Research Unconventional Oil and Gas PDF - VanEck

Transcript of Research Unconventional Oil and Gas PDF - VanEck

1 of 15

Unconventional Oil & GasDemystifying Fracking and Understanding Global Opportunities

September 2014

2 of 15

THIS MATERIAL MAY ONLY BE PROVIDED TO YOU BY VAN ECK GLOBAL AND IS FOR YOUR PERSONAL USE ONLY AND MUST NOT BE PASSED ON TO THIRD PARTIES WITHOUT THE PRIOR EXPRESS WRITTEN CONSENT OF VAN ECK GLOBAL. IF YOU HAVE NOT RECEIVED THIS MATERIAL FROM VAN ECK GLOBAL, YOU ARE HEREBY NOTIFIED THAT YOU HAVE RECEIVED IT FROM A NON-AUTHORIZED SOURCE THAT DID NOT ACT ON BEHALF OF VAN ECK GLOBAL AND THAT ANY REVIEW, USE, DISSEMINATION, DISCLOSURE OR COPYING OF THIS MATERIAL IS STRICTLY PROHIBITED.

Information contained in this presentation is for information purposes only and should not be construed as an offer or solicitation for the purchase or sale of any financial instrument, product or service sponsored by Van Eck Global or its affiliates. This material does not constitute an offer to sell or solicitation to buy any security, including shares of any fund. An offer or solicitation will be made only through the fund’s official offering document and will be subject to the termsand conditions contained therein.

Please note that the information herein represents the opinion of the portfolio manager and these opinions may change at any timeand from time to time and portfolio managers of other investment strategies may take an opposite opinion than those stated herein.Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may notcontinue.

The information herein reflects prevailing market conditions and our judgments as of the date of this document, which are subject tochange. In preparing this document, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. Opinions and estimates may be changed without notice and involve a number of assumptions which may not prove valid. There is no guarantee that any forecasts or opinions in this material will be realized. Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. This information should not be construed as investment advice. This information should not be construed as sales or marketing material or an offer or solicitation for the purchase or sale of any financial instrument, product or service sponsored by Van Eck Associates Corporation or its affiliates. © 2014, Van Eck Global

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of Van Eck Global.

Van Eck Global 335 Madison Avenue, New York, NY 10017 www.vaneck.com 800.826.2333

3 of 15

Demystifying Fracking & Understanding Global Opportunities

Unconventional oil and gas extraction from shale via horizontal drilling and fracturing (often referred to as “fracking”), though in existence for some time in some form or another, has only recently been explored in depth in the U.S. and has experienced significant advancements via the evolution of drilling technology

While unconventional oil has been transformational for the U.S., we believe we are still primarily in the “discovery and delineation” stage of unconventional oil resources

As the U.S. enters the “exploitation phase”, companies may continue to improve and capitalize upon drilling efficiencies, adding value and potentially contributing, perhaps significantly and over longer periods, to global production and reserves

Unconventional oil reserves are not unique to the U.S.; many other countries have substantial potential

When taken to its logical conclusion, unconventional oil and gas production has significant implications with respect to the global energy supply, though challenges still remain

4 of 15

Stepping Back – How is Oil & Gas Formed?

Over millions of years, heat and pressure formed by the layering of sediment and rock have turned the remains of ancient marine organisms into oil and gas which are now “trapped” in these layers miles below the earth’s surface

Source: www.need-media.smugmug.com; Data as of September 2014.

5 of 15

Conventional vs. Unconventional Oil: A Primer

Source: Pioneer Natural Resources; Data as of September 2014.

CONVENTIONAL UNCONVENTIONAL

High permeability

Fracking: minimal

Principal evaluations:

Trap Seal Source Reservoir Migration Timing

Primary risk: geologic

Access: vertical wells

Ultra tight rock

Fracking: large, hydraulic

Principal evaluations:

Kerogen content Maturity Clay content Pressure Bulk volume

Hydrocarbon

Primary risk: economic

Access: horizontal wells

Seal/Trap

Conventional Gas

Conventional Oil

Permeable rock formations(oil and gas can migrate through)

Source rock where oil and gas forms

6 of 15

Three Factors that Sparked the U.S. Shale Revolution

Source: EnCana, Pioneer Natural Resources; Data as of September 2014.

I. Horizontal drilling technology (began 1930’s):

allowed access to significantly greater volume of reservoir rock

II. Horizontal hydraulic fracture stimulation technology (began 1950s):

created porosity and permeability – created “channels” that allowed oil and gas to flow

III. Historically strong commodity prices

Horizontal Well With Multi-Stage Fracturing

7 of 15

Natural Gas19%

Renewables9%

Nuclear19%

Petroleum & Other Liquids

3%

Coal50%

Source: Pioneer Natural Resources; Data as of September 2014.

Natural Gas27%

Renewables13%

Nuclear19%Petroleum & Other

Liquids1%

Coal40% Natural Gas

35%

Renewables16%

Nuclear16%

Petroleum & Other Liquids

1%

Coal32%

Previous Power Generation Mix2005

Current Power Generation Mix2013

Projected Power Generation Mix2040

2005 Capacity = 4.1 Trillion Kilowatthours

2013 Capacity = 4.1 Trillion Kilowatthours

2040 Capacity = 5.2 Trillion Kilowatthours

Natural gas has encouraged coal-to-gas switching among electricity producers

How the U.S. Shale Revolution Has Shaped U.S. Energy Production

8 of 15

How the U.S. Shale Revolution Has Shaped Global Supply

Source: U.S. Energy Information Administration (EIA); Data as of July 31, 2014.

Oil Supply Growth During 2009 – 2014 (with Brent Crude Oil at $105 / bbl)

-1

-0.5

0

0.5

1

1.5

MM

Bbl/d

US FSU NON-OPEC ex-US & FSU

Year-over-Year Growth in SupplyU.S., Former Soviet Union (FSU), Non-OPEC ex-U.S. & FSU

Mill

ion

Barr

els

Per D

ay (M

Mbb

l/d)

Mill

ion

Barr

els

Per D

ay (M

Mbb

l/d)

80

85

90

95

2009 NorthAmerica

Other Non-Opec

Saudi Arabia Other Opec 2014

85.2

4.9

1.41.4

92.8

-0.1

U.S. and Canada have been the only recent source of non-OPEC (Organization of the Petroleum Exporting Countries) supply growth

9 of 15

How Can the Value of Unconventional Resources be Increased?

Acquire more land

More stratigraphic layers

Tighter well spacing

Longer, more accurate laterals

More frac stages

Bigger frac stages

Faster drilling

Reduce drilling costs

Optimize production

Stack laterals

Integrate frac distribution

Access More Rock Improve Well Economics

10 of 15

Case Study: Whiting Petroleum – More and Bigger Frac Stages

Source: Whiting Petroleum; Data as of June 30, 2014.

Annulus (Gaps) Stages Frac Ports / StagePotential

Entry Points

Free fluidbetween packers

30 1 30

Annulus (Gaps) StagesPerforation

Clusters / StagePotential

Entry Points

Cemented 40 3 120

Older Style Completion

New Style Completion

11 of 15

Case Study: Concho – Faster Drilling, Longer Laterals and More Frac Stages

Source: Concho Resources; Data as of June 30, 2014.

3026

23

2012 2013 1H14

4,266

4,359

4,657

2012 2013 1H14

2012 2013 1H14

175

186

206

2012 2013 1H14

Average Drilling Days – 23% Decrease Average Lateral Length (Feet) – 9% Increase

Average Stages Per Well – 27% Increase (note: figures intentionally hidden)

Average 30-Day Initial Production (Boepd* per 1,000 Wells) – 18% Increase

*Boepd = Barrels of Oil Equivalent per Day

12 of 15

0

500

1000

1500

2000

2500

3000

0 6 12 18 24 30 36 42 48

Barr

els

of O

il Eq

uiva

lent

/ Da

y

MonthsOld Completion - 5,000 ft. lateral; 12 stages (12-well average)

New Completion - 5,000 ft. lateral; 20 stages (4-well average)

Long Lateral - 10,000 ft.; 43 stages (single well - Gallant Fox)

Case Study: Cimarex – Longer Laterals and More Frac Stages

Well Cost Estimates – Culberson County Wolfcamp D Wells

Source: Cimarex; Data as of June 30, 2014.

Old New Long

Well Cost ($MM) $8.0 $8.7 $13.5

Before Tax Internal Rate of Return (IRR) 30% 90% 161%

Net Present Value (NPV) with 10% Discount ($MM) $4.0 $12.2 $31.6

*Assumptions: Oil = $90 / barrel ; Gas = $4 / thousand of cubic feet; Natural Gas Liquid = $30 / barrel (full recovery)

13 of 15

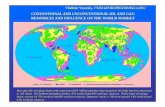

Game Hasn’t Even Started Yet Globally

The potential U.S. unconventional resource opportunity remains vast; yet represents a fraction of global unconventional gas reserves and overall global oil production

Countries with Major Unconventional Gas Resources(# of Technically Recoverable Resources) Global Oil Production

Source: U.S. Energy Information Administration (EIA), Bloomberg; Data as of July 31, 2014.

Mill

ion

Barr

els

Per D

ay (M

Mbb

l/d)

(Trillion cubic feet)

14 of 15

Some Issues to Consider: Capital Intensity (Production Profiles)

Production Profile – Constant Well Quality

Source: Pickering Energy Partners; Data as of July 31, 2014.

Production Profile by Year – Constant Well Quality

High initial rates deliver a growing production profile

Production growth typically moderates but this happens, generally, after many years

Gas

Prod

uctio

n, B

illio

ns o

f Cub

ic F

eet P

er D

ay (b

cf/d

)

Gas

Prod

uctio

n, M

illio

n of

Cub

ic F

eet p

er D

ay (M

mcf

/d)

15 of 15

Some (Additional) Issues to Consider: Environmental Impacts

Source: The American Oil & Gas Reporter; Data as of September 2014.

Sample Map of Frac Treatments – Barnett Shale

Oil W

ell,

Frac

Leng

th, a

nd A

quife

r Dep

th (F

eet)

Groundwater contamination risk should be less of a concern as tests on well depth, frac length and corresponding distance from water aquifers generally exhibit large separations

Distance between the deepest aquifer and longest frac is approx. 4,000 ft.

Deepest Aquifer Depth

Frac Length – TopOil Well – Top Oil Well – Midpoint Oil Well – Bottom Frac Length – Bottom