Direct Vacancy (%)Average Asking Rate

$15.00

$16.00

$17.00

$18.00

$19.00

$20.00

$21.00

$22.00

$23.00

YTD20172016201520142013201220112010200912.0%

13.0%

14.0%

15.0%

16.0%

17.0%

18.0%

19.0%

20.0%

Direct Vacancy (%)Average Asking Rate

CLASS A - ASKING RATE VS. DIRECT VACANCY

CLASS B - ASKING RATE VS. DIRECT VACANCY

Average Asking Rate Direct Vacancy

Average Asking Rate Direct Vacancy

BOSTON 10TH LARGEST NATIONAL METRO

Faster population growth than New York & San Francisco

VACANCY DROPS TO 11.9%Strong demand across submarkets, relief for Downtown/Cambridge

ASKING RATES RISE AGAINInner suburban markets accelerate growth, outer markets steady

CONTEMPORARY UPGRADES Landlords must adapt and keep common areas & lobbies fresh

CREATING A SENSE OF PLACEOpen layouts, collaborative environments & unique amenities

LOCATION IS NOT FORGOTTENHighway access, public transit & parking remain paramount

INVESTMENT SALES QUANDARYAre seller’s expectations above willingness to pay?

DIRECT VACANCY RATE BY SUBMARKET

0.0% 4.0% 8.0% 12.0% 16.0% 20.0%

Vacancy Rate

Route 3 North

128 West

495 South

128 North

128 South

Inner Burbs

Mass Pike

495 Northeast

Route 2 West

SUBMARKET AVERAGE ASKING RATES

495 North$19.87/SF

Rte-3 North$20.18/SF

I-495/Mass Pike$20.49/SF

495 South$20.07/SF

Rte-2 West$19.96/SF

128 West $31.60/SF

128 West$31.91/SF

128 North$26.03/SF

128 South$21.59/SF

CLASS A & B OFFICE INTERSTATE 495

$14.0% DIRECT VACANCY

#2.3% SUBLEASE AVAILABILITY

$20.6% TOTAL AVAILABILITY

#1,200,000 SF 12-MONTH ABSORPTION

#$20.23/SF AVERAGE ASKING RATE

• Quarterly performances were positive across nearly every I-495 submarket which lead to over 634,000 square feet of net quarterly absorption. Generally speaking, I-495 offers less volatility that its more urban suburban counterparts by historically maintaining a 12-18% vacancy rate with average rents in the high teens to mid $20’s for well positioned product.

• The market captures both expansion and relocation demand from tech, medical and defense tenants feeling the squeeze in more urban locations. In addition, there is a large share of the I-495 market that is smaller non publicly traded companies whose workforce and clients prefer the conveniences that the less congested market provides.

• The Mass Pike submarket posted nearly 223,000 square feet of absorption through a handful of leases. At the formerly vacant EMC property, 35 Parkwood Drive, Speedline recently leased 40,000 square feet. A few exits north in Marlborough, ViaSat signed for 20,800 square feet at 300 Nickerson Road, while Rockwell Automation leased 17,600 square feet at 100 Nickerson Road. Across from the APEX Center, Valeritas leased 15,200 at 293 Boston Post Road.

• Despite its negative quarterly absorption, largely the result of relocation space from Kronos’ move to Crosspoint, Route 3 North maintained strong leasing velocity with Aspect Software signing for 29,900 square feet at 5 Technology Drive in Westford and Mirror Image Internet leasing 15,600 square feet at 2 Highwood Drive in Tewksbury.

• The forecast for the Interstate 495 market remains very bright. Tenants are more real estate conscience than ever before and face the challenge of keeping costs in check while cultivating corporate culture that retains and attracts top talent. In many instances, landlords are pro-actively meeting the market through enhanced on-site amenities and other creative innovations that emphasize placemaking.

CLASS A & B OFFICEINTERSTATE 495

NOTABLE QUARTERLY LEASES

$15.00

$16.00

$17.00

$18.00

$19.00

$20.00

$21.00

$22.00

$23.00

Mass PikeSouthNortheast

YTD20172016201520142013201220112010200920082007 6.0%

9.5%

13.0%

16.5%

20.0%

23.5%

27.0%

30.5%

34.0%

Mass PikeSouthNortheast

YTD20172016201520142013201220112010200920082007

AVERAGE DIRECT VACANCY BY SUBMARKET

AVERAGE ASKING RATE BY SUBMARKET

Northeast South Mass Pike

ADDRESS TOWN SUBMARKET TENANT SF

32 Wiggins Road Bedford Route 3 North Anika Therapeutics 134,000

2 Executive Drive Chelmsford Route 3 North Rockwell Automation 57,000

80 Central Street Boxborough Route 2 West Symantec 42,500

35 Parkwood Drive Hopkinton 495 Mass Pike Speedline 40,000

5 Technology Drive Westford Route 3 North Aspect Software 29,900

300 Nickerson Road Marlborough 495 Mass Pike ViaSat 20,800

100 Nickerson Road Marlborough 495 Mass Pike Rockwell Automation 17,600

2 Highwood Drive Tewksbury Route 3 North Mirror Image Internet 15,600

293 Boston Post Road Marlborough 495 Mass Pike Valeritas 15,200

Mill & Main Maynard Route 2 West Revolution Factory 9,000

500 Nickerson Road Marlborough 495 Mass Pike Wetabix Corp 7,600

Brickstone Square, Andover$90,000,000 ($93/RSF)

Recap: KS Partners & Contrarian Capital

100 Nagog Park, Acton$9,250,000 ($48/RSF)

Buyer: Insulet Corporation

15 Crosby Drive, Bedford$13,700,000 ($194/RSF)

Buyer: Atlantic Management

RECENT INVESTMENT

SALES

40 Shattuck Road Andover

15 Crosby Drive Bedford

40 Shattuck Road, Andover$12,000,000 ($99/RSF)

Buyer: Cummings Properties

Brickstone Square Andover

100 Nagog ParkActon

CLASS A & B OFFICEROUTE 128

$10.3% DIRECT VACANCY

$2.7% SUBLEASE AVAILABILITY

$15.4% TOTAL AVAILABILITY

$12,400 SF 12-MONTH ABSORPTION

#$27.18/SF AVERAGE ASKING RATE

• The market has submitted a strong half year performance with two quarters of consecutive positive adsorption, lowering the vacancy rate to 10.3%. The best performing assets are those which cater to tenants needs including; contemporary lobbies and common areas, fitness & dining services, creative outdoor spaces and upgraded building mechanicals. Looking forward through the remainder of 2017 and 2018 there is a disproportionately large share of tenant roll during will drive strong demand and positive rent growth.

• To the west of the city, the largest lease signed occurred at the former Atrium Mall, 300 Boylston Street, where Dana Farber will take 140,000 square feet and along with Lifetime Athletic help nearly fully stabilize the repositioned shopping mall. Last quarter, Bosch Thermotechnology became the first the tenant to secure space at the newly redeveloped 65 Grove Street in Watertown. Last month, they were joined by Lyndra who will shift locations within Watertown to approximately 14,500 square feet at the same R&D facility. Newton posted a strong quarter as well, with beverage company, Spindrift, committing to 12,400 square feet at 55 Chapel Street and Adviser Investments leasing 14,000 at 75 Wells Avenue.

• The northern market, lead by amenity rich Burlington, remains one of suburban Boston’s strongest technology and defense clusters. The region attracts tenants from Downtown and outer I-495 locations because its position allows tenants to draw from the younger educated urban labor pool as well as provide easy commutes from workers in the north shore and southern New Hampshire.

• The southern market has made a strong push the past 18-24 months by leveraging its position within the suburban market as the cost alternative solution. The submarket scored a big win last month with the announcement from Prodrive Technologies that it would open a 300,000 square foot at Union Point at the home of the former South Weymouth Naval Base. The Dutch electronics manufacturing will be the first commercial tenant at the project.

NOTABLE QUARTERLY LEASES

CLASS A & B OFFICEROUTE 128

ADDRESS TOWN SUBMARKET TENANT SF

Union Point Weymouth South Weymouth 128 South Prodrive Technolgies 300,000

300 Boylston Street Chestnut Hill 128 West Dana Farber 140,000

70 Everett Avenue Chelsea Inner Suburbs Bunker Hill CC 70,000

247 Station Drive Westwood 128 South Beth Israel 21,000

1210 Washington Street Newton 128 West VideoLink 20,800

65 Grove Street Watertown 128 West Lyndra 14,500

75 Wells Avenue Newton 128 West Adviser Investments 14,000

55 Chapel Street Newton 128 West Spindrift Beverage 12,400

20 William Street Wellesley 128 West Wilchins, Cosentino & Novins 12,300

55 Walkers Brook Reading 128 North Mavenir 12,200

100 5th Avenue Waltham 128 West Assuricare 10,500

480 Pleasant Street Watertown 128 West InCrowd 10,500

Trade Center 128 Woburn 128 North Healthcare Science 9,000

$16.00

$18.00

$20.00

$22.00

$24.00

$26.00

$28.00

$30.00

$32.00

201720162015201420132012201120102009200820073.0%

6.0%

9.0%

12.0%

15.0%

18.0%

21.0%

24.0%

27.0%

20172016201520142013201220112010200920082007

AVERAGE DIRECT VACANCY BY SUBMARKET

AVERAGE ASKING RATE BY SUBMARKET

West South North

RECENT INVESTMENT

SALES

120/150 Presidential WayWoburn

120/150 Presidential Way, Woburn$47,250,000 ($217/RSF)

Buyer: Andover Companies

343 Winter Street, Waltham$18,250,000 ($279/RSF)

Buyer: Hobbs Brook Management

233 Needham Street, Newton$20,850,000 ($342/RSF)Buyer: MA Credit Union

200 Pleasant Street Malden

233 Needham Street Newton

343 Winter StreetWaltham

200 Pleasant Street, Malden$10,040,000 ($239/RSF)

Buyer: NW Mutual

OFFICE REPORT STATS

Office Total Inventory (SF)

Direct Vacancy

Sublease Availability

Total Availability

Quarterly Absorption (SF)

12 Month Absorption (SF)

Average Asking Rate

TOTAL A&B

Inner Suburbs 4,184,000 12.4% 3.8% 14.7% (84,400) (176,000) $33.88

ROUTE 128 60,093,000 10.3% 2.7% 15.4% 290,500 12,400 $27.18

128 West 24,446,000 8.6% 3.6% 14.7% 31,150 95,650 $31.91

128 North 18,883,000 11.0% 2.3% 16.8% 146,350 57,650 $26.03

128 South 16,764,000 12.2% 1.8% 15.0% 113,050 (140,900) $21.59

INTERSTATE 495 42,456,000 14.0% 2.3% 20.6% 634,800 1,198,900 $20.23

495 Mass Pike West 19,114,000 14.0% 3.6% 22.2% 222,900 525,150 $31.91

495 Route 2 West 6,585,000 18.5% 1.5% 23.5% 267,350 371,400 $26.03

495 Northeast 5,721,500 18.4% 0.9% 19.8% 123,050 167,650 $21.59

Route 3 North 6,763,500 8.4% 1.6% 15.5% (83,200) (29,700) $20.14

495 South 4,272,500 9.9% 0.6% 18.1% 104,800 164,450 $19.95

TOTAL 106,732,700 11.9% 2.6% 17.5% 840,900 1,035,350 $24.68

CLASS A

Inner Suburbs 2,751,750 7.9% 5.6% 13.7% (45,600) (130,450) $35.00

ROUTE 128 37,714,100 10.2% 3.7% 15.7% 162,000 (535,750) $30.33

128 West 15,180,950 8.4% 4.9% 14.9% (20,200) (173,500) $36.28

128 North 12,906,050 11.3% 2.8% 17.3% 123,100 (181,850) $28.68

128 South 9,627,150 11.7% 2.8% 14.7% 59,100 (180,400) $23.17

INTERSTATE 495 22,709,650 11.6% 2.6% 18.9% 208,550 620,800 $21.53

495 Mass Pike West 11,595,400 12.6% 3.3% 21.1% 70,650 271,600 $21.58

495 Route 2 West 2,649,250 10.1% 2.7% 14.2% (22,300) 3,750 $21.44

495 Northeast 3,173,500 18.6% 1.5% 20.6% 106,600 196,000 $20.58

Route 3 North 3,699,850 6.8% 2.2% 13.3% (23,100) 3,400 $22.48

495 South 1,591,650 4.1% 0.2% 19.7% 76,750 146,000 $20.95

TOTAL 63,175,500 10.6% 3.4% 16.7% 324,950 (45,400) $27.37

CLASS B

Inner Suburbs 1,432,00 21.2% 0.2% 21.5% (38,800) (45,550) $33.07

ROUTE 128 22,378,800 10.5% 1.0% 15.0% 128,550 548,150 $24.18

128 West 9,265,000 8.9% 1.3% 14.4% 51,350 269,200 $28.42

128 North 5,976,700 10.2% 1.2% 15.6% 23,250 239,500 $22.10

128 South 7,137,050 12.8% 0.4% 15.3% 53,900 39,450 $20.43

INTERSTATE 495 19,746,400 16.7% 2.0% 22.6% 426,300 578,200 $19.14

495 Mass Pike West 7,518,350 16.2% 4.1% 23.9% 152,300 253,550 $19.25

495 Route 2 West 3,935,500 24.1% 0.7% 29.8% 289,600 367,700 $19.43

495 Northeast 2,548,050 18.2% 0.2% 18.8% 16,500 (28,450) $18.80

Route 3 North 3,063,600 10.3% 0.8% 18.2% (60,150) (33,050) $18.23

495 South 2,680,900 13.4% 0.9% 17.1% 28,050 18,450 $19.78

TOTAL 43,557,200 13.7% 1.4% 18.7% 516,050 1,080,800 $22.19

Lincoln Property Company | 53 State Street, 8th Floor, Boston, MA | 617.951.4100 | LPCBoston.com

ETHAN ROBERT Director of ResearchO: 617.951.4160 [email protected]

Lincoln Property Company’s Boston Office Report is produced by the Boston Office’s research team in collaboration with our Suburban Brokerage Group. If you have any questions regarding market conditions and the information found in this report, please contact Ethan Robert.