Results First Half 2019 - Terpel...31, 2020. TERPEL’SSTOCK PRICE EXPERIENCED A 13.5% VALUE GAIN...

Transcript of Results First Half 2019 - Terpel...31, 2020. TERPEL’SSTOCK PRICE EXPERIENCED A 13.5% VALUE GAIN...

Results First Half 2019

Earnings Release Conference Call

Date: Thursday, August 22, 2019

Time: 8:00 am (UTC-05:00) Bogota

Telephone number in Colombia: 018009156924

Telephone numbers outside of Colombia: http://web.meetme.net/r.aspx?p=12&a=UjADQOEwsZA

WMn

ID #: 48884084

Webcast Registration: https://event.on24.com/wcc/r/2058434/BACCA7A8837

FB573F82DF75C764CD75B

Webpage:: www.terpel.com

AAA Bonds (Col) - Fitch Ratings

AAA Bonds (Col) - S&P

BVC (Colombian Stock Exchange) Stock: TPL

Press Release

August 2019

Organización Terpel, with 50 years in the business of distributing

liquid fuels and lubricants under the Terpel brand, and Natural Gas

for Vehicles (NGV) under the Gazel brand, has a broad network of

service stations (SS) in Colombia, Ecuador, Panama, Peru and

Dominican Republic, where it also serves the countries’ Industry,

Aviation and Marine sectors.

Half-Year Highlights

1

* Excluding IFRS 16 impacts

Investors’ Contact

CONSOLIDATED RESULTS FOR FIRST HALF OF 2019The volume for this first half of the year grew by 8.3% with regard to last year, jumping from 1.3

to 1.4 billion gallons. The consolidated EBITDA* during the first half of the year grew to COP$409

billion, for a growth of 6.3% as compared to the same period of last year. The net profit for the

period was COP$87.7 billion.

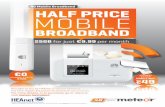

WHOLESALE MARGIN INCREASEAccording to Resolution 41278 of December 30, 2016, the wholesale margin grew 3.18% as of

June 2019, reaching COP $399.67 per gallon for regular gasoline and diesel, effective until May

31, 2020.

TERPEL’S STOCK PRICE EXPERIENCED A 13.5% VALUE GAIN DURING THE FIRST HALF OF

THE YEARBy the closing of June, Terpel’s stock price reached COP$10,900, 13.5% above the 2018 closing

price. This means a market capitalization of COP$1.98 trillion by the end of the first half of the

year.

SUPPLEMENTARY SERVICES CONTINUE EXPANDING IN COLOMBIADuring these first six months, Terpel inaugurated 8 new Altoque stores and 11 new Deuna kiosks,

thus completing a network of 54 stores and 57 kiosks in full operation by the end of June. The

supplementary services segment continues to grow, contributing to the growth of Terpel’s total

network.

PANAMA AVIATION BEGINS DISTRIBUTIONUpon obtaining the permits to provide fuel to 5 airports in Panama in April of this year, Terpel

began distributing aviation fuels in June to its first clients in the Tocumen airport. Thus, Terpel

has positioned itself as an ally of the aeronautic industry in the region.

HECHOS DESTACADOS

IFRS 16 Impact

As of March 2019, Organización Terpel has adopted IFRS 16, which sets

forth the single model for lease accounting. This standard eliminates the

figure of operating leases except for short term agreements and the lease

of low-cost assets.

The adoption of standard IFRS 16 impacted both the balance sheet and the results of the first six months. This was

reflected in an increase of the assets as of June 2019, by COP$606.1 billion and the liabilities by COP$615.7

billion. The net impact on the half year’s net profit was COP$-7.7 billion, since it reduced leases by COP$31.7

billion, increased depreciation and financial expenses by COP$23.7 billion and COP$18.5 billion, respectively, and

the associated deferred tax for COP$2.9 billion. This effect is due to the fact that depreciation and financial

expenses will be higher during the first years as compared with the lineal lease expenses recognized under the

previous standard.

3

Corporate Structure

Summary of Results

Corporate structure as of June 2019

During Q2/19, 714.1 million gallons were sold, for a 4.7% growth with regard to Q2/18. Colombia, which participated in

the volume with a 74.5% share, grew 5.5% YoY. Panama, which contributed 9.7% of the volume, sold 13% more than in

Q2/18. Ecuador contributed 11.2% of the quarter’s volume. Peru and Dominican Rep together contributed 4.6% of the

six-month volume and grew 21.7% thanks to the contribution of the operation acquired from Exxon Mobil in Peru.

Q2/19 income amounted to COP$5.4 trillion, showing a 16.3% growth YoY. Colombia, which participated with 75.1%,

grew 14.1% as compared with Q2/18 while Panama, which participated with 11.5% of the consolidated income, grew

21.8% vis-à-vis the same quarter of last year. Ecuador and Peru (consolidated with ExxonMobil) had a 10.7% share of the

consolidated income of the quarter, for a 23.7% growth rate, mainly due to the growth of the fuel segment in both

countries (due to regulated prices in Ecuador and growth of the aviation business in Peru). Dominican Republic’s income

for the quarter grew 31% YoY.

The gross profit for Q2/19 amounted to COP$478.9 billion, 1.4% over Q2/18. Colombia, which concentrated 65.7% of

the gross profit, shrank -1.1% YoY. Panama, which contributed 15.6%, grew 22.8% with regard to Q2/18. Peru, which

contributed 12.4% of the quarter’s gross profit, shrank 12.4% with regard to the same quarter last year. The remaining

countries contributed 6.3% of the quarter’s gross profit, at a 19% growth rate.

The Q2/19 EBITDA fell below that of Q2/18 by 13.6%, equivalent to COP$-30.8 billion. In Colombia, the drop reached

19.4% YoY, and it was due mainly to the lower inventory adjustment with regard to last year. Without the effect of the

inventory adjustment, the quarterly EBITDA turns out to be 3.9%. Panama showed a result 46.2% higher than during the

same quarter last year. Peru contributed 7.5% of the EBITDA and shrank 25.5%. The remaining countries contributed

5.24% of the quarter’s EBITDA, growing 17.2%.

The net profit for Q2/19 was COP$29.6 billion, as compared to the COP$63.5 billion of Q2/18 (impacted by the non-

recurring acquisition net expenses of COP$1.1 billion for the quarter). The adoption of standard IFRS 16, together with

the amortization of the intangible assets acquired under the Exxon Mobil and the transaction’s pending expenses,

impacted the net profit of the second quarter by approximately COP$19.5 billion. Without the above effect, the net

profit would have been COP$49.1 billion.

*Excluding the impact of IFRS 16

Consolidated Results 2Q/19 1Q/19 2Q/182Q/19 vs.

2Q/18Accrued 19 Accrued 18

Acc. 19

vs. Acc.

18

Volume (MM Gallons) 714.1 696.7 682.3 4.7% 1,410.8 1,302.7 8.3%

Income ($COP Billion) 5,385.5 5,098.2 4,630.7 16.3% 10,483.7 8,743.2 19.9%

Gross Profit ($COP Billion) 478.9 483.4 472.2 1.4% 962.3 829.7 16.0%

EBITDA ($COP Billion) 196.2 212.8 226.9 -13.6% 409.0 384.9 6.3%

Net Profit ($COP Billion) 29.6 58.0 63.5 -53.3% 87.7 55.8 57.1%

In Peru, where we mainly distribute NGV, the network comprises 44 SS.

Terpel, with its Gazel brand, has positioned itself with a 13% market share in

Lima’s NGV sector and is the second largest NGV distribution company. It

has also explored distributing LPG, liquid fuels and convenience stores, the

latter under the “Alto” brand. Terpel has a 34% share in the Lubes market

thanks to the acquisition of ExxonMobil, which included the operation of the

Lima airport.

During Q2/19, the Ecuador operation consolidated 98 SS (64 Terpel and 34

Mobil) with an 11% market share, which has positioned Terpel as the fourth

runner up in this sector’s market.

4

In Dominican Republic, Terpel serves 4 of the

main airports since 2011 and it began serving

the Arroyo Barril Airport in July 2015. This has

allowed it to increase its current market

share to 31%.

In turn, Panama, where liquid fuel sales are

supplemented with the convenience store

business, the distribution of lubes and the

supply to the marine, industrial and aviation

sectors (and currently with the supply of

aviation fuels to clients in the Tocumen

airport), has managed to consolidate a

network of 147 SS which has allowed it to

retain its second place in the ranking and

capture 26% of the market. Market share

grew 1.4% during the first half of the year due

mainly to the new industrial clients and the

growth of the SS network, the commercial

strategy and the fact that projects have

matured.

Extensive Regional Coverage

In Colombia, the 2,010 SS network is composed of 1,922 liquid fuel SS, of which 245 are

Terpel’s own SS and the remainder are part of Terpel’s Allied SS Owner’s Network (allies).

Furthermore, the Gazel network includes 245 SS and 157 of these SS distribute both NGV and

liquid fuels. With market share rates of 41% in liquid fuels, 46% in NGV and 78% in the

aviation sector, where we service 21 airports, Terpel has managed to uphold its position as

leader of the fuel distribution sector in Colombia. Thanks to the acquisition of the Exxon Mobil

operation, its share in the lubricants market has reached 48%.

Terpel has managed to consolidate its expansion plan in 5 countries of the region:

5

Consolidated Operating ResultsDuring the first half of 2018, 1.3 billion gallons were

sold, while during the first half of 2019 we managed to

sell 1.4 billion gallons, equivalent to a total growth

rate of 8.3%.

Regarding volume share, Colombia represented 74.2%

of the consolidated volume accrued during the first half

of the year, for a 4.5% growth rate. Panama

contributed 9.9%, at a 15.3% growth rate YoY.

Ecuador contributed 11.3% of the volume and showed

a 24.8% growth rate YoY, including 29.6 MM gallons

more than during the 1st half of 2018 from the

ExxonMobil operation. In Dominican Republic, volume

represented 2.1% of the consolidated volume, with an

8.0% growth rate YoY due to the growth of the

industrial sector. Peru contributed 2.4% of the

consolidated volume, at a growth rate of 41.2% YoY.

This growth rate includes 8.2 MM gallons more than in

the first half of 2018 due to the ExxonMobil operation,

of which 4.9 MM gallons correspond to the lubricants’

business and 3.3 MM gallons to aviation (these

operations began to be consolidated in April 2018).Regarding the consolidated EBITDA, it experienced an

accrued growth of 6.3%, jumping from COP$384.9

billion during the first half of 2018 to COP$409 billion

during the first half of 2019. This was due to the

EBITDA’s contribution in Panama and the consolidation

of the Mobil operation. ExxonMobil’s acquisitions

contributed COP$54.3 billion to this result.

In Colombia, the EBITDA shrank 0.4% YoY and

contributed 76.5% of the consolidated EBITDA. In spite

of the fact that the inventory adjustment had a positive

impact of COP$3.6 billion during this first half of the

year, it was less than last year’s by $37.3 billion.

Without this effect, the EBITDA adjusted per IFRS 16

grew by 13.3% due to a larger volume, the consolidation

of Mobil Lubes and the increase in the wholesale margin.

Panama grew by 53.9% YoY and contributed 12.6% to

the consolidated EBITDA due mainly to volume growth

and higher margins.

Dominican Republic generated an EBITDA of COP$12.6

billion, COP$1.3 billion more than during the first half

of 2018. Without the foreign exchange rate effect, it

decreased by 0.5%, due to the devaluation of the

Dominican rate of exchange.

In turn, Peru generated COP$24.1 billion during the

first half of 2019, of which 93.6% was contributed by

the operation acquired from ExxonMobil.

Ecuador contributed approximately COP$7.9 billion to

the EBITDA of the first half of 2019, including COP$4.3

billion from the ExxonMobil operation.

SALES VOLUME

(MM Gals)

EBITDA*

(COP$ Billion)

* Excluding the IFRS 16 impact

6

Operating results - ColombiaResults in Colombia have been positively impacted by the implementation of the new customer-based

commercial strategy comprising better service, better infrastructure and better prices. SSs have a

renewed design and image, excellent restroom service, novel convenience stores and a carwash system

that is unique in the country.

During the first half of 2019, Terpel distributed in Colombia

1.05 billion gallons representing 4.5% more than the volume

distributed during the first half of 2018. Of such volume,

69.16% was distributed through liquid fuel stations and

3.74% through NGV stations. Thus, the service station

segment represents approximately 72.9% of total sales in

gallons. This is why significant investments have been made

in the image of the SSs and in the construction of motorcycle

islands, since infrastructure is one of the key factors in

attracting more customers.

The Aviation business contributed 16.78% of the volume and

shrank by 2.1% with regard to the first half of 2018. The

Industry segment volume represented 8.83% of the total

volume distributed during the 1st half of 2019 and grew by

8.7% thanks to the arrival of new clients and the recovery of

the oil sector. The Marine Fuel segment shrank by 12.9%

with regard to the 1st half of 2018.

Although the share in the volume of the lubricants sector was

1.19%, this is one of the segments that most contributed in

terms of gross profit. While the SS contributed 61.2% of the

total gross profit and 72.9% of the volume, the 1.19% of the

volume corresponding to lubricants contributed 15.68% of

the total profit. This result includes COP$80.3 Billion of the

gross profit generated by Mobil lubricants during the first half

of the year.

Colombia’s gross profit for the 1st half of 2019 was COP

$645.4 billion representing a 10.5% growth with regard to

the 1st half of 2018. This was the result of volume growth,

the consolidation of the Mobil operation, and the annual

increase in the liquids wholesale margin. This compensated

for the smaller contribution of the NGV, which was affected

by the devaluation.

Industry and aviation each contributed 4.13% and 6.03% of

the gross profit, respectively. Although the marine fuel and

supplementary service segments both showed great growth

and consolidation potential, their current contribution to the

company’s gross profit was around 1.37%, given that they are

at the development stage.

Altoque Store - Weighbridge SS (Bogotá, Colombia) Deuna La América SS (Medellín, Colombia) Ziclos Highway SS (Cali, Colombia) Motorcycle Island, Acuarela SS (Pereira, Colombia)

ACCUMULATED VOLUME COMPOSITION

ACCRUED GROSS PROFIT COMPOSITION

VOLUME = 1.05 Billion Gallons

Accumulated Growth = +4.5% vs. June/18

+%: Accumulated growth

%: Share in Total

GROSS PROFIT= COP$645.4 Billion

Accumulated Growth = 10.5% vs. June/18

+%: Accumulated growth

%: Percentage share in total

% Gross Margin

7

Operating results - Colombia

Weighbridge SS (Bogota, Colombia)

NET PROFIT(COP$ Billion)

EBITDA*(COP$ Billion)

EBITDA Mobil 1st half of 2019

The EBITDA shrank by 0.4% regarding the 1st half of

2018. This result was affected by the lower inventory

adjustment compared to the same period of last year,

which contributed COP$-37.3 billion to this

difference, with regard to last year. The EBITDA per

gallon amounted to COP$298.71.

Without the inventory adjustment effect, the

EBITDA, adjusted according to IFRS 16, grew by

13.3%, favored by the annual increase of the

wholesale margin and Mobil’s consolidation.

The net profit of the 1st half of 2019 was affected

by the amortization of the intangible assets acquired

from ExxonMobil, the adoption of the IFRS 16

standard and the Mobil acquisition expenses. Setting

these effects aside, the result would be COP$113.3

billion and a growth rate of 103%.

If compared to last year, there was a significant

growth, since the profit was impacted by non-

recurrent expenses associated to the acquisition of

ExxonMobil, including: loss of hedging and expenses

for transaction consultants.

8

Operating Results - Panama

Panama has also benefitted from the new commercial strategy: better service, better infrastructure and

better prices have made Terpel the second largest fuel distribution company in this country. SSs have a

renewed design and image, excellent restroom service, novel convenience stores and a carwash system

that is unique in the country.

During the 1st half of 2019, 139.95 million gallons were

sold in Panama, representing 15.3% more than the

volume sold during the 1st half of 2018. Of such volume,

72.2% was distributed through the liquid fuel SSs, which

in turn had a 75.6% share in the period’s gross profit.

Contrary to Colombia, the SS supplementary service

segment in Panama is a mature segment contributing

13.3% of the gross profit. These two factors have led

investments in Panama to focus on expanding Terpel’s

own SS network, renewing the image of existing SS, and

building new supplementary service formats.

On the other hand, the Industry business contributed

24.6% of the volume and grew 65.7% with regard to the

1st half of 2018, thanks to the consumption of the

country’s most important clients in the mining and

transportation sectors. Regarding gross profit, its

contribution was 7%.

The share of the Marine segment in volume was 2.79%

and its contribution to the gross profit was 1.4%. The

Terpel-branded lubricants distributed in Panama

represented 0.2% of the volume, although they

contributed 2% of the gross profit, growing 5% vis-à-vis

the 1st half of 2018.

In Panama, the Aviation sector is in its development

stage, after beginning distribution at the Tocumen airport

in June 2019. This is why its contribution to volume was

0.21% for this first half of the year.

In Panama, the accrued gross profit was COP$148.2

billion equivalent to a 23.2% growth rate as compared to

the 1st half of 2018, mainly due to the growth in volume

(industrial clients’ consumption) and higher margins.

Panamericana Travel Center SS, Panama Quick Shop, Panama Wash’n Go Panama Pacífico Road SS restrooms at Panama SSs

ACCUMULATED VOLUME COMPOSITION

ACCRUED GROSS PROFIT COMPOSITION

+%: Accumulated growth

%: Percentage share in total

% Gross Margin

+%: Accumulated growth

%: Share in Total

FINANCIAL STATEMENTS (COP$ BILLION)

The EBITDA grew by 53.9% YoY and, without the

foreign exchange rate effect, the growth rate was

37.7%. This result is due mainly to an increase in

volume (industrial clients' consumption), higher

margins, spending optimization and good store

performance. The inventory adjustment for this

first half of the year was COP$-297 million.

The EBITDA per gallon went from COP$276.4 to

COP$368.9.

9

The book value of Organización Terpel’s consolidated assets at the end of the 1st half of 2019 was

COP$6.9 trillion, a 13.3% growth rate focused on PP&E and Intangibles. This amount includes the right-of-

use assets resulting from the implementation of IFRS 16, which represent 9% of the total assets as of June

2019. Regarding the composition, current assets represent 34%, PP&E represents 32% and deferred and

intangible assets represent 23%.

Liabilities, which correspond to 71.8% of the assets, are mainly composed of: the remainder of the old

syndicated loan used to acquire ExxonMobil’s assets, which was refinanced this year together with the

short term loans amounting to COP$316 billion and the short-term obligations of the countries, which

together represent 9%, the bonds issued in 2013, 2015 and 2018 representing 42%, current liabilities

which represent 25% and the remaining long-term financial obligations representing 3%. Furthermore,

they include the lease liabilities arising from the implementation of IFRS 16, representing 12% of the

liabilities. Finally, the book value of the Equity for the 1st half of 2019 is COP$1.96 trillion, which grew

with regard to 2018 as a result of the exchange rate of the dollar-denominated investments in the affiliate

that consolidated the operation acquired from Exxon Mobil in Peru (Organización Terpel Andina).

Consolidated Net Worth Situation

Operating Results - Panama

NET PROFIT(COP$ Billion)

EBITDA(COP$ Billion)

ASSETS LIABILITIES

The Net Profit grew by 9.2% and, without the rate

of exchange effect, growth amounted to -2.4%.

This reduction is the result of having adopted the

IFRS 16 standard, whose impact was COP$5.2

billion. Without this effect, the net profit would

have grown 70.9%.

10

Consolidated Financial Debt

The total debt (excluding IFRS 16) by the end of the 1st half of 2019

amounted to COP$2.7 trillion, composed mainly of obligations in Colombia

and Panama. The debt in Colombia corresponds to the Bonds issued in 2018

for COP$1.1 trillion, the bonds issued in 2013 and in 2015 for COP$985

billion and short-term financial obligations. In Colombia, the 7-year bond

series issued in 2013 has a fixed cost, which represents 9% of the fixed-rate

debt. The short-term financial obligations (mainly the old syndicated loan

for COP$115 billion) are pegged to IBR and represent 12%. 69% of the cost

of the debt is pegged to the CPI, due to the 2018 $1.1 trillion issue. The

debt subject to Libor (10%) corresponds to financial obligations in Panama.

75% of the debt has long-term maturities. The short-term maturities correspond to the financial

obligations arising from the old syndicated loan and a part of the debt in Panama which together

amount to COP$431 billion and also include the maturity of a series of bonds in 2020 for COP$241

billion. The rest of the debt has significant maturities in 2021 for COP$241 billion. The rest of the debt

has significant maturities in 2021 for COP$149 billion, 2022 for $151 billion, 2023 for COP$529

billion, and between 2028 and 2043 for a total of COP$1.2 trillion, most of them corresponding to the

bond issues.

Regarding the company’s financial soundness indicators, the debt corresponds to 3.55x times the EBITDA

(excluding the IFRS 16 effect). As to hedging, the EBITDA (twelve month estimate) is equivalent to 4.02x

times the cost of the debt (interests).

CONSOLIDATED BRIDGE DEBT ($COP Trillion)

RATE BREAKDOWN

TERM BREAKDOWN

DEBT MATURITY PROFILE (COP$ BILLION)

11

Consolidated CAPEX

Terpel Stock

The company’s current strategy requires significant investment in assets in the medium term, in order

to achieve the intended changes in the architecture and design of the SS, spotless restrooms and

convenience stores that reflect the service we intend to provide our customers. This implies making

investments topping those that have been historically implemented, and their return will depend on

volume growth and on consumer loyalty in coming years.

The inclusion of new SS in the network, the remodeling of existing ones, owned both by Terpel and by

its allies, as well as the construction of additional convenience stores, NGV conversions, the car wash

services (Ziclos) and the operating investments necessary for the fuel plants, among other operating

investments, demanded resources during the 1st half of 2019 for COP$140.4 billion.

55.7% of such investment has been targeted in Colombia and 44.1% has been devoted to the expansion

plan that is under way in Ecuador, Peru and Panama. 68.6% of the investment has been made in the

SS, either for infrastructure, conversion of vehicles into NGV or construction of supplementary services.

17.9% has been invested in Industry, Aviation and Lubricants. In turn, 6.5% was invested in fuel

storage and distribution plants so as to maintain and increase the installed capacity that is the key to

preserving sound logistics in order to deliver the product and keep our promises to our customers.

In 2014, as a result of the re-organizational merger, shares were registered at the Colombian Stock

Exchange on behalf of Organización Terpel. The security’s price at the closing of December 2018 was

COP$9,600 and since then, the price has grown by 13.5%. During this first half of the year, 3.4 million

shares have been traded, for a total of COP$34.8 billion.

By the end of the 1st half of 2019, Organización Terpel’s market capitalization amounted to COP$1.98

trillion.

The dividend decreed for 2019 was $368.58 per share, and it was paid in full in a single installment on

March 29, 2019.

CAPEX % PER COUNTRY CAPEX PER BUSINESS

TERPEL STOCK – CLOSING PRICE EVOLUTION

($COP/Share)

Detail of consolidated operating results

12

Caveats on the financial and operational information

The financial information and the operating results presented herein correspond to Organización Terpel and its affiliates in

compliance with the International Financial Reporting Standards (IFRS). Information on affiliates is reported with the

intercompany eliminations, which is why the sum of the individual results may not match the consolidated results.

The information contained in this document does not commit or suggest any type of investment decision.

* Excluding the IFRS 16 impact

Consolidated Results 2Q/19 1Q/19 2Q/182Q/19 vs.

2Q/18Accrued 19 Accrued 18

Acc. 19

vs. Acc.

18

Volume (MM Gallons) 714.1 696.7 682.3 4.7% 1,410.8 1,302.7 8.3%

Colombia 532.3 514.6 504.7 5.5% 1,046.9 1,001.3 4.5%

Panama 69.0 70.9 61.1 13.0% 140.0 121.3 15.3%

Ecuador 80.2 79.8 89.7 -10.6% 160.0 128.2 24.8%

Dominican Republic 14.9 14.9 12.2 21.6% 29.8 27.6 8.0%

Peru 17.8 16.4 14.6 21.8% 34.2 24.2 41.2%

Income ($COP Billion) 5,385.5 5,098.2 4,630.7 16.3% 10,483.7 8,743.2 19.9%

Colombia 4,047.1 3,870.4 3,547.1 14.1% 7,917.5 6,902.3 14.7%

Panama 621.0 562.4 509.8 21.8% 1,183.4 982.5 20.4%

Ecuador 351.1 330.9 291.6 20.4% 682.0 414.6 64.5%

Dominican Republic 139.1 129.9 106.2 31.0% 269.1 231.8 16.1%

Peru 227.2 204.6 175.8 29.2% 431.8 212.1 103.6%

Gross Profit ($COP Billion) 478.9 483.4 472.2 1.4% 962.3 829.7 16.0%

Colombia 314.9 330.6 318.4 -1.1% 645.4 584.1 10.5%

Panama 74.6 73.6 60.8 22.8% 148.2 120.3 23.2%

Ecuador 11.2 10.0 9.9 13.4% 21.2 14.7 44.2%

Dominican Republic 18.7 19.1 15.3 22.6% 37.8 34.0 11.4%

Peru 59.4 50.1 67.8 -12.4% 109.5 76.6 42.9%

EBITDA ($COP Billion) 196.2 212.8 226.9 -13.6% 409.0 384.9 6.3%

Colombia 146.0 166.7 181.2 -19.4% 312.7 313.9 -0.4%

Panama 25.1 26.6 17.1 46.2% 51.6 33.5 53.9%

Ecuador 4.4 3.6 3.9 12.5% 7.9 5.9 34.6%

Dominican Republic 5.9 6.8 4.9 20.9% 12.6 11.4 11.3%

Peru 14.8 9.3 19.9 -25.5% 24.1 20.2 19.1%

Net Profit ($COP Billion) 29.6 58.0 63.5 -53.3% 87.7 55.8 57.1%