RC 20110331 Non-Life Insurance Rating Methodology En

description

Transcript of RC 20110331 Non-Life Insurance Rating Methodology En

-

Insurance

www.fitchratings.com March 31, 2011

Property/Casualty Insurers, Reinsurers Global Sector-Specific Criteria

Non-Life Insurance Rating Methodology

Summary This report outlines the global rating methodology used by Fitch Ratings to analyze the credit quality and financial strength of non-life insurance (also known as property/casualty or general insurance) and reinsurance companies. The methodology ultimately supports Fitchs assignment of issuer default ratings (IDRs), insurer financial strength (IFS) ratings, and debt/issue ratings for these entities. This criteria report is a subsector report under Fitchs global master criteria report Insurance Rating Methodology. For a fuller understanding of Fitchs methodology for rating non-life (re)insurance companies, readers should refer to this report and other related criteria.

The criteria report identifies factors that are considered by Fitch in assigning ratings to a particular entity or debt instrument within the scope of the master criteria referenced. Not all rating factors in this report may apply to each individual rating or rating action. Each specific rating action commentary or rating report will discuss those factors most relevant to the individual rating action.

This report updates and replaces Fitchs Non-Life Insurance Rating Methodology dated March 24, 2010.

Scope of Criteria Non-life (re)insurance companies typically offer protection to property against loss, theft, or damage or provide financial protection against various liability claims. Common product lines include motor (auto) insurance, homeowners (household insurance), and workers compensation (employers liability). The risk associated with these products largely varies according to policy limits offered and the predictability of future claims.

Business is often segmented by the customer base (commercial or personal insurance products, the nature of protection provided (property, casualty, liability), the layer of coverage (primary/reinsurance), and the length of the loss tail (i.e. the timing of average claims payments). As a general rule, personal lines insurance tends to exhibit milder market cycle fluctuations than commercial lines.

Reserve risks tend to be lower for property business given that it is comparatively easy to establish when loss or damage has occurred and the scale of loss. Liability business is generally longer tail given sometimes lengthy court proceedings and the time that it takes to establish the extent of loss (e.g. healthcare costs). Some business lines may have greater exposure to catastrophic risks due to location and weather, such as property reinsurance and homeowners business in coastal areas.

The report provides the following:

A discussion highlighting the key characteristics of the operating environment and key risks faced by the non-life (re)insurance industry.

Key financial ratios and other performance metrics that Fitch focuses on when rating non-life operating companies.

Analysts

Chicago James Auden +1 312 368-3146 [email protected]

Brian Schneider +1 312 606-2321 [email protected]

London Federico Faccio +44 20 3530 1394 [email protected]

Asia Terrence Wong +852 2263 9920 [email protected]

Latin America Franklin Santarelli +1 212 908-0739 [email protected]

Related Research

Insurance Industry: Global Notching Methodology and Recovery Analysis, March 31, 2011

Insurance Rating Methodology, March 31, 2011

Fitchs Approach to Rating Insurance Groups, Dec. 14, 2010

Takaful Rating Methodology, Oct. 28, 2010

Rating Hybrid Securities, Dec. 29, 2009

Equity Credit for Hybrids & Other Capital Securities, Dec. 29, 2009

Table of Contents Page Summary..................................1 Scope of Criteria.........................1 Ratings Limitations ......................2 Ratings Analysis..........................2 Appendix A ............................. 10 Appendix B ............................. 11 Appendix C ............................. 15

-

Insurance

2 Non-Life Insurance Rating Methodology March 31, 2011

The process for relating the key credit factors that Fitch reviews for a non-life (re)insurer relative to ratings, for either a stand-alone insurer or a consolidated group.

Ratings Limitation Ratings of non-life (re)insurers are primarily based on a review of public information, together with Fitchs judgments and forecasts. The extent and nature of financial information for insurance entities varies by country of domicile based on unique regulatory, accounting, and disclosure practices. Where management interaction is forthcoming, the information derived may or may not influence the rating based on Fitchs judgment with respect to the usefulness of such information. In certain cases, Fitchs forward-looking views related to risk exposures or forecasts may dominate a rating conclusion, and such forward-looking views may be based on factors that are highly subjective.

Although Fitch may receive nonpublic information from rated non-life (re)insurance companies, the extent and usefulness of such nonpublic information can vary widely from issuer to issuer, as well as over time for a given issuer. Thus, while such information can be informative, Fitch generally does not rely on nonpublic information when rating non-life (re)insurers.

Rating Analysis The main rating factors used by Fitch for the analysis of non-life (re)insurance companies are as follows.

Industry Profile and Operating Environment Fitch believes that the key risks inherent in the non-life (re)insurance industry are derived from the cyclicality of year-to-year results; intense competition in most sectors; challenges in predicting, pricing, and reserving for losses from products with long reporting and claims settlement tails; and exposures to large low frequency, high severity losses such as property catastrophes. Also, certain lines of business are highly regulated from an availability and rate perspective, making it hard to exit or adjust prices if operating results are poor. Further, regulatory capital requirements provide some barrier to entry and credit protection to policyholders.

While non-life (re)insurance is inherently cyclical relating to industrywide changes in capital levels (and thus capacity) and competitive pressure in response to pricing adequacy, as well as underwriting uncertainty, individual markets, and business lines may follow unique cycles that are less correlated with the insurance market in aggregate. For instance, surety and financial lines underwriting results may be influenced by specific economic factors more so than broader industry trends. Reinsurance markets also follow unique cycles driven largely by market competition and capacity, shifts in demand for coverage, and the impact of losses from catastrophe events on pricing. As such, Fitch may recognize the benefits to scale and market share across individual businesses as a credit positive.

Also favorable to credit fundamentals, non-life (re)insurers offer a unique product that faces limited competition from outside of the industry, although competitive advantages are rare and commodity pricing is the norm for most non-life lines. Further, the demand for a number of products is supported by third-party requirements that individuals and companies carry certain types of insurance. For example, in a number of jurisdictions, auto third-party coverage is mandatory, a homebuyer must obtain insurance on the property to secure a mortgage loan, and employers in many regions around the world are required by law to provide insurance to protect injured workers.

-

Insurance

Non-Life Insurance Rating Methodology March 31, 2011 3

In general, Fitch believes that insurers selling long-tail products, such as liability lines, are exposed to greater pricing and reserving risk than those writing shorter-tail lines. Medical malpractice and workers compensation are examples of longer-tailed non-life insurance products. In the U.S., risk inherent to liability coverage is mitigated somewhat through a claims-made policy form in some segments, which in contrast to occurrence coverage, requires an earlier claims notice provision versus an occurrence policy form. A comparison of risk factors for major non-life (re)insurance products is included in Appendix A.

The longer period over which actuaries need to predict losses increases the risk of pricing errors that can result in underpricing over a several-year period. In such a case, once inadequacies are detected, the cumulative effect on the balance sheet can be significant.

However, short-tail property lines such as homeowners insurance and property catastrophe reinsurance are exposed to potentially large losses from natural catastrophes, such as windstorms, hurricanes, or earthquakes. In these cases, insurers must rely on simulation models or other estimation techniques to judge exposures that are subject to significant estimation errors and can be subjected to near-term earnings and capital volatility risk and liquidity risk.

Companies operating in the reinsurance market face several unique challenges tied to greater distance from the underlying risk exposure, and are therefore dependent to a degree on the underwriting and claims data and expertise of the ceding company, particularly on proportional accounts. Reinsurers also have to often collateralize at least a portion of their ceding company obligations via trust accounts or bank letters of credit, which can increase liquidity risk. Additionally, the willingness of reinsurers institutional client base to accept new reinsurers that are deemed to have acceptable capital levels, especially for short-duration property-exposed reinsurance business, reduces entry barriers in the reinsurance market. Fitch views the credit-negative aspects of these characteristics to be partially offset by the less restrictive premium rate and policy form regulations reinsurers face.

Generally, Fitch sets ratings for non-life insurers at levels that would be expected to remain stable while the insurer experiences customary variability associated with normal pricing and economic cycles. Sudden and swift downward ratings migration can occur for non-life ratings, and would typically be caused by sudden reserve increases or catastrophic losses.

Company Profile and Risk Management A non-life (re)insurers business mix, scale, and competitive market position within its chosen markets are important factors in considering the underlying company risk profile. Thus, individual insurers profit potential and capital volatility will differ significantly based on the composition, size, and positioning of the underlying portfolio by segment and geography. Diversification across products and geographies are typically credit positives while Fitch recognizes that even apparently diversified portfolios can become more correlated under extreme conditions.

A non-life (re)insurers ability to manage underwriting risk within a broader risk management framework is a key driver of future success. In conducting its review, Fitch recognizes the need for sophisticated underwriting processes can vary dramatically by line of business. Subject to data and information availability, factors that may be considered in assessing underwriting risk include:

Underwriting expertise in each line of business.

-

Insurance

4 Non-Life Insurance Rating Methodology March 31, 2011

Policy limits and retentions offered by segment.

Management of undue risk aggregates and concentrations.

Exposure to large losses such as property catastrophes.

Claims management and expertise.

Financial Profile Fitch will vary the weightings of the different financial profile factors depending on the circumstances of the individual non-life company. Typically, the most important financial profile areas for non-life (re)insurance companies are linked and include capitalization, reserve adequacy, investment and asset risk, and financial performance and earnings evaluation. For example, Fitchs evaluation of capital adequacy and profitability are closely tied to its assessment of reserve adequacy. Under-reserving promotes an overstatement of both historical profits (often over a multiyear period) and capitalization.

Some of the main elements that are typically reviewed are as follows.

Capitalization Analysis of a non-life (re)insurers capitalization focuses on consideration of the adequacy of capital to absorb losses tied to key risk elements, particularly underwriting and liability exposures. In all jurisdictions globally, capital adequacy for non-life (re)insurers is first evaluated using nonrisk-adjusted leverage ratios that measure capital levels in relation to a companys notional risk exposures. These include ratios such as net premium written to capital and loss reserves to capital, which measure an insurers exposure to the risk of pricing and reserving errors, respectively.

In addition, in most jurisdictions, Fitch evaluates regulatory capital standards such as the solvency discipline in Europe and the NAIC risk-based capital ratio in the U.S.

In some cases, Fitch will additionally evaluate capital using its own proprietary risk-based models or tools. Since 2007, for most U.S. non-life insurers and select European insurers, Fitch has used its internal stochastic risk-based capital model called Prism. The model is designed to capture key risks faced by a non-life insurer, including underwriting risk, reserve risk, catastrophe exposures, asset risk, and credit risk, analyzing and integrating these components on a fully aggregated basis while also allowing for recognition of reasonable, economic risk diversification.

For European and Asian non-life insurers, Fitch uses its factor-based internal calculation to assess companies capital adequacy and resilience to material shocks regarding market risk.

Finally, in select cases when such information is made available, Fitch will assess capital adequacy in conjunction with results offered by insurers internal capital models. However, typically due to limitations in the robustness of the information available to Fitch on such models, and difficulties with respect comparisons among insurers and relative to Fitchs guidelines, results of insurers internal models typically have little bearing on Fitchs overall capital assessment.

Fitch considers both risk and nonrisk-based capital analytical tools and ratios in its capital evaluation, and judgmentally determines which measures are most appropriate for an individual insurer.

Fitch also takes into account a qualitative assessment of the ability of a non-life (re)insurer to replenish capital following a large loss, particularly in light of potentially restricted capital market access during a challenging financial market and economic

-

Insurance

Non-Life Insurance Rating Methodology March 31, 2011 5

environment. This is especially true for reinsurers exposed to shock losses, such as property catastrophe reinsurers whose business models assume an ability to reload capital after a major catastrophe loss event. In such cases, Fitch considers specific elements, including the reinsurers track record in raising capital, their perception of capital market investors, and the likelihood they may be able to raise capital on reasonable terms if their capital base were to be hit by an outsized catastrophe event.

Reserve Adequacy Loss reserve adequacy is a critical part of analyzing a non-life (re)insurer, but it is also one of the most challenging areas of analysis and one most susceptible to variability in results. A demonstrated ability to maintain an adequate reserve position is a crucial characteristic for a highly rated insurer.

The greatest challenge in assessing loss reserve adequacy is that the data available to conduct the review whether information available from statutory filings (such as Schedule P for U.S. insurers or FSA returns in the U.K.), or tables available from management as used for internal analysis may be both limited in availability and difficult to interpret. Even when significant amounts of data are available, trends observed from this data can be influenced by a multitude of factors, including changes in business mix, acquisitions or dispositions, underwriting and claims practices, reinsurance arrangements, and economic inflation, making the ability to draw solid conclusions very challenging.

Typically, publicly available supplemental data to support reserve analysis is most robust in the U.S. within regulatory filings. Non-U.S. publicly traded companies also typically provide a reasonable level of supplemental information to support a reserve analysis. In cases when supplemental data is limited, Fitch relies more on basic ratio analysis, such as trends in reserves to premiums or growth in reserves relative to growth in premium to assess reserve adequacy. In some cases, Fitch may also receive nonpublic reserve reports and data from companies it rates.

To the extent that sufficient detail is available, Fitchs reserve methodology utilizes loss development factors on a paid loss and case incurred basis (preferably on a line-by-line basis) to estimate ultimate accident year losses. Fitch will then stress test the relevant financial ratios, particularly for capital adequacy, based on the estimated reserve deficiency/redundancy.

The analysis of reserve adequacy involves a blend of both quantitative and qualitative elements. Accordingly, subject to data and information availability, Fitchs review also focuses on the following:

Historical track record in establishing adequate reserves.

Reserve ratio analysis including paid losses, incurred losses, incurred but not reported (IBNR), and total reserves.

Actuarial studies prepared by the insurers independent actuaries.

Managements reserving targets relative to the point estimate on the actuarial range (high, low, middle) or on a certain confidence interval.

General market and competitive pricing environment, and propensity of management to carry weaker reserves during down cycles.

Comparison of company loss development trends relative to industry and peers.

Use of discounting, financial or finite reinsurance, or accounting techniques that reduce carried reserves.

-

Insurance

6 Non-Life Insurance Rating Methodology March 31, 2011

Investment and Asset Risk Non-life (re)insurers tend to be less aggressive in taking investment-related risks than life insurance companies given the more prominent risks tied to underwriting operations. Non-life (re)insurers also utilize less asset leverage in comparison with life insurer peers. However, despite this general observation, Fitch notes some non-life companies take on significant investment and asset risk.

Still there is natural risk exposure in any investment activity and asset risk can vary considerably across individual insurers. In Fitchs assessment of asset risk for a non-life (re)insurer, four key areas are emphasized.

Credit risk.

Interest rate risk.

Market risk.

Liquidity risk.

Non-life (re)insurers bear a varying degree of credit exposure as organizations make unique choices regarding the trade-off between yield and default risk in investment decisions, and have differing investment opportunities in their market of origin. Fitch considers the mix, composition (government/tax exempt/corporate/asset-backed), and credit quality of a non-life (re)insurers fixed-income portfolio. Asset stress testing that estimates economic losses by asset class in more severe economic conditions is completed to assess insurers credit exposures.

Non-life (re)insurers are less likely to maintain tight duration matches between assets and liabilities relative to life counterparts that manage spread or nonlinked businesses. An asset duration that is longer relative to liabilities creates an exposure to a decline in economic value as interest rates increase. Generally, an asset liability mismatch is not a major concern for an insurer with adequate cash flow, high-quality investments, and a buy and hold investment approach. However, in periods of economic stress brought on by high inflation, insurers with longer duration mismatches will face greater asset and capital volatility.

A portfolio allocation to equity securities is not uncommon for a non-life insurer. Equity investments may provide higher long-run expected returns, but also are significantly more volatile in interim periods. Fitch stress tests equity investment values to consider the potential impact on capital from severe market downturns. Equity investment positions may also include positions in derivatives, hedge funds, or private equity vehicles. Concentrations in these types of investments are viewed more cautiously as they have greater uncertainty in terms of valuation and liquidity.

At the operating company level, a non-life insurer typically generates sufficient premium and investment income cash flow to pay current claims, so the risk of having to liquidate investments at a disadvantageous point in time is generally low. Liquidity takes on greater importance in short-tail insurance sectors and in the event of large catastrophe losses, as well as at the holding company level.

Fitch evaluates liquidity at the operating company based on the marketability of investments, as well as the amount of liquid assets relative to liabilities. The manner in which the company values its assets on the balance sheet is also closely examined. Fitch also considers the amount of receivable and other balances, as well as the impact of very nonliquid assets such as affiliated holdings or office buildings. For lines exposed to catastrophic loss, such as property reinsurance, Fitch reviews how an insurer would potentially generate sufficient liquidity to fund claim costs at various probable maximum loss levels.

-

Insurance

Non-Life Insurance Rating Methodology March 31, 2011 7

For reinsurance companies, Fitch will also consider how collateralization requirements for assumed reserves may affect liquidity and financial flexibility, particularly to the extent collateralization levels are affected by financial covenants or rating triggers.

Financial Performance and Earnings Evaluation The evaluation of underwriting profitability, particularly for non-life (re)insurers in higher risk lines of business, is the first part of the financial performance and earnings evaluation review for non-life (re)insurers. Fitchs goal is to judge the overall health of the book of business and managements understanding of its risks and ability to control them.

As a first step in evaluating underwriting risk, Fitch looks at premium growth trends. Fitch typically views premium growth at rates greater than the market or peers, especially during periods of pricing pressure, cautiously from a ratings perspective. Trends in premium growth can be a leading indicator of future reserving and pricing problems. In some cases, fast premium growth in a soft market without being accompanied by an obvious competitive advantage (to explain why the growth may be healthy) can have a material adverse impact on a rating.

Other key areas considered include:

Performance versus pricing margins that management may target to produce a reasonable margin/return, including impact of investment income on pricing decisions.

Performance relative to market peers.

Volatility of underwriting results over time.

Expense efficiencies and impact of ceding commissions on expense ratios.

Fitch measures underwriting performance using two common ratios the loss ratio and the expense ratio. The combination of the loss and expense ratios is referred to as the combined ratio. A combined ratio below 100% translates into an underwriting profit and above 100%, it represents an underwriting loss.

To properly interpret these ratios, Fitch considers the companys business mix, pricing strategy, accounting practices, distribution approach, and reserving approach. Fitch examines these ratios for the company as a whole, and by product and market segment when such information is available. Fitch also looks at underwriting results both before and after the impact of ceded reinsurance, as well as on a calendar and accident year basis when such information is available.

The focus of Fitchs profitability analysis is to understand the sources of profits and return on capital, the level of profits on both an absolute and relative basis, and the potential variability in profitability. Profits for non-life (re)insurers are sourced from two primary functional areas underwriting and investment income.

Profits derived from investments can take the form of interest, dividends, and capital gains, and can vary as to their taxable nature. The level of investment earnings is dictated by the investment allocation strategy and the quality of management. Like underwriting income, investment returns and their volatility are also correlated with the level of risk assumed.

Fitch measures overall operating profitability (underwriting and investing) for a non-life (re)insurer by calculating the companys operating ratio, which is the combined ratio less the investment income ratio (investment income divided by premiums earned). Operating margin can be evaluated on a consolidated basis and by major product and market.

-

Insurance

8 Non-Life Insurance Rating Methodology March 31, 2011

Non-life (re)insurers strive to strike a balance between underwriting and investment returns. (Re)insurers with secure insurer financial strength (IFS) ratings and short-duration reserves typically maintain high levels of liquid high-quality investments that are subject to little performance volatility. While this limits investment yields, such insurers typically target a loss ratio that enables them to be profitable.

Catastrophe Exposures Fitchs analysis of catastrophe risk for non-life (re)insurers involves both traditional risk analysis and in some regions, sophisticated risk modeling, with the ultimate goal of evaluating various large loss scenarios relative to capital.

In all regions, the starting point for Fitchs catastrophe risk analysis is to evaluate business mix, geographic concentration, premium growth rate, and past results in order to understand the companys overall catastrophe risk management profile. This review considers the nature of catastrophe risk on both a marketwide basis within a jurisdiction, as well as a companys specific share of market losses.

In many but not all cases, Fitch also reviews the results generated by non-life (re)insurers internal catastrophe models and software. Fitch reviews model results at various confidence levels, including but not limited to 100-year, 250-year, 500-year, and 1,000-year probabilities, and beyond, when possible. Fitch believes a full evaluation of the extreme ends of tail is useful, in part recognizing that actual catastrophe events seem to occur at frequencies greater than implied by many models.

Finally, Fitch has licensed AIR Worldwide Corporations (AIR) CATRADER natural catastrophe modeling tool for the U.S. and Europe that models catastrophe risk and, where appropriate and feasible, produces a loss distribution curve for each insurer that fits its overall risk exposure.

Modeled catastrophe results are most informative on an annual aggregate basis (both gross and net of reinsurance) as opposed to a single-event occurrence basis, thus allowing Fitch to capture the compounding effects of multiple events in a single year, as well as the impact of diversifying exposures. Furthermore, Fitchs catastrophe risk analysis uses a tail value-at-risk (T-VaR) measure rather than a probable maximum loss (PML) approach where available. T-VaR is the average of all potential losses from a specific threshold through the most extreme tail event and not just a single-point PML return period event.

When available, this more sophisticated, model-based catastrophe risk methodology can allow for more robust and better differentiated capital requirements among insurers. However, Fitch recognizes the potential shortfalls in any model-driven analysis and also takes care not to become overly reliant on the results of any one model without also applying judgment in interpretation of the model outputs.

Reinsurance, Risk Mitigation, and Capital Markets Products In assessing a non-life insurers use of reinsurance, (or a reinsurers use of retrocession protection), Fitchs goal is to determine if capital is adequately protected from large loss exposures and to judge if the ceding companys overall operating risks have been reduced or heightened.

Further, Fitch also looks for cases in which financial or finite reinsurance is being used to hide or delay the reporting of emerging problems that may ultimately negatively affect performance or solvency. Finally, Fitch tries to assess whether a company is becoming excessively reliant on reinsurance to manage down its gross risk exposures, and to the performance of reinsurance counterparties (including concentrations of exposure to any given reinsurers). Availability of reinsurance coverage, particularly

-

Insurance

Non-Life Insurance Rating Methodology March 31, 2011 9

retrocession coverage for reinsurers, is at times less robust, which provides further motives against over reliance on reinsurance.

In the traditional sense, reinsurance is used as a defensive tool to lay off risks that the non-life insurance ceding company does not want to expose to its earnings or capital. When reinsurance is used defensively, Fitchs goal is to gain comfort that:

Sufficient amounts and types of reinsurance are being purchased to limit net loss exposures given the unique characteristics of the book.

Reinsurance is available when needed.

The cost of purchasing reinsurance does not excessively drive down the non-life insurance ceding companys profitability to inadequate levels and weaken its competitive pricing posture.

The financial strength of reinsurers is strong, limiting the risk of uncollectible balances due to insolvency of the reinsurer.

Exposure to possible collection disputes with troubled or healthy reinsurers is not excessive.

Data available to Fitch to assess each of the above areas can vary greatly from company to company. In some cases, Fitch receives detailed information on reinsurance programs, and in other cases information available to Fitch may be limited to amounts ceded or recovered from reinsurers and the level of receivables and ceded reserves.

Non-life insurance companies may also sponsor catastrophe bonds (cat bonds) in place of, or to supplement, their traditional property catastrophe reinsurance program. In its analysis, Fitch considers cat bonds to be defensive reinsurance. This treatment affects Fitchs analysis in that the protection provided to the ceding company may not be complete due to basis risk. The use of catastrophe bonds can also create a need for a non-life insurer to maintain ongoing market access to support ongoing business generation, and thus catastrophe bonds are considered a part of debt leverage in Fitchs total financing and commitment (TFC) ratio discussed in the agencys global master criteria.

Non-life insurers can also use reinsurance offensively and potentially add to risk. In such cases, Fitch examines why the reinsurance approach is being used, and stresses what would happen if the program was unwound or developed adversely. Examples of offensive uses of reinsurance include excessive cessions under quota-share treaties simply to earn ceding commissions and the use of finite or other financial reinsurance. Typically, purchasers of finite risk reinsurance are driven less by risk transfer and more by risk financing objectives (although finite risk transactions contain elements of both). Finite reinsurance can be used to improve current period earnings, smooth earnings, and effectively discount reserves thereby enhancing capital. Fitch typically views the quality of such capital to be less than that obtained through the use of other forms of reinsurance.

-

Insurance

10 Non-Life Insurance Rating Methodology March 31, 2011

Appendix A

Risk Characteristics of Non-Life Products

Product Profile

Risk Features

Short-Tail Exposure

Catastrophe Exposure

Long-Tail Exposure

Higher Policy Limits

Heavy Regulation

Personal Lines Motor/Auto X X Homeowners X X X

Commercial Lines Commercial Auto X Property X X Workers Comp X X X General Liability/Umbrella X X Professional Liability X X Surety/Financial Lines X X

Reinsurance Property X X X Casualty X X

-

Insurance

Non-Life Insurance Rating Methodology March 31, 2011 11

Appendix B

Financial Ratios and Definitions Discussed below are some of the key financial ratios used by Fitch in its financial review of non-life (re)insurance companies.

Financial ratios are evaluated relative to peer performance, median guidelines by rating category (see Appendix C for additional details), and expectations developed by Fitch specific to the rated entity. In many cases, there is information value in the change in ratio values over time as well as the absolute level. As such, Fitch typically looks at a time series made up of at least five years of historical data.

Fitchs ratings are intended to look through the peak and trough of the normal non-life (re)insurance cycle. Thus, many financial ratios, particularly those tied to underwriting performance and profitability will vary based on the stage of the market cycle. Adverse deviations from normal cyclical variations are typically viewed as outside of ratings expectations, and could result in downgrades.

Underwriting Quality and Profitability Loss Ratio measures the magnitude of incurred losses (including loss adjustment expenses) for the current calendar year relative to net premiums earned. Loss and loss adjustment expenses represent the largest expense item for most non-life (re)insurers.

Variances among insurers can be due to differences in the lines of business written, the level of rate adequacy, the tail of the book, pricing strategy with respect to expense/loss ratio mix, adverse loss items (i.e. catastrophes), and development of prior years business, and changes in relative loss reserve strength.

Expense Ratio measures the level of underwriting and acquisition expenses, such as commissions, salaries, and overhead, relative to net premiums. The denominator will use earned or written premiums depending on the local accounting convention, and the nature as to how expenses are incurred to better match costs to volume. In certain accounting regimes expenses are incurred as paid, and in others they are incurred as premiums are earned.

Variances in expense ratio among insurers can be due to differences in distribution system costs (agency, direct, underwriting manager), the nature of the book and varying needs to underwrite each risk, pricing strategy with respect to expense/loss ratio mix, level of fixed versus variable costs, cost efficiencies and productivity, profit sharing and contingent commission arrangements, and ceding commission levels.

Combined Ratio measures overall underwriting profitability and is the sum of the loss ratio and expense ratio (including any policyholder dividends). A combined ratio less than 100% indicates an underwriting profit. Typically, lower combined ratios are required for companies writing short-tail lines generating modest investment income levels, or in which the book is exposed to periodic catastrophic or other large losses that need to be priced into income over longer periods of time.

Operating Ratio measures operating profitability, which is the sum of underwriting and pretax investment income, excluding realized and unrealized capital gains or losses. The ratio is the combined ratio less the ratio of investment income to net earned premiums. Due to the combining of underwriting and investment earnings, the ratio is fairly comparable across both long- and short-tail lines of business. Several factors can make comparisons among companies difficult, including:

-

Insurance

12 Non-Life Insurance Rating Methodology March 31, 2011

Differences in operating leverage and the amount of investment earnings derived from invested assets supporting policyholders surplus.

Differences in investment strategies, particularly with respect to the taxable/tax-exempt mix and allocations to lower income/higher capital gain producing investments such as common stocks.

Strong growth in long-tail lines for which reserves and invested asset balances have not yet accumulated to levels reflective of a mature book.

Return on Surplus/Equity measures a companys after-tax net income relative to mean surplus or equity levels, and indicates both overall profitability and the ability of a companys operations to grow surplus organically. Variances among companies are explained by both differences in operating profitability and differences in net operating and/or financial leverage. For a profitable company, a less favorable (i.e. higher) leverage position will result in a more favorable result on this test.

Premium Growth Rate is a useful measure when compared with peer companies and judged relative to cyclical industry trends. Companies exhibiting above-average growth rates may be the result of underpricing their products. Premium growth is also a useful measure of franchise value, as negative growth can be a sign of an eroding franchise. The ratio is influenced by both changes in rate adequacy and changes in volume, so care is taken in interpreting this ratio.

Cash Flow Ratio measures the level of operating cash inflows relative to operating cash outflows in a given period. A ratio more than 100% indicates positive operating cash flow and a ratio less than 100% indicates operating cash flow is negative. The ratio will frequently be evaluated both in absolute terms and from the perspective of a trend. Values greater than 100% are viewed positively. Companies with positive cash flow are less likely to need to liquidate assets to pay claims. The cash flow ratio is also analyzed relative to premium growth, as a fast-growing company or one that practices cash flow underwriting will have strong cash flow, but it is unlikely to be sustainable over time.

Investment and Liquidity Non-Investment-Grade Bonds as a percentage of surplus/equity measures the surplus/equity exposure to bonds below investment-grade (rated lower than BBB), which carry above-average credit risks. In some jurisdictions, where the country ceiling is below the investment-grade level, Fitch measures the actual exposure to stressed investments as a substitute measure.

Unaffiliated Common Stocks as a percentage of surplus/equity measures the surplus/equity exposure to common stock investments. Since common stocks are both subject to price volatility and are carried at market values, a high level of common stocks potentially adds an element of volatility to reported surplus/equity levels.

Investments in Affiliates as a percentage of surplus/equity measures the surplus/equity exposure to affiliated investments. High levels of affiliated investments can reduce liquidity, expose surplus to fluctuations (if common stock), and potentially signal a stacking of capital within the organization.

Liquid Assets to Technical Reserves measures the portion of a companys net policyholder reserves covered by cash and unaffiliated investment-grade bonds, stocks, and short-term invested asset balances. Higher values indicate better levels of liquidity.

Investment Yield is calculated as a percentage of mean beginning and ending cash and investments and accrued investment income. It is a measurement of investment performance. Acceptable values vary over time depending on market conditions.

-

Insurance

Non-Life Insurance Rating Methodology March 31, 2011 13

Deviations among companies can be explained by differences in the taxable/tax-exempt mix, the credit quality and resultant yield characteristics of the bond portfolio, concentrations in higher return/lower yielding common stocks, the level of investment expenses, and the quality of portfolio management.

Loss Reserve Adequacy Reserve Development to Prior-Year Loss Reserves measures a companys one-year loss reserve development as a percentage of prior years loss reserves, and indicates the historical accuracy with which loss reserve levels were set. Negative numbers indicate redundancies and a more conservative reserving profile, while positive numbers indicate deficiencies and a less conservative reserving profile.

Reserve Development to Surplus/Equity measures a companys one-year loss reserve development as a percentage of prior years surplus/equity, and indicates the extent surplus/equity was either under or overstated due to reserving errors.

Reserve Development to Earned Premium measures a companys one-year loss reserve development as a percentage of net premiums, and indicates the extent the current calendar year loss ratio was influenced by development on prior years business.

Ceded Reinsurance Exposures Retention Ratio measures the percentage of gross premiums written retained after premiums are ceded to purchase reinsurance protections. The amount of reinsurance necessary to protect surplus from large losses varies significantly by line of business and the nature of loss exposures, as well as the absolute size of an insurers capital base relative to its single risk and aggregate policy limits. Unusually high or low retention levels could signal that inadequate reinsurance protections are in place, or that reinsurance is used for financial or other reasons beside risk spreading.

Reinsurance Recoverables to Surplus/Equity measures a companys exposure to credit losses on ceded reinsurance recoverables. The ratio includes recoverables from all reinsurers. Generally, recoverables from affiliates, pools, and associations are considered to carry lower levels of risk. The ratio should also be interpreted in light of the credit quality of reinsurers, the stability of the relationship between insurer and reinsurer, historical collection patterns, and any security held in the form of letters of credit, trust accounts or funds withheld. Acceptable levels for this ratio will generally be higher for long-tail writers and lower for short-tail writers, reflecting natural differences in the build up of ceded loss reserves.

Capital Adequacy Net Premiums Written to Surplus/Equity indicates a companys net operating leverage on current business written, and measures the exposure of surplus/equity to pricing errors. Acceptable levels of net operating leverage vary by line of business, with longer-tail lines and catastrophe-prone lines often requiring lower levels of net underwriting leverage due to their greater exposure to pricing errors. Since net premiums written are influenced by both volume and rate adequacy, interpretations must be made carefully since an adverse decline in rate adequacy could lead to apparent improvements in this ratio.

Net Leverage indicates a companys net operating leverage on current business written, as well as liabilities from business written in current and previous years that have not yet run off. The ratio is calculated by dividing the sum of net premiums written and total liabilities, less any ceded reserves, by surplus/equity, and it measures the exposure of surplus/equity to both pricing and reserving errors. Acceptable levels for this ratio will generally be higher for long-tail writers and

-

Insurance

14 Non-Life Insurance Rating Methodology March 31, 2011

lower for short-tail writers, reflecting natural differences in the build up of loss reserves.

Gross Leverage indicates a companys overall gross operating leverage, combining both net and unaffiliated ceded premium and liability exposures. The ratio is calculated by dividing the sum of gross premiums written (direct plus assumed) and gross liabilities (total liabilities including ceded loss and unearned premium reserves) by surplus/equity. The ratio measures the exposure of surplus to pricing errors, reserving errors, and credit losses on uncollectible reinsurance recoverables. Acceptable levels for this ratio will generally be higher for long-tail writers and lower for short-tail writers, reflecting natural differences in the build up of loss reserves.

Regulatory Capital Ratios are also reviewed in regions where they are available. These include the NAICs risk-based capital ratio in the U.S., the minimum continuing capital and surplus requirements (MCCSR) in Canada, the Solvency I ratio in Europe, and various solvency margins in other regions. Although, in some regions, local regulatory capital rules can be limited in scope and result in greater emphasis on simple leverage measures discussed above.

Financial Leverage and Coverage Total Financing and Commitment (TFC) Ratio is a comprehensive measure of debt-related leverage, making use of a broad definition of debt to include essentially all financing activities, including traditional financial debt as well as both recourse and nonrecourse securitizations, letters of credit facilities with banks provided to third-party beneficiaries (largely used by alien or offshore reinsurers and so-called match-funded debt), and debt guarantees and other financing-related commitments. The ratio is designed to measure the debt, financing, and capital markets footprint of an organization, and its overall reliance on ongoing access to funding sources. The measure is intended to flag those companies that have an above average reliance on the capital markets for funding, which would trigger further analysis by Fitch to understand the relative risk of the companys various funding activities. Perceived high levels of risk would have a negative impact on ratings.

Adjusted Debt to Total Capital measures the use of financial leverage within the total capital structure. Financial debt excludes operational debt, such as obligations issued by non-insurance finance subsidiaries and it includes solely insurance-related financial debt provisions. Special care is taken in assessing the quality of reported equity, taking into consideration the portion supported by intangible assets such as goodwill. This ratio is adjusted to account for equity credit for any hybrid securities, which possess both debt and equity characteristics, and liquid assets maintained at the holding company.

Fixed-Charge Coverage Ratios are calculated on both an operating earnings and cash flow basis to judge economic resources available to pay interest expense, including the interest portion of rent expense, and preferred dividends. Where applicable, coverage ratios are also calculated to reflect dividend restrictions from regulated entities.

Interest Coverage Ratios are calculated on both an earnings and cash flow basis to judge economic resources available to pay interest expense associated with outstanding debt. Where applicable, coverage ratios are also calculated to reflect dividend restrictions from regulated entities.

-

Insurance

Non-Life Insurance Rating Methodology March 31, 2011 15

Appendix C

Relating Key Credit Factors to Rating Levels This section includes a description of how the various key credit factors discussed earlier in this report, as well as key ratios discussed in Appendix B, can relate to rating levels. The goal is to give readers a clearer understanding of how differences in performance under the various aspects of Fitchs analysis translate into ratings. For sake of simplicity, the focus of this discussion is on International-scale ratings in markets that are not constrained by country ceilings.

It should be noted that the discussion in this Appendix is illustrative only, and is highly simplified. The setting of ratings is ultimately highly judgmental and dynamic, as is not based on a formulaic approach.

Industry Profile and Operating Environment The rating of any entity is influenced, and potentially constrained by, the risk profile of its industry and operating environment. As discussed on pages 23 of this report, pricing cyclicality, intense competition, actuarial pricing and reserving challenges, catastrophe losses, and regulatory issues are the key credit factors that affect the core industry risk profile of all non-life (re)insurers.

Despite these industry risks, a majority of non-life (re)insurers in Fitchs rated universe (which is weighted more to larger and midsize companies) have IFS ratings in the AA and A categories, and holding company IDR and senior debt ratings in the A and BBB categories. Additionally, a very select number of non-life (re)insurers are rated as high as AAA for IFS (AA for debt), and some are rated in the BBB and lower categories for IFS (non-investment grade for debt). Fitch observes that most insurance companies in the broader non-life (re)insurance sector manage their risk profiles with a goal of achieving higher ratings because it is generally difficult for companies to compete at lower ratings levels. Key risk mitigants are prudent capital and liquidity management, as well as conservatism in overall risk management strategies.

Accordingly, there are no constraints on ratings levels that are achievable in the non-life (re)Insurance sector based on industry profile and operating environment alone. This, as well as an expected concentration of ratings levels in the AA and A categories, is highlighted in Table 1 below. It should be noted Table 1 applies to both primary and reinsurance companies, and to all lines of business.

Interpreting the Rating Range Tables

In the Rating Range tables, the wide band indicates a probable ratings range within which a majority of companies would be expected to reside. The narrow band extending out to the arrows reflects the full range of ratings that could theoretically be achieved. Accordingly, a smaller number of companies with more unique circumstances would fall in the ratings range represented by the area between the arrows and wide band.

When a soft cap exists based on the credit factor being considered, this is noted in the commentary preceding the table.

Each column header includes both the IFS rating and the senior debt rating. The debt ratings are shown one category lower than the IFS rating, which is the norm when senior debt is issued by a holding company. See the notching criteria referenced on page 1 of this report for additional details on the relationship between IFS and debt ratings.

Table 1: Ratings Range Based on Industry Profile/Operating Environment

Debt:

IFS: AAA AA A BBB

-

Insurance

16 Non-Life Insurance Rating Methodology March 31, 2011

Company-Specific Traits The following is a discussion of how the company-specific aspects of an insurers credit profile are related to ratings levels.

Ownership Implications of ownership are discussed more broadly in Fitchs global master criteria for insurance companies, referenced on the first page of this report. For purposes of this summary, one critical aspect of ownership that can affect the achievable rating level is mutual versus stock ownership.

Fitch currently does not, nor does it anticipate, assigning AAA IFS ratings to insurance companies other than those owned under the mutual form of ownership (and even then, only in rare cases). Fitch believes that the need to meet shareholder return hurdles, together with the marginal (if any) competitive advantages of being rated in the AAA versus AA category for IFS, imply that AAA rating levels generally do not make economic sense for stock companies in the non-life sector. Mutual insurers, on the other hand, have greater incentives to hold excess capital and liquidity positions, or employ other conservative risk management measures, since returns on capital are a lower priority.

This difference is illustrated in Table 2 below, which is intended to simply demonstrate that stock ownership provides for an effective soft cap on IFS ratings at AA+.

Company Profile and Risk Management As noted on pages 3 of this report, company profile and risk management are important factors in considering a non-life insurers risk profile. In fact, both can play a dominant role in establishing rating levels.

In the context of this discussion, company profile is primarily defined by the composition of the insured portfolio, focusing mainly on business mix, with an emphasis on scale/size and market positioning. Typically, only larger companies with both significant scale and major market positioning, can achieve ratings in the AA and AAA categories for IFS. Midsize companies, or more modestly positioned or specialized companies, can typically achieve ratings in the A category. Very small, and/or narrowly focused companies often achieve ratings no higher than the BBB category. The relationship between market positioning and scale/size, and ratings levels, is illustrated in Table 3 below.

Three other credit factors comprising a companys qualitative risk profile that can materially affect ratings include: risk management, corporate governance, and financial flexibility. While the three are clearly distinct ratings considerations, in relating each to

Table 2: Ratings Range Based on Ownership Form

Debt:

IFS: AAA AA A BBB

-

Insurance

Non-Life Insurance Rating Methodology March 31, 2011 17

ratings levels they share a common characteristic: each is generally considered neutral to a rating when considered effective/adequate. When this is the case, it will be the other aspects of the companys credit profile that drive its rating level.

When these credit factors are considered generally effective and adequate but with a modest weakness, then the rating achievable may be somewhat constrained. Subsequent improvement in these characteristics may remove prior constraints on ratings.

However, if any of these characteristics are deemed to be weak, ineffective or inadequate, this could have a material negative impact on a rating. The impact is illustrated in Table 4 below, which indicates a soft cap of BB+ for IFS when there is material concerns.

A final key aspect of a companys profile that can materially affect the achievable rating is years of operations. Other than on an exceptional basis, typically, newly formed companies with limited operating histories will not be able to achieve higher than the BBB category for IFS ratings and non-investment grade for debt during their initial years of operation absent formal support. This is demonstrated in Table 5 on the next page.

Table 3: Ratings Range Based on Market Position and Size/Scale

Debt:

IFS: AAA AA A BBB

-

Insurance

18 Non-Life Insurance Rating Methodology March 31, 2011

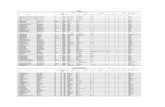

Financial Profile Median Ratios As noted on page 4 of this report, capitalization, reserve adequacy, investments, and financial performance play key roles in Fitchs assessment of a non-life insurers financial profile, as do catastrophe management and reinsurance. While employing qualitative elements, these analyses also rely heavily on ratio analysis.

To help make the relationship between ratio performance and ratings levels more transparent, included below in Table 6 are median guideline ratios by rating category for a number of the ratios discussed in Appendix B. These median guidelines represent targets that Fitch would typically look for as a standard of performance to meet a rating bogey. For example, for an IFS rating, Fitchs median guideline for an AA quality combined ratio is 95%, and for a BBB rating, Fitchs standard is 110%. Thus, if a non-life insurer achieved a combined ratio of 97%, the agency would say that the companys underwriting performance, as measured by the combined ratio, achieved Fitchs AA standard. If the combined ratio was 108%, the agency would say it met Fitchs BBB standard.

These ratio guidelines were developed based on Fitch judgment, and are intended to apply globally on the international rating scale. It should be noted that these are general in nature, are through the cycle medians, and reflect average results across all business lines. Ultimately, interpretation of a companys actual performance relative to these bogeys can be quite challenging, since it will be influenced by a mix of business and other issues, such as trend and year-to-year variability of performance; impact of pricing cycles; and position in cycle at any given measurement point, stock versus mutual ownership form, long tail versus short tail focus, country/region, and accounting treatment, including uses (or not) of reserve discounting. See page 21 for further discussion of limitations.

Table 5: Ratings Range Based on Years of Operations

Debt:

IFS: AAA AA A BBB

-

Insurance

Non-Life Insurance Rating Methodology March 31, 2011 19

Weighting of Credit Factors in Final Rating In any discussion of how various credit factors affect ratings, one logical question would be to ask how the various areas of analysis are ultimately weighed in arriving at a final rating. In practice, ratings are derived by Fitch rating committees via judgment based on a review of all relevant credit factors highlighted in all applicable criteria reports. Neither Fitch analysts nor rating committees employ any formal, quantitative weighting mechanism, nor is the final weighting of the various elements explicitly documented in committee materials.

Rather, the rating is determined after the committee considers all of the risk elements deemed material to the rating analysis. The rational in setting the rating, including identification of key strengths and weaknesses, expectations, as well as sensitivities of the rating, are documented in a manner consistent with the rationale described in published research reports.

With that caveat, Fitch recognizes that readers are nonetheless interested in better understanding the thought process that may be employed by a rating committee. Recognizing that interest, below is a discussion of how a committee may assimilate the various credit factors in establishing a rating. It must be emphasized that the discussion below is illustrative only.

Weighing of Qualitative Elements As noted, the following qualitative credit factors linked to a (re)insurers qualitative company-specific profile can have a material impact on achievable ratings levels: ownership (stock versus mutual), market positioning and scale/size, risk management/governance/financial flexibility, and years of operations. These qualitative factors, which are highlighted in Tables 25, have the effect of establishing an implied rating category. As discussed in the next section of this Appendix, this is combined with analysis of the financial profile (and any other relevant information) to arrive at a final rating.

Table 6: Select Long-Term Median Ratio Guidelines

Insurer Financial Strength

AAA AA A BBB

Underwriting Quality and Profitability (%)

Combined Ratio 80 95 103 110 Operating Ratio 67 82 90 97

Investment and Liquidity (%)

Risky Assetsa to Surplus/Equity 25 50 75 100 Liquid Assets to Technical Reserves 200 150 125 100

Loss Reserve Adequacy (%)

Long-Term Average Reserve Development to Surplus/Equity (5) (2) 0 5

Ceded Reinsurance Exposure (%)

Reinsurance Recoverables to Surplus/Equity 25 45 65 100

Capital Adequacy (x)

Net Premiums Written to Equity 0.5 1.1 1.8 2.5 Net Leverage 2.0 3.5 5.0 7.0

Financial Leverage and Coverage

Interest Coverage Ratio (x) 18 12 7 3 Adjusted Debt to Total Capital (%) 5 15% 23 30

aThis ratio is a combination of the non-investment-grade bond, unaffiliated common stock, and investment in affiliates to surplus/equity ratios discussed in Appendix B.

Financial Leverage, Coverage, and Notching

While the median financial leverage and interest coverage ratios in Table 6 give a general indication of reasonable levels for these ratios by rating category, in practice, leverage and coverage ratios are often more heavily weighed into Fitchs ratings via ratio guidelines related to notching between IFS and debt ratings of operating and holding companies. These are described in detail in the criteria report, Insurance Industry: Global Notching and Recovery Analysis, that is referenced on page 1 of this report.

In the noted report, Fitch discussed how financial leverage and coverage influence the degree of notching between the IDRs of an operating subsidiary and holding company, as well as their IFS and debt ratings. For example, Fitch states that it typically views financial leverage of 16%30% as customary for larger, debt issuers in the insurance industry, and that typically if financial leverage were to exceed 30%, the agency would likely expand notching. For example, typical IDR notching of 1 may be expanded to 2, and typical IFS to holding company senior debt rating notching of 3 may be expanded to 4. This tolerance varies by rating category, with additional details found in the noted report.

-

Insurance

20 Non-Life Insurance Rating Methodology March 31, 2011

The weighting of the various qualitative credit factors is ultimately based on judgment. While to some degree the weakest factor may receive the highest weighting, no strict weakest link theory is employed. It should be noted that the credit factors in Table 4 can have the affect of hurting, but not helping ratings, as previously discussed.

To illustrate, assume a non-life (re)insurer with the following characteristics per Tables 25:

Table 2: Stock company.

Table 3: Moderate market positions, and modest scale/size.

Table 4: Risk management, governance, and financial flexibility deemed effective.

Table 5: Years of operation of 15.

In this case, the initial implied category for the IFS rating would be A, with the constraint being driven mainly by the insurers moderate market positioning and modest scale and size.

Assume also a second non-life insurer below:

Table 2: Stock company.

Table 3: Very small company, book of business limited to property reinsurance provided in limited number of regions to limited number of ceding companies.

Table 4: Risk management, governance, and financial flexibility deemed effective.

Table 5: Years of operation of two.

In this case, the initial implied IFS rating category would be BBB, driven by both the limited years of operation, as well as the companys very narrow business focus.

Finally, assume a third company:

Table 2: Mutual company.

Table 3: Large and highly diverse, with several major positions in several major markets.

Table 4: Risk management, governance, and financial flexibility deemed effective.

Table 5: Years of operation of 50.

In this case, the highest achievable category implied for the IFS rating would be AAA, though as previously noted, the typical range would be AA to A.

Weighing of Quantitative Elements/Financial Ratios Next, Fitch will illustrate how the qualitative elements can be combined with the financial analysis to arrive at a final rating. While for purposes of this illustration the agency shows the order of the analysis as the qualitative assessment coming first and the financial analysis coming second, the ordering is not important and will vary in practice.

Assume a case in which the rating category implied by the qualitative assessment is A.

Generally, the final notch-specific rating will be established at the + (plus) end of the category, or even within the next highest category, if performance on the various financial ratios exceeds that for the initial implied rating category. Accordingly, in this

-

Insurance

Non-Life Insurance Rating Methodology March 31, 2011 21

case if a majority of the financial ratios demonstrate A or higher performance, it is likely the final rating will be established at A+. If performance was especially strong, the final rating could potentially be AA or higher.

On the other hand, if ratio performance is below parameters for the initial implied rating category, the notch-specific rating will likely be established at the (minus) level in that category, or at a lower rating category. For example, if the implied rating category based on the qualitative assessment is A and most ratios were at A to BBB performance, the notch-specific rating would likely be A to BBB+. If the ratio performance was typically much worse than A, at BB, or B, the final notch-specific rating would likely fall to the BB or B categories.

Extraordinary Weighing of a Credit Factor There may be cases as well when the committee may give extraordinary weighting to any one credit factor. For example, assume the implied rating based on Table 25 attributes is A, and performance on most financial ratios also falls in the A category. Typically, one would expect a final rating of A. However, assume in Fitchs analysis of reserve adequacy, the committee was concerned that reserves may be materially deficient, and that on a pro forma basis, adjusted for estimated reserve deficiencies, capital would be negative (implying technical insolvency). In such a case, Fitch would likely rate the non-life (re)insurer non-investment grade, giving heavy weighting to that one risk element given its critical implications.

Any such cases in which one or more credit factors receive extraordinary weighting in the final rating, it would be highlighted in Fitchs published rating rationale.

Peer Analysis Another important exercise in establishing ratings is relative peer analysis. Peer analysis is especially useful after Fitch has established a fairly large portfolio of ratings across numerous ratings grades in a given sector, and when ratings levels are generally stable. In fact, in many cases, relative peer analysis is a noteworthy aspect of the analysis used by analysts and rating committees to form conclusions with respect financial ratio analysis, or review of certain non-financial attributes, such as market positioning. In such cases, an explicit comparative analysis of a given non-life (re)insurers ratios to Table 6 medians may not be performed, since the Table 6 medians would already be implied in the peer company ratios.

A summary of Fitchs peer analysis is typically included in long-form company-specific research reports.

Additional Limitations The general limitations of this rating criteria, as well as non-life (re)insurance ratings generally, are discussed on page 2 of this report. The following are additional limitations that apply to this Appendix C:

The impact on ratings of credit factors such as group support and country ceilings, as well as topics such as notching between IFS ratings and debt/holding company ratings, and national ratings, can be found in separate criteria reports referenced on page 1 of this report, and are not discussed in this Appendix. The Appendix focuses primarily on investment-grade ratings in developed markets, and accordingly does not provide significant information on standards for non-investment-grade ratings or ratings in developing markets. These exclusions represent limitations of this Appendix.

The Appendix outlines indicative factors observed or extrapolated for rated insurers. Though used for development of global guidelines in developed countries, the

-

Insurance

22 Non-Life Insurance Rating Methodology March 31, 2011

underlying data reviewed was heavily skewed to U.S. companies. Ratio levels refer to the midpoint of a through-the-cycle range, and actual observations in any given period are likely to vary from these, at times significantly. Ratio levels reflect a compilation of observations across non-life (re)insurers with materially different books of business. Material differences can exist, at times, in median ratios for cohorts of insurers with different books of business. Since these differences are not reflected, that can limit the interpretative value of the median ratios.

The weighing of credit factors will vary substantially over time, both for a given insurer and among insurers, based on the relative current significance agreed upon by the rating committee. This Appendix gives a high level overview, and is neither exhaustive in scope nor uniformly applicable. Additional factors not discussed in this Appendix will influence ratings, at times materially.

ALL FITCH CREDIT RATINGS ARE SUBJECT TO CERTAIN LIMITATIONS AND DISCLAIMERS. PLEASE READ THESE LIMITATIONS AND DISCLAIMERS BY FOLLOWING THIS LINK: HTTP://FITCHRATINGS.COM/UNDERSTANDINGCREDITRATINGS. IN ADDITION, RATING DEFINITIONS AND THE TERMS OF USE OF SUCH RATINGS ARE AVAILABLE ON THE AGENCY'S PUBLIC WEB SITE AT WWW.FITCHRATINGS.COM. PUBLISHED RATINGS, CRITERIA, AND METHODOLOGIES ARE AVAILABLE FROM THIS SITE AT ALL TIMES. FITCH'S CODE OF CONDUCT, CONFIDENTIALITY, CONFLICTS OF INTEREST, AFFILIATE FIREWALL, COMPLIANCE, AND OTHER RELEVANT POLICIES AND PROCEDURES ARE ALSO AVAILABLE FROM THE CODE OF CONDUCT SECTION OF THIS SITE.

Copyright 2011 by Fitch, Inc., Fitch Ratings Ltd. and its subsidiaries. One State Street Plaza, NY, NY 10004.Telephone: 1-800-753-4824, (212) 908-0500. Fax: (212) 480-4435. Reproduction or retransmission in whole or in part is prohibited except by permission. All rights reserved. In issuing and maintaining its ratings, Fitch relies on factual information it receives from issuers and underwriters and from other sources Fitch believes to be credible. Fitch conducts a reasonable investigation of the factual information relied upon by it in accordance with its ratings methodology, and obtains reasonable verification of that information from independent sources, to the extent such sources are available for a given security or in a given jurisdiction. The manner of Fitchs factual investigation and the scope of the third-party verification it obtains will vary depending on the nature of the rated security and its issuer, the requirements and practices in the jurisdiction in which the rated security is offered and sold and/or the issuer is located, the availability and nature of relevant public information, access to the management of the issuer and its advisers, the availability of pre-existing third-party verifications such as audit reports, agreed-upon procedures letters, appraisals, actuarial reports, engineering reports, legal opinions and other reports provided by third parties, the availability of independent and competent third-party verification sources with respect to the particular security or in the particular jurisdiction of the issuer, and a variety of other factors. Users of Fitchs ratings should understand that neither an enhanced factual investigation nor any third-party verification can ensure that all of the information Fitch relies on in connection with a rating will be accurate and complete. Ultimately, the issuer and its advisers are responsible for the accuracy of the information they provide to Fitch and to the market in offering documents and other reports. In issuing its ratings Fitch must rely on the work of experts, including independent auditors with respect to financial statements and attorneys with respect to legal and tax matters. Further, ratings are inherently forward-looking and embody assumptions and predictions about future events that by their nature cannot be verified as facts. As a result, despite any verification of current facts, ratings can be affected by future events or conditions that were not anticipated at the time a rating was issued or affirmed.

The information in this report is provided as is without any representation or warranty of any kind. A Fitch rating is an opinion as to the creditworthiness of a security. This opinion is based on established criteria and methodologies that Fitch is continuously evaluating and updating. Therefore, ratings are the collective work product of Fitch and no individual, or group of individuals, is solely responsible for a rating. The rating does not address the risk of loss due to risks other than credit risk, unless such risk is specifically mentioned. Fitch is not engaged in the offer or sale of any security. All Fitch reports have shared authorship. Individuals identified in a Fitch report were involved in, but are not solely responsible for, the opinions stated therein. The individuals are named for contact purposes only. A report providing a Fitch rating is neither a prospectus nor a substitute for the information assembled, verified and presented to investors by the issuer and its agents in connection with the sale of the securities. Ratings may be changed or withdrawn at anytime for any reason in the sole discretion of Fitch. Fitch does not provide investment advice of any sort. Ratings are not a recommendation to buy, sell, or hold any security. Ratings do not comment on the adequacy of market price, the suitability of any security for a particular investor, or the tax-exempt nature or taxability of payments made in respect to any security. Fitch receives fees from issuers, insurers, guarantors, other obligors, and underwriters for rating securities. Such fees generally vary from US$1,000 to US$750,000 (or the applicable currency equivalent) per issue. In certain cases, Fitch will rate all or a number of issues issued by a particular issuer, or insured or guaranteed by a particular insurer or guarantor, for a single annual fee. Such fees are expected to vary from US$10,000 to US$1,500,000 (or the applicable currency equivalent). The assignment, publication, or dissemination of a rating by Fitch shall not constitute a consent by Fitch to use its name as an expert in connection with any registration statement filed under the United States securities laws, the Financial Services and Markets Act of 2000 of Great Britain, or the securities laws of any particular jurisdiction. Due to the relative efficiency of electronic publishing and distribution, Fitch research may be available to electronic subscribers up to three days earlier than to print subscribers.