Results Q1 2016 - Wacker Neuson Group · 2019. 9. 20. · Cem Peksaglam (CEO) –Günther C. Binder...

Transcript of Results Q1 2016 - Wacker Neuson Group · 2019. 9. 20. · Cem Peksaglam (CEO) –Günther C. Binder...

Q1/16 at a glance

At a glance

Revenue almost on record level of prev. year, but less favorable regional and product mix

Europe: Solid demand in construction, continued downturn in ag business (revenue ag: -11% vs. prev. year)

Americas: Oil & gas crisis in NA, Latin America weak negative impact mainly on light equipment business

Asia-Pacific: nearly doubled revenue vs. prev. year, rise in sales of compact machines in China share of total

revenue for the region increased by 2.7 PP to 5.5%

Successful trade fair “bauma’” (April 2016, Munich); customers from Central Europe deferred orders

from March to April

Q1/16: Key figures

Revenue: -2% yoy to EUR 316 m (adjusted for currency effects: -1%)

EBITDA: -28% yoy to EUR 34 m; margin: 10.7% (Q1/15: 14.6%)

EBIT: -45% yoy to EUR 17 m; margin: 5.5% (Q1/15: 9.8%)

EPS: -48% yoy to EUR 0.16 (Q1/15: EUR 0.30)

3

A challenging start to the year – confident for 2016

(Revenue in € million; EBIT Margin as a %)

Q1/16: Multi-year comparison (5 years)

4

Revenue and EBIT Margin Q1 (2012–2016)

Revenue in Q1/16 more or less on par with record level Q1/15 (only -2%),

but profitability weak and unsatisfactory

9.6%

4.3%

7.6%

9.8%

5.5%

+11% -2%

Q1/16: Revenue growth by regions and divisons1

231,3 227,4

Q1/15 Q1/16

5

Europe2

-2% (-1%)

100,091,7

Q1/15 Q1/16

Light equipment3

-8% (-7%)

83,971,6

Q1/15 Q1/16

Americas2

-15% (-14%)

166,1 165,2

Q1/15 Q1/16

Compact equipment3

-1% (+0%)

9,1

17,4

Q1/15 Q1/16

Asia-Pacific2

+91% (+98%)

62,5 63,5

Q1/15 Q1/16

Services3

+2% (+3%)

1 In brackets: adjusted for currency effects; 2 Nominal, after cash discounts; 3 Nominal, before cash discounts

(€ million)

(€ million)

(€ million)

(€ million)

(€ million)

(€ million)

NA business weak – demand for light equipment remained subdued

Construction and other industries

Agriculture

Services

Q1/16 Q1/15

65% 65%

15% 16%

20% 19%

Ag business (Weidemann, Kramer, Claas)

Q1/15 Q1/16

6

(in €m)

53.6

47.5

Continued downturn in Ag business

Q1/16 vs. Q1/15: -11%

(2015 vs. 2014: -2%)

-11%

Revenue breakdown for Q1/16 Revenues1 Q1/16 vs. Q1/15

(% of revenue)

1 Nominal, before cash discounts

Q1/16: Comparison of peer group construction divisions

Company Change in Profit Q1 (Margin)

Peer 1 Construction division Op. Profit: 1 Mio.$ (Q1/15: -4 Mio.$) (margin: 0.9%)

Wacker Neuson EBIT: -45% (margin: 5.5%)

Peer 2 Construction division Op. Income: -3% (margin: 2.8%)

Peer 3 (Constr./Agri.) Not disclosing

Peer 4 Construction division Adj. Op. Profit: +28% (margin: 4.3%)

Peer 5 Construction division Op. Profit: -9% (margin: 12.0%)

Peer 6 Construction division1 Op. Profit: +17% (margin: 10.4%)

Peer 7 Construction division Op. profit: 14 Mio.$ (Q1/15: 0 Mio.$) (margin: 2.6%)

Peer 8 Construction division1 Op. Profit: -15% (margin: 11.2%)

Peer 9 Construction division Op. Profit: -41% (margin: 10.9%)

Peer 10 Tele handlers Not disclosing

7

-19%

-12%

-11%

-11%

-8%

-5%

-3%

-2%

-2%

-20% -15% -10% -5% 0% 5%

Change revenue Q1/16 vs. Q1/15

1 No calendar fiscal year, ending March 31; figures showing Q4.

-43%

17%

Q1/16: Comparison of peer group construction divisions

Q1/16: Comparison of peer group agriculture divisions (global)

8

Company Change in Profit Q1 (Margin)

Peer 11 Agriculture division Op. Income: -59% (margin: 1.2%)

Wacker Neuson Agr. Div. Not disclosing

Peer 12 Agriculture division Op. Profit: -56% (margin: 4.2%)-18%

-11%

-8%

-20% -15% -10% -5% 0%

Change revenue Q1/16 vs. Q1/15

Q1/16: Comparison of peer group agricultural divisions

Awards won at bauma

10

Kramer electric wheel loader received the bauma Innovation Award in the

Machinery category.

Wacker Neuson battery-powered rammers won the Euro Test Award

from BG Bau for their outstanding contribution to health and safety.

Official opening of our new assembly facility in Brazil (since April 2016)

11

Itatiba, São Paulo, Brazil

Products: mobile generators:

50-70 kilovolt-amps (kVA)

expanding to 150 kVA

Target market: Latin America

Start of production: April 2016

„In the region – for the region“

Roberto Martinez (Managing Director

Wacker Neuson Máquinas Ltda. Brazil)

and Cem Peksaglam (CEO) cutting the

ribbon at the opening ceremony.

Q1/16: Development of revenue and profitability

13

Q1/16 As % of

revenue

Q1/15 As % of

revenueChange in %1

Revenue 316.4 100.0 324.3 100.0 -2.4 (-1.3)

Gross profit 87.0 27.5 96.5 29.7 -9.8

Sales and service expenses 46.0 14.5 45.2 13.9 1.8

Research and development expenses 8.9 2.8 8.1 2.5 9.9

General administrative expenses 16.2 5.1 17.5 5.4 -7.4

Operating expenses2 71.1 22.5 70.8 21.8 0.4

EBITDA 34.0 10.7 47.4 14.6 -28.3

EBIT 17.3 5.5 31.7 9.8 -45,4

Net profit 11.1 3.5 21.3 6.6 -47.9

Net profit per share in € 0.16 0.30 -47.9

Income statement (extract) and number of employees

(€ million)

1 in brackets: adjusted to discount currency effects

2 without other income/expenses

31,734,0

15,5

22,4

17,3

9,8%8,9%

5,0%6,3%

5,5%

0,0%

2,0%

4,0%

6,0%

8,0%

10,0%

12,0%

14,0%

16,0%

18,0%

20,0%

0,0

5,0

10,0

15,0

20,0

25,0

30,0

35,0

40,0

Q1/15 Q2/15 Q3/15 Q4/15 Q1/16

EBIT EBIT margin

Q1/16: Development of profit since Q1/15

14

EBIT development Q1/15-Q1/16

(EBIT in € million; EBIT Margin as a %)

Revenue in € million 324.3 382.1 311.0 357.9 316.4

Q1/16: Comparison of EBIT vs. previous year

15

1

1 Other income & expense

Earnings negatively impacted in crisis-hit emerging markets/industries, regional/product mix and FX effects.

(in € m)

0

5

10

15

20

25

30

35

EBIT Q1/15 Revenue volume effect Revenue margin effect S,G&A Other EBIT Q1/16

31.7 -2.4-7.1

-0.2 -4.7

17.3

EBIT-change Q1/16 vs. Q1/15

Q1/16: Development of profit per region

16

EBIT-change by region Q1/16 vs. Q1/15

(€ million)

0

5

10

15

20

25

30

35

40

EBIT Q1/15 Europe Americas Asia-Pacific Consolidation EBIT Q1/16

Q1/16 vs. Q1/15 Europe Americas Asia-Pacific Total

Revenue -2% -15% +91% -2%

EBIT -42% -118% -94% -45%

EBIT Margin (Q1/15)1 9.1% (15.5%) -2.1% (9.9%) 0.6% (19.8%) 5.5% (9.8%)

31.7 -15.2

-9.8

-1.7

+12.3 17.3

1 EBIT Margin of regions on total external sales

0,0

2,0

4,0

6,0

8,0

10,0

12,0

14,0

16,0

18,0

20,0

Q1/15 Q1/16-35,0

-30,0

-25,0

-20,0

-15,0

-10,0

-5,0

0,0

Q1/15 Q1/16

-25

-20

-15

-10

-05

00

Q1/15 Q1/16

-70%

(in € million)(in € million)

-20.6

Depreciation/amortizationCash flow

from operating activities

Cash flow

from investment activitiesFree cash flow

Q1/16: Comfortable liquidity situation despite high investments

17

(in € million) (in € million)

-6.1

+17%

-25.4

-29.7

-50,0

-45,0

-40,0

-35,0

-30,0

-25,0

-20,0

-15,0

-10,0

-5,0

0,0

Q1/15 Q1/16

-22%

-45.9

-35.8

+6%15.7

16.7

Q1/16: Working capital development

18

305369 344

495 464

181

191 197

227220

-73 -57 -72 -97 -85

March 31, 2012 March 31, 2013 March 31, 2014 March 31, 2015 March 31, 2016

Inventories Trade receivables Trade payables

Working Capital ratio (3M annualized revenue)

37.7% 48.9% 40.2% 48.2% 47.3%

Decrease of working capital due to strict inventory management

(€ million)

-3%

WC: -4%

599

469

-12%

-6%

503

413

Working capital Q1/12 – Q1/16

625

149

257

185226 235

919 926 950

1.065 1.062

16%

28%

19%21% 22%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

0

200

400

600

800

1.000

Q1/12 Q1/13 Q1/14 Q1/15 Q1/16

Net financial debt Equity before minority interests Gearing as a %

Q1/16: Gearing and equity

19

High equity ratio of 67%, increase of net debt by 4%

(€ million)

Equity, net debt and gearing Q1/12 – Q1/16

+4%

Share price development

20

in € 2013 2014 2015 Q1/15 Q1/16

Earnings per share 0.87 1.30 0.94 0.30 0.16

Dividend payment 0.40 0.50 0.501 – –

End of period 11.49 16.96 14.23 23.27 13.98

High 12.75 18.00 24.60 23.47 15.57

Low 9.24 11.49 11.12 16.30 11.44

Market capitalization (in € m) 805.6 1,189.2 998.1 1,632.2 980.6

ISIN / WK DE000WACK012 / WACK01

Reuters /

Bloomberg

WACGn.DE / WAC GR

Indices SDAX, DAXplus family, CDAX,

GEX, Classic All Shares

Share Prime All Share

Total shares 70.140.000

Shareholder

structure

63% Family; 37% Free float

(thereof management: 0.5%)

Share price performance since January 2016

Key figures share

%

1 Dividend payment to be proposed at the AGM on May 31, 2016

0

5

10

15

20

25

30

0,0

200,0

400,0

600,0

800,0

1.000,0

1.200,0

1.400,0

1.600,0

2015 2016e

(Revenue in € billion)

Revenue and margins 2015–2016e

1.38

+2% to +5%

EBIT Margin

7.5%

1.40–1.45

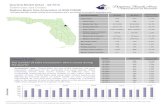

Forecast for 2016 (unchanged)

22

Europe

North America

Latin America

South Africa and Sub Sahara

Asia

Australia

Agriculture

Construction

Mining

Oil & Gas

Other channels

1

Wacker Neuson Group revenue trend 2016e

Some developments offset each other, low visibility

1 Strong increase, but from a low base

Revenue growth +2% to +5%, EBIT Margin 7.0% to 8.0%

Investments of ~ 100 m €, positive free cash flow

EBIT Margin

7-8%

Financial calendar and IR contact

Financial Calendar

IR contact

Investor Relations Department

Preussenstrasse 41, 80809 Munich, Germany

Phone: +49-89-35402-713, Fax: +49-89-35402-298

May 12, 2016 Publication of first-quarter report 2016; Analysts' Conference Call

May 31, 2016 AGM, Munich

August 4, 2016 Publication of half-year report 2016; Analysts' Conference Call

November 10, 2016 Publication of nine-month report 2016; Analysts' Conference, Frankfurt

Numerous international trade fairs, roadshows and conferences

23

DisclaimerCautionary note regarding forward-looking statements

The information contained in this document has not been independently verified and no representation or

warranty expressed or implied is made as to, and no reliance should be placed on, the fairness, accuracy,

completeness or correctness of this information or opinions contained herein.

Certain statements contained in this document may be statements of future expectations and other forward

looking statements that are based on management‘s current view and assumptions and involve known and

unknown risks and uncertainties that could cause actual results, performance or events to differ materially

from those expressed or implied in such statements.

None of Wacker Neuson SE or any of its affiliates, advisors or representatives shall have any liability

whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of this document or its

content or otherwise arising in connection with this document.

This document does not constitute an offer or invitation to purchase or subscribe for any securities and neither

it nor any part of it shall form the basis of or be relied upon in connection with any contract or commitment

whatsoever.

24