Revised FM Jai

-

Upload

umar-suleman -

Category

Documents

-

view

18 -

download

3

description

Transcript of Revised FM Jai

LATEST TOOLS AND TECHNIQUES OF FINANCIAL MANAGEMENT

Dr. Navita Nathani

Head, Management,

Chief Coordinator EDC

Prestige Institute of Management, Gwalior

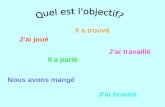

Overview of the subtopics

Brief introduction Goal Need Why Valuation Tools of Wealth maximization and SVC Empirical evidences Tools of Working Capital Management Empirical evidences Tools of Capital Budgeting Conclusion

Introduction

With the liberalization of Indian economy, the Indian corporate world has found itself in an environment where it has to contest with the market forces, large corporations with significant brand equity and also follow different resource strategies and practices.

India faces the task of not only integrating itself with the rest of the world, but more importantly, of understanding future global trends to work towards finding a place among the leading economies.

GOAL

It is widely accepted that the primary aim of the firm is to maximize the wealth or it is generally agreed that the goal of the firm should be Shareholders Wealth Maximization

From the economist's viewpoint, value is created when management generates revenues over and above the economic costs.

Costs come from four sources: employee wages and benefits; material, supplies, and economic depreciation of physical assets; taxes; and the opportunity cost of using the capital.

It is therefore more important to know the variables which influence value addition.

NEED

Today, financial managers play a dynamic role in solving complex problems like

Shaping the fortunes of the enterprise, Decisions regarding allocation of capital, Raising of funds most economically and using them in the most

efficient and effective manner. Because of this change , the descriptive treatment of the subject of

financial management is being replaced by growing analytical contents. The subject now accords a far greater importance to management

decision-making and policy. Hence new tools in financial management emerged. It comprises of

Tools and techniques in Financial Analysis, Profit Planning and Control

Long-term Investment or capital budgeting DecisionsWorking Capital Management

Why Value Addition Creating value for shareholders is now a widely accepted corporate

objective. The interest in value creation has been stimulated by several developments.

Performance measurement (qualitative or quantitative) is the key to value addition

Capital markets are becoming increasingly global. Investors can readily shift investments to higher yielding, often foreign, opportunities.

Institutional investors, which traditionally were passive investors, have begun exerting influence on corporate managements to create value for shareholders.

Corporate governance is shifting, with owners now demanding accountability from corporate executives. Manifestations of the increased assertiveness of shareholders include the necessity for executives to justify their compensation levels, and well-publicized lists of under performing companies and overpaid executives.

Greater attention is being paid to link top management compensation to shareholder returns.

Valuation tools

Creating shareholder value is the key to success in today's marketplace.

There is increasing pressure on corporate executives to measure, manage and report the creation of shareholder value on a regular basis.

In the emerging field of shareholder value analysis, various measures have been developed that claim to quantify the creation of shareholder value and wealth.

Financial Performance Measurement Traditional Vs New Economic Measures ROE, ROI, EPS, NOPAT, and OP. New measures are given by different

consultant from time to time It include lot many approaches

Marakon Approach

Marakan Associates, an international management-consulting firm founded in1978, has done pioneering work in the area of value-based management.

This measure considers the difference between the ROE and required return on equity (cost of equity) as the source of value creation.

ALCAR APPROACH

The Alcar group Inc. a management and software company, has developed an approach to value-based management which is based on discounted cash flow analysis. In this framework, the emphasis is not on annual performance but on valuing expected performance. The implied value measure is akin to valuing the firm based on its future cash flows and is the method most closely related to the DCF/NPV framework.

With this approach, one estimates future cash flows of the firm over a reasonable horizon, assigns a continuing (terminal) value at the end of the horizon, estimates the cost of capital, and then estimates the value of the firm by calculating the present value of these estimated cash flows. This method of valuing the firm is identical to that followed in calculating NPV in a capital-budgeting context.

McKINSEY APPROACH

McKinsey & Company a leading international consultancy firm has developed an approach to value-based management which has been very well articulated by Tom Copeland, Tim Koller, and Jack Murrian of McKinsey & Company. According to them:

Properly executed, value based management is an approach to management whereby the company's overall aspirations, analytical techniques, and management processes are all aligned to help the company maximize its value by focusing decision making on the key drivers of value.

The key steps in the McKinsey approach to value-based maximization are as follows:

* Ensure the supremacy of value maximization* Find the value drivers* Establish appropriate managerial processes* Implement value-based management philosophy

THE DISCOUNT CASH FLOW APPROACH

The true economic value of a firm or a business or a project or any strategy depends on the cash flows and the appropriate discount rate (commensurate with the risk of cash flow). There are several methods for calculating the present value of a firm or a business/division or a project.

The first method uses the weighted average cost of debt and equity (WACC) to discount the net operating cash flows. When the value of a project with an estimated economic life or of a firm or business over a planning horizon is calculated, then an estimate of the terminal cash flows or value will also be made. Thus, the economic value of a project or business is:

Economic Value=Present Value of net operating cash flows+ Present value of terminal value

ECONOMIC VALUE ADDED

Consulting firm Stern Steward has developed the concept of Economic Value Added. Companies across a broad spectrum of industries and a wide range of companies have joined the EVA badwagon. EVA is a useful tool to measure the wealth generated by a company for its equity shareholders. In other words, it is a measure of residual income after meeting the necessary requirements for funds.

Computation of EVA EVA is essentially the surplus left after making an appropriate

charge for capital employed in the business. It may be calculated by using following equation.

EVA= Net operating profit after tax- Cost charges for capital employed

Market Value Added

Market value is referred to as the “Enterprise value”. It is the total of the firm’s market value of debt and equity

SVC is also referred to as MVA Market value added = Market value- Invested

Capital MV increases only in case firm earns returns in

excess of the cost of capital

Balance Score Card

No manager can ignore the bottom line the key indicator of what has happened that is a “lagging indicators”. How well you are doing i.e. “current indicator” and “leading indicators” that means what can expect to do in the future ?

For this we need a more comprehensive view with an equal emphasize on three important indicators. Indicators that clearly measures performance against objectives and can help you to set specific ,realistic, measurable and time bound targets so you get where you want to go.

Cont…

Balance Scorecard is a way of Measuring organizational business unit or

dept. success . Balancing long term & short term actions Balancing different measures of success Financial Customer Internal business Innovation & learning

EVA as tool for measuring the Shareholder’s wealth The study was empirical and descriptive

in nature. The total population was Indian banks which are listed in NSE-50.The sample frame were individual banks during the year 2005-06.

The sample sizes were five Indian banks selected on the basis of the convenience sampling technique. The data was collected through secondary resources i.e. websites of NSE.

Objectives of the Study

To calculate shareholders return using EVA. To calculate shareholder’s return using

traditional measures (by OP, EPS, ROE, ROI)

To determine the most accurate method of calculating shareholder’s wealth.

To compare shareholder’s return calculated through EVA and traditional measures.

To see correlation between EVA and traditional measures.

To open new vistas for further research.

Empirical findings are different from the views of consultant

Ho = EVA is the best measure to evaluate the stock returnsEVA-deene.doc

Correlation

ROI ROE EPS

OPERATIN

G PROFIT EVA

0.1 0.16 29.2 67794947 -276433162

0.112 0.16 27.92 13396615 -312728000

0.12 0.11 32.49 39078072 -108772675

0.115 0.17 17.45 7462826 -320172274

0.057 0.11 27.1 12722456 -65259714

-0.57273 -0.98481 0.506888 0.002638312

Results of Correlation between EVA and other Variable of Indian banks

It is evident from this table that the only variable with which EVA strongly correlates is EPS and with returns on investment and return on equity it is showing negative correlation.

Because of the negative EVA the correlation between EVA and ROI is -.57 and between EVA and ROE is -.98.

Then it shows that there is no relation between EVA and return on equity and return on investment. So if any bank has higher earning per share then we can assume that bank is focusing on value creation and rewarding banks which increase shareholder value.

The results are in alignment with Fernández (2001) who had calculated using EVA, MVA, NOPAT and WACC data for 582 American companies provided by Stern Stewart. For each of the 582 companies there are 210 companies for which the correlation with the EVA has been negative.

Beta values

Items

Beta

ROI ROE EPS O.P EVA

ROI

dependent

- -7.815 -1.361 .990 7.581

ROE

dependent

-.128 - -.174 0.127 -.970

EPS

dependent

-.735 -5.742 - 0.728 -5.570

OP dependent 1.010 7.890 1.374 - -7.655

EVA

dependent

.132 1.031 0.180 -.131 -

Accurate method of measuring the shareholder’s wealth

For measuring the accurate method of performance the regression was applied among various variables (ROI, ROE, OP, EPS, and EVA).

The value of beta is higher in the case of operating profit and hence it can conclude that the operating profit, which is a traditional measure, still is the best method of measuring the shareholder’s wealth. After that ROE is the second best method then EPS and ROI respectively.

Working capital management Many companies still underestimate the

importance of working capital management as a lever for freeing up cash from inventory, accounts receivable, and Payables

By effectively managing these components, companies can sharply reduce their dependence on outside funding and can use the released cash for further investments or acquisitions.

This will not only lead to more financial flexibility, but also create value and have a strong impact on a company’s enterprise value by reducing capital employed and thus increasing asset productivity.

Value creation vs. working capital management: A study of manufacturing companies

The present study was empirical in nature and was conducted on manufacturing companies by considering sample of about 35 manufacturing companies listed in NSE 50 from duration 2005-2008.

For evaluating the degree of relationship between net working capital and profitability and between net working capital and investment, correlation was applied. Moreover, Descriptive statistics was applied to know the distribution pattern of net working capital, investment and ROI. And also Non – parametric Mann Whitney U test was applied to know the significant difference between the above variables. and all such calculations and testing was done by using SPSS Statistical software.

Hypothesis

There is significant difference between Net working capital and ROI of manufacturing companies.

There is insignificant difference between ROI and investment of manufacturing companies.

If these two hypotheses are true, then companies will always try to reduce their NWCValue and wc.doc

balances and increase their investments with a view to enhance companies’ profitability and ultimately create value for them.

Results

The findings indicate that Net working capital and ROI, Net working capital and Investment are negatively correlated to each other.

The results show that firms are specifically for two years following this strategy but do not follow the above guidelines for another 2 years that’s in year 2006 and 2008. This is due to the downturn in economy.

This shows that firms are reducing their holdings on working capital and thus results in enlarging investment and ROI. Thus, it can be concluded that Management of working capital in a strategic mode is now contributing to the value based management systems and with the help of that manufacturing companies under study are creating value for them. This is facilitating the manufacturing companies to manage their working capital in a new route instead of following the traditional views.

Other techniques

Cash management – Cash Concentration and controlled disbursements through zero balance accounts

Inventory management- MRP, JIT and Kanban

Cash Collection –Factoring , lock boxes Credit- Credit scoring - five c’s

Capital Budgeting TechniquesDiscounted cash flow techniques Net Present Value Internal Rate of return Profitability IndexNon-discounted cash flow techniques Pay Back Average Rate of Return Discounted pay back period

Conclusion

Today the old adage “if you can’t measure it , you can’t manage it” has been taken to a new extreme in many organization the result is confusion.

When there was a single overriding indicator, such as profit /ROI it was relatively easy for manager to know what they were supposed to achieve.

In these days of multiple measures, all of which are assumed to be equally important its no longer clear to many people where the organization’s priorities lies.

Cont….

However in lot many cases the empirical evidences are quite different from the views of consultants.

There are n no of tools but the need of the hour is to identify the important indicators of the organization & implement that part which is necessary for the organization point of view.

Lastly research and development activities may help the organization in adopting and not adopting a particular tool , which is possible through industry institute linkages.

Cont..

Alfred Toffler has rightly said that “In 21st century the illiterate person is not

that person who is not able to read and write but the person who is not able to

learn”.

Thank You