Reserve Bank of India 03

Transcript of Reserve Bank of India 03

-

8/6/2019 Reserve Bank of India 03

1/15

-

8/6/2019 Reserve Bank of India 03

2/15

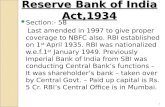

Introductiony RBI is the central Bank Of India

y Established on 1st April in 1935 under the RBI Act

y Its head quarters is in Mumbai (Maharashtra)

y The Present Governor of RBI is D. Subbarao

-

8/6/2019 Reserve Bank of India 03

3/15

Contiy It has 26 offices in which four are regional offices

located in metropolitan cities.

-

8/6/2019 Reserve Bank of India 03

4/15

Preambley The Preamble of the Reserve Bank of India describes

the basic objectives of the Reserve Bank as

y ...to regulate the issue of Bank Notes and keeping ofreserves with a view to securing monetary stability inIndia and generally to operate the currency and credit

system of the country to its advantage."

-

8/6/2019 Reserve Bank of India 03

5/15

Historyy It was set up on the recommendations of the Hilton

Young Commission

y Initially it was located in Kolkata. It moved to Mumbaiin 1937.

y

It was privately owned.

y Since nationalization in 1949, the Reserve Bank is fullyowned by the Government of India.

-

8/6/2019 Reserve Bank of India 03

6/15

Role ofCentral Banky Issue of notes

y Banker, Agent and Financial Advisor to the State

y Banker to the Banksy Custodian of Foreign Exchange Reserves

y Controller of Credit

y Supervisory Functions

y Promotional Role

-

8/6/2019 Reserve Bank of India 03

7/15

Issue of notesy The reserve Bank of India enjoys monopoly in the issue of

currency notes as central Bank of the country.

y All the currency notes except one rupee note are issued byRBI. One rupee note and all coins of small magnitude areissued by the Government of India and are circulatedthrough the Reserve Bank of India.

y The RBI Act permits RBI to issue notes in thedenominations of rupees 2, 5, 10, 20, 50, 100, 500, 1000.

-

8/6/2019 Reserve Bank of India 03

8/15

y It keeps the banking accounts of the government.

y It advances short-term loans to the government and

raises loans from the public.y It purchases and sells through bills and currencies on

behalf to the government.

y It receives and makes payment on behalf of thegovernment.

y It advises the government on economic matters likedeficit financing price stability

Banker, Agent and Financial Advisor to the

State:

-

8/6/2019 Reserve Bank of India 03

9/15

Banker to the Banks

y It acts as a guardian for the commercial banks.Commercial banks are required to keep a certainproportion of cash reserves with the Reserve bank.

y Reserve bank provide them various facilities likeadvancing loans, underwriting securities etc.

y Similarly, in times of their needs, the banks borrowfunds from the RBI. It is, therefore, called the bank oflast resort or the lender of last resort.

-

8/6/2019 Reserve Bank of India 03

10/15

Custodian of Foreign Exchange

Reserves

y It is the responsibility of the Reserve bank to stabilize the

external value of the national currency.

y The Reserve Bank keeps gold and foreign currencies asreserves against note issue and also meets adverse

balance of payments with other counties.

-

8/6/2019 Reserve Bank of India 03

11/15

Lender of the Last Resort

y At one time, it was supposed to be the most importantfunction of the Reserve Bank.

y When Commercial banks fail to meet obligations oftheir depositors the Reserve Bank comes to theirrescue as the lender of the last resort.

y The Reserve Bank assumes the responsibility ofmeeting directly or indirectly all legitimate demandsfor accommodation by the Commercial Banks underemergency conditions.

-

8/6/2019 Reserve Bank of India 03

12/15

Controller ofCredity In modern times credit control is considered as the

most crucial and important functional of a ReserveBank.

y The Reserve Bank regulates and controls the volume

and direction of credit by using quantitative andqualitative controls.

y Quantitative controls include the bank rate policy,the open market operations, and the variable reserveratio.

y Qualitative or selective credit control, on the otherhand includes rationing of credit, marginrequirements, direct action, etc.

-

8/6/2019 Reserve Bank of India 03

13/15

Supervisory Functionsy In addition to its traditional central banking functions,

the Reserve Bank has certain non- monetary functions

of the nature of supervision of banks and promotion ofsound banking in India.

y The supervisory functions of the RBI have helped agreat deal in improving the methods of their

operation.

-

8/6/2019 Reserve Bank of India 03

14/15

Promotional Roley A striking feature of the Reserve Bank of India Act was

that it made agricultural credit the Banks specialresponsibility.

y This reflected the realization that the countrys centralbank should make special efforts to develop, under itsdirection and guidance, a system of institutional creditfor a major sector of the economy, namely, agriculture,

which then accounted for more than 50 per cent of thenational income.

-

8/6/2019 Reserve Bank of India 03

15/15

Functions of RBI

y Monetary Authority Regulator

y Supervisor of Financial Systemy Manager of Foreign Exchange

y Issuer of Currency

y Developmental Role