Regarding the income distribution in the United States, we have: 0 of 30 1. Too much inequality 2....

-

Upload

lillian-aleesha-watson -

Category

Documents

-

view

215 -

download

2

Transcript of Regarding the income distribution in the United States, we have: 0 of 30 1. Too much inequality 2....

Regarding the income Regarding the income distribution in the United distribution in the United States, we have:States, we have:

0 of 30

1.1. Too much inequalityToo much inequality

2.2. Just the right amount Just the right amount of inequalityof inequality

3.3. Not enough Not enough inequalityinequality

4.4. No opinion/don’t No opinion/don’t knowknow

Which do you prefer?Which do you prefer?

0 of 30

1.1. Every household earns Every household earns exactly $40,000exactly $40,000

2.2. 10% of the households 10% of the households each earns $40,000, each earns $40,000, the next 40% each the next 40% each earns $45,000, the earns $45,000, the next 40% earns next 40% earns $60,000, and the $60,000, and the richest 10% earns richest 10% earns $10,000,000.$10,000,000.

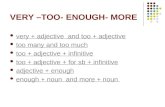

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

United States Income DistributionUnited States Income Distribution

The United States Census Bureau The United States Census Bureau measures the percentage of income measures the percentage of income each quintile (poorest to richest) earns each quintile (poorest to richest) earns as part of the total income. as part of the total income.

A quintile is 20% of the total.A quintile is 20% of the total.

The table on the next slide provides the The table on the next slide provides the latest data for 2009 households and latest data for 2009 households and compares this with 2006 and 1979 data.compares this with 2006 and 1979 data.

Microeconomics

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

Percentage Distribution of U.S. Households, by Percentage Distribution of U.S. Households, by Income Group, 2009, 2006 and 1979 Income Group, 2009, 2006 and 1979 (source: U.S. (source: U.S. Census)Census)

Mean Income Mean Income Threshold( (upper Threshold( (upper limit) of 2009 limit) of 2009 HouseholdsHouseholds

Share of Income Share of Income Received in Received in 20092009

Share of Income Share of Income Received in Received in 20062006

Share of Share of Income Income Received in Received in 19791979

$20,453 (lowest quintile, appr. 23.4 mill. households)

3.4%3.4% 3.4%3.4% 4.2%4.2%

$38,550 (second lowest quintile)

8.6%8.6% 8.6%8.6% 10.3%10.3%

$61,801 (third quintile)

14.6%14.6% 14.5%14.5% 16.9%16.9%

$100,000 (fourth quintile)

23.2%23.2% 22.9%22.9% 24.7%24.7%

Over $100,000 (top quintile)

50.3%50.3% 50.5%50.5% 44.0%44.0%

Are the rich getting richer, Are the rich getting richer, and the poor getting poorer?and the poor getting poorer?

1.1. YesYes

2.2. NoNo

3.3. It dependsIt depends

4.4. Not sureNot sure

1979This Year

44%50.3%

4.2%

3.4%

Income distribution comparison by households

Unit 9 - Distribution of Wealth and Unit 9 - Distribution of Wealth and IncomesIncomes

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

United States Income DistributionUnited States Income Distribution

In absolute and relative terms, the In absolute and relative terms, the rich are getting richer.rich are getting richer.

In absolute terms (the size of the In absolute terms (the size of the slice), the poor are getting richer, too.slice), the poor are getting richer, too.

In relative terms (the percentage of In relative terms (the percentage of the income), the poor are getting the income), the poor are getting poorer.poorer.

Microeconomics

Tracking studies that look at Tracking studies that look at households over a 10 year time households over a 10 year time period indicate that what percentage period indicate that what percentage of households moves into a higher of households moves into a higher quintile after 10 years?quintile after 10 years?

0 of 30

1.1. 20%20%

2.2. 35%35%

3.3. 50%50%

4.4. 75%75%

5.5. 85%85%

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

Income InequalityIncome Inequality

The Lorenz Curve (see next slide) The Lorenz Curve (see next slide) shows the degree of income shows the degree of income inequality.inequality.

Microeconomics

The straight 45-degree linerepresents perfect equality.The more the Lorenz Curvebows outward, the more income inequality exists.

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

Income Inequality – The Lorenz Income Inequality – The Lorenz CurveCurve

Microeconomics

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

Income InequalityIncome Inequality

The Gini Coefficient is a ratio between The Gini Coefficient is a ratio between 0 and 1. A coefficient of 0 means that 0 and 1. A coefficient of 0 means that the country has perfect income the country has perfect income equality. A coefficient of 1 means that equality. A coefficient of 1 means that the country has perfect income the country has perfect income inequality.inequality.

The Gini Index is the coefficient The Gini Index is the coefficient expressed as a percentage.expressed as a percentage.

Microeconomics

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

Income InequalityIncome Inequality

What do you think the Gini coefficient What do you think the Gini coefficient should be?should be?

Is there too much income inequality Is there too much income inequality in our country? in our country?

The 2009 Gini coefficient for the The 2009 Gini coefficient for the United States was 44.3%; in 1988 it United States was 44.3%; in 1988 it was 42.6%.was 42.6%.

Microeconomics

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

Income Equality Income Equality

Advantages of having income equality:Advantages of having income equality:

People who stress due to comparisons are People who stress due to comparisons are happier.happier.

Less use of natural resources and lower Less use of natural resources and lower consumption.consumption.

More consumer satisfaction among the poor. More consumer satisfaction among the poor. Greater political equalities. Greater political equalities.

Microeconomics

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

Income InequalityIncome Inequality

Advantages of having income Advantages of having income inequality:inequality:

Greater incentives to work hard.Greater incentives to work hard. Greater savings and investment.Greater savings and investment. More high-quality and innovative More high-quality and innovative

products.products. More resources for the government and More resources for the government and

private citizens to help the needy.private citizens to help the needy.Microeconomics

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

PovertyPoverty

The poverty line is an income amount below The poverty line is an income amount below which households are considered poor. which households are considered poor.

In the United States, a family of three persons In the United States, a family of three persons (two parents and one child in all states except (two parents and one child in all states except Alaska and Hawaii) was considered poor if it Alaska and Hawaii) was considered poor if it earned less than $17,552 in 2010. The earned less than $17,552 in 2010. The poverty line increases each year along with poverty line increases each year along with increases in the cost of living.increases in the cost of living.Source: http://www.census.gov/hhes/www/poverty/data/threshld/thresh09.htmlSource: http://www.census.gov/hhes/www/poverty/data/threshld/thresh09.html

Microeconomics

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

PovertyPoverty

In the U.S. the official poverty rate in 2009 was In the U.S. the official poverty rate in 2009 was 14.3%. In 2008 it was 13.2%. In 2007, it was 14.3%. In 2008 it was 13.2%. In 2007, it was 12.5%.12.5%.

For detailed information about incomes and distribution For detailed information about incomes and distribution across racial and demographic groups, visit:across racial and demographic groups, visit:

http://www.census.gov/hhes/www/poverty/data/index.htmlhttp://www.census.gov/hhes/www/poverty/data/index.html

Microeconomics

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

PovertyPoverty

Not all poverty causes can be Not all poverty causes can be eliminated. However, these actions eliminated. However, these actions have helped many people avoid have helped many people avoid poverty:poverty:

Live a healthy lifestyle.Live a healthy lifestyle. Learn a trade. Learn a trade. Invest wisely.Invest wisely. Make sound relationship decisions. Make sound relationship decisions.

Microeconomics

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

Government Anti-poverty ProgramsGovernment Anti-poverty Programs

Main programs in the United States include:Main programs in the United States include: TANF (Temporary Aid For Needy Families – 4.4m; TANF (Temporary Aid For Needy Families – 4.4m;

$22b) $22b) Social SecuritySocial Security Medicare (Medical assistance for the elderly)Medicare (Medical assistance for the elderly) Medicaid (Medical assistance for the poor – 50m; Medicaid (Medical assistance for the poor – 50m;

$273b)$273b) Unemployment Compensation (10m; $160b)Unemployment Compensation (10m; $160b) Food Stamps (40+m; $70b)Food Stamps (40+m; $70b) Housing SubsidiesHousing Subsidies Head StartHead Start Earned Income Tax CreditEarned Income Tax Credit Job Training ProgramsJob Training Programs Microeconomics

Should we reform welfare Should we reform welfare programs?programs?

1.1. Yes, increase total Yes, increase total spendingspending

2.2. Yes, decrease total Yes, decrease total spendingspending

3.3. NoNo

4.4. Not sureNot sure

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

Anti-Poverty Program EffectivenessAnti-Poverty Program Effectiveness

How effective are government anti-poverty How effective are government anti-poverty programs?programs?

How much do they cost?How much do they cost?How much do they raise taxes?How much do they raise taxes?How much do they help the poor?How much do they help the poor?Are people better off when they work, or Are people better off when they work, or when they are on welfare?when they are on welfare?

Microeconomics

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

Government Poverty Program AlternativesGovernment Poverty Program Alternatives

There will always be a need to aid the less There will always be a need to aid the less fortunate.fortunate.

The 1996 Welfare Reform Act has been a The 1996 Welfare Reform Act has been a step in the right direction.step in the right direction.

Are there more effective ways to help the Are there more effective ways to help the poor?poor?

Microeconomics

Should we cut back on government Should we cut back on government welfare programs and rely more on welfare programs and rely more on private charities to provide help to private charities to provide help to the poor?the poor?

1.1. YesYes2.2. NoNo3.3. IndifferentIndifferent4.4. Not sureNot sure

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

Government Poverty Program Government Poverty Program AlternativesAlternatives

Advantages of private charities:Advantages of private charities:

Decrease in taxesDecrease in taxes Less government spending, less borrowing, Less government spending, less borrowing,

lower inflation.lower inflation. Higher incomes mean more giving to charities, Higher incomes mean more giving to charities,

especially if government is no longer especially if government is no longer responsible. responsible.

Volunteers are motivated to help; government Volunteers are motivated to help; government welfare workers have possible conflict of welfare workers have possible conflict of interest.interest.

Small, private charities have better information Small, private charities have better information regarding the needs of the poor.regarding the needs of the poor. Microeconomics

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

Government Poverty Program Government Poverty Program AlternativesAlternatives

Disadvantages of private charities:Disadvantages of private charities:

No guarantees.No guarantees. Decrease in giving during recessions.Decrease in giving during recessions. More potential for discrimination?More potential for discrimination?

Microeconomics

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

Government Poverty Program AlternativesGovernment Poverty Program Alternatives

The negative income tax plan proposes an The negative income tax plan proposes an income level (for instance $18,000) income level (for instance $18,000) aboveabove which an individual will pay which an individual will pay taxestaxes, but , but belowbelow which an individual would receive a which an individual would receive a government government subsidysubsidy (a subsidy is a (a subsidy is a negative tax).negative tax).

The main advantage is that people will The main advantage is that people will always receive more income as they earn always receive more income as they earn more money on the job. more money on the job.

Microeconomics

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

The Negative Income Tax PlanThe Negative Income Tax Plan

Microeconomics

Job Earnings Job Earnings Government Government Subsidy Subsidy (50%) (50%)

Total Income Total Income

$0 $0 $9,000 $9,000 $9,000 $9,000

$4,000 $4,000 $7,000 $7,000 $11,000 $11,000

$10,000 $10,000 $4,000 $4,000 $14,000 $14,000

$18,000 $18,000 $0 $0 $18,000 $18,000

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

Tax SystemsTax Systems

We distinguish between three types We distinguish between three types of tax systems:of tax systems:

1.1. Progressive taxesProgressive taxes

2.2. Proportional (flat) taxesProportional (flat) taxes

3.3. Regressive taxesRegressive taxes

Microeconomics

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

Progressive TaxesProgressive Taxes

Higher income earners pay a Higher income earners pay a higher marginal tax rate.higher marginal tax rate.

Example: Individual Income Tax Example: Individual Income Tax System.System.

Microeconomics

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

Individual Income Tax SystemIndividual Income Tax System

Taxable Income for a Taxable Income for a Single Person in the Single Person in the U.S. in 2010U.S. in 2010

Marginal Tax RateMarginal Tax Rate

$0 – $0 – $8,375 10%10%

$8,375 and $34,000 15%15%

$34,000 and $82,400 25%25%

$82,400 and $171,850 28%28%

$171,850 and $373,650

33%

over $373,650 35%35%

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

Proportional TaxesProportional Taxes

Everyone pays the same percentage Everyone pays the same percentage tax.tax.

Example: Social Security tax (up to a Example: Social Security tax (up to a certain income amount).certain income amount).

Microeconomics

Unit 9 - Distribution of Unit 9 - Distribution of Wealth and IncomesWealth and Incomes

Regressive TaxesRegressive Taxes

Higher income earners pay a lower Higher income earners pay a lower percentage tax as a percentage of percentage tax as a percentage of their income.their income.

Example: state sales taxesExample: state sales taxes

Microeconomics