REVIEW OF BALTIC STATES REAL ESTATE...

Transcript of REVIEW OF BALTIC STATES REAL ESTATE...

Spring 2000

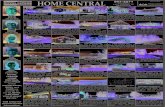

REVIEW OF BALTIC STATES REAL ESTATE MARKET

Real estate market and itsdevelopment is an extremelysignificant process for the economicdevelopment of the state. The role ofreal estate market in the promotionof economic processes cannot bedenied, therefore a review of realestate market and analysis of thesituation are of utmost importance.

The review of real estate market ofthe Baltic countries (hereinafterreferred to as Review) covers themarket previously neglected.Examining the Baltic countries –Estonia, Latvia and Lithuaniaseparately, it is obvious that eachcountry has a small number ofconsumers and relatively smallterritory which, if considered in theglobal and even European scale, is

an insignificant real estate market.At the same time if these markets areunited in the single economic space(totally 7.6 millions population, 174600 km2), we can speak about the realestate market of the Baltic countrieswhich covers a significant territorynear the Baltic Sea and borders onFinland, Sweden, Russia, Belarusand Poland.

The common real estate market ofthe Baltic countries allows a moreobjective comparison of the fiscaland regional policies of thecountries, of the effectiveness ofchosen economic and politicaloptions as well as many otheraspects. Estonia, Latvia andLithuania are states, which caneasily be compared not only as

neighbouring and geographicallyclose countries, but also as thestates having common traits ofhistoric development.

It is essential to compare the Balticcountries as a single economicspace influenced not so much byborders of the states, home andforeign affairs, but rather by overalleconomic processes in the Balticregion.

The Review has been compiled onthe basis of transactions performedin 1999.

The goal of the Review is torecognise the common real estatemarket and to compare the Balticcountries.

INTRODUCTION

2Spring 2000

Estonia, Latvia and Lithuania asindependent countries were recognisedofficially (de jure) after World War Iin accordance with the Peace Treatyof Versailles.

Upon the beginning of World War IIthe Baltic countries were occupiedand incorporated into the SovietUnion. The communism rule lastedtill the former head of the SovietUnion M. Gorbachov announced"perestroika" and "glasnostj". Thesereforms marked the beginning of therenewal of independence which wasfinally attained in 1991. Since then atransition period was commencedwhich contained various reforms

aimed at the restructuring ofeconomic, legal and social systemsas well as thinking. Criteria of values,business approach and welfare ofpopulation changed.

The primary aim of property reforminitiated in the Baltic countries wasto establish a free real estate market,because in the former Soviet Unionit was possible neither to buy norlease the land. At the beginning ofreform the owners had to face variousdifficulties on their way to therestoration of ownership. Nowhowever the property reform is soonto be completed both in Estonia,Latvia and Lithuania.

Free market is possible only in a freecountry. We can speak about a free realestate market as understood in marketeconomy only upon the renewal ofindependence, when a possibility tobuy and sell freely not only buildings,but also land occurred. Eight yearshave passed since the regaining ofindependence in 1991. It is the end ofthe 20th century when the term RealEstate Market of the Baltic countrieshas been put forward for the first time.It denotes the Real Estate Marketincorporating the best qualities of thethree markets thus serving as proof ofthe attempts of the Baltic countries toachieve freedom in the political andeconomic spheres.

COUNTRY PRESENTATION - ECONOMIC AND LEGAL BACKGROUNDS

Equivalent geographical position of theBaltic countries and pace of their historicdevelopment at the end of the 20th centuryhave prepared equal starting conditionswhen passing over from commandeconomy to market economy.Within a short time healthy competitionhas developed among the Baltic countriesas regards the improvement of social andeconomic situation of the countries bothby optimising their own resources andattracting foreign investors.

Economic indicators presented in thetable below show that there is nodistinct leader among the Balticcountries and it is possible to speakonly about slower or more rapiddevelopment of particular branches.

The Baltic countries have declared theaccession to the European Union as apriority to be observed when tacklingeconomic and political issues. Uponseveral years of intense work andfulfilment of the main economicdemands of the EU, the Balticcountries have received invitation toprepare for the accession negotiationswith the European Commission.

The Baltic countries possess similaramount of natural resources. Allproduction branches have started torecover from the crisis. Agriculture andforestry are popular branches, however,these have not received sufficienttechnical support.

When examining the Market of theBaltic countries from the legal pointof view it is essential to note that thereis an official Title Book* in eachcountry. The legal registrationmechanism of real estate is completelydeveloped and registration with theTitle Book testifies that absoluteownership (ius in rem) to the real estate

has been acquired. At the same timethe registration with the Title Book alsoensures State's guaranteed protectionfor the respective property and owner.

It must be noted that upon regainingof independence of the Baltic countriesreal estate (land plots) had to beregistered anew. Currently theregistration continues andapproximately 50% of all real estatehave been registered with the TitleBooks of the Baltic countries.

*Title Book = Land Register in UK

HISTORICAL BACKGROUND

3 Spring 2000

Source: National Statistic Departments, Central Bank, Ministry of Finance

* forecast, not approved

4Spring 2000

REAL PROPERTY CADASTRE AND TITLE REGISTRATION

The experience of many countriesshows that an established and wellfunctioning real property formationand administration system ensures asuccessful operation of real propertymarket, guarantees the security andinviolability of owner's rights to thereal property belonging to him, alsopromotes the investment in realproperty as a reliable investmentform. The collected data about realproperty allow to estimate assessedvalues using common principlesbased on market.

As in many other Central and EasternEuropean countries, the reform is

going on in the Baltic countries too.One part of the reform is therestoration of rights in real propertyand the privatisation. To ensure aneffective operation of this process andan efficient collection and provisionof data, the real propertyadministration system is developed.The system includes recording of realproperty ownership and other legalrights in and over land. In all threeBaltic countries real property cadastreis linked or integrated with Registerof Ownership. Registration of rightsconsist of:

• Registration of real property ofnatural and legal entities

• Registration of ownership andother real rights (includingmortgages) in real property• Registration of restrictions onthe rights to posses, use anddispose real property• Registration of obligations ofproperty owners and rights of otherpersons in real property• State security of all owners rightsin real property

Systems are wholly or partlycomputerised. The table indicates themain elements and differences ofReal Property Cadastre and RightsRegistration systems in the Balticcountries.

Institutions Responsible for Real Property Cadastre and Register

STRUCTURE OF REAL ESTATE STOCK

Land Market

Land in all three Baltic States isclassified by main land use types,which are confirmed by municipality.Obviously the Baltic States weretended to be agricultural countries,this is why the largest part ofterritories is covered by agriculturalland. Also the percentage of forestareas is high, thus average forest areasare bigger than in other Europeancountries.

SALE OF LAND

Structure of Land %

In the table the great price difference in forest landprices is due to the fact that in Lithuania the forestland price is equal to the price of mature forest (forestready for felling)

5 Spring 2000

Land Sales Market activity is 5-6% per year, i.e.5-6% of properties change owners.The "most active" land use types areresidential land (44% of alltransactions) and forest land (37% ofall transactions). The big number oftransactions with forest land is causedby the fact that timber is the majorexport article in Estonia and almosthalf of Estonia's territory is coveredwith forest.

Compared with Finland and Swedenthe land prices are considerably lowerin Estonia. Foreigners are activebuyers, they find coastal areas andislands to be especially attractive. In1998 the share of foreigners (asbuyers) from the total number oftransactions was 2%, in 1999 3%.

Comparing different regions, thenumber of transactions is clearlybiggest in Harjumaa including ourcapital Tallinn (30% of alltransactions, the rest is dividedbetween remaining 14 counties). Bythe value of transactions Harjumaa isleading even more. About 63% of thetotal value of transactions fall onHarjumaa including Tallinn.

Land Sales in CitiesThere were more than 1700transactions performed in the biggestcities of Estonia (Tallinn, Tartu, Pärnu,Haapsalu, Kuressaare, Rakvere) in1999. Of them over one thousandtransactions were carried out in Tallinn.75% of all transactions were withresidential land. Prices of land inTallinn and other cities are verydifferent, it depends on district. E.g theprice of residential land in Tallinn is 5- 40 EURO/m², other cities 2 - 30EURO/m²; commercial land in Tallinn10 - 135 EURO/m², other cities 2 - 70EURO/m²; industrial land in Tallinn 10- 35 EURO/m², in other cities about 5EURO/m². The dominating size ofplots of residential land is between 800- 2000 m², commercial land between1100 - 4000 m².

Agricultural and ForestlandIn 1999 about 3000 transactions withagricultural and forestland wereperformed in Estonia. Altogether 45000 hectares of agricultural andforestland with the value of 29.5million EURO changed owners.Majority of these transactions wastransactions with forestland (1900transactions). The transactions withforestland covered 36 500 ha, of it

actually covered with forest were 22500 ha. The average size of sold parcelwas 20 ha of which the share of forestwas 12.5 ha. The average price of forestland including the price of growingstock was 780 EURO/ha.

As to selling activity, forest land wasfollowed by agricultural land boughtwith the aim of building a summer-house on it. Such transactions tookplace mostly in coastal areas. Onislands the price level was between 0.2-0.6 EURO/m² and in mainland 0.1-0.3EURO/m².

The prices of land purchased for agri-cultural productions were mainly 100- 400 EURO/ha. The average size ofan agricultural land parcel was 13.9 ha.

Estonian landscape

Land Sales in CitiesIn cities the sales prices for land werenot influenced by the Russianeconomic crisis which left significantimpact on the production. However,the impact of Russian economic crisiswas present in such sectors asagricultural land and forestland.

The land market continued to developin cities and it kept the prices at thesame level. Nevertheless, there wereconsiderable differences between theprices for industrial land, which wasexplained by the shortage of

information available to the buyer anddifferent future prognoses.

The standard plots for a residential landare from 700 m2 - 2000 m2 in the majorcities of Latvia and 500 m2 - 1400 m2

in Riga. The prices for these plots arerespectively 7 - 40 EURO/m² and9 - 40 EURO/m².

The growth of prices indicates thatthere is a demand for land forcommercial building, however, thetendency of prices for retail premisesgives the reason to assume that the

market participants are not satisfiedwith the existing premises and it ismore advantageous for them toconstruct new. Growth of price forcommercial land has been stable anda constant increase of demand is amore vital factor for these types ofland, while supply remains limited.

Standard plot of commercial land arefrom 1000 m2 - 1100 m2 in Riga and600 m2 - 5000 m2 in the major cities.Certainly, lack of vacant land isessential in Riga, therefore biggerplots were sold in Riga's suburbs.

Estonia

Latvia

6Spring 2000

Similarly to commercial land,standard plot size for industrial landis bigger in Riga's suburbs (3000 -8000 m2), and 2500 - 12000 m2 inmajor cities.

It is almost impossible to determineconcrete demand and supply ofindustrial land. In most casesindustrial land is bought fortransformation to another land usetype. Construction of new factoriesis very seldom because production asbranch of business is not profitable.

Prices of Agricultural LandGenerally in the rural areas the priceof land is proportional to the averagecadastral values of agricultural land.The market of agricultural land isslack. The low prices for agriculturalproducts are considered to be themain reason for the slack market ofagricultural land. Larger activity is

recorded in those regions wherefertility of soil is better than on theaverage in Latvia. Most of thesedistricts are situated in the South of thecountry where there are the highestprices (400 - 440 EURO/ha). In otherregions the prices are floating between150 - 380 EURO.

It must be noted that in the South ofthe country there are some internationaljoint-stock companies establishedincorporating Latvian and Swedishenterprises. It is apparent that if such acompany purchases real property, theprice for land is higher.

The price for forestland is closelylinked to the timber value as well asaccessibility of land and distance to thenearest sawmill, port or other tradingplace. It is observed that disregardingthe quality of soil and due to the factthat prices for agricultural products

traditionally have been low in thenorthern districts, the price for forestland is one of the highest in thesedistricts - from 517 - 862 EURO. Inthe eastern districts the price forforestland rises as high as 1034 EURO.Market of forestland is considerablylivelier than market of agricultural land,because of time in which it is possibleto profit from the sales of forestland.

Latvian landscape

Lithuania

Lithuanian landscape

Land Sales in CitiesMore than 1800 land parcels forhouseholds were sold during 1999 in5 largest cities. More than 500 ofthem in Vilnius, around 400 inKaunas and the same number inKlaipėda. The average price forresidential land in Vilnius for 1 squaremeter was 40 EURO, in Klaipėda andKaunas - 25 EURO, in Šiauliai andPanevėžys - 10 EURO. Average plotsize for household in cities is 1000 -1500 m².

Industrial land is obtained in auctionsaranged by municipalities or fromprivate persons. Industrial land pricein cities is 9-15 EURO for 1 squaremeter depending on the location.

The price for private parcels in thebest places for commerce in Vilniusexceeds 150 EURO for square meter.

Agricultural and ForestlandIn 1999 around 14 thousand landparcels changed their owners. Thetotal area of these parcels makes morethan 33 thousand ha. The largestamount of transactions took place inKaunas county (23%) and Vilniuscounty (20%). The highest prices foragricultural land are in Vilnius county

(730 EURO/ha), Kaunas and Klaipėdacounties (410 EURO/ha), the lowest -in Tauragė and Telšiai counties (230EURO/ha).

Small land parcels up to 1 ha not so farfrom Vilnius and Kaunas and on thelakeshores are popular for householdsand summerhouses and are much moreexpensive. Prices for such parcels are3-5 thousands EURO per ha in Molėtųand Švenčionių regions, and even morein Trakai region.

Forestland prices are almost the sameover the whole territory of Lithuaniaand depend on amount, age and qualityof wood. Mostly it is 1 to 3 thousandEURO per ha for mature forests. Foroaks wood price is up to 6000 EURO/ha. Only in western Lithuania pricesare higher by 5-10 percent because oflower transportation costs to theseashore.

7 Spring 2000

SALES OF BUILDINGS AND APARTMENTS

Estonia

Buildings classification used in allBaltic countries is harmonised with theEU classification (CC) made accordingto the building type. The diagrambelow shows the distribution ofbuildings according to the different usetype. Type other includes commercial,cultural, leisure and other.The total number of flats and

The Old Town of Tallinn

residential space in Estonia is ca 623000. Buying and selling of apartmentsand houses is more common thanrenting. Recently this market segmenthas become even more active becausebanks are more willing to offer loans.The market is most active in Tallinnand its vicinity. According to the size,

Building Structure in Estonia

the apartments can be divided intothree groups:• 1-2 room flats ca 30-55 m²• 3-4 room flats ca 60-80 m²• family houses ca 100-200 m².According to the Statistical Office ofEstonia, the number of transactionswith movable property in 1999 wasabout 1000 transactions per month(there is no information available forfamily houses).

Compared to the beginning ofindependence period, the construction

volumes of family houses haveannually grown. Since 1995 the yearlyincrease has been about 100 000 - 105000 m². In 1996, 103 500 m² of newresidential space in family housesentered the market, in 1997 121 600m², in 1998 99 300 m² and in 1999 76400 m². The new construction ofapartments has decreased in particularcompared to 1980ies.

Prices of 2-Room ApartmentEURO/m² in Tallinn

In comparison, 413 854 m² (1063buildings) of new non-residential spaceentered the market in 1998.

As of 01 Jan. 2000, the total amountof residential space in Estonia was 31154 204 m², of which 11 934 122 m²in dwelling houses, 19 909 034 m² insingle family houses, row houses, two-family houses, homesteads, and 211004 m² in non-residential buildings.

Latvia

Riga City must be singled out as themost active and costly part ofapartments market in Latvia. Whenanalysing the market of apartments inother cities, the centre of the city mustbe distinguished from the rest of city.

By type of apartment the market ofapartments can be divided in thefollowing way: modern apartments inmulti-tenant houses (built in 90ies),serial multi-tenant (built 60ies - 80ies),multi-tenant houses built in 50ies -60ies of brickwork, houses built till40ies (mostly wood constructions) andhouses built till 20ies.

The construction of new apartmentsis passive, however, there is a smalldemand for apartmentscorresponding to the highest qualitycriteria of today.

By categories of owners the numberof privately owned apartments hasconsiderably increased and share ofstate and local governments hasrespectively decreased.

Due to the privatisation of residentialhouses large number of apartmentscame on the market making it moreactive. The demand for good and

comfortable apartments has beendeveloping gradually since 1997.

The Old Town of Riga

8Spring 2000

Lithuania

This year it is possible to state that theratio of permanent demand and supplyhas formed. An apartment has becomea commodity without any restrictionsto its commercial circulation. Theexpiry of validity of privatisationvouchers at the end of 2000 allowsassuming that supply in the market ofapartments will decrease and alongsidewith the levelling of demand the stabili-sation phase of market will set in.

In case of Riga this division must besupplemented by Old Riga as a historiccentre of the city. Large part of theapartment districts which surround thecentre of Riga are the so called"sleeping districts" whose inhabitantsleave them in the morning and return

in the evening. There are 9 "sleepingdistricts" around Riga, which aredescribed as communities with largeamount of multi-tenant houses.

In Riga the differentiation of apart-ments by location and type of planning- standard or individual planning - isbecoming more distinct. Variouslegislative acts have been adoptedwhich promote the development ofmortgage market. The adoption ofthese acts has left a definite impact onthe real estate market. At the momentit is difficult to foresee whether theimpact of these legislative acts will benegative or positive, however, onewould like to believe in positivechanges.

In other cities of Latvia the demand forapartments is lower and growth ofprices is not that high. Despite thedifficult financial situation, the markethas preserved slight developmenttendency.

Till the completion of propertyreform whose final phase will set inafter 2000, one cannot talk about themarket of apartments as defined inthe theory of economy.Building Structure in Latvia

The Old Town of Vilnius

Buildings' market can be divided intoresidential (1-2 family houses and apart-ments) and non-residential (commercialand industrial). The apartment market isthe most active. The stock of all apart-ment living space is about 80 millionsquare meters. About 90 per cent ofthem are private. The two and threeroom apartment are most common andmake almost 60 per cent of the totalnumber of apartments. 1,000-2,500transactions with apartments wereregistered in every month of 1999.Almost half of all transactions areregistered in Vilnius, Kaunas andKlaipeda. In small towns and even inmany district centres the marketactivity is not so high.

Construction of new apartments isabout 5 000-6 000 apartments per year,what makes about 500-600 thousandsquare meters per year and it has beenquite stable in recent years. The areaof new apartments is 70-120 squaremeters and is larger than average.Construction of 1-2 family houses hasbeen quite stable from 1990 and wasabout 2300 houses per year in 1996-1999.

Prices for 1-2 family houses mostlydepend on the location and are relatedto the prices of land for residentialhouses. Only for good quality space nottoo large and quite new houses in goodlocations the market price is close or abit higher than the construction costs(added to the land's price). In othercases it is less than construction costs,sometimes up to 1.5 -3 times, especiallyfurther off from big cities.

It is difficult to judge about the averageprices for industrial buildings andpremises because of big variety andlack of transactions. The prices varyin a very wide range depending onlocation, area and condition. Averageprices for industrial premises vary inrange 15-30 EURO/ m2. In the largestcities it can be several times higher, inthe countryside remarkably lower.

Building Structure in Lithuania

The supply of commercial and officespace of good quality was for some timevery limited but now it is rising rapidly.So happened because quite manyresidential and industrial buildings wererestructured to meet new requirements.New construction of this kind propertywas growing too. Commercial andoffice space is most expensive in thecentral part and old town of Vilnius. Theprice for one square meter sometimesexceeds 4,000 EURO.

Prices of 2-Room ApartmentEURO/m² in Vilnius

9 Spring 2000

RENT OF RESIDENTIAL SPACE

Estonia

Average Prices for 1 m2 in 1-2 Family Houses and Apartments,1999 (EURO/m²)

Prices of 2-Room Apartmentsin Centres of Capitals

EURO/m²

2-Room Apartment EURO/month in Tallinn

Purchase and sale are more commonon the market of apartments thanrenting. As the majority of apartmentsare rented without the help of agents,the analysis below is based on theestimation of real property experts.

As in the capital city of Estonia,Tallinn, the price differences are verybig, the whole town is divided into two:the town's centre and the remainingareas of Tallinn.

The centre of Tallinn includesapartments in the Old Town and in theremaining central areas. Theapartments in town's centre are usuallyin better repair and with a more originallayout of rooms than the apartments insuburban areas.

The apartments in the remaining partsof Tallinn can be characterised by

Latvia

following: panel houses built between1960 and 1980, in average or goodrepair. On rental market the demand ishighest for 2-roomed apartments (ca45-50 m²), both in town's centre andsuburban areas. The main differencebetween 1-, 2-, 3- and 4-roomapartments is the size in square meters,i.e. the present analysis includespredominantly similar apartments ofdifferent size that have the highestdemand and supply on the rentalmarket of apartments.

Regarding 4-room apartments thesituation is problematic in all above-mentioned towns. The demand forthem is very low or entirely lacking.The rent is low because the costs forpublic utilities are high and they arealso expected to be paid by the tenant.

To the prices given in the table shouldbe added costs for public utilities(electricity, heating, warm and coldwater, garbage removal, etc.) that areapproximately 1.5 - 2 EURO/m²/month.

The following figure showsseparately 2-room apartments that arepredominating on the rental market.Average rents in Tallinn's suburbs aregiven. Generally, in 1995-1997 theincrease was ca 10% a year, in 1998-1999 ca 5%.

The market segment of rent ofresidential space is very active incomparison with other segments.Nevertheless, it is difficult to obtain

impartial information on the actualnumber of transactions within thesegment what makes the rent markettough to forecast.

Payments for public services (electri-city, sewage, heat, hot and cold water)must be added to the rentals, becauseusually these are paid by tenant.

10Spring 2000

Lithuania

Purchase and sale are more commonon the market of apartments thanrenting. Despite this the rent ofapartments in the Vilnius centre andOld City is quite profitable. Up to nowthe scarcity of well equippedapartments with furniture available forrent led to high rent prices - up to 15EURO per square meter per monthplus expenses for public utilities.Recently the supply of such apartments

increased, part of them are vacant, butprices are still very high.

In districts of Vilnius farther away fromthe centre the rent of apartments instandard multistore buildings is muchcheaper. The monthly rent for of 1-2-3-4 rooms apartments is about 100-150EURO per month. An additionalpayment for public utilities is higherfor larger apartments and depends on

area. The supply is higher than demandtherefore a lot of apartments areavailable. Similar situation is in othercities.

In other cities, except Vilnius, the demandfor 4-room apartments is very low orentirely lacking because of the costs forpublic utilities. Most of 4-roomapartments in Vilnius are in good shapeand good location and are occupied.

Rents of Residential Space

RENT OF NON-RESIDENTIAL SPACE

Estonia

Non-residential space is dividedaccording to use into three groups:office space, retail space, and industrialand warehouse space. Included arebuildings and rooms that are in averageor very good repair. In the prices ofnon-residential space are included onlynew leases, i.e. rents paid in the periodJuly - December 1999.

Even in this case, due to great diffe-rences in rents, Tallinn is divided into

Mainly the prices depend on the factwhether the apartment is repaired ornot. If the residential space is

furnished, the rental may be severaltimes higher than for unfurnishedapartment. At present the range of

rental is rather wide, however, thenumber of unrepaired apartmentstends to decrease.

two: the town's centre and remainingparts of Tallinn.

The rental market of non-residentialspace is quite active in Estonia,particularly in Tallinn, where a lot ofnew office space has been completedin recent years, e.g. HobujaamaCentre, Ühispank, Kawe Plaza, etc.Especially appealing is space in verygood location, i.e. in town's centre.An important factor is also the

accessibility by car, i.e. in the OldTown, where there are restrictionsfor car traffic, no major new officespace has entered or is expected toenter the market. Currently thesupply is higher than the demand,mostly due to the fact that severalbank buildings have remainedempty. However, compared with1998, the market has become moreactive, which is a result of stabili-sation of economy.

11 Spring 2000

The construction of trade centres, especially in suburbanareas, has also intensified. In recent years a number ofnew objects, e.g. Rocca Al Mare trade centre, KristiineCentre, Kadaka Selver, etc. have entered the market. Thetotal area of them is 695 thousand m². The majority ofnew objects have become popular among customers,therefore there is no fear for loss of clients. Even thisyear five new objects of that kind are underconstruction.

As to warehouses and industrial space, the situation isnot so good. So far the demand exceeds the supply. Onlysome new objects have entered the market and mostly

The Top Rents of Offices EURO/m²/year in Estonia

Latvia

Lithuania

Rental for office space wasinfluenced by construction of largeA class offices (Valdemâra Centre)which meet the internationalstandards. As a result the demand forrent of uncomfortable office spacediminished, what consequentlyreduced also the rental for suchoffices. Nevertheless, the largeinvestments have not paid off yet,because the new office space findsits lessees slowly. It is possible thatthe demand for the office space ofhighest class is low due to the highprice which exceeds the averageprice in the city by 50%.

Outside the centre of Riga there is atendency to use privatised apartmentsas office space what can be explainedby shortage of reasonably cheappremises. In other cities than Rigarent of office space is not the mostactive market segment, therefore no

for owner-occupation. As the rents are low, the situationis not favourable for developers.

significant changes have beenrecorded during the year.

The rental for retail space has increasedin the centres of cities. Lessees ofcommercial space change actively,while stay those whose goods meet aready sale and bring sufficient incometo pay for the increasingly costly publicservices and rent. In the suburbs of citya tendency is observed to set upcommercial space on the first floor ofmultistorey building or add subsidiaryspace to the single-family detachedhouse.

In 1999 several supermarketsconstructed on the foundations of oldor unfinished buildings were openedin Riga. The lessees willingly chosesuch premises, because usually theseare appropriately prepared for tradingand conveniently situated.Supermarket is a new type of trading

in Latvia with development prospects.Decreasing of sales in the traditionalmarket places leads to the conclusionthat supermarkets oust the traditionaltrading places.

The rental for production space hasdecreased, because it is often rentedfor trading. As already indicated inthe previous paragraph, several newsupermarkets were opened exactly onthe premises of former productionobjects where upon the renewal ofindependence the production haddecreased gradually and finallystopped completely. This allows todraw a conclusion that the existingpremises do not meet theexpectations of the potential lesseeand it is more advantageous to investin the construction of new premisesthan rebuild the old premises whosephysical and functional deteriorationis extremely high.

The most active cities are Vilnius and Klaipeda. Officerent prices in Vilnius centre are decreasing becauseseveral new modern buildings of large area were builtand provided to market. On the other hand the economicsituation in 1999 after the Russian crises in 1998 showsthe same trends.

The rent prices for prestige shops and trading centresin the best places of Vilnius are high because of

limited supply in this quite small area - Old City andGedimino Avenue. Similar situation is withwarehouses in this area.

Production premises and warehouses in other partsof Vilnius and other cities are available for very lowprices. Many of these premises are in good locationand have good infrastructure, but not always meet therequirements of modern production.

Spring 2000

CONCLUSIONS

Rents of Non-Residential Space

Prices are given as net rents, i.e. the tenant should take intoaccount that a part of operating costs (heating, electricity,water, garbage removal, security, etc.) will be added, the costsare approximately 24 -32 EURO/m²/month.

Aadresses:

Estonian Land BoardMustamäe tee 5110602 TallinnTel: +37-2-665 0623, 665 0622Fax: +37-2-665 0604www.maaamet.eeMonika Pihlak e-mail: [email protected] Kurm e-mail: [email protected]

Latvian State Land Service11. Novembra krastmala 31LV-1050 RigaTel: +37-1-750 3778, 750 3811Fax: +37-1-722 1049www.vzd.gov.lvJuris Valainis e-mail: [email protected] Lauskis e-mail: [email protected]

Lithuanian State Land Cadastre and RegisterV. Kudirkos 182600 VilniusTel: +370-2-688 205, 688 309Fax: +370-2-688 311www.kada.ltArvydas Bagdonavičus e-mail: [email protected] Mikėnas e-mail: [email protected]

The Review has been produced inclose co-operation between the landservices of the Baltic countries:Estonian Land Board, State LandService of the Republic of Latviaand State Land Cadastre andRegister of Lithuania. The maintasks of the Land Services involvethe registration of real estate andchanges made to it as well asmonitoring of the development ofreal estate market and defining ofthe cadastral value of real estate fortaxation purposes.

The Review is a practical proof ofthe attempts of the Baltic countriesto represent themselves in a unitedform at the same time preserving theircultural and social characteristics.

It is impossible to reflect all thedetails in the current Review andactually it was not our intention. Asalready indicated in the verybeginning, the aim of the Review wasto discuss the common Real EstateMarket of the Baltic countries, whichmight be more advantageous than

separate markets of each country.This review was the first but surelyit won't be the last one. We hope verymuch for feedback from you. If youhave any comments or you takeparticular interest in any of thediscussed issues or need moredetailed review of the Real EstateMarket of one or all the Balticcountries, you are welcome to contactus.

The review and additionalinformation are available on Internet.

Retail Rents in Centres of Capitals in 1999EURO/m²/year