PwC's 2013 Health and Well-being Touchstone Survey results

description

Transcript of PwC's 2013 Health and Well-being Touchstone Survey results

www.pwc.com/us/hrs

Health and Well-being Touchstone Survey resultsJune 2013

Launch

Overview Section 1: Key trends 3

Section 2: Summary of findings 5

Detailed findings Section 3: Medical plan costs 13

Section 4: Medical plan design highlights 17

Section 5: Wellness and Disease Management 37

Section 6: Welfare benefits 44

Section 7: Retiree medical 48

Section 8: Retirement plans 53

Section 9: Health reform—Affordable Care Act (ACA) 59

Section 10: Future solutions 63

Appendix Section 11: Summary of survey participants 65

Contact PwC contacts 68

Table of contents

Overview

S1: Key trends

S2: Summary of findings

Detailed findings

Appendix

Contact

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 3

Click to return to the table of contents

Overview—Section 1: Key trends

Overview

S1: Key trends

S2: Summary of findings

Detailed findings

Appendix

Contact

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 4

2013 Health and Well-being Touchstone Survey highlights

Section 1: Key trendsClick to return to the table of contents

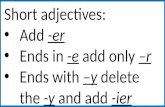

7.5%

5.3%

7.8%

5.4%

The average reported trend in healthcare costs before plan changes in 2012 was 7.5% and is projected to increase to 7.8% in 2013. These have been managed down through plan design changes to 5.3% and 5.4%, respectively.

These increases are being shared with employees through increases in contributions and cost sharing through plan designs (higher deductibles and out-of-pocket maximums)

Preferred provider organization (PPO) plans are still the most prevalent plan designs for 54% of employers (down 3 percentage points from 2012 while High deductible plans are now the most prevalent plan designs for 21% of employers (up 4 percentage points from 2012). Exclusive provider organization (EPO) plans are growing slightly from 2012, while Health maintenance organization (HMO) plans are declining, and Point of service (POS) plans are remaining constant.

Overall, employers are offering fewer medical plan options– 2.6 plans offered on average in 2013 versus 3.0 plans in 2012.

31% employers with <500 employees self-insured

55% employers with 500–1,000 employees self-insured

Employers are self-insuring medical benefits more now than before. While prevalent in employers with 1,000+ employees, 31% of employers with <500 employees are now self-insured (up from 22% in 2012) as are 55% of employers with 500–1,000 employees (up from 49% in 2012). This could be a reaction to the Affordable Care Act (ACA).

The prevalence of Wellness programs has decreased for mid-size employers (1,000-5,000 employees). The prevalence of Disease Management programs has decreased for both mid-size and large employers (5,000+ employees).

The immediate future looks to be a continuation of current strategies:

• Cost sharing through plan design and contributions will continue to increase

• Full replacement High deductible plans are being considered by 44% of employers, while 17% have already implemented them

• 53% of employers are considering implementing/improving wellness in the US and 16% are considering implementing/improving wellness outside of the US

• 33% of employers are considering performance-based networks and 43% are considering value-based plan designs

• Only 19% are considering direct contracting with providers

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 5

Click to return to the table of contents

Overview—Section 2: Summary of findings

Overview

S1: Key trends

S2: Summary of findings

Detailed findings

Appendix

Contact

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 6

Click to return to the table of contents 2013 Health and Well-being Touchstone Survey summary

Section 2: Summary of findings

Overview

S1: Key trends

S2: Summary of findings

Detailed findings

Appendix

Contact

Background

• The survey was completed in the first quarter of 2013

• The survey data contains detailed benefits information provided by approximately 1,100 participating employers in 35 different industries across the nation

• There was a larger percentage of smaller and mid-size employer participating in 2013 as compared to 2012

• The 2013 survey provides summary data on medical and prescription drug plan design, costs, COBRA rates, Wellness and Disease Management programs, work-life programs, fringe benefits, future healthcare strategies, retirement benefits, and health reform

• Customized reports are available upon request based on industry, size, and/or geographic location

Medical costs continue to increase faster than inflation

• The average reported increase in medical plan costs before plan changes was 7.5% for 2012 over 2011

– The average reported annual increase after plan changes was 5.3% for 2012 and 5.4% expected for 2013

• The average employee-only monthly COBRA rate increased by 5.6% from $498 in 2012 to $526 in 2013

– A smaller percentage of employers are utilizing 4-tier and 5-tier rate structures (63% in 2012 decreased to 55% in 2013)

Employee-only coverage contribution

<1,000 employees

(Smaller employers)

1,000–5,000 employees (Mid-size

employers)

5,000+ employees

(Large employers)

<10% 22% 11% 8%

10%–14% 15% 12% 12%

15%–19% 12% 16% 17%

20%–24% 18% 30% 30%

25%–29% 12% 14% 16%

30%–39% 12% 13% 11%

40%+ 9% 4% 6%

Average 21% 22% 23%

Employee contributions as a percent of premium increased in 2013

19%of employees contribute 30% or more for employee-only coverage(up from 12% in 2009)

34%of employees contribute 30% or more for family coverage(up from 25% in 2009)

while

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 7

Click to return to the table of contents 2013 Health and Well-being Touchstone Survey summary

Medical plan features

Section 2: Summary of findings

Overview

S1: Key trends

S2: Summary of findings

Detailed findings

Appendix

Contact

74%of employers offer

two or more medical plans

54%of employers have the

largest enrollment in PPO plans

74% of employers offer two or more medical plan options

PPO plans capture the largest enrollment for 54% of responding employers, with an average enrollment of 76%

In-network features Out-of-network features

32%have a deductible of $1,000 or more (up from 11% in 2009)The Services and Financial Services industries had the highest deductible

Coinsurancehas increased since 2009, but has leveled out during the past 3 years

44%have a copay between $20–$29

for primary care office visits and 20% use coinsurance instead

49%have out-of-pocket maximums greater than $3,000 (up from 33% in 2009) and 13% have unlimited out-of-pocket maximums

46%use coinsurance

instead of copays for hospital admissions

75%use copays for the emergency room, down from 83% in 2009

47%have a copay over $30 for specialist office visits and 23% use coinsurance instead

54%have coinsurance of 20% or more for most services Coinsurance tends to be higher for the Retail & Consumer and Services Industries

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 8

Click to return to the table of contents 2013 Health and Well-being Touchstone Survey summary

Medical plan features

Section 2: Summary of findings

Overview

S1: Key trends

S2: Summary of findings

Detailed findings

Appendix

Contact

74%of employers offer

two or more medical plans

54%of employers have the

largest enrollment in PPO plans

74% of employers offer two or more medical plan options

PPO plans capture the largest enrollment for 54% of responding employers, with an average enrollment of 76%

In-network features Out-of-network features

55%have a deductible of $1,000 or more (up from 20% in 2009)

53%have out-of-pocket maximums of $5,000 or greater (up from 23% in 2009) and 10% have unlimited out-of-pocket maximums

63%have coinsurance of 30% or more

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 9

Click to return to the table of contents

Overview

S1: Key trends

S2: Summary of findings

Detailed findings

Appendix

Contact

2013 Health and Well-being Touchstone Survey summary

Section 2: Summary of findings

85% use copays / 14% have coinsurance

Retail generics

82% use copays / 16% have coinsurance

72% use copays / 25% have coinsurance

Retail brand formulary

Retail brand non-formulary

(vs. 82% / 16% in 2012)

(vs. 72% / 26% in 2012)

(vs. 68% / 28% in 2012)

74%indicated that a deductible was not applicableThe majority of employers’ plans do not have a separate prescription drug deductible

The most common copays for retail prescription drug benefits are

$10/$30/$5059% have the same copay for specialty drugs as retail brand

Copays remained the most common cost sharing method (fewer use coinsurance)

Prescription drug benefits

% offering HSA HRA

2013 2012 2013 2012

<1,000 employees 35% 28% 18% 12%

1,000–5,000 employees 40% 42% 20% 14%

5,000+ employees 46% 52% 25% 26%

Year total 39% 40% 20% 17%

High Deductible Health Plans (HDHPs)

• 39% offer an HDHP with Health savings account (HSA), 20% offer an HDHP with Health reimbursement account (HRA), and 3% offer HDHP without HSA or HRA

• For those that offer an HDHP with an HSA: – Reported average enrollment increased from

20.5% in 2010 to 34.6% in 2013

– 30% of employers do not fund the HSA while 53% fund up to $1,000 a year; 17% fund over $1,000 a year

• For those that offer an HDHP with an HRA: – Reported average enrollment has steadily

increased from 34.2% in 2010 to 54.2% in 2013

– 2% of employers do not fund the HRA while 62% of employers establish an allowance of up to $1,000 a year and 36% have an allowance over $1,000 a year

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 10

Click to return to the table of contents 2013 Health and Well-being Touchstone Survey summary

Section 2: Summary of findings

Overview

S1: Key trends

S2: Summary of findings

Detailed findings

Appendix

Contact

Wellness and Disease Management

• 68% offer Wellness programs (85% of large employers offer Wellness programs, same as in 2012)

– Most common Wellness program was EAP (86%), followed by health risk questionnaire (80%), tobacco cessation (61%), body mass index (58%), and weight management (52%)

– Health risk questionnaire had the largest participation rate of 52% followed by body mass index with 49%

• 49% offer Disease Management programs (75% of large employers offer Disease Management programs, down from 81% in 2012)

– Most common programs were diabetes (70%), asthma (59%), cardiac (57%), and chronic obstructive pulmonary disease (54%)

– Cancer and diabetes had the largest participation rate of 11%

• 9 out of 10 employers do not have sufficient data to calculate or do not measure a return on investment for either Wellness or Disease Management programs

• Smaller employers overall offer fewer Wellness and Disease Management programs as compared to large employers

68%offer Wellness programs

49%offer Disease Management programs

Self-insurance and stop loss

• Self-insurance is most prevalent for large employers, however, it is becoming more popular with smaller employers

– 55% of employers with 500–1,000 employees are self-insured, up from 49% in 2012

– 31% of employers with <500 employees are self-insured, up from 22% in 2012

• 54% of those self-insured employers do not have aggregate stop loss coverage while only 21% do not have specific stop loss

– The prevalence and level of specific/individual stop loss coverage varies significantly depending on the size of the employer

– Employers with 5,000 or more employees are less likely to have stop loss coverage

Specific/individual coverage

<1,000 employees

1,000–5,000 employees

5,000+ employees

<$50,000 5% 0% 0%

$50,000–$99,999 36% 4% 0%

$100,000–$199,999 38% 30% 6%

$200,000–$299,999 9% 30% 12%

$300,000–$499,999 2% 18% 18%

$500,000–$999,999 1% 7% 13%

$1,000,000+ 3% 2% 6%

N/A 6% 9% 45%

The prevalence of self-insurance is increasing in the under 1,000 employee segment

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 11

Click to return to the table of contents

Overview

S1: Key trends

S2: Summary of findings

Detailed findings

Appendix

Contact

2013 Health and Well-being Touchstone Survey summary

Section 2: Summary of findings

Retiree medical programs

• 36% of employers provide Pre-65 retiree medical programs, while 31% provide Post-65, down from 2012 (48% and 42% respectively)

• Of those who provide retiree medical plans, new hires are often excluded: 40% do not offer Pre-65 coverage and 45% do not offer Post-65 coverage to new hires

• The average Pre-65 subsidy amount is 53% and the Post-65 amount is 55%

• The majority of employers are not considering making any changes to both their Pre-65 and Post-65 retiree medical coverage

401(k) plans are the most prevalent form of retirement program

• 96% of employers offer 401(k) plans – 37% vest employer 401(k)

contributions immediately

– 32% provide a maximum employee contribution match of 6.0%, similar to 2012 results

• 26% of employers offer a defined benefit plan with 48% of those plans closed to new accruals or closed to new employees

Paid Time Off (PTO) Banks are less common than traditional vacation/sick day programs

• 49% of employers offer a PTO combination of vacation, personal, and sick days, which averages to be 16 days annually for new hires and 21 days annually for full-time employees with 5 or more years tenure

• 51% of employers offer sick and vacation days separately

– On average, employees receive 7 sick days a year regardless of tenure

– On average, new hires receive 12 vacation days a year and employees with 5 or more years tenure receive 17 vacation days a year

– 82% offer new hires the same amount of sick days and 21% offer the same amount of vacation days as employees with 5 or more years tenure

• Employees receive an average of 9 holidays a year

49%of employers offer a PTO combination of vacation, personal, and sick days

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 12

Click to return to the table of contents

Overview

S1: Key trends

S2: Summary of findings

Detailed findings

Appendix

Contact

2013 Health and Well-being Touchstone Survey summary

Section 2: Summary of findings

Work-life programs remain common for many employers

Future solutions for mitigating health care cost increases

• 87% of employers have already implemented/are considering increased employee cost sharing

• 89% of employers have already implemented/are considering increasing employee contributions

• 44% of employers are considering offering a High deductible plan as a full replacement to their current plans and 17% have already implemented HDHPs as the only option

43%Telecommuting

36%Flexible schedules

25%Parental leave

23%Reduced hours

19%Community service

Health reform

• Fewer employers than last year indicated that the provisions of health reform will have a significant financial impact

• 39% of employers have already performed a Pay-or-Play analysis and 32% are planning to do so soon

The most common work-life programs included:

(With no major differences between smaller and large employers)

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 13

Click to return to the table of contents

Detailed findings—Section 3: Medical plan costs

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 14

Click to return to the table of contents

Section 3: Medical plan costs

Medical plan cost before/after plan change

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Expected calendar year 2013 over 2012

Calendar year 2012 over 2011

Decrease 3% 6%

Unchanged 8% 10%

1%–4% increase 14% 14%

5%–9% increase 41% 35%

10%–14% increase 21% 22%

15%–19% increase 8% 7%

20% or greater increase 5% 6%

Average 7.8% increase 7.5% increase

Before plan changes

Expected calendar year 2013 over 2012

Calendar year 2012 over 2011

Decrease 8% 11%

Unchanged 9% 10%

1%–4% increase 24% 22%

5%–9% increase 39% 37%

10%–14% increase 15% 13%

15%–19% increase 3% 4%

20% or greater increase 2% 3%

Average 5.4% increase 5.3% increase

After plan changes

Healthcare costs continue to rise at rates in excess of Consumer Price Index (CPI) and employers are expecting them to increase slightly more this year than they did last year

The7.5%increase from 2011 to 2012 was more than expected based on the 7.0% indicated in the 2012 Touchstone Survey

The 5.3%increase from 2011 to 2012 was more than the expected rate of 5.1% from the 2012 Touchstone Survey

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 15

Click to return to the table of contents

Section 3: Medical plan costs

Medical plan 2013 monthly COBRA rates by tier

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

The majority of employers offer 3- or 4-tier rates with the most common coverage tier for any size employer being 4-tier

Monthly dollars by percentile

Tier/plan Distribution % 25th 50th 75th

2-tier rates

Employee18%

450 556 684

Family 1,200 1,496 1,793

3-tier rates

Employee

27%

450 518 588

Employee + 1 921 1,044 1,199

Employee + 2 or more 1,335 1,491 1,759

4-tier rates

Employee

50%

417 491 574

Employee + spouse 899 1,041 1,210

Employee + child(ren) 773 913 1,092

Family 1,263 1,485 1,725

5-tier rates

Employee

5%

402 512 563

Employee + spouse 901 1,030 1,283

Employee + child 656 778 1,029

Employee + children 902 1,002 1,222

Family 1,164 1,462 1,619

Tier <1,000 employees

1,000–5,000 employees

5,000+ employees

2-tier 25% 12% 9%

3-tier 27% 35% 21%

4-tier 45% 48% 62%

5-tier 3% 5% 8%

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 16

Click to return to the table of contents

Section 3: Medical plan costs

Average medical plan monthly COBRA rates—2013 vs. 2012

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Monthly dollars

Tier/plan 2013 20122013

Average 2012

Average% change from

2012 average

2-tier rates

Employee18% 12%

567 515 10.1%

Family 1,497 1,306 14.6%

3-tier rates

Employee

27% 25%

536 518 3.5%

Employee + 1 1,086 1,045 3.9%

Employee + 2 or more 1,551 1,505 3.1%

4-tier rates

Employee

50% 56%

512 485 5.6%

Employee + spouse 1,087 1,023 6.3%

Employee + children 963 909 5.9%

Family 1,532 1,449 5.7%

5-tier rates

Employee

5% 7%

470 499 -5.8%

Employee + spouse 1,020 1,084 -5.9%

Employee + child 808 872 -7.3%

Employee + children 984 1,122 -12.3%

Family 1,344 1,423 -5.6%

Overall employee-only 526 498 5.6%

Overall dependent 1,231 1,163 5.8%

The average employee-only COBRA rate increased by 5.6% from 2012 to 2013

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 17

Click to return to the table of contents

Detailed findings—Section 4: Medical plan design highlights

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 18

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Medical plans with the largest enrollment

Section 4: Medical plan design highlights

2013 2012 2011 2010 2009

PPO plan 54% 57% 57% 63% 61%

High deductible plan 21% 17% 17% 13% 8%

HMO plan 9% 13% 12% 9% 14%

POS plan 8% 8% 7% 10% 9%

EPO 6% 4% 6% 4% 5%

Indemnity 1% 1% 1% 1% 3%

All other plans (mini-med, Open Access, etc.)

1% 0% 0% 0% 0%

<1,000 employees

1,000–5,000 employees

5,000+ employees

PPO plan 51% 59% 57%

High deductible plan 23% 14% 24%

HMO plan 12% 5% 7%

POS plan 8% 13% 5%

EPO 4% 8% 6%

Indemnity 2% 0% 0%

All other plans (mini-med, Open Access, etc.)

0% 1% 1%

PPO plans are still attracting the largest enrollment with employers. Survey participants selected the following plans as those with the largest enrollment:

The average enrollment of the plans that attract the most employees is 76% 60%

of the plans with the largest enrollment are self-insured

In 2013, the percentage of employers who had a High deductible plan with the largest enrollment increased to 21% whereas PPO and HMO plans saw a decrease

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 19

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Medical plan options

Section 4: Medical plan design highlights

• Large employers tend to offer more medical plan options to their employees than smaller employers

• 9% of employers offer 5 or more medical plan options

• The average number of plans offered has decreased from 3.0 plans in 2012 to 2.6 plans in 2013

Number of medical plan options

<1,000 employees

1,000–5,000 employees

5,000+ employees

2013 total

2012 total

0 2% 0% 0% 1% 1%

1 36% 12% 12% 25% 23%

2 35% 34% 26% 33% 27%

3 20% 29% 30% 24% 26%

4 5% 12% 12% 8% 10%

5 1% 4% 7% 3% 5%

6 1% 3% 3% 2% 2%

7 0% 1% 2% 1% 1%

8 0% 2% 2% 1% 1%

9 0% 0% 1% 0% 1%

10 0% 0% 0% 0% 0%

10+ 0% 3% 5% 2% 3%

Average 2.0 plans 3.1 plans 3.6 plans 2.6 plans 3.0 plans

82%of employers offer 1 to 3 medical plan options to their employees

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 20

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Most common medical plan features by plan type

Section 4: Medical plan design highlights

PPO High deductible

HMO POS EPO

% Selected as largest enrolled plan 54% 21% 9% 8% 6%

EE contributions

Employee-only 20%–24% 20%–24% 20%–24% 20%–24% 20%–24%

Family 20%–24% 20%–24% 20%–29% 20%–24% 20%–24%

In-network

Deductible $500–$749 $1,000–$1,999 Not applicable Not applicable Not applicable

Out-of-pocket max $2,000–$2,999 $3,000–$4,999 Unlimited $1,000– $1,999 Unlimited

Coinsurance 20%–29% 20%–29% Not Applicable 20%–29% Not applicable

Primary care office visit $20–$24 copay Coinsurance $20–$24 copay $20–$24 copay $25–$29 copay

Specialist care office visit $35+ copay Coinsurance $35+ copay $35+ copay $35+ copay

Max hospital copay (per admit) Coinsurance only Coinsurance only $0 copay Coinsurance only $0 copay

Emergency room visit $100–$149 Coinsurance only $100–$149 $100–$149 $100–$149

Out-of-network

Deductible $1,000–$1,999 $4,000+ Not applicable $1,000–$1,999 Not applicable

Out-of-pocket max $5,000–$9,999 $5,000–$9,999 Unlimited $5,000–$9,999 Unlimited

Coinsurance 30%–49% 30%–49% Not applicable 30%–49% Not applicable

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 21

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Medical plan in-network features

Section 4: Medical plan design highlights

2013 2012 2011 2010 2009

Not applicable 18% 21% 22% 24% 31%

<$200 4% 8% 8% 8% 11%

$200–$299 10% 11% 14% 16% 15%

$300–$399 7% 9% 9% 9% 12%

$400–$499 5% 5% 5% 7% 5%

$500–$749 17% 19% 16% 14% 12%

$750–$999 7% 5% 4% 6% 3%

$1,000–$1,999 17% 13% 11% 11% 7%

$2,000–$2,999 9% 6% 7% 3% 3%

$3,000+ 6% 3% 4% 2% 1%

Education & Nonprofit

Financial Services

Health Industries Manufacturing

Retail & Consumer Services Technology

Not Applicable 35% 20% 23% 11% 12% 23% 13%

<$200 6% 3% 7% 6% 3% 1% 3%

$200–$299 13% 9% 10% 8% 11% 9% 11%

$300–$399 8% 5% 4% 6% 6% 2% 11%

$400–$499 1% 7% 6% 5% 7% 0% 3%

$500–$749 11% 13% 17% 20% 16% 23% 20%

$750–$999 6% 3% 3% 9% 10% 5% 12%

$1,000–$1,999 11% 20% 15% 17% 21% 14% 12%

$2,000–$2,999 7% 14% 10% 10% 7% 13% 9%

$3,000+ 2% 6% 5% 8% 7% 10% 6%

Single deductible

For the medical plan selected as having the largest enrollment, the historical and industry breakdown of the medical deductible feature follows:

The typical in-network deductible is now over $500, more than double what it was in 2009 65% of respondents in the service industry have a deductible of $500 or more, while manufacturing is a close second with 64%

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 22

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Medical plan in-network features

Section 4: Medical plan design highlights

Out-of-pocket maximum

For the medical plan selected as having the largest enrollment, the historical and industry breakdown of the medical out-of-pocket maximum feature follows:

2013 2012 2011 2010 2009

<$1,000 6% 13% 10% 10% 11%

$1,000–$1,999 19% 27% 27% 28% 34%

$2,000–$2,999 26% 27% 27% 29% 22%

$3,000–$4,999 24% 16% 20% 17% 15%

$5,000–$9,999 11% 6% 6% 5% 4%

$10,000+ 1% 1% 1% 0% 1%

Unlimited 13% 10% 9% 11% 13%

Education & Nonprofit

Financial Services

Health Industries Manufacturing

Retail & Consumer Services Technology

<$1,000 4% 6% 8% 7% 4% 6% 9%

$1,000–$1,999 24% 15% 21% 20% 22% 17% 20%

$2,000–$2,999 24% 26% 24% 30% 23% 17% 25%

$3,000–$4,999 11% 25% 22% 24% 29% 22% 28%

$5,000–$9,999 4% 13% 9% 10% 13% 19% 13%

$10,000+ 3% 1% 2% 1% 2% 1% 0%

Unlimited 30% 14% 14% 8% 7% 18% 5%

30%of Education & Nonprofit employers have an unlimited out-of-pocket maximum whereas only 5% of Technology employers have an unlimited out-of-pocket maximum

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 23

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Medical plan in-network features

Section 4: Medical plan design highlights

Employee coinsurance

For the medical plan selected as having the largest enrollment, the historical and industry breakdown of the employee coinsurance for most services medical feature follows (only coinsurance plans were considered):

Employee coinsurance has been

gradually increasing since 2009, with Retail & Consumer and Services requiring the highest coinsurance

2013 2012 2011 2010 2009

0%–9% 10% 12% 8% 6% 13%

10%–19% 36% 39% 41% 41% 47%

20%–29% 47% 41% 46% 49% 35%

30%–49% 2% 3% 1% 2% 2%

50%+ 5% 5% 4% 2% 3%

Education & Nonprofit

Financial Services

Health Industries Manufacturing

Retail & Consumer Services Technology

0%–9% 19% 11% 12% 7% 6% 10% 7%

10%–19% 38% 43% 41% 38% 22% 38% 47%

20%–29% 36% 39% 44% 48% 63% 42% 40%

30%–49% 2% 2% 1% 3% 6% 0% 0%

50%+ 5% 5% 2% 4% 3% 10% 6%

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 24

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Medical plan in-network features

Section 4: Medical plan design highlights

Office visits

For the medical plan selected as having the largest enrollment, the following is the breakdown of the medical features:

2013 2012 2011 2010 2009

Not applicable (free visit) 8% 6% 7% 6% 8%

$1–$9 copay 1% 1% 1% 1% 2%

$10–$19 copay 12% 16% 17% 20% 26%

$20–$24 copay 24% 26% 29% 30%46%

$25–$29 copay 20% 19% 16% 17%

$30–$34 copay 11% 10% 8% 6%6%

$35 or greater copay 4% 3% 4% 2%

Coinsurance applies 20% 19% 18% 18% 12%

2013 2012 2011 2010 2009

Not applicable (free visit) 5% 4% 5% 3% 9%

$1–$9 copay 0% 1% 1% 0% 0%

$10–$19 copay 6% 6% 9% 10% 14%

$20–$24 copay 9% 10% 11% 15%31%

$25–$29 copay 10% 12% 9% 11%

$30–$34 copay 13% 12% 14% 17%31%

$35 or greater copay 34% 33% 29% 21%

Coinsurance applies 23% 22% 22% 23% 15%

Primary care office visit

Specialist office visit

• The average primary care copay has not increased significantly since 2009

• The percentage of employers offering coinsurance as opposed to copays for both primary care and specialist has also been increasing

51%of employers have the same specialist office copay as primary care

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 25

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Medical plan in-network features

Section 4: Medical plan design highlights

Hospital and ER

For the medical plan selected as having the largest enrollment, the following is the breakdown of the medical features:

46% of employers are applying coinsurance to hospital admissions (up from 37% in 2009)

2013 2012 2011 2010 2009

$0 copay 18% 20% 16% 0% 18%

$1–$199 copay 9% 11% 13% 12% 14%

$200–$399 copay 14% 16% 17% 24% 21%

$400–$599 copay 9% 7% 7% 7% 7%

$600+ copay 4% 5% 5% 4% 3%

Coinsurance only 46% 41% 42% 53% 37%

2013 2012 2011 2010 2009

<$50 copay 4% 7% 8% 2% 12%

$50–$99 copay 15% 17% 21% 26% 29%

$100–$124 copay28%

27% 26% 30% 30%

$125–$149 copay 3% 4% 2% 2%

$150–$199 copay 14% 13%19% 17% 10%

$200+ copay 14% 12%

Coinsurance only 25% 21% 22% 23% 17%

Maximum hospital cost per admission

Emergency room copay per visit

ER copays have been

steadily increasing or moving to coinsurance over the past five years

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 26

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Medical plan out-of-network features

Section 4: Medical plan design highlights

For the medical plan selected as having the largest enrollment:

The typical out-of-network deductible is now over

$1,000,

about twice the typical in-network deductible

2013 2012 2011 2010 2009

Not applicable 13% 17% 18% 17% 22%

<$200 1% 3% 2% 1% 7%

$200–$499 9% 12% 13% 19% 21%

$500–$749 15% 17% 17% 19% 24%

$750–$999 7% 8% 6% 9% 6%

$1,000–$1,999 25% 24% 23% 21% 15%

$2,000–$2,999 10% 9% 8% 6% 0%

$3,000+ 20% 10% 13% 8% 5%

Deductible

2013 2012 2011 2010 2009

<$1,000 3% 4% 5% 5% 19%

$1,000–$1,999 6% 10% 9% 9% 15%

$2,000–$2,999 11% 16% 12% 16% 16%

$3,000–$4,999 27% 27% 29% 26% 27%

$5,000–$9,999 32% 22% 25% 24% 3%

$10,000+ 11% 7% 8% 9% 7%

Unlimited 10% 14% 12% 11% 13%

2013 2012 2011 2010 2009

Not applicable * 16% 18% 20% - -

0%–19% 4% 6% 7% 6% 12%

20%–29% 17% 17% 16% 19% 23%

30%–39% 49%

22% 23% 28% 30%

40%–49% 23% 23% 29% 21%

50%+ 14% 14% 11% 18% 14%

Out-of-pocket maximum

Employee coinsurance for most services

* Not a survey response option in prior years

53% have an out-of-network out-of-pocket maximum of $5,000 or more (up from 23% in 2009)

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 27

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

High deductible plans

Section 4: Medical plan design highlights

• Large employers tend to offer more HSA and HRA plans than smaller employers

• Enrollment in both HSA and HRA plans has been steadily increasing the last few years

Employer subsidy

Average enrollment

% Offering

HSA HRA

<1,000 employees

1,000–5,000 employees

5,000+ employees

2013 total

<1,000 employees

1,000–5,000 employees

5,000+ employees

2013 total

$0 34% 25% 28% 30% 1% 2% 3% 2%

$1–$499 13% 19% 21% 17% 17% 17% 25% 20%

$500–$999 29% 41% 45% 37% 31% 57% 48% 42%

$1,000–$1,999 16% 13% 6% 12% 29% 16% 22% 24%

$2,000–$2,999 4% 1% 0% 2% 15% 2% 2% 8%

$3,000+ 4% 1% 0% 2% 7% 6% 0% 4%

HSA HRA

2013 34.6% 54.2%

2012 28.2% 43.2%

2011 29.5% 37.9%

2010 20.5% 34.2%

HSA HRA

<1,000 employees 35% 18%

1,000–5,000 employees 30% 20%

5,000+ employees 46% 25%

2013 total 39% 20%

39%of employers are offering High deductible plans with an HSA

20%of employers are offering High deductible plans with an HRA

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 28

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Financing of medical plans with the largest enrollment

Section 4: Medical plan design highlights

2013 2012 2011 2010 2009

Self-insured 31% 22% 20% 29% 21%

Fully-insured 65% 65% 67% 68% 70%

Minimum premium arrangement 4% 13% 13% 3% 9%

<500 employees

2013 2012 2011 2010 2009

Self-insured 55% 49% 54% 69% 50%

Fully-insured 43% 47% 39% 26% 46%

Minimum premium arrangement 2% 4% 7% 5% 4%

500–1,000 employees

2013 2012 2011 2010 2009

Self-insured 85% 86% 87% 87% 84%

Fully-insured 13% 12% 12% 11% 14%

Minimum premium arrangement 2% 2% 1% 2% 2%

1,000+ employees

31% of employers with <500 employees and 55% of employers with 500-1,000 employees were self-insured in 2013

In total, 60% of employers were self-insured in 2013

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 29

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Most common prescription drug plan features by plan type

Section 4: Medical plan design highlights

In-network prescription drug deductible

PPO POS High deductible

HMO EPO

Deductible N/A N/A N/A N/A N/A

Retail (30-Day Supply)

Generic $10–$19 copay

$10–$19 copay

$10–$19 copay

$10–$19 copay

$10–$19 copay

Brand “formulary”

$30–$34 copay

$30–$34 copay

$35–$49 copay

$35–$49 copay

$35–$49 copay

Brand “non-formulary”

$50–$54 copay

$50–$54 copay

$50–$54 copay

$50–$54 copay

$50–$54 copay & $60–$74 copay

Specialty $50–$59 copay

$50–$59 copay

$50–$59 copay

Not covered

$50–$59 copay & not

covered

• Most prescription drug plans are copay-based rather than deductible or coinsurance based

• Copay programs continue to be not only the most popular across all plan types, but were also observed to utilize common metric bands and differentials across the three drug classifications: Generic, Brand “formulary”, and Brand “non-formulary”

• The majority of plans are using a $20–$25 copay differential between drug types, which is traditionally needed to achieve consumer behavior changes

74%

15%

5%

4%1%

1%

N/A

Applies to medical deductible

<$100

$100–$199

$200–$299

$300+

A majority of participating employers (74%) do not have a prescription drug deductible

While 74% of the plans do not apply a deductible on pharmacy claims, when applicable, the most common deductible continues to be an integrated deductible with medical claims rather than a standalone prescription deductible

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 30

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

In-network prescription drug plan features

Section 4: Medical plan design highlights

For the medical plan selected as having the largest enrollment, the following is the breakdown of the prescription drug plan features:

The average copay for generics has been static for the past five years reflecting the relative low inflation of generic drugs and the Plan Sponsors continued interest in encouraging the use of generic alternatives

2013 2012 2011 2010 2009

Not covered 1% 2% 2% 1% 2%

<$10 copay 30% 21% 21% 22% 21%

$10–$14 copay 51%

42% 43% 43% 43%

$15–$19 copay 12% 10% 11% 10%

$20 or greater copay 4% 7% 5% 4% 5%

<14% coinsurance 5% 6% 6% 6% 7%

15%–24% coinsurance 6% 8% 8% 9% 8%

25%+ coinsurance 3% 2% 5% 4% 4%

Average copay, not including coinsurance $13 $14 $13 $13 $13

2013 2012 2011 2010 2009

Not covered 2% 2% 3% 1% 3%

<$19 copay 7% 6% 6% 5% 8%

$20–$29 copay 27% 28% 32% 36% 37%

$30–$34 copay 23% 20% 17% 16%24%

$35 or greater copay 25% 18% 13% 9%

<15% coinsurance 2% 2% 2% 2% 2%

15%–34% coinsurance 11% 21% 22% 27% 24%

35% or greater coinsurance

3% 3% 5%4% 2%

Average copay, not including coinsurance $33 $32 $30 $29 $29

Generic 30-day supply

Brand “formulary” 30-day supply

The average copay for brand “formulary” has been slowly increasing since 2009, going from

$29 to $33

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 31

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

In-network prescription drug plan features

Section 4: Medical plan design highlights

For the medical plan selected as having the largest enrollment, the following is the breakdown of the prescription drug plan features:

59% of employers have the same specialty drug cost sharing requirements as retail brand

2013 2012 2011 2010 2009

Not covered 3% 4% 6% 4% 6%

<$30 copay 7% 8% 9% 4% 7%

$30–$49 copay 25% 24% 26% 32% 35%

$50–$59 copay 22% 23% 18% 20% 15%

$60 or greater copay 18% 13% 10% 8% 9%

<19% coinsurance 2% 2% 3% 2% 3%

20%–29% coinsurance 6% 6% 6% 9% 7%

30%–39% coinsurance 6% 7% 8% 5% 7%

40% or greater coinsurance 11% 13% 14% 16% 11%

Average copay, not including coinsurance

$51 $49 $46 $47 $46

2013 2012 2011 2010 2009

Not covered 13% 9% 11% 6% 9%

<$30 copay 3% 8% 5% 22% 42%

$30–$49 copay 15% 20% 21% 20% 14%

$50–$59 copay 18% 19% 17% 13% 6%

$60 or greater copay 20% 16% 13% 7% 8%

<19% coinsurance 4% 3% 3% 3% 4%

20%–24% coinsurance 8% 7% 7% 10% 5%

25%–39% coinsurance 10% 8% 18% 10% 7%

40% or greater coinsurance 9% 10% 11% 9% 5%

Average copay, not including coinsurance $60 $56 $44 $39 $31

Brand “non-formulary” 30-day supply

Specialty drug tier 30-day supply

For the medical plan selected as having the largest enrollment, the following is the summary of the prescription drug plan average copay amounts:

2013 2012 2011 2010 2009

Generic $13 $14 $13 $13 $13

Brand “formulary” $33 $32 $30 $29 $29

Brand “non-formulary”

$51 $49 $46 $47 $46

Specialty drug tier $60 $56 $44 $39 $31

30-day supplies

• Copays for non-preferred brands continues to be approximately 55% higher than preferred brands

• The average copay for specialty drugs has almost doubled since 2009, going from a $31 copay to a $60 copay

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 32

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Contribution percentages for largest enrolled plan

Section 4: Medical plan design highlights

Employee-only coverage

2013 2012 2011 2010 2009

Less than 10% contribution 16% 16% 17% 14% 18%

10%–14% 13% 11% 12% 11% 11%

15%–19% 14% 15% 19% 18% 16%

20%–24% 24% 27% 27% 24% 27%

25%–29% 14% 13% 14% 16% 16%

30%–39% 12% 9% 8% 10% 9%

40%–49% 3% 2% 1% 3% 1%

50%+ 4% 7% 2% 4% 2%

Average contribution 22% 23% 20% 21% 20%

2013 2012 2011 2010 2009

Less than 10% contribution 7% 7% 8% 7% 9%

10%–14% 9% 7% 8% 7% 7%

15%–19% 13% 11% 15% 16% 14%

20%–24% 22% 27% 23% 24% 27%

25%–29% 15% 17% 18% 19% 18%

30%–34% 13% 11% 12% 13% 11%

35%–39% 6% 3% 3% 3% 4%

40%–49% 5% 4% 3% 3% 4%

50%+ 10% 13% 10% 8% 6%

Average contribution 29% 30% 28% 27% 26%

Family coverage

Employee contributions as a percentage of premium for the largest enrolled plan appear to have leveled out Although the largest enrolled plans tend to have higher cost-sharing at the point of care

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 33

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Contribution percentages vary by company size

Section 4: Medical plan design highlights

The most common employee contribution level is

20%–24% of premium for both employee-only and family coverage, but...

...the average employee contribution for family coverage is

4%–10% higher as a percentage of premium

Smaller employers tend to have higher contribution levels for family coverage than large employers

Employee-only coverage

Contribution <1,000

employees1,000–5,000 employees

5,000+ employees

<10% 22% 11% 8%

10%–14% 15% 12% 12%

15%–19% 12% 16% 17%

20%–24% 18% 30% 30%

25%–29% 12% 14% 16%

30%–39% 12% 13% 11%

40%+ 9% 4% 6%

Average 21% 22% 23%

Family coverage

Contribution <1,000

employees1,000–5,000 employees

5,000+ employees

<10% 10% 5% 2%

10%–14% 11% 6% 8%

15%–19% 12% 16% 13%

20%–24% 17% 26% 29%

25%–29% 13% 15% 22%

30%–34% 11% 15% 13%

35%–39% 6% 6% 5%

40%–49% 6% 6% 3%

50%–74% 7% 2% 1%

75%+ 7% 3% 4%

Average 31% 27% 27%

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 34

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Stop loss coverage

Section 4: Medical plan design highlights

54% of self-insured plans do not have aggregate stop loss coverage, down from 66% in 2012 and 21% do not have specific/individual coverage, down from 30% in 2012

54%

7%4%

8%

21%

6%

None

<115%

115%

120%

125%

Other

Aggregate coverage

Specific/individual coverage

0% 10% 20% 30%

$1,000,000+

$500,000–$999,999

$300,000–$499,999

$200,000–$299,999

$100,000–$199,999

$50,000–$99,999

<$50,000

None

For the medical plan(s) selected as self-insured, the following is the breakdown of stop loss coverage:

Stop loss coverage by company size

<1,000 employees

1,000–5,000 employees

5,000+ employees

<115% 13% 7% 3%

115% 6% 5% 1%

120% 12% 8% 5%

125% 32% 25% 8%

Other 8% 3% 4%

N/A 29% 52% 79%

Aggregate coverage

<1,000 employees

1,000–5,000 employees

5,000+ employees

<$50,000 5% 0% 0%

$50,000–$99,999 36% 4% 0%

$100,000–$199,999 38% 30% 6%

$200,000–$299,999 9% 30% 12%

$300,000–$499,999 2% 18% 18%

$500,000–$999,999 1% 7% 13%

$1,000,000+ 3% 2% 6%

N/A 6% 9% 45%

Specific/individual coverage

Large employers tend to purchase less aggregate stop loss coverage than smaller employers:

The majority of self-insured smaller employers obtain specific/individual stop loss coverage whereas almost half of large employers do not obtain specific/individual stop loss coverage:

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 35

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Medical plan providers with the largest enrollment

Section 4: Medical plan design highlights

Blue Cross (Wellpoint/Anthem + Others) has the largest share of those who participated in the survey, but other health plans and TPAs combined continue to be prevalent, especially among smaller employers

Survey participants selected that they use the following administrators for their medical plans with the largest enrollment:

<1,000 employees

1,000–5,000 employees

5,000+ employees

Aetna, including Coventry 6% 12% 13%

BCBS–Wellpoint/Anthem 10% 9% 12%

BCBS–Other than Wellpoint/Anthem 29% 31% 21%

CIGNA 8% 18% 11%

UnitedHealthcare 18% 19% 26%

Other health plan 20% 7% 12%

Other third party administrator (TPA) 9% 4% 5%

Vendor satisfaction

Satisfaction with vendors has been on an overall decline since 2011

• 38% indicated they were very satisfied with claim administration in 2013 versus 73% in 2011• 18% indicated they were very satisfied with consumer/decision support in 2013 versus 73% in 2011• 19% indicated they were very satisfied with wellness in 2013 versus 58% in 2011• Employers are no longer very satisfied with both core administrative (claims administration & member services)

or value added (network discount, medical management, & wellness) services

2013 2012 2011

Very satisfied

SatisfiedNot

satisfiedVery

satisfiedSatisfied

Not satisfied

Very satisfied

SatisfiedNot

satisfied

Claim administration 38% 58% 4% 44% 52% 4% 73% 25% 2%

Consumer/decision support 18% 68% 14% 22% 66% 12% 73% 24% 3%

Member services 27% 65% 8% 34% 59% 7% 63% 34% 3%

Medical management 23% 70% 7% 27% 66% 7% 56% 40% 4%

Network discounts 36% 59% 5% 44% 53% 3% 45% 45% 10%

Pharmacy benefit administration * 25% 69% 6% - - - - - -

Wellness 19% 63% 18% 23% 62% 15% 58% 37% 5%

* Not a survey response option in prior years

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 36

Click to return to the table of contents The benefit administration of medical plans by company size

Section 4: Medical plan design highlights

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Smaller employers are trending towards more in-sourcing and co-sourcing and moving away from outsourcing and larger employers are trending towards more co-sourcingMore employers are co-sourcing in 2013 as compared to 2012 and fewer employers are outsourcing

<1,000 employees 1,000–5,000 employees 5,000+ employees Total

2013 2012 2013 2012 2013 2012 2013 2012

Insourced 38% 33% 31% 28% 21% 21% 32% 27%

Outsourced 24% 44% 25% 41% 39% 55% 28% 47%

Co-sourced 38% 23% 44% 31% 40% 24% 40% 26%

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 37

Click to return to the table of contents

Detailed findings—Section 5: Wellness and Disease Management

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 38

Click to return to the table of contents Wellness and Disease Management programs

Section 5: Wellness and Disease Management

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Employers offering Wellness and Disease Management programs:

Wellness programs Disease Management programs

2013 2012 2011 2010 2013 2012 2011 2010

<1,000 employees 57% 56% 52% 65% 31% 28% 40% 41%

1,000–5,000 employees 71% 76% 81% 73% 60% 65% 74% 68%

5,000+ employees 85% 85% 88% 85% 75% 81% 86% 83%

2013 total 68% 72% 73% 76% 49% 58% 66% 68%

As company size increases, the percentage of employers offering Wellness and Disease Management programs increasesIn 2013, the prevalence of both Wellness and Disease Management programs declined for mid-size employers, and Disease Management also declined for large employers

Highlights

Wellness programs• 68% of all survey participants and

85% of large employers offer Wellness programs to eligible individuals

• 76% of employers with 20,000+ employees and 50% of employers with <500 employees spend more than 1.0% of total medical costs on Wellness programs

• 36% of employers use their medical vendor for their Wellness programs, 25% manage the programs in-house, and 39% utilize an external vendor

Disease Management programs• 49% of all survey participants and

75% of large employers offer Disease Management programs to eligible individuals although participation rates are typically low (ranging from 9% to 18%)

• 84% of employers use their medical vendor for their Disease Management programs, 4% manage the programs in-house, and 12% utilize an external vendor

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 39

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Wellness programs: Incentives

Section 5: Wellness and Disease Management

For those employers that offer incentives, participation rates increase, although not dramatically:

82%of employers offer incentives for their Wellness programs

Programs where incentives did not significantly impact participation:

• Employee assistance program (EAP)• Ergonomics• Executive health exam• On-site fitness• On-site health clinic• Stress management• Tobacco cessation

Incentives Wellness

Cash/gift card <$100 16%

Cash/gift card $100–$199 6%

Cash/gift card $200+ 9%

Annual premium incentive <$100 3%

Annual premium incentive $100–$199 5%

Annual premium incentive $200–$299 4%

Annual premium incentive $300–$499 8%

Annual premium incentive $500+ 13%

Small gifts 12%

Raffles for large gifts 10%

Other 14%

0%

10%

20%

30%

40%

50%

60%

Weight managementNutritionHealth risk questionnaireBody mass index

No incentive Incentive

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 40

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Disease Management programs: Incentives

Section 5: Wellness and Disease Management

For those employers that offer incentives, the impact of incentives on participation varied:

19%offer incentives for their Disease Management programs

Programs where incentives did not significantly impact participation:

• Cardiac • Lower back pain

Common other incentives:

• Penalty if they do not participate• FSA/HSA/HRA contributions• Deductible credit/copay waiver

Incentives Disease Management

Cash/gift card <$100 16%

Cash/gift card $100–$199 10%

Cash/gift card $200+ 5%

Annual premium incentive <$100 0%

Annual premium incentive $100–$199 2%

Annual premium incentive $200–$299 5%

Annual premium incentive $300–$499 6%

Annual premium incentive $500+ 8%

Small gifts 3%

Raffles for large gifts 4%

Other 41%

0%

5%

10%

15%

20%

25%

30%

OtherDiabetesDepressionCOPDCancerAsthma

No incentive Incentive

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 41

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Wellness and Disease Management programs

Section 5: Wellness and Disease Management

Wellness program Offered? Utilization

Employee assistance program 86% 29%

Health risk questionnaire 80% 52%

Tobacco cessation 61% 9%

Body mass index 58% 49%

Weight management 52% 15%

Nutrition 41% 23%

On-site fitness 38% 22%

Stress management 35% 15%

Ergonomics 25% 36%

Executive health exam 23% 42%

On-site health clinic 15% 42%

Disease Management program Offered? Utilization

Diabetes 70% 11%

Asthma 59% 9%

Cardiac 57% 9%

Chronic Obstructive Pulmonary Disease

54% 8%

Cancer 46% 11%

Depression 35% 10%

Lower back pain 35% 8%

86%of employers offer an Employee assistance program (EAP) and 29% of employees utilize EAP when offered

15%of employers offer an On-site health clinic with 42% average participation

70%of employers offer a Diabetes program and 11% of eligible employees participate in this program when offered

Effectiveness of Wellness programs at:

Very effective

Somewhat effective

Not effective

Mitigating healthcare costs 11% 67% 22%

Improving performance and productivity

9% 68% 23%

Enhancing employee engagement, attraction and loyalty

17% 65% 18%

Reinforcing corporate responsibility and image

23% 62% 15%

Effectiveness of Disease Management programs at:

Very effective

Somewhat effective

Not effective

Mitigating healthcare costs 11% 71% 18%

Improving performance and productivity

6% 66% 28%

Enhancing employee engagement, attraction and loyalty

6% 57% 37%

Reinforcing corporate responsibility and image

9% 58% 33%

Overall, satisfaction with Wellness and Disease Management programs has remained fairly consistent to last year

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 42

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

ROI from Wellness and Disease Management programs

Section 5: Wellness and Disease Management

Of those that measure ROI for Wellness and Disease Management programs,

50% and 64% respectively have a positive impact

Return on investment (ROI)

Wellness Disease

Management

Do not measure 45% 55%

Insufficient information provided to calculate ROI 47% 34%

Below 1 to 1 1% 1%

1 to 1 3% 3%

2 to 1 2% 4%

3 to 1 1% 2%

4 to 1 or more 1% 1%

0%2%4%6%8%

10%12%14%16%18%20%

5,000+1,000–4,999<1,000

Disease Management Wellness

4%

4%

7%

6%

19%

14%

Employers measuring ROI by company size

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 43

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Work-life programs

Section 5: Wellness and Disease Management

Work-life programs by company size

The popularity of work-life programs has seen a decrease in 2013 whereas in the past they were generally increasing

Employers sponsor the following work-life programs:

2013 2012 2011 2010 2009

Telecommuting 43% 55% 51% 47% 51%

Flexible work schedule 36% 46% 46% 41% 48%

Parental leave 25% 36% 35% 34% 38%

Reduced hours 23% 31% 30% 30% 30%

Community service time 19% 26% 25% 20% 19%

Adult leave/care * 17% 16% - - -

Childcare 13% 25% 22% 20% 28%

Job share 8% 14% 14% 16% 20%

Concierge service 5% 8% 9% 8% 10%

Other 2% 4% 4% 3% 3%

* Not a survey response option in prior years More than one option was allowed to be chosen

2013 2012

<1,000 employees

1,000–5,000 employees

5,000+ employees

<1,000 employees

1,000–5,000 employees

5,000+ employees

Telecommuting 35% 45% 56% 49% 54% 62%

Flexible work schedule 28% 39% 47% 36% 47% 53%

Parental leave 18% 30% 34% 30% 45% 35%

Reduced hours 18% 27% 28% 26% 34% 34%

Community service time 15% 23% 24% 18% 30% 29%

Adult leave/care 12% 20% 23% 12% 19% 16%

Job share 5% 7% 16% 7% 13% 21%

Childcare 6% 12% 29% 8% 26% 41%

Concierge service 3% 8% 7% 5% 10% 11%

Other 2% 1% 3% 3% 5% 5%

More than one option was allowed to be chosen

Availability of work-life programs increases as company size increases

• Telecommuting is the most common work-life program at any company size

• As size increases, availability of work-life programs also increases

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 44

Click to return to the table of contents

Detailed findings—Section 6: Welfare benefits

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 45

Click to return to the table of contents Welfare benefit programs

Section 6: Welfare benefits

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

2013 2012

Employer subsidized Voluntary Employer subsidized Voluntary

Auto insurance 3% 97% 3% 97%

Basic life insurance 96% 4% 99% 1%

Cancer/specified disease insurance 6% 94% 3% 97%

Dental 86% 14% 86% 14%

Dependent life 17% 83% 13% 87%

Homeowners insurance 2% 98% 0% 100%

Legal insurance 8% 92% 6% 94%

Long-term care insurance 18% 82% 7% 93%

Long-term disability 83% 17% 83% 17%

Personal excess liability insurance 19% 81% 15% 85%

Pet insurance 0% 100% 0% 100%

Short-term disability 85% 15% 86% 14%

Supplement/optional life 9% 91% 5% 95%

Vision 51% 49% 53% 47%

Benefit programs offered

Of those employers that offer long-term care insurance, the percentage who subsidize coverage has increased since 2012

For employers offering the following welfare benefit programs:

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 46

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Paid time off (PTO) policies

Section 6: Welfare benefits

23% of respondents provide the same amount of PTO days for a new hire as they do for a full-time employee with 5 or more years’ tenure

Do you offer paid time off that employees can use to address family needs in addition to family medical leave of absence?

• As employer size increases, paid time off also increases

• Only 16% of employers are not offering additional time off to address family needs/other personal needs as compared to 44% last year

Average5+ years tenure

New hire

PTO Days 21 days 16 days

Do you offer a PTO bank rather than a traditional vacation & sick day allotment?

49%51%

Yes

No

Number of PTO days

0%

5%

10%

15%

20%

25%

30%

35%

30+25–2920–2415–1910–14<10

5+ years tenure New hire

<500 employees

500–1,000 employees

1,000+ employees

2013 total

Bereavement 72% 82% 81% 77%

Maternity leave (birth of a child) 37% 50% 52% 44%

Military leave 31% 49% 54% 42%

Paternity leave (birth of a child) 26% 35% 30% 29%

Adoption leave (placement of a child) 21% 34% 37% 28%

Family illness, including care of extended family 22% 29% 24% 24%

Not available/not offering 22% 11% 9% 16%

Other 7% 12% 11% 9%

Sabbatical leave 3% 8% 11% 7%

Paid time off by company size

More than one option was allowed to be chosen

Click the topics below to view findings

This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Health and Well-being Touchstone Survey results | PwC 47

Click to return to the table of contents

Overview

Detailed findings

S3: Medical plan costs

S4: Medical plan design highlights

S5: Wellness and Disease Management

S6: Welfare benefits

S7: Retiree medical

S8: Retirement plans

S9: Health reform– Affordable Care Act (ACA)

S10: Future solutions

Appendix

Contact

Paid time off (PTO) policies

Section 6: Welfare benefits

82% of respondents provide the same number of sick days and 21% of respondents provide the same number of vacation days for a new hire as they do for a full-time employee with 5 or more years tenure

Average 5+ years tenure New hire

Holidays 9 days