Refinery Draft

-

Upload

tapas-tiwari -

Category

Documents

-

view

268 -

download

6

Transcript of Refinery Draft

Refinery Group 2AnandAnkitAnujAshutoshDilipGaurav TomarTanujYash

A petroleum refinery is an industrial process plant where crude oil is processed and refined into more useful petroleum products.

CATEGORIES:Petroleum products are usually

grouped into three categories: light distillates (LPG, gasoline,

naphtha) middle distillates (kerosene,

diesel) heavy distillates and residuum

(heavy fuel oil, lubricating oils, wax, asphalt)

I/P => Crude Oil

Crude Oil : mixture of Hydrocarbon in liquid form

In terms of API Gravity: high API; lighter the crude and low specific gravity. Yield greater portion of gasoline

In terms of Hydrogen Sulphide content

less sulphur: sweet high sulphur :sour

Classification of Crude Oil

Classification Range°API Light >= 33Medium >=24 and <33Heavy < 24Sulphur Low (Sweet) Up to 0.5%Medium 0.5% to 1.5%High (Sour) Above 1.5%

General

Purpose

Crude

• Can be processed by any refiner

• Usually within the range of “medium” to “light” API crude

• Usually a low sulphur, low acidic grade

Niche Crude

• Can be processed by specialized refiners, like those with deep conversion configuration

• Usually within the range of “heavy” API crude

• Can have a high sulphur and acidic content

Quality Comparative

Properties Dubai Napo DuriNorth

GujaratBonny Light

°API 30.4 18.8 21 26.3 34.5

Sulphur, % wt 2.13 2.18 0.21 0.13 0.14

Pour Point, °C -30 -15 +21 +30 -6

TAN, mg KOH/gm 0.05 0.33 1.25 2.06 0.21

Viscosity, cSt

@ 50°C 7.54# 175.44 164 49.01 3.07

@ 60°C - 107.6 98.9 - -

Heavy End( 350°C+), % wt 50.03 71.51 78.37 67.65 34.0

CRUDE OIL BENCHMARKWest Texas Intermediate(WTI)LightSweet Light Sweet crude oil is sells at

higher prices than heavy sour which is difficult to refine and yield less valuable oil products

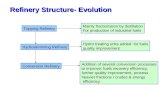

TYPES OF REFINERYTopping refinery :-separates the crude

into its constituent petroleum products by distillation, known as Atmospheric Distillation; produces naphtha but no gasoline.

Hydro skimming refinery:- defined as a refinery equipped with Atmospheric Distillation ; produces naphtha along with gasoline; produces a surplus of fuel with unattractive price and demand.

Cracking:- equipped with vacuum distillation and catalytic cracking; adds one more level of complexity to the hydro skimming refinery by reducing fuel oil by conversion to light distillates and middle distillates.

Coking:-refers to the one which is equipped to process the vacuum residue into high value products using the Delayed Coking Process ;adds further complexity to the cracking refinery by high conversion of fuel oil into distillates and petroleum coke.

PETROLEUM DEMAND BY PRODUCT

ComplexityIn the Refining Industry, a common index

termed as "EDC" - Equivalent Distillation Capacity is defined to calculate the benchmark of manpower requirement.

Calculation of EDC is a two-step process. The first step is the multiplication of the capacity of each unit in the refinery with the Nelson's complexity factor and the second is the sum of these products to arrive at the EDC for the refinery in total. Complexity

Crude production Sweet vs. Sour

Crude trends toward heavy and sour

GRMGross Refinery MarginHigher the GRMs, higher the profit yields.

GRM is the difference between total value of petroleum products and price of crude. So if crude is at USD 50 per barrel and basket of petroleum products sold at USD 55 per barrel, GRM is at USD 5 per barrel.

The Singapore crude is considered a benchmark for complex refineries. If GRM for Singapore crude is between USD 5-7 per barrel, RIL has actually been giving a number between USD 8-16 per barrel.

GRM CalculationProduct Prices

Bonny Light Crude Oil $/Ton Bonny Light Crude OilA B C A x C B x C

LPG 1.4 1.0 578.0 8.1 5.8Naphtha 22.4 19.0 601.2 134.7 114.2Gas Oil (0.5% "S") 42.2 32.0 556.1 234.7 178.0Fuel Oil - 2% S 17.0 24.0 431.3 73.3 103.5Low Sulphur WaxyResidue (LSWR)

17.0 24.0 421.8 71.7 101.2

Total 100.0 100.0522.5 502.77.435 7.370.3 68.9

-1.469.367.9

Bonny Light Price, $/bblGPW Differential,$/bbl [GPW Crude Oil - GPW Bonny Light]

Crude Oil Price, $/bbl [Bonny Light + GPW Differential]

Yield(% wt)

Yields (% wt) GPW Adjustment

Gross Product Worth, $/TonBarrel Per Ton Conversion Factor, BPT

Gross Product Worth, $/bbl [ GPW($/Ton) / BPT Factor]

INDIA AS AN INTERNATIONAL REFINING DESTINATION Investment requirements lesser by 25% - 50%

India enjoys 3% of the international capacity share

Domestic demand growth and trade parity pricing for domestic sales (High margins) Export potential�

West cost refineries close to eastern markets

High refining margins(eg RPL) will allow for competitive exports from America�

Most Asian/ SEA countries are expected to have deficit of Petroleum products ->export opportunity Integrated refining and petrochemical for value addition.

Demand for Petroleum Products in India

(In KT) FY 2009-10 FY 2008-09 Growth (%)

Diesel 56,148 51,649 8.7%

Gasoline 12,818 11,258 13.9%

ATF 4,627 4,454 3.9%

LPG 12,728 11,935 6.6%

Kerosene 9,304 9,303 0.0%

Total

(incl. others) 130,542 124,171 5.1%

Refinery in India Jamnagar Refinery (Reliance Industries), 650,000 bbl/d (103,000 m3/d) Reliance Petroleum (Reliance Industries), 580,000 bbl/d (92,000 m3/d) Mangalore Refinery (MRPL), 199,000 bbl/d (31,600 m3/d) Digboi Refinery, Assam (IOC), 13,000 bbl/d (2,100 m3/d) Guwahati Refinery Assam (IOC), 20,000 bbl/d (3,200 m3/d) Bongaigaon Refinery Assam (IOC), 48,000 bbl/d (7,600 m3/d) Numaligarh Refinery Limited Assam (NRL), 58,000 bbl/d (9,200 m3/d) Haldia Refinery (IOC), 116,000 bbl/d (18,400 m3/d) Panipat Refinery (IOC), 240,000 bbl/d (38,000 m3/d) Gujarat Refinery (IOC), 170,000 bbl/d (27,000 m3/d) Barauni Refinery (IOC), 116,000 bbl/d (18,400 m3/d) Mathura Refinery (IOC), 156,000 bbl/d (24,800 m3/d) Chennai Refinery (IOC), 185,000 bbl/d (29,400 m3/d) Mumbai Refinery (HPCL), 107,000 bbl/d (17,000 m3/d) Visakhapatnam Refinery (HPCL), 150,000 bbl/d (24,000 m3/d) Mumbai Refinery Mahaul (BPCL), 135,000 bbl/d (21,500 m3/d) Nagapattnam Refinery (CPCL), 20,000 bbl/d (3,200 m3/d) Kochi Refinery (BPCL), 172,000 bbl/d (27,300 m3/d) Tatipaka Refinery (ONGC), 1,600 bbl/d (250 m3/d) Essar Refinery (Essar), 289,256 barrels per day (45,988.0 m3/d)

No New Oil Refineries Since 1976 in US

REASONS30-year construction droughtEnvironmental activistsArizona Clean Fuels

Global Issues Economic Growth concerns – Oil Demand slowdown – Short term supply avails – spare capacity – Project Finance for new projects • Delays due to Economic justification • Constrained opportunities • Energy Security – Vulnerable supply growth – Lower the Oil prices now may lead to a higher rise in future • Climate Change – Global warming – Greenhouse gas emissions – Food vs. Fuel debate, Deforestation – Socio economic impacts due to increased Air pollution • Transport sector - one of the key contributor to Air

pollution • Impact of new IMO bunker fuel specification changes

EXXON Mobil CaseJapan’s law to shut refineries may see exit of

ExxonMobil Sunday, 29 August 2010 04:50

TOKYO: Japan’s new rule to boost capacity to process heavy oil represents a subtle policy change that industry sources say may shake up its overcrowded refining industry and prompt the exit of top foreign investor ExxonMobil.

The nation’s shrinking domestic market offers refiners little incentive to invest in costly new units to meet the trade ministry’s directive. Energy demand in the world’s third-largest oil consumer is contracting as a falling population focuses on conservation and greener fuel, and manufacturing shifts abroad

Risk InvolvedFive major types of risks market risk(unexpected changes in interest rates,

exchange rates, stock prices, or commodity prices) credit/default risk operational risk(equipment failure, major outage) liquidity risk(inability to pay bills, inability to buy or

sell commodities at quoted prices) political risk(new regulations, specifications,

restrictions)

Oil and Gas industries are particularly susceptible to market risk or more specifically, price risk as a consequence of the extreme volatility of energy commodity price

Risk MitigationCrude price:Hedging Domestic crude purchases and sale In Annual statement for the year-9 RBI has permitted �

hedging of domestic crude purchases and sale of products to reduce the price risk. �

Hedging on the basis of international prices based on physical underlying contracts linked to international prices.

Hedging of anticipated imports of crude oil Hedging allowed based on the basis of past �

performance up to% vol of actual imports during last year or% of average volume of imports during last financial years

Whichever is higher

Latest-INDIA In 2010 the state-owned oil firms are expected to splurge US$

11.34 billion on developing supplies and constructing new shipping networks for petroleum and natural gas.

Indian Oil Corporation is looking forward to establish a petroleum plant in the state of West Bengal by bringing in investments worth US$ 596.63 million

ONGC will bring in US$ 694 million for raising services at its oil fields in Assam and adjoining states to enhance the petroleum output. In addition it will also splurge US$ 5.65 billion on capital expenses in the next two years.

GAIL (India) Limited and OVL, the international associate of leading oil and gas player ONGC, are expected to bring in investments worth US$ 250 million.

The energy industry of India will help tin the expansion of the petroleum sector by bringing in investments worth US$ 120 billion-US$ 150 billion in the next 3-5 years. By 2012, the prospects in India Petroleum Industry are estimated to accomplish US$ 35 billion to US$ 40.

Thanks