Risk Register - chubb.com · Risk Register A new study of the ... Watches, jewellery, antiques and...

Transcript of Risk Register - chubb.com · Risk Register A new study of the ... Watches, jewellery, antiques and...

Risk Register

A new study of the risks facing wealthy customers and their families.

Contents

Introduction from Tara Parchment: Protecting our clients 5

Defining the world of the wealthy 6

Physical risks: Home and family 12

Online risks: Click for intrusion 16

Claims case studies 18

The importance of appraisals 20

Conclusions and recommendations 22

Introduction

Protecting our clients

How can we help? That’s what we ask ourselves time and time again. How can we help affluent clients protect their lifestyle and support them in fulfilling their ambitions and aspirations? How can we help them protect the people and possessions that matter most? The answer is to understand the people we look after.

Research like this Risk Register is just one of the ways in which we gain the knowledge we need. We’ve spoken to hundreds of affluent individuals in the UK, Ireland and France about their lives and the things that concern them. This gives us an opportunity to reaffirm what’s important to our clients – their fundamental values – but also to understand how they believe the threats to their worlds are evolving. We all know that social and technological changes are relentless. What’s harder to grasp is how these changes manifest themselves in the daily lives of wealthy individuals and their families.

Yes, technology brings with it new concerns, new exposures, but the threat of physical and mental harm, combined with the core risk of property damage, still occupy a central place in the thoughts of these individuals.

Our clients have worked long and hard to build a lifestyle and an environment in which they and their families can thrive. By working closely with our broker partners, we seek to protect that lifestyle.

This latest study, conducted in partnership with independent research experts Longitude, paints a picture of a world in a state of flux, yet with many familiar themes.

Tara Parchment Head of European Personal Risk Services

We approached over 500 affluent individuals in the UK, Ireland and France to ask them for their views on their lifestyle and the risks they perceive to it. We also wanted to know more about their insurance-buying decisions.

The result is a comprehensive picture of individuals struggling to weigh up the impact of emerging risks while still being highly attuned to more traditional threats.

Those who took part in our survey were predominantly aged 25–44. Two-thirds of them are male, one-third female. Over half (57%) live in London and the south east of England (see chart 1 and 2).

The study

Respondent profile

Chart 1: Country and Region

6

France 30%

Republic of Ireland 10%

UK 60%

Defining the world of the wealthy

London

South East

Leinster

Munster

South West

Yorkshire and Humberside

West Midlands

Ulster

East of England

North East

North West

East Midlands

48%

9%

8%

3%

6%

3%

5%

3%

5%

3%

5%

2%

When asked about the source of their wealth, the overwhelming majority (90%) have earned most or all of their net worth, while 9% are the recipients of an inheritance.

In terms of the level of wealth accumulated, disregarding their properties, most (80%) indicate their net worth is in the region of £1m–£7.49m (see chart 3).

Chart 2: Age & Gender

Chart 3: Income/ Net worth

7

Risk Register

18-24

£1 - £1.49 million

25-34

£1.5 - £2.99 million

35-44

£3 - £4.99 million

45-54

£5 - £7.49 million

55-64

£7.5 - £9.99 million

65-74

£10 million and more

75+

3%

15%

27%

25%

38%

24%

16%

16%

10%

10%

6%

9%

1%

All or moslty earned

All or mostly inherited

Other (1%)

Which of the following best describes your overall net-worth (excluding the property you live in)?

90% 9%

35% are Female

65% are Male

35%

65%

8

Property is a significant asset for affluent individuals. Three-quarters told us that during the course of a year they live in between one and three homes – most pointing towards traditional houses and apartments or flats as their residences.

The combined value of these properties is considerable. Most respondents estimate their portfolio of properties to be worth in the region of £10m–£49m (see charts 4 and 5).

Bricks and mortar

Chart 4: Properties in UK/ Europe/ Outside Europe

In aggregate, how much would you say your residential properties are worth?

Chart 5: Types and net worth of Properties

1%

93%

6%

31%

68%

1%

51%

49%

0%

within the UKProperties are:

None

1- 3

3 - 5

within the Europe outside of the Europe

Appartment or flat Country home

Urban / suburban house Seaside / other holiday home

58% 29%

67% 41%

< £10m

£10m - £29m

£30m - £49m

£50m or more

30%

36%

26%

9%

9

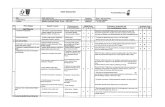

Chart 6: Valuable assets

While the bulk of these individuals’ wealth manifests itself in the form of property, many have used their wealth to acquire collections of items that clearly have emotional significance for them, often called ‘passion assets’.

Art is the most frequently sought-after purchase: over three-quarters of those who took part in our survey (77%) said they own valuable paintings or sculptures. Watches, jewellery, antiques and luxury handbags also feature highly as do wine and, of course, classic

cars and motorcycles. Notably, over half (57%) said they own a high value supercar while approaching half (44%) have acquired literature of significance such as rare books and comics (see chart 6). One complexity frequently exhibited by affluent individuals is that their valuable possessions are often housed in more than one property. Just over half of those collecting antiques (51%) house them in multiple locations, which could be outside the UK.

Possessions

Yes No

Art- e.g. paintings/sculptures etc. 77% 23%

Watches 73% 27%

Jewellery/precious metals and stones 69% 31%

Antiques – e.g. furniture, ornamental 63% 37%

Luxury/designer handbags 62% 38%

Wine 60% 40%

Clothing and fashion (Haute couture) 57% 43%

Classic cars/motorcycles 57% 43%

High value supercars 57% 43%

Literature (Book/magazine collections – incl. comic books)

44% 56%

Other (please specify) 1% 99%

Risk Register

Do you have collections of the following assets that you would describe as valuable and/or important to you? (Yes/No)

Perhaps most tellingly, the cost of the insurance cover is not one of the principle factors in the decision-making process.

there is considerable scope for growth for intermediated insurance sales in this market.

‘‘

’’

10

One of the most notable aspects of our survey is insurance buying behaviour.

Just under half (47%) continue to use online price comparison sites and aggregators offering what may be unsuitable products. Just over two-thirds told us they frequently buy direct from an insurance company. Only 19% said they currently buy insurance using a broker. While this illustrates the degree of competition brokers are currently facing, it also suggests there is considerable scope for growth for intermediated insurance sales in this market (see chart 7).

The reason for the sample group’s affinity for comparison sites is not wholly apparent. They express a strong preference for a straight-forward purchase process and access to an online portal. It may be that, in their minds, these features are most immediately associated with online aggregators.

Considering these buying behaviours, it comes as no surprise, then, that from an insurer’s perspective many affluent individuals lack cover for the significant risks that affect them.

Less than one-third (30%) thought they had insurance protection for the kidnap of a family member while less than half (49%) believed they had liability cover for their family. For a demographic exposed to the potential of these particular risks, this seems a dangerous oversight.

If price is not the key factor, this raises the question of why so many affluent individuals use comparison sites when their circumstances and requirements might be better suited to a specialist. The answer may be that they are simply unaware of alternative channels, which suggests brokers have an important role to play in educating these individuals.

So if price isn’t a factor, what is influencing buying behaviours? Ease of cover for what were described as ‘unusual items’ ranks highest in their thoughts. Generous and flexible limits matter, as does a lack of exclusions to their ‘all risks’ cover. Notably, these are all product features around which the broker’s expertise and experience have a valuable role to play when arranging the most suitable cover to meet customer needs.

Buying insurance

Just under half (47%) continue to use online price comparison sites and aggregators offering what may be unsuitable products

47%

11

The challenge

What our research shows is that the challenge for both Chubb and our broker partners is to strive to help affluent individuals and their families appreciate the value of specialist, bespoke insurance, which will protect their world. The individuals we protect have worked hard to build a lifestyle and an environment in which they and their family can thrive. Standard insurance

bought from an online comparison site will not necessarily suffice; neither will a copycat product coupled with a ‘drive-by’ appraisal.

A life less ordinary demands insurance protection of an entirely different calibre. A specialist broker, working in partnership with a skilled underwriter, is best placed to deliver it.

A life less ordinary demands insurance protection of an entirely different calibre.

‘‘

’’

Risk Register

Chart 7: Insurance Purchase Patterns

How do you currently purchase insurance? Please tick more than one.

Directly from the insurance company

From a broker

Shop around using a comparison site/ aggregator

From an insurer via their agent

Shop around and buy from individual insurers who are specialist in specific areas

7%

19%

64%

47%

30%

12

A 2017 analysis reported by The Daily Telegraph and other national newspapers showed that while both London and New York have populations of around 8 million, this latest data suggests a family is almost six times

more likely to be burgled in the British capital than in the US city, and one-and-a-half times more likely to fall victim to a robbery. Some experts have cited declines in neighbourhood patrols in the UK as a factor 2.

Crime Survey of England and Wales - https://www.ons.gov.uk/peoplepopulationandcommunity/crimeandjustice/bulletins/crimeinenglandandwales/june2017#main-points

BBC report of CSEW - http://www.bbc.co.uk/news/uk-41677046

Daily Telegraph comparison of London-New York crime - http://www.telegraph.co.uk/news/2017/10/20/london-now-dangerous-newyork-crime-stats-suggest/

The Crime Survey of England and Wales (CSEW) is one of the most important ways in which the British government assesses the level of criminal activity in the country. The latest survey from October 2017 revealed a 13% increase in recorded crimes on the previous year, pushing the total number of crimes over 5m for the first time. This constitutes the largest annual rise in a decade and continues a recent trend of crime increases.

The Office for National Statistics reported crime categorised as ‘violent’ rose by 19% in 2017, with rises in offences including stalking and harassment. With the number of violent crimes against adults estimated at 1.2m incidents, this means that for every 100 adults in England and Wales, two were the victim of some form of violent crime.

In tandem, police-recorded offences of ‘violence with injury’ rose by 10% to just under 0.5m crimes. It is also worth noting that, in 2014, an estimated one-in-three violent crimes reported to police were not ultimately recorded as such. This means that the true level of violent crime could be higher than reported.

Stalking and harassment, a crime to which prominent and high-status individuals are particularly vulnerable, was only recorded separately by police from 2015 onwards. This new category resulted in 64,924 crimes being recorded with harassment offences specifically rising 17% 1.

Physical risks: Home and family

London more dangerous than New York?

If you’ve got money, you are aware that people will want to take it away from you. Collectively, the world is a more dangerous place than it was five years ago.- Larry Tucker, private collector

‘‘’’

1

2

(...) for every 100 adults in England and Wales, two were the victim of some form of violent crime.

‘‘

’’

London more dangerous than New York?

Against this picture of rising recorded crime, we asked our group of affluent individuals to tell us about their perception of risk.

Overall, it is clear that the group feels increasingly vulnerable. When asked to consider a variety of environments – home, work, travelling – on average, 28% feel more vulnerable than five years ago while only around 16% feel less vulnerable (see chart 8).

Asked to think beyond their home and contents, aggravated burglary remains their primary concern. The prospect of violent home invasion is the single most pressing worry, scoring nearly twice as highly as kidnap and ransom, the risk ranked second in our survey. This is understandable considering the series of high profile incidents of aggravated burglary that have made headlines in recent years.

13

Main concerns

Risk Register

When asked to consider a variety of environments – home, work, travelling – on average, 28% feel more vulnerable than five years ago (...)

(...) only around 16% feel less vulnerable.

28%

16%

When considering risks to you and your family, where do you feel more or less vulnerable compared to five years ago?

Chart 8: Customers perception on risks to self and family

At home

Online

On holidays

Away on business

32%

32%

26%

23%

53%

56%

56%

57%

15%

11%

18%

19%More vulnerable About the same Less vulnerable

Ranking second in our study, kidnap is clearly a concern, although the number of kidnappings and abductions in the UK remains relatively low. Official figures are not readily available although in 2014, the UN Office on Drugs and Crime estimated the UK had a kidnapping rate of 3.5 kidnappings per 100,000 people, placing it tenth in its global league table.

It should be stressed, though, that this ranking only included countries for which data was available. If travelling to certain areas of the world such as Central or South America, parts of the Middle East and Africa, the kidnapping rate may be considerably higher3.

Families from countries where violent home invasion is prevalent tend to be more aware of specialist insurance. A wealthy British family may not have thought about this type of insurance.- Mark Robertson, CEO, wealth manager

‘‘

’’

With a Chubb Signature policy, clients receive a number of benefits under the kidnap and ransom section. We cover the professional fees and expenses relating to:

• Professional negotiation and security consultancy

• PR management and consultancy• Cost of living, medical and lawyers

expenses• Lost salary In the painful event of a child’s abduction, Chubb would provide financial assistance to pay for the specialist services and support necessary to resolve the situation as quickly as possible. If the client felt unable to work during the incident or medical expenses were incurred, Chubb would pay for these, too.

As part of our service, we provide advice and guidance about how to deter violent criminals and also how to stay as safe as possible during an aggravated burglary. Some of that advice includes:

• Create a safety zone between yourself and callers – install heavy-duty door chains, spyholes and a voice intercom.

• Beware of distraction crime – a second caller whose arrival or requests distract your attention from a first caller.

• If confronted in your home, act passively and be careful about what you say.

• Co-operate but do not initiate anything. Do not inadvertently cause violence by saying something like ‘Don’t hurt me’.

• In a prolonged robbery, try to humanise yourself in the intruder’s eyes. This will lessen the chance of violence.

PACT child abduction figures for UK - http://www.independent.co.uk/news/uk/crime/child-kidnap-andabduction-increase-as-crimes-come-under-greater-scrutiny-10062014.html Red24 global kidnap hotspots - https://www.red24.com/pdf/red24_Special_Risks_-_Global_Kidnapping_Hotspots_2017.pdfGlobal kidnap rates - http://www.theglobaleconomy.com/rankings/kidnapping/

3

14

Advice for policyholders

For any parent, the prospect of images of their child circulating online or being shared on phones is a worry, even if it’s their child who’s doing the sharing. Images displaying a particular lifestyle swapped innocently between friends can take on a whole different hue if they fall into the wrong hands. Worse still, more intimate images shared between teenagers and young adults can cause problems for the sender as well as opening up both sender and their family to the risk of extortion or bullying.

While not the prime concern for affluent individuals, so-called cyber risks posed a significant worry for our sample group. Affluent families are particularly vulnerable to this type of activity because their high profiles make them visible to criminals as well as susceptible to threats of extortion based on reputational damage. Just under a quarter (23%) feel their status makes them a target for extortion, while 16% believe it places them and their family at risk of cyber bullying (see chart 9) 4.

16

Online risks: Click for intrusion

Chart 9: Risks beyond home and content

As a high net worth individual, and thinking about the present moment in time, please rank the the top three types of risks beyond home and contents that concern you now.

Aggravated burglary/ violent home invasion

Identity theft

Kidnap and ransom Terrorism and political violence

Damage to your reputation

Extortion Personal liability (e.g. as an estate owner)

Cyber bullying Commercial liability (e.g. as a company director)

Fraud and embezzlement Carjacking

Rank 1 Rank 2 Rank 3

31% 10%

16% 4%

5%

12% 2%

8% 1%

10% 1%

8% 15%

4% 12%

10%

13% 11%

8% 3%

11% 6%

7% 17%

15% 7%

8%

9% 5%

10% 4%

16% 2%

According to internet security company McAfee, one-in-three children has been the victim of online bullying.

Affluent individuals are only too aware of this risk. In our survey, cyber bullying is flagged as a clear concern for them as is identity theft and extortion, much of which takes place online. 2017’s CSEW noted that there were 3.3m incidents of fraud over the year in England and Wales, 57% of which related to new technology and the connected environment.

Of course, the problem is not restricted to children. Adults can also find themselves the victims of online scams and abuse.

One of our clients was alerted to a webpage that had been published with the sole intention of tarnishing her reputation.

This is why Chubb provides generous cover for costs associated with tackling online crime and its longer-term impact on our clients and their families. Necessary expenses could involve changing schools, psychological counselling, even engaging a law firm to act on our client’s behalf. All of these are included in our policy. We can also pay for the services of cyber security experts, public relations professionals and skilled lawyers to ensure our client’s reputation remains intact 5.

17

Risk Register

Ten years ago, the advice around children was to ensure they did not use computers while alone in their rooms. Today, this has changed. Children can now access the internet via a multitude of devices in numerous locations, which has moved the emphasis to educating them about the risks posed by online activity.

Thinking about cyber bullying specifically, here are six valuable pieces of advice from one of our expert security consultants, Peter French from Gold Command:

• Tell the bully to stop. Clearly and in writing. The aggressor needs to be informed that their behaviour is unacceptable.

• Keep evidence of the bully’s activities. Save any emails. Take screenshots of Facebook or Twitter posts. Note the date and time received.

• Block the bully from being able to contact the victim via phone or social media. Most privacy settings have this functionality.

• Most internet service providers (ISPs) will shut down online bullying via email domains or message boards which use their networks. For example, you can contact BT at [email protected].

• If you suspect your child is a victim, threatening to take away their phone or gadgets may deter them from being honest with you.

• Although cyber bullying is not currently a crime in the UK, harassment is. Harassment is ‘causing alarm or distress’ or putting a person ‘in fear of violence’. Should the bully issue a threat, this is also a criminal offence. The police can be involved.

Online crime and aggressive behaviour has the potential to undermine our clients’ efforts to build a safe and comfortable environment for their families. We will do our utmost to help ensure these risks do not occur. If they do, we will take action quickly and decisively to help undo that damage.

Keeping safe online

One-in-three children has been the victim of online bullying.

1/3

Sexting major worry for parents - http://www.telegraph.co.uk/education/2016/07/20/sexting-now-a-biggerconcern-to-parents-than-smoking-or-alcohol/

NSPCC and McAfee data - https://www.nspcc.org.uk/preventing-abuse/child-abuse-and-neglect/ online-abuse/facts-statistics/

BT’s contact email address for bullying - http://home.bt.com/tech-gadgets/internet/how-to-deal-with-fraudulentemails-11363932621450

4

5

6

At the very heart of an insurance product is the promise to indemnify – to return our client’s life to the state it was in before he or she had to make a claim. Rapid payment of the claim itself is, of course, a major part of this.

But lives are more than physical assets. Sometimes traumatic events cause physical and mental harm that is slow to heal. This is where Chubb with its holistic approach truly excels.

18

Claims case studies

19

Aggravated burglary

Carjacking

Our Masterpiece client and his wife were entertaining friends at home when two knife-wielding intruders forced their way through the front door. Violence was threatened unless the safe was opened. Fearful of the consequences of refusing, our client complied. The intruders also took cash and jewellery from everyone, plus laptops and ornaments. When a scuffle broke out, our client and his guest sustained serious knife wounds.

The Chubb response

Our client received payment in full for everything stolen within days of the incident. As the total claim was over £10,000, no excess was due. Because of the comprehensive nature of our cover, their guests also received full payment for their stolen jewellery and cash. In order to offer reassurance to our clients, we paid £4,000 for an immediate security review of their home. Bills for urgent medical treatment and recuperation expenses while the client and his guest were off work were met. Chubb also paid for psychiatric counselling for all victims.

Late one afternoon, while driving abroad with their young family, our clients, were subjected to a violent carjacking in which their Mercedes was stolen. Injured in the attack, both clients needed hospital treatment. The husband was discharged within a few hours, but his seriously injured wife was taken to a private hospital for further treatment and recuperation.

The Chubb response

Chubb paid £53,000 ‘agreed value’ for the Mercedes – with no deductions and no excess as the vehicle was not recovered. Possessions stolen from the car were also covered. We paid medical bills for our client’s treatment and recuperation, totalling £6,500. One of our clients was unable to return to work immediately and required counselling, so we paid a further £14,500 for psychiatric services and loss of salary. As the family was away from home, we also paid £4,000 for them to rent accommodation to be close while the wife recuperated.

Risk Register

One of the most fundamental differences between a standard insurance product and the type of bespoke all-encompassing coverage provided by Chubb is the degree to which we engage with the client to protect their lifestyle.

We use our technical expertise, our significant experience of this market and our mass of claims data to analyse every aspect of a client’s lifestyle and their specific risks. Once we’ve gained an intimate understanding of their risk profile – in part through a physical appraisal conducted by one of our team – we offer advice and guidance. And even if, after all our efforts, our client needs to make a claim, we handle it quickly and with care, making every effort to pay within 48 hours of settlement.

Typically, an insurer of affluent clients will conduct an appraisal of the client’s property as part of the underwriting process. But not all appraisals are created equal.

At Chubb, we conduct comprehensive face-to-face appraisals that include buildings, outbuildings, land, furnishings, possessions – in other words, everything our client considers important to them. Importantly, we also use the opportunity to review security – something that’s clearly relevant bearing in mind the respondents’ concerns about aggravated burglary.

The appraisal is vital for several reasons. It allows us to value assets accurately so that, should a claim be made, the replacement value of the item has been agreed in advance, hence no delays or unpleasant surprises.

Appraisals also allow us to assess the risks to which the client’s assets and lifestyle are vulnerable. We can then provide detailed and informed risk management advice such as moving an oil painting away from a hot spot in a wall or strong sunlight that could fade it. We may also recommend adding a ‘duress code’ to a safe so that it sends a silent alarm should the client be forced to open it.

20

The importance of appraisals

Nothing left to chance

Any insurer can write a cheque; at Chubb, our goal is to stop the claim before it happens.

‘‘

’’

Unusual items our appraisers have seen in recent years include Errol Flynn memorabilia, equipment used in the development of X-rays and smoking paraphernalia collected by a lung surgeon.

‘‘

’’

Finally, during an appraisal we conduct a security review in which we can advise on safety and any recommended precautions. We have a number of expert security consultants available to offer support in this area.

Our team of expert appraisers come from a variety of professional backgrounds including the worlds of art and antiques, so are able to fully engage clients in conversation about their treasured collections. Unusual items our appraisers have seen in recent years include Errol Flynn memorabilia, equipment used in the development of X-rays and smoking paraphernalia collected by a lung surgeon. These conversations, as you can imagine, are often the start of an enduring relationship with client, broker and insurer.

21

Risk Register

Appraisals are one of the most significant ways in which we build trust between ourselves and the insured – something our research flags as an important purchasing factor.

Conclusions and recommendations: The keys to a safer world

Based on this research and our analysis of the findings, these are the key points we want to share with our broker partners and their clients.

Affluent clients need specialist cover

The lifestyle and consequent risk profile of an affluent individual is markedly different to that of most people. A standard home and contents policy, even with higher than usual limits, is not necessarily designed to meet their requirements. Nor will the service standards behind that policy be suitable. This presents a real opportunity for brokers.

Spread the word

We and our broker partners must strive to help affluent individuals understand the benefits of buying a specialist product designed explicitly for their lifestyle and needs. Currently, too many potential clients remain unaware of the existence of these solutions and their considerable benefits.

Specific covers matter

As this study shows, affluent individuals have some very specific concerns when it comes to policy coverage. Aggravated burglary and kidnapping consistently rank highly in their thoughts as do online threats. Reputational damage is also a risk to which this group is particularly exposed because of their status.

Praise the appraisal

A thorough appraisal of the client’s security arrangements, property and contents is critical to the overall success of the insurance solution.

Without a proper face-to-face appraisal, underwriters may lack the information necessary to ensure adequate cover is in place and provide risk management guidance. This, in turn, allows us to restore a client’s world to order as quickly as possible should they make a claim.

Safety matters

Physical risks to family and home remain a major concern. The prospect of violent attack and its resultant physical and psychological harm is understandably paramount in wealthy clients’ assessment of the risks they face. Financial compensation will help after the event, but ensuring clients are aware of the risks in advance and take necessary steps to protect themselves is the most important service we can provide.

Chubb protects what matters most

Building a life isn’t easy. It’s about finding the perfect home; creating a world in which children can blossom and grow; enjoying the results of years of hard work. It’s finding time for relationships and the people who matter most. It’s indulging those passions that enrich and enliven.

At Chubb, we understand what it takes to build that world. That’s why so many clients choose to make us part of theirs.

So by partnering with Chubb and our years of expertise in this demanding sector, we help your business grow by ensuring your clients are perfectly covered.

22

All content in this material is for general information purposes only. It does not constitute personal advice or a recommendation to any individual or business of any product or service. Please refer to the policy documentation issued for full terms and conditions of coverage. Chubb European Group Limited registered number 1112892 registered in England & Wales with registered office at 100 Leadenhall Street, London EC3A 3BP. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Full details can be found online at https://register.fca.org.uk/

UK7315-JD 01/18

Chubb

The Chubb Building 100 Leadenhall Street London EC3A 3BP United Kingdom

T +44 (0)20 7173 7000 chubb.com