Quiz New

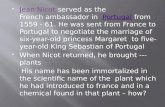

description

Transcript of Quiz New