RISKAFRICA - Issue 15

-

Upload

cosa-media -

Category

Documents

-

view

229 -

download

2

description

Transcript of RISKAFRICA - Issue 15

Issue 15 | 2014 I S S N 1 8 1 2 - 5 9 6 4

RISKAFRICA

THE FUTURE OF TERROR

AFRICA’S HOTSPOTS OF OPPORTUNITY

MOBILE MONEY IN WEST AFRICA

HOT

THE FUTURE OF TERRORMOBILE MONEY IN WEST AFRICA

Trust for your home and car...

PGNAMIBIA

Glass

EXPERT INSTALLATION | CUT TO SIZE WHILE YOU WAIT

FOR ALL YOUR GLASS REQUIREMENTS

Emergency Glass Replacement: | New Glazing

Mirrors | Showers Aluminium products

Patio Doors | Safety Film | Architectural Film

Fix broken windows, Install new windows

| Windscreens | Sideglass | Chip repairs |

Contact us on:Oshakati

Otjiwarongo

Swakopmund

(+26465) 222 143

(+26467) 304 510

(+26464) 406 980

Walvis Bay

Windhoek Windscreens

Windhoek Building Glass

(+26464) 204 102

(+26461) 287 5555

(+26461) 287 5000

Contact us on:

STOCKISTS OF WORLD’S BEST BRANDS

Dear readerThis issue, we delve deeper into the opportunities on offer in this vast continent. Where they are, which sectors and support sectors they are in, and what investors and business decision-makers need to know about these ‘hotspots of opportunity’.

Reading Christy van der Merwe’s thorough investigation and mapping of growth and opportunity, I am further assured of the wonderful optimism I hear again and again in conferences, interviews and conversations on the future of this so-long disempowered and troubled continent.

It is that optimism which drives us here at RISKAFRICA to do what we do, to keep creating content that supports and enables this positive growth. From our next issue, we will be doing this with a greater focus on risk management in Africa – what the latest risk intelligence is telling us, and how industry leaders and innovators are responding to avoid, minimise and improve these situations in order to build competitive advantage.

With this in mind, in this issue we look at the realities of one of the most unpredictable and unfathomable risks: that of terrorist activity. In the wake of recent surges in terror activity in the key economic hub countries of Nigeria and Kenya, we discuss future scenarios and mitigation measures with leading risk advisors and analysts.

Enjoy the read,

Publisher Andy Mark Editor Sarah Bassett Production Nicky Mark Copy editor Gemma RedelinghuysFeature writers Christy van der Merwe; Dominic Uys; Neesa Moodley-Isaacs Design and layout Herman Dorfling; Mariska Le Roux

Editorial [email protected]: +27 21 555 3577Advertising and salesMichael Kaufmann | [email protected] Claudia Heyl | [email protected] Tel: +27 21 555 3577 | Fax: +27 21 555 3569 Tel: +264 61 400 717

RISKAFRICA is published by COSA Media

Copyright THE RISKAFRICA MAGAZINE PUBLISHER CC 2014. All rights reserved.Opinions expressed in this publication are those of the authors and do not necessarily reflect those of the Publisher, Cosa Communications (Pty) Ltd, COSA Media, and or THE RISKAFRICA MAGAZINE PUBLISHER CC. The mention of specific products in articles or advertisements does not imply that they are endorsed or recommended by this journal or its publishers in preference to others of a similar nature, which are not mentioned or advertised. While every effort is made to ensure accuracy of editorial content, the publishers do not accept responsibility for omissions, errors or any consequences that may arise therefrom. Reliance on any information contained in this publication is at your own risk. The publishers make no representations or warranties, express or implied, as to the correctness or suitability of the information contained and/or the products advertised in this publication. The publishers shall not be liable for any damages or loss, howsoever arising, incurred by readers of this publication or any other person/s. The publishers disclaim all responsibility and liability for any damages, including pure economic loss and any consequential damages, resulting from the use of any service or product advertised in this publication. Readers of this publication indemnify and hold harmless the publishers of this magazine, its officers, employees and servants for any demand, action, application or other proceedings made by any third party and arising out of or in connection with the use of any services and/or pro-ducts or the reliance of any information contained in this publication.

Ground floor, Manhattan Tower, Esplanade Road Century City, 7441, Cape Town, South Africa

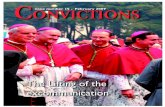

Cover image: Shutterstock.com

Subscription [email protected]: +27 21 555 3577

www.riskafrica.com

VAT and postage included standard postage FREE to RSA addresses only

CO

NT

EN

TS

04 Accessing Africa 12 The future of terror: managing, mitigating and understanding your risk

15 Financial crime controls needed to draw investors

16 The rise and rise: Sanlam shares insight into Africa’s middle class

19 Investing in Africa: the numbers

EAST AFRICA

20 Capacity to carry

SOUTHERN AFRICA

26 Southern Africa’s game: high risk, high reward?

30 Accuracy and abnormal loads 36 Lifestyle diseases on the rise across urbanising Africa

WEST AFRICA

40 Mobile money in West Africa

44 International news

46 RISKAFRICA – a new focus

4

By Christy van der Merwe

AfricaACCESSING Africa

Africa

Africa

5

Expansion into Africa is at the heart of many companies’ growth strategies, and the continent is bursting with opportunity. RISKAFRICA takes a look at some of the activity taking place on the continent, showing where the greatest potential lies.

Transport and logistics are a major problem. “We are suffering from stranded resources. We have what the world wants, but we cannot move it,” explains Runge. He delivers a familiar story about how it took three hours to travel 68 kilometres in the Democratic Republic of Congo (DRC), and was then stopped at the borderpost for hours. Only this time, it’s business and not an overland adventure trip.

Delays in moving goods across borders within and between regions are significant, and cannot be downplayed. A Deloitte report, Mitigating business risk in Africa through regional integration points out that delays at African customs are, on average, longer than in the rest of the world, with goods taking 12 days to clear in sub-Saharan countries, compared with seven days in Latin America, less than six days in Central and East Asia, and four days in Central and Eastern Europe.

These delays add tremendous cost to importers and exporters, and increase the transaction costs of trading among African

countries. Delays are exacerbated by high paperwork volumes, the high cost of clearing goods at borders, and cumbersome visa requirements.

The problems are well known, and conferences, workshops, task teams, discussions, studies and reports by all manner of countries, corporations and academics have taken place to propose solutions. Regional integration in Africa is a must for Africa if it is to progress and enhance competitiveness. “Regional integration is lauded, but when the tyre hits the road, national interests take priority,” notes Runge.

The costs of internal trade within Africa are exorbitant, and improvements proposed include road and rail upgrades, and one-stop border posts. President Jacob Zuma, for example, is a fan of the north-south corridor, a project aimed at enhancing road, rail and ports in Botswana, DRC, Malawi, Mozambique, South Africa, Tanzania, Zambia and Zimbabwe.

The problemAfrica is experiencing hotspots of exponential growth, all linked to resources. “In 30 years working throughout Africa, I have never

seen as much activity. But now it’s a global game, and Africans are competing on a global stage. There are plenty of projects, and there is much money to be made,” says Africa Project Access director Paul Runge.

NATURAL CATASTROPHES

6

There is an infatuation with corruption on the African continent, and there is an emphasis on corporates keeping their hands clean. Corruption is a real threat and the line between relationship building, nepotism and corruption can be vague. “Corruption will return to bite you in the butt sooner or later. You are digging your own grave if you submit to it. We do not advocate corrupt business practices,” says Runge. Foreigners are often viewed as walking cash machines, and will be targeted for bribes. One should be prepared to deal with this.

For all the risks and opportunities on the continent, Runge highlights that there are also a fair number of fallacies doing the rounds. He advises visitors to remain alert and aware while travelling in Africa, and avoid potentially dangerous situations. “The impression that locals are wandering around with sticks, shooting at bodyguards and waiting to kidnap businessmen is

greatly exaggerated. There have been instances where a company has scaled down operations for economic reasons, but blamed this on safety concern, which is unwarranted,” adds Runge. Of course, visitors should play it safe, and make the most of expat services on offer.

This also highlights the importance of conducting health impact assessments, particularly if employees will be working on remote sites. If working in an area where meningitis is a threat, there should be a corporate policy in place so that everyone knows how to deal with it.

One mine operator in the Copperbelt has made it mandatory for workers to have a breathalyser test before they start work – no matter what time of day their shift starts. Nobody is allowed on site without passing the breathalyser test. These are problems that one may not plan for but that can seriously affect operations.

Russell Myers, CEO of Mirabilis Engineering Underwriting Managers, tells RISKAFRICA that 35 to 40 per cent of the company’s premium now comes from outside of South Africa, and this is expected to increase.

The business often comes out of local or London-based brokers, depending on which brokers the client, who is usually the contractor, owner or employer on the project, uses. Global brokerages including Aon, Marsh and Jardine Lloyd Thompson, are increasing their African footprint, as well as smaller local companies such as Hamtern Financial Services.

These companies will analyse the risk of a project and advise on the insurance needs, as commercial insurance requirements form part of feasibility studies required to take a project to a bankable stage.

Owing to the increased political risks associated with working in Africa, political risk insurance is recommended for projects in Africa. This can be purchased through the Lloyd’s market, and through commercial operators such as Munich Re and AIG, although one of the limitations in this regard is the terms, which often only extend to a maximum of 12 years.

Given that a project such as a hydroelectric power station is likely to be operational for well over 20 years, there is a need for longer terms.

The Multilateral Investment Guarantee Agency (MIGA) is the World Bank’s political risk insurance and credit enhancement provider, with a mandate to incentivise private investment into developing countries. MIGA provides political risk insurance with terms up to 20 years.

Cresco Project Finance is the only MIGA-authorised agent for Africa. MD Conrad Hefer, explains that there are five or six MIGA agents globally and the transactors are located in Washington.

The political risk insurance solutions include transfer and convertibility cover, which deals with the inability to convert or transfer dividends or loan payments due to forex restrictions; breach of contract cover, which deals with the failure of a government to honour obligations under key project documents such as concessions or off-take agreements; expropriation cover, for instances where a government could nationalise or make it impossible to operate a project through discriminatory measures; and war and civil disturbance cover, which deals with destruction or interruption of business due to political violence.

The C word

Covering the risks

7

its own. The Kenyan coast and the coast of Madagascar are also experiencing an increase in prospecting for natural gas. Development of these resources will require investment into natural gas infrastructure.

The Mtwara gas pipeline is another project on the radar, which will transport gas to Dar es Salaam, where it will be used for power generation rather than being exported. The gas finds in Mozambique mean that the northern city of Pemba has seen a lot of growth. Property companies have started selling industrial land for a potential gas plant.

There is dire need for basic services in the region such as accommodation and catering. Botswana is also seeing its share of the action with continued development of the Mmamabula coal complex by Jindal Africa. There is prospecting for natural gas and coal-bed methane, but the issue of how to get these resources out of the landlocked country has long been debated.

The Namibian port at Walvis Bay has already allocated space for the export of Botswana coal, but the railway from Botswana through to Walvis Bay is yet to

Santam CEO, Ian Kirk, reiterates the opportunities available through expansion into Africa, but also highlights that this does not come without challenges.

Speaking to sister publication RISKSA at the PSG Konsult conference, he said that there is a significant opportunity on the adviser side as well, and not just for the multinationals, which are already active in Africa. “I think for companies like PSG and other intermediated groups that have got scale in more developed markets, it does create opportunity in Africa, where there are huge opportunities for intermediaries.

Direct is a very popular method, but it is not direct in the context that we understand

direct. Direct means that the agents are employed by the insurance company themselves, and are not independent. I think that the independent intermediary will develop strongly in Africa and there will be numerous benefits to the market as a result of that,” Kirk adds.

Increasing wealth in African countries means more of a need for financial services, and companies would do well to leave their offices, visit the countries where the growth is happening; listen and learn about what is needed by the people on the ground. “Understand the opportunities, understand what it means to have success. Take time and have patience,” Kirk concludes.

Much activity in Africa is linked to resources, and while there is still much focus on raw materials, the need for energy has added a new dimension to the exploration on the continent. South Africa does not possess a wealth of oil and gas expertise, and other nationalities are ahead of the game in this regard. Foreign companies would do well to provide secondary supplies, equipment and services.

The Tete province in Mozambique is teeming with activity as coal prospecting, mine development, transport and export takes hold. The Changara area in the Zambezi Valley is also seeing more action. The Beira railway line needs about $200 million for short-term upgrades; at the moment the capacity is about four million tons a year, but this needs to be increased to transport roughly 20 million tons of coal a year.

There has also been significant natural gas discoveries in northern Mozambique, extending along the Tanzanian coastline. There has been some discussion about a natural gas plant on the border of the two countries, which could be beneficial; however, the Tanzanian Government has indicated that it would prefer a plant of

be constructed. The other option is to construct a railway east; however, crossing borders through South Africa, Swaziland and Mozambique has proven problematic.

Angola’s oil and gas industry continues to thrive, while inland, in Zambia, the Copperbelt is the backbone of the economies. Copper accounts for over 64 per cent of Zambia’s exports, which are mainly destined for China and South Africa. In January 2013, the Zambia Environmental Management Agency (ZEMA), approved 27 mining and exploration licences, showing that there is no likely slowdown.

Construction of a $1.1 billion railway line in Zambia’s Copperbelt, from Solwezi to Kalumbila, a joint venture between North West Rail and JSE-listed logistics company, Grindrod, will start in 2014.

Cameroon and Equatorial Guinea are seeing increased prospecting for iron ore while in Sierra Leone, the Tonkolili iron ore mine is exporting some 15 million tons of iron ore a year along a 270-kilometre railway line to Pepel port. Grindrod is supplying the locomotives.

Grasping the opportunity

Hotspots

Major risks to projects in Africa

Political risks Insurance solutions include: transfer and convertability cover; breach of contract cover; expropriation cover; and war and civil disturbance cover.

Exchange risks Deals have to be structured very carefully to limit the exposure to foreign exchange.

Technology leapfrog

African undersea cables

8

The impact of technology on the continent has been phenomenal, and because there are no legacy systems in place that require upgrades, much of the continent has been able to leapfrog over developed world systems to provide services. Connectivity on the continent has increased exponentially, and access to telecommunications is changing the way financial services such as banking and insurance are delivered, as well as basic rights such as healthcare and education. The map showing connectivity on the continent through undersea fibre-optic cables, which bring Internet and telephony capacity, is a startlingly different picture today to what it was five years ago. Back then, it was only the Telkom operated SAT-3 cable that allowed for international connectivity.

The challenge now lies in extending this fibre capacity inland, and this requires digging trenches to lay fibre terrestrially. This will make connectivity more affordable. To date, the continent has largely relied on mobile telecoms, which have changed the communications landscape dramatically, but are relatively expensive. South African telecoms giants MTN and Vodacom have been active players in this arena, and continue to exploit opportunities in this still expanding market.

Securing bonds This must be done on the government side.

Environmental risks Projects have to be stopped if they are too environmentally sensitive. The ‘soft’ issues have become hard issues.

Social risks The issue of land and ownership is a very complicated one in Africa. The 99-year lease has gone some way to alleviate these complications.

9

10

11

2361

The

Che

eseH

asM

oved

Experienceinsurance in a box

Complete results focused solutions for your business.

What this means is technology in a box with our Operation Enabling Platform, where a range of pre-defined automated processes across key insurance functions boosts productivity, reduces processing time and doubles new business acquisition while reducing costs. It’s everything you need to create and manage an insurance operation end-to-end.

At SSP we understand insurance from top to bottom, inside and out, every angle and every side. That's why we have it boxed - to make it simple for you. Our in the box solutions deliver exactly what you need today while still offering the flexibility to grow your business in the future.

To find out more about SSP’s boxed solutions (and what we offer outside of the box too) call today on +27(0) 11 384 8600 email [email protected] or visit www.ssp-worldwide.co.za

C

M

Y

CM

MY

CY

CMY

K

2361 SSP Risk AFRICA 2.pdf 1 2012/10/12 12:47 PM

central MozambiqueGaza Province road and bridge rehabilitation programme, southern MozambiqueBalama graphite and vanadium project, Cabo Delgado Province, northern MozambiqueGas-fired power plantAgriculture projects, Vilankulos region, Inhambane Province, central MozambiqueTourism initiative, Bazaruto Archipelago, Inhambane ProvinceNational airborne geophysical surveyChangara coal project, Tete, Zambezi River Valley, central MozambiqueNacala fuel depot, northern MozambiqueNcondezi 300 MW coal-fired power plant, Zambezi ValleyResidential complex, Palma, far north coastPalma industrial park, far north coastMaputo piped gas network

NamibiaUsed tyres to heavy oil projectOffshore oil exploration

NigeriaBiomass energy project, LagosNasarawa State coking coal programme, Obi Area, central NigeriaDeli Foods biscuit production plant, new production line, LagosAgbaja plateau iron ore project, Kogi State, central NigeriaNew deep-sea port, Port@Lekki project, Lekki, Lagos, southern NigeriaPetrochemical and fertiliser plant, OK-LNG free trade zone, south-western NigeriaTier III Communications data centre, Lekki Peninsula, Lagos

TanzaniaNational E-Health programmeOil and gas exploration programme, north-east TanzaniaCommercial complex project, Dar es Salaam

Runge’s top tips when working in Africa

“Speak to someone who is invested in the market and get the knowledge from people who walk the talk, like operators, not simply academics and diplomats who are represented in the media. And listen carefully. You have to leave your office to understand the major issues. Relationship building is very important,” emphasises Runge.

1. Know who the decision-makers are. If you want to supply products or services, you have got to understand how the game works and who to speak to. Rather than knowing which big company won a tender, it might be more appropriate to find out who the subcontractor on the ground is, and find out what they need.

2. Develop good relations with utilities. This is often where the decisions are being made.

3. Know how development finance works, because buyers’ credit and terms are being offered to many African customers.

4. Specifications for products are written at pre-feasibility stage, very early on in the project food chain – knowing this is incredibly important. Make contact with the people involved earlier in this food chain.

5. Hunt in packs. Form a consortium and share contacts so that an holistic solution can be offered to potential clients.

Soya bean production plant, Rovuma Region, southern TanzaniaArusha–Kibanga–Kongwa road, northern Tanzania

UgandaHoima refinery project, north-west UgandaKingfisher oil field, Lake Albert, western Uganda

ZambiaHydro power projects, Luapula Province, northern ZambiaLuena farm block, Luapula Province, northern ZambiaSamfya beach tourist facilities, Bangweulu, Luapula Province, northern ZambiaGeological survey, Luapula Province, northern ZambiaNchelenge rubber plantation, Luapula Province, northern ZambiaChisinga cattle-breeding ranch, Luapula Province, northern ZambiaNational agriculture investment planFood processing plant, Livingstone industrial area, southern ZambiaDangote power plant, near Ndola, CopperbeltNew hydro power plant, Namalundu, Kafue Gorge lowerRoma Park development project, LusakaMulobezi railway concession, southern ZambiaRevival of Mansa batteries and Manganese processing plant, Luapula Province, northern ZambiaNew power plant, Ndola

ZimbabweTokwe-Murkosi dam, Masvingo Province, central ZimbabweHope Fountain gold mine, MatabelelandTelecel Zimbabwe Telecash mobile money serviceHarare–Beit bridge road dualisationGreater Harare transportation master planThree solar power plants, Matabeleland Province, western Zimbabwe

12

terrorThe future of

By Sarah Bassett

13

Acts of terror are not new to Africa, but this has been a year in which such horrors have ricocheted across our headlines in relentless sequence. RISKAFRICA chats to risk and advisory experts on how they see future scenarios developing in the East and West African regions, what the impacts are for business, and what busi-nesses can do to ensure continuity and minimise their risk.

Ever since the shocking news of the Westgate Mall attack in Nairobi, Kenya in September last year, and the kidnapping of an estimated 200

(still-missing) girls in northern Nigeria in April this year, an unrelenting sequence of attacks in both regions has created a sense of crisis in these critically important economic hubs, with very real repercussions for business and economic growth.

Future risk

“Kenya’s participation in the AMISON mission in Somalia has led to a severe risk of attack by Somali Islamist group al-Shabaab and its sympathisers,” explains Natznet Tesfay, head of Africa analysis at IHS country risk. “The group claimed responsibility for the gun and grenade attack on Westgate Mall, with the mall remaining under siege for four days, with at least 67 killed and 175 injured. The fatalities included expatriates and high-profile Kenyans, with sources indicating that non-Muslims were targeted. Al-Shabaab continues to threaten to launch large-scale attacks in Nairobi.”

Since this attack, there has been a consistent and ongoing sequence of attacks, with multiple raids by gunmen in public spaces this

year. “Therefore, large international hotels, Western diplomatic assets and US businesses in Nairobi and Mombasa are at particular risk, most likely from al-Shabaab-sympathiser suicide bombs (either vehicle-borne or on foot), remote-controlled IEDs, shootings and grenade attacks.

Public places such as markets, transport hubs, churches, restaurants and shopping malls are also targets, especially if foreigners or Christians congregate there. Military and government assets are also at severe risk of attack in North Eastern province, particularly the capital Garissa, which borders Somalia,” says Tesfay. According to Frontier Advisory analyst, John De Villiers, “It’s highly unlikely that the security situation in Kenya will reach endemic levels on account of its localised nature.”

Darlington Munhuwani, regional controller for Aon Sub-Sahara Africa, emphasises that with terrorist activity, it is very difficult to predict future developments. “I don’t have specific information on how the response is being coordinated behind the scenes. But my view is that it doesn’t take a large group of people to destabilise a region. Just a few people who are unhappy with the current political situation or

the socio-economic environment can create a sense of insecurity in the whole nation. In Mali for instance, there was a civil war situation last year with a strong element of terrorism and it was brought under control last year. But in the northern part of Mali now, some of the terrorist groupings have regrouped, and the nation is expecting further attacks.

The nature of terrorism is that you don’t know who is going to attack you and from where, so I think it is very difficult to suggest that international intervention is going to bring the situation under control. Consider Somalia, international units came in but could not resolve the situation. So, my belief is that terrorism is here to stay. The level of violence may decrease and attacks may become a lot more sporadic but I don’t think it is going to go away any time soon. However, I do think the Kenyan situation is all dependent on what happens in Somalia. If there is stability in Somalia, then the Kenyan situation will be resolved much sooner,” he adds.

For Nigeria and the West African region, the situation is far less localised and the situation less apparently clear. In Nigeria, ongoing attacks in the northern region have been attributed to local Islamist grouping, Boko

14

Haram. Latest reports suggest that as many as 140 000 people in the northern state of Borno have fled due to the threat of attack. But the broader situation is not a local one.

“According to the French military, Islamist militants are regrouping to conduct a more intensive campaign in northern Mali, as well as to extend their operational reach across West and Central Africa, with Niger, Chad, Nigeria, and potentially Central African Republic at the greatest risk of attack. This will expose Westerners in the Sahel to risk of kidnap for ransom and Western businesses, in particular French firms, to targeted IED attacks,” says Tesfay. “The military appears incapable of stifling the attacks in spite of their sizeable presence in the afflicted states. As a result, there have been an increased number of attacks in 2014. While Boko Haram’s attacks have, thus far, not extended as far south as Lagos, where most companies are headquartered, there is an increased likelihood of them carrying out an attack in the commercial capital,” De Villiers notes.

“If the situation in Nigeria isn’t brought under control, it will escalate to a conflict affecting the entire region. Beyond the northern states of Nigeria, Boko Haram has already made in-roads in southern Cameroon, southern Niger, and Chad. I don’t believe the same can be

said for East Africa – where the fighting will probably stay localised.”

“In Nigeria, there are internal dynamics that need to be

resolved. In the northern, Islamic part of the country,

the population feel marginalised and, as

a result, the level of mistrust between the

southern and the northern regions

remains unabated.

So, the

future of the terror situation depends on what happens internally. But this also requires that international terrorist organisations do not take advantage of the situation. If there is an alliance between Boko Haram and Al Qaeda, for instance, then I think the level of tensions are elevated to a different level altogether, and the whole western region may be affected,” says Munhwani.

Managing the risks

At a government level, Munhuwani emphasises the need for cohesive security plans for country borders, and to understand and pay attention to the dynamics within a country – and the continent – that lend themselves to terrorism. “If you have a restless young population, with no guarantee of employment or a good education, then you have laid the ground for terrorism; for a terrorist organisation to manipulate and use people against their own people as well as their government,” he warns, suggesting that it is critical to maintain an enabling environment that supports foreign investment flows and directs these into job creation. For businesses, “Security risk will continue to be an inherent factor when investing/operating in either of these regions over the long-term. This will warrant the use of full political risk insurance for assets against non-commercial risks. Beyond this, there is also the threat to the security of expatriate workers. For companies operating in these regions, security costs will be elevated,” De Villiers notes.

Munhuwani adds the risk and challenge posed by closing borders and import/export embargoes to this list. “In Kenya, at times they have had to close and shut down the borders and the airports, for instance, to avoid attacks at these points. If you are a business reliant on the airport, or are expecting delivery of supplies into the country, you cannot do any business for this period, so it can be a significant disruption to supply chains.”

Planning for continuity

Munhuwani emphasises the need for businesses to stay informed of what is happening on the ground, in the country, and to make use of the tools available to help in surveillance of terrorism and political risk. In the Aon offering, these tools include the Terrorism and Political Risk Map, updated on a regular basis, as well as the Aon WorldAware service, a risk management tool which supplies clients with continuous up to date information on any political-related issues that may take place in a country or region.

He recommends that businesses diversify their risk by not focusing operations in only one country. “If you use Kenya as your hub, make sure that you have support structures and contingency operations in neighbouring countries that will allow you to continue your business from there. Oil companies in Mozambique, for example, anticipate potential issues in Mozambique by investigating the possibility of drilling oil and gas from Tanzania as an alternative.”

“Finally, insurance is another way of transferring the risk,” adds Munhuwani. “Once you have explored all the options, and you can’t contain the risk, then you look to transfer the risk to an insurer to avoid carrying that risk on your balance sheet.” As a final response to the threat posed by terror activity, the world of business operating in Africa would do well to heed and consider the circumstances that enable terrorism to thrive. There is much talk at present of inequality and the risks it poses, Munhuwani notes, but little

being done to convert political rhetoric into action. “I think businesses need to

participate in the conversation and be active because, ultimately, they

stand to suffer – and alternatively to benefit, from peace and tranquillity in the continent. Businesses should not leave it to the government to take a standpoint on some of these issues,” he concludes.

15

Financial crime control

needed to draw investors

By Sarah Bassett

risk assessment. The risk-based approach embraces the ‘know your customer’ guidelines to prevent an organisation from money laundering activity. Marc Anley, risk advisory partner at Deloitte, described the risk-based approach as augmenting a company’s internal rules and compliance processes with an element of common sense towards the assessment of customer risk. Companies can do this by taking into account risk factor elements such as:

Geography e.g. private companies headquartered in offshore tax havens generally require far more scrutiny than publically-traded companies, which typically undergo far more public scrutiny in their day to day operations.Inherent Customer Risk e.g. companies that hide behind layers of legal and jurisdictional complexity are more likely to be trying to hide something.Distribution channels e.g. companies that distribute their goods or services on a face-to-face basis are more likely to be open and transparent than those that do so at arm’s length.

Industry e.g. companies that distribute high risk products associated with terrorism, bribery and corruption such as arms, may require extra levels of financial scrutiny. “Financial crime is dynamic and ever-changing, so an efficient and effective risk-based approach needs to evolve constantly in order to act as an adequate deterrent,” said Anley.

Woods says financial crime needs to be tackled in an integrated manner through close partnerships with local and international regulators as well as the private sector, in order for countries and corporate entities to safeguard against financial risk. “It’s more effective if all the necessary stakeholders in a country present a united front against money laundering and financial crime activity than if they try to act entirely alone,” he emphasised. Financial institutions in particular need to ensure that they have the proper systems, processes and procedures in place to combat financial crime in a cost-effective and sustainable manner that offers both them and their customers a suitable degree of protection.

The conference brought together key stakeholders required to combat financial crime, ranging from banks to regulators and government

representatives, and demonstrated how companies and governments can tackle financial crime through the use of sophisticated technological solutions.

“Financial crime is international and will inevitably migrate to countries where the implementation of anti money laundering regulations is perhaps lagging the rate at which their markets are developing,” said Martin Woods, global head of financial crime for the Regulated Businesses of Thomson Reuters.

“As the risk of financial crime increases, so too does the level of regulatory scrutiny, so it is in the interests of both companies and countries to continually improve their efforts to combat such crime,” he continued.

It is essential that companies operating in Africa learn from the experience of their international counterparts by migrating from a rules-based approach to financial risk and compliance, which Woods describes as ‘box ticking’, towards a risk-based approach that takes a selective attitude towards client

African markets need to tighten measures to combat financial crime in order to boost investor confidence and avoid migration of crime from stricter nations. This was the message at the Anti Money Laundering Conference hosted in Johannesburg by professional services firm, Deloitte, and financial data provider, Thomson Reuters.

16

Margaret Dawes, executive for the rest of Africa, Sanlam Emerging Markets

The United Nations estimates that Africa’s population will surpass 1.5 billion by 2030, making it the world’s fastest growing continent. Couple

this with the increasing income levels and rapid growth of multiple African markets and the motivation for new investments into the region is clear. For early investors, this trend will be a windfall.

Excluding Namibia, Sanlam has been active in Africa (outside South Africa) since its acquisition of African Life in late 2005. This experience has given the group key insights into trends in the financial services sectors of the continent and leaves the group well-positioned to leverage the growing middle class trend.

As Sanlam Emerging Markets (SEM) pursues new partnerships in the diversified financial services sector in order to build on an Africa presence that already spans eleven countries,

Sanlam shares insight into Africa’s middle class

The rise& rise

we have identified four mini-trends that go hand in hand with the rising Africa middle class and make financial services investment into Africa more attractive than ever.

Above average GDP growth prospectsFirst among these is the high growth that emerging markets achieve relative to the developed world. The Africa Development Bank expects gross domestic product (GDP) growth of some 7.4 per cent in West Africa in 2014, with the continent pencilled in for 4.8 per cent. South Africa, meanwhile, looks set to achieve 2.3 per cent GDP growth in 2014.

Most of the African markets we have exposure to are reporting GDP growth rates in the high single digits – multiples of what South Africa achieves. High GDP growth fuels the middle class which in turn underpins a burgeoning consumer-led economy, creating a growth spiral that is evidenced by major infrastructure

17

projects and a boom in cross-border air travel throughout Africa.

Mobile phone penetrationPeople with more money demand more services. Mobile phone penetration across Africa is a godsend for financial services firms as it acts as an enabler for the rising middle class. Technology, the second mini-trend identified by SEM, assists insurers with two processes that are critical for their success, namely distribution (access to product) and the collection of premiums. The rising middle class often have more than one phone, and the impact of smartphone technology and data have yet to be fully felt. Just about everybody in Africa has access to a mobile phone, and SEM has already partnered with a number of cellphone providers to benefit from this trend – technology is a potential game changer.

Consumers throughout Africa can buy

financial products on their mobile phones as well as pay premiums, lodge claims and receive payouts. Product providers meanwhile can use the technology to run cheaper distribution models and achieve wider access.Certain challenges that go hand in hand with selling insurance policies over a mobile phone must still be addressed. Regulators, for example, must be convinced that financial services firms are treating customers fairly at each stage of the business process – from product development to distribution, and on to claims payments.

Political and regulatory stabilityA third significant trend is the shift toward political and regulatory stability exhibited by even the poorest of African economies. Investors have to take political and regulatory uncertainty into consideration before committing capital to a new country. And SEM has noticed improvements in both categories in recent years.

Africa’s rising middle class appears to be broadly supportive of pro-business / pro-consumer regulatory interventions. On the political front, high profile examples include Kenya’s 2013 elections, the peaceful, albeit unsuccessful, challenge of Ghana’s election result by the country’s opposition and most recently the peaceful resolution of Malawi’s election issues.

We have also noticed enhancements to the regulatory regimes in just about all of the countries we operate in. A number of East African countries have taken steps to harmonise financial regulations across the region. It is also encouraging that many sub-Saharan authorities are in contact with South Africa’s Financial Services Board on regulatory matters.” Issues that still need to be addressed include regulatory intervention without sufficient stakeholder consultation and the over reliance by regulators on laws that are appropriate for the operating methodologies of European rather than African insurers.

Increasing trust in insurance productsAnother factor that is critical for financial services success is that consumers trust insurance products more, despite the history of consumer distrust of insurers across Africa.

The trust issue informed Sanlam’s decision not to rebrand the African businesses when it bought African Life in 2005. SEM has subsequently found that entering new markets in partnership with an ‘on the ground’ brand is a faster track to success.

By partnering with a strong local brand, we are able to address the trust issues that consumers have as well as benefiting from their understanding of the local environment. Increasing trust among Africa’s rising middle class is a fourth mini-trend that will drive investment into the region. The rising African middle class is integral to the four mini-trends outlined in this article. These forces combine to create a perfect storm for financial services firms to enter Africa. It is up to companies like SEM – alongside their various country partners – to fine-tune their product offerings and ensure maximum penetration as the African consumer matures.

Historically we have focused on the lower income market with mostly funeral and simple savings type products. We have also identified opportunities in the microinsurance space where we expect good results. One of the challenges that remain is to design sophisticated investment products for the mid and upper-income market given the shortage of appropriate local investment assets.

Whichever country we operate in – and whichever segment of that economy we market to – our success hinges on our ability to work with our country partners to offer value and financial security across the broad spectrum of financial services to the end consumer.

18

Under the theme 2014 Year of Agriculture and Food Security, leaders from across the continent debated the expansion of

agriculture in Africa, as a means of alleviating poverty. The heads of state also adopted a number of ambitious commitments for the next 50 years. Among these were eliminating hunger for all Africans, reducing poverty by half through agriculture, creating job opportunities for at least 30 per cent of Africa’s youth, and tackling under-nutrition in children across the region.

The event also marked 10 years since the introduction of the 2003 Maputo Declaration, which urged African countries to allocate at least 10 per cent of their national budgets to agricultural development. This provided a chance for leaders to deliver feedback on the progress made in this regard.

In the past decade, only eight countries in sub-Saharan Africa have consistently reached the 10 per cent annual public spending target, and on average, African governments allocate just six per cent of their national budgets to agriculture, according to a report by international advocacy organisation, the ONE Campaign. There was positive news to share, however.

“Several countries that significantly increased

By Dominic Uys

The year of AGRICULTURE

The 23rd ordinary session of the African Union (AU) summit held in Equatorial Guinea in June this year focused on a number of key areas for development

on the continent, with particular emphasis on the agricultural sector.

their agricultural investments – such as Burkina Faso, Ethiopia Ghana and Rwanda – experienced tremendous progress, not just in agriculture, but also in economic growth across their economies,” noted Jane Karuku, president of the Alliance for a Green Revolution in Africa, adding that their investments in agriculture have “coincided with major reductions in the percentage of people living in extreme poverty: Burkina Faso by 37 per cent, Ethiopia by 49 per cent; and Ghana by 44 per cent.”

UN involvement

Also during the summit, the Africa Solidarity Trust Fund, managed by the United Nations (UN) Food and Agriculture Organisation, announced support to four new projects in 24 African countries.

UN secretary-general, Ban Ki Moon, stated that the four projects, worth $16 million, will be spread across West, Central, East, and Southern Africa. The projects will focus on youth employment and malnutrition, trans-boundary animal diseases, and food safety and urban food security.

“In Africa we see the growing commitment of countries not only to improving their own food security, but that of their neighbours as well,” said the UN Food and Agriculture

Organisation’s Graziano da Silva. “The Africa Solidarity Trust Fund is a concrete manifestation of Africa’s willingness to work together to guarantee the food security of the entire continent.”

Other summit developments

The summit also focused on the advancement of education, health, trade, women and youth development, with a number of key decisions being made at the event. On the side-lines of the summit, the Department of Trade and Industry convened the third High-Level African Trade Committee meeting, to facilitate fast-tracking of the continental free-trade area and the action plan for boosting intra-African trade.

The summit also established a clear link between security and agriculture. “We need conditions of peace and stability, and for our people not to be under threat from armed gangs, terrorists, human and arms traffickers and poachers,” AU commission chairperson, Dr Nkosazana Dlamini Zuma said.

The assembly adopted the AU Budget for 2015, which amounts to around $522 million. The budget is comprised of around $142 million for operational costs and $379 million for programmes across all of the key areas identified.

19

Africa is tied with Asia as the second-most attractive market in the world for foreign direct investments (FDI) in 2014. This is

an increase from fifth position in 2013 and 2012, and from eighth and third from the bottom in 2011, according to the new Africa attractiveness survey by Ernst & Young (EY). Only North America is considered a more desirable destination for investors. Respondents say that Africa is 60 per cent more attractive as a place to do business than it was in 2012.

EY noted three key trends in previous

Investing in Africa:

By Luka Vracar

Africa’s attractiveness as an investment destination is on the rise, and a 2014 survey by Ernst & Young illustrates the continent’s rapid growth to becoming one of the most desirable investment destinations worldwide. These are the numbers.

The Numbers

Africa attractiveness surveys, and in 2013 those areas continued to influence the positive perceptions placed in the continent. Firstly, FDI into sub-Saharan Africa (SSA) continues to rise, and it reached an all-time high last year with 83 per cent of Africa’s FDI share directed to this region. This is a 4.7 per cent increase in new FDI projects for sub-Saharan Africa.

Secondly, the growing share of intra-regional investment in Africa is encouraged by improving regional value chains and strengthening integration. The share of FDI projects in Africa with other African countries as their source, reached an all-time high of 22.8 per cent last year, and is second to Western Europe as a source for FDI on the continent.

The last shift was a change in sector focus from extractive to consumer-facing industries. Metals and mining, and coal, oil and natural gas, used to be the key sectors of interest for foreign investments, but consumer-related industries have now increased in importance. Technology, media and telecommunications (TMT) has 20 per cent share in FDI projects, whereas metal and mining has only two per cent. Retail and consumer products, financial services and

business services have significantly increased in their shares of FDI projects as well.

Even with 3.1 per cent of FDI projects decreased in North Africa, due to

political instability, and 3.1 per cent decrease in the number of FDI projects, Africa’s share of global projects reached an all-time high last year with 5.7 per cent. Furthermore, the average size of FDI projects increased from $60.1 million in 2012 to $70.1 million 2013.

Sub-Saharan Africa remains key for investments in Africa, with South Africa still considered the top FDI destination. However, Ghana, Kenya, Mozambique, Tanzania, Uganda and Zambia have emerged as desirable destinations as well, with Morocco representing North Africa. Investments in West and East Africa have increased by 28 and 23 per cent respectively. Southern Africa still has the majority of FDI projects, with 33 per cent of Africa’s share – an increase of 14 per cent from the previous year.

The survey points out those investors that are not already established in Africa are not as confident in Africa’s prospects as current investors. Only 39 per cent of non-established investors believe Africa’s attractiveness has improved over the past year, and only 51 per cent of non-established investors think Africa will improve over the next three years. However, EY indicates that the perceptions of the non-established investors are turning in Africa’s favour – improving from last year’s 31 per cent and 47 per cent respectively.

Publication

19

EAST AFRICA

EAST 20

Prior to September last year, terror risk seemed to many Kenyan businesses a remote and low priority risk. However, in the wake of last year’s high-profile

Westgate Shopping Mall attack in Nairobi by Al-Shabaab insurgents, followed by the ongoing sequence of attacks throughout this year, this trend has shifted and demand in the market has surged.

“In response to increased demand, many insurance companies are now developing terrorism insurance for enterprises, domestic and personal covers,” says Christian Ramamonjiarisoa, group director for Afro-Asian Insurance

Insurance cover for terror-related risk in East Africa has increased dramatically as the war in South Sudan wages on and Islamic militant attacks intensify in Kenya, Somalia, Ethiopia and Uganda, pushing the limits of the market’s capacity. A newly launched product will more than double capacity, but some call for further government intervention on the matter.

to Capacity

carry By Sarah Bassett

EAST21

in Eastern and Central Africa, confirming that the market has changed quickly as the threat of terror has become a prevalent reality in the country.

International credit rating agency A.M. Best, confirms that the demand for political and terrorism risk cover has increased tremendously following the Westgate attack. The agency predicts an increase in premium rates across Africa due to the ongoing attacks.

The London-based Afro-Asian Insurance is the regional brokerage representative of Lloyd’s of London and set up regional offices

in Nairobi last year. It was the main reinsurer for Nakumatt’s Westgate Mall branch, which was destroyed during the September attack. The company has now announced a new product to increase the region’s political and terrorism risk reinsurance capacity by more than 220 per cent.

Previously, the maximum insurance risk that regional underwriters could undertake for a single business was Ksh400 million ($4.7 million), but with the new product the risk can be underwritten for up to $15.2 million.

“This additional capacity allows insurance companies to take bigger risks relating to political and terrorism risk, and offers companies and organisations more leeway to increase their investments without the worry of such risks,” says Ramamonjiarisoa. “If the capacity exceeds this amount, we can still transfer the reinsurance to London for up to $40 million,” he adds.

The new product will come as a relief to regional insurance companies, who have been facing capacity challenges to insure large risks. It also means local insurers do not have to seek for reinsurance services for such risks abroad, a move that has contributed to capital flight from Africa, notes Ramamonjiarisoa.

Souvik Banerjea, senior marketing officer at the African Trade Insurance Agency (ATI), notes that awareness of political risk had been on the increase since the post-election violence of 2008, when looting and rioting caused extensive damage to property.

Demand in the Kenyan market began increasing from the start of 2013 in the lead up to national elections, driven by individuals as well as businesses.

“Consumers have learned the hard way

that their vehicle’s comprehensive insurance cover does not include the terrorism and political risk element,” Banerjea says. In the run-up to the 2013 election, the spike in demand was so severe that political risk premiums went up by 100 per cent, with rating agencies raising the risk of operating in Kenya.

“It is our feeling that the government should involve itself actively and make this insurance a compulsory add-on with property and motor insurances. This is the only way to generate more spread and revenue, and thereby bring down the prices,” he continues, calling on the government to step in and create a fund or encourage the setting up of a terrorism pool, where all premium collected from such insurance could be shared, and policies set up for equitable compensation.

According to the 2014 Aon Risk Solutions Terrorism and Political Violence Map, 46 per cent of East Africa region is rated as high or severe risk in both categories. The report suggests that terrorism is the predominant risk reinforced by the internationally high profile attack on the Westgate Mall in Nairobi. The inability of the Government of Somalia to establish its influence in the country underpins to the continued high terrorism threat across the region, according to Aon.

Kenya’s risk rating is four, which is considered high, the same rating given to Uganda, Ethiopia and Burundi. South Sudan is rated five, which is severe, as is the Democratic Republic of Congo and Somalia. Rwanda and Tanzania are rated two, which is considered low.

22EAST

The report presents key findings from the 2013 survey and asks captive executive and non-executive directors for their opinions on the rankings of

various risks and findings as identified by over 1 400 risk decision-makers including risk managers, CFOs and CEOs globally, representing over 100 organisations from a broad range of countries, revenue sizes and business sectors.

Most notably, more than half of the research

Business leaders significantly underrated global terror risk in 2013. This was a key finding of the Aon Risk Solutions 2014 Underrated threats report, Aon’s first research report into the perceived importance of risks as seen by captive directors and is a follow-up to the 2013 Global Risk Management Survey.

risk of terrorThe underrated

respondents stated that the ranking of 46 in the 2013 report was too low for terrorism risk. “Not a day goes by without news of political unrest and terrorist attacks which are taking place all over the globe, destroying lives and disrupting businesses, but it seems that the world has become de-sensitised to such news as these events are now occurring with regular frequency and may soon be regarded as a normal part of our lives,” comments Darlington Munhuwani, regional controller for Aon Sub-Sahara Africa.

“Based on the research in the 2014 Underrated threats report, it appears larger organisations place a much lower priority on this risk which leads us to the belief that they are better prepared for such events and have appropriate measures in place to address and manage the impact of human and economic loss to their organisations, either through insurance or business continuity planning. But can any of us be fully prepared for these events and have the capacity to carry the risk in our balance sheets?” he asks.

“Given that this is a global report, we need to consider more closely the relevance of the findings to what is happening in Africa. From an African perspective, there can be no denying that the threat of terrorism or political risk is real. The ranking of country risk ranges from medium to severe in 43 out of 54 countries on the continent. This has significant implications for multinational and Africa-based businesses in terms of their risk

management strategies, business continuity plans and decisions on where to deploy their capital. Risks arising from civil unrest and terrorism had limited effect on business 10 to 15 years ago, this is no longer the case,” Munhuwani adds.

The war in South Sudan and terrorism threat by the Al-Shabaab in Somalia, Kenya and Uganda, political instability in the Central African Republic and Boko Haram activities in Nigeria, are key political and terrorism issues facing regional and multinational businesses as they seek to increase their African footprint. The report authors suggest that these risks have, and will, continue to have a negative impact on the flow of foreign direct investments and expansion plans of most companies.

“This constellation effect of, or interconnectivity between risks, might not always have been recognised by organisations but could have a significant impact on their approach to risk management and overall business performance,” concludes Munhuwani.

Anton Roux, CEO: Aon South Africa, explains:

“This award follows a number of innovative risk management and insurance solutions, empowering human and economic possibilities for our clients to help them achieve sustainable growth, continuity and profitability. Aon has the largest majority-owned network in Africa, servicing clients in 45 out of 54 countries.”

Best Global Insurance Broker in Africa for 2013*

* Aon received the Best Global Insurance Broker in Africa award from Global Finance magazine in its 2013 Best Global Insurers Awards.

Partner with Aon

Partner with Aon – put us to the test.

Call 0860 453 672 or SMS** ‘Africa’ to 31762 or visit aon.co.za

Aon South Africa (Pty) Ltd is an Authorised Financial Services Provider (FSP #20555). Aon is the Principal Sponsor of Manchester United.

** Standard rates apply.

Risk. Reinsurance. Human Resources.

#AskAon

Aon07273_1_E.indd 1 2014/06/10 9:11 AM

24EAST 24

EAST AFRICA NEWS

East Africa most affordable region for start-upsEast Africa has been revealed as the most affordable region in sub-Saharan Africa to start-up a business, according to research from venture capital group Savannah Fund.

The survey considered six countries regarded as ‘key’ on the continent – Ghana, Kenya, Nigeria, South Africa, Tanzania and Uganda. It compared costs of start-ups in their first year, including administrative costs (sales, business, permits, legal, accounting and travel), office space, as well as hiring of staff.

SEM acquires $24.3 million stake in Rwanda’s Soras GroupSanlam Emerging Markets (SEM) has acquired a 63 per cent stake in Rwanda’s largest life and non-life insurance company, Soras Group. The acquisition is valued at $24.3 million.

The transaction will see Sanlam doing business directly for the first time in Rwanda, which has one of the fastest growing economies on the continent. The Kigali-based Soras Group was established in 1984 and has over the years maintained a strong growth record, a strong brand and a well-established local management team.

“Rwanda is an attractive market because of the low insurance penetration rate and the country’s economic growth prospects. We believe Sanlam has the requisite technical expertise and experience which will add value to the business,” says SEM’s chief executive officer, Heinie Werth.

The country’s average real growth rate was 8.2 per cent a year from 2000 to 2012, with its current GDP approximately $7 billion. There are currently eight industry players, including three new entrants – Radiant, BRITAM and UAP, both from Kenya.

Zep-Re gets $4 million AfDB equity injectionNairobi headquartered specialist reinsurer Zep-Re (PTA Reinsurance company) has had its request for an additional $4 million equity investment from the African Development Bank (AfDB) approved.

The request was submitted to the AfDB as part of the final phase of Zep-Re’s capital base increase programme. The company intends to use this additional funding to support the next phase of its strategic business plan, which seeks to expand its reinsurance services in Africa and, more generally, to foster the development of the

insurance and reinsurance industry on the continent

The AfDB’s investment will be used to expand Zep-Re’s capital base from $79 million (end 2012) to $143 million by the end of 2014. This is expected to boost the company’s credit rating.

The AfDB says that Zep-Re’s capital base increase project will contribute to the development of the insurance and reinsurance industry in the region; boost the company’s underwriting capacity; and ensure it is better placed to meet regional insurance sector needs. This additional capacity will also help to drive down retrocession costs and will improve overall risk coverage.

According to the research, infrastructure is cheapest in East Africa. Administrative costs and human resources also come cheaper than in competing regions including West and Southern Africa. South Africa is seen as the most expensive country in Africa for startups.

With regard to costs of paying engineers, costs in East African countries, Kenya and Uganda were lowest overall, with average total costs slightly below $30 000 in Uganda and $35 000 in Kenya. Tanzania however recorded $50 000 average cost.

The majority of start-ups from Kenya apply for financing with a financial technology idea.

the world’s specialist insurance marketJoin Lloyd’s South Africa and participants from the Lloyd’s market at our Meet the Market event during The Insurance Conference Southern Africa event at Sun City on 27-30 July 2014.

At the Meet the Market event, meet:

• Abelard Underwriting Agency• Amlin• Arch Underwriting Managers• Ark Underwriting• Arthur J. Gallagher• Camargue Underwriting Managers• Catlin• CFC Underwriting• Chaucer• Factory & Industrial• Hiscox• Natsure• Novae• Praesidio Risk Managers• RFIB• Talbot Underwriting

To register for the IISA conference, visit www.iisa.co.za

Find out about Lloyd’s in South Africa

www.lloyds.com/southafrica

John Linda Sibanda, General RepresentativeTelephone +27 (011) 505 0000

facebook.com/lloyds

Follow us on Twitter: @LloydsofLondon

lloyds.com/linkedin

8273 SA AIO Ad A4 Photo AW.indd 1 12/05/2014 14:48

26SOUTH

Southern Africa’s game:

By Sarah Bassett

high reward?

high risk,

SOUTHERN AFRICA

SOUTH27

Rare-game breeding is a rapidly growing sector in several Southern African markets, enticing savvy investors and businesspeople. But if ever there was truth to the

truism ‘high risk for high reward’, this is it. RISKAFRICA takes a look at the risks, returns and insurance options for this intriguing high-growth sector.

In the last two years, in particular, the values of rare game animals in South Africa have exploded, driving a self-perpetuating surge in interest and demand, and the Namibian market looks set to follow suit. Rare species such as buffalo, sable, roan antelope, tsessebe or Livingstone eland, and rare colour variations such as golden wildebeest and black impala, are highly sought after among game farmers, breeders and a widening pool of investors.

“Up until as recently as two or three years ago, the very exotic bloodlines were largely kept and traded between a few individuals and there was little broad market interest in these animals,” explains Donald Munro, managing director of specialist wildlife insurer, Animalsure. “But this has shifted, with many investors buying into animals and breeding programmes in order to drive returns through breeding and reselling for profit, rather than only to hold for trophy hunting,” Munro explains.

There are varied theories for what precisely has driven the shift, but most agree that increased interest from foreign buyers, coupled with increased awareness of the industry and new mechanisms for opening investment opportunities to a variety of buyers, has driven the increased demand. “Foreign

If you had thought to buy a black impala four years ago, it would have set you back around

R40 000 (US$4000). Today, you could sell that same animal for close to R400 000 (US$40 000). Had you bought a few and bred them,

well, we’re talking retirement.

buyers in particular are able to inject large sums into the market, given their currency advantage. Three to four years ago, if there was a R15 million or R20 million turnover at auction, it was considered exceptionally successful. An auction this year saw a R150 million turnover,” Munro says.

While Namibia remains a small market by comparison, a lift on border regulations this year has allowed the transport of live animals from South Africa into Namibia. With South African farmers and investors drawn by the reduced cost of land, Munro reports that the change has already driven an increased variety of game into the market. “Where Namibia used to be purely a hunting and biltong market, there are now more and more farmers getting involved with the more exotic species rare breeding. Last year, Namibia saw its highest game auction turnover yet at US$2.5 million where previously the average was around US$100 000 to US$300 000. The Namibian breeding market is definitely on the way up,” notes Munro.

Investment options

Becoming an exotic game owner is now easier than you might think and does not necessarily require that you own your own farm, vehicles or employ specialist staff. For those who do not have the capital or other practical prerequisites, there are investors who syndicate by pooling investor money to buy game. Investors can also simply buy into a breeding programme on an established game farm.

The risks

As with any investment that offers the possibility of significant returns, the risks are correspondingly extreme. “A prospective investor must realise that the investment is made by buying live animals and that brings about a number of risks,” notes Wehann Smith, managing director of Kuda Insurance. These risks include death from illness, predation, poaching and theft, all of which can be included in a standard all-risk policy. “In the case of rhino specifically, poaching poses a major risk, which is insurable but at a considerable premium.”

“Cashing in on your investment in game does not merely entail calling your stockbroker and getting your price and money upon settlement being completed. When selling game you have to physically capture the animals and move them to auction or to the buyer’s farm.

Roan antelopes

28SOUTH

Capture and transport causes stress to the animals which can lead to death,” he adds.

“The reality is that the animals that promise the highest return – the ones with the unusual colour variants – are rare and valuable precisely because they are so vulnerable and high risk.” The highest risk is during the capture and transit stage. “These are not animals that come from generations of being captured by man, so it is extremely stressful for them,” Munro explains.

After relocation, the first 14 days in which the animal adapts to the new environment remain extremely high risk. “These two stages account for our highest risk and claims ratio and the greatest portion of the premium is allocated to these,” says Munro. “The interaction with humans is very stressful as is the acclimatisation to a new habitat, perhaps a more controlled or restricted environment, can be too much for them. This is why we place certain restrictions on animals and relocations. For instance, we do not cover oryx being moved from the Kalahari to the North West because the species does not adapt to the bushveld-type habitat. With black impala, we restrict movement to nothing beyond 200 kilometres because anything more is just too much and the animals do not adapt.”

Once an animal has made it through the first 14 days of readjustment, risks decrease significantly, at which point the standard all-risk mortality policy is applied. A further risk for investors is that of price movement, warns Smith. “The price of game has been moving up constantly in recent years

across a wide range of species. There is always a possibility that supply could outstrip demand for a specific species and prices will then go down. Price risk is not an insurable risk.”

In Namibia, certain risks are much reduced, while others are exacerbated. “From a geographical point of view there are far fewer diseases and less climate risk, so from that point of view the market is a better risk for us. On the other hand , the country is vast and there are fewer highly qualified vets available. If disease breaks out in South Africa, you can make a call to four or five vets in your area who can reach you within an hour. In Namibia, it will take a couple of days to get to your farm. So, controlling an outbreak is much more difficult in countries like Botswana and Namibia,” says Munro. It is due to a shortage of veterinary skill that Animalsure has not entered Mozambique.

Most valuable species to invest in

“In our experience sable, buffalo and colour variants like saddleback, king wildebeest, black and white impala are most valuable and fetch the highest returns,” says Anthony Jackson, divisional manager of commercial insurance at One Insurance.

“There are a lot of new species and variants. In general, the most expensive animals remain rare buffalo and sable and, on average, these animals remain the primary investment opportunity. The risks with these animals also tend be lower, so from an outsider’s perspective this makes them most attractive,” Munro comments.

Insuring your investment

When it comes to risk, value and the calculation of premium – no two animals are ever the same. “There are no two animals in any species that are exactly the same and therefore there could not be a standard insurable value across any species,” Smith explains. “The first base used for insuring game is the prices being achieved on game auctions. Generally the insurable value is the value for which an animal was bought or sold on auction.”

“Animals can be insured only for a year or any shorter period agreed to by both parties. When the period expires there are a number of factors taken into account if there is a request for renewal. Firstly, the average market price for similar animals would be taken into consideration. Secondly, consideration would be given as to whether the animal has risen in value because of factors such as horn growth. Another consideration is the age of the specific animal. Age adds value to an animal up to a certain point; the animal could be in the productive breeding phase. Past this and age starts to deplete the value, as older animals pose a higher risk of death,” he continues.

“We require the clients to complete a proposal form and submit their game register with any and all supporting documentation such as DNA certificates, animal profiles and identification of the animals. We will take into account the management styles of the farms; the claims and losses history; the lightning and fire risks; what species to be insured and the values. We would ascertain whether the client is a full-time breeder or a ‘weekend’ breeder. In some cases, we would appoint an assessor to evaluate the farm and the management style; the camp system; feeding and watering; and any additional risks,” Jackson explains.

Note to the broker

“The wildlife insurance market is definitely growing. We face a lot of issues: lack of historic knowledge, specialist support, claims assessing, brokers who are not specialists in the market or who lack knowledge on the product. This often results in incorrect information being supplied to the client via the broker,” notes Jackson.

Brokers and clients need to understand the product and what the conditions are, they need to follow the claims procedures. Once an animal dies, there is a limited time to extract samples for pathology reports. The weather is also a determining factor in how long the carcass stays viable for sample collection, he cautions.

As with all form of specialist cover, brokers should be selective and rather than cover based on premium, they need to consider what cover best suits the needs of the client and their risk.

The new integration is the result of an alignment to

the overall objective of the company, one that sees

it broaden its to both current clients and

intermediaries of Mutual & Federal and Old Mutual

Namibia.

The main objectives are to define a shared, clear

and streamlined vision of the company, which will

enable it to build on its portfolio of products and

continue its aim of being the leading financial

services franchise in Africa; one which can clearly

identify, communicate and harness sources of value

and therefore benefit clients in the long- and short-

term.

Sakaria Haufiku Nghikembua, the former Chief

Executive Officer of Operations at Old Mutual

Namibia, was appointed as the new head of the

Old Mutual short-term insurance division in July of

last year. On his appointment, he declared: “I feel

privileged that I have been accorded the opportunity

of serving our customers and the Old Mutual Group

in this new role. I look forward to providing added

value to our customers and other stakeholders,

as we strive to build a dynamic and responsive,

integrated, financial services provider of distinction

in Namibia.”

What will happen to current policy holders of

Mutual and Federal?

Whether clients have comprehensive short-term

insurance cover, business, or farmers’ insurance, all

Mutual & Federal policies will remain active without

Together with the peace of mind that comes from

knowing that their policies remain unchanged,

clients of Mutual & Federal can also look forward to

a host of product enhancements and new product

launches under Old Mutual.

According to the company, these changes include

an added range of tailored insurance packages

for customers and intermediaries alike, while still

providing the same competitive premium rates that

are currently available for personal, company and

agri-business insurance.

Says Mr. Nghikembua: “Combined, Old Mutual

Namibia and Mutual & Federal will deliver a full-

service to customers, ranging from investment and

long-term insurance management to short-term

insurance; while the resulting synergistic operation

and focus will ensure additional value to current

and future stakeholders across both companies.”

In this time of growth, while flexibility and value are

fundamental, another positive change for clients of

the new operating sector is in place. Whilst Mutual

& Federal branches and offices will still remain the

chief points of access for clients of that company,

Old Mutual Namibia Advisors and Broker Houses

will be available to their clients, in order to add to

the ease of submitting claims. The latter will also

provide information about the new extended range

of policies and by Old Mutual Namibia,

for both long- and short-term dealings.

With this innovation, Old Mutual Namibia promises

to deliver immense value to their customers, brokers,

employees and to the business in general.

To broaden its insurance offering, Old Mutual, one of the leading investment and insurance companies in the world, has now integrated its Mutual & Federal short-term business into its main operations.

“Combined, Old Mutual and Mutual & Federal will deliver a full-service

ranging from investment and long-term insurance management to short-term insurance.”

FULL CIRCLEINSURANCEOld Mutual Namibia is bringing long-term vision into short-term insurance

Visit www.oldmutual.com.na or call 061 207 7111.

30SOUTH

Accuracy and

abnormal loads

Sub-Saharan Africa has witnessed a steady increase in projects that require cover for special and oversized cargo. A softening insurance market may, however, make the underwriter’s task more challenging.

By Dominic Uys

SOUTH31

Steffen Siljeur, marine underwriting and business development manager at Mutual & Federal, explains that a new development in the industry has been

the notable upsurge in new renewable power generation projects in South Africa, Botswana and Namibia. With this, overland shipping of abnormal and oversized components via South Africa has also been on the increase.

“The real challenge has been to make sure that the various projects are correctly underwritten and what we have been doing at Mutual and Federal is coordinate the various components for these projects in-house from an insurance perspective. Our marine cover for the components coming in from China or Europe ties in with our engineering department and we have done a lot to become a one-stop provider for these kinds of projects in terms of cover,” he says.