Realizing Operating Efficiencies Through a Platform...

Transcript of Realizing Operating Efficiencies Through a Platform...

Realizing Operating Efficiencies

Through a Platform-Based

Approach: A Case Study

Henry Marquiss

SVP, Specialty Loan Accounting, PNC

Umar Syyid

CTO, Primatics Financial

Agenda

• Background

• Future Targets

• Achieving Operating Efficiencies through Consolidation

• Leveraging a “Domain Aware” Platform

• Challenges & Risk

• Fit with Existing Architecture

• Results

2

Background: PNC’s Rapid Growth

PNC has grown rapidly in the past 7 years through a series of acquisitions and

organic growth during a tumultuous credit, regulatory and business cycle. This

led to:

• Tactical investment in parallel on both automated and human based processes to solve

for business changes across the back office in both the finance and risk areas

• Multiple complex systems and businesses processes rapidly setup that now require

careful thought to scale and manage

3

Announced

National City

Bank

Acquisition

Announces

RBC US

Acquisition

Loss

Mitigation

Efforts

Peaked

Credit Cycle

Bottoms 2008 2011 2012

Regulatory Changes

for Non Performing

Assets

Initial Dodd

Frank Reforms

Enacted

Accounting Guidance

for Restructured Assets

Bank hits $300Bn

in assets

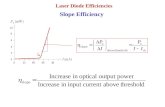

Establishing Targets and Strategy

4

Simplify operating architecture, remove

redundancies and reconciliations

Save money, primarily focus on reducing

current operating expense

Improve future ability to handle business

and regulatory change

Fit within enterprise data and systems architecture

(finance architecture, data architecture and IT roadmap)

Strategy

formulation

Joint discovery effort (Primatics/PNC) to first fully

understand current landscape and then

recommend a solution to meet PNC’s goals.

Started project in Q3 2013. Formulated

recommendation mid Q4.

Solution: Consolidate with a Single Platform

Analysis of Legacy Paradigm The Platform Paradigm

SILOED

PROCESSES

COMPLEX

RECONCILIATION

DIFFICULT

REPORTING

DISTRIBUTED SUPPORT &

MAINTENANCE

RE

Credit

Models

Non-

accru

al

SOP

03-3

NPL

FAS 91

Specific

ALLL

What

if?

FAS

114

TDR

Scena

rios

INCREASED

EFFICIENCIES

ONE SUBLEDGER

WITH MULTIPLE

PERSPECTIVES

GREATER CONTROLS,

LESS RISK

SINGLE

PROCESSING

SPACE

6/23/2015

RIS

K

PR

OC

ES

SE

S

Siloed Processes, Complex to Support and

Adapt to Change

• Confluence of change; credit, risk and finance coming

together to build solutions

• Complex data integration processes between siloes

particularly as they cross natural domain boundaries

• Large and continuing human capital investment with focus

on running the process in a controlled way

• Multiple hand-offs between processes, data copying and

point-to-point reconciliations

Single Platform Solution

• One platform for loan finance functions, reducing operating

costs and providing consistency across the institution

• Ability to extract and enrich data from internal and other

third-party systems

• Greatly reduced reconciliations and automated, flexible

workflows

• Expected operating efficiencies of ~ 30% annually

RISK

PROCESSES

.

5

Leveraging a “Domain Aware” Platform

• Still just a platform…but pre-packaged services are specific to the problems

associated with the operating domain (bank finance concerns in this case)

• Domain Aware Services: Finance & risk relevant services on top of which a set of

solutions are provided

6

En

terp

rise S

erv

ice B

us (

ES

B)

Su

pp

ort

ed

Pro

toco

ls (

RE

ST

, S

OA

P,

JC

A, JM

S)

Loan

Accounting &

Forecasting

Credit and

Reserving

Model

Execution

Smart Data

(Sourcing and

Analytics)

Security Cloud (Utility) Computing Software-Defined Storage

Persistence Integration

Services

Distributed

Computing Identity

Management Multi-Tenancy

Business Workflow Layer

Solutions

“Domain

Aware”

Business

Services

Platform

Services

Infrastructure

Services

SD

K E

xte

nsib

ilit

y F

eatu

res

Lifecycle Event

Processing Calculations

Accounting Rules

Calculations Risk

Rules Journalization Reporting

Common

Technology

Services

Building Functions on Top

6/23/2015 7

Loan

Accounting

Credit

Disclosures

PNC Risk

Analytics

Production Data

Flows

PNC Business Process Integration

Data &

Orchestration

Extension

..category leaders combine deep domain knowledge in various risk topics with deep technology assets and capabilities. They can demonstrate this by addressing the needs of very large clients with complex risk management and technology requirements, as well as addressing the needs of smaller clients with standardized requirements…

Extension

Less is

More

Build bank specific solutions

by focused development of

orchestration and extensions

that augment and leverage

existing business services

available on the solution.

A Closer Look: Complex Problems Solved with Business Services

6/23/2015 8

ID

ENGINE

EVENT

SVCS

LOAN

MASTER

TDR

SUB

LEDGER

JOURNAL

ENG

114

ACTG

PCI

ACTG AMORT

MODEL

EXEC

EXPECTED

CFLW

FAIR

VALUE

CFLW

SVCS

NON PERFORMING EVENT OP & ACTG TRANSACTION FLOW RISK ANALYTICS

RIS

K

OP

AC

TG

CR

ED

IT

Credit Accounting Solution

EVOLV

Deeper Look: Solution Architecture

Information flows required to perform credit accounting functions include flow from operational, risk and credit systems.

1. Leverage loan credit identification services (non-accrual, credit restructurings, TDR etc.), convert to accounting

events and record for disclosures

2. Capture operational accounting transactions and then leverage various credit accounting services to calculate

accounting adjustments and accretion within sub-ledger

3. Connect with risk analytics functions to convert risk outputs to expected cash flows, fair values and other modeled

outputs to compute allowance adjustments

Challenges with Platform Approach

9

Data normalization is complicated. The same data elements mean different things to different

stakeholders, requiring a “multi-verse” perspective to be effective

Integration with source systems with “closed” architectures generally requires a focus on

simplification to ensure interfaces don’t break

Determining what are truly reusable building blocks across a domain without over-

complicating architecture by adding services that are never reused

Building a team, knowledge base and support structure internally to support agile

delivery

Establishing a production paradigm that includes multiple parties, including

multiple business and technology groups on the same platform

Fit with Bank Architecture - Intermediate State

10

Other Finance

Systems

Pluggable Adapter

Architecture

Commercial

Retail

Mortgage

Other Data

Enterprise ODS Enterprise Warehouse Enterprise Information

Architecture

Other Applications

Feeds to

Enterprise

Bank Operating Platforms

Finance

User

Fit with Bank Architecture - Future State

11

Other Finance

Systems

Feeds to

Enterprise

Enterprise Data

Pluggable Adapter

Architecture

Commercial

Retail

Mortgage

Other Data

Enterprise ODS Enterprise Warehouse Enterprise Information

Architecture

Bank Operating Platforms

Other Applications

Finance

User

Result of Improvements

12

Summarized

Results

Primatics’ EVOLV® Solution • Creates substantial ROI, cutting annual operating costs by 30%

• Positions PNC to quickly adapt to changing strategies and to scale operations expediently and

efficiently

• Enables better decision-making through more advanced analytics and elimination of time-

consuming “processing” steps

• Enables more automated and defensible compliance of critical current and potential future

regulations

• Through the integration of data, applications, and analytics, greatly consolidates and/or eliminates

needs for point solutions, hand-offs, reconciliations, manual steps, etc.

TDR

2013 FUNCTIONALITY

BEFORE AFTER Acquired

Loans

(PCI &

Non-

Impaired)

NaCo

(Core

Only)

NaCo

(Core and

RTA) Acquired

Loans (PCI

& Non-

Impaired)

Enhanced

Reporting Automated

Disclosures

FAS 91

2015 FUNCTIONALITY

94 % of PNC

loans

on the platform

Loans

in

Evolv