Rize Environmental Impact 100

Transcript of Rize Environmental Impact 100

Rize Environmental Impact 100 UCITS ETF (LIFE)

N A T U R E I S O U R B I G G E S T A L L Y A N D G R E A T E S T I N S P I R A T I O N

An ETF that rises above the tide of conventionalism as your investments should

> S I R D A V I D A T T E N B O R O U G H

1

Investment Case Why LIFE?

Our planet is under threat like never before. Temperatures are rising, rainfall patterns are shifting and sea ice cover is retreating. Oceans are acidifying, soils are degrading and droughts and floods are now commonplace. Exploitation and degradation of Earth’s remaining resources, habitats and biodiversity continues. In The Vocation of Man, Johann Gottlieb Fichte wrote “you could not remove a single grain of sand from its place without thereby… changing something through all parts of the immeasurable whole”. He was talking about the butterfly effect – the sensitive dependence that small change can have broad, non-linear implications on a complex system. Our planet is such a complex system. And our persistent assault on both its health and vitality has started to alter its very fundamentals. Microplastics have been found in Antarctic ice for the first time. Canada’s last intact ice shelf has collapsed. Unprecedented wildfires – from the Arctic to the Amazon, Africa and Australia – have killed billions of animals and wiped-out mass areas of forest. We have lost our balance with nature. And so – how do we restore it? How do we create a future in which both people and nature can thrive? Our first-of-its-kind investment strategy and ETF – Europe’s first environmental impact ETF – provides investors with exposure to the 100 most innovative and impactful companies that are tackling the world’s most pressing climatic and environmental challenges. Companies across clean water, EVs, renewables and hydrogen, energy efficiency, waste and the circular economy and nature-based solutions that hold the promise of a greener future.

We can make nature our ally. We can look to restore the rich and diverse world we inherited.

• Favourable Growth Prospects LIFE is Europe’s first environmental impact ETF, and provides investors with exposure to the top 100 companies that are developing and applying innovative and impactful solutions in clean water, EVs, renewables and hydrogen, energy efficiency, waste and the circular economy and nature-based solutions.

• Powered by Sustainable Market Strategies® LIFE is purpose-built in collaboration with Sustainable Market Strategies, an independent ESG intelligence firm based in Montreal, Canada, and leverages their unique insights and proprietary classification system of companies that is aligned with the environmental objectives set out in the EU Taxonomy for Sustainable Activities.

• Unconstrained Approach LIFE’s composition transcends classic sector, size and geographic classifications by tracking an emerging theme.

• ETF Efficiency In a single trade, LIFE delivers access to the top 100 companies that are favourably positioned to ride the tailwinds of the environmental impact theme.

Key Risks: Please note that the value of an investment and any income taken from it is not guaranteed and can go down as well as up. You may not get back the amount you originally invested. If your investment currency is different to $USD, then the return you will get from your investment may increase or decrease as a result of currency fluctuations between $USD and your investment currency.

2

W H O S H O U L D C O N S I D E R T H I S E T F ?

3

Investors Who Are:

• Seeking capital appreciation through investment in companies that are addressing the world’s most pressing climatic and environmental challenges

• Interested in a diverse portfolio of stocks with a mid-cap bias, and minimal overlap to major benchmarks such as the S&P 500 or the Nasdaq

• Climate change and environmentally focused executives, business owners, researchers, campaigners or general market advocates

• Concerned about UN Sustainable Development Goals: – No. 3: Good Health and Well-Being – No. 6: Clean Water and Sanitation – No. 7: Affordable and Clean Energy – No. 9: Industry, Innovation and Infrastructure – No. 11: Sustainable Cities and Communities – No. 12: Responsible Consumption and Production – No. 13: Climate Action – No. 14: Life Below Water – No. 15: Life on Land – No. 17: Partnerships for the Goals

Key Risks: Please note that the value of an investment and any income taken from it is not guaranteed and can go down as well as up. You may not get back the amount you originally invested. If your investment currency is different to $USD, then the return you will get from your investment may increase or decrease as a result of currency fluctuations between $USD and your investment currency.

4

What Happens If We Do Nothing?Science predicts that a person born today would witness the following…

Source: David Attenborough’s “A Life on Our Planet” 2020

The Amazon rainforest, cut down until it can no longer produce enough moisture, degrades into a dry savannah, bringing catastrophic species loss, and altering the global water cycle

At the same time, the Arctic becomes ice free in the summer

Without the white ice cap, less of the sun’s energy is reflected back into outer space, and the speed of global warming increases

2030’S

Throughout the north, frozen soils thaw, releasing methane, a greenhouse gas many times more potent than carbon dioxide, accelerating the rate of climate change dramatically

2040’S

As the ocean continues to heat and becomes more acidic, coral reefs around the world die

Fish populations crash

2050’S

2060’S

2070’S

Global food production enters a crisis as soils become exhausted by overuse

Pollinating insects disappear, and the weather is more and more unpredictable

2080’S

2090’S

Our planet becomes 4 ºC warmer, large parts of the earth are inhabitable

Millions of people are rendered homeless

A sixth mass extinction event is well underway. This is a series of one-way doors.

Within the span of the next lifetime, the security and stability of the Holocene, will be lost

2100’S

5

What Are the Environmental Challenges of Our Time?Climate change is undoubtedly one of the biggest challenges of our time. Rising global temperatures and sea levels, melting glaciers, shifting rainfall patterns, more frequent floods and wildfires as well as other adverse effects of greenhouse gas emissions are challenging the biological support systems of our planet. Yet, climate change is not the only challenge of our time. Natural resource depletion and other consequences of environmental degradation, including desertification, drought, land infertility, soil erosion, freshwater scarcity and the continued destruction of our habitats and biodiversity further exacerbate the list of challenges we face.

Source: Mackaycartoons 2020 Source: Shutterstock 2020

COVID-19

RECESSION

CLIMATE CHANGE

BIODIVERSITY COLLAPSE

Problem of waste disposal

The world food problem

Changes in the Earth’s climate

Impoverishment of biological diversity

Air pollution, the greenhouse effect

Land pollution, the destruction of soil cover

The depletion of fresh water, polution of the world ocean

Destruction of the ozone layer

6

Sources: 1United Nations 2021 2World Health Organisation 2019 3World Wildlife Fund 2020

How Do We Tackle These Challenges?We must tackle our climatic and environmental challenges using the most innovative and impactful technologies and solutions that we have. Steering capital towards industries and sectors that can help decarbonise our planet is a critical first step.

We must green our transport Readily available solutions exist for more than 70% of today’s emissions. Investing in EVs and other future mobility solutions can help move the needle in transport, and backing green hydrogen technologies can help reduce emissions from hard-to-electrify sectors such as heavy manufacturing, especially steel and cement. 1

We must electrify our energy Within 20 years, renewables are predicted to be the world’s main source of power. By making meaningful investments today, we can make it the only source. 1

We must build sustainable cities The megacities of tomorrow will be clean and energy efficient, with more green spaces, more environmentally friendly buildings and more sustainable transport. Achieving ‘Net Zero’ requires backing ‘systemic efficiency’ technologies like clean electrification, smart digitisation and efficient infrastructure, and creating new approaches to waste and materials management. 2

We must preserve our freshwater Responsible management of our finite hydrological resources is needed if we want to ensure human, plant and animal health. It is also needed if we want to protect our marine life and safeguard the biodiversity of our water ecosystems. We must prioritise investment in critical water infrastructure in the world’s most under-resourced areas where our impact can be greatest. 2

We must transition to a circular economy Pollution control and circular economy solutions can offer economic, social and environmental benefits through reduced demand for natural resources and maximisation of reusable, recyclable and compostable products. We must design out waste and pollution and keep products and materials in use, while regenerating natural systems. 2

We must protect our biodiversity Conclusive action is needed to conserve our natural environment and biodiversity, including our threatened forests and mangroves. Areas needing investment today include nature-based rehabilitation, water filtration and erosion and flood control systems, among others. 3

– WE MUST GREEN OUR TRANSPORT

– WE MUST ELECTRIFY OUR ENERGY

– WE MUST BUILD SUSTAINABLE CITIES

– WE MUST PRESERVE OUR FRESHWATER

– WE MUST TRANSITION TO A CIRCULAR ECONOMY

– WE MUST PROTECT OUR BIODIVERSITY

7

Source: Earth.org 2021 Source: Global Footprint Network 2021

Nature-Based Solutions: Can We Make Nature Our Ally?

The World Is Not EnoughIf all citizens of the world lived like the people of the United States, we would require 5 full planets to satisfy the annual demand for resources. This data is highlighted by Global Footprint Network, a US-based NGO, every year. The NGO also publishes the exact date – every year – that humans have collectively used up more resources than mother nature is able to create in a single year. Last year, this so-called “Earth Overshoot Day” occurred on August 22, 2020 – a little later than usual, due to the coronavirus pandemic. In 2019, it occurred on July 29. The date has been steadily advancing since 2009.

Nature-based solutions leverage the natural world to tackle climate change, water security, pollution, human health, biodiversity loss and disaster risk management. Nature-based solutions can include, for example, the restoration of forests and wetlands in catchments to secure and regulate water supplies or to protect communities from floods, soil erosion and landslides. They may also include the protection of coastal ecosystems (mangroves, reefs and salt marshes), which are particularly good at sequestering carbon, or even creating green roofs and walls or planting trees in cities to moderate the impact of heatwaves, capturing storm water and abating pollution.

UnitedStates

5

Denmark

4.3

South Korea

3.8

Germany

2.9

UnitedKingdom

2.6

China

2.3

Brazil

1.8

Indonesia

1.1

TYPES OF NATURE-BASED

SOLUTIONS

GREEN URBAN SPACES

BIOSWALES NATIONAL WETLANDS

CONSTRUCTEDWETLANDS

MANGROVES

REFORESTATIONS

8

9

10

The State of the Paris AgreementThe Paris Agreement is now 5 years old. 196 countries have now signed up. Yet, the road to get here was not smooth. The United States removed its signature from the agreement in 2017, under President Trump. The rejection of the agreement was met with rebukes from world leaders including Angela Merkel, Emmanuel Macron and Paolo Gentiloni. In January 2021, however, new President Biden moved to reinstate the United States into the Paris Agreement. As part of a flurry of executive actions issued on his first day in office, President Biden wrote to Secretary-General António Guterres of the United Nations to inform him of his intention to rejoin the Paris Agreement. Following a 30-day notice period, the United States was allowed in. The United States is now working with the rest of the world to achieve its climate objectives.

Source: United Nations Framework Convention on Climate Change 2021

What is the Paris Agreement? The Paris Agreement is a legally binding international treaty on climate change. It was adopted in Paris on December 12, 2015, and officially entered into force on November 4, 2016. The goal of the agreement is to limit global warming to well below 2 ºC, preferably to 1.5 ºC, compared to pre-industrial levels.

Ratified Signed

11

Source: Statista Global Carbon Atlas 2017

What Percentage of Global Fossil Fuel Emissions Have Occurred in Your Lifetime?If you are 15 years old, you have seen more than 30% of global fossil fuel emissions. If you are 30 years old, you have seen more than 50%. And if you are 85 years old, you have seen more than 90% of global fossil fuel emissions!

0%

AG

E

10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

5101520253035404550556065707580859095100

30%

50%

90%

The World’s Most Popular Climate Policies

Percentage of people who support each climate policy for the immediate future

Climate policies are rapidly going global. Renewable energy is expected to overtake coal and oil in the coming decades. Data shows that the majority of people support extensive climate reform. Results from the world’s largest opinion poll on climate change – the People’s Climate Vote – which is sponsored by the United Nations – showed that 54% of people surveyed supported the conservation of forests and land to help combat climate change. The next most popular policy was the continued use of renewables (most notably, wind, solar and hydro, along with climate-friendly farming method).

Source: United Nations 2021

53%Renewable

power

52%Climate-friendly

farming

50%Green business

and jobs

48%Electricvehicles

54%Conserve

forests / land

12

A Unique Approach to Thematic Investing

We believe out-of-the- box research has the power to unlock ground breaking insights.

We have created an ETF capability that leverages the best of thematic research and rules-based implementation to deliver solutions that are purpose-built for the thematic investing community. We achieve this by working with leading specialists in each of our themes, in addition to your typical index provider. In this way, we are able to purpose-build all of our investment strategies, which are then codified into indices. We believe that working with experts is the best way to successfully capture the secular, technical and behavioural drivers of a theme, and adopt a targeted approach in accessing the companies that are best placed to benefit.

13

Sustainable Market Strategies®

About The Partners

Foxberry®

SMS Financial Technologies Inc (“Sustainable Market Strategies” or “SMS”) has been engaged to power up the Rize Environmental Impact 100 UCITS ETF. Sustainable Market Strategies is an independent ESG intelligence firm that provides thematic ESG research and market insights to a global audience of asset owners, investment managers, and public policy decision makers. Their research caters to portfolio managers, ESG teams and C-suite executives in the investment, regulatory and policy space. Their world-class team brings together extensive experience in capital markets, investment research, money management, economics, policy, academic research, and sustainable investing. The company is headquartered in Montreal, Canada.

Foxberry Limited (“Foxberry”) has been engaged to administer the index replicable by the Rize Environmental Impact 100 UCITS ETF. Foxberry are an independent index administrator with state-of-the-art index management, structuring, analysis and technological capabilities typically only found within top-tier investment banks. Foxberry is authorised and regulated by the FCA and registered under the EU benchmark regulation.

14

About The Index

S T A T E O F T H E A R T I N D E X M A N A G E M E N T

The Foxberry SMS Environmental Impact 100 Index provides exposure to companies that are developing and applying innovative and impactful solutions to tackle the world’s most pressing climatic and environmental challenges. The classification employed by the index has been designed to be aligned with the six environmental objectives set out in the EU classification: (1) Climate Change Mitigation; (2) Climate Change Adaptation; (3) The Sustainable Use and Protection of Water and Marine Resources; (4) The Transition to A Circular Economy; (5) Pollution Prevention and Control; and (6) The Protection and Restoration of Biodiversity and Ecosystems. The index follows a purity screened, impact-based weighting scheme where companies with a higher impact score achieve a bigger weight in the index.

15

SMS Environmental Impact Opportunities Thematic ClassificationRENEWABLE ENERGY GENERATIONCompanies engaging in the generation and distribution of electricity produced from renewable energy sources.

RENEWABLE ENERGY EQUIPMENT MANUFACTURERSCompanies designing, manufacturing, producing and maintaining renewable power generation equipment.

HYDROGEN AND ALTERNATIVE FUELSCompanies engaging in the development, processing, production and/or distribution of alternative energy sources.

ENERGY EFFICIENCYCompanies enabling more efficient methods of energy usage and management in residential, commercial and/or industrial buildings.

GREEN TRANSPORTCompanies designing, developing and/or manufacturing sustainable transport alternatives.

CLIMATE RESILIENCECompanies engaging in the reduction of material physical climate risk and/or provision of resilience-related solutions.

CLEAN WATERCompanies designing, developing and/or manufacturing products and services that enhance clean water quality and availability.

CIRCULAR ECONOMYCompanies supporting the transition to a circular economy.

POLLUTION CONTROLCompanies addressing pollution prevention and control at the primary source of emission.

NATURE-BASED SOLUTIONSCompanies engaging in the development of nature-based solutions for tackling environmental challenges.

ENVIRONMENTAL IMPACT

OPPORTUNITIES

THE SUSTAINABLE USE AND PROTECTION OF WATER AND MARINE RESOURCES

THE TRANSITION TO A CIRCULAR ECONOMY

CLIMATE CHANGE ADAPTATION

POLLUTION PREVENTION AND CONTROL

CLIMATE CHANGE MITIGATION

THE PROTECTION AND RESTORATION OF BIODIVERSITY AND ECOSYSTEMS

16

17

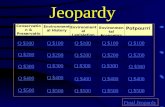

Fund Details

Fund Name • • • • • • • Rize Environmental Impact 100 UCITS ETF • • • • • • • • • • • • • • • • • • • •

Total Expense Ratio • • • • • 0.55% • • • • • • • • • • • • • • • • • • • • • • • • • • • • •

Inception • • • • • • • • 14 July 2021 • • • • • • • • • • • • • • • • • • • • • • • • • • •

ISIN • • • • • • • • • IE00BLRPRR04 • • • • • • • • • • • • • • • • • • • • • • • • • •

Base Code • • • • • • • • LIFE • • • • • • • • • • • • • • • • • • • • • • • • • • • • •

Base Currency • • • • • • • USD • • • • • • • • • • • • • • • • • • • • • • • • • • • • •

Index Name • • • • • • • • Foxberry SMS Environmental Impact 100 Index NTR • • • • • • • • • • • • • • • • •

Thematic Industry Classification • • SMS Environmental Impact Opportunities Thematic Classification • • • • • • • • • • • • • •

Index Replication Method • • • • Physical - Full Replication • • • • • • • • • • • • • • • • • • • • • • • •

Income Treatment • • • • • • Accumulating • • • • • • • • • • • • • • • • • • • • • • • • • • •

UCITS • • • • • • • • • Yes • • • • • • • • • • • • • • • • • • • • • • • • • • • • •

Domicile • • • • • • • • Ireland • • • • • • • • • • • • • • • • • • • • • • • • • • • • •

Fund Type • • • • • • • • Irish ICAV • • • • • • • • • • • • • • • • • • • • • • • • • • • •

Issuer • • • • • • • • • Rize UCITS ICAV • • • • • • • • • • • • • • • • • • • • • • • • • •

Promoter • • • • • • • • Rize ETF Limited • • • • • • • • • • • • • • • • • • • • • • • • • •

Manager • • • • • • • • Davy Global Fund Management Limited • • • • • • • • • • • • • • • • • • • •

Investment Manager • • • • • Davy Global Fund Management Limited • • • • • • • • • • • • • • • • • • • • •

Depositary / Custodian • • • • • Northern Trust Fiduciary Services (Ireland) Limited • • • • • • • • • • • • • • • • • •

Listings and Tickers • • • • • Borsa Italiana • • • • • • • • • • • • • • • • • LIFE (EUR) • • • • • • •

• • • • • • • • • • • Deutsche Börse Xetra • • • • • • • • • • • • • • • WRLD (EUR) • • • • • •

• • • • • • • • • • • London Stock Exchange • • • • • • • • • • • • • • LIFE (USD) • • • • • • •

• • • • • • • • • • • London Stock Exchange • • • • • • • • • • • • • • LVNG (GBP) • • • • • •

• • • • • • • • • • • SIX Swiss Exchange • • • • • • • • • • • • • • • ENVR (CHF) • • • • • • •

ISA Eligible (UK) • • • • • • Yes • • • • • • • • • • • • • • • • • • • • • • • • • • • • •

SIPP Eligible (UK) • • • • • • Yes • • • • • • • • • • • • • • • • • • • • • • • • • • • • •

Reporting Fund Status (UK) • • • • Yes • • • • • • • • • • • • • • • • • • • • • • • • • • • • •

Equity Fund (DE) • • • • • • Yes • • • • • • • • • • • • • • • • • • • • • • • • • • • • •

Registered Countries • • • • • Austria, Denmark, Finland, Germany, Ireland, Italy, Luxembourg, Netherlands, Norway, Portugal (pending), Spain, Sweden,

• • • • • • • • • • • Switzerland and the United Kingdom • • • • • • • • • • • • • • • • • • • • •

18

At Rize ETF, we believe there’s a better way to invest in the future. Our ETFs provide investors with unprecedented access to the megatrends that are transforming our world. We believe we’re pioneering a new way of investing, one that enables investors of all stripes to generate long-term returns whilst staying on the right side of history.

We are committed to challenging orthodoxy and providing investors with seamless access to the most ground-breaking megatrends shaping our planet.

R I Z E E T F I S E U R O P E ’ S F I R S T S P E C I A L I S T T H E M A T I C E T F I S S U E R

Important Information

Marketing communication/financial promotion:

Communications issued in the European Economic Area (“EEA”): This marketing communication has been issued by Davy Global Fund Management Limited (“DGFM”) acting in its capacity as management company of Rize UCITS ICAV (“Rize ETF”). DGFM is authorised and regulated by the Central Bank of Ireland. DGFM is registered in Ireland with registration number 148223.

Communications issued in jurisdictions outside of the EEA: This marketing communication has been issued by Rize ETF Limited (“Rize UK”) which is an Appointed Representative of Aldgate Advisors Limited, a firm authorised and regulated by the Financial Conduct Authority (FCA FRN 763187). Rize UK is registered in England and Wales with registration number 11770079.

This is a marketing communication. This is not a contractually binding document. Please refer to the prospectus and Fund-specific supplement and Key Investor Information Document (the “KIID”) of the relevant Fund and do not base any final investment decision on this communication alone.

You should seek professional investment advice before making any decision to invest in a Fund.

This marketing communication is not being provided to you on the basis that you are a client of DGFM or Rize UK. Neither DGFM nor Rize UK is acting on your behalf and neither entity is responsible for providing protections that would otherwise be afforded to clients of DGFM or Rize UK. This marketing communication is for information purposes only. Its contents, and the fact of its distribution, do not constitute investment advice, nor do they constitute tax, legal or any other form of advice or service. It does not constitute or form part of any offer to issue or sell, or the solicitation of any offer to buy or sell any investment. It shall not form the basis of, or be relied upon in connection with, any contract. Information and opinions contained herein have been compiled from sources believed to be reliable but neither DGFM nor Rize UK nor any of their respective partners makes any representations as to its accuracy or completeness. Any opinions, forecasts or estimates herein constitute a judgement that is subject to change without notice. DGFM and Rize UK disclaim all liability and responsibility arising from any reliance placed by any person on the information contained within this marketing communication.

Where past performance and projected performance information is shown, it must be noted that past performance and projected performance is not a reliable indicator of future performance. Simulated past performance does not represent actual past performance and is not a reliable indicator of future performance.

The Rize Environmental Impact 100 UCITS ETF replicates the Foxberry SMS Environmental Impact 100 Index. An investment in the Fund involves significant risk and is subject to the volatility of companies in the clean energy, environmental and technology sectors and exchange rate fluctuations and you may lose some or all of your capital.

Capital at Risk Warning – Please note that the value of an investment and any income taken from it is not guaranteed and can go down as well as up. You may not get back the amount you originally invested. If your investment currency is different to the Funds’ currency of denomination (USD) or the currencies in which the Funds’ assets are denominated (which may be a range of different global currencies), then the return you will get from your investment may increase or decrease as a result of currency fluctuations between your investment currency and such currencies.

The products referred to in this marketing communication are offered by Rize UCITS ICAV (“Rize ETF”). Rize ETF is an open-ended Irish collective asset management vehicle which is constituted as an umbrella fund with variable capital and segregated liability between its sub-funds (each, a “Fund”) and registered in Ireland with registration number C193010 and authorised by the Central Bank of Ireland as a UCITS. Rize ETF is managed by Davy Global Fund Management Limited

(“DGFM”). The prospectus (including the Fund-specific supplements and other supplements), the KIIDs, the constitutional document of Rize ETF and the latest annual and semi-annual reports of Rize ETF, the latest Net Asset Values of the Funds and details of the underlying investments of the Funds (together, the “Fund Information”) are available at http://www.rizeetf.com. Any decision to invest must be based solely on the Fund Information. Investors should read the Fund-specific risks in Rize ETF’s prospectus, Fund-specific supplements and the KIIDs. The indicative intra-day net asset values of the Funds are available at http://www.solactive.com.

The Funds are not offered or aimed at residents in any country in which (a) Rize ETF and the Funds are not authorised or registered for distribution and where to do so is contrary to the relevant country’s securities laws, (b) the dissemination of information relating to Rize ETF and the Funds via the internet is forbidden, and/or DGFM or Rize UK are not authorised or qualified to make such offer or invitation.

The Funds may be registered or otherwise approved for distribution to the public or certain categories of investors in one or more jurisdictions. Where this is the case, a country-specific web page and copies of the Fund Information will be available at http://www.rizeetf.com. The fact of such a registration or approval, however, does not mean that any regulator (including the FCA) has determined that the Funds are suitable for all categories of investors.

United Kingdom: This is a financial promotion. For the purposes of the United Kingdom Financial Services and Markets Act 2000 (“FSMA”), Rize ETF is a UCITS that has been recognised by the Financial Conduct Authority (the “FCA”) pursuant to s.264 of the UK Financial Services and Markets Act 2000. The Fund Information is available in English free of charge upon request from the Facilities Agent in the United Kingdom, Davy Global Fund Management Limited, at Dashwood House, 69 Old Broad Street, London, EC2M 1QS.

Germany: This is a financial promotion. The offering of the Shares of Rize ETF has been notified to the German Financial Services Supervisory Authority (BaFin) in accordance with section 310 of the German Investment Code (KAGB). The Fund Information in English (and the KIIDs in German language) can be obtained free of charge upon request from the Information Agent in Germany, German Fund Information Service Ug (Haftungsbeschränkt), at Zum Eichhagen 4, 21382 Brietlingen, Germany.

Switzerland: The Representative in Switzerland is 1741 Fund Solutions AG, Burggraben 16, CH-9000 St. Gallen. The Paying Agent in Switzerland is Tellco AG, Bahnhofstrasse 4, PF 713, CH-6430 Schwyz. The Fund Information may be obtained free of charge from the Representative. In respect of the units distributed in and from Switzerland, the place of performance and jurisdiction is the registered office of the Representative.

Austria: This is a marketing communication and serves exclusively as information for investors. Under no circumstances may it replace advice regarding the acquisition and disposal of investments which may result in a total loss of the investment. The Fund Information in English (and the KIIDs in German language) can be obtained free of charge upon request from the Paying and Information Agent in Austria, Erste Bank der oesterreichischen Sparkassen AG, Am Belvedere 1, 1100 Vienna, Austria.

United States: This marketing communication and its contents are not directed at any person that is resident in the United States (“US person”), and no offer or invitation is made to any US person to acquire or sell any service, product or security referred to. The provision of any information in this marketing communication does not constitute an offer to US persons to purchase securities.

.

20

F U T U R EF I R S TE T F S

rizeetf.com