Rearrangement Algorithm and Maximum...

Transcript of Rearrangement Algorithm and Maximum...

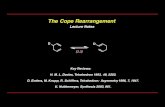

Rearrangement Algorithm and Maximum Entropy

Oleg Bondarenko

University of Illinois at Chicago

Joint withCarole Bernard

Vrije Universiteit Brusseland

Steven VanduffelVrije Universiteit Brussel

R/Finance, May 19-20, 2017

Oleg Bondarenko Rearrangement Algorithm and Maximum Entropy

Introduction

An important problem in Finance:

Given marginal distributions of random variables X1, . . . , Xd and oftheir weighted sum I = ω1X1 + ... + ωdXd, can we inferdependence among the variables?

For example, if Xj’s are stock prices and I is the stock index, wecan estimate their risk-neutral densities from traded options usingBreeden and Litzenberger (1978) result:

f (K) =∂2C(K)

∂K2 .

Using forward-looking risk-neutral densities implied by option prices,can we infer the dependence?

Oleg Bondarenko Rearrangement Algorithm and Maximum Entropy

Introduction

In this paper, we study properties of the Block RearrangementAlgorithm (BRA) in the context of inferring dependenceamong variables given their marginal distributions and thedistribution of the sum.

Although there are typically infinitely many theoreticalsolutions, we show that BRA yields solutions that are close toeach other and exhibit maximum entropy.

Thus, BRA is a stable algorithm for inferring dependence andits solution is economically meaningful.

Oleg Bondarenko Rearrangement Algorithm and Maximum Entropy

Setup

Inputs: d random variables X1 ∼ F1, ..., Xd ∼ Fd.

Goal: look for a dependence such that the variance of sumS = X1 + ... + Xd is minimized.

Assume that each Xj is sampled into n equiprobable values, i.e., we

consider the realizations xij := F−1j ( i−0.5

n ) and arrange them in an

n× d matrix:

X = [X1, . . . , Xd] =

x11 x12 . . . x1dx21 x22 . . . x2d

......

......

xn1 xn2 . . . xnd

Want to rearrange elements xij (by columns) so that the variance ofrow sums is minimized.

This is an NP complete problem. Brute force search requireschecking (n!)(d−1) rearrangements!

Oleg Bondarenko Rearrangement Algorithm and Maximum Entropy

Rearrangement Algorithm (RA)

Greedy algorithm developed in Puccetti and Ruschendorf(2012) and Embrechts, Puccetti, and Ruschendorf (2013):

1 For j = 1, . . . , d, make the jth column anti-monotonic with thesum of the other columns.

2 If there is no improvement in var(

∑dk=1 Xk

), output the

current matrix X, otherwise return to step 1.

Step 1 ensures that the columns before rearranging (Xk) andafter rearranging (Xk) satisfy

var

(d

∑k=1

Xk

)> var

(d

∑k=1

Xk

).

Oleg Bondarenko Rearrangement Algorithm and Maximum Entropy

Block Rearrangement Algorithm (BRA)

When d > 3, the standard RA can be improved by consideringblocks, Bernard and McLeish (2014), Bernard, Ruschendorf,and Vanduffel (2014):

1 Select a random sample of nsim possible partitions of thecolumns {1, 2, . . . , d} into two non-empty subsets {I1, I2}.

2 For each of the nsim partitions, create block matrices X1 andX2 with corresponding row sums S1 and S2 and rearrange rowsof X2 so that S2 is anti-monotonic to S1.

3 If there is no improvement in var(

∑dk=1 Xk

), output the

current matrix X, otherwise, return to step 1.

When d is reasonably small, we can take nsim = 2d−1 − 1 (allnon-trivial partitions are considered). Otherwise, randomize.

Oleg Bondarenko Rearrangement Algorithm and Maximum Entropy

Inferring Dependence

Inputs: d random variables X1 ∼ F1, ..., Xd ∼ Fd and their sumS ∼ FS.

Assume that each Xj and S are sampled into n equiprobable values,arranged in an n× (d + 1) matrix:

M = [X1, . . . , Xd,−S] =

x11 x12 . . . x1d −s1x21 x22 . . . x2d −s2

......

. . ....

...xn1 xn2 . . . xnd −sn

.

Apply BRA on the augmented matrix M.

When row sums of the rearranged matrix are close to zero, acompatible dependence has been found.

Oleg Bondarenko Rearrangement Algorithm and Maximum Entropy

Simulation Exercise: Gaussian Case

Gaussian margins Xj ∼ N[0, σ2j ] and Gaussian sum S ∼ N[0, σ2

S].

Number of components d ranges from 3 to 10.

Standard deviations σi are linearly decreasing from 1 to 1/d.

Set σS such that ρimp = 0.8.

Discretization level n from 1,000 to 10,000.

Run BRA K = 500 times.

Find that for each k the inferred dependence is close to the one withthe maximum entropy, which

has a Gaussian copula,maximizes the determinant of the correlation matrix for Xj.

Oleg Bondarenko Rearrangement Algorithm and Maximum Entropy

Maximum Determinant and Maximum Entropy

Entropy refers to disorder of a system, Shannon (1948).

Let f be the density of a multivariate distribution of (X1, ..., Xd),then the entropy is

H(X1, ..., Xd) = −E(log( f (X1, ..., Xd))).

Proposition: Maximum entropy

The entropy of the multivariate distribution of (X1, ..., Xd) with Gaussianmargins and invertible correlation matrix R satisfies

H(X1, .., Xd) ≤d2(1 + ln(2π)) +

12

d

∑i=1

ln(

σ2i

)+

12

ln (det(R))

where the equality holds iff (X1, ..., Xd) is multivariate Gaussian.

Oleg Bondarenko Rearrangement Algorithm and Maximum Entropy

Stability of BRA

Figure: K = 500 blue dots correspond to different runs of BRA. Shaded grayarea is set of feasible solutions; red star is maximal correlation matrix RM(=maximum entropy). Left panel: realized correlations ρ12, ρ13, and ρ23. Rightpanel: relation of determinant ∆ versus ρ12.

Oleg Bondarenko Rearrangement Algorithm and Maximum Entropy

Stability of BRA

Figure: K = 500 blue dots correspond to different runs of BRA. Shaded grayarea is set of feasible solutions; red star is maximal correlation matrix RM(=maximum entropy). Left panel: realized correlations ρ12, ρ13, and ρ23. Rightpanel: relation of determinant ∆ versus ρ12.

Oleg Bondarenko Rearrangement Algorithm and Maximum Entropy

Recovering Pairwise Correlations

PE(ρ) (%)-0.4 -0.3 -0.2 -0.1 0

-0.5

0

0.5

1

PE1(d√

∆) (%)

PE(ρ) (%)-0.4 -0.3 -0.2 -0.1 0

0.04

0.06

0.08

0.1

0.12

0.14

0.16

0.18

V

PE(ρ) (%)-0.4 -0.3 -0.2 -0.1 0

-1

-0.8

-0.6

-0.4

-0.2

0

PE2(d√

∆) (%)

ρ12 ρ13 ρ23

0

0.2

0.4

0.6

0.8

1Correlations: 5th, 50th, and 90th Percentiles

Normal Distribution: d = 3 and n = 1, 000

Oleg Bondarenko Rearrangement Algorithm and Maximum Entropy

Recovering Pairwise Correlations

PE(ρ) (%)×10-3

-1.4 -1.2 -1 -0.8 -0.6 -0.4 -0.2 0

-1

-0.8

-0.6

-0.4

-0.2

0

PE1(d√

∆) (%)

PE(ρ) (%)×10-3

-1.4 -1.2 -1 -0.8 -0.6 -0.4 -0.2 0

×10-3

0.5

1

1.5

2V

PE(ρ) (%)×10-3

-1.4 -1.2 -1 -0.8 -0.6 -0.4 -0.2 0

-1

-0.8

-0.6

-0.4

-0.2

0

PE2(d√

∆) (%)

ρ12 ρ23 ρ34 ρ45 ρ56 ρ67 ρ78 ρ89

0

0.2

0.4

0.6

0.8

1Correlations: 5th, 50th, and 90th Percentiles

Normal Distribution: d = 10 and n = 1, 000

Oleg Bondarenko Rearrangement Algorithm and Maximum Entropy

Robustness to Initial Conditions

I Start from a particular candidate solution.

I Introduce small noise, by randomly swapping 0.2% of rows:

2 rows out of 1,000,6 rows out of 3,000,20 rows out of 10,000.

I Check where K = 500 runs of BRA converge.

Oleg Bondarenko Rearrangement Algorithm and Maximum Entropy

Robustness to Initial Conditions

Figure: K = 500 blue dots correspond to different runs of BRA. Each runstarts at a particular solution (green star), but with 2 random rows swapped.Shaded gray area is set of feasible solutions; red star is maximal correlationmatrix RM (=maximum entropy).

Oleg Bondarenko Rearrangement Algorithm and Maximum Entropy

Robustness to Initial Conditions

Figure: K = 500 blue dots correspond to different runs of BRA. Each runstarts at a particular solution (green star), but with 6 random rows swapped.Shaded gray area is set of feasible solutions; red star is maximal correlationmatrix RM (=maximum entropy).

Oleg Bondarenko Rearrangement Algorithm and Maximum Entropy

Robustness to Initial Conditions

Figure: K = 500 blue dots correspond to different runs of BRA. Each runstarts at a particular solution (green star), but with 20 random rows swapped.Shaded gray area is set of feasible solutions; red star is maximal correlationmatrix RM (=maximum entropy).

Oleg Bondarenko Rearrangement Algorithm and Maximum Entropy

Conclusions

Robust to non-Gaussian distributions (e.g., Multivariate Skewed-t).

Does not hold for the standard RA.

Applications:

Pricing multivariate options (basket, exchange, spread, etc.),Forward looking indicators of implied dependence, measuresof tail risk,Down and Up implied correlation,Optimal portfolios.

Paper is available on SSRN.

Oleg Bondarenko Rearrangement Algorithm and Maximum Entropy