Real Insights: Real Estate Overview Yamuna Expressway · PDF fileSWOT Analysis of Yamuna...

Transcript of Real Insights: Real Estate Overview Yamuna Expressway · PDF fileSWOT Analysis of Yamuna...

Executive Summary

Yamuna Expressway has grown significantly over the last three to four years. With an aim to reduce the

travel time between Delhi and Agra, India’s longest motorway, was opened in the year 2012. Covering about

2,40,000 hectares, it include six cities, namely Gautam Buddh Nagar, Bulandshahr, Aligarh, Maha Maya

Nagar, Mathura and Agra. While the expressways is up and running, the authority has envisaged an

elaborate plan for its further development.

To smoothen the work process, Yamuna Expressway Master Plan 2031 has been divided into three

phases, out of which only the first phase (40 km stretch from Greater Noida to Jewar) has been approved.

As per the Master Plan, out of the total area sanctioned in Phase 1, about 22 per cent is earmarked for green

cover, 20 per cent for industrial development, 19 per cent for residential development, 15 per cent for the

transport links and remaining 24 per cent for commercial and institutional development.

To further enhance the infra quotient of the stretch, several projects are in the pipeline. These include

metro expansion, IT hub, manufacturing units, international airport, to name a few. Understanding the

growth prospects, several leading developers are already cashing on the opportunities sprouting along the

expressway.

While the development, at present, may seem little slow; with new proposed infrastructure development

including the metro is expected to give new impetus to the residential real estate demand.

For the following report, we have analysed the data using GIS-based tools. Using CommonFloor’s

exhaustive database, we have analysed both supply and demand side of the market.

Index

Index ............................................................................................................................................................................................................... i

List of Maps ................................................................................................................................................................................................. ii

List of Figures ............................................................................................................................................................................................ ii

List of Tables .............................................................................................................................................................................................. ii

Introduction ............................................................................................................................................................................................... 1

Master Plan: A Closer Look ................................................................................................................................................................. 2

SWOT Analysis of Yamuna Expressway ........................................................................................................................................ 3

Connectivity: Existing and Upcoming ............................................................................................................................................ 3

Major Pull Factors ................................................................................................................................................................................... 5

Water Supply ........................................................................................................................................................................................ 5

Power Supply ....................................................................................................................................................................................... 6

Real Estate Snapshot.............................................................................................................................................................................. 7

Land Market Overview ......................................................................................................................................................................... 7

Price Trends for Plots ....................................................................................................................................................................... 7

Number of Units Launched for Projects with Plotted Units ............................................................................................ 8

Project Size of Plotted Development ......................................................................................................................................... 9

Analysis of Other Property Types ................................................................................................................................................. 10

What are Buyers Looking At In Yamuna Expressway?........................................................................................................ 14

Rental Market Snapshot .................................................................................................................................................................... 15

Available Typology ......................................................................................................................................................................... 15

Future Growth Aspects ...................................................................................................................................................................... 16

Recreation and Entertainment .................................................................................................................................................. 16

Manufacturing and Logistics ...................................................................................................................................................... 16

Affordable Housing ......................................................................................................................................................................... 16

IT/ITeS ................................................................................................................................................................................................. 16

Connectivity ....................................................................................................................................................................................... 16

Infrastructure .................................................................................................................................................................................... 16

Conclusion ............................................................................................................................................................................................... 17

References ................................................................................................................................................................................................. 17

List of Maps

Map 1 YEIDA Master Plan 2031 with an overlay of residential projects ....................................................................... 1

Map 2 Proposed Connectivity around the Yamuna Expressway ....................................................................................... 4

Map 3 Map showing the availability of water sources ........................................................................................................... 5

Map 4 Map showing the probable power supply sources for YEIDA region ................................................................ 6

List of Figures

Figure 1 Price trend for the plots and layouts (2010-2014) ............................................................................................... 7 Figure 2 Supply trend of plots and layouts (2010-2014) ...................................................................................................... 8 Figure 3 Unit Ranges for plots and layouts (2011-2014) ...................................................................................................... 9 Figure 4 Typology Distribution of the projects along Yamuna Expressway (2011-2014) ................................. 10 Figure 5 BHK split of projects along Yamuna Expressway (2011-2014) .................................................................... 11 Figure 6 Distribution of projects according to their average per sq.ft. price (2011-2014) ................................ 13 Figure 7 Distribution of projects according to the size of the project (2011-2014) .............................................. 13 Figure 8 Rental Market Distribution based on property typology ................................................................................. 15 Figure 9 Rental Market distribution based on Unit configurations ............................................................................... 15

List of Tables

Table 1 Top 5 ongoing projects in residential lands and layouts (2012-2015) ....................................................... 10 Table 2 Size and Capital Values based on unit configurations ......................................................................................... 11 Table 3 Top 5 ongoing projects in Apartment launches along the expressway (2012-2015) ........................... 12 Table 4 Rental Profile at Yamuna Expressway according to unit configurations ................................................... 16

1

Introduction

Opened in 2012, Yamuna Expressway has evolved as one of the most vibrant real estate destinations in the

last two to three years. The entire project was ideated with the aim to reduce the travel time between Delhi

and Agra, which has been successfully accomplished. However, a lot more awaits to change the fortunes of

the area as the authority has envisaged an elaborate plan for its development.

The 166 km long, six-lane expressway is India’s longest motorway, connecting New Delhi with Agra and,

thus, opening up an untouched area for economic development and expansion of NCR (National Capital

Region).

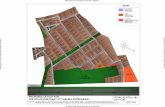

Map 1 YEIDA Master Plan 2031 with an overlay of residential projects

[Source: Real [email protected]]

2

Before going further, let’s see which cities fall under the purview of

the Yamuna Expressway. Covering about 2,40,000 hectares, it

include six cities, namely Gautam Buddh Nagar, Bulandshahr,

Aligarh, Maha Maya Nagar, Mathura and Agra.

Master Plan: A Closer Look

To smoothen the work process, Yamuna Expressway Master Plan 2031 has been divided into three phases.

Phase I covers the 40 km stretch from Greater Noida to the proposed airport in the town of Jewar,

Gautam Buddha Nagar District, Uttar Pradesh.

Phase 2 covers a distance of 20 km starting from the proposed airport to an intermediate

destination before Agra.

Phase 3, the last one, goes beyond Agra and covers a distance of 105km.

As of now, only the first phase of the Yamuna Expressway Master Plan 2021 has got the green signal. Thus,

the current focus is on developing Gautam Budh Nagar.

Out of the total area sanctioned in Phase 1, about 22 per cent is earmarked for green cover, 20 per cent for

industrial development, 19 per cent for residential development, 15 per cent for the transport links and

remaining 24 per cent for commercial and institutional development.

Quick Facts

Length: 166 km

Number of Lanes: 6 (Extendable to 8)

Main Toll Plazas: 3

Ramp Plazas: 8

3

SWOT Analysis of Yamuna Expressway

Connectivity: Existing and Upcoming

Yamuna Expressway is undoubtedly one of the most hi-tech highway in the country today. It boasts of

‘Intelligent Transport System’ installed with the objective of providing safe, secure and convenient travel

between Agra and Greater Noida.

It is well-connected at both ends. Starting from Noida-Greater Noida Expressway at one end, Yamuna

Expressway is connected to the Agra Ring Road. Just about 10 km from its starting point from Noida-Greater

Noida Expressway, Yamuna Expressway intersects with proposed Eastern Peripheral Expressway (as

shown in map with purple dotted line). This will further join it with other NCR towns such as Gurgaon,

Manesar, Rohtak & Sonipat in Haryana and Ghaziabad, Hapur & Meerut in Uttar Pradesh. Although, Yamuna

Expressway will directly connect NCR with Agra, it will also connect few major cities, such as Kanpur,

Gwalior and Lucknow, by shortening the distance and reducing the travel time.

Moreover, there are several plans in the pipeline to upgrade the connectivity of the stretch. The map below

highlights the same.

5

Major Pull Factors

From good connectivity to upcoming infra projects, Yamuna Expressway boasts of a plethora of factors that

are driving growth. But two major factors that sets it apart from several other markets are adequate water

and electricity supply.

Water Supply

Yamuna Expressway falls in the Yamuna Basin, which possesses three important rivers - Yamuna, Hindon

and Kali. Among these, Yamuna and Hindon rivers have huge untapped floods and a large network of canals

(as shown in the Map 3). This caters as the main water source for domestic and industrial development

proposed along the expressway. Thus, even in the times to come, the stretch will never have water shortage.

Map 3 Map showing the availability of water sources

[Source: Yamuna Expressway Industrial Development Authority]

6

Power Supply

Yamuna Power Generation Company has been created to address the power supply and demand of the

YEIDA region. There is a proposed 765 KVA Substation of 3000 MW capacity at Jahangirpur, YEIDA region.

Add to this, there are long-term development infrastructure plans including the establishment of

Independent Yamuna Power Corporation Limited, a 2,000 MW power plant.

Map 4 Map showing the probable power supply sources for YEIDA region

[Source: Yamuna Expressway Industrial Development Authority]

7

Real Estate Snapshot

Realising the immense potential that the area holds, several realty majors have already flocked to Yamuna

Expressway. Jaypee, Supertech, Cosmic Group, ATS, Gaursons, Orris, Ajnara, Logix are few developers

whose projects are already under-construction.

Considering the fact that Phase 1 of the master plan has got the requisite approvals, we have taken into

consideration the projects towards YEIDA region. Interestingly, majority of real estate activity is also

aligned towards this phase, particularly towards Gautam Buddh Nagar (GB Nagar).

QUICK FACTS

Guidance Values in Yamuna Expressway for the Financial Year 2014-15 (in sq.mt)

[Source: Yamuna Expressway Industrial Development Authority Website]

Land Market Overview

CommonFloor data suggests that from 2010, plots constitute more than 30 per cent share of launches every

year till 2014. This can be attributed to the lack of social infrastructure facilities, which are requisite for

day-to-day living. Also, the stretch holds immense potential for long term investment rather than short

term.

Price Trends for Plots

Figure 1 Price trend for the plots and layouts (2010-2014)

[Source: Real [email protected]]

0

500

1000

1500

2000

2500

3000

2010 2011 2012 2013 2014

Pri

ce p

er s

q.f

t.

Year

Price Trend in Yamuna Expressway

8

Data clearly indicates that in 2011, as construction work on Yamuna Expressway was nearing

completion, prices witnessed a significant increase when compared to 2010.

With the expressway thrown open to the public and improved connectivity, property values

witnessed a constant rise in 2012 and 2013. This rise can also be attributed to the attention that

the stretch got due to the first F1 race to be ever hosted by India.

However, due to lack of social infrastructure, prices in 2014 stabilised.

Number of Units Launched for Projects with Plotted Units

Figure 2 Supply trend of plots and layouts (2010-2014)

[Source: Real [email protected]]

In 2011, about 2300 units (plots & layouts) entered the market in anticipation of the upcoming

Yamuna Expressway.

The year 2012 saw maximum number of these launched due to the commencement of Yamuna

Expressway. As compared to 2011, the number of units entering the market almost doubled, which

continued till 2013.

Interestingly, in 2012 and 2013 most of projects were launched along the stretch after Buddh

International Circuit.

In 2014, due to overall slowdown, developers mostly focused on completing their existing projects

rather than launching new ones. Thus, less number of units were launched, which units mostly

skewed towards Greater Noida.

0

1000

2000

3000

4000

5000

6000

2011 2012 2013 2014

No

. of

Un

its

Supply in Yamuna Expressway

Supply

9

Project Size of Plotted Development

Figure 3 Unit Ranges for plots and layouts (2011-2014)

[Source: Real [email protected]]

Touted as an affordable destination, Yamuna Expressway is currently dotted by projects with small

number of units (plots & layouts). However, a closer look at data suggests that in 2011, due to

availability of huge land parcels, about 60 per cent projects were large size having 500-1000 units.

This was followed by projects with 100-300 units.

With Yamuna Expressway thrown open to public, stretch after Buddh International Circuit also

came under the purview of development. Thus, with the availability of huge land parcels, in 2012,

most of the projects launched had units more than 300-1000.

In 2013, new project launched were equally spread along the stretch from Greater Noida to Jewar.

Thus, even the projects were launched with units in all the categories. As per data, projects with

less than 300 units occupy 60 per cent of the market share.

In 2014, 55 per cent projects were launched with 100-300 units, followed by 30 per cent projects

with 300-500 units.

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2011 2012 2013 2014

Project Segmentation in Yamuna Expressway

More than 1000 units

500 - 1000 units

300 - 500 units

100 300 units

Less than 100 units

10

Table 1 Top 5 ongoing projects in residential lands and layouts (2012-2015)

Project Name Developer Name No. of Units

Approx. Ticket Price

(in Rs)

PropZone Taj Green Residency

PropZone Realcon Pvt.Ltd

1900 38 lakh

Orris Greenbay Golf Village Plots

Orris Infrastructure Pvt Ltd

720 27 lakh

Supertech Golf Country Plots Supertech Limited 636 29 lakh

Jaypee Yamuna Vihar Plots Jaypee Group 500 60 lakh

Yamuna City 32nd Park View Gaursons India Limited 488 26 lakh

[Source: Real [email protected]]

Analysis of Other Property Types

Figure 4 Type of projects along Yamuna Expressway (2011-2014)

[Source: Real [email protected]]

As per the data, apartments dominate the property spectrum of Yamuna Expressway with a whopping 81

per cent. This is followed by plots with 19 per cent.

81%

19%

apartments layouts and plots

11

Figure 5 BHK configuration of projects along Yamuna Expressway (2011-2014)

[Source: Real [email protected]]

Like conventional market trend, 2BHK units rule the roost with 39 per cent availability, closely

followed by 3BHK units with 33 per cent. This can be attributed to the fact that Yamuna

Expressway as of now is predominantly an investor driven market.

Interestingly, 1BHK units comprises of about 18per cent of the market share, while larger BHK

configuration such as 4,5 and 6 BHK units forms a minuscule part of the market share. This enable

investors to enter the market at lower ticket price.

Table 2 Size and Capital Values based on unit configurations

BHK Configuration

Approx. Sizes (sq.ft.)

Approx. Ticket Price

(Rs in lakh)

1BHK 370-830 13-35

2BHK 700-1,640 18-75

3BHK 1,200-4,600 25-80

4BHK 1,800-5,800 28-120

[Source: Real [email protected]]

18%

39%

33%

8%

2%

1bhk

2bhk

3bhk

4bhk

5bhk

12

Table 3 Top 5 ongoing projects in Apartment launches along the expressway (2012-2015)

Project Name Developer

Name

No. of

Units

Approx. Project

Area (Ha)

BHK

Approx. Sizes

(sq.ft.)

Approx. Ticket Price

Min Max

Gaur 16th Park View

Gaursons India Limited

4000 25 2BHK 1000-1115 Rs 23 lakh Rs 26 lakh

3BHK 1475-1475 Rs 34 lakh Rs 34 lakh

Supertech Grand Circuit

Supertech Limited

3496 100

1BHK 625-625 Rs 21 lakh Rs 21 lakh

2BHK 900-1155 Rs 30 lakh Rs 39 lakh

3BHK 1295-1295 Rs 44 lakh Rs 44 lakh

Nimbus The Golden Palm Village

Nimbus Group

2800 12.5 2BHK 1020-1175 Rs 31 lakh Rs 36 lakh

3BHK 1470-1470 Rs 44 lakh Rs 44 lakh

Ajnara Panorama

Ajnara India Ltd

2750 2BHK 800-1250 Rs 25 lakh Rs 39 lakh

3BHK 1300-1300 Rs 41 lakh Rs 41 lakh

Le Solitairian City

Solitaire Realinfra Pvt Ltd

2500 22

1BHK 615-655 Rs 20 lakh Rs 21 lakh

2BHK 1000-1030 Rs 32 lakh Rs 33 lakh

3BHK 1370-2070 Rs 44 lakh Rs 66 lakh

4BHK 4000-4000 Rs 1.3 Cr Rs 1.3 Cr

[Source: Real [email protected]]

13

Figure 6 Distribution of projects according to their average per sq.ft. price (2011-2014)

[Source: Real [email protected]]

About 38 per cent projects in Yamuna Expressway were launched in the price brackets of Rs 3,000-3,500

per sq.ft. This was followed 18 per cent projects in the price range of Rs 2,000-3,000 per sq.ft. and 3,500-

4,000 per sq.ft. each.

Figure 7 Distribution of projects according to the size of the project (2011-2014)

[Source: Real [email protected]]

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

30.00%

35.00%

40.00%

45.00%

Mar

ket

Shar

e %

Price Range in Rs per sq.ft.

Market Segmentation in Yamuna Expressway

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

30.00%

Mar

ket

Shar

e %

No. of Units

Project Segmentation in Yamuna Expressway

14

With availability of huge land parcels, large size projects dominate Yamuna Expressway market.

As per data, about 24 per cent projects launched had more than 1200 units and 500-800 units each.

As the stretch lacks social infrastructure, developers tend to launch township projects and try to

provide all the requisite amenities inside the projects itself.

Yamuna Expressway offers a good mix of projects in all sizes. While large size projects have a

bigger share, smaller projects with units in the range of 100-300 constitute about 16 per cent of

the market share.

Quick Facts :

FAR norms in Yamuna Expressway

Plot Area (sq.mts)

Maximum Ground Coverage (%)

Maximum Floor Area Ratio

Maximum Height in mt

2000 - 40000 35 3 No Limit*

Above 40000 40 3 No Limit*

*Buildings above 30 Mt should get an approval from the Airport Authority

[Source: Yamuna Expressway Industrial Development Authority Website]

What are Buyers Looking At In Yamuna Expressway?

To give our readers a 360 degree view of a market, we have also analysed buyers’ preferences, i.e, the

demand side of the market. Our research clearly indicates that in Yamuna Expressway, demand is in tandem

with supply. Here is a snapshot.

In line with supply, about 79 per cent prospective buyers were looking for apartments in Yamuna

Expressway.

However, this was followed by independent house and plots with 9 and 5 per cent respectively.

In line with supply, with 43 per cent maximum demand was skewed towards 3BHK units, closely

followed by 2BHK units with 30 per cent.

For 3BHK units, buyers were looking for units in the price range of Rs 30-38 lakh, while for 2BHK

units, the preferred range was Rs 20-30 lakh.

15

Rental Market Snapshot

Available Typology

For rentals, Yamuna Expressway has maximum availability of apartments, followed by independent houses

and studio apartment.

Figure 8 Market Segmentation based on available rental properties: Yamuna Expressway

[Source: Real [email protected]]

As per BHK configuration, 3BHK units are the showstopper, followed by 2 and 1BHK units. One can also

find few 4BHK units for rent.

Figure 9 BHK Configuration based on available rental properties: Yamuna Expressway

[Source: Real [email protected]]

76%

2%

11%

9%

2%

Apartment

Builder Floor

House

Studio Apartment

Villa

9%

39%50%

2%

1 BHK

2 BHK

3 BHK

4 BHK

16

Table 4 Rental Profile at Yamuna Expressway according to unit configurations

BHK Configuration

Approx. Unit Sizes (sq.ft.)

Expected Monthly Rent (Rs)

Approx. Ticket Size (Rs per

sq.ft.)

1 BHK 520-830 4,500-30,000 26.3

2 BHK 600-1100 5,000-32,000 11.3

3 BHK 1000-2000 8,000-30,000 9.5

4 BHK 3120-3150 55,000-55,000 17.6

[Source: Real [email protected]]

Future Growth Aspects

Connectivity

Noida authority has planned a Transport Hub,

which will have a range of transportation modes.

It will include an Inter State Bus Terminus and a

Railway Station. Further, to solve parking issues,

there will be a proper provision for vehicle

parking.

Infrastructure

Development around Gautam Buddha University

on the Expressway with necessary social

infrastructure is more likely to turn the area into

a nice sustainable residential zone soon.

Last but not the least, an International Airport is also planned to encourage tourism. The airport will have direct access to the Taj Expressway.

Manufacturing and Logistics

Proposed Delhi-Mumbai Industrial Corridor is expected to go through Dadri, which is to boost both the Logistics & Warehousing Hubs and Special Development Zones along the expressway.

About 12 major Japanese, Chinese and Korean companies have shown interest in setting up their manufacturing plants along the expressway.

IT/ITeS

Proposal of an Information Technology hub with

an investment of about Rs 15 crore by YEIDA.

Recreation and Entertainment

Night Safari Upcoming project of amusement park on the lines of Disney World. Sports amenities such as multi-purpose stadium, cricket stadium, tennis court complex, among

several others. India’s first exposition mart for Cottage and Handicraft industry

Affordable Housing

Proposed housing units under Samajwadi Awas Scheme and MIG Scheme with an expected investment of Rs 500 crore by YEIDA.

17

Conclusion

Yamuna Expressway’s growth can be attributed to robust inter and intra city connectivity. Moreover, the

peaceful backdrop of the region, with abundant water bodies and green spaces, has also worked in its

favour. This has cajoled several developers to utilise the stretch for industrial, residential, and commercial

projects.

Additionally, with Centre’s ‘Make in India’ initiative doing the rounds, Yamuna Expressway could soon

transform into a manufacturing hub for electronic products. As the stretch is meant to be developed as a

manufacturing and logistic hub, the demand for housing will multiply in the times to come. Further, it is

expected that by 2021, Yamuna Expressway will be connected by metro to the inner parts of NCR, thus

making it accessible for middle-income class group.

References

YEIDA Master Plan 2031. (2015, April 14). Retrieved from Yamuna Expressway Industrial Development

Authority: http://yamunaexpresswayauthority.com

7,400 Cr infra plans for GB Nagar. (2015, March 4). Retrieved from The Times of India:

http://timesofindia.indiatimes.com/city/noida/7400cr-infra-plans-for-GB-

Nagar/articleshow/46449939.cms

Yamuna Expressway. (2015, April 14). Retrieved from Yamuna Expressway:

http://yamunaexpressway.in/index.html

Yamuna Expressway to turn into electronics manufacturing hub. (2015, March 2). Retrieved from INDIA

TV: http://www.indiatvnews.com/news/india/yamuna-expressway-to-turn-into-electronics-

manufacturing-hub-48121.html

Yamuna Expressway: Futuristic Realty Hub. (2015). Retrieved from NDTV Profit:

http://profit.ndtv.com/delhiproperty/story/1?pfrom=home-propertydelhi_hpsmarttips

18

CommonFloor.com, Bangalore

maxHeap Technologies Pvt Ltd

Tower-B, Fourth Floor, Diamond District

Kodihalli

Bangalore – 560008

------------------------------------------------------------------------------------------------------------------- -------------------

Authors

----------------------------------------------------------------------------------------------------------------------------- ---------

Disclaimer: The information provided in this Website is based on CommonFloor data which is collected from

various publicly known sources viz, websites, documents and maps including CommonFloor's proprietary data

resources, and from the inputs of unidentified individuals. It ought to be considered as a guideline and not as

absolutely certain. While care has been taken for groundwork, no responsibility is accepted for the accuracy of whole

or any part. This information is absolute property of CommonFloor /maxHeap Technologies Private Limited. It

should not be reproduced in any form, in part or whole, without prior written permission of CommonFloor. The

information is provided on an "as is" and "as available" basis. CommonFloor expressly disclaim warranties of any

kind, whether express or implied, including, but not limited to, the implied warranties of merchantability, fitness for

a particular purpose and non-infringement.

Yadunandan Batchu

Research Associate

Bangalore

Nikunj Joshi

Sr. Research Associate

Bangalore

Meha Singla

Head Domain Research (Real Estate)

Bangalore