Rice Midstream Partnerss2.q4cdn.com/444921097/files/doc_presentations/2015/RMP...2 Investment...

Transcript of Rice Midstream Partnerss2.q4cdn.com/444921097/files/doc_presentations/2015/RMP...2 Investment...

1

Rice Midstream PartnersInvestor Presentation

March 2015

2

Investment Highlights 141K net acres in the dry gas cores of the Marcellus and Utica with 13+ year inventory in each area

Top-tier well results generate single-well returns of 55-64%; PV10 breakevens below $3 NYMEX

100% of 2015 production covered by firm sales and transportation

100% of RMP acreage dedications are located within the dry gas core of the Marcellus Shale

Substantially all of RICE’s drilling locations within the RMP dedication are within 5 miles of the current PA system and within 2 miles of the system at year end 2015

RICE’s concentrated position + multi-well pad drilling = minimal RMP capex to meaningfully increase gathering capacity

Expectations unchanged from IPO despite drop in gas prices

RMP expects to grow throughput ~60% in 2015

Significant growth expected from contracted third party dedications from top tier producers

MLP cash flow driven by scalable dry gas throughput and protected with 100% fixed fee contracts

Throughput driven by RICE’s well protected growth and conservative rig program

Visible, top tier distribution growth

E&P Sponsorship with RICE

Strategically Located Midstream Assets

Rapid Organic Growth

Predictable Cash Flow Profile

RMP has a ROFO on RICE’s OH gas gathering system and PA and OH fresh water distribution systems

RICE OH gathering expects to grow throughput to ~200 MDth/d in 2015

Expect to continue to grow third party gathering and water dedications

Drop Down Potential

3

Premier E&P Sponsorship – RICE

DE

PA Gathering & Compression

OH Gathering & Compression OH WaterPA Water

IDRs

50%LP interest50% LP interest

Non-economic GP Interest

RICE owns 100% of the GP and IDRs and a 50% LP ownership, creating alignment between RMP and RICE

ROFO Assets

$300 mm Credit Facility

$450 mm Credit Facility

Rice Midstream Holdings LLC

Rice Midstream Management LLC(General Partner)

Public Unitholders

__________________________Note: Ownership percentages assume no shoe exercise.

4

Rice Midstream Partners – MLP Overview

GATHERING SYSTEM INFORMATION12/31/14

DedicatedGross

Acreage

4Q 2014 Throughput

(MDth/d)

2015E EBITDA ($MM)

2015E Capex ($MM)

PA Gathering 86,000 517 $ 55 – 60 $ 180

Marcellus Gathering and Compression Initial assets consist of gas gathering system

with expected capacity of 4.1MMDth/d by YE15 Gathering throughput driven by SW PA technical

leaders ~85% of 2015E estimated throughput

from RICE operated volumes, ~15% from 3rd party, primarily EQT

RMP will spend $90MM to install compression in 2015 that will start generating revenue in 2016

Adding incremental compression capacity for third party volumes starting in 1H 2015

Installing compression for RICE in 2H 2015

RMP will spend $85MM to build 30 miles of gathering pipeline in 2015

SYSTEM MAP

Greene

Washington

MarshallFayette

Ohio

Brooke

Beaver PENNSYLVANIA

OHIO

WEST VIRGINIA

Legend

RMP Gathering Pipeline to be ConstructedRICE Acreage

RMP Gathering Pipeline

3rd Party Dedicated to RMPPre-existing 3rd Party Dedication

Wetzel

Beaver

Jefferson

Brooke

Substantially all of RICE’s drilling locations will be within 2 miles of gathering pipeline by year end 2015

5

3rd Party Midstream Dedications – RMPSYSTEM MAP

Greene

Washington

MarshallFayette

Ohio

Brooke

Beaver PENNSYLVANIA

OHIO

WEST VIRGINIA

Legend

RMP Gathering Pipeline to be ConstructedRICE Acreage

RMP Gathering Pipeline

3rd Party Dedicated to RMPPre-existing 3rd Party Dedication

Wetzel

Beaver

Jefferson

Brooke

Commentary

• 3rd party gathering dedications ~21,000 gross acres dedicated 4Q 2014 production of 44 MDth/d

(11% of total RMP throughput)• Contracted high quality third party operators

with active development programs• 3rd party dedications differentiate RMP from

recent E&P sponsored MLP IPOs

3RD PARTY DEDICATION SUMMARY

PA

Dedicated Acreage 21,000

Gatherer RMP

Shipper EQT/AR/RRC

4Q 2014 Throughput (MDth/d) 44

Contract Term ~6 years (wtd. avg)(1)

Gathering/Compression Fee $0.43/$0.07

__________________________1. Calculated based on weighted average historic throughput.

RMP’s assets are well positioned to capture 3rd party growth

6

Drop Down Opportunities Overview Overview of Assets

__________________________1. RICE and GPOR have entered into an LOI for RICE to gather certain portions of GPOR’s dry gas acreage in Belmont County.

Assets include OH gas gathering and PA/OH water sourcing and distribution

Gathering throughput driven by SE OH technical leaders

~80% of 2015E estimated throughput from RICE operated volumes, ~20% from GPOR(1)

OH gathering system will be attractive drop-down candidate for RMP (RMP has a ROFO on RICE’s OH midstream system)

RICE will spend $30 MM to build ~30 miles of gathering pipeline and $120 MM on compression

RICE will spend $60MM to complete the build-out of our fresh water distribution systems in PA and OH

SYSTEM INFORMATION12/31/14

DedicatedGross

Acreage

4Q 2014 Throughput

(MDth/d)

2015E EBITDA ($MM)

2015E Capex ($MM)

OH Gathering 57,000 74 $ 10 – 11 $ 150

Water NA NA $ 25 – 29 $ 60

Greene

Washington

Belmont

Marshall

Fayette

Ohio

Brooke

Beaver

Hancock

JeffersonHarrison

Monroe

PENNSYLVANIA

OHIO

WEST VIRGINIA

Legend

RICE Acreage

RICE Gathering Pipeline RICE Gathering Pipeline to be Constructed

3rd Party Dedicated to RICEPre-existing 3rd Party Dedication

RICE Water Pipeline RICE Water Pipeline to be ConstructedRICE Water Interconnects

Wetzel

Building significant retained midstream value

7

Industry-Leading Throughput GrowthDec. 2014 throughput of ~682 MDth/d through RICE and RMP midstream systems (14% 3rd Party), represents a 286% increase since Jan. 2014 average throughput

• RMP System: 584 MDth/d (8% 3rd Party)• RICE OH System: 98 MDth/d (49% 3rd Party)

RMP and RICE OH Midstream Historical Throughput

–

100,000

200,000

300,000

400,000

500,000

600,000

700,000

10/17/10 3/17/11 8/17/11 1/17/12 6/17/12 11/17/12 4/17/13 9/17/13 2/17/14 7/17/14 12/17/14

Dth/d

RMP - Rice Operated (PA) RMP - 3rd Party (PA) RICE - Rice Operated (OH) RICE - 3rd Party (OH)

Long wall undermining temporarily shut-In ~60 MMcf/d

Average Throughput (MDth/d)

2010 2011 2012 2013 2014Throughput 4 18 61 176 409YoY Growth 405% 238% 188% 133%

(1)

__________________________1. PA 3rd party volumes as of April 2014 close of Momentum asset acquisition.

8

RMP Financial Overview

CAPITALIZATION AND LIQUIDITY AT 12/31/14 2015 GUIDANCE

2015 Capital Budget (in millions)

Gas Gathering 85$ Compression 90$

Total Expansion Capex 175$ Maintenance Capex 5$ Total Capital Expenditures 180$

Adjusted EBITDA (in millions) 55$ 60$ % Third Party

Distributable Cash Flow (in millions) 48$ 53$ Average DCF Coverage Ratio 1.1x 1.2xAnnualized Distribution ($ per unit)

Guidance

20%

$0.75

Leverage StatisticsDebt / EBITDA N/AEBITDA / Interest nmDebt to EBITDA Covenant 4.75

Liquidity SummaryRevolving Credit Facility $450Less: Amount Drawn --Availability Under RCF $450Plus: Cash On Hand 27Liquidity as of 12/31/14 $477

$ millions, except per share data, as of 12/31/14Common Units (MM) 29Subordinated Units (MM) 29

Total Units Outstanding 58Price as of 12/31/14 $16.75

Market Capitalization $963Debt –Cash 25

Enterprise Value $938

RMP Units Owned

% of RMP Units - Public 50%% of RMP Units - RICE 50%% of RMP IDRs - RICE 100%

9

RICE Overview

10

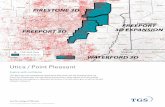

Concentrated, Core AssetsCORE ASSETS

Monroe

Harrison

Greene

WashingtonBelmont

Fayette

Monongalia

Utica Core

Marcellus Core

COMPANY TOTAL

OHIO

PENNSYLVANIA

Highly concentrated position of ~141,000 net acres in the cores of the lowest breakeven gas shale plays in the U.S. ~1,230 net undeveloped locations 398 MMcfe/d net 4Q14 production from 83 net wells Breakeven NYMEX PV-10 of $2.35-$3.05 / MMBTU

~55,000 net Utica acres, <1% developed 356 net undeveloped Utica locations 7 net (3 operated) producing Utica wells

RICE FT & MIDSTREAM

~86,000 net Marcellus acres, <5% developed 495 net undeveloped Marcellus locations 382 net undeveloped Upper Devonian locations 81 net producing wells (78 Marcellus, 3 Upper Devonian) Drilling first Pennsylvania Utica well

FT: 1.3 MMDth/d of firm capacity: 65% to Gulf Coast and Midwest markets by Q1’15 80% by Q4’17 RMP Midstream by YE2015: 4.1 MMDth/d gas gathering

capacity RICE Midstream by YE2015: 2.6 MMDth/d gas gathering

capacity and 25.9 MMgpd of water distribution__________________________(1) Net undeveloped locations as of 12/31/14. Approximately 77,000 net acres in the Marcellus Shale is also prospective for the Geneseo (Upper Devonian) Shale. The Upper Devonian and the Marcellus Shale are stacked formations within the same geographic

acreage and footprint. See slide entitled “Additional Disclosures” on detail regarding RICE’s methodology for the calculation of locations.(2) Conversion of Dth to Mcf assumes 1,050 Btu factor.

RMP Gathering PipelineRMP Gathering Pipeline to be Constructed

RICE OHIO Gathering PipelineRICE OHIO Gathering Pipeline to be ConstructedRICE Acreage

Legend

Marshall

Wetzel

Fayette

Ohio

Brooke

BeaverHancock

JeffersonHarrison

Monroe

Utica Stack Potential

11

Deep Inventory of High Returning Projects

Inventory and Returns SummaryLow breakevens between $2.35-$3.05/MMBtu = profitable returns throughout the commodity price cycle

Net Locations 356 139 302NYMEX PV-10 Breakeven ($/MMBtu)(1) $2.60 $3.05 $2.35

__________________________Note: See appendix for summary of assumptions used to generate single well IRRs.1. See appendix for a detailed explanation of adjusted midstream fees. Marcellus 750’ economics assume E&P is burdened by 50% of the gathering and compression fee (RICE owns a 50% LP interest in RMP and owns 100% of the IDRs) . W. Greene

economics assume E&P is burdened by 100% of the gathering and compression fee (RICE acquired W. Greene assets which were previously dedicated to a third party).Utica Dry 750’ economics assume E&P is not burdened by gathering and compression fee (RICE owns 100% of RICE’s OH midstream assets).

2. Basis assumption = 9% of NYMEX, Firm Transportation cost (“FT”) assumption = $0.52/MMBTU and Heat content uplift (“BTU”) assumption = 1050 MMBTU/Mcf. Marcellus heat content = 1050, W. Greene = 1090, Utica Dry = 1080.

NYMEX($/MMBTU)

IRR

$1.84 $2.32 $2.80 $3.28 $3.75 $4.23Realized (FT+Basis+BTU $/mcf) (2)

7% 24%

49%

81%

121%

171%

8% 27%

53%

88%

132%

13%

32%

56%

87%

124%

168%

–

25%

50%

75%

100%

125%

150%

175%

200%

$2.50 $3.00 $3.50 $4.00 $4.50 $5.00

12

TETCO

TCO

DTIDEO

REX

ET Rover

–

200

400

600

800

1,000

1,200

1,400

1/1/15 1/1/16 1/1/17 1/1/18 1/1/19 1/1/20

Average FT & FS Portfolio (BBtu/d)2015 2016 2017 2018 2019 2020

PA Only 256 207 207 207 189 142 OH Only 135 182 225 275 275 275 Flexible 423 529 579 841 841 841 Total 813 918 1,011 1,323 1,305 1,258

Firm Transportation and Firm Sales Portfolio

RICE was early in identifying and securing its basin-leading portfolio of firm capacity Firm capacity covers ~100% of 2015 and a significant portion of RICE’s volumes in 2016-2018

Firm Transport De-Risks Production Growth

BBTU/D

13

$483

$300 $450

$229

$27

$712

$300

$477

–

$100

$200

$300

$400

$500

$600

$700

$800

Rice Energy Rice Midstream Holdings Rice Midstream Partners

Cash

AvailableRevolver

Ample Liquidity and Financial Flexibility RICE is capable of funding 100% of 2015 capital plan with liquidity on-hand Favorable credit metrics & covenants ensure flexibility

Cash & Revolver Capacity

Debt/EBITDA Covenant NONE 4.25x 4.75xQ4 Debt/RR EBITDA 2.6x 0.0x 0.0x

EBITDA/Interest Covenant 2.5x 2.5x 2.5xLTM EBITDA/Interest 7.0x NM NM

(E&P)

(1)

__________________________(1) E&P Cash Balance.

$MM

14

Industry Activity Underscores Rice’s Core Position

In the wake of declining commodity price and downstream infrastructure constraints, Appalachia activity has migrated to the most economic counties

We are the only operator with an acreage position in the top 3 counties (Washington, Greene, Belmont) 100% of our capital is invested in these 3 counties

0

2

4

6

8

10

12

14

WAS

HING

TON

BELM

ONT

GREE

NEMO

NROE

HARR

ISON

DODD

RIDG

ESU

SQUE

HANN

ABU

TLER

CARR

OLL

BRAD

FORD

LYCO

MING

TYLE

RNO

BLE

GUER

NSEY

WYO

MING

TIOG

AME

RCER

JEFF

ERSO

NCO

LUMB

IANA

MCKE

ANFA

YETT

EAL

LEGH

ENY

LAW

RENC

EW

ESTM

OREL

AND

CAME

RON

ELK

POTT

ERRI

TCHI

EHA

RRIS

ONTA

YLOR

MARS

HALL

WET

ZEL

MONO

NGAL

IAOH

IO

March 2015 Rig Counts By County

10+ Rigs

County Activity Levels

6-10 Rigs3-6 Rigs1-2 Rigs

Rice Acreage

PAOH

WV

Rice’s upstream and midstream assets are centered within the most resilient counties in Appalachia

Appalachia Rig Activity (1)

_______________________Source: Rigdata.

15

RMP & Rice Market SnapshotRice Midstream Partners LP

(NYSE: RMP)Rice Energy Inc(NYSE: RICE)

__________________________1. As of December 31, 2014.

$ millions, except per share data, as of 3/6/15 Management Ownership 30%

Shares Outstanding (MM) 136 Price as of 3/6/2015 $18.76

Market Capitalization $2,557 Cash(1) 229Revolving credit facilities – 6.25% Senior notes due April 2022 900

Enterprise Value $3,228

52 Week Price Range High $34.34Low 16.04

Website: www.riceenergy.comInvestor Contact: Julie Danvers

$ millions, except per unit data, as of 3/6/15Common Units 29Subordinated Units 29

Total Units Outstanding 58Price $14.00

Market Capitalization $805Cash(1) 27Revolving credit facility –Debt –

Enterprise Value $778

52 Week Price RangeHigh $18.02Low 13.35

RMP Units Owned% of RMP Units - Public 50%% of RMP Units - RICE 50%% of RMP IDRs - RICE 100%

Website: www.ricemidstream.comInvestor Contact: Julie Danvers

16

Appendix

17

Midstream System Statistics

__________________________1. Fees will be annually escalated based upon changes in the Consumer Price Index. Compression fees are derived on a per stage basis 2. Assumes that gathering and compression fees for OH services are equivalent to those to be paid by RICE to RMP for gathering and compression for Pennsylvania assets. The gathering and compression fees for OH services are subject to negotiation and

final agreement and may ultimately be changed.3. Certain of RMP’s third-party contracts provide for an increase in the gathering fee we will receive upon completion of construction of an 18-mile, 30 inch pipeline connecting its gathering system to TETCO (completed November 2014)4. Certain of RMP’s 3rd party agreements, the per stage fees charged for compression varies depending on line pressure as opposed to being a flat fee per stage. Accordingly, the 3rd party compression fee is shown on a wtd avg based on historical throughput.

RMP Assets at IPO

Marcellus (PA) Utica (OH)

Gathering and Compression Statistics Gathering and Compression StatisticsYE14 YE15 YE14 YE15

Gathering and Compression StatisticsGas Gathering Pipeline Mileage (miles) 81 111 Gas Gathering Pipeline Mileage (miles) 21 50

Design Gathering Capacity (MMDth/d) 3.2 4.1 Design Gathering Capacity (MMDth/d) 0.5 2.6

Acreage Dedications Acreage DedicationsRICE 65,000 RICE 37,4003rd Party 21,000 3rd Party 19,600Total Acreage Dedications 86,000 Total Acreage Dedications 57,000

Midstream Fees Paid by RICE to RMP ($/dth) (1) Midstream Fees Paid by RICE to RICE OH ($/dth) (1) (2)

Gathering $0.30 Gathering $0.30Compression (per stage of compression) $0.07 Compression (per stage of compression) $0.07

3rd Party Midstream Fees ($/dth) 3rd Party Midstream Fees ($/dth)Gathering (3) $0.43 Gathering undisclosedCompression (4) $0.07 Compression undisclosed

Water Distribution System Statistics Water Distribution System StatisticsYE15 YE15

Water Distribution System StatisticsConnected Water Sources (MMGPD) 9.2 Connected Water Sources (MMGPD) 16.7

18

RMP Gathering System Build-out

RMP’s midstream system has grown significantly since 2013

As of 12/31/14, constructed 81 miles of gathering pipelines

System will be substantially complete by YE 2015

YE 2015 Mileage: 111 miles YE 2015 Total Capacity 4.1 MMDth/d

Substantially all of RICE’s drilling locations within the RMP dedication will be within 2 miles of the completed PA gathering system

2011 2012

2013 2014 2015E

2010 2011 2012 2013 2014 2015RICE AcreageDedicated to RMP

RICE AcreageDedicated to 3rd Party

Greene

Washington

Greene

Washington

Greene

Washington

Greene

Washington

Greene

Washington

SUMMARY

19

Right of First Offer – RICE PA + OH Water Systems

__________________________Note: RMP’s potential acquisition of the fresh water distribution systems will be conditioned upon RICE obtaining a ruling or interpretive guidance from the IRS that income from fresh water distribution services is qualifying income for federal income tax purposes.1. In PA, water usage per well based on 7,000’ lateral, 200’ stage spacing (35 stages) and 378,000 gallons per stage. In OH, water usage per well based on 8,000’ lateral, 200’ stage spacing (40 stages) and 399,000 gallons per stage.

OVERVIEW OF ASSETS

WATER DISTRIBUTION SYSTEM INFORMATION

SystemConnected Sources

(MMGPD)

Water Usage perWell

(MMGal) (1)

Pennsylvania 9.2 13

Ohio 16.7 16

Total 25.9

RICE is expanding two independent fresh water distribution systems to service PA and OH completions operations Partially in-service now and expect both

PA and OH systems to be fully constructed by YE2015

Water distribution system is a more cost efficient method to transport fresh water than trucking and minimizes operational delays due to greater certainty of water availability and elimination of truck traffic

We expect RICE will use these systems to complete substantially all of their wells going forward

Building the system beyond RICE’s water completion needs, given its expectation to contract 3rd party business

PA and OH Water Asset Description

Water Pipeline Water Pipeline to be Constructed RICE Acreage

WetzelUtica

Marcellus

PAOH

Greene

Washington

Monroe

Marshall

HarrisonJefferson

Ohio

Brooke

Hancock Beaver

AlleghenyCarroll

Belmont

Monongahela RiverWithdrawal

Ohio RiverWithdrawal

Water Impoundment Water Impoundmentto be Constructed

20

–

2.0

4.0

6.0

8.0

10.0

12.0

14.0

16.0

– 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0750' Avg. Historical Production 750 Type Well

–

2.0

4.0

6.0

8.0

10.0

12.0

14.0

16.0

– 1.0 2.0 3.0 4.0

Utica Type Well Utica Avg. Historical Production

Single Well Production Profile – Marcellus, Utica

__________________________1. Not applicable to RICE’s 500’ spaced Marcellus wells. Normalized production excludes six 750’ spaced wells; five due to suboptimal spacing to offset producing wells and one well excluded because majority of lateral was drilled in suboptimal zone (second

Marcellus well in RICE’s history). Data has been adjusted to reflect only producing days See appendix for more details on 500’ spaced Marcellus wells

Marcellus Type Well Versus Historical Production (Normalized for 7,000’ Lateral) (1)

Utica Type Well Versus Historical Production (Normalized for 8,000’ Lateral)

• Marcellus – production profile supported by 3+ years of historical production• Utica – initial wells performing better than RICE’s best Marcellus wells

Cumulative Production1 year 3.8 Bcf2 years 5.6 Bcf5 years 8.2 Bcf10 years 10.3 BcfEUR 13.9 Bcf

MMcf/

d

Type curve defined by 3+ years of historical production

Rate and pressures from initial wells are expected to outperform type curve

Restricted Rate

Years

Cumulative Production1 year 5.2 Bcf2 years 7.8 Bcf5 years 11.3 Bcf10 years 14.2 BcfEUR 20.0 Bcf

MMcf/

d

Restricted Rate

21

Efficient Production Growth Demonstrates Production Potential

__________________________1. Horizontal Marcellus wells only. Data for RICE based on actuals through 11/30/2014, peer data based on Pennsylvania Department of Environmental Protection production reports through June 30, 2014. RICE production excludes acquired CHK wells.

MMcf/d Production versus Wells - Top 10 Marcellus Producers in Pennsylvania(1)

• RICE’s peer-leading production growth is driven by a focus on well quality, not quantity• RICE reached 500 MMcfe/d of gross operated Marcellus production with fewer wells than every other operator(1) in Pennsylvania• Chart below demonstrates RICE’s ability to rapidly grow production with a clear path to 1 Bcf/d+ and beyond

Producing Well Count

Peers: APC, CHIEF, CHK, COG, CVX, EQT, NFG, RRC, SWN, TLM

SW PA Operators

NE PA Operators

72 Operated Marcellus Wells

22

DisclaimerFORWARD-LOOKING STATEMENTSThis presentation and the oral statements made in connection therewith may contain “forward looking statements” within the meaning of the securities laws. All statements, other than statements of historical fact, regarding Rice Midstream’s strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. These statements often include the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Without limiting the generality of the foregoing, forward-looking statements contained in this presentation specifically include expectations of plans, strategies, objectives, and anticipated financial and operating results of Rice Midstream and RICE. These forward-looking statements are based on Rice Midstream's current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Rice Midstream assumes no obligation to and does not intend to update any forward looking statements included herein. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements described underthe heading “Risk Factors” included in the prospectus. These forward-looking statements are based on Rice Midstream’s current belief, based on currently available information, as to the outcome and timing of future events. Rice Midstream cautions you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond their control, incident to the exploration for and development, production, gathering and sale of natural gas, natural gas liquids and oil. These risks include, but are not limited to, commodity price volatility, inflation, lack of availability of drilling and production equipment and services, environmental risks, drilling and other operating risks, regulatory changes, theuncertainty inherent in estimating natural gas reserves and in projecting future rates of production, cash flow and access to capital, the timing of development expenditures, and the other risks described under “Risk Factors” in the prospectus. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, Rice Midstream’s actual results and plans could differ materially from those expressed in any forward-looking statements.This presentation has been prepared by Rice Midstream and includes market data and other statistical information from sourcesbelieved by Rice Midstream to be reliable, including independent industry publications, government publications or other published independent sources. Some data are also based on Rice Midstream’s good faith estimates, which are derived from its review ofinternal sources as well as the independent sources described above. Although Rice Midstream believes these sources are reliable, it has not independently verified the information and cannot guarantee its accuracy and completeness.

23

Determination of Identified Drilling Locations as of December 31, 2014

Net undeveloped locations are calculated by taking RICE’s total net acreage and multiplying such amount by a risking factor which is then divided by RICE’s expected well spacing. RICE then subtracts net producing wells to arrive at undeveloped net drilling locations

Undeveloped Net Marcellus Locations: RICE assume these locations have 7,000 foot laterals and 750 foot spacing between wells which yields approximately 121 acre spacing. In the Marcellus, we applies a 20% risking factor to its net acreage to account for inefficient unitization and the risk associated with its inability to force pool in Pennsylvania. As of 12/31/14, RICE had 64,355 net acres in the Marcellus which results in 356 undeveloped net locations

Undeveloped Net Western Greene County Locations: RICE assumes these locations have 7,000 foot laterals and 750 foot spacing between wells which yields approximately 121 acre spacing. In Western Greene County, RICE applies a 20% risking factor to its net acreage to account for inefficient unitization and the risk associated with its inability to force pool in Pennsylvania. As of 12/31/14, RICE had 22,000 net acres in Western Greene County which results in 139 undeveloped net locations

Undeveloped Net Upper Devonian Locations: RICE assumes these locations have 7,000 foot laterals and 1,000 foot spacing between wells which yields approximately 161 acre spacing. In the Upper Devonian, we applies a 20% risking factor to its net acreage to account for inefficient unitization and the risk associated with its inability to force pool in Pennsylvania. As of 12/31/14, RICE had 77,242 net acres prospective for the Upper Devonian which results in 382 undeveloped net locations

Undeveloped Net Utica Locations: RICE assumes these locations have 8,000 foot laterals and 750 foot spacing between wells which yields approximately 138 acre spacing. In the Utica, RICE applies a 10% risking factor to its net acreage to account for inefficient unitization. As of 12/31/14, RICE had 55,000 net acres prospective for the Utica in Ohio which results in 356 undeveloped net locations. This excludes ~2,500 net acres in Guernsey and Harrison Counties in Ohio

Additional Disclosures