RE: QUARTERLY REPORT · 10/31/2011 · RE: QUARTERLY REPORT ... pond design and costing as the...

Transcript of RE: QUARTERLY REPORT · 10/31/2011 · RE: QUARTERLY REPORT ... pond design and costing as the...

31 October 2011 The Manager Company Announcements Office Australian Stock Exchange Via Online Electronic Lodgement Dear Sirs, RE: QUARTERLY REPORT Enclosed please find the Quarterly Report for the period ended 30 September 2011. Yours sincerely, CERRO RESOURCES NL Craig J McPherson Company Secretary

For

per

sona

l use

onl

y

- 2 - QUARTERLY REPORT 30 SEPTEMBER 2011

QUARTERLY REPORT PERIOD ENDED 30 SEPTEMBER 2011

1. QUARTERLY HIGHLIGHTS Mexico

Cerro del Gallo gold/silver project

Final crushing and processing circuit design nears completion;

Greater recovery through HPGR confirmed;

BFS for heap leach continues and nears final inputs;

Namiquipa silver project

Encouraging drill results released for first 3 drill holes in August;

Second core rig added and program extended;

Further drilling results released post quarter end for a further 11 drill holes completed

during quarter:

o Zones of good grade mineralization detailed below (Tables 4 to 8) but including:

NAM-009: 16m @ 921g/t AgEq from 202m, including 1m @ 14,741g/t AgEq (12,136g/t Ag, 26.97% Pb and 6.06% Zn)*;

NAM-014: 7.5m @ 601g/t AgEq from 354.4m, including 1m @ 1,606g/t AgEq;

NAM-016: 13m @ 272g/t AgEq from 301m; o Potential extension to Princesa Vein identified - NAM-018: 15m @ 184g/t AgEq

from 102m, including 3.6m @ 535g/t AgEq and 10m @ 272g/t AgEq from 156.6m, including 1.2m @ 1,583g/t AgEq;

Espiritu Santo Jalisco acquisition

New project acquisition announced boosting precious metals focus in Mexico;

Potential for Au Ag discovery highlighted by historic rock chip sampling and mining in the

broader region;

Australia

Inferred resource announced for part project area at Mt Philp;

Drilling for resource over total strike length by year end;

2. CORPORATE

Management focused during the quarter on advancement of the Company‟s three projects:

Cerro del Gallo, Namiquipa and Mt Philp; advancement to acquisition of the new Espiritu Santo

Jalisco project; and completion of the statutory audit plus preparation and publication of the

annual report to stakeholders.

* Sample was re-assayed using four methods, including as a concentrate, at ALS in Vancouver and it should be noted that core

recovery was within fault zone with 50 to 70% core recovery.

For

per

sona

l use

onl

y

- 3 - QUARTERLY REPORT 30 SEPTEMBER 2011

3. MEXICO

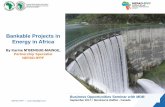

Cerro Resources Project Location Map

Cerro del Gallo

Near final assessments of the crushing and processing plant were made at quarter end having

taken advantage of time delays with third party design of plant, pad and pond designs. These

have been momentarily delayed to allow some further site assessment in order to ensure the

site layout can accommodate the potential increase in open pit heap leach resource due to

potentially increased metal recoveries and longer term higher metal prices. The additional site

assessment work is due to take place mid-November, which will allow finalisation of the pad and

pond design and costing as the last of the outstanding inputs to the bankable feasibility study

(BFS).

Meanwhile the time has been useful for running further recovery tests to improve confidence

and de-risk the project. The high pressure grinding rolls (HPGR) were reported upon last

quarter and the recovery levels have been confirmed this quarter (Table 1). Details of the

change in production forecasts from these increased recoveries are shown in Table 2.

Namiquipa Silver Project,

Chihuahua

Cerro del Gallo Gold/Silver

Project, Guanajuato

Espiritu Santo Gold/Silver

Project, Jalisco

For

per

sona

l use

onl

y

- 4 - QUARTERLY REPORT 30 SEPTEMBER 2011

Table 1: HPGR Gold/Silver Recoveries

Previous Study

Recoveries*

HPGR

Test Work

Results

New Recoveries for Study

Weathered (heap leach)

Gold Recovery (%) 75 73 75

Silver Recovery (%) 40 59 50

Oxidised (heap leach)

Gold Recovery (%) 55 65 65

Silver Recovery (%) 30 69 50

Fresh (for CIL processing)

Gold Recovery (%) 78 - 78

Silver Recovery (%) 20 - 20

Table 2: Metal Production

Previous Study

Recoveries*

New Production

for BFS

Change in Production

Forecast

Weathered (heap leach)

Gold (koz) 228 228 -

Silver (koz) 3,536 4,420 884

Oxidised (heap leach)

Gold (koz) 395 464 69

Silver (koz) 3,621 6,035 2,414

Fresh (for CIL processing)

Gold (koz) 503 503 -

Silver (koz) 2,891 2,891 -

* As previously reported in the NI43-101 technical report titled “Feasibility Study

and Preliminary Assessment Cerro del Gallo Project Guanajuato, Mexico” and lodged

26 May 2011.

The actual HPGR test work recoveries for silver are significantly higher than previously. For

cash flow projections, more conservative recoveries are being used for the base case since

silver mineralogy and therefore recoveries by cyanidation can be more variable. For the design

work we use the higher silver recoveries to ensure an adequate allowance for the potential

increased amount of silver metal. Merrill-Crowe test work was investigated and has been

discounted due to the presence of copper. This process is not the optimum hence design

parameters have now been determined for the use of carbon for metal recovery from heap

leach solutions (CIL), where the presence of copper is more easily managed. These parameters

are being reconfirmed with the higher silver levels present.

The HPGR laboratory trials have been completed allowing the HPGR unit to be sized and

costed by Polysius. The test work has confirmed the production of material of the required size

distribution from HPGR crushing (80 per cent passing 4.4mm). This is finer than the originally

For

per

sona

l use

onl

y

- 5 - QUARTERLY REPORT 30 SEPTEMBER 2011

targeted 6.3mm by conventional and will give greater confidence that recoveries achieved by

the column tests can be realised in practice. To ensure the heap leach will have the required

permeability with the fine crush size, further agglomeration test work using cement has been

completed and two additional column leach tests have commenced. The columns are 6 metres

high and are filled with the HPGR crushed material with the 80 per cent passing 4.4mm crush

size. These tests are confirmatory tests to provide additional support information for the BFS.

Namiquipa

Drilling commenced late May 2011 and at the end of June 8 holes for a total of 2,800m of

diamond core had been completed. During the September quarter a second drill rig was added

and a further 26 holes for a total of 9,300m of drilling was completed with very encouraging drill

intercepts.

First results were released early August and returned good silver, lead and zinc grades as

shown in table 3 below.

Table 3: Initial Princesa Vein Drill Results

Drill Hole From (m)

To (m)

Drilled Length

(m)

Ag g/t

Pb %

Zn % AgEq1

g/t

NAM-001 158.50 165.00 6.50 56 0.10 0.26 66

Including 163.45 164.00 0.55 553 0.14 0.15 560

228.76 241.00 11.05 49 0.88 0.29 81

NAM-002 194.50 213.82 19.32 30 1.29 3.40 158

Including 194.50 202.00 7.5 54 2.11 4.45 235

236.50 237.74 1.24 85 5.31 8.61 466

NAM-003 162.00 167.00 5.00 542 .047 0.39 565

Including 164.53 167.00 2.47 854 0.66 0.33 881

259.65 325.35 65.70 33 0.82 2.24 115

including 293.00 294.44 1.44 440 7.48 17.68 1,130 1The Silver equivalent grades (“AgEq”) have been calculated using metal prices of US$25oz Silver; US$1.00/lb Zinc; and

US$1.00/lb Lead. Metal recoveries are not considered in this calculation. Further drilling is required to provide a more accurate

assessment of vein thickness and true width may vary.

The program was extended from 10,000m to 20,000m minimum and the intention is to continue

the program beyond that level.

The first rig is drilling to test potential extensions of the vein mineralization from the historic La

Venturosa Mine – which produced an estimated 14.4 million ounces of silver, 32,550 tonnes of

lead and 43,530 tonnes of zinc from two prominent quartz/breccias vein systems; the America

and Princesa. The drill results to date indicate the mineralized system continues at depth along

the Princesa vein system with the geological setting suggesting significant potential for high

grade material to be hosted in additional vein spurs/shoots.

The second core rig has focused on exploration of possible extensions of the known systems as

well as testing for new systems to the north, south and to the east of the known vein systems.

For

per

sona

l use

onl

y

- 6 - QUARTERLY REPORT 30 SEPTEMBER 2011

The program has confirmed its significant potential and since quarter end results for an

additional 11 drill holes drilled during the quarter have been released and are shown below in

Tables 4 to 8.

Table 4: Princesa and Megan Vein Drill Results

Drill Hole From (m) to (m) Length (m) Ag (g/t) Pb (%) Zn (%) AgEq2 (g/t)

NAM-004 172.0 180.0 8.0 weakly anomalous 16

NAM-008 65.38 66.07 0.69 174 0.08 0.03 177

NAM-008 140.47 140.75 0.28 184 1.27 3.84 324

170.69 176.79 6.1 Open Stope

NAM-009 93.0 95.0 2.0 75 .06 .14 80

NAM-009 182.0 185.0 3.0 66 .04 .07 69

NAM-009 202.0 218.0 16.0 834 2.29 0.88 921

Including 202 203 1.0 168 0.78 0.41 201

203 204 1.0 23 0.06 0.37 35

204 205 1.0 40 0.04 0.10 44

205 206 1.0 29 0.11 0.23 38

206 207 1.0 41 0.38 0.17 56

207 208 1.0 11 0.86 0.74 55

208 209 1.0 0.8 0.23 0.53 22

209 210 1.0 1 0.88 0.67 43

210 211 1.0 534 3.95 1.18 674

211 212 1.0 12,136 26.97 6.06 14,741

212 213 1.0 47 0.16 0.11 54

213 214 1.0 28 0.08 0.08 32

214 215 1.0 15 0.06 0.26 24

215 216 1.0 5 0.03 0.07 8

216 217 1.0 51 0.12 0.46 67

217 218 1.0 218 1.9 2.55 340

NAM-009 224.0 225.0 1.0 92 0.7 6.1 278

NAM-009 229.0 231.0 2.0 84 0.58 .77 121

NAM-009 256.0 258.0 2.0 40 0.23 2.80 123

NAM-009 377.58 380.17 2.59 11 2.90 1.57 133

NAM-009 455.0 456.0 1.0 957 0.2 0.22 968

NAM-014 244.74 250.3 5.56 60 2.12 2.09 175

NAM-014 273.17 275.25 2.08 42 .32 1.19 83

NAM-014 286.0 289.6 3.6 52 .32 .43 72

NAM-014 307.25 311 3.75 25 1.17 2.94 138

NAM-014 313.0 314.6 1.6 68 0.8 5.92 253

NAM-014 319.7 327.0 7.3 53 2.03 8.04 329

Including 319.7 320.4 0.7 142 6.02 20.9 880

320.4 321.0 0.6 28 1.28 7.7 274

321.0 322.0 1.0 23 3.7 6.52 303

322.0 323.0 1.0 36 1.82 8.12 308

323.0 324.0 1.0 77 1.81 7.74 339

324.0 325.0 1.0 15 0.93 3.80 145

325.0 326.0 1.0 98 1.10 12.15 461

NAM-014 332 333.4 1.4 7 0.68 1.52

67

NAM-014 354.42 361.93 7.51 576 0.51 0.42 601

Including 358.0 359.0 1.0 1,595 0.16 0.25 1,606

For

per

sona

l use

onl

y

- 7 - QUARTERLY REPORT 30 SEPTEMBER 2011

Drill Hole From (m) to (m) Length (m) Ag (g/t) Pb (%) Zn (%) AgEq2 (g/t)

359.0 360.0 1.0 856 0.06 .14 861

360.0 360.55 0.55 371 0.01 .01 371

NAM-016 266.0 269.0 3.0 217 4.03 3.59 426

Including 266.8 267.64 0.84 334 4.46 6.41 632

267.64 269.0 1.36 216 6.1 3.92 411

NAM-016 281.0 283.0 2.0 92 0.49 0.15 110

NAM-016 289.0 295.0 6.0 116 0.2 0.15 126

NAM-016 299.0 300.4 0.97 20 1.91 2.14 131

NAM-016 301.0 314.0 13.0 151 2.18 2.23 272

Including 307.0 308.15 1.15 247 12.95 1.24 635

311.9 312.7 0.8 366 1.14 1.81 446

312.7 314.0 1.3 589 0.65 1.17 638

NAM-016 325.0 329.0 4.0 154 1.91 7.64 416

Including 326.76 328.6 1.84 326 3.63 15.25 843

Table 5: North Zone Drill Results

Drill Hole From (m) To (m) Length (m) Ag (g/t) Pb (%) Zn (%) AgEq

2 (g/t)

NAM-018 102 117 15.0 146 1.29 0.1 184

Including 111 114.6 3.6 394 4.99 0.15 535

156.6 166.7 10.10 115 170.0 4.04 272

Including 160.7 161.9 1.2 645 10.69 23.55 1,583

Table 6: Mexico and Esmeralda Vein Drill Results

Drill Hole From (m) to (m) Length (m) Ag (g/t) Pb (%) Zn (%) AgEq

2 (g/t)

NAM-007 91.0 100.15 9.15 48 0.09 0.06 52

NAM-007 112.0 115.82 3.82 123 0.12 0.05 128

Including 113.9 115.82 1.92 184 0.17 .05 189

NAM-007 187.0 188.0 1.0 148 .07 .18 154

NAM-007 193.0 196.0 3.0 148 .06 .13 153

NAM-007 208.0 209.0 1.0 76 0.35 0.05 87

NAM-007 223.0 224.0 1.0 178 .07 .34 189

NAM-007 246.0 256.0 10.0 69 .14 .25 80

NAM-007 313.0 319.8 6.8 71 3.05 1.88 207

Including 313.0 313.94 0.94 51 0.04 0.31 60

313.94 315.41 1.47 103 0.29 0.46 123

315.41 316.44 1.03 82 0.51 0.5 110

316.44 317.50 1.06 134 13.55 3.94 613

317.50 319.8 1.55 27 3.18 2.71 188

319.8 320.4 0.75 26 0.6 3.92 150

NAM-013 118.87 122.16 3.29 268 0.23 0.11 277

Including 121.7 122.16 0.46 1,360 .71 .12 1,382

NAM-013 134.0 135.0 1.0 93 .10 .52 110

NAM-013 184.0 192.0 8.0 41 .14 .26 52

NAM-013 195.0 196.0 1.0 91 .25 .05 99

NAM-013 223.0 224.0 1.0 23 .64 1.80 90

NAM-013 238.0 243.15 5.15 23 .81 2.3 108

NAM-013 247.75 248.55 .8 34 .77 1.62 100

For

per

sona

l use

onl

y

- 8 - QUARTERLY REPORT 30 SEPTEMBER 2011

Drill Hole From (m) to (m) Length (m) Ag (g/t) Pb (%) Zn (%) AgEq2 (g/t)

NAM-013 249.45 249.8 .35 79 .62 1.33 132

NAM-013 259.0 264.0 5.0 268 .17 .24 279

Including 259.0 261.0 2.0 435 .39 .44 457

NAM-013 346.67 352.5 5.83 186 1.08 2.81 293

Including 351.48 352.5 1.02 998 2.47 6.61 1,246

Table 7: America Vein Drill Results

Drill Hole From (m) to (m) Length (m) Ag (g/t) Pb (%) Zn (%) AgEq

2 (g/t)

NAM-012 244 245 1.0 23 3.35 5.42 264

NAM-012 271.27 280.42 9.15 Open stope

NAM-012 280.42 285 4.58 20 0.69 1.51 80

NAM-012 318 321 3 27 1.27 2.87 141

Table 8: NW Antenna Vein Drill Results

Drill Hole From (m) to (m) Length (m) Ag (g/t) Pb (%) Zn (%) AgEq

2 (g/t)

NAM-005 149.0 157.0 8.0 107 0.07 0.16 114

Including 153.0 156.0 3.0 208 0.15 0.25 219

NAM-005 177.0 190.0 13.0 65 0.04 0.14 70

NAM-005 195.0 204.0 9.0 66 0.06 0.09 70

NMA-006 126.0 126.6 0.6 299 0.24 0.18 310

NAM-006 129.0 131.0 2.0 149 0.02 0.03 150 2

The Silver equivalent grades (“AgEq”) in tables 4 to 8 have been calculated using metal prices of US$25oz Silver; US$1.00/lb

Zinc; and US$1.00/lb Lead. Metal recoveries are not considered in this calculation. Further drilling is required to provide a more

accurate assessment of vein thickness and true width may vary.

The Namiquipa vein systems (Figure 1) are „blind‟ in that they are not all evident at surface. The

early success and encouraging drill results is however sufficient for management and

shareholders to be encouraged.

For

per

sona

l use

onl

y

- 9 - QUARTERLY REPORT 30 SEPTEMBER 2011

Figure 1: Namiquipa Silver Project Vein System

NW ANTENNA VEINS

For

per

sona

l use

onl

y

- 10 - QUARTERLY REPORT 30 SEPTEMBER 2011

Espiritu Santo Jalisco

The Espiritu Santo Jalisco project was secured at the end of the quarter and announced on 7th

October, 2011. The project is in Jalisco State in central western Mexico and was targeted

because of the historic workings in the broader region of Jalisco State and also given no

modern exploration has been undertaken following historic soil and rock-chip sampling. Historic

rock-chip sampling confirmed the presence of gold and silver in numerous epithermal veins as

show in table 9.

Figure 2: Gold values collected from known veins

For

per

sona

l use

onl

y

- 11 - QUARTERLY REPORT 30 SEPTEMBER 2011

Table 9: Historic Rock Chip Samples

No.

Samples SAMPLE_ID LAT LONG Au ppm Ag ppm AuEq3

OXIDOS-AFLOR VETA

1 420791 20.701 -104.62 0.709 90.4 2.52 V. EL GRINGO

2 420792 20.701 -104.62 2.34 27.3 2.89 V. EL GRINGO

3 420793 20.701 -104.62 0.751 11.4 0.98 V. EL GRINGO

4 420797 20.7019 -104.62 0.496 7.9 0.65 V. EL GRINGO

5 420798 20.7019 -104.62 1.215 6.9 1.35 V. EL GRINGO

6 420802 20.7026 -104.62 0.102 10.7 0.32 V. EL GRINGO

7 420803 20.7026 -104.62 0.118 11.4 0.35 V. EL GRINGO

8 420804 20.7026 -104.62 0.173 11 0.39 V. EL GRINGO

9 420805 20.7026 -104.62 0.807 18.3 1.17 V. EL GRINGO

10 420807 22.9513 -105.396 0.234 6.3 0.36 V. EL GRINGO

11 4268 20.7014 -104.62 0.475 1.9 0.51 V. EL GRINGO

12 4269 20.7014 -104.62 0.201 3.2 0.27 V. EL GRINGO

13 4272 20.7014 -104.62 0.671 7.6 0.82 V. EL GRINGO

14 4277 20.7025 -104.613 0.892 1.1 0.91 CAMPAMENTO VIEJO

15 4273 20.7014 -104.62 1.487 136 4.21 V. EL GRINGO

16 4275 20.7014 -104.62 0.831 37 1.57 V. EL GRINGO

17 7910 20.7048 -104.62 0.442 5.8 0.56 V. EL GRINGO

18 7911 20.706 -104.618 0.343 14.5 0.63 V. EL GRINGO

19 7962 20.7003 -104.62 1.145 8 1.31 ENT. RAMPA V. EL GRINGO

20 7963 20.7012 -104.62 0.597 2.3 0.64 TIRO EL GRINGO

21 305 20.7005 -104.62 1.14 15.70 1.45 V. GRINGO

22 306 20.7005 -104.62 1.18 91.50 3.01 V. GRINGO

23 309 20.7012 -104.62 0.85 8.30 1.02 V. GRINGO

24 316 20.7021 -104.62 0.49 6.50 0.62 V. GRINGO

25 317 20.7027 -104.62 0.38 9.10 0.56 V. GRINGO

26 326 20.7049 -104.62 0.33 5.20 0.43 V. GRINGO

27 327 20.7048 -104.62 1.71 24.00 2.19 V. GRINGO

28 378 20.7094 -104.61 1.05 17.60 1.40 V. NUÑEZ

29 384 20.7093 -104.612 0.35 1.00 0.37 V. NUÑEZ

30 388 20.7092 -104.612 0.48 5.50 0.59 V. NUÑEZ

31 7922 20.7093 -104.61 0.902 33.1 1.56 V. DE NUÑEZ

32 7939 20.7092 -104.611 3.34 4.7 3.43 V. DE NUÑEZ

33 420840 20.7099 -104.611 1.545 51.7 2.58 V. DE NUÑEZ

34 420842 20.7099 -104.61 7.04 17.9 7.40 V. DE NUÑEZ

35 420849 20.7124 -104.609 0.387 9.9 0.59 VETA DE QZO S/N 1

36 339 20.7104 -104.616 1.64 6.70 1.77 V. EL PATAS

37 344 20.7107 -104.616 3.17 4.40 3.26 V. EL PATAS

38 346 20.7117 -104.616 0.49 0.60 0.50 V. EL PATAS

39 352 20.7115 -104.615 1.21 10.70 1.42 V. EL PATAS

40 354 20.712 -104.615 1.83 9.80 2.03 V. EL PATAS

41 383 20.712 -104.613 4.28 7.50 4.43 V. EL PATAS

For

per

sona

l use

onl

y

- 12 - QUARTERLY REPORT 30 SEPTEMBER 2011

No.

Samples SAMPLE_ID LAT LONG Au ppm Ag ppm AuEq3

OXIDOS-AFLOR VETA

42 420811 20.7121 -104.616 0.11 1.5 0.14 V. EL PATAS

43 420812 20.7121 -104.616 0.33 6.3 0.46 V. EL PATAS

44 4280 20.7104 -104.616 1.219 1.1 1.24 V. EL PATAS

45 4281 20.7104 -104.616 7.65 26.4 8.18 V. EL PATAS

46 4283 20.7114 -104.615 0.425 2.4 0.47 V. EL PATAS

47 4284 20.7114 -104.615 0.739 0.7 0.75 V. EL PATAS

48 7912 20.7106 -104.616 2.84 4.5 2.93 V. EL PATAS

49 420821 20.7121 -104.616 2.51 3.7 2.58 ROCA ENCAJONANTE

50 420822 20.7117 -104.616 0.514 5.4 0.62 ROCA ENCAJONANTE

51 420829 20.7109 -104.617 1.945 9.7 2.14 VETA EL PATAS

52 420830 20.7109 -104.617 1.1 3.6 1.17 FALLA RESPALDO VETA

53 420833 20.7114 -104.616 0.493 2.4 0.54 V. EL PATAS

54 420844 20.7116 -104.609 2.37 9.1 2.55 V. EL PUMA

55 420845 20.7117 -104.609 0.51 6.6 0.64 V. EL PUMA

56 420858 20.7139 -104.607 0.165 7.1 0.31 V. EL RELIZ

57 420878 20.7197 -104.616 0.583 8.4 0.75 V. EUGENIA

58 420879 20.7197 -104.616 0.948 0.25 0.95 V. EUGENIA

59 421476 20.7071 -104.611 1.365 8.7 1.54 V. STA. RITA

60 420868 20.7145 -104.612 0.105 11.6 0.34 VETA MASIVA DE QZO S/N 2

61 420870 20.7113 -105.76 0.246 8.8 0.42 STOCKWORK

62 420871 20.7113 -105.76 0.317 10.4 0.53 STOCKWORK

63 420873 20.7245 -104.615 0.534 25.4 1.04 VETA EN PORF. AND.S/N 5

64 7932 20.7057 -104.611 0.414 0.6 0.43 V. EL TIGRE

65 7961 20.7015 -104.613 0.143 0.3 0.15 V. EL TIGRE

66 23018 20.7008 -104.613 3.48 12.60 3.73 V. EL TIGRE

67 7923 20.6974 -104.611 4.99 22.2 5.43 V. PLAN VERDE

68 4286 20.7194 -104.62 6.58 12.8 6.84 V. LOS CUAMAJALES

69 7957 20.7166 -104.616 0.242 4.9 0.34 V. LOS CUAMAJALES

70 7920 20.7126 -104.609 0.965 3.8 1.04 V. EL CRESTON -( RELIZ )

71 332 20.709 -104.614 1.22 6.30 1.35 V. CRESTON

72 361 20.7141 -104.606 0.51 2.70 0.56 V. CRESTON

73 368 20.7137 -104.607 0.45 16.50 0.78 V. CRESTON

74 23012 20.7162 -104.601 0.33 12.00 0.57 V. CRESTON

75 4289 20.7077 -104.609 1.231 22.7 1.69 V. CRESTON

76 4301 20.7111 -104.609 0.485 1.2 0.51 V. CRESTON

77 7950 20.7194 -104.615 0.281 5.5 0.39 V. STA. CECILIA

78 7953 20.7192 -104.615 0.314 4.2 0.40 V. STA. CECILIA

79 7954 20.7192 -104.615 0.98 4.5 1.07 V. STA. CECILIA

80 7942 20.7196 -104.615 0.175 16.6 0.51 V. STA. CECILIA

81 420834 20.7182 -104.619 0.312 8.2 0.48 V. HARRIZON

82 420836 20.7195 -104.625 0.512 21.6 0.94 ALTO DE VETA HARRIZON

83 7946 20.7188 -104.619 0.358 4.1 0.44 V. HARRIZON

For

per

sona

l use

onl

y

- 13 - QUARTERLY REPORT 30 SEPTEMBER 2011

No.

Samples SAMPLE_ID LAT LONG Au ppm Ag ppm AuEq3

OXIDOS-AFLOR VETA

84 7948 20.7123 -104.619 0.896 2.9 0.95 V. HARRIZON

85 4285 20.7194 -104.62 0.463 11.4 0.69 V. HARRIZON

86 harryson1 20.7193 -104.62 2.29 10 2.49 V. HARRIZON 3The Gold equivalent grades (“AuEq”) have been calculated using US$1,200/oz Gold; and US$24/oz Silver. Metal

recoveries are not considered in this calculation.

4. AUSTRALIA Mt Philp

This quarter work advanced as targeted and enabled the Company to release a resource

estimate on part of the project just after close of the quarter. The resource is summarised in

table 10 below.

Table 10: Resource Summary for Northern 2.75km

Geological Boundary

Volume

‘000 m3

SG

t/m3

Tonnes

millions

Fe

%

SiO2

%

P

%

Al2O3

%

Haematite Ironstone 3145 3.85 12.1 47.6 29.1 .02 0.94

Siliceous Ironstone 4076 3.27 13.3 26.5 59.8 .02 1.25

Total * 25.4 36.6 45.2 .02 1.10

Mineral resources that are not mineral reserves do not have demonstrated economic viability.

It remains the Company‟s intention to complete the resource drilling over the Mt Philp Project

total strike length, make the resource estimate and consider a range of commercial options

available.

For further information, please contact: Tony McDonald, Managing Director; or Craig McPherson, Chief Financial Officer +61 7 3252 0122 [email protected] Greg Germon, Ms. Gerri Paxton General Manager Investor Relations - Australia Manager Investor Relations – North America +61 2 9300 3341 +1-514-544-2696 [email protected] [email protected]

About Cerro Resources

Cerro Resources is a precious and base metals exploration and development company. The Company is

currently focused on Mexico where it is developing the Cerro del Gallo gold/silver project in the central

state of Guanajuato, Mexico, actively exploring the Namiquipa silver project in northern Mexico, and

commencing exploration on the Espiritu Santo gold/silver project in Jalisco. It also maintains an active

working focus on the Mt Isa, Queensland, region where it is exploring the Mt Philp haematite project and

it holds an interest in the Kalman molybdenum, rhenium, and copper project.

Additional information about the Company is available on the Company‟s website at

www.cerroresources.com and on SEDAR.

For

per

sona

l use

onl

y

- 14 - QUARTERLY REPORT 30 SEPTEMBER 2011

Competent Person/Qualified Person

The information in this report that relates to Exploration Results, Mineral Resources or Ore Reserves is based on information compiled by Mr John Skeet (as it relates to process related material), who is a Member of the Australasian Institute of Mining and Metallurgy; Mr Bill Fleshman (as it relates to the San Anton, Namiquipa, and Espiritu Santo Projects), who is a Fellow of the Australasian Institute of Mining and Metallurgy; and Mr Trevor Leahey (as it relates to the Mt Philp Project), who is a Member of the Australasian Institute of Mining and Metallurgy. Mr Skeet is the Chief Operating Officer of Cerro Resources NL. Mr Fleshman and Mr Leahey are consultant to Cerro Resources NL. They have sufficient experience, which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which they are undertaking to qualify as a Competent Person as defined in the 2004 edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves” and “qualified persons” as this term is defined in Canadian National Instrument 43-101 (“NI 43-101”). Mr Skeet, Mr Fleshman and Mr Leahey consent to the inclusion in the report of the matters based on their information in the form and context in which it appears. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this

release.

Forward-Looking Information

This quarterly report contains "forward-looking information" under Canadian securities law. Any statement that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words such as "expect", "anticipate", "believe", "plans", "estimate", "scheduling", “projected” or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking information. Forward-looking information relates to, among other things: the results of exploration programs, the interpretation of such results, the potential of the projects, the planned continuation of a drilling program, the accuracy of mineral resource and mineral reserve estimates, the ability of the Company to finance its operations and capital expenditures, future financial and operating performance including estimates of the Company's revenues and capital expenditures and estimated production. Forward-looking information is subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking information, including, without limitation, risks relating to: fluctuating commodity prices; calculation of resources, reserves and mineralization and precious and base metal recovery; interpretations and assumptions of mineral resource and mineral reserve estimates; exploration and development programs; feasibility and engineering reports; permits and licences; title to properties; recent market events and conditions; economic factors affecting the Company; timing, estimated amount, capital and operating expenditures and economic returns of future production; operations and political conditions; environmental risks; and risks and hazards of mining operations. This list is not exhaustive of the factors that may affect any of the Company's forward-looking information. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. The Company's forward-looking information is based on the assumptions, beliefs, expectations and opinions of management as of the date of this quarterly report, and other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements and information if circumstances or management's assumptions, beliefs, expectations or opinions should change, or changes occur in any other events affecting such statements or information. For the reasons set forth above, investors should not place undue reliance on forward-looking information.

For

per

sona

l use

onl

y

Appendix 5B Mining exploration entity quarterly report

+ See chapter 19 for defined terms. 30/9/2001 Appendix 5B Page 1

Rule 5.3

Appendix 5B

Mining exploration entity quarterly report Introduced 1/7/96. Origin: Appendix 8. Amended 1/7/97, 1/7/98, 30/9/2001, 01/06/10.

Name of entity

CERRO RESOURCES NL

ABN Quarter ended (“current quarter”)

72 006 381 684 30 SEPTEMBER 2011

Consolidated statement of cash flows

Cash flows related to operating activities

Current quarter $A’000

Year to date (3 months) $A’000

1.1 Receipts from product sales and related debtors

- -

1.2 Payments for (a) exploration & evaluation (b) development (c) production (d) administration

<3,213> - -

<583>

<3,213> - -

<583> 1.3 Dividends received - - 1.4 Interest and other items of a similar nature

received

210

210 1.5 Interest and other costs of finance paid - - 1.6 Income taxes paid - - 1.7 Other (provide details if material) - -

Net Operating Cash Flows

<3,586>

<3,586>

Cash flows related to investing activities

1.8 Payment for purchases of: (a) prospects (b) equity investments (c) other fixed assets

- - -

- - -

1.9 Proceeds from sale of:(a) prospects (b) equity investments (c) other fixed assets

- - 6

- - 6

1.10 Loans to other entities - - 1.11 Loans repaid by other entities - - 1.12 Other (Business combination costs with San

Anton Resource Corporation Inc. and Namiquipa Project Acquisition)

-

-

Net investing cash flows

6

6

1.13 Total operating and investing cash flows (carried forward)

<3,580>

<3,580>

For

per

sona

l use

onl

y

Appendix 5B Mining exploration entity quarterly report

+ See chapter 19 for defined terms. Appendix 5B Page 2 30/9/2001

1.13 Total operating and investing cash flows

(brought forward)

<3,580>

<3,580>

Cash flows related to financing activities

1.14 Proceeds from issues of shares, options, etc. 60 60 1.15 Proceeds from sale of forfeited shares - - 1.16 Proceeds from borrowings - - 1.17 Repayment of borrowings - - 1.18 Dividends paid - - 1.19 Other (share issue costs) -

Net financing cash flows

60 60

Net increase (decrease) in cash held

<3,520>

<3,520>

1.20 Cash at beginning of quarter/year to date 18,739 18,739 1.21 Exchange rate adjustments to item 1.20 <14> <14>

1.22 Cash at end of quarter 15,205 15,205

Payments to directors of the entity and associates of the directors Payments to related entities of the entity and associates of the related entities

Current quarter $A'000

1.23

Aggregate amount of payments to the parties included in item 1.2

204

1.24

Aggregate amount of loans to the parties included in item 1.10

-

1.25

Explanation necessary for an understanding of the transactions

Item 1.23 - Includes payment of $26,202 to MIS Corporate Pty Ltd, a company associated with NA Seckold for provision of investor relation services. The balance, being $177,500, represents directors fees paid to executive and non-executive directors.

Non-cash financing and investing activities

2.1 Details of financing and investing transactions which have had a material effect on consolidated assets and liabilities but did not involve cash flows

-

2.2 Details of outlays made by other entities to establish or increase their share in projects in

which the reporting entity has an interest

-

For

per

sona

l use

onl

y

Appendix 5B Mining exploration entity quarterly report

+ See chapter 19 for defined terms. 30/9/2001 Appendix 5B Page 3

Financing facilities available Add notes as necessary for an understanding of the position.

Amount available $A’000

Amount used $A’000

3.1 Loan facilities

- -

3.2 Credit standby arrangements

- -

Estimated cash outflows for next quarter

$A’000

4.1 Exploration and evaluation

4,000

4.2 Development

-

4.3 Production

-

4.4 Administration

500

Total

4,500

Reconciliation of cash

Reconciliation of cash at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts is as follows.

Current quarter $A’000

Previous quarter $A’000

5.1 Cash on hand and at bank 503 285

5.2 Deposits at call 14,684 18,436

5.3 Bank overdraft - -

5.4 Other (provide details) – Security Deposits 18 18

Total: cash at end of quarter (item 1.22)

15,205 18,739

Changes in interests in mining tenements Tenement

reference Nature of interest (note (2))

Interest at beginning of quarter

Interest at end of quarter

6.1 Interests in mining tenements relinquished, reduced or lapsed

6.2 Interests in mining tenements acquired or increased

For

per

sona

l use

onl

y

Appendix 5B Mining exploration entity quarterly report

+ See chapter 19 for defined terms. Appendix 5B Page 4 30/9/2001

Issued and quoted securities at end of current quarter Description includes rate of interest and any redemption or conversion rights together with prices and dates.

Total number

Number quoted Issue price per security (see note 3) (cents)

Amount paid up per security (see note 3) (cents)

7.1 Preference +securities (description)

7.2 Changes during quarter (a) Increases through issues (b) Decreases through returns of capital, buy-backs, redemptions

7.3 +Ordinary securities

748,768,606 718,768,606

7.4 Changes during quarter (a) Increases through issues (b) Decreases through returns of capital, buy-backs

500,000

500,000

$0.12

7.5 +Convertible debt securities (description)

7.6 Changes during quarter (a) Increases through issues (b) Decreases through securities matured, converted

7.7 Options (each exercisable to convert to 1 fully paid share)

4,175,000 4,175,000 2,625,000 1,250,000

125,000 4,250,000 2,100,000 2,100,000

10,000,000 10,000,000 5,000,000

NIL NIL NIL NIL NIL NIL NIL NIL NIL NIL NIL

Exercise Price 15c 20c 32c 12c

60c 32c 15c 20c 17.32c 20c 27c

Expiry Date 11 September 2012 11 September 2013 7 December 2011 8 September 2014

4 June 2012 13 May 2013

3 December 2013 3 December 2014 3 December 2015 3 December 2015 25 February 2013

7.8 Issued during quarter

-

-

Exercise Price -

Expiry Date -

7.9 Exercised during quarter

500,000

NIL

Exercise Price 12c

Expiry Date 8 September 2014

For

per

sona

l use

onl

y

Appendix 5B Mining exploration entity quarterly report

+ See chapter 19 for defined terms. 30/9/2001 Appendix 5B Page 5

7.10 Expired during quarter

1,500,000

750,000

- -

Exercise Price 32c 32c

Expiry Date 7 December 2011

13 May 2013

7.11 Debentures (totals only)

7.12 Unsecured notes (totals only)

Compliance statement 1 This statement has been prepared under accounting policies which comply with

accounting standards as defined in the Corporations Act or other standards acceptable to ASX (see note 4).

2 This statement does give a true and fair view of the matters disclosed.

Sign here: ............................................................ Date: 31 October 2011

(Company secretary) Print name: Craig J McPherson

Notes 1 The quarterly report provides a basis for informing the market how the entity’s

activities have been financed for the past quarter and the effect on its cash position. An entity wanting to disclose additional information is encouraged to do so, in a note or notes attached to this report.

2 The “Nature of interest” (items 6.1 and 6.2) includes options in respect of

interests in mining tenements acquired, exercised or lapsed during the reporting period. If the entity is involved in a joint venture agreement and there are conditions precedent which will change its percentage interest in a mining tenement, it should disclose the change of percentage interest and conditions precedent in the list required for items 6.1 and 6.2.

3 Issued and quoted securities The issue price and amount paid up is not

required in items 7.1 and 7.3 for fully paid securities.

4 The definitions in, and provisions of, AASB 1022: Accounting for Extractive

Industries and AASB 1026: Statement of Cash Flows apply to this report. 5 Accounting Standards ASX will accept, for example, the use of International

Accounting Standards for foreign entities. If the standards used do not address a topic, the Australian standard on that topic (if any) must be complied with.

For

per

sona

l use

onl

y